Emerging Market Links + The Week Ahead (March 18, 2024)

Disillusioned Chinese EV owners, China's massive hidden local debt, lessons from Japan’s self-inflicted decline, bullish case for South Africa, EM stock picks and the week ahead for emerging markets.

Caixin has reported about a McKinsey China Survey (I believe its this post in Chinese linking to the full report here that’s also in Chinese) that reality is setting in for Chinese EV owners with 22% stating they wouldn’t consider new energy vehicles (NEVs) for their next car. Much of the problem though involves the lack of charging infrastructure outside the bigger wealthy cities.

Meanwhile, The Asset had an interesting piece about how Japan’s self-inflicted decline offers lesson. In the 1980s, Japan had a dynamic consumer-electronics sector; but new digital technologies began to replace the analogue devices on which the Japanese had a near-monopoly with both producers and the government failing to adapt.

Finally, the Financial Times has noted how South Africa’s infrastructure crisis has deepened as Johannesburg taps run dry while another recent FT piece gave the bullish case for South Africa that outlined grounds for medium-term optimism after years of negative news.

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

🇹🇼 Taiwan Stopover + Non-Tech Taiwan Stock Updates

A short Taiwan stopover; Bafang Yunji International (TPE: 2753) vs. Gourmet Master Co., Ltd. (TPE: 2723); China Airlines (TPE: 2610) vs. Eva Airways (EVA) (TPE: 2618) updates; etc.

🌐 EM Fund Stock Picks & Country Commentaries (March 17, 2024) $

Korean market reforms, Baidu abandons "moonshots" for earthly profits, 2 Taiwanese stocks that are solar plays, Indian hospital stock, Indonesia, Uranium market, qualities of a good money manager, etc

📰🔬 Emerging Market Stock Picks / Stock Research

$ = behind a paywall / 🗃️ = Archived article

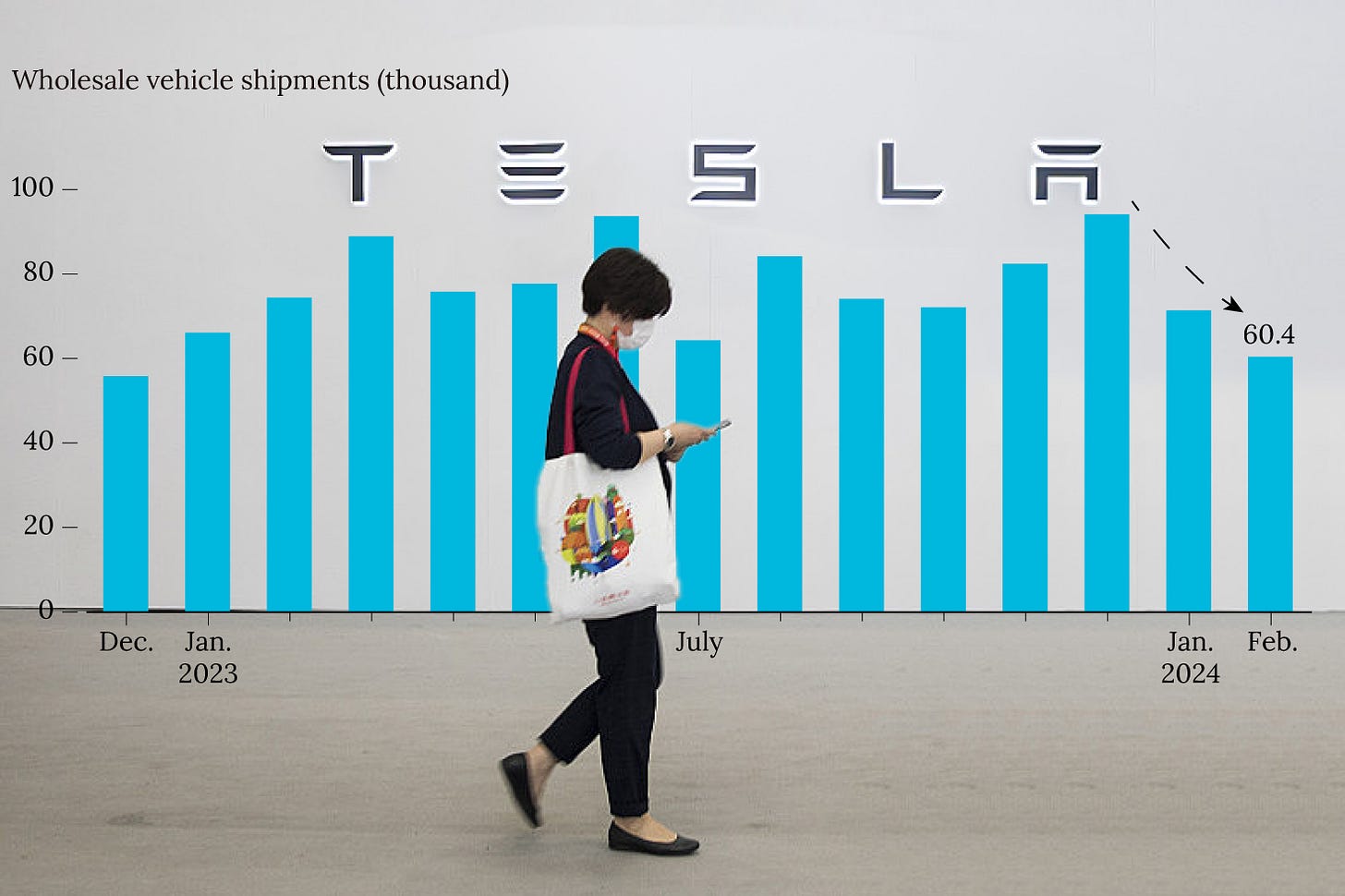

🇨🇳 Analysis: Mounting Competition in China Comes at a Bad Time for Tesla (Caixin) $

More of Tesla’s Chinese rivals are catching up in the sales race just as the U.S. electric-vehicle (EV) maker finds itself in a lull between product launches.

Tesla’s enviable sales growth is set to slow this year as it remains more than a year away from launching the next generation of models that it is counting on to drive a new wave of growth.

Despite making history when its Model Y SUV passed Toyota Motor Corp.’s conventionally powered RAV4 as the world’s best-selling car in 2023, Tesla Inc.’s latest financials show it is struggling to maintain the high profitability that has kept investors’ mouths watering.

🇨🇳 China’s smartphone makers can find an edge in cars as Apple retreats (FT) $ 🗃️

🇨🇳 Prosus (PRX NA) (Asian Century Stocks) $

Tencent at a 35% discount with consistent share buybacks

Prosus (JSE: PRX / AMS: PRX / OTCMKTS: PROSY / OTCMKTS: PROSF / ETR: 1TY) (US$76 billion) is an Amsterdam-listed investment holding company with a 25.2% stake in Chinese Internet company Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY) (US$337 billion).

Its parent company, Naspers (JSE: NPN / FRA: NNWN / OTCMKTS: NPSNY), began as a newspaper publisher in 1915 and then became a book publisher.

Fast-forward 20 years, and Tencent has become one of the most successful growth stories ever. The value of that initial 33% stake (later upped to 50%) has gone up over 3,000x.

🇨🇳 JD.com Inc.: Market Share Expansion via Platform Ecosystem Improvements! - Key Drivers (SmartKarma) $

JD.com (NASDAQ: JD)'s latest earnings showed a strong commitment to growth, navigating a mix of macro recoveries, seasonality factors and strategic refocus.

They delivered a growth in net revenues by 4% and recorded a non-GAAP net income attributable to ordinary shareholders of RMB 8.4 billion.

Cash and cash equivalents, restricted cash, and short term investments totaled RMB 198 billion.

🇨🇳 MT/ Meituan (3690 HK) Earnings Preview: Fourth Positive EPS, 99% Upside (SmartKarma) $

In 4Q23, we believe total revenue will grow by 20% YoY and MT will have the fourth profitable quarter.

We believe Douyin [ByteDance Ltd.] will not threaten Meituan (SEHK: 3690) in the long run according to other competitors’ failure.

We believe EPS will reach RMB0.35 in 4Q23 and RMB2.23 in 2023.

🇨🇳 Exclusive: ByteDance revives gaming ambitions amid fears of U.S. TikTok ban (SmartKarma) $

In a surprising reversal of its recent strategy, TikTok parent company ByteDance Ltd. plans to re-enter the gaming industry. This decision came less than four months after it chose to wind down its Nuverse gaming brand and retreat from mainstream video games.

The Beijing-based short-form video platform said it will be watching how the industry develops, and will keep exploring the gaming business, according to an internal letter seen by Caixin.

