Emerging Market Links + The Week Ahead (April 29, 2024)

China iPhone sales plunge, bubble tea IPO fizzles + China-HK IPO market struggles, more Yuan devaluation speculation, SA Inc struggles in Africa, EM stock picks & the week ahead for emerging markets.

Apple iPhone sales are down 25% in China and Pavel Durov, the Founder of Telegram, has noted that his app is the #1 most downloaded mobile app in China on Android (according to Google Play) - despite being blocked and the need to use a VPN to access it. He added:

Unlike iPhones, most Android phones allow sideloading apps outside app stores — such as the direct version of Telegram (https://telegram.org/android) — so more users from China will migrate to Android.

Once again, Apple shot itself in the foot with its centralized “walled garden” app policies. As a result of this change, the iPhone market share in China will keep shrinking.

Durov’s take makes complete sense as I previously used a BlackBerry which was a great phone. As I recall, either BlackBerry or my specific handset stopped supporting WhatsApp - a very important app in Malaysia and certain other countries. I then switched to Taiwanese and Chinese handsets that use Android to avoid future headaches as most app developers did not want to deal with BlackBerry’s operating system.

Meanwhile, the bubble tea IPO bubble may be bursting before even getting started as shares of Chabaidao fell 26.9% from their IPO price of HK$17.50. There are more bubble tea IPOs in the pipeline, but perhaps they may want to reconsider their listings as the Chinese and Hong Kong markets continue to struggle.

Finally, IOL has noted that SA Inc struggles to find a footing in lucrative African markets. I would have thought thought that big South African companies would be well positioned to have the same level of success that Lebanese, South Asian and Coptic Greek entrepreneurs seem to have all over Africa. Or at-least they would be in a better position to succeed than their European-American corporate counterparts. Maybe some South African readers can shed some insight in the comments section about why some high-profile South African companies have struggled in the rest of Africa...

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

🌐 🇨🇳 Can Temu Take on Amazon.com & the Rest of the World?

Amazon may regret giving up the “sinking markets” (less than $40 orders) to the Chinese; what's wrong with US Big Tech; & my experience ordering from Temu, Amazon, Sea Limited's Shoppe & Lazada.

🌐 EM Fund Stock Picks & Country Commentaries (April 28, 2024) $

What key valuation multiples miss/differ on, why non-AI stock laggards are not broken companies, JSE challenges + SA bonds, We Buy Cars Holdings, Argentina's challenges, overlooked small caps, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Following a great launch quarter, China iPhone sales are pretty bad so far in 2024

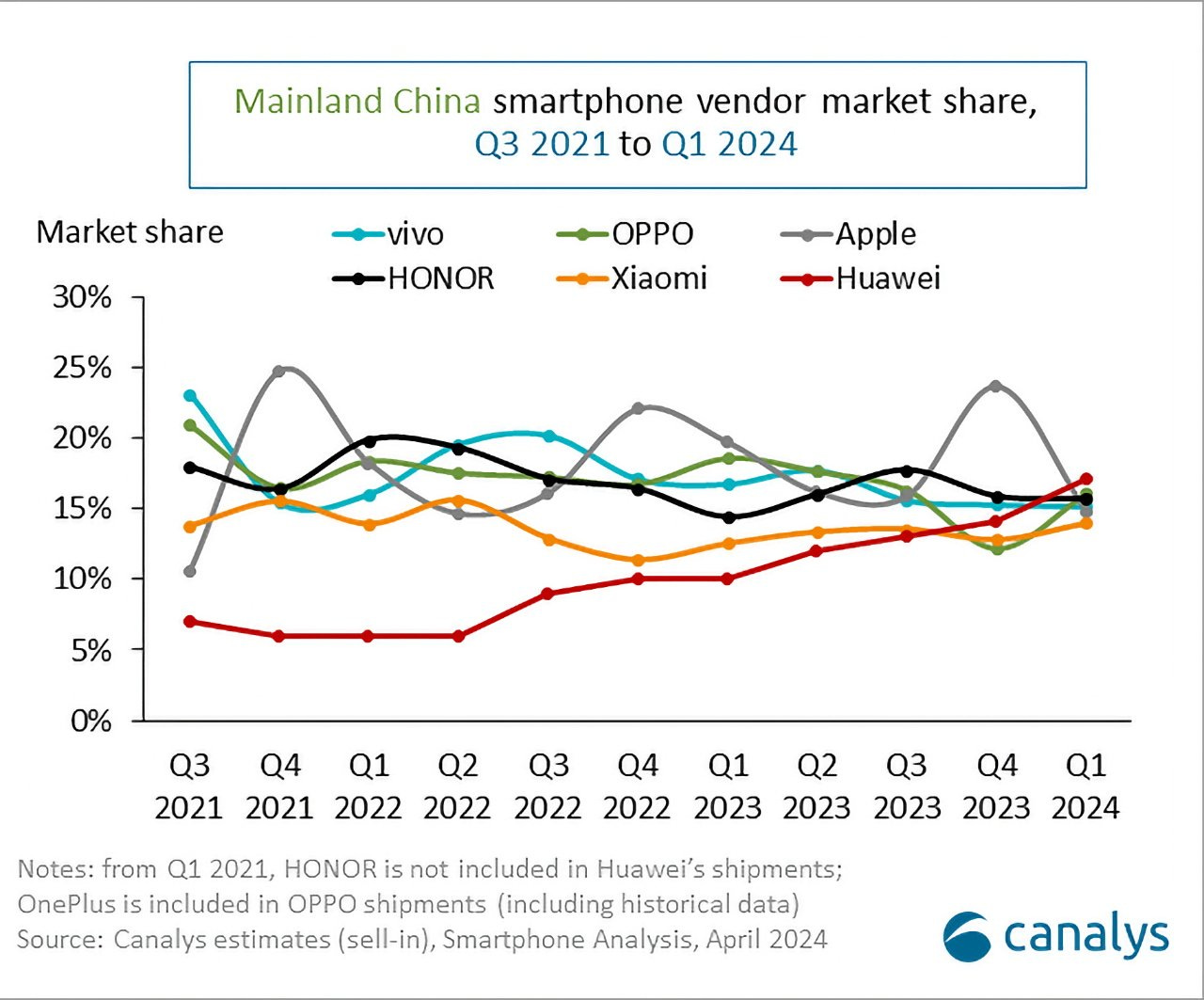

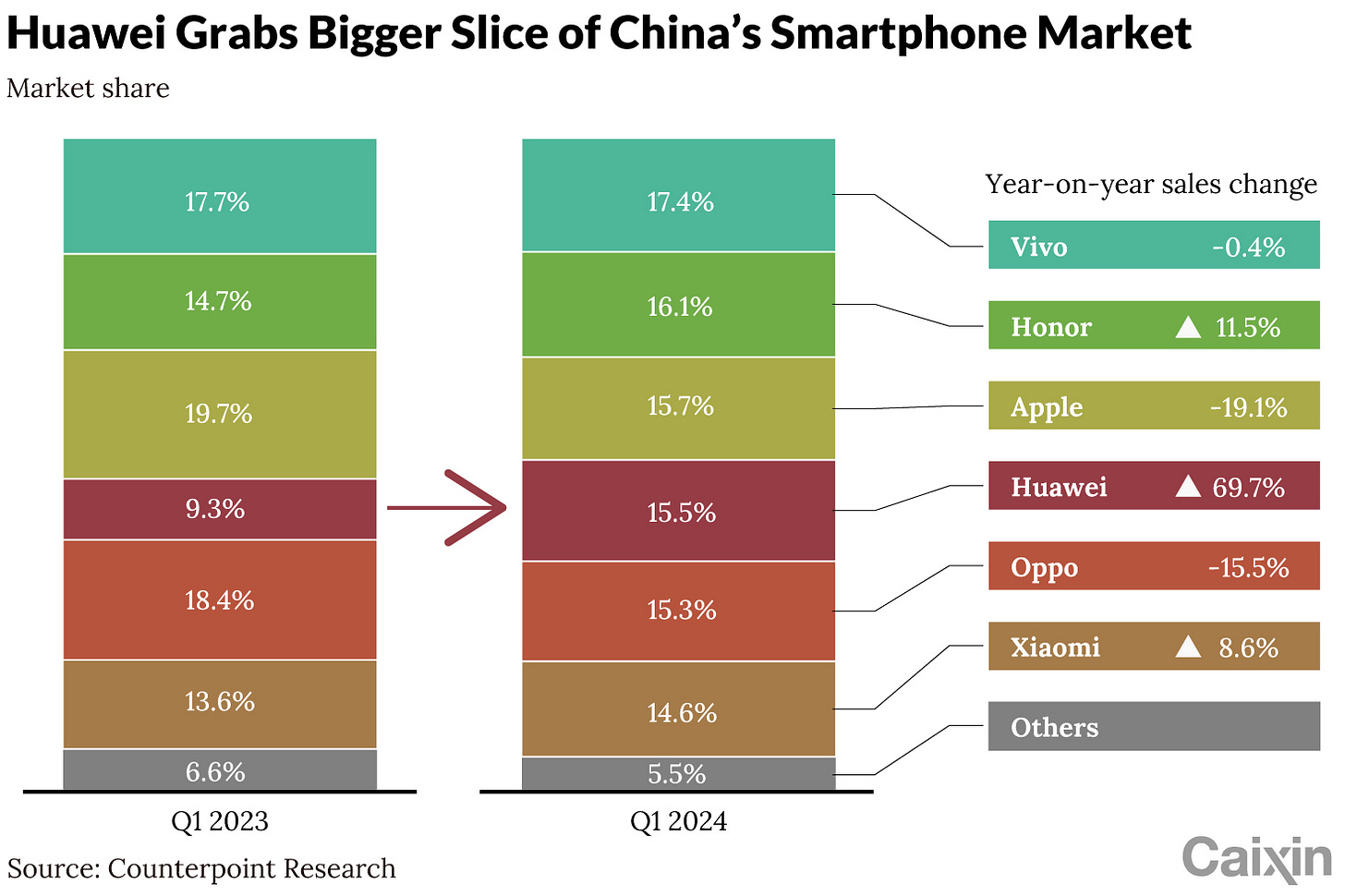

Figures from Counterpoint Research have already claimed that Apple's iPhone sales for Q1 2024 in China were down 19.1% year over year. Now Canalys says that sales were significantly worse with a 25% drop.

