Emerging Market Links + The Week Ahead (June 3, 2024)

New $47.5B China chip fund, chip machines have kill switches, business chiefs see EU-China relations worsening, Mexico + SA elections, EM stock picks and the week ahead for emerging markets.

Mexico elections were held yesterday and there is no real mystery with who will become the next President there. However, the ANC in South Africa only received just over 40% of the vote with serious concerns they will need to form a “doomsday coalition” with more radical parties (the EFF and/or MK) rather than the DA (the traditional opposition).

Meanwhile, its been reported that chipmakers can disable advanced chipmaking machines remotely - which makes you wonder what else has backdoors or backend kill switches. Its probably another reason why China is pouring $47.5 billion into a third fund to boost chip development.

Finally, Malaysia is also planning to spend 25 billion ringgit (US$5.3 billion) to lure more semiconductor investments to the country and train local engineers.

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

🇮🇳 Quick Service Restaurant (QSR) Stocks in India (May 2024) Partially $

Last posted moneycontrol Stock of the Day stocks (from April) plus Indian QSR stocks, Indian fine dining restaurant stocks and restaurant proxy player stocks (e.g. QSR suppliers, etc).

🌐 EM Fund Stock Picks & Country Commentaries (June 2, 2024) Partially $

The case for India + 10 reasons to invest, El Niño + La Niña Latam impacts, Turkish stocks, EM elections to watch, South Korea reforms, EM w/o China, is China exporting deflation, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 NetEase Inc.: Will The Increased Revenue From Game Innovation & Expansion Last? - Major Drivers (SmartKarma) $

NetEase (NASDAQ: NTES)'s first quarter earnings highlighted the company's ongoing growth, driven in large part by its game portfolio.

Net revenue for Q1 rose to RMB 26.9 billion, marking an accelerated YoY increase led by the company's diversified game offerings.

There was significant growth from established game franchises which have managed to maintain high popularity among their user bases, showcasing the sustainability of the company’s games.

🇨🇳 Alibaba/JD.com: Thoughts On The Recent Convertible Bond Issuance (SmartKarma) $

Alibaba Group (NYSE: BABA) and JD.com (NASDAQ: JD) both announced the issuance of convertible debt last week (Alibaba on May 23 and JD.com on May 21).

Both have mentioned that the reasons for the issuance are the low funding cost (0.25% coupon for JD.com and 0.5% for Alibaba) and to fund their current share repurchase program.

I think the convertible debt structures makes sense and it is beneficial for both companies to buy back as much as possible at the current share price.

🇨🇳 Alibaba signs David Beckham to boost global sales (Caixin) $

Alibaba Group (NYSE: BABA) ’s global online marketplace AliExpress has enlisted English soccer star David Beckham as a global brand ambassador, the company announced Monday, as the Chinese e-commerce giant doubles down on efforts to boost sales overseas.

The one-year partnership is part of a campaign for the upcoming UEFA Euro 2024 soccer tournament, AliExpress said. Users of the online marketplace will get a chance to win discounts and other prizes like match tickets, the company said in a statement.

🇨🇳 JD rights its shopping cart with first-quarter turnaround (Bamboo Works)

The e-commerce giant’s latest results beat market expectations, earning new confidence as it seeks to regain its lost momentum

JD.com (NASDAQ: JD) reported a profit of 7.1 billion yuan for the first quarter, up nearly 13% year-on-year

Many investment banks upwardly revised their price targets and ratings for the stock after the release of the latest report

🇨🇳 JD.com Inc.: How Are They Strengthening the Platform Ecosystem & Continuing Their Market Dominance? - Major Drivers (SmartKarma) $

JD.com (NASDAQ: JD), a China-based multinational technology conglomerate, has announced its first-quarter results for 2024 in an earnings call and reported robust profit and revenue growth, along with an encouragingly high Net Promoter Score (NPS).

The revenue growth was accelerated by strong execution amidst evolving industry dynamics, improved user experience, price competitiveness, and platform ecosystems.

Importantly, the general merchandise and supermarket category recorded a notable jump in terms of gross merchandise value (GMV) and revenue growth.

🇨🇳 Commentary on Pinduoduo’s Q1 2024 Earnings (Investing in China)

Fraud or opportunity?

PDD Holdings (NASDAQ: PDD) or Pinduoduo’s Q1 2024 earnings report raised eyebrows with a 100% increase in revenue and over 200% growth in earnings. Some critics quickly labeled these results as fraud, claiming such performance is impossible. Here, I’ll share my experience, insights about Pinduoduo, and my perspective on this situation.

In summary, Pinduoduo’s status as a latecomer in the market has necessitated a high level of secrecy to effectively compete with well-established players. This secrecy often leads to confusion and fear among investors, who equate it with a lack of transparency and, given that it’s a Chinese tech company, potential fraud. However, I prefer to rely on the insights of more knowledgeable entities, like Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY), which has a significant stake and better access to Pinduoduo’s data. If Tencent starts selling their shares, I would be concerned. Until then, I trust their judgment over speculative concerns.

🇨🇳 Chart of the Day: PDD’s Growth Leaves E-Commerce Rivals in the Dust (Caixin) $

Chinese e-commerce giant PDD Holdings (NASDAQ: PDD) or Pinduoduo’s quarterly growth far outpaced rivals Alibaba Group (NYSE: BABA) and JD.com (NASDAQ: JD), reflecting online shoppers’ preference for cheaper products during an uneven economic recovery.

PDD Holdings Inc., which owns e-ecommerce platforms Temu and Pinduoduo, reported its first-quarter net income soared 246% from a year earlier to nearly 28 billion yuan ($3.9 billion) on revenue that more than doubled, according to its earnings results released Wednesday.

🇨🇳 Trip.com voyages back from pandemic lows, but lags global peers in valuation (Bamboo Works)

The latest results from China’s top online travel agent showed it continues to dominate its home market, as it attempts to replicate that success overseas

Trip.com (NASDAQ: TCOM)’s revenue grew 27.8% in the first quarter, as its stock caught up to the company’s strong business gains from last year

The company’s overseas businesses, Trip.com and Skyscanner, are shaping up as new growth drivers

🇨🇳 EDA woos investors with its cross-border e-commerce story (Bamboo Works)

Shares of the e-commerce logistics services provider jumped 84% on their first trading day last week, though they later gave back some of the gains

EDA Group Holdings Ltd (HKG: 2505 / FRA: 7OZ)’s revenue rose 71% last year on strong demand for its logistics services for Chinese cross-border e-commerce merchants

The company’s “pre-sale stocking model” could give it an advantage as the direct-shipping model used by rivals Temu and Shein comes under fire in the U.S.

🇨🇳 Hello Group still looking for investor love as revenue declines accelerate (Bamboo Works)

The company sometimes called the ‘Tinder of China’ said its revenue fell 9% in the first quarter, and predicted the rate of decline would accelerate

Hello Group (NASDAQ: MOMO)’s three years of revenue declines continued in the first quarter and are accelerating as the company faces both internal and external headwinds

The dating-app operator said it could soon receive a policy boost, in an apparent reference to China’s recent efforts to raise its tumbling birthrates

🇨🇳 iQiyi beats profit estimates but leaves subscriber numbers a mystery (Bamboo Works)

Lacking a megahit drama series this time, the Chinese streaming platform logged lower first-quarter earnings but still exceeded market expectations

The platform’s operating revenue fell 5% in the first quarter and non-GAAP profit dropped 10% from a high base a year earlier

The streaming service was not able to match the success of online drama “The Knockout”, which screened last year

🇨🇳 Yeahka braces investors for bad first half while trying to depict a rosy future (Bamboo Works)

The payment services company said an extraordinary adjustment that hit its revenue last year will continue to weigh on its first-half results, as it talked up progress in its overseas expansion

Yeahka (HKG: 9923 / FRA: 4YE / OTCMKTS: YHEKF) said a “non-recurring adjustment on revenue” will no longer be a factor for the company from July, indicating it will continue to impact its first-half results

The company also said its “strategic upgrade” is making good progress, including an overseas expansion to diversify beyond China

🇨🇳 In Depth: Mega blunder adds to Li Auto’s troubles as Huawei rivalry hots up (Caixin) $

Li Auto (NASDAQ: LI) (理想汽车) had reasons to be upbeat heading towards the official launch of its much-anticipated Mega electric vehicle (EV) on March 1.

However, an edited image that went viral after the launch event suggested the 559,800 yuan ($77,800) Mega looked like something else — a hearse. After the launch, orders fell short of expectations.

Moreover, this blunder comes as the company, despite its rosy financials, is facing tougher competition than ever, especially from rival Huawei Technologies Co. Ltd.