🇨🇳 Temu’s Push Into America Pays Off Big Time for Meta and Google (WSJ) $ 🗃️

The e-commerce platform’s parent company spent nearly $2 billion at Meta last year and it was a top advertiser at Google

🇨🇳 Tuya’s losses narrow, but stock still looks pricey (Bamboo Works)

The internet of things services provider’s gross margin hit a record high last quarter and its loss narrowed on strong performance for its platform as a service business

Tuya Inc (NYSE: TUYA)’s revenue jumped 42.2% in last year’s fourth quarter, with its platform as a service business as the biggest contributor

The company’s stock could be vulnerable if major shareholder Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY) decides to sell down its stake, or if the company gets caught in a flareup of China-U.S. tensions

🇨🇳 GDS preparing to spin off its global business? (Bamboo Works)

The data center operator is reportedly in talks to sell a stake in its fast-expanding global operation to several major investors, including Hillhouse and Boyu Capital

GDS Holdings Ltd (NASDAQ: GDS) is aiming to raise up to $600 million by selling part of its fast-growing global unit that operates data centers in Malaysia and plans to enter Indonesia

The funding would give a small group of global investors a majority of the global operation’s stock, potentially paving the way for the unit’s spinoff

🇨🇳 Chinese electronics duo nosedive after graft busters detain chairman (Caixin) $

Chengdu Screen Micro-Electronics Co. Ltd. (SHA: 688053) (成都思科瑞微电子股份有限公司) and Guoguang Electric Co. Ltd. Chengdu (SHA: 688776) (成都国光电气股份有限公司) were sent plunging after Zhang Ya, the actual controller and chairman of both firms, was detained by graft investigators in North China’s Hebei province.

The companies — both listed on Shanghai’s Nasdaq-like STAR Market — said they were notified of Zhang’s situation on Monday by his family, according to exchange filings submitted Wednesday. They provided no further details.

🇨🇳 TCL Electronics (1070.HK) – a rising star in the TV business (Pyramids and Pagodas)

Vertical integration and surging emerging market sales have allowed the Hong Kong-listed manufacturer to leapfrog established Korean and Japanese rivals to number 2 position globally

TCL Electronics Limited (HKG: 1070 / FRA: TC2A / OTCMKTS: TCLHF) (“TCL”), with a market cap of HKD 7.57 billion (USD 968 million), is not your ordinary Chinese TV manufacturer. TCL focuses on mid-to-high end audio/video products like miniLED, QLED, Android, and smart TVs, ranking second in the global TV market behind Samsung. The Company also produces air conditioners, refrigerators, smartphones, tablets, and smart home devices. A recent catch-up with the IR team at TCL’s Shenzhen Industrial Park Headquarters intrigued us and we decided to dig a bit deeper. Currently, we have a trading position open in TCL with average in-price of HKD 2.71. Our personal target range for the stock is HKD 3.71–4.26.

🇨🇳 [Miniso Group (MNSO US, BUY, TP US$31) Target Price Change]: Near Term Story Is Still the Americas (SmartKarma) $

MINISO Group Holding (NYSE: MNSO) report C4Q23 revenue in-line/7.9% vs. our estimate/consensus, non-GAAP NI is 5.1%/10.5% higher than our estimate/consensus on strong overseas sales from North and Latin Americas.

Company guided for soft operating margin thanks to robust new store openings, which we believe to be accretive to earnings in the long run

We maintain the stock as BUY and but cut TP by US$2 to US$31/ADS

🇨🇳 Facing winter at home, Cango looks overseas (Bamboo Works)

The auto-trading platform operator unveiled a new service for overseas dealers aiming to import used Chinese cars

Cango (NYSE: CANG) has launched a new app, AutoCango, to facilitate the export of used Chinese cars to dealers in developing markets

The company’s revenue plunged 73% in last year’s fourth quarter, but it remains relatively well regarded by investors due to its conservative stance in China’s difficult car market

🇨🇳 Legend Holdings shows diversification isn’t always a winning formula (Bamboo Works)

The investment holding company warned it will post a large loss for 2023, as losses from some assets may outweigh declining profits at others

Legend Holdings (HKG: 3396 / FRA: 1PC / OTCMKTS: LGNRF) warned that it would post a net loss of up to 4 billion yuan for 2023, in a major negative swing from its 1.17 billion yuan profit in the previous year

Its listed subsidiaries posted revenue and profit declines in the first nine months of 2023, while its losses from investments in startups may have widened

🇨🇳 Ping An Insurance Is Turning Inward (Seeking Alpha) $

🇨🇳 Li Ning (2331 HK): Evaluating a Potential Privatisation (SmartKarma) $

Reuters reported that due to the steep share price declines, Mr Li Ning is considering leading a consortium to privatise Li Ning (HKG: 2331 / FRA: LNLB / FRA: LNL / OTCMKTS: LNNGY / LNNGF).

The shares have been weighed down by concerns about channel inventory, steep retail discounts, and unauthorised distributor sales. To counter this, Li Ning aims to achieve RMB50bn sales by 2028.

The probability of an offer is low as funding the scheme consideration could prove challenging. Nevertheless, the downside is low as Li Ning trades at an undemanding valuation.

🇨🇳 Li Ning (2331 HK): Update On The Name Given Potential Privatization News (SmartKarma) $

According to public news today afternoon during trading hours, the founder and biggest shareholder of Li Ning (HKG: 2331 / FRA: LNLB / FRA: LNL / OTCMKTS: LNNGY / LNNGF), Mr. Li Ning, is mulling privatizing the public company.

Mr. Li Ning has shown the opposite intention over the last few years, with several major sell-down of stake.

The company is trading at 16x 2024 PE, with visibility being quite low.

🇨🇳 Amer Sports aims to score another group winner after Fila jackpot (Bamboo Works)

Amer Sports (NYSE: AS), spun off from Anta Sports, went public on the New York Stock Exchange on Feb. 1

Amer Sports reported revenue growth of 61% last year in Greater China, led by Arc’teryx clothing

The company is keen to boost the global profile of the Arc’teryx brand by opening more specialty stores

🇨🇳 Belle Fashion Pre-IPO - Refiling Updates (SmartKarma) $

Belle Fashion (BF) aims to raise up to US$1bn in its Hong Kong listing. The company recently refiled its application proof after a gap of two years.

As per F&S, it was the largest player in China’s fashion footwear market with a 12.3% market share, based on 2022 retail sales.

We have looked at the company’s past performance based on its earlier filings in 2022. In this note, we talk about the updates from its recent filings.

🇨🇳 Chinese Bottled Water Giant Nongfu Spring Falters Under Boycott (Caixin) $ & China’s richest person has a new headache: Nationalist Chinese social media users are claiming his bottled water brand, Nongfu Spring, is pro-Japan (Fortune) $ 🗃️

Chinese beverage giant Nongfu Spring (HKG: 9633 / OTCMKTS: NNFSF) (农夫山泉股份有限公司) saw both its stock and sales tumble after nationalist Chinese internet users initiated a widespread boycott of the brand’s products.

The Hangzhou-based drinks-maker, known for its eponymous bottled water, was thrust into a firestorm of online anger that began on Feb. 28, after its billionaire founder Zhong Shanshan attended the memorial service of Zong Qinghou, founder of rival Hangzhou Wahaha Group Co. Ltd., who died last month.

🇨🇳 China loves cured meat. But will Wing Yip’s satisfy investor palates? (Bamboo Works)

While its pork sausages and bacon-like smoked meats may seem niche outside China, they are big business in the world’s largest meat market

Wing Yip Food Holdings Group Ltd (KOSDAQ: 900340) has filed for a Nasdaq IPO that could raise $30 million, similar to the $25 million it raised in its 2018 listing on South Korea’s Kosdaq exchange

The company competes in China’s vast $87.8 billion market for meat products, which is projected to grow 20% annually between 2023 and 2027

🇨🇳 Stock disconnect triggers investor exodus from CStone Pharma (Bamboo Works)

The share price fell nearly 40% in a week after the drugs company was dropped from a scheme allowing mainland investors to trade Hong Kong-listed stocks

CEO Jason Yang has increased his CStone Pharmaceuticals (HKG: 2616 / FRA: PH4 / OTCMKTS: CSPHF) stake multiple times over the past 18 months to 4.79% of outstanding shares, signaling confidence in the company

The drug developer slimmed down its operations last year and licensed out several products, switching its focus to R&D and widening the approved uses for existing medicines

🇨🇳 Bar chain Helens tastes profits again after reboot (Bamboo Works)

The Hong Kong-listed bar operator has found a way back to profit after launching a new franchise model last year

Helens International Holdings Co Ltd (HKG: 9869 / FRA: 5ZW) said it is on track to swing from a loss of 1.6 billion yuan in 2022 to a profit of at least 160 million yuan for last year

The bar chain launched a revised franchise scheme in the middle of last year and stopped taking a cut of partner profits

🇨🇳 CRRC to benefit from growing demand for railway rolling stock (Bamboo Works) $

CRRC Co. Ltd. (SHA: 601766 / HKG: 1766 / FRA: C2L / OTCMKTS: CRCCY)

With policy support, railway rolling stock is expected to be replaced and upgraded at an accelerating pace, boosting revenue for railway equipment makers

🇭🇰 Cathay Pacific (293 HK, BUY, TP HK$9.90): FY23 Better than Expected, and Surprise Dividends (SmartKarma) $

FY23 net profit of HKD9.1b, easily beating the consensus forecast of HKD8.5b, and announced a surprise dividend, the first since 2019, signally pandemic effects are over

Perfect execution from the team, leveraging on a strong market

Cathay Pacific Airways Limited (HKG: 0293 / OTCMKTS: CPCAY) is a value BUY, our target price of HK$9.90 (+10% UPSIDE) implies 10x FY2024 PE. We will update more after tuning in the 2 pm analyst briefing

🇭🇰 Cathay Pacific – Rising Inflationary Pressure Expedites Earnings Normalisation (SmartKarma) $

2023 results came in broadly in line with expectations but included a concerning step up in ex-fuel unit cost inflation.

We cut our 2024 EBITDAR by 10% to HK$22.2bn, which drives net income down 21% to HK$6.6bn, leaving us well below consensus.