Apple's decline was the worst amongst the top five vendors, selling 10 million iPhones, dropping from a 20% market share to a 15% one. That compares to the top reseller, Huawei, which shipped 11.7 million smartphones, rising to 17% share from 10% in Q1 2023.

Pavel Durov, the Founder of Telegram, has also posted this on his Telegram channel:

🇨🇳 Chart of the Day: Huawei Smartphone Shipments Surge in First Quarter (Caixin) $

🇨🇳 BYD (1211 HK) 1Q24 Preview: No Concern for Slow Quarter, To Achieve a Strong Year, 60% Upside (SmartKarma) $

We believe the revenue growth will be slow in 1Q24, but it will still be rapid for the full year 2024.

We also believe the operating margin will hit the historical high in 1Q24, but it will be just stable for the year 2024.

We conclude the stock has an upside of 60% for the year end 2024. Buy.

🇨🇳 Li Auto joins price war with major discounts following Tesla and BYD cuts (Caixin) $

Li Auto (NASDAQ: LI) has announced discounts of between 6% and 7% across its lineup following Tesla’s price cuts in China.

Aiming to cement its reputation as a high-end brand and maintain profit margins, Li Auto has until now strived to avoid the price war. But with competition in China’s electric vehicle (EV) market becoming increasingly fierce since the second half of 2023, Li Auto has had to choose between sales and profit margin.

🇨🇳 In Depth: Geely Auto comeback gets into gear as EV sales soar (Caixin) $

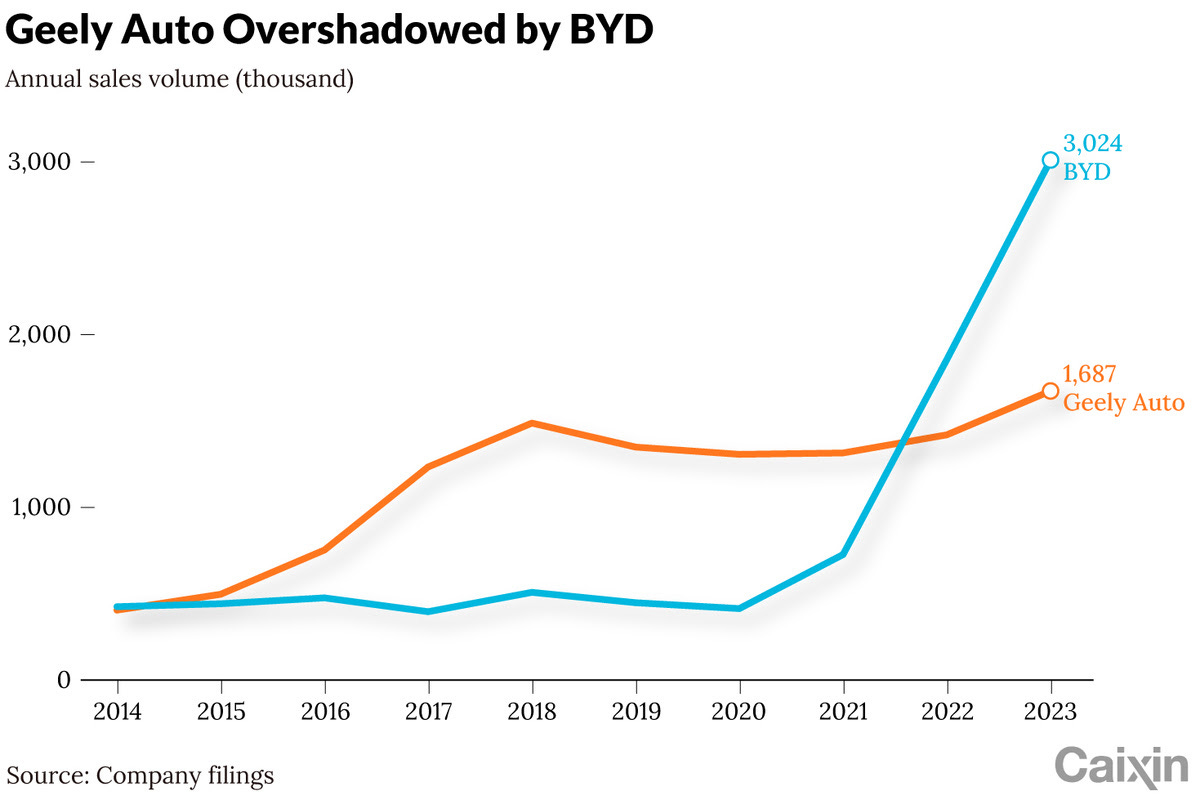

In January, Geely Automobile Holdings Ltd. (吉利汽车) sold over 213,000 cars, surpassing electric vehicle (EV) manufacturer BYD Company (HKG: 1211 / SHE: 002594 / OTCMKTS: BYDDY / BYDDF) to become China’s top carmaker by sales. A one-month lead is no guarantee of success for the whole year, but for Geely Automobile Holdings (HKG: 0175), which has trailed BYD for the last two years, the result is worth celebrating.

The Hong Kong-listed company is the flagship subsidiary of Chinese auto conglomerate Zhejiang Geely Holding Group Co. Ltd.

🇨🇳 How did a Sequoia-backed founder become a Buddhist monk (Momentum Works)

It has recently emerged that Chen Tao (陈涛), founder of Chinese ecommerce SaaS ERP company Centaur, (圣特尔)has a new identity – Buddhist monk Bodhi.

Centaur, founded in 2004, developed China’s first SaaS-based ecommerce ERP system EDianbao (E店宝) in 2006.

According to an EY analysis of the financials of 22 China-based SaaS companies in 2022, while most of these companies had improved gross margins to above 50%, the high sales & marketing (i.e. customer acquisition) cost and high R&D costs (i.e. more features and customisation) meant overall profitability remained dismal.

Not everyone is losing hope, though. Publicly listed Glodon Co Ltd (SHE: 002410), a developer of software tools for the basic construction industry, now has a market cap of CNY16.85 billion (US$2.33 billion) and a P/E ratio of 144. The company has developed real product expertise in the particular sector that no other competitor can match.

🇨🇳 $CAAS Quick Pitch (The Chop Wood, Carry Water Newsletter)

China Automotive Systems (NASDAQ: CAAS) is one of the largest power steering components and systems suppliers in China.

China Automotive Systems, Inc. sits among China's top suppliers of power steering components and systems, serving over 60 vehicle manufacturers, including notable names like FAW Group and Dongfeng Group. Their collaborations extend to companies such as Shenyang Brilliance Jinbei, Chery Automobile, Xi’an BYD Automobile, and Zhejiang Geely.

Expected Gain: Given that China Automotive Systems' current trading level is lower than its cash and equivalents, there is substantial room for growth in its stock price, which could potentially increase by 100%.

🇨🇳 EHang seeks capital refueling as its self-flying vehicles inch toward grand takeoff (Bamboo Works)

The maker of autonomous aerial vehicles is seeking to raise up to $100 million in a public offering of new shares

EHang Holdings Ltd (NASDAQ: EH) said it plans to sell up to $100 million worth of new shares in New York, more than double the amount it raised in its 2019 IPO

The company is getting close to commercializing its self-flying aircraft, including its recent receipt of a regulatory certificate allowing it to mass-produce its flagship product

🇨🇳 CIMC Enric (3899 HK): Robust Order Backlog Outshined Lower 1Q24 Revenue (SmartKarma) $

Although the 1Q24 revenue of [advanced intelligent manufacturing of clean energy equipment stock] Cimc Enric Holdings Ltd (HKG: 3899 / FRA: E8F / OTCMKTS: CIMEF) has edged down by 6.8%, this is not a concern as its order backlog suggested a resilient pipeline.

New orders signed increased by 35.7% with that for clean energy surged 100.2%. Order backlog of Rmb26.9bn represents a growth of 41.9% YoY and 17.8% against end-FY23.

Management also commented that there is a marked improvement in gross margin for 1Q24 and expects this trend to continue. Its 10.8x PER is inexpensive.

🇨🇳 Revisiting China Merchants Ports (144 HK) (SmartKarma) $

Four years ago, almost to the day, Bloomberg ran an article, "China Merchants Group Ltd. is exploring taking China Merchants Port Holdings private". China Merchants Port Holdings Co Ltd (HKG: 0144) popped 23%.

