Business Day TV Daily Stock Picks (October 2023)

Sibanye-Stillwater, TFG Limited (The Foschini Group), MultiChoice Group, Anglo-American, MTN Group, Woolworths Holdings, Naspers, Life Healthcare Group, GrowthPoint, Attacq, Nepi Rockcastle, etc.

Business Day TV is South Africa's most watched business news TV channel who does short (usually 1-3 minutes long) Daily Stock Pick video pitches mostly about South African stock picks (this post won’t cover any USA based ones, but does cover their other non-South African picks).

Stocks featured in their October Daily Stock Pick videos (from newest to oldest) and covered in this post include:

Sibanye-Stillwater & TFG Limited (The Foschini Group); MultiChoice Group & Anglo-American; Mondi & MTN Group; Omnia Holdings; Gold Fields; Pick N Pay; Prosus; Richemont; British American Tobacco; Woolworths Holdings; Naspers; Life Healthcare Group Holdings and African Rainbow Minerals; LVMH Moët Hennessy Louis Vuitton; Shoprite and Bidcorp; ABSA; Sasol; Karooooo; Quilter; FirstRand; Platinum Stocks…; Spar; GrowthPoint and Attacq; Nepi Rockcastle; Zeda; Glencore; Adevinta ASA; & Aspen Pharmacare Holdings

As mentioned in the past, South Africa has its share of problems as well as many well managed companies who have an extensive presence outside the country. Nevertheless, some of those companies have been leaving:

Invested in SA: Discovery says it’s not migrating to London as local headwinds swirl (IOL) November 2023

Discovery Limited (JSE: DSY) offers banking, investment, health, life and vehicle insurance among other services to South Africans as well as to other international markets, including the UK.

Billiton, Anglo American and SA Breweries are among the companies that have already re-domiciled abroad as South African investors have seen the JSE decimated by capital outflows from South Africa’s equity and bond markets since the start of 2023. This comes as the country’s challenges mount with a power and logistics crisis and now water shedding, among many other issues.

Discovery, however, denied that it was moving its operations to London. It told “Business Report” by email that it was “not considering moving its operations” overseas

In addition, I have updated the Emerging Market ETF Closures/Liquidations section for last Monday’s post and there was this recent ETF closure:

11/09/2023 - Franklin FTSE South Africa ETF - FLZA

No explanation was given by the ETF manager, but performance has not exactly been exciting given the negativity foreign investors have towards South Africa:

Yahoo! Finance gives the net assets as $1.96M. I am not sure how old that figure is, but its hardly enough for most fund managers to keep an ETF holding.

Finally, and without any explanation, the Business Day TV YouTube channel was terminated some weeks ago. That’s a real shame as they had separate individual videos with just the few minute long stock picks on there without the need to watch the whole show they were from (although the whole shows would be interesting for anyone investing in South African stocks).

Otherwise, their shows that have various South African fund managers or analysts on as guests will typically have a few minute stock pick segment at the very end - which you will now need to scroll to on your own (as the videos or podcasts on their site don’t have individual chapters bookedmarked).

Thus, this post includes:

A quick description of the stock pick with links to the IR page and stock quote(s) on Yahoo! Finance.

A link to any Wikipedia page (for what it might be worth…)

The title of the Business Day TV Daily Stock Pick video and their very brief summary of who is making the pitch.

A screenshot linked to the page on the Business Day TV website containing the video and podcast audio format of the show with the stock pick (the last few minutes of the show).

The embedded video (again, they were usually 1-3 minutes long) from the terminated YouTube account (in case the channel reappears) as this post was partially completed as a draft before I went to Japan.

Forward or trailing P/E and dividend yields linked back to the Yahoo! Finance statistics page.

The latest long term technical chart linked back to Yahoo! Finance.

The stock description and/or last two bullet points will help you decide whether to click on the screenshot and go to the end of the video or podcast segment to hear about the stock pick(s).

And as always, this post is provided for informational purposes only (and to make your life easier by providing you with relevant information, links, and charts). It does not constitute investment advice and/or a recommendation…

Sibanye-Stillwater & TFG Limited (The Foschini Group)

Sibanye Stillwater Ltd (NYSE: SBSW) is a multinational mining and metals processing group with a diverse portfolio of projects and investments across five continents. The Group is also one of the foremost global recyclers of PGM autocatalysts and has controlling interests in leading mine tailings retreatment operations.

Sibanye-Stillwater has established itself as one of the world’s largest primary producers of platinum, palladium, and rhodium and is a top-tier gold producer. It also produces and refines iridium and ruthenium, nickel, chrome, copper and cobalt. The Group has recently begun to build and diversify its asset portfolio into battery metals mining and processing and is increasing its presence in the circular economy by growing and diversifying its recycling and tailings reprocessing operations globally.