We revisit Cathay Pacific Airways Limited (HKG: 0293 / OTCMKTS: CPCAY)'s margin generation problems from the last cycle, illustrating structural problems which require structural solutions.

🇭🇰 Unpacking Samsonite (HKG:1910) (Acid Investments)

Recently, there floated rumors of Samsonite International SA (HKG: 1910 / FRA: 1SO / OTCMKTS: SMSOF) receiving takeover interest from various suitors including private equity firms, which are interested in potentially relisting the company in another market, such as the United States, believing that it would help Samsonite garner a better valuation. The same situation is happening at L'Occitane International (HKG: 0973 / FRA: COC / OTCMKTS: LCCTF), which I believe will cease to be public very soon.

The basic background for many of these HK listed stonks that are headquartered in Western jurisdictions is that many were looking to tap into the increasingly affluent Chinese market and the Hang Seng Index wasn’t too shabby then, hence the HKEX listings. However, as investor appetite for HK stonks has waned, the rationale to remain listed there is no longer applicable.

🇹🇼 Taiwan Semi (Investing City)

One of the most important companies in the world

I’ll end with this incredibly impressive stat that reveals the company’s dominance: 92% of 10nm or smaller chips are made by Taiwan Semiconductor Manufacturing (TSMC) (NYSE: TSM / TPE: 2330). And chips are only getting smaller as computing needs increase, especially considering the explosion in AI.

🇰🇷 Korea Electric Power: Return To Profitability And Dividend Reinstatement Are Potential Catalysts (Seeking Alpha) $

Korea Electric Power Corporation or KEPCO (NYSE: KEP / KRX: 015760 / FRA: KOP) is likely to generate positive earnings in the current year, with expectations that the company will optimize its power generation mix to reduce fuel-related costs.

There is a high likelihood of Korea Electric Power resuming dividend distributions this year, considering its profitability outlook and the Korean regulators' focus on shareholder capital return.

KEP's valuations are appealing, as it trades at a discount to book value that is greater than 50%.

🇰🇷 Samsung quashes activist proposals backed by Norway’s oil fund (FT) $ 🗃️

South Korean conglomerate’s de facto holding company rejects calls to increase dividends and share buybacks

🇰🇷 KCC Corp: Taking a Closer Step to Separating the Ownership Structures of the KCC Group (Douglas Research Insights) $

There is an increasing probability that KCC Corp (KRX: 002380) is closer to separating the ownership structures of the three Chung brothers regarding the various KCC Group related companies.

KCC's 9.17% stake in Samsung C&T Corp (KRX: 028260) is worth 2.8 trillion won. KCC's stake in Samsung C&T is worth 117% of KCC's own market cap.

According to our valuation analysis, it suggests NAV of 355,925 won per share, representing a 30% upside from current levels.

🇰🇷 LG Electronics: Investment In Bear Robotics and Aggressive Plans to Expand in Global Robotics (Douglas Research Insights) $

In this insight, we discuss LG Electronics (KRX: 066570 / FRA: LGLG / LON: 39IB)'s investment in Bear Robotics (US) and LG Electronics' aggressive ambitions to become a major player in the global robotics industry.

LG Electronics announced that it invested a $60 million Series C funding round in Bear Robotics, a Silicon Valley based company that provides service robotics and artificial intelligence solutions.

One of the key goals of LG Electronics is to expand into the global robotics software market, which is expected to grow to about 100 trillion won in eight years.

🇰🇷 Angel Robotics: IPO Bookbuilding Results Analysis (Douglas Research Insights) $

Angel Robotics reported exceptional IPO bookbuilding results. Angel Robotics' IPO price has been determined at 20,000 won, which is 33% higher than the high end of the IPO price range.

A total of 2,067 institutional investors participated in this IPO book building. The demand ratio was 1,157 to 1. Angel Robotics will start trading on 26 March 2024.

We remain positive on Angel Robotics. There is likely to be a sharp overshooting of its share price relative to its intrinsic value on the first day of trading.

🇰🇷 An Update of the Potential KOSPI200 Rebalance Candidates in June 2024 (Douglas Research Insights) $

We provide an update of the potential KOSPI200 rebalance candidates in June 2024.

The bottom 5% market caps in KOSPI200 could be excluded from the KOSPI200 rebalance in June 2024. These 10 stocks are down on average 12.6% YTD.

We identified seven potential inclusion candidates. Among them, those that have low PBR multiples including Hyundai Heavy Industries (KRX: 329180) and Dongwon Industries (KRX: 006040) could continue to outperform the market leading up to rebalance announcement.

🇰🇷 Another Brewing Fight for the Controlling Shareholding of Hanjin Kal? (Douglas Research Insights) $

On 14 March, NPS announced that it has decided to vote against the re-appointment of the CEO Cho Won-tae as the executive director of Korean Air (KRX: 003490).

It was also announced on 14 March that GS Retail (KRX: 007070) purchased a 1% stake in [logistics solutions stock] Hanjin Kal (KRX: 180640). In addition, Korean Air Lines also purchased a 1.2% stake in GS Retail.

One of the growing probabilities of the changing shareholding structures is that KDB may be interested in selling its 10.6% stake in Hanjin Kal.

🇸🇬 Sheng Siong Reports Higher Profits and Ups its Dividend: 5 Highlights from the Retailer’s 2023 Results (The Smart Investor)

The supermarket operator looks set to increase its store count in Singapore.

Here are five highlights from Sheng Siong Group (SGX: OV8 / OTCMKTS: SHSGF)’s latest financial report.

A solid finish to the year

Gross margin continues to climb

Expanding its presence in Singapore

A bright outlook

Higher dividends declared

🇸🇬 Nanofilm Technologies Share Price is Close to its All-Time Low: Can it Find its Mojo Again? (The Smart Investor)

The nanotechnology company is facing tough conditions but could 2024 be the year that the company pulls off a recovery?

It has not been an easy time for Nanofilm Technologies (SGX: MZH / OTCMKTS: NNFTF).

The nanofabrication specialist’s share price tumbled to an all-time low earlier this year at S$0.67.

Let us dig deeper to find out.

A downbeat set of earnings

Weakness across all three divisions

Better prospects for AMBU, NFBU and Sydrogen

A slower outlook for IEBU

Get Smart: A better performance expected for 2024

🇸🇬 ComfortDelGro Corporation Announced a String of Acquisitions: Can its Share Price Soar? (The Smart Investor)

The land transport giant is extending its presence into other countries. Are these moves sufficient to cause its share price to continue rising?

Comfortdelgro Corporation (SGX: C52 / FRA: VZ1 / VZ10 / OTCMKTS: CDGLF / CDGLY), or CDG, has enjoyed a reprieve of sorts.

The group has pulled off a series of acquisitions in the past 18 months.

A strong set of earnings

Acquisitions to boost its capabilities

Joint ventures to grow its footprint

A sanguine outlook

Get Smart: Expanding its global reach

🇸🇬 4 Singapore Stocks That Increased Their Dividends (The Smart Investor)

We feature four Singapore stocks that upped their dividends.

DFI Retail Group (SGX: D01 / FRA: DFA1 / OTCMKTS: DFIHY) is a pan-Asian retailer that operates supermarkets, hypermarkets, health and beauty stores and convenience stores.

United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF), or UOB, is Singapore’s third-largest bank.

IHH Healthcare Bhd (KLSE: IHH / SGX: Q0F / OTCMKTS: IHHHF) is an integrated healthcare provider operating a portfolio of healthcare brands such as Parkway, Pantai, Gleneagles, Fortis, and Acibadem.

Sembcorp Industries (SGX: U96 / FRA: SBOA / OTCMKTS: SCRPF), or SCI, is a blue-chip utility and urban solutions provider.

🇸🇬 Grab: Its Profitability Could Reveal Undervaluation (Seeking Alpha) $

Southeast Asia offers a compelling investment opportunity often overshadowed by China and India.

Grab Holdings Limited (NASDAQ: GRAB) is the dominant "super-app" in Southeast Asia. Its diverse services, market leadership, and strong network effects make it a central player in the region's digital transformation.

The company managed to grow their financial services and advertising business by more than 100%, and launched the first digital bank in Malaysia.

Significant cash reserves and a $500 million share buyback program, along with great growth prospects, present a strategic opportunity for investors.

🇸🇬 Sea Limited: Q4 2023 Earnings, Accelerating Growth And Better Unit Economics, Maintain Buy (Seeking Alpha) $

Sea Limited (NYSE: SE) shares surged by 13% following the 4Q23 earnings. These results prompted analysts to revise their revenue and earnings estimates.

Average bookings per user growth accelerated on a quarter-on-quarter basis. However, quarterly active users ("QAU") count fell. Normalizing QAU and the relaunch of Free Fire India are catalysts for Garena.

Shopee reported an acceleration in GMV growth and gross orders, while adjusted EBITDA losses narrowed. Unit economics improved as Shopee solidified its market leadership and remains focused on logistics.

SeaMoney demonstrated robust growth and sustained its profitability. The fintech business will continue to grow as Shopee scales up, and this will also lower overall costs.

We revised our fair value estimate from $88 per share to $94 per share, derived from 10-year DCF valuation. Risks include the continued decline in Garena's user base and heightened e-commerce competition.

