Emerging Market Links + The Week Ahead (December 25, 2023)

Red Sea conflict benefits air cargo, Yuan overtakes Yen to rank 4th for global payments, Chile rejects 2nd constitution re-write, EM stock picks, and the week ahead for emerging markets.

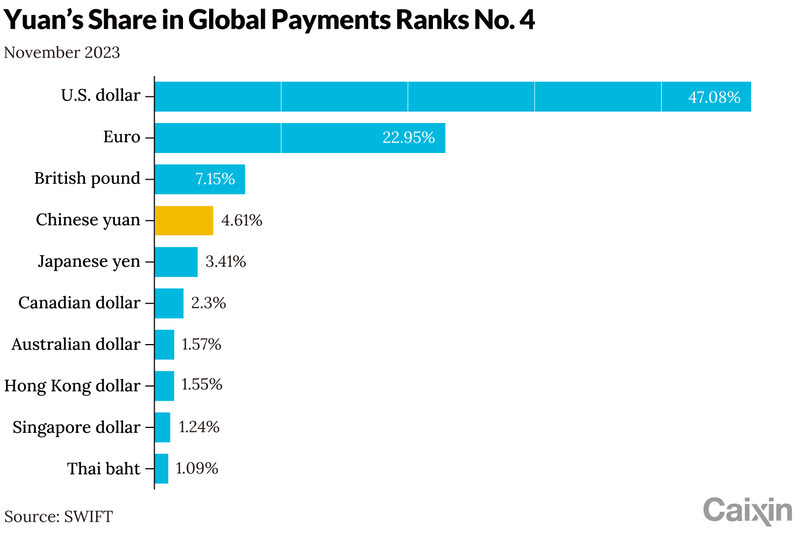

Air Cargo carriers appear to be the winner in the growing conflict in the Red Sea and they are also benefiting from the West’s growing love for eCommerce sites Shein and Temu. In addition, the Yuan has unseated the Yen to rank #4 for global payments while China’s stock market (the world’s worst-performing major market) leave many high-quality and high-yielding stocks trading at bargain valuations.

Finally, and while Argentina has been grabbing recent headlines about Latin America, Chileans have rejected another attempt (this time from the country’s Right) to rewrite their Pinochet era constitution. It remains to be seen whether or not both the Left and the Right will can just move on or focus their attention on tweaking the existing Constitution which has served the country (and investors) well.

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall / 🗃️ = Archived article

🇮🇳 moneycontrol India Stock of the Day (November 2023) Partially $

Includes: Vijaya Diagnostic Centre, BSE Ltd (Bombay Stock Exchange), Amber Enterprises, HDFC Bank, S Chand and Company, Zee Entertainment Enterprises, Emami, Paradeep Phosphates, Ami Organics, Star Health & Allied Insurance, MAS Financial Services, Navin Fluorine International and Container Corporation

📰🔬 Emerging Market Stock Picks / Stock Research

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 U.S. chipmaker Qorvo sells China facilities in supply chain revamp (Caixin) $

American chipmaker Qorvo (NASDAQ: QRVO) has agreed to sell its assembly and test facilities in China to contract manufacturer Luxshare Precision Industry (SHE: 002475), amid a broader supply chain revamp of the U.S. semiconductor industry.

Qorvo has reached a definitive agreement with the Chinese company Luxshare to sell operations and assets of Qorvo’s two facilities in Beijing and Dezhou, Shandong province, said the wireless connectivity chip manufacturer in a Monday statement. The sale includes the property, plant and equipment, as well as the existing workforce to allow operations to continue.

🇨🇳 [Meituan (3690 HK, BUY, TP HK$118) Company Update]: Why ByteDance’s Purchase of Eleme Is a Bad Idea? (Smart Karma) $

Local news reported an unnamed expert suggesting ByteDance might be buying Eleme for US$7bn, leading to share of Meituan (SEHK: 3690) to fall;

While we believe (1) buying a food delivery business to complement Douyin’s in-store business makes some sense and...

(2) ByteDance has been aggressive in pushing the boundary of its businesses, an entry into domestic food delivery is a daunting challenge that yields very little benefits for ByteDance;

🇨🇳 Dada Nexus rides closer to JD.com’s orbit with management shakeup (Bamboo Works)

The intra-city delivery company named a new chairman and CFO, both with close ties to JD Logistics

Dada Nexus (NASDAQ: DADA) has appointed two JD Logistics (HKG: 2618 / OTCMKTS: JDLGF) veterans as its new chairman and CFO, hinting at closer integration between the two companies

The intra-city delivery company has become more integrated with JD.com (NASDAQ: JD) since JD boosted its stake in Dada Nexus to 52% last year from a previous 47%

🇨🇳 RoboSense steers tricky course in self-drive tech market (Bamboo Works)

China’s leading LiDAR company, Hesai Group (NASDAQ: HSAI), listed its shares in the United States earlier this year and now one of its key competitors, RoboSense Technology Co. Ltd., is on track to become the first auto sensor specialist to make its debut on the Hong Kong Stock Exchange.

Can a Hong Kong listing help the maker of LiDAR automotive sensors break out of a cycle of rising sales but mounting losses?

The sensor technology firm’s losses have widened over the past three years, reaching 2.09 billion yuan last year

Gross margins are narrowing and last year spiraled to minus 7.4%, hit by price pressure from automakers

🇨🇳 REPT BATTERO Energy IPO Trading - Needs to Correct by 20-30%, at Least (Smart Karma) $

REPT BATTERO Energy (HKG: 0666) raised around US$270m in its Hong Kong IPO.

REPT is a lithium-ion battery manufacturer in China, focusing on R&D, production, and sales of EV/ESS lithium-ion battery products such as battery cells, modules and packs.

We have covered various aspects of the deal in our previous note. In this note, we will talk about the demand and trading dynamics.

