Emerging Market Links + The Week Ahead (August 29, 2022)

US-China audit deal, Chinese economic & real estate troubles, deglobalization, Grab vs GoTo, hidden Venezuela plays, Peru still a top performer and the week ahead for emerging markets.

The US and China has reached an audit deal. Its clear that many Chinese ADRs still need or desire a listing on a Western stock exchange. And with China’s mounting economic troubles, it also appears the Chinese government was ready to make a deal to have one less problem to worry about. However, it remains to be seen what the specifics are and whether most Chinese companies will abide by them to avoid delisting.

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as some ETF lists are still being updated as of Summer 2022).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Suggested Reading

$ = behind a paywall

Factbox-Highlights of the U.S.-China audit deal (Reuters)

In principle at least, the United States secured what it has long demanded from Beijing: full access to Chinese audit papers. The deal does not allow China to withhold or redact any information contained in audit documentation for any reason, and allows the PCAOB to take direct testimony from audit company staff in China for its investigations. The PCAOB can also transfer information to the Securities and Exchange Commission, the federal U.S. securities regulator which oversees the PCAOB.

In Depth: How Chinese private equity firms got scammed by their own sales teams (Caixin) $

NOTE: I can’t find a non-paywalled, version but this article feeds into another recent article: China’s Trillion-Dollar Research Funds Squandered On Travel and Leisure (Epoch Times via ZeroHedge)

When an entrepreneur surnamed You set out to build a sales team in Shanghai in December 2020, she thought she had hired a team full of potential to sell her firm’s fund products.

What she didn’t count on was for the 10 new hires to be regularly absent from work and fail to seal any deals. Worse still, they worked together to create a false sense of assurance of progress.

Eventually, she learned that these employees were con artists whose ulterior motive was to milk the firm of base salaries.

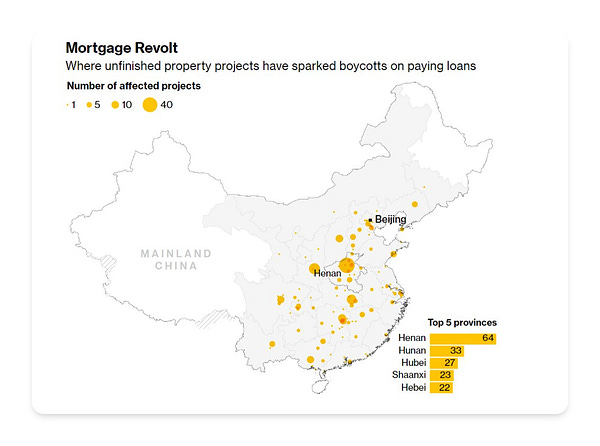

What's going on in the Chinese real estate market? (Yielddive)

Note: Many excellent charts and graphs. For example:

China’s Rocky Economy Is a Major Warning for the U.S. (InvestorPlace)

Deglobalization is quickly picking up, and China’s getting left behind.

The tale unfolding in China is something of a warning – a prelude, perhaps – to what happens when companies fail to deglobalize.

“NMIC” or “Not Made In China” is a trend that I’ve been keeping a steady eye on for the better part of two years (I identified it in the September 2020 issue of Fry’s Investment Report). Though it’s not necessarily one of my “megatrends,” it is an undeniably powerful force that will come to shape the U.S. economy – and the world – in the coming years…

The Chinese economy is experiencing a near-complete collapse (Lengthy Twitter Thread)

China's Water Crisis Could Trigger Global Catastrophe (ZeroHedge)

China's water crisis is nothing new, but it's gotten worse - and is now on the 'brink of catastrophe' and could trigger a global catastrophe, according to Foreign Affairs.

Also worrisome, is that 19% of China's surface water is not fit for human consumption according to China’s Ministry of Ecology and Environment. Roughly 7% was deemed unfit for any use at all.

Groundwater was worse - with around 30% considered unfit for consumption, and 16% unfit for any use.

In order to utilize this water, Beijing will need to make major investments in treatment infrastructure, which will require a significant increase in electricity usage in order to power the equipment.

Go to south-east Asia, young one (FT) $ (Non-Paywalled)

See Southeast Asia ADRs, Southeast Asia ETFs and Southeast Asia Closed-End Funds lists.

A new British graduate faces a country facing uncontrollable decline. For his one in the United States, it’s the dirtiest politics ever where they could hatch an escape plan.

