Emerging Market Links + The Week Ahead (April 8, 2024)

Malaysia + Costa Rica get in on nearshoring-friendshoring, Brazil may block Twitter, China FDI hits 23 year low, not yet at peak K-pop, EM stock picks and the week ahead for emerging markets.

For those interested in nearshoring or friendshoring, FT just had an interesting podcast (A surprising winner in the US-China chip wars - How Malaysia is making the most of the rivals’ battle for global tech supremacy) while the NY Times had a piece about Costa Rica (Is This the Silicon Valley of Latin America? 🗃️ - Now Costa Rica is positioning itself to become a major hub outside Asia for packaging and testing microchips…). I don’t know much about Costa Rica, but I do know that the FT (as a corporate mainstream media outlet…) completely left out or danced around a number of details concerning the challenges Malaysia faces.

That brings me to Brazil which is lurching more and more towards dictatorship (or at-least heavy handed government censorship) thanks to a leftist Supreme Court judge - it looks like Twitter may soon get blocked there. What the Brazilian Senate or people do remains to be seen.

Investors in Brazil and especially in state-controlled Petrobras (NYSE: PBR / PBR-A) need to remember what happened the last time Lula was in power - Operation Car Wash who’s investigation eventually ensnared politicians, corporate executives and companies all over Latin America (before the investigation was shut down…)

I had once asked someone if there is a good objective research source (especially in English) for Brazilian stocks and the economy in general. I was told there were none - local stock analysts, economists, or journalists need to be careful criticizing a publicly listed company or [“mainstream” non-populist] economic policy.

For all it’s faults, Twitter is still a place where critical stories or accurate details the mainstream media will not touch can be reported. For example: Brazil has experienced massive anti-government protests in recent months and here is how the mainstream English language media reported about them:

And here is just one of many videos of the “thousands” of protesters on Twitter (search: Sao Paulo Protests) and its just the protestors on the main street in downtown Sao Paulo - not the side or parallel streets where there were additional protestors (plus busloads of protestors from other places were apparently stopped by Lula controlled police on Brazilian highways…)…:

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

🌐 EM Fund Stock Picks & Country Commentaries (April 7, 2024) $

How Capital structure ripples through management, guide to picking infrastructure stocks, EM infra stock earnings reports, when EM economies falter, Indian energy stocks, Indonesian banks, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Tencent Music Entertainment Group: Initiation Of Coverage - Core Business Strategy (SmartKarma) $

Tencent Music Entertainment Group (NYSE: TME) posted robust results in its fourth quarter and full year 2023 earnings call.

Increasing subscribers and expedited revenue growth were notable positives, taking the total number of subscribers to the 100 million milestone due to the company’s focus on content leadership, platform value, and offering a high-quality user experience.

Yet, the company also faced some headwinds, particularly in the social entertainment business.

🇨🇳 JST Group shows there’s still growth potential in China’s tough e-commerce market (Bamboo Works)

The country’s largest provider of ERP software as a service for e-commerce has filed a second time to list in Hong Kong, reporting its revenue grew more than 30% last year

JST Group has filed to list in Hong Kong, disclosing it became China’s largest ERP SaaS provider for e-commerce last year with 23.2% market share

The company’s revenue grew 33.3% to 690 million yuan last year, while its gross profit margin improved by 10 percentage points to 62.3%

🇨🇳 Chinese robot maker says protectionism will not stop its march (FT) $ 🗃️

Shenzhen Inovance Technology (SHE: 300124) founder says automation tech is indispensable to global supply chains

🇨🇳 China's Zeekr renews plans to raise up to $500 million in U.S. IPO, sources say (Reuters) 🗃️

Zeekr, the premium electric vehicle (EV) brand of Chinese automaker Geely Automobile Holdings (HKG: 0175), has restarted stalled plans to raise up to $500 million in a New York initial public offering (IPO), according to two sources with direct knowledge of the matter.

The company in November put listing plans to raise about $500 million on hold because of a mismatch in valuation expectations between investors and the company, Reuters reported then citing sources.

🇨🇳 Keep Inc. sprints towards profits as investors remain wary (Bamboo Works)

China’s leading fitness app operator returned to revenue growth in the second half of last year, as it adjusted to a post-pandemic return to outdoor-related activities.

Keep Inc.’s (HKG: 3650)’s revenue grew 3.7% in the second half of the year, reversing a 2.7% decline in the first half on falling product sales

The fitness app operator slashed its headcount and costs last year, helping to significantly boost its margins

🇨🇳 ‘Sing! China’ flames out, leaving STAR CM in the dark (Bamboo Works)

The popular talent reality show was temporarily suspended, and its creator’s revenue plunged, after a famous singer criticized it in a video last year

STAR CM Holdings Ltd (HKG: 6698) fell into the red last year with a 1.6 billion yuan loss after a controversy broke out surrounding its main money-spinner, the “Sing! China” reality show

The company is suing Warner Records China (Hong Kong) for critical remarks made by the late singer Coco Lee in a video that ignited the controversy

🇨🇳 Strawbear slips into the red but seeks salvation in AI (Bamboo Works)

The drama production company has lost 90% of its market value since an IPO three years ago, and just posted its first annual loss

Strawbear Entertainment Group (HKG: 2125) made a net loss of 109 million yuan last year and its revenue dropped 14.3%

The maker of dramas for film and TV hopes to cut costs by using AI to generate content

🇨🇳 Midea Group (000333 CH): Strong 4Q23 Result As Expected (SmartKarma) $

🇨🇳 Tian Tu plunges into the red on sagging Hong Kong stock market (Bamboo Works)

The venture capital company posted 814 million yuan in investment losses last year, reversing 337 million yuan in gains for 2022

Tian Tu Capital (HKG: 1973) posted an 873 million yuan net loss last year, reversing a 559 million yuan profit in 2022

The venture capital firm is getting hit by weakness in the Hong Kong IPO market, one of its primary venues for disposing of its consumer-related investments

🇨🇳 Investors lap up China Feihe despite declining profits and revenue (Bamboo Works)

The premium infant formula maker is taking a hit from China’s low birth rate, but investors may like its dividends and transition to other dairy products

China Feihe Ltd (HKG: 6186 / OTCMKTS: CHFLF / CFEIY) posted declines in both profits and sales last year, as it is heavily exposed to the country’s falling birth rate

The company, which gets 91% of its revenue from infant milk formula, may remain attractive to investors due to its pledge to pay much of its profits as dividends

🇨🇳 In Depth: Luckin challenger pushes China’s coffee price war toward boiling point (Caixin) $

China’s coffee market is in the midst of a price war, and it’s showing no sign of abating as the country’s leading affordable brand Luckin Coffee (OTCMKTS: LKNCY) faces down challenger Cotti Coffee, the upstart launched by Luckin’s disgraced co-founders Lu Zhengyao and Qian Zhiya.

Forced out of Luckin for their role in perpetrating a $300 million fraud, Lu and Qian returned in late 2022 with a new venture and promptly went to battle with their former brainchild. They adopted the same low-price strategy, at one point undercutting Luckin’s best discount.

🇨🇳 Shangri-la finds new life in tourism industry rebound (Bamboo Works)

The high-end hotel operator ended three years of losses with a return to profits last year, buoyed by a post-pandemic rebound in global travel

Shangri-La Asia (HKG: 0069 / FRA: SHN / OTCMKTS: SHALF) earned a profit of $184 million last year and distributed a dividend of HK$0.15 per share to celebrate its return to the black after three years of losses

The Hong Kong-listed hotel operator expects its next growth driver to come from a pickup in Chinese traveling abroad

🇨🇳 Anta Sports (2020 HK): Sustains Strengths into FY24 (SmartKarma) $

After a solid FY23, ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF)'s outlook for FY24 looks equally encouraging. Its various brands are expected to grow by 10-30% YoY still.

Listing of Amer Sports (NYSE: AS) will provide Rmb1.6bn non-recurring gain in 1H24. For the full year, there will be a positive swing in its profit contribution.

Anta Sports can be considered as a sportswear brand incubator, and its premium PERs of 18.3x and 15.9x for FY24 and FY25 reflect the ability to brew new brands.