🇸🇬 Sea: The Three-Headed Monster Awakens (The Wolf of Harcourt Street)

Sea Limited (NYSE: SE) Q4 2023 Earnings Analysis

🇸🇬 Sea Limited's Rally Was Too Fast & Furious - Time To Hit The Brake (Seeking Alpha) $

Sea Limited (NYSE: SE) remains a Hold here, with the stock recording immense recovery over the past few months well exceeding the wider market.

The GMV wins are only attributed to TikTok Shop's inactive e-commerce presence in Indonesia, with things likely to dramatically change once the GoTo/ TikTok Shop platform is launched.

Combined with the more than doubled FWD valuations and elevated short interest, there remains great volatility ahead, depending on the management's ability to deliver the profitable growth target.

🇸🇬 Singapore Exchange: Watch Cost Guidance And Dividend Growth Target (Seeking Alpha) $

Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) has revised its FY 2024 expense and capital expenditures guidance downwards, which might indicate that the company's near-term growth outlook is lackluster.

But the company has committed to a goal of achieving a mid-single digit percentage expansion in its dividends for the intermediate term.

A Hold rating for Singapore Exchange is justified in my opinion; the stock is a decent dividend growth play, but its short-term financial prospects aren't favorable.

🇮🇳 Delfi (DELFI SP) - 2024 update (Asian Century Stocks) $

Delfi Limited (SGX: P34 / OTCMKTS: PEFDF) is the leading chocolate producer in Indonesia, with an estimated market share of 45%. It owns brand names such as Delfi, SilverQueen, Ceres, and ChaCha and the rights to the Van Houten brand name in Southeast Asia.

Indonesia is one of the fastest-growing chocolate markets in the world. Its growth is projected to remain high in the single digits for the foreseeable future.

The company’s earnings rebounded strongly after Indonesia’s COVID-19 social distancing restrictions. But more recently, margins have compressed for reasons that are not completely clear. There’s talk of competition and a need for higher promotional spending.

The big elephant in the room is the 2023 spike in cocoa prices. Delfi hedges 9-12 months forward, but higher prices may eventually hit the bottom line.

On my numbers, Delfi trades at a 2026e P/E of 8.8x with a projected 6.3% dividend yield.

🇮🇱 Tower Semiconductor Ltd: Initiation Of Coverage - Will The Rebound in the Mobile Market & RF Infrastructure Catalyze Growth? - Major Drivers (SmartKarma) $

This is our first report on independent semiconductor foundry, Tower Semiconductor (NASDAQ: TSEM).

The company reported its fourth-quarter and full-year financial results for 2023, with industry-wide slowdowns marking the past year and resulting in an annual revenue of $1.42 billion.

Despite this, there are clear indicators of market recovery observed by the company, with renewed demand across several key market segments as the company transitioned into 2024.

🇦🇪 Yalla seeks major game publishers for ‘Act Two’ of its hardcore gaming foray (Bamboo Works)

The Middle Eastern social media and gaming company’s revenue rose 7.7% in the fourth quarter, as its profit soared nearly 80% on better monetization and cost controls

Yalla Group’s (NYSE: YALA)’s revenue could return to double-digit growth in the first quarter, as it improves its user monetization and rolls out new functions for its core social media services

The company said its first two hardcore games were valuable test cases and is shifting its focus to working with more established game publishers

🇿🇦 Hyprop, REITS may be in for a bumpy ride from faltering retailers such as Pick n Pay (IOL)

Hyprop Investments Limited (JSE: HYP), with malls in its portfolio such as Canal Walk, Rosebank Mall, The Glen, amongst other, said yesterday in its results for the half year to the end of December, that challenges faced by South African retailers spelt uncertainty, while it also had decided to pull out of Nigeria and Ghana.

Hyprop is a retail focused REIT, owning and managing a R40 billion portfolio of mixed-use precincts underpinned by dominant retail centres in key economic nodes in South Africa and Eastern Europe.

🇿🇦 Standard Bank reports robust earnings growth in 2023 (IOL)

Standard Bank (JSE: SBK / FRA: SKC2 / OTCMKTS: SGBLY) lifted headline earnings a sturdy 27% to R42.9 billion for the 12 months to December 31 last year, underpinned by its assets’ growing franchise and positive momentum in its businesses.

Return on equity (ROE) increased to 18.8%, up from 16.3%. The cost-to-income ratio fell to 51.4%, down from 53.9%. The credit loss ratio was up by 98 bps from 83 bps in 2022.

🇵🇱 Growing, cheap and neglected. (Active Balance)

Betacom (WSE: BCM) operates a services-focused business model, providing a wide range of IT solutions to help clients digitally transform. The core of its business model involves delivering ongoing managed services, integration projects, consulting, and maintenance support across four key business lines

Betacom is trading at low valuations despite strong financial performance and future opportunities. The share structure is tight, there is no analytical coverage. Twitter is silent.

🇵🇱 Dino Polska Deep Dive Part 1, Dino Polska Deep Dive Part 2 & Dino Polska Deep Dive Part 3 (Compounding Quality) $

Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY)’s business model is based on a standardized store design, equipped with parking places for its customers and supplied with fresh products every day of the week. The company focuses on compact stores in less urbanized areas like small towns, villages, and suburban districts.

Dino Polska might be the highest-quality growth stock I’ve ever seen:

✅ Reinvesting EVERYTHING back in the business

✅ Yearly revenue growth past 10 years: 32.4% (!)

✅ Number of stores expected to grow from 2,340 to 5,300

🇵🇱 Operating Behind Enemy Lines: How Fashion Powerhouse LPP S.A. Masked A Fake Russia ‘Sell-Off’ Using Front Entities And Encrypted Barcodes (Hindenburg Research) & Polish fashion group’s shares plunge over claims of ‘sham’ Russian exit (FT) $ 🗃️

🇵🇱 CD Projekt Red: Phantom Liberty Comes Out Guns Blazing (Seeking Alpha) $

CD Projekt SA (WSE: CDR / FRA: 7CD / 7CD0 / OTCMKTS: OTGLY / OTGLF) Red's Phantom Liberty DLC for Cyberpunk is going to be big, and have a big impact on FY 2023 results coming in a couple of weeks.

The DLC sales are around 200 million PLN in the first 4 days, accounting for approximately 10% of the estimated lifetime sales for the game using typical decay curves.

While CDPR's franchises are strong, the lack of major intermediate releases and recurring properties poses a challenge for consistent earnings.

So even though it's a little discounted compared to the top bracket of game developers, a bracket in which it can belong, we are going to pass.

Also, it's an industry that's very human capital dependent. It is very easy for developers to lose their touch, and go in a matter of 10 years from the top of the industry to nowhere.

🇵🇱 CD Projekt: Future Projects Undervalued Due To Past Controversy (Seeking Alpha) $

CD Projekt SA (WSE: CDR / FRA: 7CD / 7CD0 / OTCMKTS: OTGLY / OTGLF) is a Poland-based company in the Digital Entertainment industry, operating in the production and distribution of video games.

CD Projekt Red, the company's flagship segment, has achieved significant success with titles like The Witcher and Cyberpunk 2077.

The company has implemented restructuring efforts to address past issues and is poised for success with its future projects, which include sequels to The Witcher and Cyberpunk franchises.

🇵🇱 CD Projekt: What The Next Cycle Entails For This Great Company (Seeking Alpha) $

CDP experienced impressive quarterly growth (+80%), owing to the success of its recent Cyberpunk expansion. The company has returned to its winning ways.

We believe its pipeline is developing impressively, priming CDP for an impressive end to the decade. Until then, however, we expect a quiet few years.

The coming 2-3 years will likely be uneventful, with CDP’s financials stepping down until the next Witcher game. We suspect there will be limited positive price action during this period.

CDP continues to outperform relative to its peers, even with far fewer releases. We believe this strong financial advantage can be maintained long-term.

Even though CDP is undervalued based on our DCF, we rate the stock a hold due to the lack of catalysts and the limited activity expected in the coming 2-3 years.

🌎 Mercado Libre: The Amazon of the Amazon (Fundasy Investor)

A Breakdown of a Long-term Winner

My thesis is as follows.. MercadoLibre (NASDAQ: MELI)’s business model design was and is one of the most impressive I’ve ever analyzed, creating opportunity for synergies that are tangibly creating growth and flowing to the bottom line simultaneously.

🌎 👑MercadoLibre: Quality Growth at its Finest (Invest in Quality) $

📊Fantastic Fundamentals & Growth

Since MercadoLibre (NASDAQ: MELI)’s IPO in 2007, the stock has returned 27.3% per annum to its shareholders. Over the last 10 years, it has returned 31.4% CAGR. Over the last 5 years, it has returned 25.7% CAGR. Mercadolibre has been a great investment in almost any time period (Expect 2021 peak levels).

🇧🇷 Hypera Pharma: Time to Buy Brazil's Largest Pharmaceutical Company? (Brazil Stocks) $

Today we are going to talk about the largest pharmaceutical company in Brazil: Hypera SA (BVMF: HYPE3 / OTCMKTS: HYPMY).

Hypera Pharma is the largest pharmaceutical retail company in Brazil since 2022, operating in all areas of this (RX, OTC, generics, dermo).

The company's strategy is to have a portfolio of unique and irreplicable brands. Many of its products are the best sellers in the segment, or second place.

The Top 10 brands represent less than 40% of sales.

More than 400 products launched since 2018.

🇧🇷 Sell Sendas Distribuidora: Food Deflation And Leverage Don't Justify The Valuation (Seeking Alpha) $

Sendas Distribuidora S.A. (NYSE: ASAI), a Cash & Carry retailer, faces sustainability risks in a market demanding adaptability and flexibility.