🇨🇳 Evergrande auto business gets lifeline after problems pile up (Bamboo Works)

China Evergrande has found a potential buyer for its electric car unit [China Evergrande New Energy Vehicle Group Limited (HKG: 0708 / FRA: 4NM1)], which is mired in debt and has been ordered to repay 1.9 billion yuan in government subsidies, but the prospects for the company are still uncertain

The Evergrande auto subsidiary landed more than 10 billion yuan in the red last year, with revenue coming mostly from property sales

If the deal goes through, the new buyer would have to put the struggling car business back on track

🇨🇳 China Merchants to consolidate cargo operations amid shipping boom (Caixin) $

China’s state-owned conglomerate China Merchants Group is shaking up its subsidiaries to consolidate its container line operations amid a boom in the global shipping industry.

China Merchants Energy Shipping Co. Ltd. (SHA: 601872), the Shanghai-listed cargo shipping unit of China Merchants Group Ltd., unveiled a plan to spin off its container shipping arm Sinotrans Container Lines Co. Ltd. and car carrier Guangzhou China Merchants RO-RO Transportation Co. Ltd. (CMES RoRo).

🇨🇳 U.S. rethinks timing of biotech crackdown, easing pressure on WuXi family (Bamboo Works)

The latest draft of a U.S. biosecurity law would give drug companies until 2032 to cut their ties with Chinese contract suppliers, allowing Wuxi Biologics (HKG: 2269 / OTCMKTS: WXXWY / OTCMKTS: WXIBF) / WuXi AppTec Co (HKG: 2359 / SHA: 603259 / OTCMKTS: WUXAY) / WuXi XDC Cayman Inc (HKG: 2268 / FRA: L74) companies time to focus on Europe instead

The new version of the U.S. bill to restrict business with Chinese biotechs would give U.S. companies an eight-year grace period to find other service providers

The Chinese market alone may not be able to absorb the production capacity that WuXi companies had ramped up for U.S. clients, driving a pivot towards Europe

🇨🇳 Inaugural operating profit fails to lift 111 Inc. (Bamboo Works)

The drug distributor expects to benefit from an ongoing crackdown on corruption in its industry due to the company’s focus on distribution to pharmacies rather than hospitals

111 Inc. (NASDAQ: YI)’s revenue fell in the first quarter from an unusually high base in the year-ago period when drug demand spiked after China ended its pandemic restrictions

The company’s stock remains depressed, trading at a P/S ratio of just 0.05, despite reporting its first-ever operating profit in its latest quarterly report

🇨🇳 Topsports disappoints as it focuses on quality over quantity in ‘uneven’ economy (Bamboo Works)

Shares of the seller of Nike and Adidas shoes in China fell by 9% after it reported a weak second half in its latest fiscal year

Topsports (HKG: 6110 / OTCMKTS: TPSRF) reported its revenue and profit rose 6.9% and 22%, respectively, in its latest fiscal year through February

Despite the full-year growth, the seller of Nike and Adidas sportswear in China’s profit was below analyst expectations

🇨🇳 Futu: Turning Bullish On Strong Customer Growth (Rating Upgrade) (Seeking Alpha) $

Futu Holdings Ltd (NASDAQ: FUTU)' most recent quarterly financial performance surpassed expectations as the company's Q1 2024 revenue and earnings in HK$ terms beat consensus by +1.2% and +8.0%, respectively.

Looking ahead, FUTU anticipates that the company can add 400,000 new paying customers this year, which is way better than the 220,000 new paid client additions it achieved last year.

My rating for Futu Holdings is revised to a Buy, as I am impressed with the company's above-expectations results and upward client growth guidance revision.

🇨🇳 Futu Holdings Continues To Grow, But Lock In Some Profit (Seeking Alpha) $

Futu Holdings Ltd (NASDAQ: FUTU) is an online brokerage firm based in Hong Kong with millions of customers and a range of services.

The company has reported growth in registered and paying clients, as well as an increase in client assets.

Despite this growth, total revenues only increased by 3.7% and there was a decline in net income, raising concerns about margins and profitability.

Take some profit on this trade, and consider a house position, but watch those margins.

🇲🇴 Wynn Macau Ltd board to consider semi-annual dividend (GGRAsia)

Casino operator Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) says its board approved on Thursday amendments to the company’s existing dividend policy, with immediate effect.

According to the amended dividend policy, the firm’s board “shall meet semi-annually to consider the declaration of dividends,” stated a filing that day to the Hong Kong Stock Exchange.

The company’s board “may also meet at any time during the year as the board deems fit to consider the declaration of special dividends,” it added.

Wynn Macau Ltd said it “does not have any pre-determined dividend payout ratio”.

🇰🇷 Maker of Shin instant ramen expands overseas as Korean noodles become hit (FT) $ 🗃️

NongShim Co (KRX: 004370)’s products have gone mainstream in US, where the company plans to add production lines

🇰🇷 End of Mandatory Lock-Up Periods for 45 Companies in Korea in June 2024 (Douglas Research Insights) $

We discuss the end of the mandatory lock-up periods for 45 stocks in Korea in June 2024, among which 5 are in KOSPI and 40 are in KOSDAQ.

These 45 stocks on average could be subject to further selling pressures in June and could underperform relative to the market.

The top three market cap stocks including those of which at least 1% of outstanding shares could be sold in June include Hanwha Ocean (KRX: 042660), LS Materials (KOSDAQ: 417200), and Komico (KOSDAQ: 183300).

🇰🇷 Legal Complications on Put Options on SSG.Com to Result in Ongoing Concerns for Emart and Shinsegae (Douglas Research Insights) $

E-Mart Inc (KRX: 139480)and Shinsegae Inc (KRX: 004170) are facing concerns about put options of nearly 1 trillion won on private equity investors' investment in SSG.com nearly six years ago.

From AEP and BRV's point of views, they want to get their money back through put options since an IPO is not likely in the near term.

The most probable result appears to be that this is likely to be dragged on for some time, which will cause continued concerns on both Emart and Shinsegae.

🇰🇷 DS Dansuk: Block Deal Sale by Stonebridge Capital (Douglas Research Insights) $

After the market close on 28 May, it was announced that Stonebridge Capital plans to conduct a block deal sale of a portion of its stake in DS Dansuk (KRX: 017860).

This deal involves 210,000 to 290,000 shares of DS Dansuk. The block deal price range is from 99,800 won to 101,400 won, which represents 7.06% to 8.52% discount.

After this second block deal, there will be further overhang concerns about additional sales of DS Dansuk by Stonebridge Capital in the coming months.

🇰🇷 Korea Gas Corp: Drill Baby Drill (Douglas Research Insights) $

On 3 June, the shares of Korea Gas Corp (KRX: 036460) jumped limit up 30% to 38,700 won on huge volume (13.4 million), which was 37x higher than the previous day volume traded.

This was driven by the announcement of the South Korean President Yoon giving the approval to conduct exploratory drilling for potentially vast oil and gas prospects near Pohang.

The Korean government announced that there is a "very high" possibility the area contains as much as 14 billion barrels of oil and gas.

🇰🇷 South Korea seeks to join top arms dealers with new fighter jet engine (FT) $ 🗃️

Hanwha Aerospace (KRX: 012450) has partnered with the government to move up the defence value chain

🇰🇷 Webtoon Entertainment IPO Preview (Douglas Research Insights) $

Webtoon Entertainment is getting ready to complete its IPO on the NASDAQ exchange in 2H 2024. Webtoon Entertainment is a subsidiary of NAVER Corp (KRX: 035420).

Webtoon is seeking to raise as much of US$500 million at a valuation of US$3 billion to US$4 billion.

Webtoon Entertainment is one of the largest Korean company related IPOs in 2024.

🇲🇾 GEN Malaysia 1Q rev up 21pct y-o-y, posts US$8mln profit (GGRAsia)

Global casino operator Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) reported first-quarter net profit of just under MYR36.7 million (US$7.8 million), compared with a net loss of MYR45.4 million a year earlier. Judged sequentially, net profit was down 83.1 percent, according to a Thursday filing to Bursa Malaysia.

The group’s performance in the fourth quarter of 2023 had been aided by net foreign exchange gains of MYR130.4 million.

Revenue in the three months to March 31 was just above MYR2.76 billion, up 21.1 percent from a year ago, but down 1.6 percent quarter-on-quarter.

Genting Malaysia operates Resorts World Genting (pictured in a file photo), Malaysia’s only licensed casino property. The group also runs casinos in the United States, the Bahamas, the United Kingdom, and Egypt.

🇲🇾 Maybank lowers earnings estimates for Genting group (GGRAsia)

Maybank Investment Bank Bhd says Malaysia-based Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) had an “auspicious start” to 2024, driven by “luck” at its gaming operations run by Genting Malaysia (KLSE: GENM) and Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY).

On Thursday, Genting Bhd reported first-quarter net profit of MYR998.6 million (US$212.3 million), on revenue that grew by 27.6 percent year-on-year, to MYR7.43 billion.