CMP gave back (most) of that gain a month later. Shares are up just ~10% since.

CMP's implied stub is bouncing around a multi-year low; and the simple ratio (CMP/ Shanghai International Port Group Co Ltd (SHA: 600018)) is around an all-time low.

🇨🇳 Asia Cement hardens into loss column with no relief in sight (Bamboo Works)

The company swung into the red in the first quarter as weak demand from China’s struggling property market pushed cement prices to fresh lows

Asia Cement (China) Holdings Corp (HKG: 0743 / FRA: 4OJ / OTCMKTS: AMNTF) warned it lost nearly 130 million yuan in the first quarter, reversing a 40.7 million yuan profit in the year-ago period

The cement maker’s situation is unlikely to improve in the near-term as prices remain in the doldrums due to weak demand from the struggling property sector

🇨🇳 Fosun International on cusp of new ‘asset-light’ era with latest sale (Bamboo Works)

The conglomerate is selling its stake in multinational insurer Ageas (EBR: AGS), extending a slimming exercise touched off by a liquidity crisis in 2022

Fosun International (HKG: 0656 / FRA: FNI / OTCMKTS: FOSUF / FOSUY)’s total debt-to-capitalization ratio stood at 50.4% at the end of last year, down 2.9 percentage points from the previous year

The company recently announced the sale of most of its stake in Belgian insurer Ageas, and has raised 57.3 billion yuan from similar asset sales over the past two years

🇨🇳 Hillhouse boosts Longi position after probe, as it pivots to global focus (Bamboo Works)

The private equity firm was told by China’s securities regulator to buy back shares in the solar company after selling them without the necessary disclosure

Hillhouse Capital has raised its shareholding in LONGi Green Energy Technology Co Ltd (SHA: 601012) back to 5% after being investigated by the Chinese securities regulator for violating disclosure rules

Despite its bid to go global and shed its China affiliation, Hillhouse promised the Chinese regulator it would continue to invest and increase its asset allocation in China

🇨🇳 New Horizon Health launches probe into disputed sales figures (Bamboo Works)

The provider of cancer-screening products issued a positive profit alert in January, but the full earnings report has yet to appear after auditors raised questions about the company’s revenues

New Horizon Health (HKG: 6606 / FRA: 6YZ / OTCMKTS: NHZHF) has brought in experienced accountants as independent directors and set up a special committee to investigate the allegations

The controversy revolves around the company’s revenue accounting method, in which over-shipments of goods to distributors could inflate sales figures

🇨🇳 LVMH remains committed to China even amid sluggish sales (Caixin) $

LVMH Moët Hennessy Louis Vuitton (EPA: MC / OTCMKTS: LVMUY / LVMHF) is not worried about sales pressure on the Chinese mainland as long as its clientele there is growing overall, according to Chief Financial Officer Jean-Jacques Guiony.

The world’s largest luxury goods group is looking to attract more Chinese shoppers amid a broader slowdown in demand for expensive bags, jewelry, and perfume. Many consumers have been making their purchases outside China, especially in Japan, where the yen is weak, the French conglomerate disclosed in its 2024 first-quarter earnings released last week.

🇨🇳 Anta/Li Ning/Xtep: China Sportswear 1Q24 Update (SmartKarma) $

ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF), Li Ning (HKG: 2331 / FRA: LNLB / FRA: LNL / OTCMKTS: LNNGY / LNNGF), and Xtep (HKG: 1368 / FRA: 4QI / OTCMKTS: XTEPY / XTPEF) have announced 1Q24 operational updates, with additional color given in post conference calls.

Anta: Retail sales started to accelerate in mid-March, and March were better than January and February.

Li Ning: offline retail sales down low-single-digit in 1Q24, driven by wholesale down mid-single-digit, while retail grew mid-single-digit. E-commerce grew 20-30% yoy.

🇨🇳 Fosun Tourism (1992 HK): A Long-Awaited Upturn (SmartKarma) $

Fosun Tourism Group (HKG: 1992 / OTCMKTS: FSNGF) saw a healthy 15.8% overall business volume growth in 1Q24, with net profit sustaining improvement. This should justify a catch-up in share price.

The cumulative bookings for Club Med for 1H24 have increased 13% YoY, while those for 2H24 have increased 10%. Positive forward bookings indicate an encouraging outlook.

Four new Club Med resorts to be opened in 2024 and the increase in attractiveness of Hainan after it turns into a duty-free island by 2025 are both drivers.

🇨🇳 Is Baozun’s risky leap into brand management starting to pay off? (Bamboo Works)

The provider of e-commerce services says it is turning the corner in its ‘journey of transformation’

Baozun (NASDAQ: BZUN)’s revenues rose 5% last year following its acquisition of Gap China, which represented 14% of total annual sales

Product sales from the company’s older e-commerce business fell by 21% last year, while e-commerce services revenue also slumped by 5%

🇨🇳 Luk Fook 590.HK – Losing Its Shine? (SmartKarma) $

Luk Fook Holdings (International) (HKG: 0590 / FRA: LUY1 / OTCMKTS: LKFLF)

March Same-Store sales in China disappoint mainly due to diamond jewellery demand

Overall, gold demand in China continues to rise both in the retail and the official sector

Visitor arrivals to Hong Kong pick up but are still ~40% below pre-Covid levels.

🇨🇳 Faded Sun Art seeks to shine again in China’s changing grocery market (Bamboo Works)

The former hypermarket superstar warned it fell into the red last year, as online grocers continued to eat its lunch

Sun Art Retail Group Ltd (HKG: 6808 / FRA: SRI / OTCMKTS: SURRF) lost 1.7 billion yuan in its latest fiscal year, as it tries to overhaul its business in the face of competition from grocers with stronger online components

The loss owed largely to store closure-related charges and the company’s falling average value per transaction

🇨🇳 FAST NEWS: Chabaidao’s weak debut bodes poorly for stream of new bubble tea stocks (Bamboo Works)

The Latest: Shares of Sichuan Baicha Baidao Industrial (HKG: 2555), also known as Chabaidao, fell 26.9% from their IPO price of HK$17.50 to close at HK$12.80 in their Tuesday trading debut in Hong Kong.

Looking Up: The international portion of the offering, which typically goes to institutional investors, was slightly oversubscribed. As a result of that relatively strong demand, 95.14% of the shares offered in the IPO went to the international portion.

Take Note: The local portion of the company’s public offering in Hong Kong was only about 50% subscribed, reflecting lukewarm interest among small retail investors.

🇨🇳 The Bubble Tea Market | Nayuki Holdings and interesting Midcaps in Hong Kong (Roiss' Conclusions)

An overlooked eastern consumption trend.

In the first quarter of 2024, Nayuki Holdings (HKG: 2150 / OTCMKTS: NYKHF) had 1597 self-operated and 205 franchised stores. Due to rising nationalism in China, the company rebranded their stores to the Chinese pronunciation of Nayuki: Naixue in late 2022.

The company went public at the perfect time in June 2021 with net proceeds from the public offering being HKD$4,842.4 million. Since then the companies stock has been in a free fall, and as of writing the stock price is at HKD$2.26 - a 86.43% decline - and the market cap stands at HKD$3.88b. This is despite improving operations with revenues growing 20% in 2023 and the company achieving profitability.

🇨🇳 Autostreets in the driver’s seat as China gets set for used car trading boom (Bamboo Works)

The country’s leading used car trader has passed its listing hearing in Hong Kong, positioning it to complete its IPO in the coming months

Autostreets is reportedly aiming to raise $100 million or more in a Hong Kong IPO, seeking a rich valuation as China’s leading used-car trader

Growth of used car sales in China is expected to accelerate in the next five years as Beijing promotes the sector and consumers become more budget conscious

🇭🇰 TVB tunes into new era of profits, ending six-year losing streak (Bamboo Works)

Hong Kong’s leading broadcaster said it expects to return to profitability in the second half of this year with the success of its “Queen of News” drama series

Television Broadcasts Ltd (HKG: 0511 / FRA: TBCN / OTCMKTS: TVBCF / TVBCY) forecast it would return to the black in the second half of this year, banking on a rebounding ad market and the recent success of its “Queen of News” drama series

Hong Kong’s leading broadcaster said its MY TV Super livestreaming business reported a 30% gain in digital advertising revenue in the first quarter

🇭🇰 Modern Dental Group (3600.HK) (Healthy Stock Picks)

Global provider of low cost dental prosthetics

Modern Dental Group (HKG: 3600 / FRA: 1MD) is a low cost dental laboratory company. In a very fragmented market the company is the largest global player in terms of labs and distribution network.

Riding on the tailwind of a larger elderly population in need of dental care, MDG has grown revenue with a 15% CAGR the past 10 years. Due to the HK bear market this non-cyclical high quality small cap can be bought at 2025 expected EV/EBITDA below 6x and P/E below 10x including an expected forward dividend above 3.5%.

🇭🇰 SITC – the Ryanair of container shipping stocks (Sweet Stocks)

(1308.HK, $5.3bn market cap, $16m ADVT, 48% float)

SITC International Holdings (HKG: 1308 / FRA: 7S8 / OTCMKTS: SITIY / SITIF) is a quality growth shipping company, specialised in the intra-Asia trade. Like the famous Irish low-cost airline, its niche positioning generates defendable competitive advantages that enable it to sustain profitable growth over the long term in an otherwise unattractive and cyclical industry.