With a -0.52% annual food deflation, Sendas struggles as consumers prioritize debt repayment over increased spending.

With a P/E multiple of 21x, significantly surpassing competitors, Sendas' valuation appears unsustainably high, suggesting a sell recommendation.

🇧🇷 Petrobras: What’s behind the flash crash? (The Modern Investing Newsletter)

Making sense of the dividend and price action …

Petrobras (NYSE: PBR / PBR-A) reported FY 2023 numbers yesterday, and trading volume was massive. The share price was down 13% and I could smell the fear all the way here in Europe. FinTwit (X) is escalating and people that missed the entire run up are now in the “I told you so mode”.

My conclusion is, that Petrobras is obviously still a fantastic company. Operationally, the company is like Arnold Schwarzenegger in his prime. But the risks shouldn’t be underestimated.

🇧🇷 Petrobras: They're Panicking Again (Superfluous Value)

My initial Petrobras (NYSE: PBR / PBR-A) purchase was in response to the removal of the CEO and his replacement with a military man and Bolso ally, with no energy experience. This was taken as a sign dividends would soon cease and and the company would become a re-election slush vehicle, through price caps and spending programs. Asset confiscation was certainly considered possible, but the shares were under 2x earnings and seemed a promising investment.

Obviously none of the above happened to any meaningful degree, despite multiple CEO changes since. Expectations were just so low that simply continuing the dividend was enought to march the shares higher.

🇧🇷 Petrobras' Dividend Crisis Is Overblown (Seeking Alpha) $

Petrobras (NYSE: PBR / PBR-A) has declined 20% in the past month due to concerns about its record-breaking dividends.

The company's financial results are strong, with over $50 billion in adjusted EBITDA and $30 billion in FCF.

Petrobras has exciting assets and has increased production capacity, but faces government interference and pressure to retain dividends for investments.

🇧🇷 Vale: Why I'm Buying More Despite The Noise (Seeking Alpha) $

Vale (NYSE: VALE)'s investment thesis focuses on delivering shareholder returns through dividends and buybacks amidst operational challenges and political noise.

The company's competitive advantages as a low-cost producer and its robust cash generation support its ability to provide consistent returns to shareholders.

Vale's dividend policy aims to distribute profits to shareholders, with an expected average yield of around 8% per year.

Despite recent turbulence, Vale's discounted valuation and operational strengths position it well for delivering attractive shareholder yield in the long run.

🇧🇷 Is Vale A Phoenix Rising From The Ashes? Decoding The Recent Slump (Seeking Alpha) $

Vale (NYSE: VALE), the largest iron ore producer in the world, is facing short-term challenges due to falling iron ore prices and concerns about China's property crisis.

Despite these challenges, Vale reported strong 4Q23 earnings driven by higher iron ore prices and cost management initiatives.

Vale's strategic initiatives, including expansion projects and partnerships, position the company for sustainable growth, but conservative investors should approach with caution due to market volatility and Chinese uncertainty.

🇨🇴 Ecopetrol Pays Out 18% Yield With Successful Permian Play And Gas Exploration (Seeking Alpha) $

Ecopetrol SA (NYSE: EC) is expanding into the U.S.'s Permian Basin for oil and gas production, providing short-term growth opportunities.

The company is focusing on natural gas development and Permian Basin expansion to replace reserves and drive revenue growth.

Ecopetrol is targeting 50% hydrocarbons and 50% diversification by 2040, with a focus on clean energy production and hydrogen exports.

🇨🇴 Parex Resources: Dirt-Cheap Oil Producer Amidst Political Fears (Seeking Alpha) $

Parex Resources (TSE: PXT / FRA: QPX / OTCMKTS: PARXF) is significantly undervalued at 1.96x EV/EBITDA due to concerns about political risks.

Parex is a stellar business with great capital allocation at a 23.5% ROCE and top EBITDA margins at 68%.

With a great track record of debtless growth, Parex continues to capitalize on growth opportunities.

With a 7.15% dividend yield and plentiful buybacks decreasing outstanding shares with 35% over five years, Parex has rewarded shareholders immensely.

Temporary headwinds like workover, a stronger Colombian peso and protests contributed to excessive downwards pressure for the stock.

🇲🇽 A Mexican Blue Chip Bargain (Exploring with Alluvial Capital)

Grupo Herdez SAB de CV (BMV: HERDEZ / OTCMKTS: GUZOF), founded in 1914, is a major Mexican food company. Herdez has a dominant position in several different grocery store categories, including mayonnaise and pre-made salsas. The company’s market capitalization is MXN 15.2 billion, or USD $900 million.

It’s difficult to overstate just how dominant Herdez’s brands are. The company has huge market share in Mexican supermarkets. Herdez is number 1 or 2 in 10 different categories of popular, frequently-purchased items.

🇲🇽 🇦🇷 Vista Energy: High Growth Oil Play With Low Valuation (Seeking Alpha) $

Vista Energy (NYSE: VIST / FRA: 1CIA / BMV: VISTAA) shows promise in 2024 with a low valuation and strong above-average revenue and earnings growth.

Vista is increasing production which is likely to drive growth.

Vista Energy has a strong quantity of proven & probable reserves which can drive growth for many years.

🇵🇦 Copa Holdings Is Bafflingly Undervalued (Seeking Alpha) $

Copa Holdings (NYSE: CPA) is a Panama-based airline with strong financials, industry-leading margins, and TBV approaching 50% of its market cap.

Following steep COVID losses in 2020, Copa quickly returned to rapid and profitable growth, with revenue nearly doubling in both 2021 and 2022.

Management is forecasting low-double-digit growth in 2024. The Panamanian tourism industry now surpasses pre-pandemic levels and continues to grow.

The stock's single-digit P/E and P/FCF multiples suggest that it is dramatically undervalued.

Following its recent dividend increase, Copa now yields 6.4%. The company also recently authorized a new $200M buyback program after fully exercising the prior authorization.

📰🔬 Further Suggested Reading

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 One in Five of China’s Electric Car Owners Wouldn’t Buy Another Due to Charging Problems, McKinsey Report Reveals (Caixin) $ 🗃️

A report [FULL REPORT] by McKinsey China has shown significant disillusionment among Chinese electric car owners in 2023, with 22% stating they wouldn’t consider new energy vehicles (NEVs) for their next car. This figure starkly contrasts with the mere 3% recorded in 2022.

The recent findings mark the first decline in new energy vehicle adoption in a decade, signaling a notable shift in consumer sentiment towards electric vehicles.

🇨🇳 In Depth: Why China’s efforts to resolve hidden government debt could fall short (Caixin) $

China’s central government has rolled out a new round of measures since the second half of last year to help local governments swap or restructure their off-the-books borrowing in a bid to control debt risk.

However, the sheer scale of the country’s local government hidden debt — up to more than 70 trillion yuan ($9.8 trillion) according to some estimates, more than twice Germany’s GDP — means that the measures at best are far inadequate and will provide only temporary relief to what experts say is a looming liquidity crisis for regional authorities.

🇨🇳 China pushes banks, Alipay and WeChat Pay to be more foreigner-friendly (Caixin) $

China is further pushing banks and nonbank payment platforms, such as Alipay and WeChat Pay, to improve services for foreigners, as it rolls out an array of measures aiming to make the country a more attractive destination for foreigners.

A directive released Thursday by the State Council, China’s cabinet, stresses boosting accessibility of mobile payments, as well as acceptance of cash and foreign bank cards.

🇨🇳 Some Chinese Exporters Face Increased Costs due to Red Sea Crisis (FitchRatings)

We believe this supply-chain disruption has less overall impact on Chinese exporters than in the pandemic years of 2021-2022, because of reduced external demand for Chinese goods and growing container shipping capacity, which is likely to expand further this year.

Around 60% of Chinese trade with Europe typically transits through the Suez Canal. Some vessels now face detours and heightened costs as they have to re-route via the Cape of Good Hope, lengthening the transit by 10 to 15 days. Shipping freight rates have increased, particularly for container shipping. Some smaller-volume goods have been shifted to rail, notably on the China-Europe railway line, where utilised capacity for goods transport from China to Europe has increased significantly from the pre-crisis level.

The impact on Fitch-rated Tongwei Co., Ltd (SHA: 600438) (BBB-/Stable) should be minor, as its earnings – as measured in EBITDA – are predominantly from upstream polysilicon manufacturing, which has low reliance on overseas markets due to China’s dominance in wafer production.

🇨🇳 🇮🇳 Emerging market ETFs chalk up new record inflows in February (FT) $ 🗃️

China ‘national team’ activity and interest in India emerge as clear trends in otherwise ‘messy’ picture from analysts

🇯🇵 Japan’s self-inflicted decline offers lesson (The Asset) $ 🗃️

In the 1980s, Japan boasted a dynamic consumer-electronics sector that served as a cornerstone of its robust export industry. But soon, new digital technologies began to replace the analogue devices on which Japan had a near-monopoly – and both producers and the government failed to adapt

🇳🇬 The false prophets who doomed Nigeria: The promise of a prosperity is unravelling (Unheard)

Five years ago, economists prophesied a prosperous future for Nigeria, and the rest of the continent. Yet today, the country is facing what one leading Nigerian academic recently told me is its “biggest crisis since independence”. The devaluation of the Nigerian naira by 230% over the past year, along with a huge rise in inflation, has sparked an economic crisis unequalled in its modern history. With meat, eggs and milk now a luxury, there have been reports of people in the north of the country being forced to eat poor-grade rice usually used as fish food.