🇨🇳 Chinese IVF specialist expands into Southeast Asia with Indonesian investment (Caixin) $

Jinxin Fertility Group (HKG: 1951 / FRA: 3NX / OTCMKTS: JXFGF), China’s largest private provider of in vitro fertility (IVF) services, is buying a stake in an Indonesian peer, venturing into Southeast Asia as demand in China declines with more couples opting not to have babies.

Hong Kong-listed Jinxin Fertility has signed an equity investment deal to become a “significant shareholder” of PT Morula Indonesia, an IVF specialist affiliated with PT Bundamedik Tbk (IDX: BMHS), a major women- and children-focused health care services group in Indonesia, according to a joint statement Monday. It did not specify how much capital Jinxin will invest.

🇨🇳 Hansoh Pharmaceutical (3692 HK): Performance Improves in 2H23; Innovative Drugs to Continue to Roar (SmartKarma) $

Hansoh Pharmaceutical Group Company (HKG: 3692 / FRA: 3KY / OTCMKTS: HNSPF) reported a whopping 55% YoY net profit growth to RMB3 billion on just 13% YoY revenue growth to RMB6 billion in 2H23.

Revenue from innovative drugs zoomed 52% YoY to RMB4 billion and its proportion to total revenue increased to 73% in 2H23 from 54% in 2H22 and 62% in 1H23.

Although Hansoh is not expected to receive marketing approval for any in-house innovative product in 2024, existing portfolio of innovative drugs will continue to drive the growth of the company.

🇨🇳 Citic Resource Holdings (1205.HK) - A Play on Oil and Coal Demand

CITIC Resources Holdings Limited (HKG: 1205 / FRA: CZR / OTCMKTS: CTJHF / CTJHY)

One of a basket of Hong Kong commodity stocks we like

One off issues in 2023 which should reverse in 2024

Can also be viewed as a tangential play on India's industrial growth

🇨🇳 Exclusive: Beijing nudged Syngenta to withdraw $9 billion Shanghai IPO on market weakness (Reuters) $ 🗃️

Chinese authorities nudged Swiss agrichemicals and seeds group Syngenta to withdraw its application for a long-delayed $9 billion IPO in Shanghai on concerns about the impact a sizeable new offering would have on a volatile market, four people said.

The Chinese state-owned pesticide giant last Friday withdrew its bid for the initial public offering (IPO) saying the decision was taken "after careful consideration of (the) industry environment and the company's own development strategy".

🇲🇴 Timing on Macau Legend Laos casino sale extends to Apr 15 (GGRAsia)

The timing for arrangements regarding planned disposal of a Laos casino resort business by Hong Kong-listed Macau Legend Development Ltd (HKG: 1680 / OTCMKTS: MALDF) has been extended again, now to April 15.

The disposal, if realised, is expected to help strengthen Macau Legend’s cash flow and its financial resources for Macau operations, the firm has said in previous filings.

Macau Legend owns a tourism complex called Macau Fisherman’s Wharf, where it runs casino hotel Legend Palace, via a so-called services agreement, under the gaming licence of Macau concessionaire SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY). Fisherman’s Wharf is waterfront complex close to Macau’s Outer Harbour Ferry Terminal on the city’s peninsula.

Macau Legend had a net loss for 2023 of HKD4.9 million (US$626,193), according to its annual results filed on March 28.

🇲🇴 LVS buybacks, dividends a credit constraint: Moody’s (GGRAsia)

Casino operator Las Vegas Sands (NYSE: LVS), which runs gaming resorts in Macau and one in Singapore, has a ‘Baa3’ long-term rating with ‘stable’ outlook on its senior unsecured obligations, supported by the “high quality, popularity, and favourable reputation” of its properties, says Moody’s Investors Service Inc in a Tuesday update.

In Macau, Las Vegas Sands’ unit, Sands China Ltd, is one of that city’s six casino concessionaires. In Singapore, the parent group runs Marina Bay Sands, one half of that city-state’s casino duopoly.

In October last year, it increased its share repurchase programme to US$2 billion and extended the expiration to November 2025.

🇹🇼 6807 :TW a true one foot hurdle with a good catalyst (One foot hurdle)

6807 FY Group (TPE: 6807) is a couch ODM with IKEA as its largest customer (over 80% of sales in 2022). It was listed in April 2022. It is now trading at an EV/EBIT of 3.71 with a dividend yield of 6.28%, near an all time high. Right off the bat there are plenty of signs people do not like: a manufacturer, a concentrated customer with strong bargaining power, newly listed, trading at all time high. However, it is profitable six years in a row, has a healthy balance sheet, and I believe there is an effective catalyst that is working in favor of the company. FY Group is tradable on interactive brokers and English filings are available.

🇹🇼 As predicted, TCL Electronics (1070.HK) wows with 2023 results and continues push into high-end products (Pyramids and Pagodas)

Sales up in lucrative large TV segment, with supplementary income streams showing healthy growth

Spirits were high as we attended the TCL Electronics Limited (HKG: 1070 / FRA: TC2A / OTCMKTS: TCLHF) (“TCL”) investor conference last Thursday (28 March) at the Shangri-La in Hong Kong, following its after-market earnings release. The results topped our own expectations in some areas, which we outlined in our recent write-up on the Company. We decided to summarize the results, as well as management insights shared at the conference for added context.

🇹🇼 Taiwan Dual-Listings Monitor: TSMC, ASE Spreads Bounce Back to Historically Extreme Highs (SmartKarma) $

Taiwan Semiconductor Manufacturing Company (TSMC) (TPE: 2330 / NYSE: TSM): +16.2%, Bounced Back to Historically Extreme Level, Consider Short

United Microelectronics Corp (TPE: 2303 / NYSE: UMC): -0.3% Discount, Flipped to Positive and Now Negative Again

ASE Technology Holding (NYSE: ASX / TPE: 3711): +15.3% Premium; Bounced Back to Extreme Highs, Short the Spread

🇰🇷 S.Korea 1Q casino rev: Paradise Co sales up y-o-y, GKL down (GGRAsia)

Foreigner-only casino businesses Paradise Co Ltd (KOSDAQ: 034230) and Grand Korea Leisure Co Ltd (KRX: 114090), operating from South Korea, each reported on Tuesday their March and first-quarter performance.

Paradise Co’s first-quarter casino revenue was just under KRW208.83 billion, up 55.4 percent year-on-year. First-quarter table drop amount was just under KRW1.73 trillion, a rise of 36.8 percent on the same period in 2023.

GKL saw its casino revenue for the three months to March 31 fall 12.9 percent year-on-year, to just under KRW93.67 billion. Its first-quarter casino drop was KRW916.04 billion, up 21.5 percent from the same period in 2023.

🇰🇷 Kangwon Land to triple casino space in US$1.85bln revamp (GGRAsia)

South Korea’s Kangwon Land (KRX: 035250), which operates Kangwon Land casino resort complex (pictured), has announced a KRW2.5-trillion (US$1.85-billion) new phase for the property, that will triple the size of its casino space by 2032.

Kangwon Land, the only casino in the country open to locals, is in a rural upland area three hours east of Seoul. Its promoters recently announced plans to expand the venue’s appeal and marketing effort, in order to draw more players from overseas.

In full-year 2023, Kangwon Land Inc’s net income attributable to its owners stood at KRW345.15 billion, up 198.5 percent from 2022, on sales that grew by 9.3 percent year-on-year, to just under KRW1.39 trillion.

🇰🇷 Samsung signals end to chip downturn with forecast 10-fold jump in profit (FT) $ 🗃️

World’s biggest maker of memory chips beats expectations with strong first-quarter guidance

🇰🇷 Korean Holdcos Vs Opcos Gap Trading Opportunities in 2Q 2024 (Douglas Research Insights) $

In this insight, we highlight the recent pricing gap divergences of the major Korean holdcos and opcos which could provide trading opportunities in 2Q 2024.

Of the 38 pair trades, 26 of them involved holdcos outperforming opcos in the past six months, suggesting increased capital allocation to Korean holdcos relative to their opcos.

These pairs could generate trading opportunities in terms of their pricing gaps closing reversal. [CJ Corp vs CJ Cheiljedang & Hanjin KAL Corp vs Korean Air Lines].