The region, with its ambivalent geopolitical stance, will become what economists call a “main battleground” between the United States and China. Each superpower will flood with decades of investment and public attention. Even without these feuding giants, the heavily populated and recently impoverished region would ooze potential. With them, living here will feel like living at the hinge of the world.

Once South-East Asia’s most valuable startup, Grab falls US$13bil behind GoTo (Bloomberg via The Star)

Singapore’s Grab Holdings Ltd, once South-East Asia’s most valuable startup, is faltering behind GoTo Group in the public markets as it fights to gain ground on its Indonesian ride-hailing rival’s home turf.

The unprofitable companies are both struggling to convince investors of their moneymaking potential after staging their stock-market debuts in recent months.

Venezuela – a multi-bagger recovery play? (Undervalued Shares)

See our Venezuela ADRs list.

In the case of Venezuela, there is an almost forgotten stock trading in Canada that allows investors to combine the two. Rusoro Mining (ISIN CA7822271028, CA:RML) is a company that used to operate a gold mine in Venezuela, but which nowadays is effectively dormant, except its ongoing lawsuit against the Republic of Venezuela.

Between 2006 and 2008, Rusoro Mining had acquired Venezuelan mining licences that gave it gold reserves of 5.6m ounces, as well as further possible 6.8m ounces subject to additional exploration work. In 2009, the company produced 126,000 ounces from its core gold field, and a further 25,000 ounces from a co-owned project.

In 2011/12, Venezuela nationalised all mining assets without paying suitable compensation. Rusoro Mining didn't just take this laying down, but teamed up with a litigation financier to provide millions of upfront costs for a lawsuit that was going to claim USD 3.3bn in compensation from Venezuela.