This suggests that the real cause of Nigeria’s crisis is what scholars Ruben Andersson and David Keen aptly label “wreckonomics” in their provocative new book of the same name: a label that describes how the setting of a war economic model is used for profiteering by existing institutional interests. For these interest groups, the purpose of the war is not necessarily in winning it, but in extracting profit from the crisis situation — often by extending it for as long as possible.

Such analysis offers a different twist to the concept of the neoliberal “permacrisis”. While these rolling crises are usually spoken of in political terms, wreckonomics shows that it is part of an economic framework.

🇿🇦 South Africa’s infrastructure crisis deepens as Johannesburg taps run dry (FT) $ 🗃️

Parts of the country’s biggest city have been without running water for almost two weeks amid a heatwave

🇿🇦 The bullish case for South Africa (FT) $ 🗃️

There are grounds for medium-term optimism after years of negative news

🇧🇷 Brazil launches China anti-dumping probes after imports soar (FT) $ 🗃️

Investigations reflect fears of flood of cheap Chinese products but could strain Brasília’s ties with Beijing

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

Russian FederationRussian PresidencyMar 17, 2024 (d) Confirmed Mar 18, 2018Kuwait Kuwaiti National Assembly Apr 4, 2024 (d) Confirmed Jun 6, 2023

South Korea South Korean National Assembly Apr 10, 2024 (d) Confirmed Apr 15, 2020

Croatia Croatian Assembly Apr 17, 2024 (d) Confirmed Jul 5, 2020

Ecuador Referendum Apr 21, 2024 (d) Confirmed Aug 20, 2023

India Indian People's Assembly Apr 30, 2024 (t) Date not confirmed Apr 11, 2019

Panama Panamanian National Assembly May 5, 2024 (t) Confirmed May 5, 2019

Panama Panamanian Presidency May 5, 2024 (t) Confirmed May 5, 2019

South Africa South African National Assembly May 29, 2024 (d) Confirmed May 8, 2019

Mexico Mexican Senate Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

Mexico Mexican Chamber of Deputies Jun 2, 2024 (t) Date not confirmed Jun 6, 2021

Mexico Mexican Presidency Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

Mongolia Mongolian State Great Hural Jun 28, 2024 (d) Confirmed Jun 24, 2020

Venezuela Venezuela Presidency Jul 28, 2024 (d) Confirmed May 20, 2018

Czech Republic Czech Senate Sep 30, 2024 (t) Date not confirmed Sep 23, 2022

Romania Romanian Presidency Sep 30, 2024 (t) Date not confirmed Nov 24, 2019

Sri Lanka Sri Lankan Presidency Sep 30, 2024 (t) Date not confirmed Nov 16, 2019

Georgia Georgian Parliament Oct 26, 2024 (d) Confirmed Oct 31, 2020

Uruguay Uruguayan Presidency Oct 27, 2024 (t) Date not confirmed

Uruguay Uruguayan Chamber of Representatives Oct 27, 2024 (t) Date not confirmed

Uruguay Uruguayan Chamber of Senators Oct 27, 2024 (t) Date not confirmed

Jordan Jordanian House of Deputies Oct 31, 2024 (t) Date not confirmed Nov 10, 2020

Georgia Georgian Presidency Nov 30, 2024 (t) Date not confirmed Nov 28, 2018

Romania Romanian Senate Nov 30, 2024 (t) Date not confirmed Dec 6, 2020

Romania Romanian Chamber of Deputies Nov 30, 2024 (t) Date not confirmed Dec 6, 2020

Namibia Namibian Presidency Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

Namibia Namibian National Assembly Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

Uzbekistan Uzbekistani Legislative Chamber Dec 31, 2024 (t) Tentative Dec 22, 2019

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Linkers Industries Ltd. LNKS, Pacific Century Securities LLC, 2.2M Shares, $4.00-6.00, $11.0 mil, 3/18/2024 Week of

Linkers Industries Ltd. is the holding company that conducts business through its operating subsidiary, which is a manufacturer and a supplier of wire and cable harnesses to the automotive, home appliances and industrial products industries mostly in the Asia Pacific region. (Incorporated in the British Virgin Islands)

Through our operating subsidiary, we are a manufacturer and a supplier of wire/cable harnesses with our manufacturing operations in Malaysia and have more than 20 years’ experience in the wire/cable harnesses industry. Wire/cable harness refers to an assembly of wires/cables bound together with straps, cable ties and electrical tapes to transmit signals or electrical power. Our customers are generally global brand name manufacturers and original equipment manufacturers (“OEMs”) in the home appliances, industrial products and automotive industries that are mainly based in the Asia Pacific Region.

We work closely with customers in each stage of a product’s life cycle, including design, prototyping and production. Our business model enables us to offer customized wire harness for different applications and electrics designs. Our products are customized and made-to-order in accordance with the specific technical requirements of our customers.

*Note: Net income and revenue are in U.S. dollars for the year that ended June 30, 2023.

(Note: Linkers Industries Ltd. filed its F-1 dated Dec. 8, 2023, and disclosed terms for its U.S. IPO: 2.2 million Class A ordinary shares at $4.00 to $5.00 to raise $11.0 million. The company submitted confidential IPO documents to the SEC on Sept. 22, 2023.)

SKK Holdings Limited SKK, Bancroft Capital LLC, 2.5M Shares, $4.00-5.00, $11.3 mil, 3/18/2024 Week of

We are a civil engineering service provider that specializes in subsurface utility works in Singapore and have participated in numerous public utility projects, including but not limited to power and telecommunication cable laying works, water pipeline works and sewer rehabilitation works. (Incorporated in the Cayman Islands)

We were founded in 2013 by Mr. Sze, our Chief Executive Officer, together with, among others, Mr. Ng, one of our Executive Directors and our Chief Operating Officer. Our Executive Officers including Mr. Sze, Mr. Ng, Mr. Wong and Mr. Tang have over 28, 26, 18 and 15 years of experience in the field, respectively.

As of the date of this prospectus, we were equipped with a fleet of five HDD rigs, 18 excavators and 36 vehicles and a staff over 140. We are one of the five major contractors in Singapore for horizontal directional drilling, or HDD works.

*Note: Net income and revenue are for the 12 months that ended June 30, 2023 (in U.S. dollars converted from Singapore dollars)

(Note: SKK Holdings Limited filed its F-1 on Jan. 29, 2024, and disclosed terms for its IPO: 2.5 million ordinary shares at a price range of $4.00 to $5.00 to raise $11.25 million. Of the 2.5 million ordinary shares in the IPO, the company is offering 1.75 million shares and selling stockholders are offering 750,000 shares. The company will not receive any proceeds from the sale of the selling stockholders’ shares. Background: SKK Holdings filed confidential IPO documents with the SEC on Sept. 20, 2023.)

Intelligent Group Limited INTJ, WestPark Capital, 2.0M Shares, $4.00-5.00, $9.0 mil, 3/19/2024 Tuesday

(Incorporated in the British Virgin Islands)

We are a professional services provider in Hong Kong that engages in the business of providing Financial PR services. Our Financial PR services include arranging press conferences and interviews, participating in the preparation of news releases and shareholders’ meetings, monitoring news publications, identifying shareholders, targeting potential investors, organizing corporate events, and implementing crisis management policies and procedures.

We aim to build an effective channel for the exchange of information between the public, investors and our clients. We provide information about our clients to the public and investors in a manner designed to enable them to understand our clients’ operations more easily. We also provide training to our clients so as to allow them to understand public relations tactics and practice. The objective is to create a positive market image of our clients to the public.

Our Industry

Hong Kong, which occupies a unique geographic position, continues to achieve remarkable expansion in its role as a regional financial leader. As one of the financial centers in the Asia-Pacific region, Hong Kong attracts a number of public relations firms to provide services in Hong Kong, mainly in Financial PR, corporate public relations and consumer marketing services. According to the website of the HK Stock Exchange — Annual Market Statistics (As of December 30, 2022) (source: https://www.hkex.com.hk/-/media/HKEX-Market/Market-Data/Statistics/Consolidated-Reports/Annual-Market-Statistics/e_2022-Market-Statistics.pdf and https://www.hkex.com.hk/-/media/HKEX-Market/Market-Data/Statistics/Consolidated-Reports/Annual-Market-Statistics/2021-Market-Statistics_e.pdf), Hong Kong has ranked number four and four in the world in 2021 and 2022, respectively, in terms of the amount of funds raised through IPOs. According to the market statistics published by the HK Stock Exchange, the total funds raised through IPOs on the HK Stock Exchange in 2021 and 2022 were approximately HK$328.9 billion and HK$99.1 billion, respectively. The total post-IPO funds raised by listed companies on the HK Stock Exchange in 2022 amounted to HK$147.3 billion and, together with funds raised by IPOs, the total funds raised on the Main Board (“Main Board”) and GEM Board of the Hong Kong Stock Exchange, amounted to approximately HK$251.9 billion. Despite the decrease in the total funds raised in 2022 due to the impact of resurgences of the COVID-19 outbreak, the capital market and fund-raising activities are expected to rebound in 2023.The demand for Financial PR services is expected to correlatively rebound.

Competitive Strengths

We believe the following competitive strengths differentiate us from our competitors:

• We provide comprehensive Financial PR services to our clients;

• We provide extensive coverage in media monitoring and promotion services for our clients;

• We have a strong client base; and

• We have experienced and competent management and professional staff.