🇰🇷 Gap Trades in Korean Prefs Vs Common Share Pairs in 2Q 2024 (Douglas Research Insights) $

In this insight, we discuss numerous gap trades involving Korean preferred and common shares in 2Q 2024.

Although the discount on the preferred shares versus the common shares has been gradually narrowing in the past decade, this discount increased from end of 2021 to 1 April 2024.

On a longer timeframe (3-4 years), we believe this discount could narrow further to the 20-25% range, which provides additional opportunities for the Korean preferred shares to further make gains.

From 3 January to 1 April 2024, the preferred stocks of Amorepacific Corp (KRX: 090430 / 090435) and Hyundai Motor (KRX: 005380 / 005385 / 005387 / FRA: HYU / OTCMKTS: HYMTF) displayed sharply higher share price appreciation relative to their common counterparts.

In the same period, the common stocks of CJ Corp (KRX: 001040), Doosan Corp (KRX: 000150), and S-Oil Corp (KRX: 010950) displayed significantly higher share price appreciation relative to their preferred counterparts.

🇰🇷 SK Square: Higher NAV Driven by Its Holding in SK Hynix (Douglas Research Insights) $

SK Square (KRX: 402340) owns a 20.07% stake in SK Hynix (KRX: 000660) which is now worth 27.2 trillion won. SK Square's market cap is only 39% of SK Square's stake in SK Hynix.

SK Square has benefited from increased capital allocation to low P/B stocks in Korea due to the Corporate Value Up program. SK Square is trading at P/B of 0.7x.

Amid the tremendous demand for Nvidia (NASDAQ: NVDA)'s AI related chips, this has also benefited several Korean companies including SK Hynix and SK Square.

🇰🇷 Hyundai Motor Group Becomes the Largest Shareholder of KT Corp (Douglas Research Insights) $

Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF) has become the largest shareholder of KT Corp (NYSE: KT / KRX: 030200 / FRA: KTC), as the National Pension Service has recently reduced its stake in KT from 8.53% previously to 7.51%.

Despite this recent change in the largest shareholder status of KT Corp, this requires the approval from the Korean Ministry of Science and ICT.

Although the Hyundai Motor Group (HMG) has become the largest owner in KT Corp, the most likely scenario is for HMG to remain a passive investor in KT.

🇰🇷 Tender Offer of 25% of Hyundai Home Shopping Shares by Hyundai GF Holdings (Douglas Research Insights) $

On 3 April, it was reported that Hyundai G.F. Holdings will be conducting a tender offer of 3 million shares of Hyundai Home Shopping Network Corp (KRX: 057050) (25% of outstanding shares).

The tender offer price is 64,200 won. The main reason for this tender offer is to meet the regulatory requirement of a holding company by 2025.

We are positive on the tender offer of a 25% stake in Hyundai Home Shopping by Hyundai G.F. Holdings.

🇰🇷 Hanwha Group's Restructuring to Positively Benefit Hanwha Corp but Negatively Impact Hanwha Ocean (Douglas Research Insights) $

We believe the new restructuring plan of the Hanwha Group is likely to have a positive impact on Hanwha Corp (KRX: 000880) but could negatively impact Hanwha Ocean (KRX: 042660).

Our NAV analysis of Hanwha Corp suggests NAV of 3.2 trillion won or NAV per share of 43,168 won, which is 50% higher than current share price.

The biggest component of the valuation is Hanwha Corp's 34% stake in Hanwha Aerospace (KRX: 012450) which is worth 4.1 trillion won. (187% of Hanwha Corp's market cap).

🇰🇷 Douzone Bizon: To Become the Fourth Internet Bank in Korea? (Douglas Research Insights) $

On 4 April, Douzone Bizon (KRX: 012510) announced that it plans to become the fourth Internet bank in Korea. Following this news, Douzone Bizon's share price increased by 21%.

If the company succeeds in receiving the license to operate an Internet bank, this could meaningfully impact the company's long-term sales and profits.

If Douzone Bizone expands into the Internet banking services, it may need additional backing from strategic/financial partners including Bain Capital which has a 10.2% stake in Douzone Bizon.

🇰🇷 Hanwha Aerospace: Spin Off of Semiconductor Equipment and Video Surveillance Units (Douglas Research Insights) $

On 5 April, Hanwha Aerospace (KRX: 012450) formally announced that it will spin off its semiconductor equipment and video surveillance units which contributed to about 16% of its revenue.

We are Negative on Hanwha Aerospace mainly due to valuations. Its share price has risen so much in the past year that its valuations are no longer attractive.

Hanwha Aerospace is trading at premium valuation to Lockheed Martin on an EV/EBITDA basis. Despite its recent strong growth, Hanwha Aerospace is no Lockheed Martin.

🇰🇷 Hanmi Science: If Talks With Mum and Sister Break Down, Then KKR May Provide a Partial Tender Offer (Douglas Research Insights) $

The 2024 AGM of Hanmi Science (KRX: 008930) is over and the two Lim brothers have control of the company. Nonetheless, the fight for the control of Hanmi Science is not over.

There is an increasingly probable scenario where the KKR private equity firm gets involved, joining hands with the Lim brothers.

If mum and sister do not sell their shares (which seems to be the higher likely scenario), then KKR may issue a tender offer to the remaining minority shareholders.

🇸🇬 Micro-Mechanics (MMH SP) (Asian Century Stocks)

Singapore’s favorite child, now experiencing an industry downturn

Micro-Mechanics (Holdings) Ltd (SGX: 5DD / OTCMKTS: MCRNF) - US$147 million) is a manufacturer of precision tools used in the back-end processes of semiconductor chip manufacturing.

The company’s founder, Chris Borch, is an American who was sent to Singapore as an expat working for a semiconductor equipment maker. After two years, he left his job and used his US$600 of savings to build a precision manufacturing company in the back of a hat factory in suburban Singapore.

🇸🇬 Better Buy: Keppel DC REIT Vs Digital Core REIT (The Smart Investor)

We size up both data centre REITs to determine which qualifies as the better investment.

Industrial REITs, however, have held up better than most other REIT sub-sectors as demand for e-commerce remains strong.

In particular, data centre REITs demonstrated resilience as technology companies need vast amounts of storage space with the explosion in digitalisation and electronic device usage.

Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF) and Digital Core REIT (SGX: DCRU / OTCMKTS: DGTCF) are beneficiaries of this trend.

Both REITs are pure data centre REITs but we compare each REIT on various metrics to determine which is the better buy.

🇸🇬 🇿🇦 Grindrod Shipping: Minority Shareholder Buyout Proposal Might Not Pass (Seeking Alpha) $

Grindrod Shipping (NASDAQ: GRIN) shares rallied by 30% after the company announced plans to buy out minority shareholders for $14.25 in cash per common share.

The offer represents a 12% discount to estimated net asset value and an approximately 45% discount to controlling shareholder Taylor Maritime's $26 cash tender offer back in 2022.

However, with Taylor Maritime Investments Ltd (LON: TMI / TMIP / FRA: 91E / OTCMKTS: TMILF) not permitted to vote on the proposal, approval won't be an easy task.

Singapore law requires a 75% majority of shareholders to pass a special resolution on a yet to be scheduled extraordinary general meeting which appears to be a Herculean task.

With approval anything but certain and shares trading just 4% below the proposed buyout price, I would strongly advise investors to consider selling into the open market next week to avoid the risk of shares giving back all of Thursday's gains in case the special resolution doesn't pass.

🇸🇬 Flex Ltd.: Undervalued With Solid Fundamentals (Seeking Alpha) $

🇰🇭 🇭🇰 NagaCorp 1Q GGR up 24pct y-o-y, EBITDA tops US$80mln (GGRAsia)

First-quarter casino gross gaming revenue (GGR) at Cambodia operator NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF) rose by 23.7 percent year-on-year, to nearly US$145.4 million, according to a non-statutory filing on its quarterly results made to the Hong Kong Stock Exchange on Wednesday.

The company reported a net profit of US$177.7 million for full-year 2023, up 65.7 percent on the prior year. Such profit was on revenue that rose by 15.7 percent year-on-year, to US$533.2 million.