SITC was nicely profitable every year during the tough 2010s, when overcapacity dogged the industry and forced peers into losses. Then when freight rates spiked due to COVID, the boom generated multi-billion dollar windfall profits and dividends, and also whipsawed the stock.

🇭🇰 Asian Dividend Gems: Eagle Nice International Holdings (Asian Dividend Stocks)

Eagle Nice International Holdings (HKG: 2368)' dividend yield averaged 9.2% from FY 2019 to FY 2023. Its annual dividend payout averaged 72.2% in the same period.

Eagle Nice (Intl) Hldgs is mainly engaged in the design and manufacture of sportswear for adults and children on an OEM basis. [Taiwanese footwear manufacturer] Yue Yuen Industrial Holdings (HKG: 0551 / FRA: YUE1 / OTCMKTS: YUEIY / YUEIF) is the largest shareholder.

Eagle Nice Holdings also has attractive valuations and consistent growth in sales and profits.

🇭🇰 Keck Seng Investments (0184.HK) (Small Cap Value Investing with Phil)

When you achieve triple-digit growth in profit while operating in the hotel business

And now let me tell you why I believe that this stock could double in the near future:

Double-digit growth in revenue, triple digit growth in profit, and a P/E below 3

Manages hotels featuring prominent and widely recognized brands situated in prime locations

Operates within an industry characterized by foreseeable revenue streams

Insiders own 74% of the company

Keck Seng Investments (HKG: 0184 / FRA: KEC / OTCMKTS: KCKSF) holds property investments within mainly the hotel sector across five countries.

🇹🇼 TSMC – Let’s be realistic; this is a no-brainer today (Rijnberk InvestInsights)

In this post, we take a closer look at semiconductor giant Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM), discussing its recent results, the threat from competition and China, and its growth prospects.

🇰🇷 HD Hyundai Marine Solution (443060 KS) IPO: No Passive Buying Near-Term (Smart Karma) $

HD Hyundai Marine Solution [HD Hyundai Group] (443060 KS) is looking to raise KRW 742bn (US$540m) in its IPO, valuing the company at KRW 3,707bn (US$2.69bn). Listing is expected to be in early-May.

Competition for the shares has been fierce with institutional investors indicating demand for 201x the number of shares on offer at prices higher than the top end of the range.

Barring a doubling of the stock price, the earliest that the stock will be added to major indices is December 2024. So, no passive buying in the short-term.

🇰🇷 HD Hyundai Marine Solution: IPO Book Building Results Analysis (Douglas Research Insights) $

HD Hyundai Marine Solution [HD Hyundai Group]'s IPO price has been determined at 83,400 won per share, which is at the high end of the IPO price range.

A total of 2,021 institutional investors participated in this IPO book building. The demand ratio was 201 to 1. HD Hyundai Marine Solution will start trading on 8 May 2024.

Our base case valuation of HD Hyundai Marine Solution is target price of 98,254 won per share, which represents an upside of 18% from the IPO price.

🇰🇷 Korea Small Cap Gem #28: Chokwang Leather - A Cheaper Way to Invest in Berkshire Hathaway (Douglas Research Insights) $

At the end of 2023, Chokwang Leather (KRX: 004700) owned 190.3 billion won worth of Berkshire Hathaway shares, which represents 56% of Chokwang Leather's market cap.

Chokwang Leather also has 3.1 million treasury shares (46.6% of outstanding shares). It has the highest levels of treasury shares as a percentage of outstanding shares among Korean stocks.

Chokwang Leather is likely to be one of the key companies to be targeted to improve its corporate governance as part of the Corporate Value Up program.

🇰🇷 A Nasty Power Struggle Between ADOR CEO and HYBE (Douglas Research Insights) $

A nasty power struggle between ADOR CEO Min Hee-Jin and [K-Pop Stock] HYBE (KRX: 352820) has erupted which is likely to continue to negatively impact HYBE's share price in the next several months.

ADOR CEO Min Hee-Jin owns an 18% stake in ADOR which was founded in 2021. HYBE owns the controlling 80% stake in ADOR.

Given the nasty fight between ADOR and HYBE, it is likely that the two companies (including ADOR's CEO Min Hee-Jin) are likely to part their ways.

🇮🇩 Bank Central Asia (BBCA IJ) - Credentials Remain Intact (SmartKarma) $

Bank Central Asia (BCA) (IDX: BBCA / FRA: BZG2 / OTCMKTS: PBCRF) surprised with a strong set of 1Q2024 numbers driven by unseasonably strong loan growth coupled with continuing growth in CASA, helping to underpin NIMs.

Loan growth was driven by corporate loans with investment loans outpacing working capital loans together with SME loans and consumer loans, especially mortgages, autos, and personal loans.

Digital banking initiatives drove customer numbers and transactions, whilst improving operating efficiencies. Credit costs continue to come down with falling loans at risk. Valuations remain high but credentials remain intact.

🇲🇾 Malaysia PM denies nation looking at second casino (GGRAsia)

Malaysia’s political leader, Prime Minister Anwar Ibrahim, described on Thursday as “a lie” and “not true” a Bloomberg report that the Malaysian government was mulling a second casino for the country, at struggling real estate development Forest City in Johor next door to Singapore.

Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) runs what is currently Malaysia’s only casino resort, Resorts World Genting, at Genting Highlands, outside the national capital Kuala Lumpur.

The Bloomberg report said the current ceremonial monarch of Malaysia, Sultan Ibrahim Iskandar, who is also sultan of Johor state, held more than 20 percent of the joint venture vehicle – involving Chinese real estate firm Country Garden Holdings (HKG: 2007 / OTCMKTS: CTRYF / OTCMKTS: CTRYY) – that is the master developer of Forest City.

🇲🇾 Bloomberg Casino article exposes the intricacies of how business is done by the elite (Murray Hunter)

The recent Bloomberg article exposing that informal talks had taken place about granting a casino license at Forest City was very quickly denied by prime minister Anwar Ibrahim.

The Bloomberg article was most probably an intended leak to gauge public opinion. Prime minister Anwar is in a bind where he must assist the development of Forest City and at the same time maintain his “Islamic credentials” with voters in the Malay heartlands. This is the biggest dilemma in the way of granting such a license.

This leak tells us something very important about the Madani government. The Madani government is one of pragmatism, not ideology. This is the biggest take-away from the Bloomberg article. There is some recognition that a casino in Forest City could be a game changer for the southern Johor development.

🇵🇭 PLDT: Spotlight On Broadband Business And EBITDA Guidance (Seeking Alpha)

PLDT (NYSE: PHI)'s home broadband business has the potential to grow in the long run, notwithstanding a negative short-term outlook.

The company is at risk of delivering a Q1 results miss, considering the current expectations for the Philippines' economy.

A Hold rating for PHI stock is maintained following an evaluation of the broadband business' prospects and its financial guidance.

🇵🇭 Jollibee Foods: The Good And The Bad (Rating Downgrade) (Seeking Alpha)

The key positive for Jollibee Foods (PSE: JFC / OTCMKTS: JBFCF / JBFCY) is that the company is making good progress with its plans to expand in overseas markets.

JBFCF's key negative is that the growth outlook for its business operations in the Philippines is unfavorable, considering inflationary pressures.

After assessing both the good and bad for the stock, I have chosen to award a Hold rating to Jollibee Foods.

🇸🇬 iFAST’s Dividend Climbs 30% as its Latest Quarter Net Profit Leaps 387%: 5 Things Investors Need to Know (The Smart Investor)

The fintech saw strong growth from its Hong Kong ePension project while its digital bank division attracted higher deposits.

Last year, iFAST Corporation Limited (SGX: AIY / FRA: 1O3 / OTCMKTS: IFSTF) reported a strong set of earnings after receiving a huge boost from its Hong Kong ePension contract.

Here are five things that investors should know about the fintech’s latest results.

A sparkling set of results

AUA hits a record high amid healthy net inflows

Hong Kong ePension contract flowing smoothly

More digital bank initiatives

Advancing its three-year plan

🇸🇬 Mapletree Industrial Trust Ekes Out a DPU Increase for 4Q FY2024: 5 Highlights from the REIT’s Latest Earnings (The Smart Investor)

The industrial REIT has reported a year-on-year increase in its DPU for its latest quarter

The next Mapletree REIT to report its full fiscal 2024 (FY2024) earnings is Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF), or MIT.

Read on to find out five highlights from the industrial REIT’s latest financial report.

Financial performance driven by new projects

A slight dip in occupancy

Stable debt metrics

A diversified tenant base

Capital recycling efforts

🇸🇬 Frasers Centrepoint Trust Reports a Slight Dip in DPU: 5 Highlights from the Retail REIT’s Latest Earnings (The Smart Investor)

The suburban retail REIT’s Tampines 1 is still undergoing an AEI.

The next REIT in line to report its results is Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF), or FCT.

The retail REIT went through an interesting growth phase where the manager acquired an additional 24.5% stake in NEX Mall in Serangoon back in January this year.

Here are five highlights from its latest earnings report.