🇨🇳 Miniso's Share Repurchase Program Will Likely Help The Stock Find Stability After Its Recent Selloff (Seeking Alpha) $

See: MINISO Group Holding (NYSE: MNSO): Asia's Notorious Copycat Retailer

MINISO Group Holding (NYSE: MNSO) has the potential for a rebound if it defends the critical 18.5 neckline area.

Founder Guofu Ye's transactions are likely to significantly influence the stock price.

Miniso's strong supply chain, retail partner model, and product differentiation strategy contribute to its growth and outperformance.

🇨🇳 WuXi Bio prescribes share buyback to relieve revenue pain (Bamboo Works)

The pharma services provider has shocked investors with a steep downward revision of its earnings outlook, slashing its full-year revenue growth forecast to just 10% from an initial 30% and predicting a profit drop

After its shares plunged more than 30% in a week, Wuxi Biologics (HKG: 2269 / OTCMKTS: WXXWY / OTCMKTS: WXIBF) announced a buyback of 10% of its shares, saying the battered price did not reflect the company’s value or business prospects

The company blamed the weaker revenue outlook on a financing slowdown in the biopharma industry and regulatory delays in launching star drugs

🇨🇳 HBM gets health boost from drug licensing deals (Bamboo Works)

The biopharma company has marked out a path to profitability by licensing its drug expertise and antibody platforms to partners such as Pfizer

Nona Biosciences, a subsidiary of HBM Holdings (HKG: 2142 / FRA: 6XY / OTCMKTS: HBMHF), has struck a licensing-out deal with a Pfizer-owned biotech for an initial sum of $53 million and milestone payments of up to $1.05 billion

HBM Holdings boosted its revenue by 48% in the first half of this year through licensing-out partnerships and by providing R&D services

🇨🇳 Li Ning buys Hong Kong building for overseas expansion, flipping out investors (Bamboo Works)

The sportswear brand is paying $283 million for a North Point area building that will become headquarters for its non-Mainland operations

Shares of Li Ning (HKG: 2331 / FRA: LNLB / FRA: LNL / OTCMKTS: LNNGY / LNNGF) tumbled 14% after it announced its purchase of a Hong Kong building to become its headquarters outside Mainland China

The purchase will lay the groundwork for the sportswear maker’s overseas expansion, which it intends to officially launch in 2024.

🇨🇳 KFC plucks up major milestone with 10,000th China store opening (Bamboo Works)

The chain launched its latest store in the city of Hangzhou 36 years after becoming the first Western fast food operator in China

KFC [YUM China (NYSE: YUMC)] has opened its 10,000th China store in Hangzhou, and plans to accelerate net new openings to about 1,200 annually over the next three years

The chain has bounced back strongly post-pandemic, but faces uncertainties due to growing Chinese consumer caution

🇨🇳 Midea (000333 CH): Positive Read-Through From Gree's Profit Alert (Smart Karma) $

Gree Electric Appliances (SHE: 000651) announced a profit alert for FY22 yesterday. Net profit is expected to increase 10.2% - 19.6% yoy for the whole year.

The resilient result of Gree should alleviate concerns of the market that Midea is too correlated with China's new home sales.

The stock is trading at 10x 2024E earnings compared to an average of 13x over the last 10 years, with earnings likely growing at a high-single-digit pace.

🇨🇳 Hywin undermined in the shadows of China’s real estate slump (Bamboo Works)

Some products distributed by the real estate-focused wealth management company may be having trouble paying promised returns

Hywin Holdings Ltd (NASDAQ: HYW) said it was dealing with “redemption issues” over some asset-backed products it distributed, sparking a massive selloff of its shares

The company traditionally relied heavily on real estate-linked wealth management products, but has been trying to move into other businesses like healthcare services

🇹🇼 Asian Dividend Gems: O-Ta Precision Industry (Asian Dividend Stocks) $

O-TA Precision Industry (TSE: 8924) is a company based in Taiwan that mainly makes golf clubs for global golf equipment branded companies including Titleist, PXG, Mizuno, and Honma.

O-Ta Precision's dividend yield averaged 9.2% annually from 2019 to 2022. Its annual dividend payout averaged 68.5% in the same period.

We like the company's strong niche in the golf club OEM/ODM business with excellent list of customers with its its historically high dividend payout ratio and dividend yields...

🇰🇷 Taihan Electric Wire: Rights Offering of 50% of Outstanding Shares (Smart Karma) $

Last week, Taihan Electric Wire (KRX: 001440) announced a rights offering of 50% of its outstanding shares. The company is expected to raise 526 billion won.

Taihan Electric Wire is expected to use the rights offering proceeds to mostly expand its submarine cable production.

With the share price falling 21% since the announcement of the rights offering last week, Taihan Electric Wire looks more attractive.

🇰🇷 LG Display: Announces a Rights Offering Capital Raise of 1.36 Trillion Won (Smart Karma) $

LG Display (NYSE: LPL) announced today that it will conduct a rights offering capital raise worth 1.36 trillion won.

The rights offering capital raise involves 142 million shares, which represent 39.7% of its existing outstanding shares.

We believe this rights offering will have a negative impact on LG Display's share price as it will significantly dilute existing shareholders.

🌏 There's Something About Air Cargo (Smart Karma) $

FT article [West’s love for Shein and Temu drives ecommerce boom for air freighters] uncovers other contributors to surging air freight rates—Chinese online brands Temu and Shein are flooding Western nations with fast fashion and inexpensive e-commerce goods

The biggest beneficiaries are Chinese carriers with significant air cargo exposure, and Cathay Pacific [Swire Pacific Limited (HKG: 0019 / HKG: 0087 / OTCMKTS: SWRAY / OTCMKTS: SWRAF)]. This presents a potential catalyst for an earnings beat and a boost to the share price.

