Emerging Market Links + The Week Ahead (March 25, 2024)

Vietnam ousts 2nd President in 14 months, greying China challenges health care, Mexico's nearshoring advantages fade as costs rise, EM stock picks and the week ahead for emerging markets.

Vietnam has seen the second president ousted in 14 months - although its not yet clear if this due to the continued anti-graft drive. Unlike in China where President Xi Jinping has consolidated power, the gloves have been coming off in the battle for power between various factions of Vietnam’s Communist Party. As with the anti-China protests that turned into riots ten years ago, this sort of instability could impact Vietnam’s attractiveness as a friendshoring and investment destination.

Mexico becomes the latest major Latin America economy to cut rates. However, there is some concern that Mexico’s perceived nearshoring advantages are fading as costs rise.

Finally, I have updated the ETF launch and liquidation sections at the end of this post. Global X has liquidated approximately ten China ETFs (many have experienced large outflows) plus their Pakistan ETF. Two more emerging market ESG ETFs, one from BNY Mellon (“investor behavior has shifted…”) and another from WisdomTree (“lack of investor demand…”), have also liquidated as ESG becomes more toxic. Most of these ETFs also had less than $10 million in assets and were likely unprofitable for their big global asset managers.

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

🇮🇳 moneycontrol India Stock of the Day (February 2024) Partially $

Royal Orchid Hotels Ltd, ICICI Lombard Insurance, Cochin Shipyard, PG Electroplast Ltd, Faze Three Ltd, Global Health Limited (Medanta), Gabriel India, Aarti Industries, Kaynes Technology, Blue Star Ltd, Navin Fluorine International, Titan Company, Britannia Industries Ltd, Rategain Travel Technologies Ltd, BSE Ltd (Bombay Stock Exchange), Bharat Electronics, Kajaria Ceramics, Repco Home Finance & Krsnaa Diagnostics

🇰🇷 Mirae Asset Securities' Korean Stock Picks (February 2024) Partially $

Focus on tangible book value + LX Hausys Ltd, Dentium, KoreaGasCorp, HYBE, Kolmar Korea, Hanwha Systems, Hanwha Aerospace, KEPCO, InBody, Hanwha Solutions, Iljin HySolus, Hyundai Livart Furniture, JejuAir, SOCAR, SK Oceanplant, CS Wind Corp, Ray Co Ltd, Seegene, HD Hyundai Electric, Korea Aerospace Industries, Dong-A ST Co Ltd, PearlAbyss Corp, Kakao, Classys, Neowiz, Vieworks, Pan Ocean, CJ Logistics, SM Entertainment, Krafton, KT Corp, NCSoft Corp, CS Bearing Co, Kakao Games, LIG Nex1 Co, Lotte Rental, LG Uplus, Lotte Chemical, Netmarble Corp, Wemade, OCI Holdings, SoluM Co Ltd, Yuhan Corp, SK Innovation, SKC, Vatech, Hankook Tire & Technology, HL Mando Corp, SK Telecom, Daewoong Pharmaceutical, Koh Young Technology, Hanmi Pharma, LX International, S-Oil Corp, NAVER, ST Pharm, Hyundai Rotem, DL E&C Co Ltd, GS Engineering & Construction Corp, CowinTech, LG H&H, Samsung Electro-Mechanics Co Ltd, Samsung C&T Corp, Posco International Corp, Samsung Electronics, LG Chem & Samsung SDI.

🌏 EM Fund Stock Picks & Country Commentaries (March 24, 2024) $

Confident outlook for Asia dividends, robust earnings for some SE Asia stocks, key drivers of sovereign bond ratings, Greek banks, value to be found in South African banks (Standard Bank), EPAM, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Alibaba's Strategy Reset (Investing in China)

There is a striking contrast between JD.com (NASDAQ: JD) and Alibaba (NYSE: BABA), especially in their strategic approaches to business adjustments and market challenges.

Alibaba's strategic realignment marks a pivotal moment in the company's history, as it seeks to navigate through the challenges posed by delayed adjustments and leadership missteps. The good news is that current management has recognized the problems, albeit late. It's time to execute the changes now that their competitors made some time ago. However, the good news is that at current levels, most of the bad things are priced in, and any progress should push the stock upwards. I'm not aiming for a detailed valuation at this point as this article is already too long, but it seems clear to me that the cash position and Chinese e-commerce alone should be equal to the current market capitalization.

🇨🇳 [PDD Holdings (PDD US, BUY, TP US$159) TP Change]: Bargain Valuation, Even if Temu Disappears (SmartKarma) $

PDD Holdings (NASDAQ: PDD) or Pinduoduo reported C4Q23 top-line, non-GAAP EBIT, and non-GAAP net income (2.4%), 12.4%, and 24% vs. our est., and 11.6%, 37.0%, and 50.3% vs. cons., respectively;

We estimate the beat was driven by (1) improved take rate on the China platform following ad tool adjustments, and (2) Temu margin expansion;

We remove Temu US from our model from 2025+, as restrictions seem more than likely following the TikTok ban and cut TP to US$ 159 to reflect this;

🇨🇳 PDD (PDD): 4Q23, Time for Low Price Goods, Revenue up by 123% YoY (SmartKarma) $

Both advertising revenue and commission revenue grew dramatically in 4Q23.

Chinese consumers are seeking low price goods, after the economy went weak.

PDD Holdings (NASDAQ: PDD)’s overseas brand, TEMU, is expanding rapidly in the U.S.

🇨🇳 Pinduoduo (PDD US): Growth Worries Overdone (SmartKarma) $

Concerns around slowdown in growth are behind the disconnect between PDD Holdings (NASDAQ: PDD)’s stellar 4Q23 results and lackluster share performance, in our view.

We have seen this before. If history is a guide, its valuation will improve after growth hits bottom in 1Q24.

We expect PDD to deliver 50% plus growth for 2024 and generate US$14 billion adjusted net profit. Reiterate US$240 billion target market cap or 50% upside.

🇨🇳 🇰🇷 China’s ecommerce groups make inroads in South Korea with lure of low prices (FT) $ 🗃️

AliExpress and Temu are undercutting domestic competition and US rivals in world’s fourth-largest online shopping market

🇨🇳 Xiaomi builds in-house sales network for first electric car (Caixin) $

Chinese smartphone giant Xiaomi (HKG: 1810 / FRA: 3CP / OTCMKTS: XIACF) (小米集团) said that it is building a three-layered sales network centered on its own retail stores for its first electric vehicle (EV), the SU7, which will be available for purchase next week.

The sales network is made up of company-run delivery centers that incorporate the functions of showrooms, sales, services and customer engagement, as well as repurposed Mi Home retail stores originally designed for selling only Xiaomi-branded electronics, but that will also sell the cars, Xiaomi President Lu Weibing said Tuesday.

🇨🇳 ATRenew polishes recycling credentials to record first profit (Bamboo Works) $

The recycling specialist has been profitable on a non-GAAP basis for the last two years, but made its first GAAP net profit in last year’s fourth quarter

ATRenew (NYSE: RERE)’s revenue rose 30% in the fourth quarter, as its non-GAAP operating margin improved by 0.9 percentage points on growing efficiencies

The company’s iPhone recycling collaboration with Apple generated an additional 300 million yuan in revenue during the fourth quarter

🇨🇳 Pop Mart (9992 HK): International Expansion Is For Real (SmartKarma) $

The thesis for Pop Mart International Group (HKG: 9992 / FRA: 735) [known for selling collectable 'designer' toys] is the successful expansion of its international business, which made up 13% of sales in 1H23 but is growing exponentially.

This has been proved true in the latest announced 2023 results, with a 135% growth in 2023 for the international business, and a further >100% growth guidance for 2024.

The company is trading at 24x 2024 earnings, assuming a 35% net profit growth in 2024.