Resorts World Sentosa (pictured), a gaming resort in Singapore run by Genting Singapore, and Resorts World Genting, operated by Genting Malaysia, are said to be the group’s main assets.

Genting Malaysia also runs casinos in the United States, the Bahamas, the United Kingdom, and Egypt.

🇲🇾 RGB back to black in 1Q, revenue doubles y-o-y (GGRAsia)

Malaysian casino equipment supplier and distributor RGB International Bhd (KLSE: RGB) reported revenue of MYR210.1 million (US$44.6 million) for the first quarter of 2024, up 120.8 percent from a year ago. Revenue was up 93.4 percent judged quarter-on-quarter, according to a Thursday filing to Bursa Malaysia.

The firm posted a first-quarter profit attributable to its shareholders of just below MYR22.2 million, compared to a profit of MYR10.5 million a year earlier. The company posted a loss of MYR26.8 million in the preceding quarter.

🇸🇬 Riding the AI Wave with Data Centres: 5 Singapore REITs and Business Trusts for Your Watchlist (The Smart Investor)

The rapid expansion of Artificial Intelligence and Machine Learning has led to a higher demand for data centre space. Here are five Singapore REITs and business trusts that stand to benefit from this trend.

Asia’s inaugural pure-play data centre REIT, Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF), was listed on the Singapore Exchange in December 2014.

Sponsored by US-listed Digital Realty Trust Inc. (NYSE: DLR), the world’s largest data centre owner and operator, Digital Core REIT (SGX: DCRU / OTCMKTS: DGTCF) was listed in December 2021.

Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF) has a diverse portfolio that includes industrial and data centre properties in Singapore, North America, and Japan.

CapitaLand Ascendas REIT (SGX: A17U / OTCMKTS: ACDSF) is Singapore’s largest industrial and business space REIT, with its focus on technology and logistics properties in developed markets.

CapitaLand India Trust (SGX: CY6U / OTCMKTS: ACNDF), Asia’s first Indian property trust, primarily invests in business space properties in India.

🇸🇬 Frasers Centrepoint Trust: Watch Both External And Internal Factors (Rating Downgrade) (Seeking Alpha) $

I have a Neutral view of Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF) taking into account both internal and external factors.

FRZCF's future performance could be affected by external headwinds like a new competing retail mall and sluggish retail sales for the Singapore market as a whole.

Internally, the REIT can rely on asset optimization moves to boost its rental income.

🇸🇬 SATS’ Profit Leaps 10-Fold for 2H FY2024, Resumes Paying Dividends: 5 Highlights from the Ground Handler’s Latest Earnings (The Smart Investor)

The airline food caterer enjoyed a surge in revenue with the consolidation of WFS.

Several beneficiaries include Singapore’s blue-chip carrier Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF) and maintenance, repair and overhaul (MRO) specialist SIA Engineering Company Ltd (SGX: S59 / FRA: O3H / OTCMKTS: SEGSF).

SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF) also reported a robust set of earnings for its latest fiscal 2024 (FY2024) results ending 31 March 2024.

Here are five highlights from the group’s latest FY2024 earnings report.

A surge in profit and free cash flow

A diversified business mix

Operating metrics soar

Encouraging commercial wins for Cargo

A promising market for Food Solutions

🇸🇬 Singapore Airlines: Turbulence Ahead (Seeking Alpha) $

Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF)' financial results show a challenging revenue environment, with total revenues increasing 7% but cargo revenues tumbling 22.4%.

Unit costs have declined, but operating profit margins have declined from 15% to 14.3%.

The investment case for Singapore Airlines is not highly compelling, with expectations of pressure on free cash flow and unit revenues remaining under pressure.

🇸🇬 JOYY Q1 Earnings: Disappointing Revenue Guidance, Maintaining My Hold Rating (Seeking Alpha) $

[Several social product operator] JOYY Inc (NASDAQ: YY)'s near-term revenue outlook is lackluster, as the company has guided for its top line to contract by -2% QoQ to $553.5 million in the second quarter of the year.

On the flip side, JOYY's latest quarterly results and disclosures had favorable read-throughs for its future share repurchases, the developed countries' growth outlook, and its ability to manage costs.

There were both good and bad takeaways from JOYY's performance and prospects, so I choose to leave my existing Hold rating for the stock unchanged.

🇮🇳 The Beat Ideas: Action Construction - A Bet on Manufacturing & Infrastructure Theme (SmartKarma) $

Action Construction Equipment Ltd (NSE: ACE / BOM: 532762) - a leader in construction and heavy equipment theme is going for transformation with a defence foray and new product launches

With strong guidance and the historical success of good execution makes a good bet on the current infrastructure and manufacturing theme

The risk includes a slowdown in the election period and stiff competition from larger players

🇮🇳 Inox Wind : Block Deal Trade Special Situations and Tactical Trade Strategy (SmartKarma) $

Inox Wind Ltd (NSE: INOXWIND / BOM: 539083)

Impending block deals which generally create supply over-hang on the stock leads to a negative impact on the stock

These block deals generally include selling promoters and big funds at a price discount to its current market price

Historically, such events suggest once the block deal is done; stock reacts positively creating a Special Situation Opportunity

🇸🇦 Saudi Arabia to sell $12bn worth of Saudi Aramco shares (FT) $ 🗃️

Saudi Arabian Oil Co (TADAWUL: 2222)

Final decision on whether to proceed with multibillion-dollar offering due to be taken later on Thursday

🇹🇷 Turkcell: Margin Expansion Thesis Playing Out; Maintain Buy (Seeking Alpha) $

Turkcell (NYSE: TKC) is a leading telecommunications provider in Turkey.

My margin expansion thesis continues to play out as the company was able to raise prices faster than inflation in Q1.

Looking forward, as long as this dynamic remains, Turkcell's earnings should continue to rise, driving shares higher.

🌍 Africa Oil Corporation: Buy The Punished Small Cap (Seeking Alpha) $

Africa Oil (TSE: AOI / STO: AOI / FRA: AFZ / OTCMKTS: AOIFF) has been punished by the market as a small cap oil company as prices have dropped.

The company has incredibly strong cash flow with the potential for additional developments in Nigeria.

Over the next few years, we expect the company to grow production, generating substantial long-term shareholder returns.

🇿🇦 Dis-Chem hikes dividend, continues to roll out new pharmacies (IOL)

Dis-Chem Pharmacies (JSE: DCP) raised its final dividend 22% to 22.49 cents a share in the year to March 1, 2024 after headline earnings a share fell slightly mainly due to an imbalance in six month performances in previous years.

The company said Friday it would invest in OneSpark, a life insurance business that Dis-Chem said possesses “the experience, capability and proprietary technology to offer transformative insurance products that align to the better health mandate of the Dis-Chem brand”.

Dis-Chem’s other area of focus for the new financial year included an accelerated retail space rollout, wholesale market share expansion, incremental improvement in total income, cost control to support positive operating leverage, working capital improvement, analytics at the core, and digital health ownership.

🇿🇦 Bumpy road forces Ackerman family to let go of control of troubled Pick n Pay after 60 years (IOL)

Pick 'n Pay (JSE: PIK / FRA: PIK) has embarked on a restructuring plan to save its market position and claw out of huge debts, with chairperson Gareth Ackerman set to relinquish control of the South African grocer that yesterday reported a reversal of fortunes into a R1.5 billion loss.

As bigger rival operator Shoprite Group (JSE: SHP) and other competitors such as Woolworths Holdings (JSE: WHL) appear to be riding out South Africa’s turbulent economy, Pick n Pay is apparently feeling the pinch of a severe financial strain worsened by its breach of debt covenants.

🇿🇦 Pick n Pay enlists new strategy, set to raise capital after big loss (IOL)

Pick 'n Pay (JSE: PIK / FRA: PIK) has embarked on a new strategy to restore it’s core Pick n Pay supermarket business to profit after its R3.2 billion taxed loss for the year to February 25, and plans for a R4bn rights issue and the listing of Boxer in November are in full swing, CEO Sean Summers said yesterday.

He said there would be costs to move staff from one store format to another – Pick n Pay traditionally pays good benefits such as 11 months maternity leave, and staff moving to other stores would get an ex-gratia payment for the loss of these benefits. There may be limited retrenchments from closures where staff could not be moved to other stores, said Summers.

He said the “back-to-basics strategy” had six priorities and would focus on simplicity, quality, affordability and sustainability.

🇿🇦 Pepkor store chains and fintech strengthening in the weak economy (IOL)

ROBUST trading in Pepkor (JSE: PPH / FRA: S1VA)’s popular store brands such as Ackermans, Refinery and PEP, and fast growth from its fintech business, saw group revenue rise a healthy 9.5% to R43.3 billion in the six months to March 31.