Carriers from Taiwan and South Korea will benefit from supply tightness to the U.S.. Logistics providers are unlikely to benefit much due to tight margins and volatile high freight rates

🇵🇭 Jollibee Foods: Positive Short-Term And Long-Term Prospects (Rating Upgrade) (Seeking Alpha)

Jollibee Foods (PSE: JFC / OTCMKTS: JBFCF / JBFCY) is the leader in the Philippines' quick service restaurant market with a 50% market share, and its Philippines business delivered a good +16.5% System-Wide Sales growth in Q3.

The company aims to have its international businesses contribute half of its sales in a couple of years' time, and this seems achievable with its emphasis on franchising.

I raise my rating for Jollibee Foods to a Buy in view of its favorable outlook for the short term and long run.

🇸🇬 Raffles Medical Group’s Share Price is Near its 52-Week Low: Is the Healthcare Player a Bargain? (The Smart Investor)

The integrated healthcare player is going through a tough period but could see better earnings in the years to come.

Raffles Medical Group (SGX: BSL / FRA: 02M1 / OTCMKTS: RAFLF), or RMG, however, is reeling from the effects of a sharp drop in vaccinations and pandemic-related tests.

The integrated healthcare player saw its share price plunge to its 52-week low of S$1.01 recently before rebounding slightly.

With medical tourism recovering and its China hospitals edging closer to breakeven, it is a matter of time before the integrated healthcare player sees its profit heading higher.

🇸🇬 4 Singapore Stocks That Conducted Acquisitions to Grow Their Business (The Smart Investor)

These four companies recently announced acquisitions to expand their business.

Grand Venture Technology (SGX: JLB), or GVT, manufactures complex precision machining, sheet metal components, and mechatronics modules.

Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF), or STE, is a technology, defence, and engineering group serving the aerospace, smart city, defence, and public security sectors.

Centurion Corporation Limited (SGX: OU8 / HKG: 6090) develops and manages purpose-built accommodation assets (PBSA) in Singapore and Malaysia as well as student accommodation assets in Australia, the UK, and the US.

Tiong Woon Corporation Ltd (SGX: BQM) is a one-stop integrated heavy lift specialist supporting the oil and gas, petrochemical, infrastructure, and construction sectors.

🇸🇬 5 Singapore Stocks That Could Benefit from a Semiconductor Recovery in 2024 (The Smart Investor)

With a recovery expected for the semiconductor sector next year, here are five stocks that could benefit.

Micro-Mechanics (Holdings) Ltd (SGX: 5DD / OTCMKTS: MCRNF), or MMH, designs and manufactures high-precision tools and parts used in the wafer fabrication and assembly processes in the semiconductor industry.

Venture Corporation (SGX: V03 / FRA: VEM / OTCMKTS: VEMLF) is a provider of technology products, services, and solutions.

Frencken Group Ltd (SGX: E28) provides original design, original equipment and diversified integrated manufacturing services to the analytical and life sciences, automotive, healthcare, industrial and semiconductor industries.

UMS Holdings (SGX: 558 / KLSE: UMS / OTCMKTS: UMSSF) provides equipment manufacturing and engineering services to original equipment manufacturers of semiconductors and related products.

AEM Holdings (SGX: AWX) offers comprehensive semiconductor and electronics test solutions and has a global presence spanning Asia, Europe, and the US.

🇮🇳 India’s assault on unsecured loans hits Paytm and other fintech companies (FT) $

Country’s central bank raises capital requirements in move to curb rising delinquencies

Since then, the shares of Paytm [One 97 Communications Ltd. (NSE: PAYTM / BOM: 543396)], one of India’s biggest fintech groups with a market capitalisation of Rs384bn ($4.6bn), have fallen more than 30 per cent, with Warren Buffett’s Berkshire Hathaway selling its 2.5 per cent stake in the company shortly after the RBI’s order.

🇸🇦 Saudi-backed fund hit as UAE oil storage Spac runs into trouble (FT) $

🇹🇷 🇷🇺 Turkish brewer to acquire AB InBev stake in Russian joint venture (FT) $

Anadolu Efes Biracilik ve Malt SanayiiAS (IST: AEFES / FRA: EF41 / OTCMKTS: AEBZY) will not pay for the share, valued at up to $1.3bn, with western companies continuing their difficult exit from Russia

🇵🇱 Fantastic Fundamentals Text SA: The Fundamentals (Compounding Quality)

🇵🇱 Asseco Poland: Large Buyback Makes Sense Considering Valuation (Seeking Alpha) $

Asseco Poland SA (WSE: ACP / LON: 0LQG / OTCMKTS: ASOZF) continues to generate strong organic growth and is undervalued, leading to a well-received buyback programme by us.

The company's earnings showed growth on a constant currency basis, with both their directly managed businesses as well as Formula Systems demonstrating growth.

The dividend is quite high and growing. We put it on the watchlist.

🇦🇷 Dog catches Argentine car (FT) $

Exploring Burford Capital Limited (NYSE: BUR)’s prospects of extracting that $16bn judgement out of Buenos Aires

🇧🇷 SLC Agricola: A Solid Investment In Brazil's Agribusiness For The Long Term (Seeking Alpha) $

SLC Agricola SA (BVMF: SLCE3) is a major player in Brazilian agribusiness, focusing primarily on soybeans, corn, and cotton, with strategic use of self-owned and leased lands.

The company utilizes joint ventures, leases lands, and operates SLC LandCo for real estate, showcasing adaptability and operational scalability.

Despite challenges in 2023, SLC Agrícola exhibits robust financials, boasting strong revenue growth, efficient cost management, and a solid financial position with low debt.

The outlook for Brazilian agribusiness in 2024 remains favorable, although concerns persist regarding logistics and climatic conditions.

With a diversified portfolio, competitive advantages, and a discounted valuation, SLC Agrícola presents an attractive long-term investment, despite short-term challenges and uncertainties.