🇨🇳 Xtep International (1368 HK): Valuation Too Cheap For A >10% Growth Stock (SmartKarma) $

[Sports equipment maker] Xtep (HKG: 1368 / FRA: 4QI / OTCMKTS: XTEPY / XTPEF) announced in-line 2023 results, with net profit up 12% yoy and sales up 11% yoy. 2024 outlook was also satisfactory.

The company paid out 50% of its earnings in dividend, which amounted to a 5% dividend yield at current share price of HKD5.04.

The company is currently trading at 10x 2024 PE (assuming a conservative 10% net profit growth in 2024).

🇨🇳 [Kuaishou (1024 HK, BUY, TP HK$81) TP Change]: Prime Beneficiary of Playlet Induced Traffic (SmartKarma) $

Kuaishou Technology (HKG: 1024 / 81024 / LON: 0A74 / OTCMKTS: KUASF / KSHTY) reported C4Q23 revenue, IFRS OP, and IFRS net income in line, 31%, and 51% vs. our estimates; and in line, 43%, and 67% vs. consensus.

The significant profit beat was mainly due to the rich content supply on the platform that led to organic traffic influx, resulted in marketing costs reductions.

We raised our TP by HK$2 to HK$81, implies 20X PE, vs. current trading at 13X PE for 2025.

🇨🇳 KS / Kuaishou (1024 HK): 4Q23, Historical High Operating Profit (SmartKarma) $

Operating profit and its margin reached historical high in 4Q23.

Monthly active user base continued to expand, which is rare for other apps.

GMV (Gross Merchandise Value) of the live broadcasting sales increased rapidly by 29% YoY in 4Q23.

🇨🇳 Investors unimpressed by massive dividend from shrinking Lufax (Bamboo Works)

The online lender’s American depositary shares rose by just $1.11 in the two days after it announced a special dividend of $2.42 per ADS

Lufax Holdings (NYSE: LU) announced a massive special dividend of $2.42 per ADS, equal to about half of its Friday closing price of $4.48

The company slashed the size of its loan portfolio by 45% last year, and expects to reduce it by another 32% this year as it focuses on higher quality borrowers

🇨🇳 Forget about growth. Qifu shows it’s all about giving back to shareholders (Bamboo Works)

In reporting its earnings for the fourth quarter of 2023, the online loan facilitator unveiled a plan to sharply ramp up its share buyback program

Qifu (NASDAQ: QFIN)’s revenue grew 13% year-on-year in the fourth quarter, and its net profit rose by more than 20%

The company announced plans to repurchase up to $350 million worth of its shares, far more than the $132 million in repurchased from last June to March this year

🇨🇳 Ailing property market got you down? Not if you’re KE Holdings (Bamboo Works)

The integrated online and offline real estate broker returned to the black last year and paid a generous dividend despite operating in China’s weak property market

KE Holdings (NYSE: BEKE) posted a net profit of 5.89 billion yuan for 2023, returning to the black after losing 1.4 billion yuan in 2022

The leading property broker paid a generous final dividend of $0.351 per American depositary share

🇨🇳 Tencent Posts Weaker Quarterly Results Amid Gaming Challenges (Caixin) $

Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY) (腾讯) reported weaker-than-expected results in the fourth quarter of 2023, as the Chinese internet behemoth faced challenges growing its gaming business, particularly in China’s domestic market.

During the three-month period, Hong Kong-listed Tencent generated 155.2 billion yuan ($21.9 billion) in revenue, up 7% from 2022, according to its earnings report released Wednesday. That missed the average estimate of 157.4 billion yuan by analysts surveyed by Bloomberg.

🇨🇳 Why JL Mag came unstuck, but is getting back on track (Bamboo Works)

The company is going through a difficult adjustment after a plunge in the price of neodymium, a key ingredient in the rare earth permanent magnets that are its core product

Jl Mag Rare-Earth Co Ltd (SHE: 300748 / HKG: 6680 / FRA: 3KLA)’s profit and revenue fell sharply last year, as neodymium prices fell by 40% over that time

China expanded its production quotas for rare earth three times in 2023, driving prices down and creating a supply glut

🇨🇳 Solar storm takes the shine off JinkoSolar (Bamboo Works)

The solar panel maker’s revenue rose just 9.4% in last year’s fourth quarter, far slower than its 66% jump in product shipments, as the industry suffered from tumbling prices

JinkoSolar Holding Co., Ltd (NYSE: JKS)’s margins plunged in the fourth quarter due to sinking prices, and the company may have only remained profitable with help from government subsidies

The company predicted consolidation in the solar sector will accelerate this year, with the top 10 producers controlling 90% of the market by year-end, up from 70% in 2023

🇨🇳 China’s hard liquor remains a hard sell overseas (Caixin) $

Kweichow Moutai (SHA: 600519) / ZJLD Group (HKG: 6979)

Baijiu-makers ramping up efforts to expand their customer base outside China are facing a tough sell among drinkers of non-Chinese descent, who prefer Western tipples such as gin and whisky, with global shipments of the fiery grain-based liquor that is so ubiquitous at business banquets and weddings slipping last year.

In 2023, China’s baijiu exports slid 5.5% year-on-year to 15,000 kiloliters

(4 million gallons), which accounted for only 0.3% of the total baijiu output that year, data from the General Administration of Customs and the National Bureau of Statistics showed

🇨🇳 Pre-IPO Sichuan Baicha Baidao Industrial - High Profitability and Growth May Not Be Sustainable (SmartKarma) $

Baicha Baidao’s business model is similar to MIXUE, but MIXUE has more heavy-asset model with own supply chain, while Baicha Baidao is more of a “transfer station” for raw materials.

Single store data of Baicha Baidao showed varying degrees of decline. It’s uncertain whether Baicha Baidao would maintain current market share/revenue growth/high gross margin in front of fierce homogeneous competition.

When Baicha Baidao submitted prospectus last year, its valuation was already about RMB18 billion.We think its valuation would be lower than MIXUE, close to Guming and higher than Auntea Jenny.

🇨🇳 Carote cooks up big growth with own-brand strategy (Bamboo Works) & Carote Ltd Pre-IPO Tearsheet (Smart Karma) $

With a young, second-generation management team in charge, the kitchenware maker has filed for a Hong Kong IPO to keep fueling its recent recipe for strong growth

Carote’s revenue and profit have grown explosively over the past three years, including 118% profit growth last year to 237 million yuan

The kitchenware maker has been shifting its focus to higher-margin own-brand products, which contributed 87.2% of its revenue last year

🇨🇳 China’s luxury tastes are changing (FT) $ 🗃️

Europe’s high-end houses are being challenged by the rapid growth of local brands

Shopper preferences are shifting away from affordable, mass market luxury to less frequent but higher-end purchases. With that comes a tendency to favour classic products, meaning a smaller number of brands are getting more demand. As share prices of European luxury companies fell this week after Kering SA (EPA: KER / OTCMKTS: PPRUF)’s warning, LVMH Moët Hennessy Louis Vuitton (EPA: MC / OTCMKTS: LVMUY / LVMHF) and Hermes International (EPA: RMS / OTCMKTS: HESAF) fared best.

🇨🇳 China will be a huge market for weight-loss drugs (FT) $ 🗃️

There is an opportunity for local pharma groups, which Nomura says could take a fifth of the market by 2033

These locally-made drugs are not far off hitting the market. Those from Chinese groups Shanghai Benemae Pharmaceutical and Huadong Medicine (SHE: 000963) have recently received approval. Suzhou-based biotech group Innovent Biologics (HKG: 1801 / FRA: 6IB / OTCMKTS: IVBXF / IVBIY) has the Chinese rights to a promising next generation obesity drug from Eli Lilly called Mazdutide. It announced positive late-stage trial results in January.