Retail sales growth strengthened in the second quarter after back-to-school campaigns and strong Easter trade, with brands expanding market share. Gross profit margins benefited from enhanced full-price sales and the continued recovery in Ackermans, where full-priced sales improved by 660 basis points.

🇿🇦 Opinion | The Promise of South African Small-Cap Industrial Stocks (daba + Capital Markets Africa)

This article was contributed to Daba by Chipo Muwowo, Founder, CEO & Managing Editor of Capital Markets Africa.

SA small-cap Industrials enjoy strong earnings potential

Some firms have completed judicious acquisitions in recent years

Stock prices remain attractive despite significant increases in their value

Afrimat Limited (JSE: AFT / OTCMKTS: AFTLF)is a mining and materials company listed on the Johannesburg Stock Exchange.

Hudaco Industries Limited (JSE: HDC) specializes in the importation and distribution of a broad range of high-quality, branded automotive, industrial, and electronic consumable products (mainly on an exclusive basis) for the South African and wider Southern African region.

Argent Industrial Limited (JSE: ART / OTCMKTS: AILTF)

The group sells and trades manufactured steel and steel-related products such as metal gates, railings, and shutters. It owns over 20 vertically integrated subsidiaries in South Africa, the UK, and the US while it sends exports to over 35 countries globally.

🇵🇱 CD Projekt: Rating Downgrade On Potential Miss In Earnings Targets (Seeking Alpha) $

CD Projekt SA (WSE: CDR / FRA: 7CD / 7CD0 / OTCMKTS: OTGLY / OTGLF)'s recent earnings report showed strong net income growth driven by tax benefits, but it is unlikely to be sustainable.

The company's ambitious target of launching two big games within a tight timeframe seems unrealistic given the complexity of game development and the recent switch to Unreal Engine 5.

Partnership revenue is also unlikely to materialize by FY26/27, making it challenging for CD Projekt to meet its earnings target.

🇰🇾 Consolidated Water: Strong Balance Sheet And Promising Development (Seeking Alpha) $

Consolidated Water Company Ltd (NASDAQ: CWCO) achieved a 91.5% YoY increase in revenue and reached all-time high margins and profitability in FY23.

The company has a solid balance sheet with net debt of $-43.7m and potential for new strategic acquisitions and a share buyback plan.

The company's business model faces risks, including the renewal of its water sales license in the retail segment, but its financial strength and growth trends justify a buy rating.

🇰🇾 Patria Investments: Stock Multiples At Historic Lows, Potential 7.87% Yield (Seeking Alpha) $

Patria Investments Limited (NASDAQ: PAX) has conducted a series of acquisitions that has more than doubled its AUM over the last three years at $32 billion.

Weak stock price performance has resulted in a -16% YTD stock decline, bringing PAX stock price and PE multiple to a previous support level.

Given its solid product offering and reputation within LATAM, buying this asset manager at its lows makes sense, especially since the elevated dividend could serve as to cover stock drops.

🌎 NUAM – the catalyst-rich "secret" new stock exchange (Undervalued Shares)

If a company goes public through a non-conventional process, its stock often ends up falling through the cracks – at least initially!

The peculiar case of Holding Bursátil Regional S.A. (SGO: NUAM) a company goes public through a non-conventional process, its stock often ends up falling through the cracks – at least initially!

The peculiar case of Holding Bursátil Regional, also known as NUAM, could become an interesting case study.

The company is newly listed following a merger of three regional stock exchanges, and it has not yet received formal analyst coverage. However, with 60 brokerage firms as members, 5-10 of them should come out with initiation reports in the foreseeable future.

The stock is also dirt cheap, which these initiation reports are likely to highlight.

"NUAM" is a story that you are going to hear a lot more about in the future. You've read it here first.

🇦🇷 Despegar.com Is Growing Profitably, But The Price Is Excessive (Seeking Alpha) $

Despegar.com Corp (NYSE: DESP) is the leading Latin American OTA.

The company posted strong top-line results in 1Q24, with 13% YoY growth and improved bottom-line results due to expense rationalization.

Despite its profitable growth, Despegar's high P/E ratio of 35x is considered excessive, and the stock is still rated as a Hold.

🇦🇷 Despegar.com: Brazil Continues To Lead Growth (Seeking Alpha) $

Q1 2024 financials show impressive growth in gross bookings and revenue, particularly in the Brazilian market.

Despegar.com Corp (NYSE: DESP) has continued to reduce its long-term debt.

I continue to take a bullish view on Despegar.com.

🇧🇷 🇰🇾 StoneCo: Unjustified Dip In 2024 Makes It A Buy (Seeking Alpha) $

StoneCo Ltd (NASDAQ: STNE) is a Brazilian fintech company focused on MSMBs, offering financial services and software solutions.

The company demonstrates consistent growth across all key financial and operating metrics. The management's long-term outlook is quite optimistic as well.

My valuation analysis suggests there is a 73% upside potential from the current share price levels.

🇧🇷 Banco do Brasil: Stronger Fundamentals Than Private Competitors (Seeking Alpha) $

Banco do Brasil (BVMF: BBAS3 / FRA: BZLA / OTCMKTS: BDORY) has a strong presence in agribusiness, which has been driving the country's GDP growth.

The bank has the best financial indicators among Brazilian private peers.

Although, Banco do Brasil has the lowest P/E multiple among its competitors, indicating a cheap valuation and potential for significant upside.

🇧🇷 SABESP: A Company With Good Prospects In A Risky Economic Environment (Seeking Alpha) $

This water utility is undervalued and operates in a region with a rapidly growing population.

The economic environment in Brazil poses risks for investors due to inflation and political instability.

Companhia de Saneamento Básico do Estado de São Paulo - SABESP (BVMF: SBSP3)'s expansion within the state of Sao Paulo and potential efficiency improvements through privatization are positive factors

🇧🇷 Companhia Siderúrgica Nacional Q1: Weak Result And Risks Materializing (Seeking Alpha) $

Companhia Siderurgica Nacional SA (NYSE: SID) released weak Q1 2024 results, failing to meet market expectations.

The steel segment is doing so badly that the mining segment is already the business that contributes most to the consolidated result.

CSN's high leverage and unattractive valuation compared to peers make it a sell recommendation.

🇧🇷 Petrobras Can Continue Providing Strong Shareholder Returns (Seeking Alpha) $

Petrobras (NYSE: PBR / PBR-A) has hit production milestones in its offshore fields, driving substantial shareholder returns.

The company is generating increased cash flow, supporting additional shareholder returns and a proposed double-digit dividend yield.

Petrobras has strong assets, including new FPSOs, and is focused on increasing exports for future shareholder returns.

🇧🇷 Petrobras: It's Hard To Be Bullish Now (Seeking Alpha) $

For many months, Petrobras (NYSE: PBR / PBR-A) stock traded at a significant discount due to the substantial risk posed by its location in an opaque economic zone, despite its high-quality assets.

Recent events (such as the firing of now-former CEO Jean Paul Prates about 2 weeks ago) have increased these risks further, in my opinion.

I understand the bulls' argument that Petrobras stock looks cheap, as my comps valuation calculations show - the upside potential could be more than 50% if we disregard political risks.

However, I see no reason to neglect these risks today. The discount to Petrobras' valuation is likely to remain the same or even widen.

In light of these points, I think it's prudent to wait for lower prices for Petrobras stock or avoid it altogether, given the significantly increased risks. My rating is "Hold".

🇧🇷 Sendas Distribuidora: The Costco Of Brazil (Seeking Alpha) $

Sendas Distribuidora S.A. (NYSE: ASAI)

Assai is the second largest grocery player in Brazil's cash and carry segment, with significant growth potential.

The company has been aggressively increasing its store count and expects continued organic store growth.

Profitability has been impacted by investments in store conversions and store openings, but is expected to improve as the stores mature and SG&A costs decrease.

🇧🇷 Sendas Distribuidora Q1: Raising The Recommendation From Sell To Hold (Seeking Alpha) $

Sendas Distribuidora S.A. (NYSE: ASAI)'s operating results in 1Q24 were good, with robust annual revenue growth and gains in operational leverage.

The company's deleveraging process is underway, but its high leverage compared to competitors remains a concern.

The company's valuation has improved, but there is still no margin of safety, leading to a recommendation to hold rather than buy shares.

📰🔬 Further Suggested Reading

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Cover Story: China’s Pension Plan Faces Prospect for Change or Going Bust (Caixin) $

China's pension system for non-government workers faces insolvency by 2035 due to demographic shifts.

Potential solutions include raising the retirement age, extending the contribution period, and encouraging private pensions.

Disparities exist between government and enterprise employee pensions, with government workers receiving significantly higher benefits, and reforms are needed for sustainability.