🇧🇷 Neoenergia: Uncovering Hidden Value In Brazil's Utility Sector (Seeking Alpha) $

Neoenergia (BVMF: NEOE3 / BME: XNEO / OTCMKTS: NRGIY), a Brazilian electricity company with a $5.12 billion market cap, boasts 88% renewable capacity, distinguishing itself in the energy sector.

Despite positive attributes, Neoenergia faces challenges, including high investments, regulatory complexities, and economic risks affecting profitability.

With a history of high indebtedness, Neoenergia's financial outlook is influenced by Brazil's interest rates, yet its strategic investments signal a positive trajectory.

Trading at a discounted valuation, Neoenergia presents an underfollowed and potentially undervalued gem in the Brazilian utility sector.

🇲🇽 Gruma Executing Well, But Sentiment And Margin Leverage Could Be More Challenging Soon (Seeking Alpha) $

Gruma SAB de CV (BMV: GRUMAB / FRA: 3G3B / OTCMKTS: GMKKY / GPAGF) has seen strong margin performance in 2023, helped by very strong pricing, stable costs, and innovative new retail products in the U.S. market.

2024 will likely be a more challenging year for the shares due to volatility in grain prices, labor costs, and more pressure on consumer prices, limiting margin leverage.

Ongoing expansion of the value-added portfolio can help support long-term revenue growth around 5% and higher dividend payouts over time.

Gruma may still have a place in defensive portfolios given the longer-term potential, but more opportunistic investors may want to wait for a better entry price.

🇵🇦 Copa Holdings' Fundamentals Continue To Fly Higher (Seeking Alpha) $

Strong Buy: Copa Holdings (NYSE: CPA) [a leading Latin American provider of airline passenger and cargo service] is a compelling buy, supported by a thorough analysis of financial metrics and strategic expansion plans.

Substantial Upside: Two DCF models project a significant upside, with a fair value of $222.1, a 113.6% increase from the current stock price of $104.

Positive Projections: The first DCF forecasts a promising future, reaching $404.3 by 2028, translating into an outstanding annual return of 57.7%, with a conservative fair price projection of $140.9.

Comprehensive Analysis: Thorough scrutiny of Copa's financial health positions it favorably for medium-term investment.

🇰🇾 Consolidated Water: Because Water May Be More Valuable Than Oil (Seeking Alpha) $

Water scarcity is a global issue, with projections indicating that 40% of the world's population could be affected by 2035.

Consolidated Water Company Ltd (NASDAQ: CWCO), a Cayman Islands-based company, is tackling water scarcity through advanced water supply, treatment, and distribution systems.

CWCO has experienced significant growth, securing major contracts and achieving record revenue and income in 2023, with strong growth prospects for the future.

📰🔬 Further Suggested Reading

$ = behind a paywall

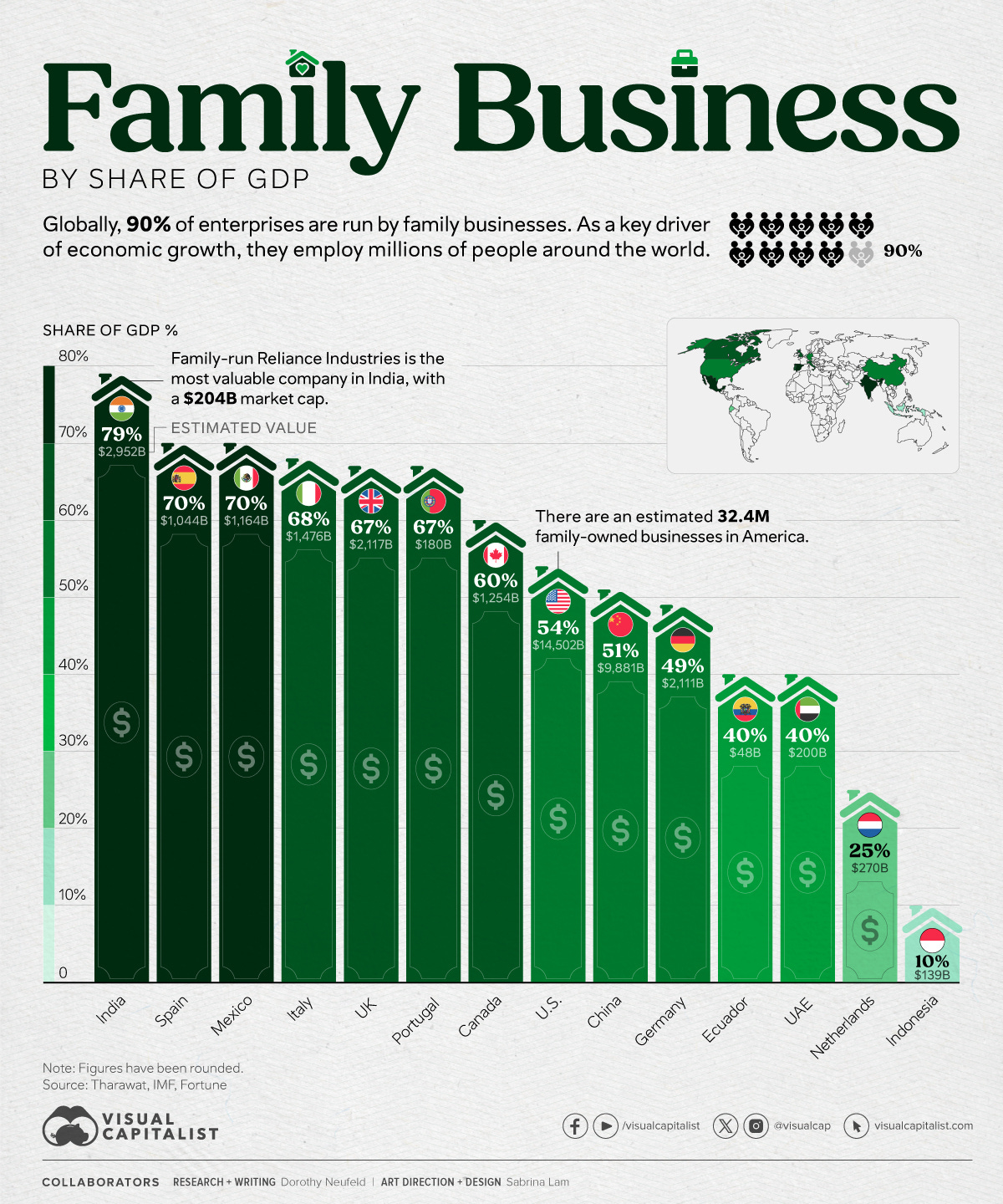

🌐 The Influence of Family-Owned Businesses, by Share of GDP (Visual Capitalist)