The management of NagaCorp said in February that it was looking to reduce the scale and budget of its Naga 3 extension project at NagaWorld, in order to minimise capital expenditure, “so that there is surplus cash flow, possibly for the payment of dividends”.

🇮🇳 Infosys: This Pullback Can Set Up For A Move Much Higher (Technical Analysis) (Seeking Alpha) $

🇮🇳 Infosys: Facing Uncertainty As Gen AI Takes Time To Deliver (Seeking Alpha) $

Infosys (NYSE: INFY) shares have gained over 30% since the release of its Topaz Generative AI tool, but have now dropped to $17.52.

The company is facing demand uncertainty and lower margins, with the AI tailwind not materializing as expected.

Gartner predicts that companies will focus more on traditional IT projects and profitability optimization, delaying investment in Generative AI.

Therefore, this is not the time to invest as there are volatility risks.

Even then, I have a Hold position as this remains a profitable company with a strong balance sheet.

🇮🇳 Wipro: Focus On Peer's Performance And Long-Term Potential (Seeking Alpha) $

Wipro Ltd (NYSE: WIT)'s upcoming quarterly results release could potentially be weaker than what the market anticipates, taking into account its peer's recent quarterly financial performance and management comments.

On the flip side, WIT's long-term growth outlook is favorable, considering the rise of AI and the projected increase in Engineering, Research & Development or ER&D spending.

Wipro's shares are rated as a Hold, after assessing the stock's valuations and evaluating the company's prospects for the near-term and long-run.

🇬🇷 Greece’s banks cap a remarkable comeback (FT) $ 🗃️

The country’s recovery has benefited its banks in particular

Greece’s bank bailout fund last month sold 27 per cent of Piraeus Bank [Piraeus Financial Holdings (FRA: BKP0 / BKP / OTCMKTS: BPIRY / BPIRF)] for €1.35bn. It received enough demand to cover the secondary sale soon after opening the book, and priced the deal at a slight premium to the share price before it was announced. This followed the initial public offering of Athens airport [Athens International Airport SA (FRA: 9O1)] in February. At the end of last year, the government sold stakes in National Bank [National Bank Of Greece (FRA: NAGF / OTCMKTS: NBGIF)], Eurobank [Eurobank Ergasias Services (FRA: EFGD / EFGA / OTCMKTS: EGFEY)] and Alpha Bank [Alpha Services and Holdings (FRA: ACBB / ACBC / OTCMKTS: ALBKY)].

🇬🇷 DB Energy - an intriguing company that supports energy efficiency in the industry (WSE:DBE) (Active Balance)

Note: 10:20 minute podcast

DB Energy SA (WSE: DBE)

Current price: 19,50 pln

Market Cap: ~68 mpln

Share#: 3.476.460

🇵🇱 Text: Commoditization And Disappointing Growth (Seeking Alpha) $

Text SA (WSE: TXT / LON: 0QTE / FRA: 886 / OTCMKTS: LCHTF)'s products are being commoditized, leading to margin contraction.

LiveChat is the company's biggest product by a sizable margin, but its growth has come to a halt.

ChatBot's growth is also lackluster compared to the overall chatbot market, indicating that Text's best days may be behind them.

🇧🇷 Companhia Siderúrgica Nacional: Competition, Low Margins And High Leverage (Seeking Alpha) $

The Brazilian steel industry is suffering from the large supply of Chinese steel in the domestic market. And there should be no action by the Government to protect the national.

Domestic market demand remains weakened, coupled with the strong supply of Chinese steel and difficulty in passing on the price. Result? Low margins.

Additionally, given the capital-intensive nature of the sector, Companhia Siderurgica Nacional SA (NYSE: SID) trades at the highest P/B among its competitors, meaning it has a stretched valuation.

🇧🇷 Petrobras: The Sell-Off Provides Opportunity (Seeking Alpha) $

In recent weeks, Petrobras (NYSE: PBR / PBR-A)'s momentum has weakened, and at the moment, it's trading 14% off-high after a wave of analyst downgrades followed dividend frustration.

PBR delivered strong financial performance last year with the second-highest EBITDA ($52.4 billion), operational cash flow ($43.2 billion), and net profit ($24.9 billion) in history.

The market is expecting a further correction in the company's financials, but this may be already reflected in its forwarding valuation multiples.

Despite risks, I think Petrobras is still undervalued and presents a buying opportunity with double-digit percentage upside potential.

🇧🇷 Ultrapar: The Peak Is Here (Seeking Alpha) $

[Energy and logistics infrastructure conglomerate] Ultrapar Participaçoes (NYSE: UGP) Q4 earnings were strong in all measures, but the stock price has fallen since.

The improvements in Gross Margin and Deleverage seem to have been priced in and are expected to subdue during FY'24.

I don't expect market-beating returns from Ultrapar as it has almost achieved my previous price target. I recommend investors to exit their positions.

🇧🇷 Braskem: A Rising Odds For ADNOC Deal, Though Declining Risk-Reward (Rating Downgrade) (Seeking Alpha) $

[Plastic producer] Braskem (NYSE: BAK)'s potential acquisition by ADNOC [Abu Dhabi National Oil Company] is still in the spotlight, with due diligence ongoing. The political environment in Brazil remains supportive of the deal.

BAK’s liquidity is more than enough to cover its obligations in the coming years, mitigating the financial risk.

The uncertainties around tag-along rights are diminishing. In February 2024, Petrobras (NYSE: PBR / PBR-A) exercised its rights when it sold its 18.8% stake in UEG Auracaria.

With the expected takeover price by ADNOC in the range of $14-$15/share and the present stock price of $10.3, the risk-reward is not skewed in our favor. I give BAK a hold rating.

🇧🇷 Blackouts spark fears of grid ‘collapse’ in Brazil’s biggest city (FT) $ 🗃️

Power outages in São Paulo reflect chronic underinvestment in country’s infrastructure

Nunes’s criticisms of Enel Américas SA (SSE: ENELAM) [Enel S.p.A. (BIT: ENEL / FRA: ENL / LON: 0TGA / OTCMKTS: ENLAY)] were echoed by Alexandre Silveira, Brazil’s energy minister, who has asked regulators to start a disciplinary process that could result in company losing its operating concession. Under the terms of the current concession, which is due to run until 2028, Enel is responsible for investing in and maintaining the grid.

🇧🇷 Cosan: A Promising Player In Brazil's Energy Transition (Seeking Alpha) $

Brazil has enormous potential to be the leading nation in the energy transition with decarbonized products. In this sense, Cosan SA (NYSE: CSAN) stands out as having the most significant energy transition projects.

Despite its promising and diversified business, the company is extremely discounted compared to national and international peers and when compared to its own history.

With the end of the investment cycle approaching, the company should report better results and have a revaluation of multiples by the market.

🇧🇷 WEG: Difficulty In Maintaining Strong Growth, Valuation Appears Stretched (Seeking Alpha) $

[Electric engineering, power and automation technology] WEG SA (BVMF: WEGE3) trades with a large premium of 31% in its valuation compared to its competitors, this is due to the quality of its managers who created a unique business model.

However, in 2023 the company had difficulty maintaining the strong earnings growth embedded in its valuation, this is due to restrictive monetary policies around the world.

With difficult prospects for capital goods businesses around the world over the next few years, the company may undergo multiple repricing by the market.

🇧🇷 BrasilAgro Faces A Challenging H2 2024 And Is Not An Opportunity Yet (Seeking Alpha) $

Brasilagro - Co Brasileira De Proprieda (NYSE: LND / BVMF: AGRO3)'s stock price remains unchanged since January, and with agricultural commodity markets declining, it is not currently an attractive investment opportunity.

The company experienced seasonal losses and an increase in debt during the planting season, but expects to recoup losses in the second half of the fiscal year.

Indications suggest that the second half of 2024 will not be a great period for BrasilAgro, with decreased corn planting, dry weather conditions, and decreasing agricultural commodity prices.

🇧🇷 Ambev: A Currency That Produces Beer (Seeking Alpha) $

Ambev (NYSE: ABEV)'s valuation is strongly tied to the strength of the Brazilian Real.

Ambev is a wide-moat company in the markets it operates in, with strong profitability and a solid balance sheet.

Ambev's valuation is attractive assuming no significant deterioration of the Brazilin real in the near future despite the economical turmoil in Latin America.