Our Strategy

We intend to pursue the following strategies to further expand our business:

• Further strengthening our Financial PR business in Hong Kong;

• Expanding our market presence in other international capital markets, in particular the U.S.; and

• Enhancing the automation and establishment of our virtual Financial PR services.

**Note: Net income and revenue are for the 12 months that ended May 31, 2023

(Note: Intelligent Group Limited filed an F-1/A dated Nov. 21, 2023. The terms of its IPO: 2 million ordinary shares at $4.00 to $5.00 to raise $9.0 million. )

U-BX Technology Ltd. UBXG, EF Hutton, 2.0M Shares, $5.00-5.00, $10.0 mil, 3/19/2024 Week of

U-BX was incorporated on June 30, 2021, in the Cayman Islands. U-BX does not have material operations of its own. We conduct business through the PRC Operating Entities. (Incorporated in the Cayman Islands)

Since U-BX China’s establishment in 2018, the PRC Operating Entities have used AI-driven technology to provide value-added services to the insurance industry, including insurance carriers and brokers.

Our PRC Operating Entities’ business primarily consists of providing the following three services/products: i) digital promotion services, ii) risk assessment services, and iii) value-added bundled benefits. We help our institutional clients obtain visibility on various social media platforms and generate our revenue based on consumers’ clicks, views or our clients’ promotion time through those channels. We have also developed a unique algorithm and named it the “Magic Mirror” to calculate payout risks for insurance carriers to underwrite auto insurance coverage. Utilizing our proprietary algorithmic model, we are able to generate individualized risk reports based on the vehicle brand, model, travel area, and vehicle age. In turn, we are able to generate revenue based on the number of assessment reports we provide to the insurance carriers. Lastly, to help major insurance carriers or brokers attract their customers, we sell bundled benefits, including car wash, maintenance plan or parking notification, to these carriers, which they may then pass onto their customers for either low or no cost. In addition to servicing institutional customers, we provide up-to-date insurance-related information to individual consumers through our mini-application embedded in other social media platforms. The information is provided to educate consumers and insurance brokers about the insurance industry, thus helping us build a stronger brand image with the general public.

At present, our client base consists of more than 300 city-level property and auto insurance carriers nationwide, in addition to approximately 200,000 insurance brokers that use our products and services to conduct business on a daily basis. Some of our clients include large corporations such as the People’s Insurance Company of China, Dajia Property Insurance Co., Ltd., China Pacific Property Insurance Co., Ltd., China Life Property Insurance Co., Ltd., Yongcheng Property Insurance Co., Ltd., and Huatai Insurance Brokers Co., Ltd.

Note: For its fiscal year ended June 30, 2021, U-BX Technology Ltd. reported a net loss of US$9,562 on revenue of US$72.3 million.

Note: For its fiscal year ended June 30, 2022, U-BX Technology Ltd. reported a net loss of US$49,022 on revenue of US$86.68 million.

Note: For its fiscal year ended June 30, 2023, U-BX Technology Ltd. swung to a net profit from a net loss in its FY ended June 30, 2022.

Note: For its fiscal year ended June 30, 2023, U-BX Technology Ltd. reported net income of $0.21 million (net income of $205,911) on revenue of $94.32 million (revenue of $94,318,710). Note: U-BX Technology Ltd. filed an F-1/A dated Dec. 5, 2023, in which it updated its financial statements through the fiscal year that ended June 30, 2023.

(Note: U-BX Technology Ltd. changed its sole book-runner to EF Hutton, replacing Prime Number Capital, in an F-1/A filing dated Feb. 12, 2024.)

(Note: U-BX Technology Ltd. filed an F-1/A dated Nov. 17, 2023, in which it slashed the IPO’s size by 60 percent – cutting the number of shares to 2.0 million – down from 5.0 million – and kept the assumed IPO price at $5.00 – to raise $10 million. In that Nov. 17, 2023, filing with the SEC, U-BX Technology changed its sole book-runner to Prime Number Capital, which replaced Boustead Securities, the original underwriter.)

(Background Note: U-BX Technology Ltd. tweaked the terms of its IPO in an F-1/A filing dated Aug. 5, 2022, by stating the assumed offering price is $5.00, the top of its previous $4.00-to-$5.00 range – and kept the number of shares at 5.0 million shares, to raise $25.0 million. Note: In an F-1/A filing dated July 19, 2022, U-BX Technology cut the size of its IPO by reducing the number of shares to 5.0 million shares, down from 6.0 million shares, and decreasing the price range to $4.00 to $5.00, down from $4.50 to $5.50, to raise $22.5 million. The new terms represented a 25 percent reduction in the IPO’s estimated proceeds, based on mid-point pricing. Note: U-BX Technology Ltd. filed its F-1 on Jan. 28, 2022, in which it disclosed that it intended to offer 6.0 million ordinary shares at a price range of $4.50 to $5.50 to raise $30.0 million – with Boustead Securities as its sole underwriter. In October 2021, U-BX Technology Ltd. submitted its confidential IPO filing to the SEC.)

Zhibao Technology ZBAO, EF Hutton, 1.3M Shares, $4.00-4.00, $5.0 mil, 3/19/2024 Week of

We launched the first digital insurance brokerage platform in China in 2020, powered by our proprietary PaaS (Platform as a Service). (Incorporated in the Cayman Islands)

We are a leading and high-growth InsurTech company primarily engaged in providing digital insurance brokerage services in China.

We operate substantially all of our business through its PRC Subsidiaries, or Zhibao China Group, in particular Zhibao China and Sunshine Insurance Brokers.

2B2C (“to-business–to-customer”) digital embedded insurance is our innovative business model, which Zhibao China Group pioneered in China.

2B2C digital embedded insurance refers to our one-stop customized insurance brokerage model conducted through Zhibao China Group, under which we provide proprietary and customized insurance solutions to be digitally embedded in the existing customer engagement matrix of business entities (our “business channels” or “B channels”) to reach and serve such B channels’ existing pool of end customers (“end customers” or “C”). Each B channel encompasses a specific scenario where its end customers also have potential, untapped insurance needs. For example, a Chinese travel agency (our B channel) has an average of 100,000 Chinese tourists traveling to the U.S. for tourism every year. We believe this presents an untapped scenario-specific opportunity for international travel accident insurance needs for a pool of 100,000 Chinese tourists as end customers. These end customers might otherwise have to search for and purchase insurance separately or might not purchase insurance at all. After Zhibao China Group reaches an agreement with such travel agency to become one of our B channels, they build and embed a travel insurance solution across this travel agency’s matrix of digital channels, including its website, App, Douyin (the Chinese equivalent of TikTok), WeChat Mini Program, and other social media accounts. Consequently, we, through Zhibao China Group, may pinpoint the 100,000-strong customer base and provide insurance brokerage services which are specifically and accurately tailored to the insurance needs of these end customers.

Note: For the fiscal year that ended June 30, 2023, Zhibao Technology Inc. reported a net loss of $5.9 million on revenue of $19.6 million.

(Note: Zhibao Technology Inc. is offering 1.25 million Class A ordinary shares at an assumed IPO price of $4.00 – the low end of its price range of $4.00 to $6.00 – to raise $5.0 million in its initial public offering. This is a NASDAQ listing. Background: Zhibao Technology Inc. filed its F-1 without disclosing terms on Sept. 8, 2023. The Shanghai-based InsurTech company submitted its confidential IPO documents to the SEC on March 23, 2023.)

Auna S.A. AUNA, Morgan Stanley/J.P.Morgan/ BTG Pactual/ Santander/ Citigroup/ HSBC, 30.0M Shares, $13.00-15.00, $420.0 mil, 3/22/2024 Friday

We operate hospitals and clinics in Spanish-speaking Latin America – specifically, in Mexico, Colombia and Peru. We also provide prepaid healthcare plans in Peru. We offer dental and vision plans in Mexico. (Incorporated in Luxembourg)

As of Dec. 31, 2023, our network of facilities included 15 hospitals with 2,301 beds and 16 outpatient, prevention and wellness facilities in Mexico, Peru, and Colombia.

Our mission is to lead the transformation toward a significantly improved and highly integrated healthcare system throughout Spanish-speaking Latin America (“SSLA”). We operate hospitals and clinics in Mexico, Peru and Colombia. We provide prepaid healthcare plans in Peru. We provide dental and vision plans in Mexico.

Our focus lies in providing access to high-quality healthcare, prioritizing prevention and concentrating on some of the high-complexity diseases that contribute the most to healthcare expenditures, such as oncology, traumatology and orthopedics, cardiology and neurological surgical procedures. Our model offers an accessible and integrated healthcare experience to a broad segment of the population in the markets we serve.

*Note: Net loss and revenue are in U.S. dollars (converted from soles (the sol), Peru’s currency) for the 12 months that ended Dec. 31, 2023.

(Note: Auna S.A. filed an F-1/A dated Feb. 22, 2024, in which it updated its financial statements to report results for the year that ended Dec. 31, 2023. The company has not disclosed terms yet for its IPO. Background: Auna S.A. filed its F-1 on Jan. 8, 2024, without disclosing terms for its IPO. The company submitted confidential IPO documents to the SEC in October 2023. Background: Before July 6, 2023, Auna was incorporated in Peru. Auna S.A. previously filed to go public in 2020, but that registration was withdrawn in 2022.)