A resilient financial performance

A slightly lower cost of debt

Robust operating metrics

Continued rise in footfall and tenant sales

Tampines 1 AEI progressing well

🇸🇬 Mapletree Pan Asia Commercial Trust Reports a DPU Increase: 5 Highlights from the REIT’s Latest FY2024 Earnings (The Smart Investor)

The commercial REIT pulls off an impressive turnaround in the final quarter of the current fiscal year.

As the earnings season rolls along, the next REIT to report its earnings is Mapletree Pan Asia Commercial Trust (SGX: N2IU / OTCMKTS: MPCMF), or MPACT.

As a recap, MPACT owns 18 commercial properties across five territories – Singapore (5), Hong Kong (1), China (2), Japan (9), and South Korea (1) with total assets under management (AUM) of S$16.5 billion as of 31 March 2024.

Here are five highlights from MPACT’s latest earnings release.

A year-on-year rise in DPU for 4Q FY2024

Stable debt metrics

High occupancy with positive rental reversions

Improved tenant sales for VivoCity and Festival Walk

Revitalising mall spaces to improve footfall

🇸🇬 CICT’s Net Property Income Continues to Climb: 5 Takeaways from its Latest Business Update (The Smart Investor)

The retail and commercial REIT continues to impress with a sparkling set of financial and operating metrics.

CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF) or CICT recently released its first quarter 2024 (1Q 2024) business update and once again reported strong financial and operating metrics.

Here are five takeaways from the REIT’s latest report card.

Higher revenue and NPI

Stable debt metrics

Robust operating metrics

Retail sales going strong

Asset enhancements in progress

🇹🇭 Home Product Center - 1Q24E Earnings to Increase 3% YoY and 9% QoQ (SmartKarma) $

Home Product Center PCL (BKK: HMPRO / HMPRO-F / OTCMKTS: HPCRF)

KTX maintains a Neutral rating (FV = Bt11.23, based on the earnings yield and a required rate of return of 4.74%).

The valuation metrics suggest neutral views on the current fundamentals, long-term growth prospects, and tactical aspects.

We have a neutral view on the 1Q24E earnings, which will be released on April 30.

🇮🇳 MakeMyTrip: Favorable Growth Outlook With Profitability Improvement Potential (Seeking Alpha) $

Looking forward, India's online travel market has the potential to grow significantly in line with the expansion of the country's internet user base and middle-income population.

Makemytrip (NASDAQ: MMYT) is a good play to capitalize on the Indian online travel industry's future growth, as it is the country's largest Online Travel Agency or OTA.

I assign a Buy investment rating to MakeMyTrip in view of the company's positive financial prospects.

🇮🇳 India’s central bank bans Kotak Mahindra from signing up digital customers (FT) $ 🗃️

The RBI is stepping up efforts to crack down on the consumer-finance sector

The Reserve Bank of India said it found “serious deficiencies” in IT risk and security governance over two consecutive years at Kotak Mahindra Bank (NSE: KOTAKBANK / BOM: 500247), a prominent private sector lender that was founded by Uday Kotak, one of India’s most influential financial figures.

🇲🇺 Alphamin: The Best Is Yet To Come (Seeking Alpha) $

Alphamin Resources Corp (CVE: AFM / FRA: 21L / JSE: APH / OTCMKTS: AFMJF) is a leading producer of tin, the forgotten transition metal.

Alphamin's Mpama South expansion project is nearing completion just as tin prices are recovering. This could provide a double tailwind for the company.

I believe the future is bright for Alphamin and continue to recommend its shares as a buy.

🇸🇦 Plastics - the future of oil (Calvin's thoughts) & Middle Eastern oil companies will continue their push into chemicals (c&en)

Insight into why all the Middle Eastern oil majors are on the hunt for petrochemical companies

Middle Eastern companies like Saudi Aramco and ADNOC [Abu Dhabi National Oil Company] are currently negotiating the acquisition of assets from a number of global petrochemical companies:

Covestro AG (ETR: 1COV / FRA: 1COV / OTCMKTS: CVVTF)

Jiangsu Shenghong Petrochemical Industry Group / Jiangsu Eastern Shenghong (SHE: 000301)

Shandong Yulong Petrochemical

Stakes or assets have already been acquired in:

The question is, why are Middle Eastern companies so bullish on plastics? The answer is, they have to be.

🇿🇦 DRDGold Should Have A Strong Second Half Of FY24 (Seeking Alpha)

DRD Gold (NYSE: DRD)’s gold production and unit costs deteriorated in H1 FY24 due to delays in the commissioning of two high-volume sites.

The issues have been resolved and I expect gold production for the second half of the fiscal year to be around 90,000 ounces.

I think high gold prices and improved production could boost the EV/EBITDA ratio above 10x by the end of the calendar year.

🇿🇦 Anglo American rejects R741 billion bid from BHP (IOL)

Anglo-American (LON: AAL / JSE: AGL / OTCMKTS: NGLOY) has rejected BHP’s $39 (R741) billion bid for its assets, excluding the platinum and iron ore units.

On Friday morning, Anglo American, whose shares surged on the JSE after announcing the proposed offer by BHP on Thursday, said the bid significantly undervalues its worth.

🇿🇦 Anglo American shines on JSE after BHP’s R740bn all-share bid (IOL)

Anglo-American (LON: AAL / JSE: AGL / OTCMKTS: NGLOY) share price rallied by as much as 15.5% to R593.55 per share in afternoon trade on the JSE yesterday following the announcement by the company that it had received an unsolicited and conditional share acquisition offer from its bigger rival, BHP.

BHP Group (NYSE: BHP)’s daring $39 billion (R741bn) offer to acquire its smaller rival under an all-share buyout scheme is expected to shake up the global mining industry, create a large mining firm with heavy tentacles over world production of copper.

🇿🇦 BHP doesn’t want Anglo American assets exposed to SA’s operational constraints, experts say (IOL)

In an interview with Business Report, Cratos Asset Management portfolio manager Roy Topol said on Friday that this was because under its rejected initial offer, BHP Group (NYSE: BHP) did not want exposure to South Africa, which is suffering operational constraints such as ports, rail, water and electricity inefficiencies.

“They (BHP) seemed to be keen on Anglo-American (LON: AAL / JSE: AGL / OTCMKTS: NGLOY)’s highly-valuable copper assets but don’t want South African exposure, as the offer specifically excludes Kumba and Amplats, which collectively make up around a third of Anglo’s value,” Topol said.

🇿🇦 SA Inc struggles to find footing in lucrative African markets (IOL)

“The bulk of the SA Inc companies that ventured into the African regions have battled to adapt to the dynamic landscape, and subsequently reduced their presence where possible,” Modisane [a senior equity sales trader at Absa Corporate and Investment Banking] said.

Food retailers such as Pick 'n Pay (JSE: PIK / FRA: PIK) and Shoprite Group (JSE: SHP), as well as financial services providers – including Standard Bank (JSE: SBK / FRA: SKC2 / OTCMKTS: SGBLY), Nedbank (JSE: NED / FRA: NCO / OTCMKTS: NDBKY / OTCMKTS: NDBKF), FNB, Absa (JSE: ABG / OTCMKTS: AGRPY) and Sanlam Ltd (JSE: SLM / FRA: LA6A / OTCMKTS: SLMAF) – are among South African companies with operations in some African markets.

“South African businesses have generally not done well abroad, including forays into the rest of the continent,” analysts at Standard Bank told BR on Friday.

Telecoms companies including MTN Group (JSE: MTN) and Vodacom (JSE: VOD / OTCMKTS: VODAF / VDMCY) have also been finding the going tough in some key regional markets, such as the Democratic Republic of Congo, Nigeria and elsewhere.

Shoprite has sold off its Nigerian operations and “reduced exposure” to the African regions.

“Retailers ventured into Africa and learnt some harsh lessons and subsequently scaled back, and exited where possible,” explained Modisane.

🇿🇦 Capitec’s success is a beacon of hope for new entrants as they eat legacy banks’ lunch (IOL)

AS Capitec Bank (JSE: CPI / OTCMKTS: CKHGY / CKHGF) shot the lights out with its stellar annual results yesterday (Tuesday), it is a beacon of hope that the South African banking landscape is changing and it is possible to challenge the top five players.

The lunch of ye old South African monopolistic banking playground – dominated by Standard Bank (JSE: SBK / FRA: SKC2 / OTCMKTS: SGBLY), FirstRand (JSE: FSR / FRA: FSRA / OTCMKTS: FANDY), Absa (JSE: ABG / OTCMKTS: AGRPY), Nedbank (JSE: NED / FRA: NCO / OTCMKTS: NDBKY / OTCMKTS: NDBKF) and Investec Group (LON: INVP / JSE: INL / INP) – is up for grabs.

This has been in the works for years, but a plethora of new entrants to the South African landscape is giving customers more choice and if they have a beef with one lender it is easy to swop to another.

🇿🇦 Telkom is investing to overcome the unique challenges of the local market (IOL)

Telkom SA SOC (JSE: TKG / FRA: TZL1) was operating in a challenging environment, but expects to continue to see positive momentum from a number of mitigation measures it has implemented such as investing in infrastructure, driving cash generation and managing its working capital.

The JSE-listed telecoms group said yesterday in a circular to shareholders about the vote on the R6.75 billion sale of its masts and towers subsidiary Swiftnet to international private equity group Actis, that South faced a unique set of challenges that include weakening growth prospects and high unemployment.