🇧🇷 BRF S.A. Has Stabilized Its Business, And Investors Await The Next Act (Seeking Alpha) $

Successful operational improvement initiatives and improving free cash flow have led to strong performance from BRF Brasil Foods SA (NYSE: BRFS / BVMF: BRFS3) shares.

The company has achieved significant improvements in feed conversion, meat yields, plant efficiency, logistical execution and retail in-store positioning.

Competition from JBS SA (BVMF: JBSS3 / OTCMKTS: JBSAY) in Brazil is a concern, but BRF's branded share has held up well and the company has continued to build share in key markets outside of Brazil.

I expect the Street to be very focused on management commentary about further margin improvement prospects with the upcoming quarterly report.

Near-term upside looks more "good" than "great," but there are certainly avenues to greater gains if mid-teen EBITDA margins become a sustainable reality.

🇧🇷 Azul Is Still A Hold Despite The Lower Price And Gol's Bankruptcy (Seeking Alpha) $

Azul Sa (NYSE: AZUL / BVMF: AZUL4), one of the main Brazilian airlines, has posted strong Q4 and FY23 results, with revenues surpassing FY19 levels and achieving close to a 15% operating margin.

The bankruptcy of competitor Gol Linhas Aereas Inteligentes Sa (NYSE: GOL / BVMF: GOLL4) is unlikely to lead to lower competition for Azul and better profitability. Instead, competition is expected to increase, leading to a decrease in Azul's current high margins.

Azul's viability is questionable due to its high debt, lease payments, and the need to generate significant EBITDA to break even. The company's profitability and viability are fundamentally questioned by industry characteristics.

🇧🇷 Inter & Co: Financial Super App Faces A Growth Test In 2024 (Seeking Alpha) $

Inter & Co Inc (BVMF: INBR32 / NASDAQ: INTR) is generating strong growth through its Fintech platform as a digital bank in Brazil.

The company has expanded operations into the United States with a plan to double its client base over the next few years.

While benefiting from solid fundamentals, a backdrop of high expectations in a highly competitive market should keep shares volatile.

🇲🇽 MXF: Expect Consolidation For Mexico Stocks As Worries Emerge In 2024 (Seeking Alpha) $

The Mexico Fund, Inc (NYSE: MXF) aims for long-term capital appreciation through equities listed on the Mexico Stock Exchange.

The fund has experienced a large discount to NAV, but this may present an opportunity for investors.

Risks in the short term are emerging though due to currency movements and upcoming elections.

🇲🇽 FEMSA Offers Underrated Quality Growth For Patient Investors (Seeking Alpha) $

Coca-Cola Femsa SAB de CV (NYSE: KOF)'s shares have come under pressure due to unexpected changes in the C-suite and disappointment about the pace of capital returns to shareholders.

The company has announced a 20% hike in the regular dividend and an extraordinary dividend for the next four quarters, doubling the dividend yield.

FEMSA has underrated growth potential, not only with its core Oxxo brand in Mexico but also with international expansion and newer store concepts like Bara.

🇲🇽 Vista Priced For $65 Oil And No Growth, Still A Buy (Seeking Alpha) $

Vista Energy (NYSE: VIST / FRA: 1CIA / BMV: VISTAA) is one of Argentina's largest oil producers and exporters, specializing in the Vaca Muerta basin.

The company showed operational improvement in FY23, with production growth, cost reduction, and improved gas to total production ratio.

Vista has high returns on capital and plans for further growth without the need for debt financing, making it an attractive investment opportunity.

📰🔬 Further Suggested Reading

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Foreign direct investment into China plummets to 23-year low (Caixin) $

Net foreign direct investment (FDI) into the Chinese mainland plummeted to a 23-year low last year, government data showed Friday.

The $42.7 billion inflow is less than a quarter of that seen in 2022. The latest result was revised up from the $33 billion preliminary number published by the State Administration of Foreign Exchange (SAFE) last month.

🇨🇳 Gloomy China stock market hits brokers’ pay packets (Caixin) $

China’s securities industry experienced another year of pay cuts in 2023 as the country’s depressed capital markets and the government’s campaign against excessive remuneration in the financial sector took their toll.

Disclosures from half of the 44 securities brokerages listed on the Chinese mainland that had published their annual reports by April 1 show a downturn in the industry’s financial performance. Their total revenue in 2023 fell 1.8% to 373.4 billion yuan ($53 billion) while their net profits attributable to their parent companies dropped 7.1% to 108.1 billion yuan, marking the second consecutive year of lower profitability.

🇨🇳 In Depth: Frugality bites for China’s cash-strapped local governments (Caixin) $

Chinese local governments are gearing up for another tough year and coming to terms with the new normal of frugality amid growing pressure on fiscal revenue and efforts to tackle their debt burdens.

In his first government work report to the annual session of the National People’s Congress, the country’s top legislature, in March, Premier Li Qiang told government officials to get used to tightening their belts, echoing a call in December by top leaders when they spoke of the growing pressure on budgets at their annual Central Economic Work Conference.

🇨🇳 China’s rival to Boeing and Airbus looks to Asia first (FT) $ 🗃️

Aircraft maker [Commercial Aircraft Corporation of China (COMAC)] hopes C919 will pick up initial overseas orders in south-east Asia

🇨🇳 China’s stockbrokers suffer pay cuts as markets decline (FT) $ 🗃️

Financial disclosures show executive salaries at leading brokerages have fallen in past two years

🇰🇷 Are we at peak K-pop? Goldman doesn’t think so (FT) $ 🗃️

The market thinks there’s a catch, but there might be growth potential not far away, in Japan

🇮🇩 Indonesia after Jokowi (Asian Century Stocks) $

How the election of Prabowo Subianto will affect the Indonesian consumer.

Prabowo Subianto will become Indonesia's president in October 2024. He has pledged to continue President Jokowi’s reforms, including building a new capital in East Kalimantan and pushing for the continued industrialization of the commodity base.

However, given Prabowo’s background as a military commander during the years of former dictator Suharto, it’s not clear what his long-term ambitions are. He has spoken favourably of Suharto, which begs the question of whether we’ll see a return to Suharto-era policies, including greater state ownership and state control.

At the end of the post, I’ll also discuss the likely implications of Prabowo’s presidency on the Indonesian stock market and the currency.

🇲🇾 A surprising winner in the US-China chip wars (FT) 19:59 Minutes + Malaysia: the surprise winner from US-China chip wars (FT) $ 🗃️

How Malaysia is making the most of the rivals’ battle for global tech supremacy

The US and China’s battle for dominance in the semiconductor industry is having some surprising knock-on effects: Companies are looking to insulate their supply chains from rising geopolitical tensions. And many from around the world are setting their sights on Malaysia to set up or expand their chip factories. FT correspondent Mercedes Ruehl explains how the country earned a prized spot in the supply chain, and what it needs to do to keep hold of it.

🌍 How Gulf states are putting their money into mining (FT) $ 🗃️

Hungry to diversify their economies beyond fossil fuels, Middle Eastern powers are investing in the resources needed to produce clean energy

🌐 Soaring coffee prices will squeeze Asia’s café culture (FT) $ 🗃️

Extreme temperatures and droughts in big bean-producing countries have led to lower harvests

🇨🇷 Is This the Silicon Valley of Latin America? (NYT) $ 🗃️

Now Costa Rica is positioning itself to become a major hub outside Asia for packaging and testing microchips. In the 1990s, Intel built a factory near San José to do just that. That opened the door to more factories and industries and, as a result, an increasingly tech-oriented work force. Today Costa Rica’s biggest category of exports is no longer coffee or bananas but medical devices.