🇨🇳 When All Else Fails, Show Me The (Dividend) Money - Play on Chinese High Dividend Yielding Stocks (Smart Karma) $

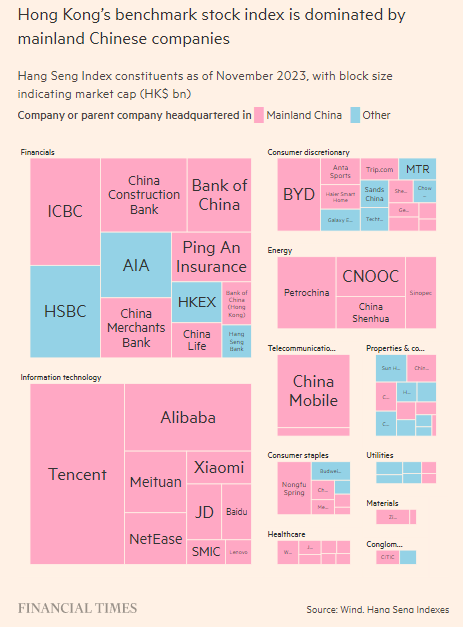

The CSI 300 Index and MSCI China Index are down 14% YTD, the third consecutive year of decline, and is the world’s worst-performing major market

Many high-quality stocks trade at bargain valuations, but investors ignore earnings and focus on news flow and policy clarity

High yielding stocks could be the best defensive shelter while waiting for sentiments to improve and for fundamentals to take center stage in investment decisions again

🇨🇳 🇭🇰 How China’s slowdown is deepening Hong Kong’s ‘existential crisis’ (FT) $

The territory’s growing reliance on China has turned into a distinctly mixed blessing — with questions of how long hallmarks of its own system can endure

🇨🇳 Chart of the Day: China’s yuan overtakes yen to rank fourth for global payments (Caixin) $

The yuan overtook the Japanese yen to become the fourth-most used currency by value in global payments for the first time in almost two years, according to a monthly tracker of the Chinese currency released by the Society for Worldwide Interbank Financial Telecommunication (SWIFT).

The share of the yuan as a global payment currency climbed to 4.61% in November from 3.6% the previous month, according to data compiled by SWIFT and released on Thursday. The redback surpassed the Japanese yen, whose share came in at 3.41% in November, down from 3.91% the month before.

🇪🇬 The Red Sea Spaces - Summary (Calvin's thoughts)

Today I hosted a 4 hour marathon open forum spaces on Red Sea / Suez Canal issues. A number of maritime and naval experts joined in. Here's the summary.

🇨🇳 Chinese shipping giant COSCO halts Red Sea transit amid attacks (Caixin)

China COSCO Shipping Corp. Ltd. [Cosco Shipping International (HKG: 0517 / FRA: CSB / SGX: F83) / COSCO Shipping. COSCO SHIPPING Holdings (HKG: 1919 / SHA: 601919] will suspend shipments through the Red Sea amid escalating attacks against commercial vessels in the area, joining its global peers and further raising some analysts’ concerns over disruption to global trade if the situation persists.

The Chinese shipping giant, which is the world’s fourth largest container shipping company by capacity, will be sending out notices to customers informing them of the service halt in the Red Sea area, a person at China COSCO Shipping told Caixin Monday.

🇨🇱 Chileans reject second attempt to rewrite constitution (FT) $

Rightwing-led draft fails to win majority approval after a left-led effort was voted down last year

🇨🇱 REACTION: Chile Rejects Second Constitutional Rewrite (Americas Quarterly)

The nation is the world’s first to turn down two consecutive constitutional proposals. The 1980 charter remains in place.

AQ asked analysts to share their reaction to the result

🇦🇷 Global Conflicts Stir Sleeping Energy Giant in South America (WSJ) $

Argentina’s Vaca Muerta shale field is among the megaprojects ramping up around the region

🇦🇷 Argentina’s Ruined Railways Will Force Milei to Confront Poverty (Bloomberg)

Those living off state subsidies in ghost towns abandoned by the once-robust train service fear the pain of the new president’s spending cuts will be acute

Since 1950, Argentina has spent more time in recession than any other nation except the Democratic Republic of Congo. This year is no different, with the economy lurching into its sixth downturn in a decade.

