CMBI Research China & Hong Kong Stock Picks (July 2023)

Prada SpA, Nayuki Holdings, Sunny Optical, Chow Tai Fook Jewelry Group, New Horizon Health, Alibaba, CR Beer, NIO, Sinotruk Hong Kong, Guangzhou Automobile Group, BYD Company, Geely, etc.

CMB International Capital Corporation is a wholly owned subsidiary of China Merchants Bank (SHA: 600036 / HKG: 3968 / OTCMKTS: CIHKY / OTCMKTS: CIHHF) - one of the largest banking groups and the largest privately-owned bank in China. They come out with (and post on their website) a steady stream of free research pieces - namely China and Hong Kong stock picks (see our front page for a full list of TAGS for our EM Stock Pick Tear Sheets)

Stocks covered during the month of July and in this post include:

Tencent Music Entertainment Group; Prada SpA; Binjiang Service Group; Sany Heavy Equipment International Holdings; Aac Technologies Holdings; Bilibili; Cutia Therapeutics; Nayuki Holdings; Kuaishou Technology; Sunny Optical; Xtep; BeiGene; Inner Mongolia Yili Industrial Group Co; ANTA Sports Products; Q Technology (Group) Company; Tencent; China MeiDong Auto Holdings; BYD Electronic International Co Ltd; iQIYI; JD.com; Zhejiang Dingli Machinery; Joinn Laboratories China; Baidu; Yancoal Australia; Ping An Healthcare and Technology; Intron Technology Holdings; Akeso; Chow Tai Fook Jewelry Group; New Horizon Health Ltd; Alibaba; CR Beer; China Tourism Group Duty Free; Cloud Music; China Yongda Automobile Services Holding; Horizon Construction Development; NIO Inc; Sinotruk Hong Kong Ltd; Weichai Power; Guangzhou Automobile Group; BYD Company; & Geely Automobile Holdings

They also come out with (and post on their website) a monthly list of 20+ high conviction stock ideas - namely Chinese stock picks (see our May and June posts summarizing those) BUT these lists do not change too much from month to month. Stocks covered by the CMBI July list (including Additions and Deletions) and included in this post with updated stats and charts include:

Zoomlion Heavy Industry, Li Auto, Great Wall Motor, Sany Heavy Equipment International Holdings, Zhejiang Dingli Machinery, CR Power, CR Gas, Atour Lifestyle Holdings, Midea, YUM China, CR Beer, Tsingtao Brewery, Prada SpA, Kweichow Moutai, Innovent Biologics, AK Medical, AIA Group, Tencent, Pinduoduo, NetEase, Alibaba, Kuaishou Technology, CR Land, BOE Varitronix, Wingtech & Kingdee International Software Group

While Bloomberg posted this obtuse article on Tuesday, Sudden Rally in China Stocks Has Traders Scratching Their Heads (Archived Article), leave it to Zero Hedge to put it more bluntly yesterday:

Beijing Unleashes 'National Team' To Rescue Chinese Stocks (Zero Hedge)

China's in trouble. (Yeah we know and 'water is wet')

But this time it's for real.

Having strong-armed funds into 'not selling' stock last week, then strongly-suggesting that companies escalate their share buyback programs (and then bullying banks into buying yuan to support the currency against the green back), Beijing was faced with the reality that nothing was working with Chinese stocks tumbling still.

And earlier today, Asia time:

Foreign selling hammers Chinese stocks in near US$1 trillion wipeout (SCMP)

Overseas investors have sold an aggregate US$10.7 billion of Chinese stocks in 13 consecutive trading sessions, the longest selling streak since records began in 2016

Foreign investor favourites bore the brunt of the selling -liquor distiller Kweichow Moutai, retail lender China Merchants Bank, solar panel manufacturer LONGi Green

Foreign investors' China share sales hit record amid property woes (Asia Nikkei)

Last Friday, the China Securities Regulatory Commission announced it was considering extending A-share trading hours as part of the effort to "activate the capital market, and lift investors' confidence." The securities watchdog also said it was "directing mutual fund managers to step up buying their own equities products."

Since then, a number of China's top asset managers, including E Fund Management, Harvest Fund Management, China Asset Management and China Universal Asset Management, have announced they will spend 50 million yuan each to buy their own funds.

These announcements have not produced the results that some have hoped for.

Now might not be a good time to try and catch a falling knife…

Nevertheless…

And as for CMBI’s stock picks and this post: Note that when I click on CMBI’s website, I receive NO pop-up asking what sort of investor I am or my location; but there is this disclaimer at the end of their research pieces:

This post will NOT be quoting directly from the research documents themselves (beyond giving the title to the linked research report - please keep the above disclosures in mind).

To make your life easier, this post includes:

A heading with the stock name.

A quick description of the stock pick with links to the IR page and stock quote(s) on Yahoo! Finance.

A link to any Wikipedia page (for what it might be worth…)

The title of the report linked to the file page on the CMBI website about the stock pick.

Forward or trailing P/E and dividend yields linked back to the Yahoo! Finance statistics page.

The latest long term technical chart linked back to Yahoo! Finance.