Note: Lengthy tweet retweeted by Elon Musk:

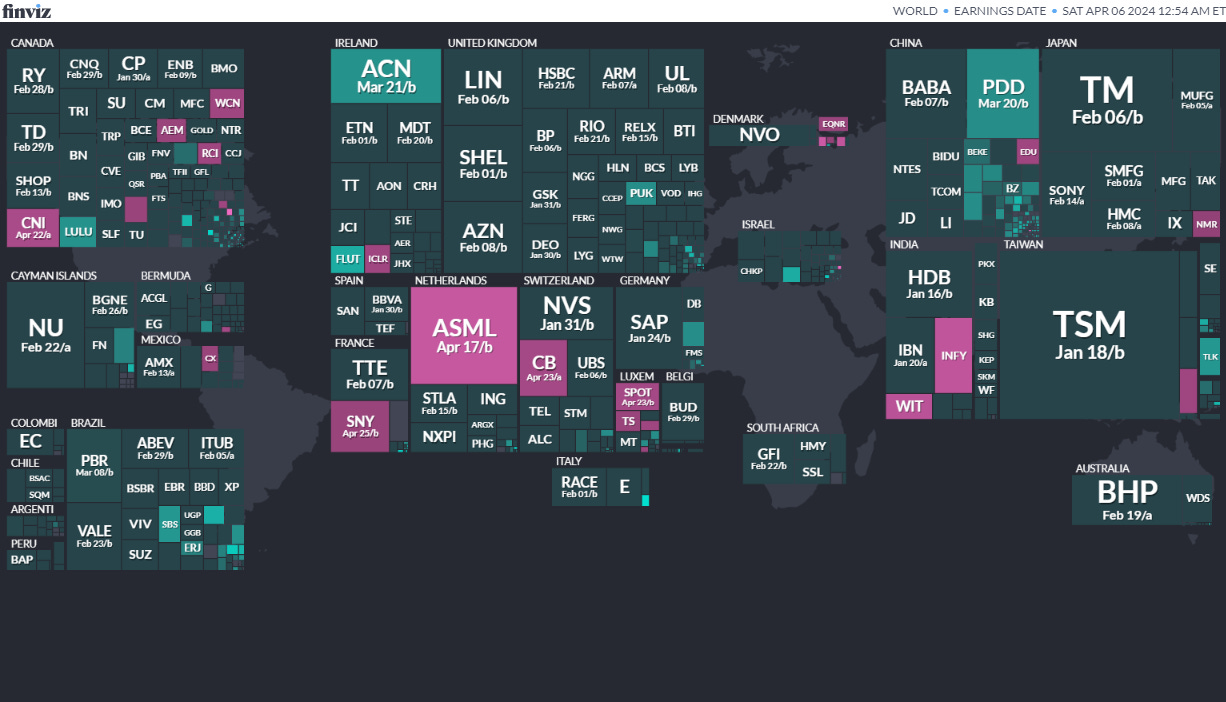

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

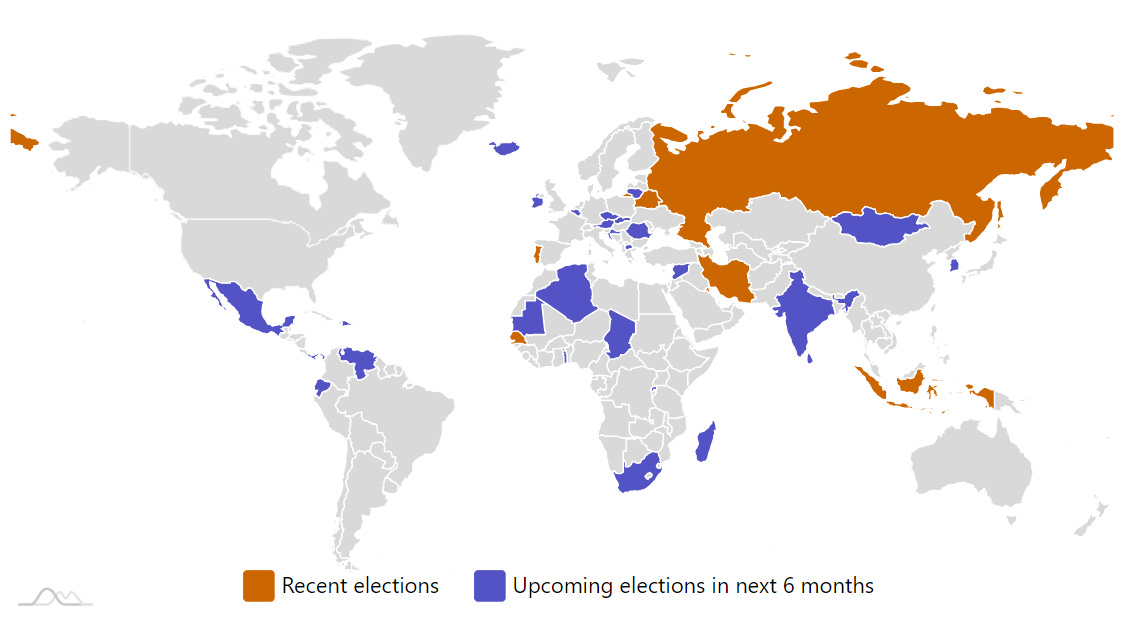

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

KuwaitKuwaiti National AssemblyApr 4, 2024 (d) Confirmed Jun 6, 2023South Korea South Korean National Assembly Apr 10, 2024 (d) Confirmed Apr 15, 2020

Croatia Croatian Assembly Apr 17, 2024 (d) Confirmed Jul 5, 2020

India Indian People's Assembly Apr 19, 2024 (d) Date not confirmed Apr 11, 2019

Ecuador Referendum Apr 21, 2024 (d) Confirmed Aug 20, 2023

Panama Panamanian National Assembly May 5, 2024 (t) Confirmed May 5, 2019

Panama Panamanian Presidency May 5, 2024 (t) Confirmed May 5, 2019

South Africa South African National Assembly May 29, 2024 (d) Confirmed May 8, 2019

Mexico Mexican Senate Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

Mexico Mexican Chamber of Deputies Jun 2, 2024 (t) Date not confirmed Jun 6, 2021

Mexico Mexican Presidency Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

Mongolia Mongolian State Great Hural Jun 28, 2024 (d) Confirmed Jun 24, 2020

Venezuela Venezuela Presidency Jul 28, 2024 (d) Confirmed May 20, 2018

Czech Republic Czech Senate Sep 30, 2024 (t) Date not confirmed Sep 23, 2022

Romania Romanian Presidency Sep 30, 2024 (t) Date not confirmed Nov 24, 2019

Sri Lanka Sri Lankan Presidency Sep 30, 2024 (t) Date not confirmed Nov 16, 2019

Georgia Georgian Parliament Oct 26, 2024 (d) Confirmed Oct 31, 2020

Uruguay Uruguayan Presidency Oct 27, 2024 (t) Date not confirmed

Uruguay Uruguayan Chamber of Representatives Oct 27, 2024 (t) Date not confirmed

Uruguay Uruguayan Chamber of Senators Oct 27, 2024 (t) Date not confirmed

Jordan Jordanian House of Deputies Oct 31, 2024 (t) Date not confirmed Nov 10, 2020

Georgia Georgian Presidency Nov 30, 2024 (t) Date not confirmed Nov 28, 2018

Romania Romanian Senate Nov 30, 2024 (t) Date not confirmed Dec 6, 2020

Romania Romanian Chamber of Deputies Nov 30, 2024 (t) Date not confirmed Dec 6, 2020

Namibia Namibian Presidency Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

Namibia Namibian National Assembly Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

Ghana Ghanaian Presidency Dec 7, 2024 (t) Date not confirmed Dec 7, 2020

Ghana Ghanaian Parliament Dec 7, 2024 (t) Date not confirmed Dec 7, 2020

Uzbekistan Uzbekistani Legislative Chamber Dec 31, 2024 (t) Tentative Dec 22, 2019

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Mobile-health Network Solutions MNDR Network 1 Financial, 2.3M Shares, $4.00-5.00, $10.1 mil, 4/9/2024 Tuesday

(Incorporated in the Cayman Islands)

Our Mission

To be our users’ trusted companion on their lifelong healthcare journey by providing a seamless healthcare experience from start to finish, which is affordable, accessible and easy to understand to both users and healthcare providers.

Our Business

We have set up one of the smartest integrated all-in-one patient care-centric platforms in the region to deliver affordable care to users. We are a leading telehealth solutions provider in Singapore in terms of the number of countries covered by our MaNaDr platform, including countries in the APAC region.