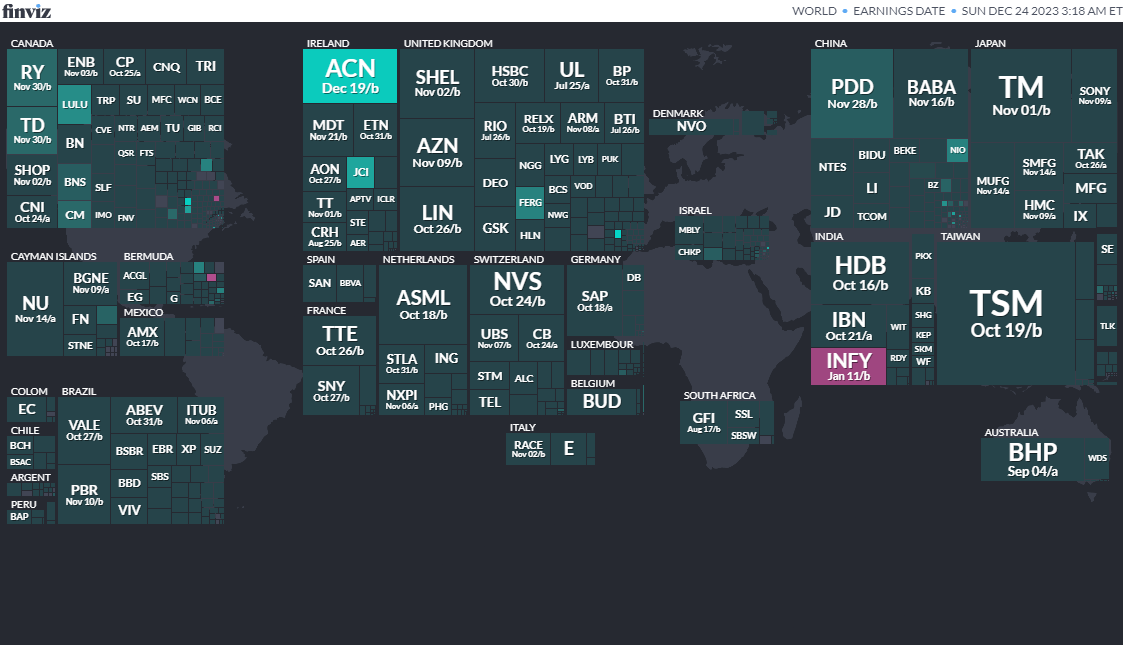

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

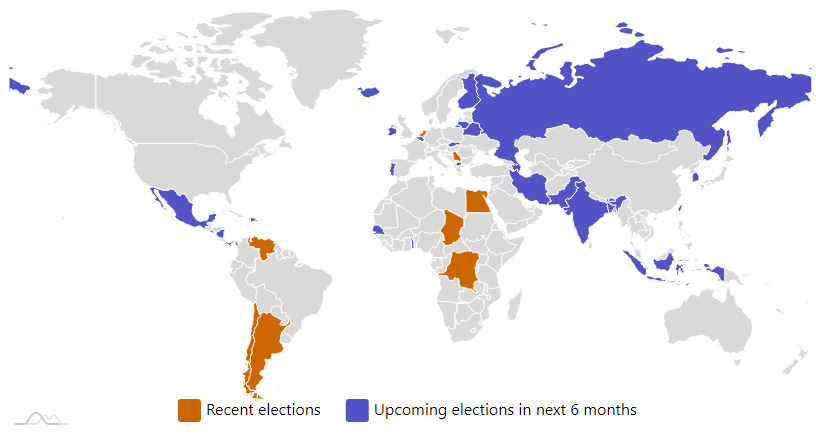

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

Bangladesh Bangladeshi National Parliament Jan 7, 2024 (d) Confirmed Dec 30, 2018

Taiwan Taiwanese Legislative Yuan Jan 13, 2024 (d) Confirmed Jan 11, 2020

Taiwan Taiwanese Presidency Jan 13, 2024 (d) Confirmed Jan 11, 2020

Pakistan Pakistani National Assembly Feb 8, 2024 (d) Confirmed Jul 25, 2018

Indonesia Indonesian Regional Representative Council Feb 14, 2024 (t) Confirmed Apr 17, 2019

Indonesia Indonesian Presidency Feb 14, 2024 (t) Confirmed Apr 17, 2019

Indonesia Indonesian House of Representatives Feb 14, 2024 (t) Confirmed Apr 17, 2019

Russian Federation Russian Presidency Mar 17, 2024 (t) Confirmed Mar 18, 2018

South Korea South Korean National Assembly Apr 10, 2024 (d) Confirmed Apr 15, 2020

India Indian People's Assembly Apr 30, 2024 (t) Date not confirmed Apr 11, 2019

Panama Panamanian National Assembly May 5, 2024 (t) Confirmed May 5, 2019

Panama Panamanian Presidency May 5, 2024 (t) Confirmed May 5, 2019

Mexico Mexican Senate Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

Mexico Mexican Chamber of Deputies Jun 2, 2024 (t) Date not confirmed Jun 6, 2021

Mexico Mexican Presidency Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

Croatia Croatian Assembly Jun 30, 2024 (t) Date not confirmed Jul 5, 2020

Croatia Croatian Assembly Jun 30, 2024 (t) Date not confirmed Jul 5, 2020

Mongolia Mongolian State Great Hural Jun 30, 2024 (t) Tentative Jun 24, 2020

South Africa South African National Assembly Jun 30, 2024 (t) Date not confirmed May 8, 2019

Czech Republic Czech Senate Sep 30, 2024 (t) Date not confirmed Sep 23, 2022

Georgia Georgian Parliament Oct 26, 2024 (d) Confirmed Oct 31, 2020

Georgia Georgian Presidency Nov 30, 2024 (t) Date not confirmed Nov 28, 2018

Uzbekistan Uzbekistani Legislative Chamber Dec 31, 2024 (t) Tentative Dec 22, 2019

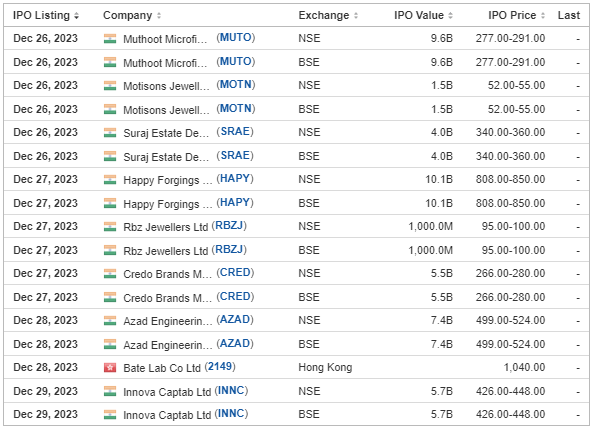

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Mingteng International Corp. MTEN, Univest Securities, 2.2M Shares, $4.00-6.00, $11.1 mil, 12/29/2023 Friday