🇨🇳 Slowing revenue growth hurts online drug platform YSB (Bamboo Works)

The B2B drug distributor posted higher annual revenues and swung to an adjusted profit, but disappointed investors still sent the firm’s stock down 9% on the day after the earnings

The gross margin on the company’s proprietary drug distribution business, its main revenue source, edged down to 6.1% last year

With the pharma market already well developed, several distribution giants have muscled onto YSB Inc (HKG: 9885)’s turf as suppliers to pharmacies and smaller clinics

🇨🇳 GenScript losses shrink on strong growth for cancer cell therapy (Bamboo Works)

The pharma company’s losses narrowed 58% last year, as its life sciences and cell therapy businesses experienced strong growth

Genscript Biotech Corp (HKG: 1548 / FRA: G51 / OTCMKTS: GNNSF)’s cell therapy revenue grew by 143.7% last year as a CAR-T cell therapy developed by its Legend Biotech subsidiary gained traction

Legend’s Carvykti is expected to hit annual production capacity of 10,000 doses by the end of 2025

🇭🇰 Samsonite (1910 HK)- another homecoming queen (Alex’s Investment Memo)

Samsonite International SA (HKG: 1910 / FRA: 1SO / OTCMKTS: SMSOF) is the sole luggage leader in the world, with 15% market share and a world-renown brand portfolio consists of Samonite, Tumi, American Tourister, Gregory, etc. Other than Rimowa and the special product line of those super luxury fancy brands, the market is just Samsonite and a bunch of cheap unbranded products. (TBH I don’t care about the brand of my luggage at all, but my wife bought two Samsonites last year. Perhaps that explains why the market structure looks like that. Yet I don’t mind to buy a Samsonite or Rimowa if I don’t have to pay my kids’ tuition. LV? My Uniqlo tee shouts Nooooo!) Conclusion: it’s definitely an above-average business with some branding moat (80-90% GPM on direct sales) and 15% ROIC in the long run, with good momentum.

🇭🇰 Pentamaster International (1665 HK) (Asian Century Stocks)

The operating company in the Pentamaster group at 6.1x P/E

A few weeks ago, Olivier at Emerging Value wrote about Pentamaster International Ltd (HKG: 1665 / OTCMKTS: PNMRF) (US$246 million) and his write-up caught my attention.

Pentamaster is one of the largest manufacturers of automated test equipment (ATE) for electronic devices. Such devices include non-memory products such as semiconductor chips, electro-optical sensors, power modules and LED lights. In the past, such work would have been done manually, but since the 1980s, machines from Pentamaster and others perform this task automatically at high speed.

The company is also involved in factory automation projects.

🇭🇰 Giordano under attack - please vote! (Apollo Asia Fund)

Giordano International (HKG: 0709 / FRA: GIO / OTCMKTS: GRDZF) shareholders, our company is under attack: please ensure that you vote at the Special General Meeting on 3rd April. Other readers, please help us to spread the word, about the importance of the vote and the interesting situation now emerging.

The Chow Tai Fook group (CTF), controlled by Henry Cheng, made a lowball bid for the company in 2022. It had made its bid conditional on reaching a shareholding over 50%, and did not, so the bid lapsed with no change in its ownership. Now it seeks control without paying at all, through resolutions to oust CEO Peter Lau and appoint four new directors to the board. (It now has 2 of 8 directors; its proposals would give it 6 appointees on a board of 11.)

Garment retail is tricky, but Giordano has made a loss in only one of the 33 years since IPO (Covid-year-1), and has never omitted a dividend. It supplies affordable everyday clothing to a wide range of consumers in some of the world's most promising markets.

🇭🇰 CK Asset: Too Early To Be Bullish (Seeking Alpha) $

CK Asset Holdings (HKG: 1113 / FRA: 1CK / OTCMKTS: CHKGF)' key headline financial numbers and dividend distribution for FY 2023 were not as good as what the sell-side analysts expected.

Notwithstanding the below expectations results, CK Asset has a strong financial position, and the stock is trading at a substantial discount to book value.

I maintain my Hold rating for CK Asset, as it is too early to turn positive on the stock's prospects given that the Hong Kong property market outlook is mixed.

🇭🇰 AIA Group: Solid Income Stock, Positive Outlook (Seeking Alpha) $

AIA Group (HKG: 1299 / FRA: 7A2 / OTCMKTS: AAIGF)

The stock is being unfairly punished.

The Group's growth story has been impeccable.

Dividends are stable and will keep growing.

🇲🇴 Dividends surprise from MGM China, Wynn Macau Ltd: JPM (GGRAsia)

In what a brokerage described as “a surprise”, two Macau casino operators respectively announced on Thursday annual dividends for the first time since the 2019 trading year preceding the Covid-19 pandemic.

The dividend move was “a year earlier than… the Street [investment community] had expected,” said JP Morgan Securities (Asia Pacific) Ltd in a Friday note.

“This means three out of six [Macau] operators are now paying dividends, including Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF) and we expect Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF) to follow suit next year… while Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) and SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) may prioritise deleveraging for some time,” wrote analysts DS Kim, Mufan Shi, and Selina Li.

🇰🇷 Magnachip Semiconductor: An Intriguing Stock On A Bad Streak (Seeking Alpha) $

The stock hit a new multi-year low after a Q4 report that might have been the worst ever, but Magnachip Semiconductor Corp (NYSE: MX) has been on the move lately.

MX is on an awful streak with the stock losing ground for almost three years, which might nonetheless be an opportunity for some.

MX is calling for a return to growth in 2024 after many years, but how sustainable it is is up for discussion for several reasons.

Long MX will find its supporters, and not without reason, but there will also be those who are not yet convinced now is the time.

🇰🇷 Magnachip Semiconductor Corp Is A Hold Opportunity While Insiders Buy (Seeking Alpha) $

Magnachip Semiconductor Corp (NYSE: MX) faces risks including low sentiment, declining revenue, and fierce competition in the semiconductor industry.

The company's valuation shows potential with insider buying, no debt, low levered/unlevered Beta and perhaps a buyout by a Chinese company.

However, the overall outlook for Magnachip is negative per growth, earnings and sentiment. It is a risky investment for retail value investors.

🇰🇷 LG Corp: Updated NAV Analysis Amid Ongoing Corporate Value Up Program in Korea (Douglas Research Insights) $

Our NAV analysis of LG Corp (KRX: 003550) suggests an implied market cap of 16.3 trillion won or 103,781 won per share which is 16% higher than current share price.

For holdco discount, we used a 50% holdco discount. If investors perceive improvement in value (such as through corporate governance improvements), the holdco discount on LG Corp would decline.

LG Corp's shares are up 5.9% in the past six months, outperforming all the major LG Group related companies including LG Chem, LG H&H, LG Electronics, and LG Energy Solution.

🇰🇷 Korea Small Cap Gem #27: Wins Co. (Douglas Research Insights) $

Wins Co (KOSDAQ: 136540) is engaged in the business of developing and supplying information security solutions and developing software related to network security to protect networks from cyber threats and viruses.

The company has a consistent growth in sales and profits. It also has a strong balance sheet. At the end of 2023, it had a debt ratio of 15.4%.

Wins Co is trading at EV/EBITDA of 1.7x, P/E of 7.8x, and P/B of 0.9x in 2024 which are 75%, 26%, and 25% lower than the historical valuation multiples.

🇰🇷 Jeil Machine & Solution IPO Valuation Analysis (Douglas Research Insights) $

Jeil Machine & Solution (JMS KS) was founded by CEO Lee Hyo-won as Jeil Machinery in Seongsu-dong, Seoul in 1981. Jeil M&S started out by supplying specialized equipment for food and pharmaceuticals and is currently expanding its business to rechargeable batteries, defense industry, and chemicals.

The company had order backlog of 303.3 billion won at the end of 2023, up 155% YoY. The company generated sales of 143.2 billion won, up 131.4% YoY.

🇸🇬 Haw Par: The Sleepy 4% Yielder in 2024. (Inve$tment Moat$)

My friend Xiaoboi has a very, very short commentary on Haw Par (SGX: H02 / OTCMKTS: HAWPF) results where he say spinning out the Tiger Balm may help.