🇨🇳 China sets new rules on how major shareholders can sell their stock (Caixin) $

China’s top securities regulator has placed new restrictions on how major shareholders of listed companies, as well as members of their leadership, can sell their stock as the watchdog looks to protect the market from instability.

As part of new measures that took effect Friday, the China Securities Regulatory Commission (CSRC) banned controlling shareholders and actual controllers of publicly listed companies from offloading shares through centralized bidding or block trades under certain situations.

🇨🇳 Currency diversification can coexist with dollar dominance, vice finance minister says (Caixin) $

The global dominance of the U.S. dollar and a multi-currency international monetary system aren’t mutually exclusive, as alternatives such as the euro, yuan and Japanese yen are expected to play a greater role in trade and financing to maintain the system’s stability, a vice finance minister of China said on Monday.

The diversification of currencies is part of efforts to form a fairer and more orderly international financial system, according to Liao Min, who spoke at the opening session of this year’s Tsinghua PBCSF Global Finance Forum in Hangzhou, Zhejiang province.

🇨🇳 Europe's business chiefs see EU-China relations worsening (Reuters)

The European Round Table for Industry (ERT), which includes chief executives and chairs of large European companies such as ASML and Unilever, found 54% of those surveyed believed EU-China relations would deteriorate, with just 7% seeing improvement.

In the ERT's survey [Confidence rebounds among European business leaders, yet their prospects are better outside Europe] published on Wednesday, China-based CEOs of Western multinationals were more upbeat than counterparts in Europe, with the number expecting no change outweighing those who saw a worsening of ties.

🇨🇳 Exodus of US law firms from Shanghai accelerates (FT) $ 🗃️

More practices are closing offices in China’s largest city as corporate work and M&A deals dry up

🇨🇳 The world's top chipmakers can flip a 'kill switch' should China invade Taiwan, Bloomberg reports (Business Insider)

Chipmakers ASML and TSMC can disable advanced chipmaking machines remotely, Bloomberg reports.

The move addresses growing fears of a Chinese invasion of Taiwan, a key semiconductor producer.

A China-Taiwan conflict could severely impact the global economy.

🇨🇳 China Piles $47.5 Billion Into ‘Big Fund III’ to Boost Chip Development (Caixin) $

China is investing 344 billion yuan ($47.5 billion) in the third phase of its National Integrated Circuit Industry Investment Fund to boost its semiconductor industry amid tensions with the U.S.

The fund, also known as the Big Fund, initiated in 2014, now faces a reset due to corruption probes involving former executives.

Big Fund III aims to address critical bottlenecks in the semiconductor sector, with significant investments from various state-owned entities and banks.

🇨🇳 China sets up third fund with $47.5 bln to boost semiconductor sector (Reuters)

China's finance ministry is the biggest shareholder with a 17% stake and paid-in capital of 60 billion yuan, according to Tianyancha, a Chinese companies information database company. China Development Bank Capital is the second-largest shareholder with a 10.5% stake.

Seventeen other entities are listed as investors, including five major Chinese banks: Industrial and Commercial Bank of China (HKG: 1398 / SHA: 601398 / FRA: ICKB / OTCMKTS: IDCBF), China Construction Bank (HKG: 0939 / SHA: 601939 / OTCMKTS: CICHY / CICHF), Agricultural Bank of China (SHA: 601288 / HKG: 1288 / OTCMKTS: ACGBY / ACGBF), Bank of China (SHA: 601988 / HKG: 3988 / FRA: W8V / OTCMKTS: BACHY / BACHF), and Bank of Communications (SHA: 601328 / HKG: 3328 / FRA: C4C / OTCMKTS: BKFCF / BCMXY), with each contributing around 6% of the total capital.

🇰🇷 Korea Exchange Launches the Disclosure of Corporate Value Up Program on KIND System (Douglas Research Insights) $

The Korea Exchange introduced the Corporate Value Up program on the KIND website. This is a voluntary system aimed at boosting the corporate value of listed Korean companies.

Five key investment indicators for the 2,400+ listed Korean companies include PBR, PER, ROE, dividend payout, and dividend yield. The detailed data these indicators can be easily downloaded on excel.

Corporate Value Up program is a marathon, not a sprint. In this race, the runners (Korean companies) also need some water (such as improvements to dividend/corporate income tax policy).

🇰🇷 Value... Up? (Asian Century Stocks) $

Korean jealousy expressed in minor reforms.

The valuation disparity between Korean and Japanese equities has increased in recent years. This so-called “Korea discount” is due to conflicts of interest between controlling shareholders and minorities.

Poor minority protection is the heart of the problem. High dividend and inheritance taxes have exacerbated it.

Korea’s new Corporate Value Up program is a step in the right direction. However, since participation is voluntary, I don’t expect a wholesale shift in corporate governance.

Individual companies might take some positive actions, including repurchasing discounted preference shares, selling cross-holdings, or canceling treasury shares.

Towards the end of the article, I discuss 5 companies I’m paying attention to.

🇰🇷 FSC Head Remarks Short Selling Could Resume in 1Q 2025 and Launch of Financial Investment Income Tax (Douglas Research Insights) $

On 27 May, Lee Bok-Hyun (Head of FSC) remarked that short selling of stocks in Korea could resume sometime in 1Q -4Q 2025.

The centralized system to detect short selling of stocks in Korea on a live basis could be completed as early as 1Q 2025.

The financial investment income tax is likely to be LAUNCHED in January 2025, which could negatively impact the local stock market.

🇲🇾 Malaysia acts to boost semiconductor ambitions (The Asset) 🗃️

Sixth-largest exporter to spend US$5.3 billion to lure foreign investment, train engineers

To support this goal, the Malaysian government, according to Anwar, will provide fiscal support of at least 25 billion ringgit (US$5.3 billion) that will be used to offer incentives to foreign investors and to train 60,000 Malaysian engineers to meet future industry demand. The strategy also includes establishing at least 10 local companies focused on the design and advanced packaging of semiconductor chips.

By the early 1980s, Malaysia had become home to 14 semiconductor firms, including companies like AMD, Hitachi and HP.

The country’s semiconductor sector is diverse, comprising firms that specialize in outsourced semiconductor assembly and testing, automated test equipment manufacturers, and high-performance test socket designers and manufacturers.

🇮🇳 Exit polls forecast decisive majority for Narendra Modi in India’s election (FT) $ 🗃️

BJP leader set to enter second decade in power when results announced on June 4

🇿🇦 ANC weighs coalition options after crushing South Africa election blow (FT) $ 🗃️

Party which has governed since first post-apartheid election slumps to 40 per cent in the polls

🇿🇦 South Africa on the precipice (FT) $ 🗃️

The ANC’s coalition choices will determine the country’s future

🇲🇽 Mexicans go to the polls after violent presidential campaign (FT) $ 🗃️

Claudia Sheinbaum of the leftwing ruling party has a clear lead over Xóchitl Gálvez.

🇲🇽 Claudia Sheinbaum, the woman hoping to be Mexico’s first female president (FT) $ 🗃️

She was formed by the campus protests of the 1980s, but supporters insist she is not an ideologue

🌐 Visualizing the Countries With the Lowest Corporate Tax Rates (Visual Capitalist)