TFG Limited, also known as The Foschini Group (JSE: TFG), is a South African JSE listed retail clothing group with 34 leading fashion lifestyle brands (which include clothing, footwear, jewelry, sportswear, mobile & tech and home & furniture offerings) with over 4 600+ outlets on five continents.

WATCH: Stock Picks - Sibanye-Stillwater & The Foshino Group

Business Day TV speaks to Mark du Toit from OysterCatcher Investments and Thamsanqa Netha from Shiloh Capital

WATCH: Daily Pick - Sibanye-Stillwater

Thamsanqa Netha from Shiloh Capital chose Sibanye-Stillwater as his stock pick of the day

WATCH: Daily Pick - Sibanye-Stillwater

Graeme Franck from PSG Wealth Sandton Grayston chose Sibanye-Stillwater as his stock pick of the day

Forward P/E: 8.41 / Forward Annual Dividend Yield: 8.31% (Yahoo! Finance)

Trailing P/E: 12.93 (no forward P/E) / Forward Annual Dividend Yield: 2.71% (Yahoo! Finance)

MultiChoice Group & Anglo-American

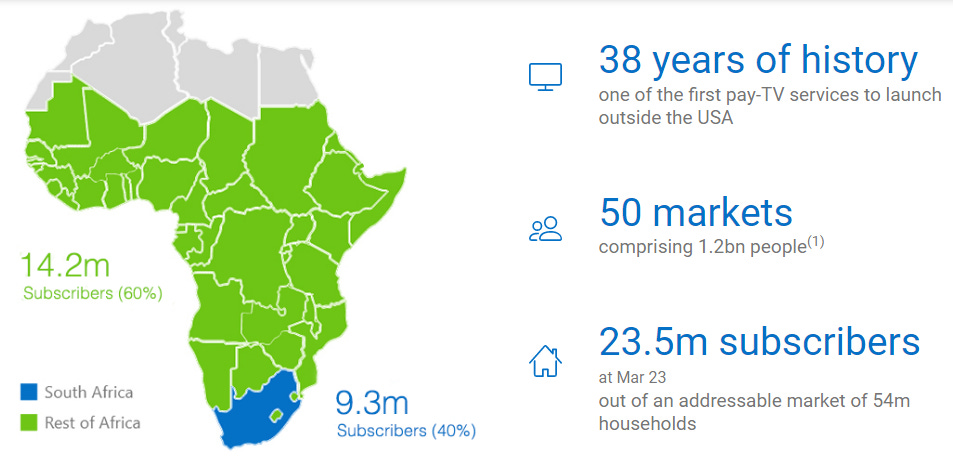

MultiChoice Group Ltd (JSE: MCG / FRA: 30R / 30R0 / OTCMKTS: MCHOY / MCOIF) operates video-entertainment subscriber platforms in South Africa, rest of Africa, Europe, and internationally.

The Company offers digital satellite television and online services, including subscription and transactional video on demand; and digital terrestrial television services to subscribers. It operates SuperSport, a sports broadcaster, producing, and broadcasting local and international sport for pay-TV subscribers; DStv that offers multiple entertainment channels and services to customers through satellite, online, and mobile apps; GOtv, a digital terrestrial television platform; M-Net, which provides international and local content; Showmax, an internet-based subscription video-on-demand service; and Irdeto, a digital cybersecurity platform. The Company also offers treasury and support services.

UK based Anglo American (LON: AAL / JSE: AGL / OTCMKTS: NGLOY) is the world's largest primary producer of platinum metals. The Company produces platinum, palladium, rhodium, iridium, ruthenium & osmium; base metals as in copper, nickel, cobalt sulphate, sodium sulphate & chrome; and precious metals as in gold. The company has operations in Africa, Asia, Australia, Europe, North America and South America.

NOTE: The company is a majority shareholder of Anglo American Platinum (JSE: AMS / FRA: RPHA / FRA: RPH1 / OTCMKTS: AGPPF / ANGPY) - the world's largest primary producer of platinum, accounting for about 38% of the world's annual supply. Based in South Africa, most of the group's operations lie to the northwest and northeast of Johannesburg.

WATCH: Stock Picks - Multichoice & Anglo-American

Business Day TV speaks to Jarred Houston from All Weather Capital and Rowan Williams from Nitrogen Fund Managers

Forward P/E: N/A / Forward Annual Dividend Yield: 7.49% (Yahoo! Finance)

Forward P/E: 8.47 / Forward Annual Dividend Yield: 4.82% (Yahoo! Finance)