EM Fund Stock Picks & Country Commentaries (April 18, 2023)

Various emerging market fund stock picks mainly from London listed funds are in focus this week covering a variety of regions and countries as several EMs role out policies to promote demand.

We have a variety of emerging market fund stock picks (mainly from London listed funds) to highlight this week (among other stocks also getting mentions late on in this post):

Some Chinese sportswear stock picks taping into China’s emerging fitness culture and more sports participation in the country.

Several more Taiwanese tech stock picks - some are benefiting from signs of a bottoming in inventory cycles that another fund talked about (and we mentioned last week).

Some SE Asia consumer products or tourism stock plays. As we also mentioned last week, international funds still largely ignore the region with one local fund manager speculating it was due to the vast majority of the investing world equating liquidity with value.

A Middle East supermarket stock pick defying the decline of supermarkets in other markets (see this interesting documentary recently posted on Youtube: The decline of supermarkets - A sector in crisis | DW Documentary)

A South African industrial group who is outperforming and raising dividends - despite the country’s power crisis. It’s another example of how resilient South African stocks and their management teams are when confronting a crisis (or a neverending series of them).

A South African food service stock benefiting from resurgent hospitality demand.

A foreign listed Ukraine stock play who’s shares are back at historic trading levels (albeit they have lost about 2/3rds of their value from their all time highs in 2021 and due to the conflict with Russia).

A Latin American energy stock pick (with North American and European listings) with what is apparently the largest shale oil and shale gas play under development outside of North America.

A Mexican logistics stock pick that is directly benefiting from nearshoring trends.

One fund talked about the three key characteristics to look for with small-cap value stocks in Asia (along with three value stock picks) and how they are trading at a significant discount to growth stocks right now. The gap is apparently even greater than the one seen around the turn of the millennium.

Another fund mentioned how at-least several emerging markets are rolling out pro-growth policies that could provide a significant tailwind to domestic demand in those markets. These policies range from tax cuts to social welfare payments to raising minimum wages to help cushion the impact of inflation, spur consumption, and potentially help certain sectors or stocks. Of course, some of these policies (e.g. the minimum wage increases) may fuel further inflation.

Finally, and on a non-investing note: Aside from being in a region international investors tend to ignore, Malaysia does not get into the international news much. And when it does, it tends to be something negative e.g. missing airplanes, the 1MDB scandal, more political noise, etc.

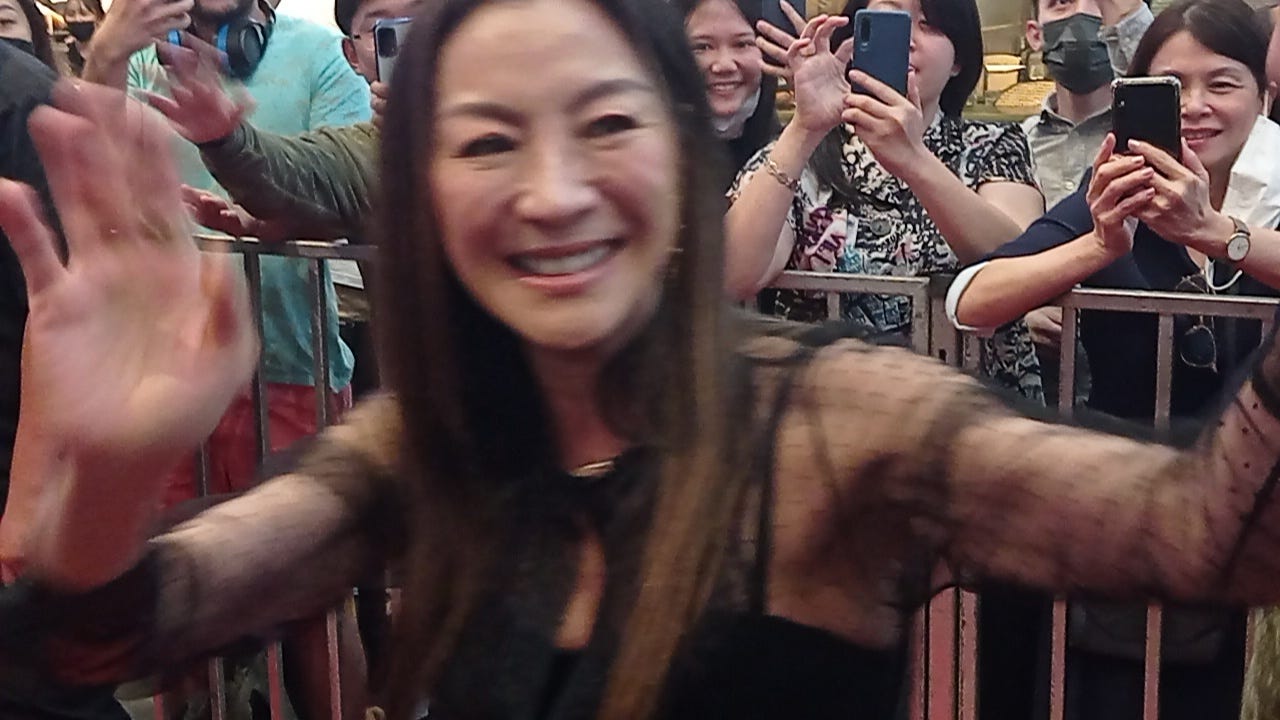

Late this afternoon, Malaysian actress Michelle Yeoh (as in Crouching Tiger, Hidden Dragon; Tomorrow Never Dies; Crazy Rich Asians, etc.) made her first public appearance in Malaysia after becoming the first Asian to win an Academy Award for Best Actress.

To her credit: She made a effort to take as many selfies with, chat with and sign as many autographs as possible for the thousands of well-wishers who gathered along the “longest red carpet in Malaysia” that was set up for her at the Pavilion KL mall:

Although she was late showing up (maybe due to the early Ramadan-Hari Raya rush hour and the monsoon hitting), she definitely deserves an Oscar how she conducted herself!

Hopefully, she and her success will also help put Malaysia in a more positive light - and maybe back on foreign investment maps.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

For a further disclaimer and an explanation of the reasoning behind these posts: DISCLAIMER: EM Fund Stock Picks & Country Commentaries Posts.

Note: Where possible, company links are to their respective investor relations or corporate pages. Region and country links are to our ADR or ETF pages where there are further country specific resources (e.g. links to local stock markets and media websites). Please report any bad links in the comments section.

Asia

East Asia

China

Fidelity International’s Catherine Yeung recently wrote an article (After China's reopening rally, what's next for Asian markets?) mentioning Chow Sang Sang (HKG: 0116 / FRA: CJW1).

Founded 1934, the jewelry retailer has a presence predominantly in Greater China (Hong Kong, Macau, Taiwan and Mainland China) as well as online (chowsangsang.com plus on sites like Tmall, JD, VIP, Douyin, HKTVmall, Lazada and Amazon).

Apparently, customers can go to some malls to design their own jewelry and try it on virtually before having it made:

Note that Chow Sang Sang has never entered into any licensing or franchising arrangements on its name as it owns and operates every one of its shops. At the end of December 2022, the Company had 977 stores with a total workforce of over 10,000 and 2022 turnover exceeded HK$20,557M / US$2.6B.

Yeung noted that while Covid-related lockdowns over the past couple of years resulted in the under-earnings of its jewelry shops relative to history, the stock has a low valuation relative to assets and strong brand recognition. The Company is also expected to be a key “reopening” beneficiary.

According to Google Finance, the stock has a P/E of 14.68 with a 2.85% dividend yield.