📅 Earnings Calendar

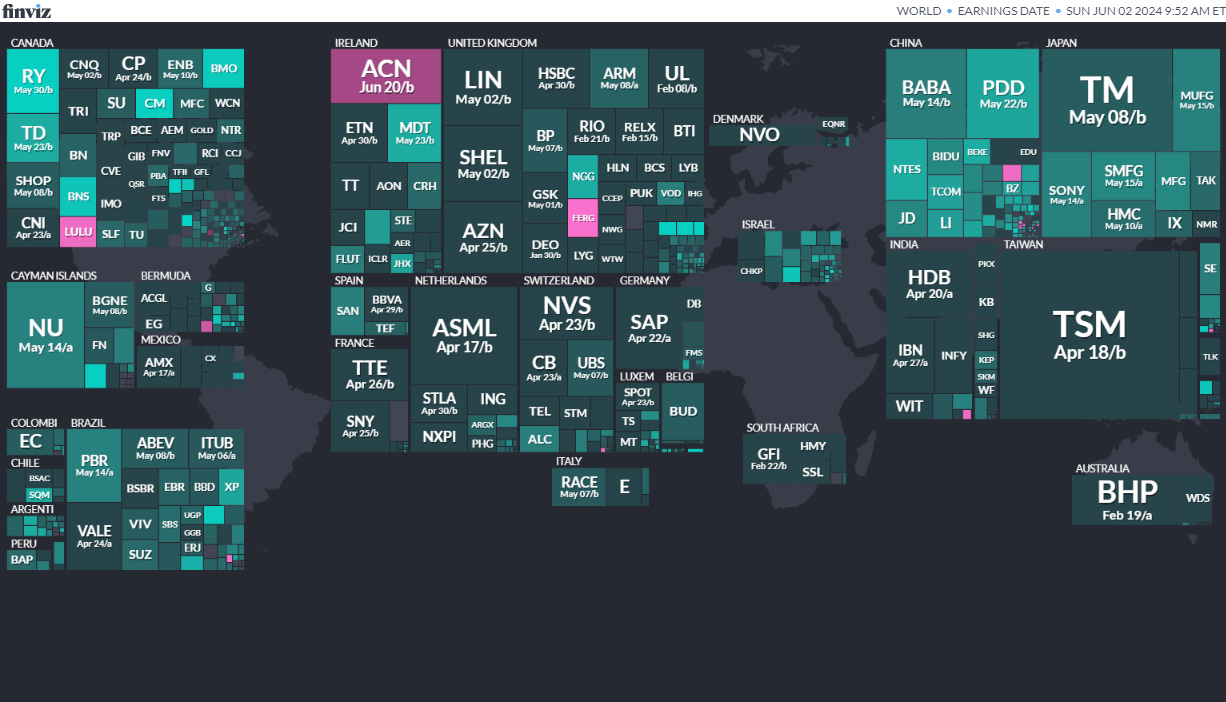

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

India Indian People's Assembly Apr 19, 2024 (d) Ongoing Apr 11, 2019

South AfricaSouth African National AssemblyMay 29, 2024 (d) Confirmed May 8, 2019MexicoMexican SenateJun 2, 2024 (t) Confirmed Jul 1, 2018MexicoMexican Chamber of DeputiesJun 2, 2024 (t) Confirmed Jun 6, 2021MexicoMexican PresidencyJun 2, 2024 (t) Confirmed Jul 1, 2018Bulgaria Bulgarian National Assembly Jun 9, 2024 (d) Confirmed Apr 2, 2023

Mongolia Mongolian State Great Hural Jun 28, 2024 (d) Confirmed Jun 24, 2020

Venezuela Venezuela Presidency Jul 28, 2024 (d) Confirmed May 20, 2018

Jordan Jordanian House of Deputies Sep 10, 2024 (d) Confirmed Nov 10, 2020

Romania Romanian Presidency Sep 15, 2024 (t Date not confirmed Nov 24, 2019

Czech Republic Czech Senate Sep 30, 2024 (t) Date not confirmed Sep 23, 2022

Sri Lanka Sri Lankan Presidency Sep 30, 2024 (t) Date not confirmed Nov 16, 2019

Georgia Georgian Parliament Oct 26, 2024 (d) Confirmed Oct 31, 2020

Uruguay Uruguayan Presidency Oct 27, 2024 (t) Date not confirmed

Uruguay Uruguayan Chamber of Representatives Oct 27, 2024 (t) Date not confirmed

Uruguay Uruguayan Chamber of Senators Oct 27, 2024 (t) Date not confirmed

Georgia Georgian Presidency Nov 30, 2024 (t) Date not confirmed Nov 28, 2018

Romania Romanian Senate Nov 30, 2024 (t) Date not confirmed Dec 6, 2020

Namibia Namibian Presidency Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

Namibia Namibian National Assembly Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

Ghana Ghanaian Presidency Dec 7, 2024 (t) Date not confirmed Dec 7, 2020

Ghana Ghanaian Parliament Dec 7, 2024 (t) Date not confirmed Dec 7, 2020

Romania Romanian Chamber of Deputies Dec 8, 2024 (t) Date not confirmed Dec 6, 2020

Uzbekistan Uzbekistani Legislative Chamber Dec 31, 2024 (t) Tentative Dec 22, 2019

Thailand Referendum Dec 31, 2024 (t) Date not confirmed Aug 7, 2016

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Gauzy Ltd. GAUZ Barclays/ TD Cowen/ Stifel/ B. Riley Securities/ Beech Hill Securities, 4.2M Shares, $17.00-19.00, $75.0 mil, 6/6/2024 Thursday

We are a fully integrated light and vision control company, transforming the way we experience our everyday environments. (Incorporated in Israel)

Our cutting-edge nanotechnology and electronics capabilities in light control, and our mechatronics and image analysis technologies in vision control, are revolutionizing mobility and architectural end-markets. We have established distinct leadership positions across these large and high-growth markets, where our technologies are replacing traditional mechanical products, such as shades, blinds and mirrors, with advanced and sustainable solutions offering superior functionality. Our key products include suspended particle device, or SPD, and liquid crystal, or LC, films for smart glass applications, as well as camera monitoring systems, or CMS, and other advanced driver assistance systems, or ADAS, solutions.

We have established serial production capabilities, either directly or through sub-contracts, with leading aerospace, automotive and architecture companies, including Boeing, Honda, Mercedes, Ford, BMW, and Avery Dennison. We benefit from both secular and regulatory tailwinds that are driving the rapid adoption of light and vision control technologies. In addition to our core markets, we believe that our products may have a multitude of tangible applications in other areas such as railway, maritime, specialty vehicle, private security and consumer appliances.

We aim to deliver a full suite of proprietary technologies that offer superior performance attributes by leveraging our differentiated technical capabilities and market insights, a competitive advantage we maintain through our core research and development and innovation organization. We have a comprehensive product offering with multiple complementary light and vision control technologies, enabling us to provide a full range of solutions for light and vision control across diverse markets, applications and geographies. Our vertically integrated in-house production capabilities enable us to offer our products at various stages in the supply chain based on the specific business needs of our customers. For example, we have the capability to simultaneously sell films to glass fabricators, prefabricated stacks to Tier 1 glass manufacturers and, in certain instances, full window systems to original equipment manufacturers, or OEMs.

Note: Net loss and revenue figures are for the 12 months that ended March 31, 2024.

(Note: Gauzy Ltd. disclosed the terms for its IPO in an F-1/A filing dated May 29, 2024: The company will offer 4.17 million shares (4,166,667 shares) at a price range of $17.00 to $19.00 to raise $75.0 million, if priced at the $18.00 mid-point. In that F-1/A filing, Gauzy added B. Riley Securities and Beech Hill Securities as joint book-runners. Gauzy updated its financial statements for the period through March 31, 2024, in the May 29, 2024, filing as well. Background: Gauzy Ltd. filed its F-1 to go public on April 12, 2024, without disclosing terms for its IPO.)

EShallGo Inc. EHGO US Tiger Securities/ Kingswood Capital Partners, 1.5M Shares, $4.00-6.00, $7.5 mil, 6/10/2024 Week of

(Incorporated in the Cayman Islands)

We specialize in two distinct market sectors: office supply sales and leasing, and after-sale maintenance & repair. These market sectors are large and fragmented, and we believe they present opportunities for significant growth through complementary services. Our mission is to become an office integrator and service provider, offer competitive overall office solutions and services, expand our service market beyond office equipment, and continue to create maximum value for customers. We place our customers’ needs, employees’ welfare and shareholders’ value as utmost importance, and we strive to build an enterprise that provides one-stop office solution.

Junzhang Shanghai is an authorized distributor of major brands of office equipment, including HP, Epson, Xerox, Sharp, Toshiba, Konica, Kyocera and other brands. Over the years, our business has expanded to encompass all other supplies offices may require, such as office furniture, IT products, water dispensers, printing paper, among many others. We also provide maintenance with Enterprise Resource Planning (“ERP”) systems we developed on our own. Our office total solution systems bring efficiency and convenience in the office. Our management believes that we have become one of the leading suppliers of office equipment for both private and public sector businesses as well as for large enterprises and institutions such as Ping An Insurance, Taiping Life, Centaline Property, Debon Securities, Tongce Real Estate, among others, and we have developed an e-commerce platform for all types of offices. As of the date of this prospectus, Junzhang Shanghai has established 20 subsidiaries across China and obtained the national high-tech enterprise certification.

Relying on our team’s rich experience in serving customer as well as technology development over the past 20 years, we have created an innovative cross-region service brand, EShallGo, to provide customers from across the country by addressing their customized office needs. As an independently developed solution provider with our own intellectual property rights, EShallGo is adopting “cloud procurement, cloud management and cloud services” and other powerful tools to lay the cornerstones for our future growth plan. We are in the process of establishing a system covering office services, sales, leasing, warranty service and life-time maintenance covering major cities across the country. We have obtained ISO9001, ISO14001, ISO45001 certifications and other national management system certifications.