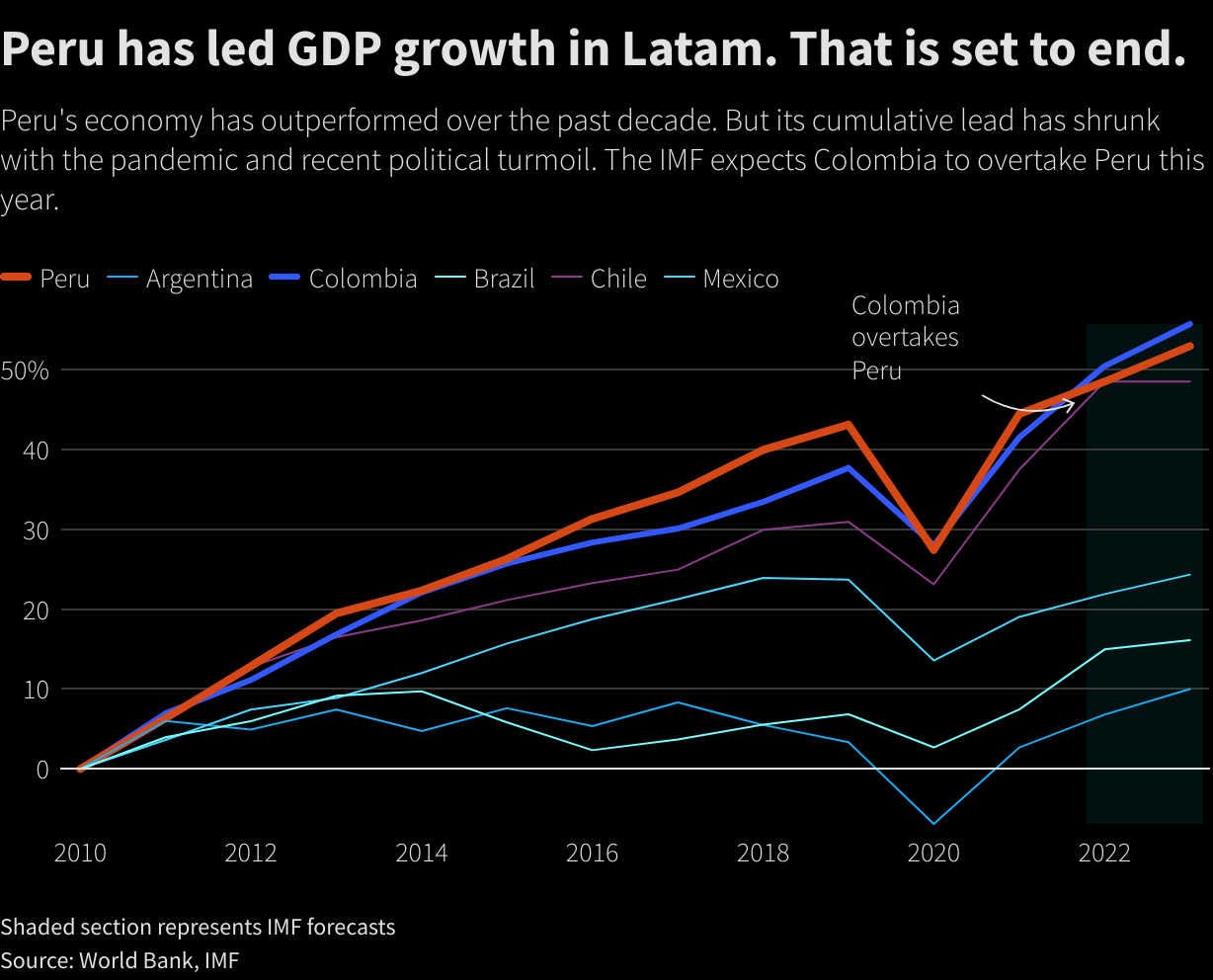

Analysis: Years of political crises in Peru are finally hitting its economy (AP)

See our Peru ADRs and Peru ETFs lists.

Peru is expected to remain among Latin America's top performing economies, according to the International Monetary Fund. Meanwhile, Moody's, Fitch and S&P all told Reuters they do not see imminent risks of a downgrade to Peru's investment-grade rating.

Peru's largest corporations, including lender Credicorp and miner Sociedad Minera Cerro Verde, have presented solid earnings so far this year.

Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

AngolaAngolan National AssemblyAug 24, 2022 (d) Confirmed Aug 23, 2017Brazil Brazilian Federal Senate Oct 2, 2022 (t) Confirmed Oct 7, 2018

Brazil Brazilian Chamber of Deputies Oct 2, 2022 (d) Confirmed Oct 7, 2018

Bosnia and Herzegovina Bosnia and Herzegovina House of Representatives Oct 2, 2022 (d)

Bosnia and Herzegovina Chairman of the Presidency Oct 2, 2022 (d)

Bahrain Bahraini Council of Representatives Nov 30, 2022 (t) Date not confirmed Dec 1, 2018

Tunisia Tunisian Assembly of People's Representatives Dec 17, 2022 (d) Confirmed Oct 6, 2019

Check out:

IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

ETF Launches

Climate change and ESG are clearly the latest flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

6/30/2022 - BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD - Passive, fixed income, emerging markets

5/2/2022 - AXS Short CSI China Internet ETF SWEB - Active, inverse, thematic

4/27/2022 - Dimensional Emerging Markets High Profitability ETF DEHP - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Core Equity 2 ETF DFEM - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Value ETF DFEV - Active, equity, emerging markets

4/27/2022 - iShares Emergent Food and AgTech Multisector ETF IVEG - Passive, equity, thematic [Mostly developed markets]

4/21/2022 - FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM - Passive, equity, ESG

4/6/2022 - India Internet & Ecommerce ETF INQQ - Passive, equity, thematic

2/17/2022 - VanEck Digital India ETF DGIN - Passive, India market, thematic

2/17/2022 - Goldman Sachs Access Emerging Markets USD Bond ETF GEMD - Passive, fixed income, emerging markets

1/27/2022 - iShares MSCI China Multisector Tech ETF TCHI - Passive, China, technology

1/11/2022 - Simplify Emerging Markets PLUS Downside Convexity ETF EMGD - Active, equity, options strategy

1/11/2022 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG - Passive, equity, ESG

ETF Closures/Liquidations

Frontier and emerging market highlights:

8/22/2022 - iShares MSCI Argentina and Global Exposure ETF AGT

8/22/2022 - iShares MSCI Colombia ETFI COL

6/10/2022 - Infusive Compounding Global Equities ETF JOYY

5/3/2022 - ProShares Short Term USD Emerging Markets Bond ETF EMSH

4/7/2022 - DeltaShares S&P EM 100 & Managed Risk ETF DMRE

3/11/2022 - Direxion Daily Russia Bull 2X Shares RUSL

1/27/2022 - Legg Mason Global Infrastructure ETF INFR

1/14/2022 - Direxion Daily Latin America Bull 2X Shares LBJ

Disclaimer: EmergingMarketSkeptic.Substack.com and EmergingMarketSkeptic.com provides useful information that should not constitute investment advice or a recommendation to invest. In addition, your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content.

Emerging Market Links + The Week Ahead (August 29, 2022) was also published on our website under the Newsletter category.