And as always, this post is provided for informational purposes only (and to make your life easier…). It does not constitute investment advice and/or a recommendation…

CMBI Research (July 2023)

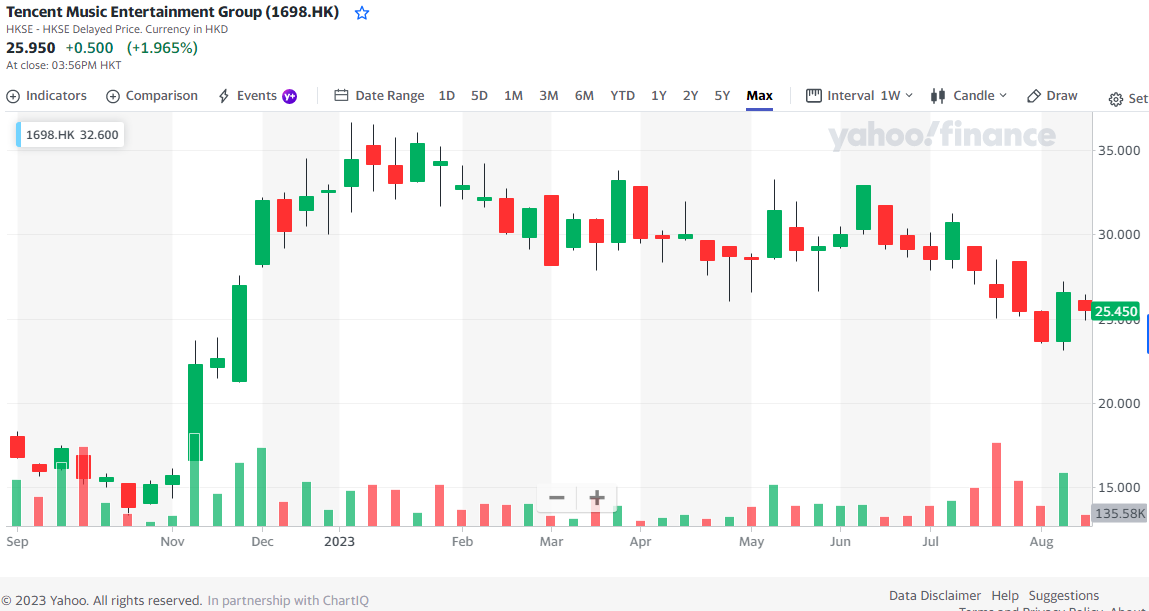

Tencent Music Entertainment Group

Tencent Music Entertainment Group (NYSE: TME) is the leading online music and audio entertainment platform in China, operating the country's highly popular and innovative music apps: QQ Music, Kugou Music, Kuwo Music and WeSing. Their platform comprises online music, online audio, online karaoke, music-centric live streaming and online concert services.

TME (TME US) – 2Q23 preview: solid earnings growth despite social entertainment business adjustment

Forward P/E: 12.92 / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

Prada SpA

Prada SpA (HKG: 1913 / FRA: PRP / PRP0 / OTCMKTS: PRDSY / PRDSF) designs, produces, and distributes leather goods, handbags, footwear, apparel, accessories, and jewelry in Europe, the Americas, the Asia Pacific, Japan, the Middle East, and internationally. The company offers its products under the Prada, Miu Miu, Church's, and Car Shoe brands. It also operates in eyewear and fragrances sector under licensing agreements; food sector under the Marchesi 1824 brand; and sailing races business under Luna Rossa brand name. In addition, the company engages in the real estate business. It sells its products through a network of owned and franchise operated stores; department stores; independent retailers; e-commerce channels; and e-tailers.

Prada SpA (1913 HK) – A decent 1H, though not a straight beat

Forward P/E: 24.15 / Forward Annual Dividend Yield: 1.76% (Yahoo! Finance)

Binjiang Service Group

Binjiang Service Group (HKG: 3316) was founded in 1995 and is headquartered in Hangzhou, China. It is a subsidiary of Great Dragon Ventures Limited and provides property management and related services.

Binjiang Service (3316 HK) – 1H23 preview: high growth secured by visionary strategy

Forward P/E: 8.90 / Forward Annual Dividend Yield: 5.40% (Yahoo! Finance)

Sany Heavy Equipment International Holdings

Sany Heavy Equipment International Holdings Company Limited (HKG: 0631 / FRA: YXS / OTCMKTS: SNYYF) is an investment holding company involved in the manufacture and sale of mining equipment, logistics equipment, robotic, smart mine products, and spare parts. It operates in two segments, Mining Equipment and Logistics Equipment. The company offers coal mining machinery products, such as road headers, including soft rock and hard rock road headers, integrated excavation, bolting, and self-protection machinery; mining equipment consisting of coal mining machines, hydraulic support system, scraper and armored-face conveyors, etc.; non-coal mining machinery products comprising tunnel road headers and mining machines; and mining transport equipment, which include mechanical and electric drive off-highway dump trucks, widebody vehicles, and other related products. It also provides smart mine products, such as unmanned driving, automated integrated mining, and smart mine operation systems; container equipment comprising front loaders, stacking machines, quayside gantry cranes, etc.; bulk material equipment consisting of grippers, elevated hoisting arms, etc.; general equipment, including heavy-weight forklifts, telehandlers, etc.; and robotic system integration, mobile robots, and electric forklifts. In addition, the company provides maintenance and other, and property development services. It operates in Mainland China, rest of Asia, the European Union, the United States, and internationally.

SANY International (631 HK) – Positive takeaways from Zhuhai plant visit

Forward P/E: 13.61 / Forward Annual Dividend Yield: 1.65% (Yahoo! Finance)