We are a leading telehealth solutions provider in Singapore in terms of various matrices, such as the number of patient consultations per day and the ranking of our mobile application, according to Frost & Sullivan. According to Frost & Sullivan, we have the largest number of teleconsultations per day in the six months ending May 2023, and are amongst the fastest-growing telehealth solutions providers in Singapore. Our MaNaDr mobile application has received a 4.8 and 4.9 star rating on the Apple App Store and Google Play Store in Singapore respectively as of June 14, 2023. According to Frost & Sullivan, on a combined basis, MaNaDr was the most reviewed and highest rated mobile application in Singapore as of June 14, 2023 and has the largest number of teleconsultations per day in the six months ending May 2023.

We provide our services on our MaNaDr platform, which is accessible via our mobile application and website. We serve both the community of users, by offering personalized and reliable medical attention to users worldwide, as well as the community of healthcare providers, by allowing them to have a broader reach to users through virtual clinics without any start-up costs and the ability to connect to a global network of peer-to-peer support groups and partners. Through our mobile application, we offer users with a range of seamless and hassle-free telehealth solutions, which encompasses teleconsultation services, including the issuance of electronic medical certificates and delivery of medications to users’ homes, as well as other personalized services such as weight management programs. Furthermore, we have set up one of the smartest 24/7 virtual care ecosystems and support groups to help users navigate the complexities faced in receiving correct and timely care, according to Frost & Sullivan. With MaNaChat, the 24/7 customer support service, we operate Singapore’s only in-app live group chat service and have one of the fastest response times in Singapore and globally to support users.

As of December 31, 2022, we had 58 employees globally, with 29 employees who are based in Singapore and 29 employees who are based in Vietnam.

Note: Net loss and revenue are for the fiscal year that ended June 30, 2023.

(Note: Mobile-health Network Solutions filed its F-1 to go public and disclosed terms for its small-cap IPO in a filing dated Feb. 22, 2024: The company intends to offer 2.25 million shares of stock at a price range of $4.00 to $5.00 to raise $10.13 million.)

CDT Environmental Technology Investment Holdings Limited CDTG WestPark Capital, 2.0M, $4.00-5.00, $9.0 mil, 4/12/2024 Week of

We are a waste treatment company that generates revenue through design, development, manufacture, sales, installation, operation and maintenance of sewage treatment systems and by providing sewage treatment services. We primarily engage in two business lines: sewage treatment systems and sewage treatment services in both urban and rural areas. Sewage treatment systems are sometimes also referred to herein as rural sewage treatment, and sewage treatment services are sometimes also referred to herein as septic tank treatment.

For sewage treatment systems, we sell complete sewage treatment systems, construct rural sewage treatment plants, install the systems, and provide on-going operation and maintenance services for such systems and plants in China for municipalities and enterprise clients. We provide decentralized rural sewage treatment services with our integrated and proprietary system using our advanced quick separation technology. Our quick separation technology uses a biochemical process for economically and sufficiently treating rural sewage. In addition, our integrated equipment generally has a lifespan of over 10 years without replacement of the core components. Due to our quick separation technology and our technological expertise and experience, our integrated rural sewage treatment system produces a high quality of outflowing water, with high degrees of automation, efficient construction and start up, and low operational costs. In addition, our equipment is typically able to process abrupt increases of sewage inflows and high contamination. Our integrated equipment consists of a compact structure and is buried underground in order to minimize changes to the surrounding environment.

**Note: Net income and revenue figures are in U.S. dollars for the 12 months that ended June 30, 2023.

(Note: CDT Environmental Technology Investment Holdings Limited updated its financial statements for the six-month period that ended June 30, 2023, in an F-1/A filing dated Nov. 20, 2023.)

(Note: CDT Environmental Technology Investment Holdings Limited cut its IPO’s size by about 35 percent to 2.0 million shares – down from 3.07 million shares – and increased the price to a range of $4.00 to $5.00 – up from an assumed IPO price of $4.00 – to raise $9.0 million, according to an F-1/A filing dated March 27, 2023. CDT Environmental Technology Investment Holdings Limited updated its financial statements in an F-1/A dated Feb. 24, 2023. The company changed its sole book-runner to WestPark Capital from ViewTrade Securities in an F-1/A filing in June 2021. The F-1 was filed on Jan. 15, 2021. The company submitted confidential IPO documents to the SEC on Nov. 15, 2019.)

Harden Technologies, Inc. HAHA U.S. Tiger Securities, 1.0M Shares, $5.00-7.00, $6.0 mil, 4/15/2024 Week of

(Note: Harden Technologies, Inc. cut its IPO’s size to 1.0 million shares – down from 2.5 million shares – and kept the price range at $5.00 to $7.00 – to raise $6.0 million, according to an F-1/A filing on Feb. 1, 2024. Harden Technologies also disclosed in that Feb. 1, 2024, filing that it has changed its proposed stock symbol to “HAHA” – replacing the original proposed symbol of “HARD” – and it has changed its exchange venue to list its stock on the CBOE BZX – a move away from the NASDAQ. Background: The British Virgin Islands-incorporate holding company filed to go public a little more than a year ago – on Feb. 14, 2023. The underlying industrial subsidiary in in China: That company is a manufacturer of industrial shredders and other material-sorting machines for waste management and material recycling.)

We make industrial shredders and material-sorting machines for waste management and material recycling industries. In 2021, we served 212 customers in the industrial, municipal and solid waste disposal sectors. (Incorporated in the British Virgin Islands)

**Note: The BVI-incorporated holding company will issue the shares in the IPO – and not the underlying industrial company in China, the prospectus says.

We were founded on May 10, 2010, by our chairman of the board of directors, director and chief executive officer, Mr. Jiawen Miao. We are located in Zhongshan City in China’s Guangdong Province. We currently employ 237 people on a full time basis — 20 people in management positions; 31 in sales and marketing positions; 29 in research and development positions; 35 people in technical engineering positions; 26 in after-sale service positions and 96 in manufacturing and installation positions.

According to Grand View Research, an international market research company, the global industrial recycling equipment market size was estimated at $852 million in 2019 and is anticipated to reach $1.3 billion by 2027, expanding at a compound annual growth rate (“CAGR”) of 5.8%. The Asia Pacific region’s market is forecast to exceed $450 million by 2025, with China as a major revenue earner.

We expect growing awareness pertaining to the economic and environmental benefits of recycled processed materials to significantly impact our market. In addition, we expect growing concerns over the increasing carbon footprint along with rising government efforts in numerous countries in order to promote recycling of material to create significant opportunities for manufacturers. Industrial recycling equipment plays a significant role in this process. Scrap materials including discarded electrical and electronic goods, automobile parts, paper, and construction materials are collected from numerous sources for further processing. Industrial recycling equipment, including baler presses, granulators, shredders, and shears are then used to reduce the shape and size of the waste materials, which are further used for recycling.

Due to the increasing awareness towards the sustainable advantages and benefits of reusing and recycling waste materials, we believe the end-use utilization of recycled materials will further benefit the industry. We anticipate that recycled material such as steel, iron, plastic, rubber, and concrete in the industries including automotive, electrical and electronics, building and construction, and packaging will drive the market.

*Note: Net income and revenue are for the 12 months that ended June 30, 2023.

(Note: Harden Technologies, Inc. cut its IPO’s size to 1.0 million shares – down from 2.5 million shares – and kept the price range at $5.00 to $7.00 – to raise $6.0 million, according to an F-1/A filing on Feb. 1, 2024. In that Feb.1, 2024, filing, Harden Technologies disclosed that it has changed its exchange venue to list its stock on the CBOE BZX – a move away from the NASDAQ. Background: Harden Technologies, Inc. filed its F-1/A and disclosed terms for its IPO on Feb. 14, 2023: 2.5 million shares at $5.00 to $7.00 to raise $15.0 million. The Chinese company submitted confidential IPO documents on Aug. 4, 2021.)