Haw Par feels like a sort of junk, high-yield bond masquerading as a stock. Some may not like me calling it a junk bond but that is what junk bond feels like: some sort of equity with a good income angle. I am not sure whether an investor will get a good capital appreciation out of this, much like a junk bond. It is not as interest rate sensitive as the typical bonds, just like junk bonds.

🇸🇬 Seatrium Aims for a Return on Equity of More Than 8% by 2028: 5 Highlights from its Latest Investor Day (The Smart Investor)

The oil rig manufacturer and shipbuilder set lofty targets for 2028 during its recent Investor Day.

Seatrium Limited (SGX: S51 / FRA: S8N / OTCMKTS: SMBMF) may have reported a downbeat set of earnings for 2023, but the blue-chip group is looking at the future rather than the past.

Here are several highlights from Seatrium’s inaugural Investor Day.

A four-prong strategy

Strong oil and gas demand expected

Blown away by wind power

Large and attractive market for repairs and upgrades

Lofty financial targets for 2028

🇸🇬 SATS Announced an Upbeat Business Update Along with an Acquisition: Can its Share Price Soar? (The Smart Investor)

The airline food caterer’s financial numbers are improving. Can its share price perform well this year?

SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF) is upping its game.

Not only did the airline ground handler and food caterer report a sparkling set of numbers for its latest business update, but management also followed up with an acquisition and divestment.

A healthy set of financial numbers

Robust operating metrics

Acquiring capacity to grow further

Effective capital recycling

Get Smart: Patience is required

🇲🇾 GEN Malaysia 2024 forecast dip amid mass rejig: analyst (GGRAsia)

An investment bank expects 2024 revenue at Genting Malaysia (KLSE: GENM / OTCMKTS: GMALY / GMALF), the operator of Resorts World Genting (pictured in a file photo), Malaysia’s only casino resort, to rise by only 1.7 percent year-on-year. That is due to the closure – possibly for at least nine months – of two mass-market gaming floors at the Genting Highlands complex.

Maybank Investment Bank Bhd now expects full-year revenue at Genting Malaysia to be MYR10.36 billion (US$2.20 billion), compared to 2023’s just under MYR10.19 billion.

The casino company also has gaming business in the United States, the Bahamas, the United Kingdom and Egypt, but gets the bulk of its revenue from the Malaysia operation.

🇮🇳 Cisarua Mountain Dairy (CMRY IJ) - Increasingly Accessible Protein Provider (SmartKarma) $

Cisarua Mountain Dairy (Cimory) (IDX: CMRY) held an analyst call after its results, revealing a positive outlook for dairy products and premium consumer foods, with potentially higher margins ahead.

The company launched several new products in 2023, with more of a focus on affordability through yoghurt sticks. It will launch more affordable Kanzler Singles in 2H2024.

Cisarua Mountain Dairy will expand distribution through general trade and Miss Cimory MCM, with ongoing sales & marketing spending. Valuations remain attractive relative to growth and returns.

🇹🇷 TAV Havalimanlari Holding Remains An Appealing Buy (Seeking Alpha) $

TAV Havalimanlari Holding AS (IST: TAVHL / OTCMKTS: TAVHF)'s stock price significantly recovered, gaining 45% compared to broader markets.

Risks for TAV include natural disasters, inflation, and exchange rate fluctuations.

TAV Airports' cost growth exceeds revenue growth, but the company's guidance suggests a bullish future with the potential for higher margins.

🇪🇬 The US$35bn Ras El-Hekma Deal: A Boon For These Listed Firms? (Capital Markets Africa)

Egypt's infrastructure and financial firms are likely to be big winners from the development, offering stock investors compelling long-term ROI.

eFinance Investment Group (EGX: EFIH) is a holding company that owns and operates in the fields of finance, digital payments, business process outsourcing (BPO), and point of sale (POS) systems.

EFG Holding (EGX: HRHO) is one of Egypt’s largest financial firms.

Elsewedy Electric Company (EGX: SWDY) is an Egyptian engineering household name.

Talaat Moustafa Group Holding (EGX: TMGH) is a real estate developer. The company builds hotels, touristic and residential projects in Egypt.

State-owned Telecom Egypt (EGX: ETEL) has been in existence for over 160 years.

🇸🇦 Investec trades well in 2023, also benefits from rand depreciation (IOL)

Investec Group (LON: INVP / JSE: INL / INP) will report a solid financial performance for the year to March 31, based on diversified revenue streams and the success of its client acquisition strategies.

The international bank and wealth manager in the UK and South Africa said in a trading statement on Friday that the average rand/pound exchange rate depreciated by about 15% for the 11 months to February 2024, resulting in a big difference between reported and neutral currency performance.

🇵🇱 Spyrosoft - A Fascinating Player in the IT Solutions Space (WSE:SPR) (Active Balance) 7:11 Minutes

Note: Spyrosoft SA (WSE: SPR / FRA: 2NP) operates as a software engineering company

Current price: 424 pln

Mcap: 462,8 mpln

Share#: 1.091.460

The company will publish its annual report on April 26th, 2024.

🇵🇱 Wittchen - A Polish luxury leather goods retailer (WSE:WTN) (Active Balance) 8:37 Minutes

Note: Wittchen SA (WSE: WTN / LON: 0RCI) is a manufacturer of luxury leather goods, shoes, handbags, fashionable accessories and high quality luggage

Current price: 28 pln

Mcap: 514 mpln

Share#: 18.360.402

The company will publish its annual report on April 18th, 2024.

🌎 🇺🇾 DLocal: The Problem Is Its Guidance, But There's More (Rating Downgrade) (Seeking Alpha) $

Dlocal (NASDAQ: DLO)'s stock has experienced a sell-off due to decelerating growth rates and uncertainty surrounding foreign fintech businesses.

The company's balance sheet is strong, with no debt and 10% of its market cap made up of cash.

DLocal's near-term prospects are bolstered by its strategic initiatives, diversified business verticals, and strong relationships with major tech companies.

🇦🇷 YPF Stock: A Shale Oil Boom In Argentina (Seeking Alpha) $

🇦🇷 Despegar.com: Strong Growth In Revenue And Gross Bookings Led By Brazilian Market (Seeking Alpha) $

[Online travel stock] Despegar.com Corp (NYSE: DESP) has experienced strong growth in gross bookings and revenue, particularly in the Brazilian market.

The company's recent earnings report showed a 31% increase in gross bookings as compared to the previous year.

Despegar.com also continues to maintain a strong balance sheet overall.

I continue to take a long-term bullish view on Despegar.com.

🇦🇷 Pampa Energia's Q4 Decoded, Still A Hold (Seeking Alpha) $

Pampa Energia Sa (NYSE: PAM) is an integrated Argentinian energy market player involved in natural gas, energy generation, and petrochemicals.

The company's forecasted operating income ranges for each segment are still valid, but there is an increase in operating expenses that could impact profitability long-term.

PAM's segments, including natural gas, generation, and petrochemicals, have limitations and are not expected to experience significant growth.

🇦🇷 Bioceres Needs To Add Clarity Around Borrowings (Seeking Alpha) $

Bioceres Crop Solutions Corp (NASDAQ: BIOX) is an agricultural supply company with growth potential in seed genetics and biopesticides markets.

The company's 2Q24 results showed revenue growth and stable cost structure, leading to profitability. These were expected, given the Argentinian drought in 2023.

Concerns remain about the company's high debt maturities and lack of clarity on its debt and refinancing plans.

The company's valuation is that of a high growth company, and yet Bioceres is not showing a growth trend.

🇦🇷 Loma Negra: Better To Avoid Now (Seeking Alpha) $

[Cement maker] Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE: LOMA) is facing many headwinds now.

LOMA stock has high debt levels, high interest payments, and uncertain revenues.