🇿🇦 Sasol share price slumps as it warns of lower than expected production (IOL)

Sasol (NYSE: SSL)’S share price fell sharply by 10.85% yesterday after it said there had been operational headwinds in the Mining and Secunda Operations (SO) in the nine months to March 31, and full-year production was expected to be lower than expected.

The chemicals and fuel from coal group said in a production and sales update yesterday that its energy business had benefited from higher basic fuel prices along with improved refining margins in the quarter to end-March 2024. The share price closed at R135.51.

🇿🇦 Amplats production falls as it forges ahead with retrenchment plans (IOL)

Anglo American Platinum (JSE: AMS / FRA: RPHA / FRA: RPH1 / OTCMKTS: AGPPF / ANGPY) slumped by as much as 7% in afternoon trade on the JSE yesterday after it reported lower production and flat platinum group metals (PGM) sales for the first-quarter period ended March.

This also came in addition to Amplats reaffirming its plans to forge ahead with plans to retrench employees.

With Sibanye Stillwater Ltd (NYSE: SBSW) and Impala Platinum Holdings (JSE: IMP / LON: 0S2J / FRA: IPHB / OTCMKTS: IMPUY / IMPUF) having already announced retrenchments, Amplats becomes the latest PGMs miner to retrench workers in light of continued low platinum prices.

🇵🇱 Stocks you'd probably want to own. Company updates. (Active Balance) $

In today's edition, we will take a closer look at the latest updates for 3 companies: Shoper SA (WSE: SHO / FRA: 8FF), [Smart metering stock] Apator SA (WSE: APT / FRA: 8QM), and one more, rapidly growing but already profitable.

Shoper is a national leader in providing its services for micro and small enterprises. Many investors wonder whether their solutions will be suitable for large clients. It is worth noting that the CEO mentioned that they are increasingly acquiring large companies, which is a very good indicator in the face of a competitive market. The CEO also mentioned potential international expansion which will further strengthen the positive outlook for the company in the coming years.

🇵🇱 PP: Dino Polska Deep Dive (Pari Passu)

Among these, Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY) stands out for its strategic acumen and efficiency. Dino adheres to a meticulously crafted playbook, focusing on penetrating small towns. This strategy involves the replication of a consistent store format across its outlets, a move that not only enhances efficiency but also facilitates reinvestment into new locations. This blend of strategic foresight and efficient execution has positioned Dino as a formidable player in the sector, setting the stage for its growth and innovation.

Tomasz Biernacki's vision and entrepreneurial acumen have not only shaped Dino's trajectory but have also contributed significantly to its reputation as a retailer that genuinely understands and meets the needs of its customers, embodying a blend of innovation, tradition, and community focus that continues to drive its growth and popularity.

🇬🇧 🇳🇮 Condor Gold – learnings from a takeover saga (Undervalued Shares)

I had first heard about Condor Gold (LON: CNR / FRA: W5XA / TSE: COG / OTCMKTS: CNDGF) (ISIN GB00B8225591, UK:CNR) in 2008. I followed the company vaguely ever since, but I did not buy into it yet, even though I had gotten to know its CEO as a trustworthy, upright fella. Condor Gold was developing a multi-million ounce gold district in Nicaragua, and was backed by a self-made billionaire with a history of setting up new mining companies before selling them to larger operators. It was obvious to me that the company was going to be put up for sale eventually, although it was way too early to bet on that when I first heard about it.

🌎 Tenaris: Underperformance, Now A 'HOLD' (Rating Downgrade) (Seeking Alpha) $

Tenaris S.A. (NYSE: TS) is a volatile commodity business that specializes in welded steel pipes for gas pipelines and is the world's largest player in steel tubing.

The company's expansion plans include Middle Eastern and North American operations, focusing on improving demand planning and supply chain management.

While Tenaris has seen record results and has a strong brand reputation, it faces competition, pricing declines, and the risk of domestic companies favoring domestic suppliers in certain markets.

🇧🇷 AFYA: Mr Market Is Mistaken (Seeking Alpha) $

The company's 2023 earnings and revenue were strong, but its stock price has declined significantly.

The selloff is largely due to Afya (NASDAQ: AFYA)'s declining revenue growth rates.

Guidance is also soft, adding to concerns from investors and analysts.

However, AFYA's business model is not broken and the market's overreaction provides a wide margin of safety to invest in a profitable company with a dominant position.

Investors who can readjust their expectations to see AFYA in a different light will see that AFYA is a strong and growing business that is selling at a discount.

🇧🇷 Banco ABC: This small cap is from Arabia! (Brazil Stocks) $

Based in the Kingdom of Bahrain, in the Persian Gulf, Bank ABC is a bank focused on credit for companies.

In 1997, Bank ABC acquired the other half of the shares that belonged to Roberto Marinho and the name was changed to Banco ABC Brasil SA (BVMF: ABCB4 / ABCB10).

You, the average investor, will not know this bank, because it is a bank focused on credit for companies. You don't need agencies for this.

Despite being a small bank, it has rich parents (Kuwait Sovereign Fund and Libyan Central Bank). If you need liquidity, your pocket is deep.

🇧🇷 VALE - The Iron Ore trade (THE MODERN INVESTING NEWSLETTER)

A great setup for the 2nd largest Brazilian stock

Apart from being one of the largest Iron Ore miners globally, the company is among the largest Nickel producers globally and is investing billions of dollars in its base metals division that is focused on copper. We have to keep in mind, that Vale (NYSE: VALE) is operating in a cyclical business that is reliant on Iron Ore, Nickel and copper prices.

Vale is currently sitting near 52 week lows, while Iron Ore has seen positive momentum.

🇧🇷 Vale Q1 2024: Decent Results And Surprise With Provisions (Seeking Alpha) $

Vale (NYSE: VALE)'s results in 1Q24 were decent and in line with expectations, the only surprise was the provision guidance.

The company has been showing a sequential increase in iron ore volumes, which indicates resilient demand from China despite doubts.

Vale has a 31% discount to its peers in terms of EV/EBITDA multiple, making it an attractive investment with strong margins and competitive cash costs.

🇧🇷 Petrobras: We Shouldn't Be Unnerved By The Overblown Dividend Crisis (Seeking Alpha) $

Petrobras (NYSE: PBR / PBR-A) investors faced significant uncertainty over the extraordinary dividend payouts.

However, recent reports suggest the board has endorsed a 50% payout, potentially calming investor fears.

PBR buying momentum has remained robust and has improved since it bottomed out in March.

The threat of further government intervention will likely dampen a sharp valuation re-rating.

However, PBR's highly attractive valuation suggests the market has likely baked in these headwinds. Don't be unduly concerned.

🇧🇷 BB Seguridade: Overestimated Risks And Very Attractive Valuation (Seeking Alpha) $

BB Seguridade (BVMF: BBSE3 / OTCMKTS: BBSEY) [holds equity investments in insurance, pension plans, premium bonds and dental care plan companies, as well as in the brokerage business] has an excellent track record of results and dividend payments. The company has a resilient business model, and an excellent partnership with Banco do Brasil.

The company operates in a sector that still has a lot to grow, and has the best indicators in the Brazilian sector, such as ROE exceeding 80%.

Despite presenting the best indicators, the company trades at a P/E multiple with a 15% discount to its peers, due to overestimated risks in my view.

🇧🇷 Nu Holdings: High-Quality Undervalued Growth Stock To Buy Today (Seeking Alpha) $

Nu Holdings (NYSE: NU) is a digital banking platform with a $50 billion market cap, based in São Paulo, Brazil.

In Brazil, Nu Holdings serves >87 million customers, representing over 1/2 the country's adult population. The company now seems to be trying to expand the same way to Mexico.

A combination of a growing TAM, growing top line, and expanding margins should give NU more room to move higher, in my view.

In 3 years, NU should trade at a P/E of 13.7, with an EPS CAGR of ~28.22% over that period.

The growth potential I've calculated today is over 40% more than the current stock price. I therefore rate NU stock as a "Buy" today.

🇧🇷 Nu Holdings: Strong Growth Fully Priced (Seeking Alpha) $

In 10 years, Nu Holdings (NYSE: NU) reached 94 million customers through a lean business model, and by focusing on user experience, the bank is beginning to threaten the big banks.

Despite the strong growth in the number of customers, the company does not have tight margins, on the contrary, Nu has the highest margins among its peers.

However, the valuation is extremely stretched with a P/B of 8x. And despite having excellent management, I believe that Nu will face major challenges to continue growing.

🇨🇱 Banco de Chile: The Sugar Rush Is Coming To An End (Seeking Alpha) $

Banco de Chile (NYSE: BCH) has sustained very strong profitability, helped by a higher interest rate environment.

The Chilean central bank is now sharply reversing rates, however, and margin pressure is ramping up.

The stock isn’t adequately priced for the coming regime shift.

🇲🇽 Key Factors Driving Volaris' Success In The Aviation Market (Seeking Alpha) $

Controladora Vuela Compañía de Aviación [Volaris (NYSE: VLRS)] delivered better than expected EPS and quarterly results.

Analysts are expecting EPS growth for Q3 2024.

Recent capex growth, bus to air conversion, internationalization efforts, and network growth could accelerate net income growth in the coming years.

I believe that the company remains quite cheap at its current stock valuation.