We are a holding company incorporated in the Cayman Islands with operations conducted in China by our PRC subsidiary, Wuxi Mingteng Mould, incorporated in the PRC. We are an automotive mold developer and supplier in China. (Incorporated in the Cayman Islands)

Wuxi Mingteng Mould was established in December 2015, focusing on molds used in auto parts. We are committed to providing customers with comprehensive and personalized mold services, covering mold design and development, mold production, assembly, testing, repair and after-sales service. We provide a wide variety of products. Our main products are casting molds for turbocharger systems, braking systems, steering and differential system, and other automotive system parts. We also produce molds for new energy electric vehicle motor drive systems, battery pack systems, and engineering hydraulic components, which are widely used in automobile, construction machinery and other manufacturing industries.

Our production plant is located in Wuxi, China. We use technologically advanced procedures and equipment to produce molds. We use a mold manufacturing processing center, which allocates different machines to manufacture according to the size of the mold and the shape of the accessories.

Our mold development and production process are supported by our research and development (“R&D”) team (including experts such as foundry technologists and mold designers), using advanced Computer Aided Design (“CAD”), Computer Aided Manufacturing (“CAM”) and software technologies to analyze feasibility and validity of mold designs and specifications. Our quality and capability have obtained the 2019 Jiangsu High-tech Enterprise Certification and ISO9001:2015 certification.

In order to improve our technical level and service quality, we are committed to developing and producing molds through technological innovation. We believe that the design and quality of our molds are extremely important to the accuracy and efficiency of our customers’ manufacturing processes.

Our existing technical team consists of 11 people, all with professional knowledge in casting, machining, and automation. They analyze customers’ casting and processing technology, and propose solutions and improvement suggestions to customers to enhance the efficiency and safety of their products.

In addition, we believe our research and patents in the field of automotive casting molds have earned us recognition from our customers, and we have registered 19 authorized utility model and invention patents in China.

We are a supplier to leading major customers in the automobile parts manufacturing industry and have established long-term business relationships with them, most of whom have more than 5 years of business relationship with us. Our customers include three Chinese listed companies: Kehua Holding Co., Ltd. (ticker: 603161), Wuxi Lihu Booster Technology Co., Ltd. (ticker: 300580), and Wuxi Best Precision Machinery Co., Ltd. (ticker: 300694). Our close relationships with these major customers demonstrate our strengths in technical capabilities, service reputation and product quality.

Our revenue mainly comes from customized mold production, mold repair and machining services. The revenue derived from customized mold production accounted for 84.3% and 80.4% of our total revenue for the six months ended June 30, 2023 and 2022, respectively. The revenue derived from mold repair accounted for 13.4% and 15.6% of our total revenue for the six months ended June 30, 2023 and 2022, respectively. The revenue derived from machining services accounted for 2.3% and 4.0% of our total revenue for the six months ended June 30, 2023 and 2022, respectively.

The revenue derived from customized mold production accounted for 82.0% and 83.9% of our total revenue for the years ended December 31, 2022 and 2021, respectively. The revenue derived from mold repair accounted for 14.2% and 14.7% of our total revenue for the years ended December 31, 2022 and 2021, respectively. The revenue derived from machining services accounted for 3.8% and 1.4% of our total revenue for the years ended December 31, 2022 and 2021, respectively.

*Note: Net income and revenue are for the 12 months that ended June 30, 2023.

(Mingteng International Corp. filed an F-1/A dated Nov. 22, 2023, in which it increased its IPO’s size by 11.25 percent to 2.23 million shares (2,225,000 shares) – up from 2.0 million shares originally – with the disclosure that the selling stockholder, Betty Chen Limited, would sell 225,000 shares. The price range remained the same – at $4.00 to $6.00 – to raise $11.13 million – up from $10.0 million initially. Background: Mingteng International Corp. filed an F-1/A dated Nov. 1, 2023, in which it disclosed the rest of the terms for its IPO. Mingteng International filed its F-1 on March 29, 2023, and disclosed partial terms for its IPO – the price range of $4.00 to $6.00 – without stating the number of shares. The company submitted confidential IPO documents to the SEC on Nov.10, 2022.)

🏁 Emerging Market ETF Launches

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

11/07/2023 - Global X MSCI Emerging Markets Covered Call ETF EMCC - Equity, leverage

11/07/2023 - Avantis Emerging Markets Small Cap Equity ETF AVEE - Active, equity, small caps

09/22/2023 - Matthews Asia Dividend Active ETF ADVE - Active, equity, Asia

09/22/2023 - Matthews Pacific Tiger Active ETF ASIA - Active, equity, Asia

09/22/2023 - Matthews Emerging Markets Sustainable Future Active ETF EMSF - Active, equity, ESG

09/22/2023 - Matthews India Active ETF INDE - Active, equity, India

09/22/2023 - Matthews Japan Active ETF JPAN - Active, equity, Japan

09/22/2023 - Matthews Asia Dividend Active ETF ADVE - Active, equity, Asia

08/25/2023 - KraneShares Dynamic Emerging Markets Strategy ETF KEM - Active, equity, emerging markets

08/18/2023 - Global X India Active ETF NDIA - Active, equity, India

08/18/2023 - Global X Brazil Active ETF BRAZ - Active, equity, Brazil

07/17/2023 - Matthews Korea Active ETF MKOR - Active, equity, South Korea

05/18/2023 - Putnam Emerging Markets ex-China ETF PEMX - Active, value, growth stocks