Debt accumulated in previous years was used to pay dividends, which was a bad decision that hurts the company now.

🇧🇷 Afya Is Performing Well And Is A Buy (Seeking Alpha) $

Afya (NASDAQ: AFYA) is one of the leading private medical education providers in Brazil.

The company's model has several quality characteristics including high pricing power, and resiliency to economic cycles.

Afya has a significant runway to grow organically and inorganically, via seat expansions, price adjustments and acquisitions.

The current stock price represents a low multiple of FY24E free cash flow adjusted for CAPEX. This leaves most growth potential as additional upside.

🇧🇷 Vale faces £3bn legal action over 2015 Mariana dam disaster (FT) $ 🗃️

New class action pursues mining group and project partner BHP Group (NYSE: BHP) over one of Brazil’s worst environmental disasters

Pogust Goodhead, which is funded by US investment manager Gramercy and Brazilian investment firms Prisma Capital, Vinci Partners Investments Ltd (NASDAQ: VINP) and Jive Investments, stands to win 30 per cent of individual damages and 20 per cent from municipalities if the Dutch case succeeds.

🇧🇷 Eletrobras' Q4: Turnaround In Full Swing At A Potential Discount (Seeking Alpha) $

Eletrobras Participacoes S/A (BVMF: LIPR3) has undergone a successful turnaround process post-privatization, marked by strong results in Q4 2023.

Key achievements include increased installed capacity, successful implementation of transmission projects, and reduced operating costs.

The company's discounted cash flow model indicates a significant margin of safety and potential for cash generation growth.

Despite legal and regulatory risks, including pending lawsuits and energy price fluctuations, the bullish stance on Eletrobrás stock is maintained.

Eletrobrás' consistent progress in its turnaround process and diminishing political risks further support the positive outlook for the company.

🇧🇷 B3: Strong Balance Sheet And Macroeconomic Tailwind - Buy (Seeking Alpha) $

B3 (BVMF: B3SA3 / FRA: YBV0 / OTCMKTS: BOLSY) is the dominant player in its stock exchange market in Brazil, and with its long history and strong investments in infrastructure, it has irreplicable assets.

The company has a strong balance sheet, dividend paying cash cow profile, high margins and an excellent return on equity.

Additionally, it is trading at a large discount compared to its international peers, which have marginally worse financial indicators than the company.

📰🔬 Further Suggested Reading

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Global CEOs flock to China as tensions mount over export glut (FT) $ 🗃️

Apple’s Tim Cook, ExxonMobil’s Darren Woods and HSBC’s Noel Quinn head to Beijing for annual development forum

🇨🇳 China Issues 24 New Measures to Attract Foreign Investment (China Briefing)

China’s legislature has released a new plan to attract foreign investment after a year of falling foreign direct investment inflows. The plan, the latest in a series of efforts to boost foreign capital in China, proposes measures to improve the business environment, ease administrative burdens, expand market access in key industries, and even the playing field for foreign companies. We outline the policy proposals that could benefit foreign companies in the coming years.

🇨🇳 Abu Dhabi fund offers to buy out investors fleeing China private equity (FT) $ 🗃️

Deal with Hong Kong-based PAG could provide exit at a discount for US pension funds

🇨🇳 China issues stringent rules to tighten listing controls and tackle financial fraud (Caixin) $

China’s stock regulator issued two sets of rules Friday that will tighten listing requirements, crack down on financial fraud by listed companies, encourage listed firms to increase dividend payouts and buy back shares.

The rules came shortly after Wu Qing, chairman of China Securities Regulatory Commission (CSRC), promised to strictly hold the IPO threshold and make every effort to block fraudulent companies from the capital market, at a press conference during the national legislative meetings known as the Two Sessions.

🇨🇳 Cover Story: China’s Challenge to Fill the Multibillion-Dollar Insurance Blackhole & Risk now determines how strictly China’s life insurers get regulated (Caixin) $

Nearly eight years after China launched a sweeping crackdown on aggressive practices among insurers, efforts to dismantle risks in troubled institutions are still far from over, leaving by some estimates 1 trillion yuan in problematic assets.

Targeting insurers backed by private conglomerates which leveraged their sprawling reach in the finance sector to fuel risky expansion, the crackdown has led to the downfall of freewheeling giants like Anbang Insurance Group Co. Ltd. and Tomorrow Holding Co. Ltd.

At stake is an industry that constitutes more than 23% of the country’s GDP. China's insurance industry, the world’s second-largest, had total assets of 29.6 trillion yuan by the end of September 2023, according to data from the National Administration of Financial Regulation (NAFR).

🇨🇳 In Depth: How a greying China is challenging the health care system (Caixin) $

Amid an unprecedented demographic shift, China is embracing a revolutionary transformation in health care for the elderly.

The number of Chinese people at age 60 or older tops 300 million. That group by itself would be the world’s fourth-largest nation, behind India, China and the United States. The total may exceed 400 million by 2040, according to the World Health Organization.

In response, the government has been pushing to expand health care services for the elderly, including the establishment of more geriatrics departments in hospitals. Nearly 6,000 hospitals across the country had set up geriatrics departments by 2022, a threefold increase from 2018.

🇰🇷 Korean Government Announces Tax Incentives for Shares Cancellation and Dividends (Douglas Research Insights) $

On 19 March, Choi Sang-Mok announced that the Korean government plans to provide corporate tax reduction benefits to companies that cancel their treasury shares.

The separate taxation of dividend income is also expected to be promoted. All of these are law amendment issues and must go through the legislative process of the National Assembly.

At this time, the Korean government did not provide the entire details about the exact amount of corporate tax reductions from share cancellation and separate taxation of dividend income.

🇰🇷 Back-Testing the Impact of National Assembly Elections on the Korean Stock Market (Douglas Research Insights) $

In this insight, we provide a back-testing analysis of the impact of the National Assembly Elections on the Korean stock market.

KOSPI tends to display positive price performance one month and three months prior to the election date leading up to the election date.

On the other hand, KOSPI tends to decline one month and three months post the election date. We believe that post National Assembly Election, KOSPI could face greater headwinds.

🇲🇾 Malaysia best in overall investment conditions among Asia's emerging nations -- Milken Institute (The Star)

Malaysia has been ranked as the country with the best overall investment condition among Asia’s emerging and developing (E&D) nations in US economic think tank Milken Institute’s Global Opportunity Index (GOI) 2024.

🇲🇾 Smart Thought Of The Week: Malaysia (The Smart Investor)

According to Milken Institute, Malaysia has claimed the top spot for investors who are looking to put money into emerging and developing markets. It ranks higher than Thailand, China, Indonesia and Vietnam. The report reckons that Malaysia performed well on institutional frameworks, which has been thanks to its strong investors’ rights.

A few years ago, I felt that Malaysian shares were ostensibly cheap. I didn’t think the hefty discount was justified. It has, however, taken a while for the thesis to play out. But now it has. It only goes to show that investing is never about timing the market but time in the market.

🇻🇳 Vietnam political star’s downfall shocks nation as graft purge widens: ‘who will be next president?’ (SCMP) $ 🗃️

Vo Van Thuong quit over than a year into the presidency after seemingly falling to a sweeping ‘blazing furnace’ anti-corruption campaign

The sudden resignation comes as Vietnam, one of Southeast Asia’s fastest-growing major economies, prepares to set its new leadership in 2026

🇻🇳 Vietnam president's resignation suggests party power struggle (Nikkei Asia)

Some see Thuong's fall from grace as a sign of Trong's waning influence. The 79-year-old Trong, a hard-core adherent to Communist Party principles in office since 2011, has thwarted political rivals pushing for market reforms, including former Prime Minister Nguyen Tan Dung. But he is rumored to have health problems and has drastically reduced his public appearances.

A power struggle could discourage investment by global companies in Vietnam, part of whose attractiveness as a destination for capital lay in political stability. Thuong is the second president to leave office in as many years.