📰🔬 Further Suggested Reading

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Yuan Devaluation Fever Heats Up As China Stockpiles Metals (ZeroHedge)

Gold trading in China has exploded and stocks of copper have risen sharply prompting speculation that policymakers are on the brink of a yuan devaluation.

Nonetheless, it is still less likely than not they will countenance a significant devaluation of the yuan versus the dollar.

First, it would compromise the financial stability that China has sought to obtain.

Second, it risks a tariff backlash from the US.

Third it may be counter-productive if it looks panicky and prompts even more capital outflow.

The stockpiling could well be for other reasons.

Rising global inflation risks (there is more to come, and even China will likely soon face consumer inflation);

reserve diversification in a more multi-polar world;

and raw materials for solar (AI needs a lot of energy) and EVs, and so on.

China planning for an invasion of Taiwan is another tail-risk that can’t be completely discounted.

🇨🇳 Cover Story: China’s balancing act to keep its social security system afloat (Caixin) $

The Chinese government is caught in a dilemma: there is a pressing need to boost contributions to what is the world’s largest social security system to better support the country’s aging population, while simultaneously addressing growing calls to reduce the financial burden amid a wobbly economy and the slowest wages growth in 40 years.

Contributions made by Chinese residents and companies to government insurance plans have continued to rise in recent years, correlating with the steady increase in average wages. Every summer, a hike in the baseline for social security contributions has become the norm after the central government’s statistics department unveils the latest wage data.

🇨🇳 China’s capital markets activity falls to multi-decade lows (FT) $ 🗃️

Mainland equity issuance is the worst on record this year in a sign of low investor confidence

🇭🇰 Hong Kong stock exchange fights to regain investors’ faith (FT) $ 🗃️

New team faces steep challenge as high-profile listings sink

🇰🇷 A Country Without Shareholder Rights (주주 권리가 없는 나라) - A Book Review (Douglas Research Insights) $

This insight is a book review of 주주 권리가 없는 나라 (A Country Without Shareholder Rights), which is one of the best books on the corporate governance in Korea.

There are so much wisdom that are included in this book. The author really goes into details about numerous corporate governance problems in Korea and ways to fix them.

This book was published in January 2024 and it was written by a famous Korean retail investor called Park Young-Ok.

🇰🇷 Will the Ban on Short Selling Stocks in Korea Extended Beyond End of June 2024? (Douglas Research Insights) $

On 6 November 2023, the Korean government announced that it will temporarily ban short selling stocks until end of June 2024.

On 25 April 2024, the FSS unveiled for the first time its plan to build a computer system to prevent naked short selling called NSDS (Naked Short Selling Detection System).

There is a high probability that the the temporary ban on short selling which currently lasts until end of June 2024, could be extended further to 2Q 2025.

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

India Indian People's Assembly Apr 19, 2024 (d) Ongoing Apr 11, 2019

Panama Panamanian National Assembly May 5, 2024 (t) Confirmed May 5, 2019

Panama Panamanian Presidency May 5, 2024 (t) Confirmed May 5, 2019

South Africa South African National Assembly May 29, 2024 (d) Confirmed May 8, 2019

Mexico Mexican Senate Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

Mexico Mexican Chamber of Deputies Jun 2, 2024 (t) Date not confirmed Jun 6, 2021

Mexico Mexican Presidency Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

Bulgaria Bulgarian National Assembly Jun 9, 2024 (d) Confirmed Apr 2, 2023

Mongolia Mongolian State Great Hural Jun 28, 2024 (d) Confirmed Jun 24, 2020

Venezuela Venezuela Presidency Jul 28, 2024 (d) Confirmed May 20, 2018

Thailand Referendum Jul 31, 2024 (t) Date not confirmed Aug 7, 2016

Jordan Jordanian House of Deputies Sep 10, 2024 (d) Confirmed Nov 10, 2020

Czech Republic Czech Senate Sep 30, 2024 (t) Date not confirmed Sep 23, 2022

Romania Romanian Presidency Sep 30, 2024 (t) Date not confirmed Nov 24, 2019

Sri Lanka Sri Lankan Presidency Sep 30, 2024 (t) Date not confirmed Nov 16, 2019

Georgia Georgian Parliament Oct 26, 2024 (d) Confirmed Oct 31, 2020

Uruguay Uruguayan Presidency Oct 27, 2024 (t) Date not confirmed

Uruguay Uruguayan Chamber of Representatives Oct 27, 2024 (t) Date not confirmed

Uruguay Uruguayan Chamber of Senators Oct 27, 2024 (t) Date not confirmed

Jordan Jordanian House of Deputies Oct 31, 2024 (t) Date not confirmed Nov 10, 2020

Georgia Georgian Presidency Nov 30, 2024 (t) Date not confirmed Nov 28, 2018

Romania Romanian Senate Nov 30, 2024 (t) Date not confirmed Dec 6, 2020

Romania Romanian Chamber of Deputies Nov 30, 2024 (t) Date not confirmed Dec 6, 2020

Namibia Namibian Presidency Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

Namibia Namibian National Assembly Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

Ghana Ghanaian Presidency Dec 7, 2024 (t) Date not confirmed Dec 7, 2020

Ghana Ghanaian Parliament Dec 7, 2024 (t) Date not confirmed Dec 7, 2020

Uzbekistan Uzbekistani Legislative Chamber Dec 31, 2024 (t) Tentative Dec 22, 2019

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

ALE Group Holding Limited ALEH EF Hutton, 1.3M Shares, $4.00-6.00, $6.3 mil, 4/29/2024 Week of

We are a holding company incorporated in the BVI with all of our operations conducted in Hong Kong by our wholly owned subsidiary, ALE Corporate Services Ltd., also known as ALECS. (Incorporated in the British Virgin Islands)

We provide accounting and corporate consulting services to small and medium-sized businesses. Our services include financial reporting, corporate secretarial services, tax filing services and internal control reporting. Our business is operated through our wholly owned subsidiary, ALE Corporate Services Ltd. (ALECS), a Hong Kong company incorporated on June 30, 2014. Our goal is to become a one-stop solution for all the accounting, corporate consulting, taxation and secretarial needs of small and medium enterprises operating in Asia and the U.S.

**Note: Net income and revenue figures are in U.S. dollars (converted from Hong Kong dollars) for the fiscal year that ended March 31, 2023.

(Note: The company disclosed that E.F. Hutton was named the sole book-runner – replacing Prime Number Capital – according to an F-1/A filing dated March 26, 2024.)

Key Mining Corp. KMCM EF Hutton, 4.4M Shares, $2.25-2.25, $10.0 mil, 4/29/2024 Week of

We are involved in exploration stage metals mining in Chile. (Incorporated in Delaware)

We are an exploration stage mining company focused primarily on the development of two projects, both of which are located in the Atacama Region (also known as Region III) of the Republic of Chile. Our Cerro Blanco project, or the Cerro Blanco Project, is focused primarily on exploring for rutile from which high grade titanium dioxide (TiO2) can be processed. Our Fiel Rosita project, or the Fiel Rosita Project, is focused primarily on exploring for copper, and to a lesser extent, zinc.

Our current business strategy is focused on the exploration for mineral deposits at the Cerro Blanco Project and at the Fiel Rosita Project. The Cerro Blanco Project has an emphasis on rutile from which high grade titanium dioxide (TiO2) can be processed, and the Fiel Rosita Project has a primary emphasis on copper (and to a lesser extent zinc and other metals). Both projects are located in the Atacama Region (also known as Region III) of the Republic of Chile.

To execute our business strategy, we will require substantial additional financial resources, including amounts necessary to fund our planned exploration program at the Cerro Blanco Project, and to fund the progress payments, the mining claim maintenance fees and our planned exploration program with respect to the Fiel Rosita Project including the exploration expenditures we must incur to satisfy a condition required under our Chilean subsidiary, Key Mining Corporation Chile SpA’s agreement relating to the Fiel Rosita Project. See “Business — SQM Exploration Agreement.” We intend to seek the necessary additional financing through the issuance of additional equity or debt securities, but there can be no assurance that such financing will be available to us in sufficient amounts, on attractive terms, on a timely basis, or at all. See “Risk Factors — Financial Risks — We will require substantial additional capital to explore and/or develop our mineral properties and we may be unable to raise additional capital on favorable terms or at all” and “Risk Factors — Risks Relating to our Business — Maintaining our right to explore and develop the Fiel Rosita mineral project is conditioned upon our making substantial future payments; and if we fail to make such payments we could lose our rights in the project.”

We consider the focus of our business strategy to be justified because we believe the long-term prospects for the copper and titanium dioxide markets are strong.

We operate and control our business and affairs through our wholly owned subsidiaries: Key Mining Corporation Chile SpA, Gold Express Mines SpA and Cerro Blanco Titanium, Inc.

Note: Net loss and revenue figures are for the 12 months that ended Sept. 30, 2023.

(Note: Key Mining Corp. cut the size of its IPO to 4.4 million shares – down from 7.5 million shares – and increased the assumed IPO price to $2.25 – up from $2.15 – to raise $9.99 million in an S-1/A filing dated April 12, 2024. Key Mining Corp. had previously changed its underwriter to EF Hutton from Titan Partners. Background: Key Mining Corp. filed an S-1/A dated Dec. 8, 2023, in which it changed its listing venue to the NYSE – American Exchange from the NASDAQ. The company has not disclosed the terms yet for its IPO. Key Mining Corp. filed its S-1 on Nov. 14, 2023, without disclosing terms for its IPO. The company submitted confidential IPO documents to the SEC in September 2023.)