05/11/2023 - JPMorgan BetaBuilders Emerging Markets Equity ETF BBEM - Passive, large + midcap stocks

03/16/2023 - JPMorgan Active China ETF JCHI - Active, equity, China

03/03/2023 - First Trust Bloomberg Emerging Market Democracies ETF EMDM - Principles-based

1/31/2023 - Strive Emerging Markets Ex-China ETF STX - Passive, equity, emerging markets

1/20/2023 - Putnam PanAgora ESG Emerging Markets Equity ETF PPEM - Active, equity, ESG, emerging markets

1/12/2023 - KraneShares China Internet and Covered Call Strategy ETF KLIP - Active, equity, China, options overlay, thematic

1/11/2023 - Matthews Emerging Markets ex China Active ETF MEMX - Active, equity, emerging markets

12/13/2022 - GraniteShares 1.75x Long BABA Daily ETF BABX - Active, equity, leveraged, single stock

12/13/2022 - Virtus Stone Harbor Emerging Markets High Yield Bond ETF VEMY - Active, fixed income, junk bond, emerging markets

9/22/2022 - WisdomTree Emerging Markets ex-China Fund XC - Passive, equity, emerging markets

9/15/2022 - KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV - Passive, equity, Asia, dividend strategy

9/15/2022 - OneAscent Emerging Markets ETF OAEM - Active, Equity, emerging markets, ESG

9/9/2022 - Emerge EMPWR Sustainable Select Growth Equity ETF EMGC - Active, equity, emerging markets

9/9/2022 - Emerge EMPWR Unified Sustainable Equity ETF EMPW - Active, equity, emerging markets

9/8/2022 - Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH - Active, equity, emerging markets, ESG

7/14/2022 - Matthews China Active ETF MCH - Active, equity, China

7/14/2022 - Matthews Emerging Markets Equity Active ETF MEM - Active, equity, emerging markets

7/14/2022 - Matthews Asia Innovators Active ETF MINV - Active, equity, Asia

6/30/2022 - BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD - Passive, fixed income, emerging markets

5/2/2022 - AXS Short CSI China Internet ETF SWEB - Active, inverse, thematic

4/27/2022 - Dimensional Emerging Markets High Profitability ETF DEHP - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Core Equity 2 ETF DFEM - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Value ETF DFEV - Active, equity, emerging markets

4/27/2022 - iShares Emergent Food and AgTech Multisector ETF IVEG - Passive, equity, thematic [Mostly developed markets]

4/21/2022 - FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM - Passive, equity, ESG

4/6/2022 - India Internet & Ecommerce ETF INQQ - Passive, equity, thematic

2/17/2022 - VanEck Digital India ETF DGIN - Passive, India market, thematic

2/17/2022 - Goldman Sachs Access Emerging Markets USD Bond ETF GEMD - Passive, fixed income, emerging markets

1/27/2022 - iShares MSCI China Multisector Tech ETF TCHI - Passive, China, technology

1/11/2022 - Simplify Emerging Markets PLUS Downside Convexity ETF EMGD - Active, equity, options strategy

1/11/2022 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG - Passive, equity, ESG

🚽 Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

11/11/2023 - Global X China Innovation ETF - KEJI

11/11/2023 - Global X Emerging Markets Internet & E-commerce ETF - EWEB

11/09/2023 - Franklin FTSE South Africa ETF - FLZA

10/27/2023 - Simplify Emerging Markets Equity PLUS Downside Convexity - EMGD

10/20/2023 - WisdomTree India ex-State-Owned Enterprises Fund - IXSE

10/20/2023 - WisdomTree Chinese Yuan Strategy Fund - CYB

10/20/2023 - Loncar China BioPharma ETF - CHNA

10/18/2023 - KraneShares Emerging Markets Healthcare Index ETF - KMED

10/18/2023 - KraneShares MSCI China ESG Leaders Index ETF - KSEG

10/18/2023 - KraneShares CICC China Leaders 100 Index ETF - KFYP

10/16/2023 - Strategy Shares Halt Climate Change ETF - NZRO

09/20/2023 - VanEck China Growth Leaders ETF - GLCN

08/28/2023 - Asian Growth Cubs ETF - CUBS

08/01/2023 - VanEck Russia ETF - RSX

07/07/2023 - Emerge EMPWR Sustainable Emerging Markets Equity ETF - EMCH

06/23/2023 - Invesco PureBeta FTSE Emerging Markets ETF - PBEE

06/16/2023 - AXS Short China Internet ETF - SWEB

04/11/2023 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF - REMG

3/30/2023 - Invesco BLDRS Emerging Markets 50 ADR Index Fund - ADRE

3/30/2023 - Invesco BulletShares 2023 USD Emerging Markets Debt ETF - BSCE

3/30/2023 - Invesco BulletShares 2024 USD Emerging Markets Debt ETF - BSDE

3/30/2023 - Invesco RAFI Strategic Emerging Markets ETF - ISEM

2/17/2023 - Direxion Daily CSI 300 China A Share Bear 1X Shares - CHAD

1/13/2023 - First Trust Chindia ETF - FNI

12/28/2022 - Franklin FTSE Russia ETF - FLRU

12/22/2022 - VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

8/22/2022 - iShares MSCI Argentina and Global Exposure ETF AGT

8/22/2022 - iShares MSCI Colombia ETFI COL

6/10/2022 - Infusive Compounding Global Equities ETF JOYY

5/3/2022 - ProShares Short Term USD Emerging Markets Bond ETF EMSH

4/7/2022 - DeltaShares S&P EM 100 & Managed Risk ETF DMRE

3/11/2022 - Direxion Daily Russia Bull 2X Shares RUSL

1/27/2022 - Legg Mason Global Infrastructure ETF INFR

1/14/2022 - Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (December 25, 2023) was also published on our website under the Newsletter category.