Although the Chinese economy annual growth rates no longer sustain an unprecedented level of 10%-plus as in the last decade, as 2010 marks the last year China’s GDP grew by 10.3%, the economic activities in China continue to thrive and prosper in recent years, and demand for corporate office services has become a new market growth point. In light of the industry growth, EShallGo is looking to take the lead in this new market by proposing the “Internet & Service E-commerce model.” Although the e-commerce business and related platform is not yet operational and will be launched upon the completion of this offering, EShallGo has completed the initial setup of e-commerce and national service outlets and gained initial success in the market. Specifically, Junzhang Shanghai has set up all service categories on the platform that are in line with the industry by acquiring the ICP certificate and EDI certificate, which are business licenses for e-commerce platform operations in China and could take up to two years to obtain. Junzhang Shanghai has also developed its proprietary software, remote management systems and the mobile applications, all of which await to be further refined and tested to accommodate the business-end users, and to be launched upon the consummation of this offering. Furthermore, Junzhang Shanghai’s continuing geographical expansion efforts have resulted in more than 155 service outlets and more than 1,500 registered technical service personnel in lower-tier cities. These service outlets have contracted with Junzhang Shanghai through one of its 21 subsidiaries to provide local aftersales maintenance and repair services to largely institutional customers of Shanghai Junzhang. In order to continue its expansion efforts, consolidate its relationship with local vendors, and further promote Eshallgo’s brand awareness, Shanghai Junzhang does not currently charge management fees at this stage and allow the service points to retain all service-related revenues. This enabled us to lay a good foundation for Eshallgo’s future e-commerce development.

Note: Net income and revenue are for in U.S. dollars (converted from China’s renminbi) for the 12 months that ended Sept. 30, 2023.

(Note: EShallGo Inc. cut the size of its small-cap IPO in half – to 1.5 million Class A ordinary shares – down from 3.0 million shares initially – and kept the price range at $4.00 to $6.00 – to raise $7.5 million, assuming that the IPO will be priced at $5.00, the mid-point of its range, according to an F-1/A filing dated May 17, 2024. Background: EShallGo Inc. disclosed terms for its IPO in an F-1 filing dated April 27, 2023: 3.0 million shares at a price range of $4.00 to $6.00 to raise $15.0 million. The Chinese company filed confidential IPO documents with the SEC on Dec. 27, 2021.)

QMMM Holdings Ltd. QMMM Revere Securities, 2.1M Shares, $4.00-4.00, $8.5 mil, 6/10/2024 Week of

We are the holding company for an award-winning digital media advertising service, virtual avatar and virtual apparel technology service company whose operating subsidiaries are based in Hong Kong. (Incorporated in the Cayman Islands)

We are an award-winning digital media advertising service and virtual avatar & virtual apparel technology service company. Through our operating subsidiaries ManyMany Creations and Quantum Matrix, we have used interactive design, animation, art-tech and virtual technologies in over 500 commercial campaigns. We have worked with large domestic and international banks, real estate developers, world famous amusement park, top international athletic apparel and footwear brands and luxury cosmetic products and international brands for their advertising and creation work in Hong Kong. Standing prominently in Hong Kong for over 18 years in the industry, with top creativity, premium account servicing, and ever-advancing tech R&D, we continue to be one of the top premium choices for enterprises and multinational enterprises looking for large scale content-heavy and tech-integrated campaigns. Our clients include local and international banks, real-estate developers, luxury brands, high fashion houses, and theme parks.

Our subsidiary ManyMany Creations has stood out in the industry by breaking through traditional forms of advertising through digital technology. We endeavour to integrate quality concepts with creative digital media technology and provide a one-stop shop for content creativity and production for ad campaigns, TV commercials, online video, 360 video and animation, VR/AR/MR technology, 3D scanning, motion capture, projection mapping and digital façade production.

In March 2014, our wholly owned subsidiary Quantum Matrix, was incorporated, and it has launched digital avatar “Quantum Human” and “Quantum Fit” solutions, which we believe is the world’s only avatar technology for mass adoption of virtual identity. Quantum Matrix has created over 30,000 digital avatars.

Quantum Matrix owns two patents in Hong Kong, providing among the world’s leading automated avatar creation as well as real-time auto-fitting for virtual fashion & apparel. The first patent is for our method of converting a three-dimensional (3D) scanned object to an avatar. The method contains the steps of conducting a 3D segmentation of the 3D scanned object to obtain segmented results; and adapting a first template to the segmented results to create an avatar. The first template includes a topology, and the adapting step contains the step of mapping the topology of the first template to the segmented results to create the avatar. The invention provides an automated process which requires virtually no human intervention to convert the 3D scanned object to the avatar. The second patent is for our method of automatically fitting an accessory object to an avatar. The method contains the steps of providing an avatar; providing an accessory object; providing a template which the accessory object does not penetrate and fitting the accessory object to the avatar as a result of the template fitted to the avatar. The invention provides an automated process which requires virtually no human intervention to fit an accessory object (e.g. a garment) to the avatar.

These technologies are applied in commercial events, theme-parks, fashion shows, luxury events, entertainment industry, travel-retail, tech platform, among others. In addition, our technologies further provide a strong foundation to develop platforms for social media, entertainment, virtual self-expression, virtual influencers, tradable and sharable digital assets for consumers and creators.

Note: Net loss and revenue are in U.S. dollars for the year that ended Sept. 30, 2023.

(Note: QMMM Holdings Ltd. is offering 2.13 million ordinary shares (2,125,000 Ordinary Shares) at $4.00 to raise $8.5 million, according to its F-1/A filing dated May 20, 2024. Background: QMMM Holdings filed its F-1 on Oct. 6, 2023. The company submitted its confidential IPO filing to the U.S. Securities and Exchange Commission on June 23, 2023.)

WORK Medical Technology Group, Ltd. WOK Kingswood, 2.0M Shares, $4.00-5.00, $9.0 mil, 6/10/2024 Week of

(Incorporated in the Cayman Islands)

We are a holding company incorporated in the Cayman Islands. We conduct all of our operations through our operating entities established in the PRC, primarily Work Hangzhou, our wholly owned subsidiary, and its subsidiaries (collectively referred to herein as the “PRC subsidiaries”). The operations of our PRC subsidiaries could affect other parts of our business.

We are a supplier of medical devices in China. We develop and manufacture Class I and II medical devices and sell Class I and II disposable medical devices through operating subsidiaries in China. The PRC subsidiaries’ products include, to name a few, medical face masks, artery compression tourniquets for bleeding control, disposable breathing circuits for delivering oxygen and anesthetic gases, laryngeal mask airways for keeping patients’ airways open during anesthesia and endotracheal tubes for keeping the trachea open for air to get to the lungs.

The PRC subsidiaries have been providing medical devices to hospitals, pharmacies, and medical institutions since 2002. The PRC subsidiaries currently have a total of 20 medical devices in their product portfolio. All of them are sold domestically, and 15 of them are sold internationally.

In the Chinese market, the PRC subsidiaries’ products are sold in 34 provincial-level administrative regions. Internationally, the products are exported to more than 30 countries in Asia, Africa, Europe, North America, South America, and Oceania. I

The PRC subsidiaries have three types of customers, i) direct end-user customers, which include hospitals, pharmacies, and medical institutions, ii) domestic distributor customers that distribute the PRC subsidiaries’ products to end-user customers in China, and iii) export distributor customers that distribute the PRC subsidiaries’ products to end-user customers in Asia, Africa, Europe, North America, South America, and Oceania. The top 10 countries and regions outside of mainland China where these products are sold are Saudi Arabia, Germany, Switzerland, Hong Kong, France, Poland, Netherlands, Mexico, Romania and Russia.

As of Sept. 30, 2022, the PRC subsidiaries had a total of 1,058 customers, of which, 154 are direct end-user customers, 867 are domestic distributor customers, and 37 are export distributor customers.

As of March 31, 2023, the PRC subsidiaries had a total of 874 customers, of which, 64 are direct end-user customers, 800 are domestic distributor customers, and 10 are export distributor customers.

*Note: Net income and revenue are for the fiscal year that ended Sept. 30, 2023.

(Note: WORK Medical Technology Group Ltd. cut the size of its IPO to 2.0 million shares – down from 3.0 million shares initially – and the assumed IPO price is $4.00 – the low end of its previous price range of $4.00 to $5.00 – to raise $8.0 million, according to its F-1/A filing on May 21, 2024. Kingswood replaced Univest Securities as the sole book-runner. WORK Medical Technology Group has updated its financial statements through Sept. 30, 2023. Background: WORK Medical Technology Group, LTD. filed an F-1/A dated Nov. 6, 2023, and disclosed terms for its IPO: 3.0 million shares at $4.00 to $5.00 to raise $13.5 million. WORK Medical Technology Group, LTD. filed its F-1 on April 27, 2023. The Chinese company submitted confidential IPO documents to the SEC on June 23, 2022.)