🏁 Emerging Market ETF Launches

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

03/19/2024 - Avantis Emerging Markets ex-China Equity ETF AVXC - Active, equity, ex-China

03/15/2024 - Polen Capital China Growth ETF PCCE - Active, equity, China

03/04/2024 - Simplify Tara India Opportunities ETF IOPP - Active, equity, India

02/07/2024 - Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares XXCH - Equity, leveraged, China

01/11/2024 - Matthews Emerging Markets Discovery Active ETF MEMS - Active, equity, small caps

01/10/2024 - Matthews China Discovery Active ETF MCHS - Active, equity, small caps

11/07/2023 - Global X MSCI Emerging Markets Covered Call ETF EMCC - Equity, leverage

11/07/2023 - Avantis Emerging Markets Small Cap Equity ETF AVEE - Active, equity, small caps

09/22/2023 - Matthews Asia Dividend Active ETF ADVE - Active, equity, Asia

09/22/2023 - Matthews Pacific Tiger Active ETF ASIA - Active, equity, Asia

09/22/2023 - Matthews Emerging Markets Sustainable Future Active ETF EMSF - Active, equity, ESG

09/22/2023 - Matthews India Active ETF INDE - Active, equity, India

09/22/2023 - Matthews Japan Active ETF JPAN - Active, equity, Japan

09/22/2023 - Matthews Asia Dividend Active ETF ADVE - Active, equity, Asia

08/25/2023 - KraneShares Dynamic Emerging Markets Strategy ETF KEM - Active, equity, emerging markets

08/18/2023 - Global X India Active ETF NDIA - Active, equity, India

08/18/2023 - Global X Brazil Active ETF BRAZ - Active, equity, Brazil

07/17/2023 - Matthews Korea Active ETF MKOR - Active, equity, South Korea

05/18/2023 - Putnam Emerging Markets ex-China ETF PEMX - Active, value, growth stocks

05/11/2023 - JPMorgan BetaBuilders Emerging Markets Equity ETF BBEM - Passive, large + midcap stocks

03/16/2023 - JPMorgan Active China ETF JCHI - Active, equity, China

03/03/2023 - First Trust Bloomberg Emerging Market Democracies ETF EMDM - Principles-based

1/31/2023 - Strive Emerging Markets Ex-China ETF STX - Passive, equity, emerging markets

1/20/2023 - Putnam PanAgora ESG Emerging Markets Equity ETF PPEM - Active, equity, ESG, emerging markets

1/12/2023 - KraneShares China Internet and Covered Call Strategy ETF KLIP - Active, equity, China, options overlay, thematic

1/11/2023 - Matthews Emerging Markets ex China Active ETF MEMX - Active, equity, emerging markets

12/13/2022 - GraniteShares 1.75x Long BABA Daily ETF BABX - Active, equity, leveraged, single stock

12/13/2022 - Virtus Stone Harbor Emerging Markets High Yield Bond ETF VEMY - Active, fixed income, junk bond, emerging markets

9/22/2022 - WisdomTree Emerging Markets ex-China Fund XC - Passive, equity, emerging markets

9/15/2022 - KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV - Passive, equity, Asia, dividend strategy

9/15/2022 - OneAscent Emerging Markets ETF OAEM - Active, Equity, emerging markets, ESG

9/9/2022 - Emerge EMPWR Sustainable Select Growth Equity ETF EMGC - Active, equity, emerging markets

9/9/2022 - Emerge EMPWR Unified Sustainable Equity ETF EMPW - Active, equity, emerging markets

9/8/2022 - Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH - Active, equity, emerging markets, ESG

7/14/2022 - Matthews China Active ETF MCH - Active, equity, China

7/14/2022 - Matthews Emerging Markets Equity Active ETF MEM - Active, equity, emerging markets

7/14/2022 - Matthews Asia Innovators Active ETF MINV - Active, equity, Asia

6/30/2022 - BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD - Passive, fixed income, emerging markets

5/2/2022 - AXS Short CSI China Internet ETF SWEB - Active, inverse, thematic

4/27/2022 - Dimensional Emerging Markets High Profitability ETF DEHP - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Core Equity 2 ETF DFEM - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Value ETF DFEV - Active, equity, emerging markets

4/27/2022 - iShares Emergent Food and AgTech Multisector ETF IVEG - Passive, equity, thematic [Mostly developed markets]

4/21/2022 - FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM - Passive, equity, ESG

4/6/2022 - India Internet & Ecommerce ETF INQQ - Passive, equity, thematic

2/17/2022 - VanEck Digital India ETF DGIN - Passive, India market, thematic

2/17/2022 - Goldman Sachs Access Emerging Markets USD Bond ETF GEMD - Passive, fixed income, emerging markets

1/27/2022 - iShares MSCI China Multisector Tech ETF TCHI - Passive, China, technology

1/11/2022 - Simplify Emerging Markets PLUS Downside Convexity ETF EMGD - Active, equity, options strategy

1/11/2022 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG - Passive, equity, ESG

🚽 Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

03/25/2024 - Global X MSCI Nigeria ETF - NGE

03/21/2024 - VanEck Egypt Index ETF - EGPT

03/14/2024 - KraneShares Bloomberg China Bond Inclusion Index ETF - KBND

03/14/2024 - KraneShares China Innovation ETF - KGRO

03/14/2024 - KraneShares CICC China Consumer Leaders Index ETF - KBUY

03/13/2024 - Xtrackers MSCI All China Equity ETF - CN

03/13/2024 - Xtrackers MSCI China A Inclusion Equity ETF - ASHX

02/16/2024 - Global X MSCI China Real Estate ETF - CHIH

02/16/2024 - Global X MSCI China Biotech Innovation ETF - CHB

02/16/2024 - Global X MSCI China Utilities ETF - CHIU

02/16/2024 - Global X MSCI Pakistan ETF - PAK

02/16/2024 - Global X MSCI China Materials ETF - CHIM

02/16/2024 - Global X MSCI China Health Care ETF - CHIH

02/16/2024 - Global X MSCI China Financials ETF - CHIX

02/16/2024 - Global X MSCI China Information Technology ETF - CHIK

02/16/2024 - Global X MSCI China Consumer Staples ETF - CHIS

02/16/2024 - Global X MSCI China Industrials ETF - CHII

02/16/2024 - Global X MSCI China Energy ETF - CHIE

02/14/2024 - BNY Mellon Sustainable Global Emerging Markets ETF - BKES

01/26/2024 - The WisdomTree Emerging Markets ESG Fund - RESE

11/11/2023 - Global X China Innovation ETF - KEJI

11/11/2023 - Global X Emerging Markets Internet & E-commerce ETF - EWEB

11/09/2023 - Franklin FTSE South Africa ETF - FLZA

10/27/2023 - Simplify Emerging Markets Equity PLUS Downside Convexity - EMGD

10/20/2023 - WisdomTree India ex-State-Owned Enterprises Fund - IXSE

10/20/2023 - WisdomTree Chinese Yuan Strategy Fund - CYB

10/20/2023 - Loncar China BioPharma ETF - CHNA

10/18/2023 - KraneShares Emerging Markets Healthcare Index ETF - KMED

10/18/2023 - KraneShares MSCI China ESG Leaders Index ETF - KSEG

10/18/2023 - KraneShares CICC China Leaders 100 Index ETF - KFYP

10/16/2023 - Strategy Shares Halt Climate Change ETF - NZRO

09/20/2023 - VanEck China Growth Leaders ETF - GLCN

08/28/2023 - Asian Growth Cubs ETF - CUBS

08/01/2023 - VanEck Russia ETF - RSX

07/07/2023 - Emerge EMPWR Sustainable Emerging Markets Equity ETF - EMCH

06/23/2023 - Invesco PureBeta FTSE Emerging Markets ETF - PBEE

06/16/2023 - AXS Short China Internet ETF - SWEB

04/11/2023 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF - REMG

3/30/2023 - Invesco BLDRS Emerging Markets 50 ADR Index Fund - ADRE

3/30/2023 - Invesco BulletShares 2023 USD Emerging Markets Debt ETF - BSCE

3/30/2023 - Invesco BulletShares 2024 USD Emerging Markets Debt ETF - BSDE

3/30/2023 - Invesco RAFI Strategic Emerging Markets ETF - ISEM

2/17/2023 - Direxion Daily CSI 300 China A Share Bear 1X Shares - CHAD

1/13/2023 - First Trust Chindia ETF - FNI

12/28/2022 - Franklin FTSE Russia ETF - FLRU

12/22/2022 - VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

8/22/2022 - iShares MSCI Argentina and Global Exposure ETF AGT

8/22/2022 - iShares MSCI Colombia ETFI COL

6/10/2022 - Infusive Compounding Global Equities ETF JOYY

5/3/2022 - ProShares Short Term USD Emerging Markets Bond ETF EMSH

4/7/2022 - DeltaShares S&P EM 100 & Managed Risk ETF DMRE

3/11/2022 - Direxion Daily Russia Bull 2X Shares RUSL

1/27/2022 - Legg Mason Global Infrastructure ETF INFR

1/14/2022 - Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (April 29, 2024) was also published on our website under the Newsletter category.