🇻🇳 ‘Political Earthquake’ Shakes Up Succession Battle in Vietnam (Bloomberg) 🗃️

Communist nation sees second president ousted in 14 months

Investors remain positive on Vietnam despite instability

🇮🇳 Inevitable in India: Crowds, cricket and capital gains tax (Franklin Templeton)

India’s vibrant economy and structural growth opportunities continue to be the envy of many emerging markets. But somewhat unique to this market are tax implications that investors should be aware of. Our Franklin Templeton Global ETF team examines these structural issues in Asia’s third-largest economy.

🇲🇽 Mexico becomes the latest major Latin America economy to cut rates (FT) $ 🗃️

Region has already begun unwinding its response to soaring inflation that has affected monetary policy around the world

🇲🇽 Mexican wave of nearshoring firms is all at sea (Reuters)

That’s concerning because Mexico’s perceived advantages are fading fast. The scramble for industrial space is driving up costs which were already rising. According to the Mexican Chamber of the Construction Industry, the price of cement and reinforced steel surged by up to 25% since the end of 2021 to mid-2022. Meanwhile, land prices are ballooning. In Santa Catarina in the northeastern state of Nuevo Leon, the cost of land has increased by 25% since Tesla announced it will be building a factory there in March 2023. It’s also becoming more expensive to employ staff. In January, the minimum wage increased 20% to nearly $22 for the free zone near the northern border and $14.50 for the rest of the country. And the surge in the Mexican peso, which was the best-performing currency in the world last year, according to Trading View, opens new tab, is also driving up local costs. The danger for the Mexican government is that these factors could soon start to deter companies.

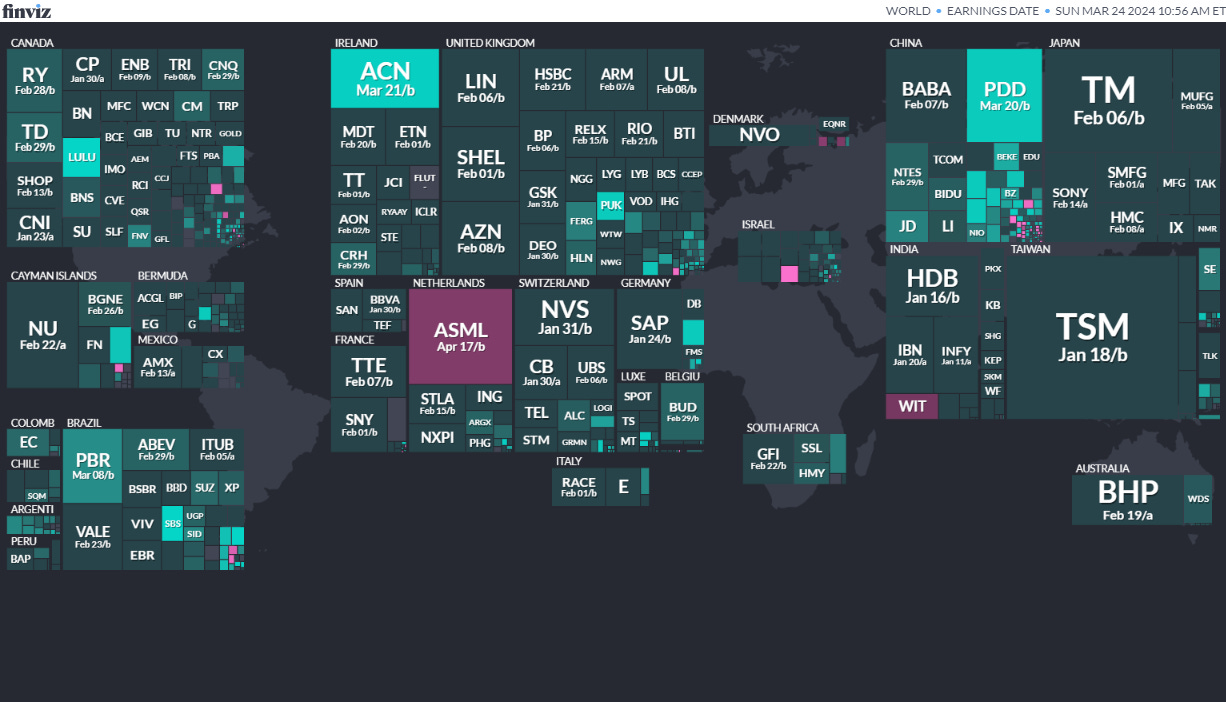

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

Russian FederationRussian PresidencyMar 17, 2024 (d) Confirmed Mar 18, 2018Kuwait Kuwaiti National Assembly Apr 4, 2024 (d) Confirmed Jun 6, 2023

South Korea South Korean National Assembly Apr 10, 2024 (d) Confirmed Apr 15, 2020

Croatia Croatian Assembly Apr 17, 2024 (d) Confirmed Jul 5, 2020

Ecuador Referendum Apr 21, 2024 (d) Confirmed Aug 20, 2023

India Indian People's Assembly Apr 19, 2024 (d) Date not confirmed Apr 11, 2019

Ecuador Referendum Apr 21, 2024 (d) Confirmed Aug 20, 2023

Panama Panamanian National Assembly May 5, 2024 (t) Confirmed May 5, 2019

Panama Panamanian Presidency May 5, 2024 (t) Confirmed May 5, 2019

South Africa South African National Assembly May 29, 2024 (d) Confirmed May 8, 2019

Mexico Mexican Senate Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

Mexico Mexican Chamber of Deputies Jun 2, 2024 (t) Date not confirmed Jun 6, 2021

Mexico Mexican Presidency Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

Mongolia Mongolian State Great Hural Jun 28, 2024 (d) Confirmed Jun 24, 2020

Venezuela Venezuela Presidency Jul 28, 2024 (d) Confirmed May 20, 2018

Czech Republic Czech Senate Sep 30, 2024 (t) Date not confirmed Sep 23, 2022

Romania Romanian Presidency Sep 30, 2024 (t) Date not confirmed Nov 24, 2019

Sri Lanka Sri Lankan Presidency Sep 30, 2024 (t) Date not confirmed Nov 16, 2019

Georgia Georgian Parliament Oct 26, 2024 (d) Confirmed Oct 31, 2020

Uruguay Uruguayan Presidency Oct 27, 2024 (t) Date not confirmed

Uruguay Uruguayan Chamber of Representatives Oct 27, 2024 (t) Date not confirmed

Uruguay Uruguayan Chamber of Senators Oct 27, 2024 (t) Date not confirmed

Jordan Jordanian House of Deputies Oct 31, 2024 (t) Date not confirmed Nov 10, 2020

Georgia Georgian Presidency Nov 30, 2024 (t) Date not confirmed Nov 28, 2018

Romania Romanian Senate Nov 30, 2024 (t) Date not confirmed Dec 6, 2020

Romania Romanian Chamber of Deputies Nov 30, 2024 (t) Date not confirmed Dec 6, 2020

Namibia Namibian Presidency Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

Namibia Namibian National Assembly Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

Uzbekistan Uzbekistani Legislative Chamber Dec 31, 2024 (t) Tentative Dec 22, 2019

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Mobile-health Network Solutions MNDR, Network 1 Financial, 2.3M Shares, $4.00-5.00, $10.1 mil, 3/26/2024 Tuesday

(Incorporated in the Cayman Islands)

Our Mission

To be our users’ trusted companion on their lifelong healthcare journey by providing a seamless healthcare experience from start to finish, which is affordable, accessible and easy to understand to both users and healthcare providers.

Our Business

We have set up one of the smartest integrated all-in-one patient care-centric platforms in the region to deliver affordable care to users. We are a leading telehealth solutions provider in Singapore in terms of the number of countries covered by our MaNaDr platform, including countries in the APAC region.