🏁 Emerging Market ETF Launches

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

03/19/2024 - Avantis Emerging Markets ex-China Equity ETF AVXC - Active, equity, ex-China

03/15/2024 - Polen Capital China Growth ETF PCCE - Active, equity, China

03/04/2024 - Simplify Tara India Opportunities ETF IOPP - Active, equity, India

02/07/2024 - Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares XXCH - Equity, leveraged, China

01/11/2024 - Matthews Emerging Markets Discovery Active ETF MEMS - Active, equity, small caps

01/10/2024 - Matthews China Discovery Active ETF MCHS - Active, equity, small caps

11/07/2023 - Global X MSCI Emerging Markets Covered Call ETF EMCC - Equity, leverage

11/07/2023 - Avantis Emerging Markets Small Cap Equity ETF AVEE - Active, equity, small caps

09/22/2023 - Matthews Asia Dividend Active ETF ADVE - Active, equity, Asia

09/22/2023 - Matthews Pacific Tiger Active ETF ASIA - Active, equity, Asia

09/22/2023 - Matthews Emerging Markets Sustainable Future Active ETF EMSF - Active, equity, ESG

09/22/2023 - Matthews India Active ETF INDE - Active, equity, India

09/22/2023 - Matthews Japan Active ETF JPAN - Active, equity, Japan

09/22/2023 - Matthews Asia Dividend Active ETF ADVE - Active, equity, Asia

08/25/2023 - KraneShares Dynamic Emerging Markets Strategy ETF KEM - Active, equity, emerging markets

08/18/2023 - Global X India Active ETF NDIA - Active, equity, India

08/18/2023 - Global X Brazil Active ETF BRAZ - Active, equity, Brazil

07/17/2023 - Matthews Korea Active ETF MKOR - Active, equity, South Korea

05/18/2023 - Putnam Emerging Markets ex-China ETF PEMX - Active, value, growth stocks

05/11/2023 - JPMorgan BetaBuilders Emerging Markets Equity ETF BBEM - Passive, large + midcap stocks

03/16/2023 - JPMorgan Active China ETF JCHI - Active, equity, China

03/03/2023 - First Trust Bloomberg Emerging Market Democracies ETF EMDM - Principles-based

1/31/2023 - Strive Emerging Markets Ex-China ETF STX - Passive, equity, emerging markets

1/20/2023 - Putnam PanAgora ESG Emerging Markets Equity ETF PPEM - Active, equity, ESG, emerging markets

1/12/2023 - KraneShares China Internet and Covered Call Strategy ETF KLIP - Active, equity, China, options overlay, thematic

1/11/2023 - Matthews Emerging Markets ex China Active ETF MEMX - Active, equity, emerging markets

12/13/2022 - GraniteShares 1.75x Long BABA Daily ETF BABX - Active, equity, leveraged, single stock

12/13/2022 - Virtus Stone Harbor Emerging Markets High Yield Bond ETF VEMY - Active, fixed income, junk bond, emerging markets

9/22/2022 - WisdomTree Emerging Markets ex-China Fund XC - Passive, equity, emerging markets

9/15/2022 - KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV - Passive, equity, Asia, dividend strategy

9/15/2022 - OneAscent Emerging Markets ETF OAEM - Active, Equity, emerging markets, ESG

9/9/2022 - Emerge EMPWR Sustainable Select Growth Equity ETF EMGC - Active, equity, emerging markets

9/9/2022 - Emerge EMPWR Unified Sustainable Equity ETF EMPW - Active, equity, emerging markets

9/8/2022 - Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH - Active, equity, emerging markets, ESG

7/14/2022 - Matthews China Active ETF MCH - Active, equity, China

7/14/2022 - Matthews Emerging Markets Equity Active ETF MEM - Active, equity, emerging markets

7/14/2022 - Matthews Asia Innovators Active ETF MINV - Active, equity, Asia

6/30/2022 - BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD - Passive, fixed income, emerging markets

5/2/2022 - AXS Short CSI China Internet ETF SWEB - Active, inverse, thematic

4/27/2022 - Dimensional Emerging Markets High Profitability ETF DEHP - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Core Equity 2 ETF DFEM - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Value ETF DFEV - Active, equity, emerging markets

4/27/2022 - iShares Emergent Food and AgTech Multisector ETF IVEG - Passive, equity, thematic [Mostly developed markets]

4/21/2022 - FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM - Passive, equity, ESG

4/6/2022 - India Internet & Ecommerce ETF INQQ - Passive, equity, thematic

2/17/2022 - VanEck Digital India ETF DGIN - Passive, India market, thematic

2/17/2022 - Goldman Sachs Access Emerging Markets USD Bond ETF GEMD - Passive, fixed income, emerging markets

1/27/2022 - iShares MSCI China Multisector Tech ETF TCHI - Passive, China, technology

1/11/2022 - Simplify Emerging Markets PLUS Downside Convexity ETF EMGD - Active, equity, options strategy

1/11/2022 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG - Passive, equity, ESG

🚽 Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

02/16/2024 - Global X MSCI China Real Estate ETF - CHIH

02/16/2024 - Global X MSCI China Biotech Innovation ETF - CHB

02/16/2024 - Global X MSCI China Utilities ETF - CHIU

02/16/2024 - Global X MSCI Pakistan ETF - PAK

02/16/2024 - Global X MSCI China Materials ETF - CHIM

02/16/2024 - Global X MSCI China Health Care ETF - CHIH

02/16/2024 - Global X MSCI China Financials ETF - CHIX

02/16/2024 - Global X MSCI China Information Technology ETF - CHIK

02/16/2024 - Global X MSCI China Consumer Staples ETF - CHIS

02/16/2024 - Global X MSCI China Industrials ETF - CHII

02/16/2024 - Global X MSCI China Energy ETF - CHIE

02/14/2024 - BNY Mellon Sustainable Global Emerging Markets ETF - BKES

01/26/2024 - The WisdomTree Emerging Markets ESG Fund - RESE

11/11/2023 - Global X China Innovation ETF - KEJI

11/11/2023 - Global X Emerging Markets Internet & E-commerce ETF - EWEB

11/09/2023 - Franklin FTSE South Africa ETF - FLZA

10/27/2023 - Simplify Emerging Markets Equity PLUS Downside Convexity - EMGD

10/20/2023 - WisdomTree India ex-State-Owned Enterprises Fund - IXSE

10/20/2023 - WisdomTree Chinese Yuan Strategy Fund - CYB

10/20/2023 - Loncar China BioPharma ETF - CHNA

10/18/2023 - KraneShares Emerging Markets Healthcare Index ETF - KMED

10/18/2023 - KraneShares MSCI China ESG Leaders Index ETF - KSEG

10/18/2023 - KraneShares CICC China Leaders 100 Index ETF - KFYP

10/16/2023 - Strategy Shares Halt Climate Change ETF - NZRO

09/20/2023 - VanEck China Growth Leaders ETF - GLCN

08/28/2023 - Asian Growth Cubs ETF - CUBS

08/01/2023 - VanEck Russia ETF - RSX

07/07/2023 - Emerge EMPWR Sustainable Emerging Markets Equity ETF - EMCH

06/23/2023 - Invesco PureBeta FTSE Emerging Markets ETF - PBEE

06/16/2023 - AXS Short China Internet ETF - SWEB

04/11/2023 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF - REMG

3/30/2023 - Invesco BLDRS Emerging Markets 50 ADR Index Fund - ADRE

3/30/2023 - Invesco BulletShares 2023 USD Emerging Markets Debt ETF - BSCE

3/30/2023 - Invesco BulletShares 2024 USD Emerging Markets Debt ETF - BSDE

3/30/2023 - Invesco RAFI Strategic Emerging Markets ETF - ISEM

2/17/2023 - Direxion Daily CSI 300 China A Share Bear 1X Shares - CHAD

1/13/2023 - First Trust Chindia ETF - FNI

12/28/2022 - Franklin FTSE Russia ETF - FLRU

12/22/2022 - VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

8/22/2022 - iShares MSCI Argentina and Global Exposure ETF AGT

8/22/2022 - iShares MSCI Colombia ETFI COL

6/10/2022 - Infusive Compounding Global Equities ETF JOYY

5/3/2022 - ProShares Short Term USD Emerging Markets Bond ETF EMSH

4/7/2022 - DeltaShares S&P EM 100 & Managed Risk ETF DMRE

3/11/2022 - Direxion Daily Russia Bull 2X Shares RUSL

1/27/2022 - Legg Mason Global Infrastructure ETF INFR

1/14/2022 - Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (April 8, 2024) was also published on our website under the Newsletter category.