🏁 Emerging Market ETF Launches

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

03/19/2024 - Avantis Emerging Markets ex-China Equity ETF AVXC - Active, equity, ex-China

03/15/2024 - Polen Capital China Growth ETF PCCE - Active, equity, China

03/04/2024 - Simplify Tara India Opportunities ETF IOPP - Active, equity, India

02/07/2024 - Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares XXCH - Equity, leveraged, China

01/11/2024 - Matthews Emerging Markets Discovery Active ETF MEMS - Active, equity, small caps

01/10/2024 - Matthews China Discovery Active ETF MCHS - Active, equity, small caps

11/07/2023 - Global X MSCI Emerging Markets Covered Call ETF EMCC - Equity, leverage

11/07/2023 - Avantis Emerging Markets Small Cap Equity ETF AVEE - Active, equity, small caps

09/22/2023 - Matthews Asia Dividend Active ETF ADVE - Active, equity, Asia

09/22/2023 - Matthews Pacific Tiger Active ETF ASIA - Active, equity, Asia

09/22/2023 - Matthews Emerging Markets Sustainable Future Active ETF EMSF - Active, equity, ESG

09/22/2023 - Matthews India Active ETF INDE - Active, equity, India

09/22/2023 - Matthews Japan Active ETF JPAN - Active, equity, Japan

09/22/2023 - Matthews Asia Dividend Active ETF ADVE - Active, equity, Asia

08/25/2023 - KraneShares Dynamic Emerging Markets Strategy ETF KEM - Active, equity, emerging markets

08/18/2023 - Global X India Active ETF NDIA - Active, equity, India

08/18/2023 - Global X Brazil Active ETF BRAZ - Active, equity, Brazil

07/17/2023 - Matthews Korea Active ETF MKOR - Active, equity, South Korea

05/18/2023 - Putnam Emerging Markets ex-China ETF PEMX - Active, value, growth stocks

05/11/2023 - JPMorgan BetaBuilders Emerging Markets Equity ETF BBEM - Passive, large + midcap stocks

03/16/2023 - JPMorgan Active China ETF JCHI - Active, equity, China

03/03/2023 - First Trust Bloomberg Emerging Market Democracies ETF EMDM - Principles-based

1/31/2023 - Strive Emerging Markets Ex-China ETF STX - Passive, equity, emerging markets

1/20/2023 - Putnam PanAgora ESG Emerging Markets Equity ETF PPEM - Active, equity, ESG, emerging markets

1/12/2023 - KraneShares China Internet and Covered Call Strategy ETF KLIP - Active, equity, China, options overlay, thematic

1/11/2023 - Matthews Emerging Markets ex China Active ETF MEMX - Active, equity, emerging markets

12/13/2022 - GraniteShares 1.75x Long BABA Daily ETF BABX - Active, equity, leveraged, single stock

12/13/2022 - Virtus Stone Harbor Emerging Markets High Yield Bond ETF VEMY - Active, fixed income, junk bond, emerging markets

9/22/2022 - WisdomTree Emerging Markets ex-China Fund XC - Passive, equity, emerging markets

9/15/2022 - KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV - Passive, equity, Asia, dividend strategy

9/15/2022 - OneAscent Emerging Markets ETF OAEM - Active, Equity, emerging markets, ESG

9/9/2022 - Emerge EMPWR Sustainable Select Growth Equity ETF EMGC - Active, equity, emerging markets

9/9/2022 - Emerge EMPWR Unified Sustainable Equity ETF EMPW - Active, equity, emerging markets

9/8/2022 - Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH - Active, equity, emerging markets, ESG

7/14/2022 - Matthews China Active ETF MCH - Active, equity, China

7/14/2022 - Matthews Emerging Markets Equity Active ETF MEM - Active, equity, emerging markets

7/14/2022 - Matthews Asia Innovators Active ETF MINV - Active, equity, Asia

6/30/2022 - BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD - Passive, fixed income, emerging markets

5/2/2022 - AXS Short CSI China Internet ETF SWEB - Active, inverse, thematic

4/27/2022 - Dimensional Emerging Markets High Profitability ETF DEHP - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Core Equity 2 ETF DFEM - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Value ETF DFEV - Active, equity, emerging markets

4/27/2022 - iShares Emergent Food and AgTech Multisector ETF IVEG - Passive, equity, thematic [Mostly developed markets]

4/21/2022 - FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM - Passive, equity, ESG

4/6/2022 - India Internet & Ecommerce ETF INQQ - Passive, equity, thematic

2/17/2022 - VanEck Digital India ETF DGIN - Passive, India market, thematic

2/17/2022 - Goldman Sachs Access Emerging Markets USD Bond ETF GEMD - Passive, fixed income, emerging markets

1/27/2022 - iShares MSCI China Multisector Tech ETF TCHI - Passive, China, technology

1/11/2022 - Simplify Emerging Markets PLUS Downside Convexity ETF EMGD - Active, equity, options strategy

1/11/2022 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG - Passive, equity, ESG

🚽 Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

03/25/2024 - Global X MSCI Nigeria ETF - NGE

03/21/2024 - VanEck Egypt Index ETF - EGPT

03/14/2024 - KraneShares Bloomberg China Bond Inclusion Index ETF - KBND

03/14/2024 - KraneShares China Innovation ETF - KGRO

03/14/2024 - KraneShares CICC China Consumer Leaders Index ETF - KBUY

03/13/2024 - Xtrackers MSCI All China Equity ETF - CN

03/13/2024 - Xtrackers MSCI China A Inclusion Equity ETF - ASHX

02/16/2024 - Global X MSCI China Real Estate ETF - CHIH

02/16/2024 - Global X MSCI China Biotech Innovation ETF - CHB

02/16/2024 - Global X MSCI China Utilities ETF - CHIU

02/16/2024 - Global X MSCI Pakistan ETF - PAK

02/16/2024 - Global X MSCI China Materials ETF - CHIM

02/16/2024 - Global X MSCI China Health Care ETF - CHIH

02/16/2024 - Global X MSCI China Financials ETF - CHIX

02/16/2024 - Global X MSCI China Information Technology ETF - CHIK

02/16/2024 - Global X MSCI China Consumer Staples ETF - CHIS

02/16/2024 - Global X MSCI China Industrials ETF - CHII

02/16/2024 - Global X MSCI China Energy ETF - CHIE

02/14/2024 - BNY Mellon Sustainable Global Emerging Markets ETF - BKES

01/26/2024 - The WisdomTree Emerging Markets ESG Fund - RESE

11/11/2023 - Global X China Innovation ETF - KEJI

11/11/2023 - Global X Emerging Markets Internet & E-commerce ETF - EWEB

11/09/2023 - Franklin FTSE South Africa ETF - FLZA

10/27/2023 - Simplify Emerging Markets Equity PLUS Downside Convexity - EMGD

10/20/2023 - WisdomTree India ex-State-Owned Enterprises Fund - IXSE

10/20/2023 - WisdomTree Chinese Yuan Strategy Fund - CYB

10/20/2023 - Loncar China BioPharma ETF - CHNA

10/18/2023 - KraneShares Emerging Markets Healthcare Index ETF - KMED

10/18/2023 - KraneShares MSCI China ESG Leaders Index ETF - KSEG

10/18/2023 - KraneShares CICC China Leaders 100 Index ETF - KFYP

10/16/2023 - Strategy Shares Halt Climate Change ETF - NZRO

09/20/2023 - VanEck China Growth Leaders ETF - GLCN

08/28/2023 - Asian Growth Cubs ETF - CUBS

08/01/2023 - VanEck Russia ETF - RSX

07/07/2023 - Emerge EMPWR Sustainable Emerging Markets Equity ETF - EMCH

06/23/2023 - Invesco PureBeta FTSE Emerging Markets ETF - PBEE

06/16/2023 - AXS Short China Internet ETF - SWEB

04/11/2023 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF - REMG

3/30/2023 - Invesco BLDRS Emerging Markets 50 ADR Index Fund - ADRE

3/30/2023 - Invesco BulletShares 2023 USD Emerging Markets Debt ETF - BSCE

3/30/2023 - Invesco BulletShares 2024 USD Emerging Markets Debt ETF - BSDE

3/30/2023 - Invesco RAFI Strategic Emerging Markets ETF - ISEM

2/17/2023 - Direxion Daily CSI 300 China A Share Bear 1X Shares - CHAD

1/13/2023 - First Trust Chindia ETF - FNI

12/28/2022 - Franklin FTSE Russia ETF - FLRU

12/22/2022 - VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

8/22/2022 - iShares MSCI Argentina and Global Exposure ETF AGT

8/22/2022 - iShares MSCI Colombia ETFI COL

6/10/2022 - Infusive Compounding Global Equities ETF JOYY

5/3/2022 - ProShares Short Term USD Emerging Markets Bond ETF EMSH

4/7/2022 - DeltaShares S&P EM 100 & Managed Risk ETF DMRE

3/11/2022 - Direxion Daily Russia Bull 2X Shares RUSL

1/27/2022 - Legg Mason Global Infrastructure ETF INFR

1/14/2022 - Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (June 3, 2024) was also published on our website under the Newsletter category.