We are a leading telehealth solutions provider in Singapore in terms of various matrices, such as the number of patient consultations per day and the ranking of our mobile application, according to Frost & Sullivan. According to Frost & Sullivan, we have the largest number of teleconsultations per day in the six months ending May 2023, and are amongst the fastest-growing telehealth solutions providers in Singapore. Our MaNaDr mobile application has received a 4.8 and 4.9 star rating on the Apple App Store and Google Play Store in Singapore respectively as of June 14, 2023. According to Frost & Sullivan, on a combined basis, MaNaDr was the most reviewed and highest rated mobile application in Singapore as of June 14, 2023 and has the largest number of teleconsultations per day in the six months ending May 2023.

We provide our services on our MaNaDr platform, which is accessible via our mobile application and website. We serve both the community of users, by offering personalized and reliable medical attention to users worldwide, as well as the community of healthcare providers, by allowing them to have a broader reach to users through virtual clinics without any start-up costs and the ability to connect to a global network of peer-to-peer support groups and partners. Through our mobile application, we offer users with a range of seamless and hassle-free telehealth solutions, which encompasses teleconsultation services, including the issuance of electronic medical certificates and delivery of medications to users’ homes, as well as other personalized services such as weight management programs. Furthermore, we have set up one of the smartest 24/7 virtual care ecosystems and support groups to help users navigate the complexities faced in receiving correct and timely care, according to Frost & Sullivan. With MaNaChat, the 24/7 customer support service, we operate Singapore’s only in-app live group chat service and have one of the fastest response times in Singapore and globally to support users.

As of December 31, 2022, we had 58 employees globally, with 29 employees who are based in Singapore and 29 employees who are based in Vietnam.

Note: Net loss and revenue are for the fiscal year that ended June 30, 2023.

(Note: Mobile-health Network Solutions filed its F-1 to go public and disclosed terms for its small-cap IPO in a filing dated Feb. 22, 2024: The company intends to offer 2.25 million shares of stock at a price range of $4.00 to $5.00 to raise $10.13 million.)

U-BX Technology Ltd. UBXG, EF Hutton, 2.0M Shares, $5.00-5.00, $10.0 mil, 3/26/2024 Tuesday

U-BX was incorporated on June 30, 2021, in the Cayman Islands. U-BX does not have material operations of its own. We conduct business through the PRC Operating Entities. (Incorporated in the Cayman Islands)

Since U-BX China’s establishment in 2018, the PRC Operating Entities have used AI-driven technology to provide value-added services to the insurance industry, including insurance carriers and brokers.

Our PRC Operating Entities’ business primarily consists of providing the following three services/products: i) digital promotion services, ii) risk assessment services, and iii) value-added bundled benefits. We help our institutional clients obtain visibility on various social media platforms and generate our revenue based on consumers’ clicks, views or our clients’ promotion time through those channels. We have also developed a unique algorithm and named it the “Magic Mirror” to calculate payout risks for insurance carriers to underwrite auto insurance coverage. Utilizing our proprietary algorithmic model, we are able to generate individualized risk reports based on the vehicle brand, model, travel area, and vehicle age. In turn, we are able to generate revenue based on the number of assessment reports we provide to the insurance carriers. Lastly, to help major insurance carriers or brokers attract their customers, we sell bundled benefits, including car wash, maintenance plan or parking notification, to these carriers, which they may then pass onto their customers for either low or no cost. In addition to servicing institutional customers, we provide up-to-date insurance-related information to individual consumers through our mini-application embedded in other social media platforms. The information is provided to educate consumers and insurance brokers about the insurance industry, thus helping us build a stronger brand image with the general public.

At present, our client base consists of more than 300 city-level property and auto insurance carriers nationwide, in addition to approximately 200,000 insurance brokers that use our products and services to conduct business on a daily basis. Some of our clients include large corporations such as the People’s Insurance Company of China, Dajia Property Insurance Co., Ltd., China Pacific Property Insurance Co., Ltd., China Life Property Insurance Co., Ltd., Yongcheng Property Insurance Co., Ltd., and Huatai Insurance Brokers Co., Ltd.

Note: For its fiscal year ended June 30, 2021, U-BX Technology Ltd. reported a net loss of US$9,562 on revenue of US$72.3 million.

Note: For its fiscal year ended June 30, 2022, U-BX Technology Ltd. reported a net loss of US$49,022 on revenue of US$86.68 million.

Note: For its fiscal year ended June 30, 2023, U-BX Technology Ltd. swung to a net profit from a net loss in its FY ended June 30, 2022.

Note: For its fiscal year ended June 30, 2023, U-BX Technology Ltd. reported net income of $0.21 million (net income of $205,911) on revenue of $94.32 million (revenue of $94,318,710). Note: U-BX Technology Ltd. filed an F-1/A dated Dec. 5, 2023, in which it updated its financial statements through the fiscal year that ended June 30, 2023.

(Note: U-BX Technology Ltd. changed its sole book-runner to EF Hutton, replacing Prime Number Capital, in an F-1/A filing dated Feb. 12, 2024.)

(Note: U-BX Technology Ltd. filed an F-1/A dated Nov. 17, 2023, in which it slashed the IPO’s size by 60 percent – cutting the number of shares to 2.0 million – down from 5.0 million – and kept the assumed IPO price at $5.00 – to raise $10 million. In that Nov. 17, 2023, filing with the SEC, U-BX Technology changed its sole book-runner to Prime Number Capital, which replaced Boustead Securities, the original underwriter.)

(Background Note: U-BX Technology Ltd. tweaked the terms of its IPO in an F-1/A filing dated Aug. 5, 2022, by stating the assumed offering price is $5.00, the top of its previous $4.00-to-$5.00 range – and kept the number of shares at 5.0 million shares, to raise $25.0 million. Note: In an F-1/A filing dated July 19, 2022, U-BX Technology cut the size of its IPO by reducing the number of shares to 5.0 million shares, down from 6.0 million shares, and decreasing the price range to $4.00 to $5.00, down from $4.50 to $5.50, to raise $22.5 million. The new terms represented a 25 percent reduction in the IPO’s estimated proceeds, based on mid-point pricing. Note: U-BX Technology Ltd. filed its F-1 on Jan. 28, 2022, in which it disclosed that it intended to offer 6.0 million ordinary shares at a price range of $4.50 to $5.50 to raise $30.0 million – with Boustead Securities as its sole underwriter. In October 2021, U-BX Technology Ltd. submitted its confidential IPO filing to the SEC.)

OrangeKloud Technology Inc. ORKT, Maxim Group, 2.0M Shares, $4.00-5.00, $9.0 mil, 3/28/2024 Thursday

(Incorporated in the Cayman Islands)

Based in Singapore, we supply software development services to small and medium-sized enterprises (SMEs) in Singapore and Malaysia through our operating subsidiaries:

MSC Consulting

Orangekloud Singapore

MSCI Consulting

(Note: OrangeKloud Technology Inc. cut the size of its small-cap IPO by a third – or 33 percent – to 2.0 million shares – down from 3.0 million shares – and kept the price range at $4.00 to $5.00 – to raise $9.0 million, according to an S-1/A filing dated March 21, 2024. Background: OrangeKloud Technology Inc. filed its S-1 on Feb. 20, 2024, in which it disclosed terms for its small-cap IPO: 3.0 million shares at a price range of $4.00 to $5.00 to raise $13.5 million.)