CDT Environmental Technology Investment Holdings Limited CDTG, WestPark Capital, 2.0M Shares, $4.00-5.00, $9.0 mil, 3/22/2024 Week of

We are a waste treatment company that generates revenue through design, development, manufacture, sales, installation, operation and maintenance of sewage treatment systems and by providing sewage treatment services. We primarily engage in two business lines: sewage treatment systems and sewage treatment services in both urban and rural areas. Sewage treatment systems are sometimes also referred to herein as rural sewage treatment, and sewage treatment services are sometimes also referred to herein as septic tank treatment.

For sewage treatment systems, we sell complete sewage treatment systems, construct rural sewage treatment plants, install the systems, and provide on-going operation and maintenance services for such systems and plants in China for municipalities and enterprise clients. We provide decentralized rural sewage treatment services with our integrated and proprietary system using our advanced quick separation technology. Our quick separation technology uses a biochemical process for economically and sufficiently treating rural sewage. In addition, our integrated equipment generally has a lifespan of over 10 years without replacement of the core components. Due to our quick separation technology and our technological expertise and experience, our integrated rural sewage treatment system produces a high quality of outflowing water, with high degrees of automation, efficient construction and start up, and low operational costs. In addition, our equipment is typically able to process abrupt increases of sewage inflows and high contamination. Our integrated equipment consists of a compact structure and is buried underground in order to minimize changes to the surrounding environment.

**Note: Net income and revenue figures are in U.S. dollars for the 12 months that ended June 30, 2023.

(Note: CDT Environmental Technology Investment Holding Limited updated its financial statements for the six-month period that ended June 30, 2023, in an F-1/A filing dated Nov. 20, 2023.)

(Note: CDT Environmental Technology Investment Holding Limited cut its IPO’s size by about 35 percent to 2.0 million shares – down from 3.07 million shares – and increased the price to a range of $4.00 to $5.00 – up from an assumed IPO price of $4.00 – to raise $9.0 million, according to an F-1/A filing dated March 27, 2023. CDT Environmental Technology Investment Holdings Limited updated its financial statements in an F-1/A dated Feb. 24, 2023. The company changed its sole book-runner to WestPark Capital from ViewTrade Securities in an F-1/A filing in June 2021. The F-1 was filed on Jan. 15, 2021. The company submitted confidential IPO documents to the SEC on Nov. 15, 2019.)

FBS Global Ltd. FBGL, Eddid Securities USA, 1.9M Shares, $4.00-4.00, $7.5 mil, 3/22/2024 Week of

(Note on corporate structure: The predecessor of our principal operating company was incorporated on March 9, 1996, in Singapore under the name Finebuild Systems Pte Ltd. Pursuant to a restructuring that took effect on August 2, 2022, FBS Global Limited, an exempted company incorporated in the Cayman Islands, through its wholly owned subsidiary, Success Elite Developments Limited, a company incorporated in BVI, became the ultimate holding company of our current principal operating subsidiary referred to herein as FBS SG. (Incorporated in the Cayman Islands) )

From its beginning as a construction company since 1996, FBS SG has developed into a premier integrated engineering company that provides a full suite of construction and engineering services. These services include the supply of building materials and precast concrete components, recycling of construction and industrial wastes, research, and development, as well as pavement consultancy services.

We are an established interior design and build (also referred to as “fit-out”) specialist in Singapore with a track record of over 20 years in institutional, residential, commercial and industrial building projects. Our scope of services comprises design, supply and installation of ceilings, partitions, timber deck, carpet, lead lining, acoustic wall panel, built-in furnishing, carpentry and mechanical & electrical services of a building. We also undertake main construction and building works projects.

**Note: Net income of US$55,168.00 on revenue of $12.65 million for the 12 months that ended June 30, 2023 (converted from Singapore dollars)

(Note: FBS Global Ltd. says its assumed IPO price is $4.00 – the low end of its $4.00-to-$5.00 price range – on 1.875 million shares, according to an F-1/A filing dated Feb. 23, 2024. Background: FBS Global Ltd. cut its IPO’s size to 1.875 million shares – down from 2.75 million shares – and set the price range at $4.00 to $5.00 to raise $8.44 million, according to an F-1/A filing dated Dec. 29, 2023. In that Dec. 29, 2023, filing with the SEC, FBS Global Ltd. also disclosed that it has changed its sole book-runner to Eddid Securities USA from Pacific Century Securities.)

(Note: FBS Global Ltd. filed an F-1/A dated July 27, 2023, in which it trimmed the size of its IPO to 2.75 million shares – down from 3.75 million shares – at US$4.00 to raise $11.0 million. The number of shares – 2.75 million – will all be offered by the company – and this is the same as in the previous prospectus (F-1/A) filed on June 26, 2023. The difference: The selling stockholder’s 1.0 million shares are not highlighted in the July 27, 2023, prospectus. However, in the July 27, 2023, filing, there is a note that the selling stockholder still intends to sell up to 1.0 million shares. Background: FBS Global Ltd. filed an F-1/A on June 26, 2023, and updated its financial statements for the year ended Dec. 31, 2022. FBS Global Ltd. filed its F-1 on Jan. 30, 2023, and disclosed terms for its IPO: 3.75 million (3,750,000) shares at US$4.00 to raise $15.0 million. Of the 3.75 million shares in the IPO, the company is offering 2.75 million shares and the selling stockholder is offering 1.0 million shares. FBS Global Ltd. will NOT receive any proceeds from the sale of the selling stockholder’s shares. FBS Global Ltd. filed confidential IPO documents on Sept. 13, 2022.)

Ten League International Holdings TLIH, Eddid Securities USA, 2.8M Shares, $4.00-5.00, $12.6 mil, 3/22/2024 Week of

We are a Singapore-based provider of turnkey project solutions. Our business primarily consists of sales of heavy equipment and parts, heavy equipment rental and provision of engineering consultancy services to port, construction, civil engineering and underground foundation industries. (Incorporated in the Cayman Islands)

Our mission is to provide high-quality equipment, value-added engineering solutions as well as maintenance and repair services through continuous adaptation and application of new technologies.

We currently conduct our operations through our wholly-owned subsidiaries, Ten-League Engineering & Technology Pte. Ltd., or Ten-League (E&T), and Ten-League Port Engineering Solutions Pte. Ltd., or Ten-League (PES), which were previously held by Ten-League Corp prior to our group reorganization for the listing of our ordinary shares. Together with the operating history of Ten-League Corp, we have a total of over 24 years of history operating our business. Our core business activities consist of the following segments:

(a)

equipment sales, which involves sale of various new and used heavy equipment and parts, or Equipment Sales Business;

(b)

equipment rental, which involves the rental of various new and used heavy equipment, or Equipment Rental Business; and

(c)

engineering consultancy services, which primarily includes the provision of value-added engineering solutions, including equipment retrofitting, upgrading, modernization, fleet management and other enhancement on equipment through the replacement or application of, among others, mechanical parts, sensor fusion, software and remote control system. Our engineering consultancy services complements our Equipment Sales Business and Equipment Rental Business. We do not provide such service to third-party equipment sales/rental companies.

The equipment we provide is categorized into (i) foundation equipment; (ii) hoist equipment; (iii) excavation equipment; and (iv) port machinery.

We have been supplying fully electric reach stacker and empty container handler to port operators in Singapore since 2021 and have been contracted to supply electric prime movers with swappable battery pack and build charging infrastructure since October 2022 by a leading port operator based in Singapore, or the Leading Port Operator. Meanwhile, we are actively exploring the market for fully electric wheel loader, excavator and forklift, and offering them as a part of our fleet of electrified equipment.

**Note: Net income and revenue are for the 12 months that ended June 30, 2023.

(Note: Ten-League International Holdings filed an F-1/A dated Feb. 23, 2024, and disclosed terms for its IPO: 2.8 million shares at $4.00 to $5.00 to raise $12.6 million. The company is offering 2.01 million shares (2,009,800 shares) and selling shareholders are offering 790,200 shares, according to the prospectus. Ten-League International will not receive any proceeds from the sale of the selling shareholders’ stoc. Background: The company filed its F-1 on Nov. 1, 2023. Ten-League International Holdings submitted confidential IPO documents to the SEC on July 7, 2023.)

SAG Holdings Ltd SAG, Spartan Capital Securities, 0.9M Shares, $8.00-8.00, $7.0 mil, 3/25/2024 Week of

We are a holding company incorporated in the Cayman Islands. The ordinary shares offered in the IPO are being offered by the holding company.

We are a Singapore-based provider of high-quality OEM, third-party branded and in-house branded replacement parts for motor vehicles and for non-vehicle combustion engines serving a number of industries. We distribute spare parts through operations primarily based in Singapore and global sales primarily generated from the Middle East and Asia. Through our On-Highway Business, we supply a wide range of genuine OEM and aftermarket parts for use in passenger and commercial vehicles bearing either the manufacturer’s brands or our in-house brands through SP Zone. Through our Off-Highway Business, we supply a wide range of components and spare parts for internal combustion engines with strong focus on filtration products through Filtec. Our Off-Highway Business serves industrial sectors that include marine, energy, mining, construction, agriculture, and oil and gas industries. Our products are sourced from genuine OEM and global premium aftermarket brands to suit the diverse needs of our customers. Over the past several years, our revenues have been relatively evenly split between our On-Highway Business and our Off-Highway Business, and approximately 10% of our revenues are derived from sale of our in-house products.