🏁 Emerging Market ETF Launches

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

03/04/2024 - Simplify Tara India Opportunities ETF IOPP - Active, equity

02/07/2024 - Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares XXCH - Equity, leveraged

01/11/2024 - Matthews Emerging Markets Discovery Active ETF MEMS - Active, equity, small caps

01/10/2024 - Matthews China Discovery Active ETF MCHS - Active, equity, small caps

11/07/2023 - Global X MSCI Emerging Markets Covered Call ETF EMCC - Equity, leverage

11/07/2023 - Avantis Emerging Markets Small Cap Equity ETF AVEE - Active, equity, small caps

09/22/2023 - Matthews Asia Dividend Active ETF ADVE - Active, equity, Asia

09/22/2023 - Matthews Pacific Tiger Active ETF ASIA - Active, equity, Asia

09/22/2023 - Matthews Emerging Markets Sustainable Future Active ETF EMSF - Active, equity, ESG

09/22/2023 - Matthews India Active ETF INDE - Active, equity, India

09/22/2023 - Matthews Japan Active ETF JPAN - Active, equity, Japan

09/22/2023 - Matthews Asia Dividend Active ETF ADVE - Active, equity, Asia

08/25/2023 - KraneShares Dynamic Emerging Markets Strategy ETF KEM - Active, equity, emerging markets

08/18/2023 - Global X India Active ETF NDIA - Active, equity, India

08/18/2023 - Global X Brazil Active ETF BRAZ - Active, equity, Brazil

07/17/2023 - Matthews Korea Active ETF MKOR - Active, equity, South Korea

05/18/2023 - Putnam Emerging Markets ex-China ETF PEMX - Active, value, growth stocks

05/11/2023 - JPMorgan BetaBuilders Emerging Markets Equity ETF BBEM - Passive, large + midcap stocks

03/16/2023 - JPMorgan Active China ETF JCHI - Active, equity, China

03/03/2023 - First Trust Bloomberg Emerging Market Democracies ETF EMDM - Principles-based

1/31/2023 - Strive Emerging Markets Ex-China ETF STX - Passive, equity, emerging markets

1/20/2023 - Putnam PanAgora ESG Emerging Markets Equity ETF PPEM - Active, equity, ESG, emerging markets

1/12/2023 - KraneShares China Internet and Covered Call Strategy ETF KLIP - Active, equity, China, options overlay, thematic

1/11/2023 - Matthews Emerging Markets ex China Active ETF MEMX - Active, equity, emerging markets

12/13/2022 - GraniteShares 1.75x Long BABA Daily ETF BABX - Active, equity, leveraged, single stock

12/13/2022 - Virtus Stone Harbor Emerging Markets High Yield Bond ETF VEMY - Active, fixed income, junk bond, emerging markets

9/22/2022 - WisdomTree Emerging Markets ex-China Fund XC - Passive, equity, emerging markets

9/15/2022 - KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV - Passive, equity, Asia, dividend strategy

9/15/2022 - OneAscent Emerging Markets ETF OAEM - Active, Equity, emerging markets, ESG

9/9/2022 - Emerge EMPWR Sustainable Select Growth Equity ETF EMGC - Active, equity, emerging markets

9/9/2022 - Emerge EMPWR Unified Sustainable Equity ETF EMPW - Active, equity, emerging markets

9/8/2022 - Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH - Active, equity, emerging markets, ESG

7/14/2022 - Matthews China Active ETF MCH - Active, equity, China

7/14/2022 - Matthews Emerging Markets Equity Active ETF MEM - Active, equity, emerging markets

7/14/2022 - Matthews Asia Innovators Active ETF MINV - Active, equity, Asia

6/30/2022 - BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD - Passive, fixed income, emerging markets

5/2/2022 - AXS Short CSI China Internet ETF SWEB - Active, inverse, thematic

4/27/2022 - Dimensional Emerging Markets High Profitability ETF DEHP - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Core Equity 2 ETF DFEM - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Value ETF DFEV - Active, equity, emerging markets

4/27/2022 - iShares Emergent Food and AgTech Multisector ETF IVEG - Passive, equity, thematic [Mostly developed markets]

4/21/2022 - FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM - Passive, equity, ESG

4/6/2022 - India Internet & Ecommerce ETF INQQ - Passive, equity, thematic

2/17/2022 - VanEck Digital India ETF DGIN - Passive, India market, thematic

2/17/2022 - Goldman Sachs Access Emerging Markets USD Bond ETF GEMD - Passive, fixed income, emerging markets

1/27/2022 - iShares MSCI China Multisector Tech ETF TCHI - Passive, China, technology

1/11/2022 - Simplify Emerging Markets PLUS Downside Convexity ETF EMGD - Active, equity, options strategy

1/11/2022 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG - Passive, equity, ESG

🚽 Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

02/16/2024 - Global X MSCI China Real Estate ETF - CHIH

02/16/2024 - Global X MSCI China Biotech Innovation ETF - CHB

02/16/2024 - Global X MSCI China Utilities ETF - CHIU

02/16/2024 - Global X MSCI Pakistan ETF - PAK

02/16/2024 - Global X MSCI China Materials ETF - CHIM

02/16/2024 - Global X MSCI China Health Care ETF - CHIH

02/16/2024 - Global X MSCI China Financials ETF - CHIX

02/16/2024 - Global X MSCI China Information Technology ETF - CHIK

02/16/2024 - Global X MSCI China Consumer Staples ETF - CHIS

02/16/2024 - Global X MSCI China Industrials ETF - CHII

02/16/2024 - Global X MSCI China Energy ETF - CHIE

02/14/2024 - BNY Mellon Sustainable Global Emerging Markets ETF - BKES

01/26/2024 - The WisdomTree Emerging Markets ESG Fund - RESE

11/11/2023 - Global X China Innovation ETF - KEJI

11/11/2023 - Global X Emerging Markets Internet & E-commerce ETF - EWEB

11/09/2023 - Franklin FTSE South Africa ETF - FLZA

10/27/2023 - Simplify Emerging Markets Equity PLUS Downside Convexity - EMGD

10/20/2023 - WisdomTree India ex-State-Owned Enterprises Fund - IXSE

10/20/2023 - WisdomTree Chinese Yuan Strategy Fund - CYB

10/20/2023 - Loncar China BioPharma ETF - CHNA

10/18/2023 - KraneShares Emerging Markets Healthcare Index ETF - KMED

10/18/2023 - KraneShares MSCI China ESG Leaders Index ETF - KSEG

10/18/2023 - KraneShares CICC China Leaders 100 Index ETF - KFYP

10/16/2023 - Strategy Shares Halt Climate Change ETF - NZRO

09/20/2023 - VanEck China Growth Leaders ETF - GLCN

08/28/2023 - Asian Growth Cubs ETF - CUBS

08/01/2023 - VanEck Russia ETF - RSX

07/07/2023 - Emerge EMPWR Sustainable Emerging Markets Equity ETF - EMCH

06/23/2023 - Invesco PureBeta FTSE Emerging Markets ETF - PBEE

06/16/2023 - AXS Short China Internet ETF - SWEB

04/11/2023 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF - REMG

3/30/2023 - Invesco BLDRS Emerging Markets 50 ADR Index Fund - ADRE

3/30/2023 - Invesco BulletShares 2023 USD Emerging Markets Debt ETF - BSCE

3/30/2023 - Invesco BulletShares 2024 USD Emerging Markets Debt ETF - BSDE

3/30/2023 - Invesco RAFI Strategic Emerging Markets ETF - ISEM

2/17/2023 - Direxion Daily CSI 300 China A Share Bear 1X Shares - CHAD

1/13/2023 - First Trust Chindia ETF - FNI

12/28/2022 - Franklin FTSE Russia ETF - FLRU

12/22/2022 - VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

8/22/2022 - iShares MSCI Argentina and Global Exposure ETF AGT

8/22/2022 - iShares MSCI Colombia ETFI COL

6/10/2022 - Infusive Compounding Global Equities ETF JOYY

5/3/2022 - ProShares Short Term USD Emerging Markets Bond ETF EMSH

4/7/2022 - DeltaShares S&P EM 100 & Managed Risk ETF DMRE

3/11/2022 - Direxion Daily Russia Bull 2X Shares RUSL

1/27/2022 - Legg Mason Global Infrastructure ETF INFR

1/14/2022 - Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (March 25, 2024) was also published on our website under the Newsletter category.