Emerging Market Links + The Week Ahead (May 13, 2024)

Amazon enters South Africa, Temu Cools on the US, China vs USA (Gallop polls), China to open up telecom-medical sectors to FDI, Milei proven right, EM stock picks & the week ahead for emerging markets

Amazon is entering the South Africa market promising “shoppers a reliable online shopping experience featuring great value, including same-day delivery, more than 3 000 pick-up points, easy returns, 24/7 customer support and free delivery on first orders either via its app or in a browser…”

Interestingly enough, Tucker Carlson just interviewed an Amazon seller who appeared in a recent documentary (Amazon — Market. Power! Monopoly? | How Amazon Hikes Prices & Copies Product) and sells a $17 product - of which, Amazon takes $10 leaving him with just $7 to cover the product’s cost, rent, employees, etc. And if he tries to sell his product cheaper elsewhere, Amazon’s computers will detect it and he looses his Amazon “buy box” along with most of his sales.

He also said that the Chinese make up roughly half of the top sellers on Amazon as they can still undercut American sellers after Amazon’s take (something that is also happening on the ground in Nicaragua: Chinese Megastores are Suffocating Nicaraguan Businesses).

Just knowing this sort of info (and watching the Amazon documentary) makes me want to limit my shopping on Amazon for low end items in favor of using Chinese owned Temu (see: Can Temu Take on Amazon.com & the Rest of the World? - the item I ordered were cheaper on Temu compared to Amazon…) or any other platform but Amazon.

However, the WSJ is reporting Temu wants to limit risks by shifting business priorities beyond the USA and is focusing more on acquiring users in Europe and other countries. I do hope that Temu still works to improve their platform (e.g. making the packaging better to avoid damaging items during shipping, etc.) and continues to offer American consumers a lower priced alternative to Amazon...

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

🌐 EM Fund Stock Picks & Country Commentaries (May 12, 2024) Partially $

Passive investors have broken the markets, HK's dividend-rich environment, reflections on 30 years of EM investing, top 10 market risks, list of Chinese stocks doing buybacks, Heineken's refresh, etc.

[Note: I am doing a post cover almost 130 holdings of the main Taiwan ETFs - the post should be ready later this week…]

📰🔬 Emerging Market Stock Picks / Stock Research

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Alibaba leverages cloud business to become a leading AI investor in China (FT) $ 🗃️

Ecommerce giant offers computing resources to fast-growing start-ups in exchange for equity

🇨🇳 Alibaba: On The Verge Of A Downfall (Seeking Alpha) $

Alibaba (NYSE: BABA)'s stock has performed poorly, with a -58% ROI in the last 5 years, due to the CCP crackdown and structural economic problems in China.

The grip of the CCP on Chinese companies, the risk of delisting in the US, and the VIE listing structure pose additional risks for investors.

Alibaba's marketplace dominance is fading. Restructuring isn't yielding benefits, and it's facing declining FCF, poor cloud-unit growth, and talent is leaving the company.

With fundamental challenges and an uncertain regulatory path forward, the stock is trading at a cheap valuation, but that does not justify buying it.

I rate Alibaba as a "Sell" as a result of the structural problems, the uncertain future, and limited growth potential.

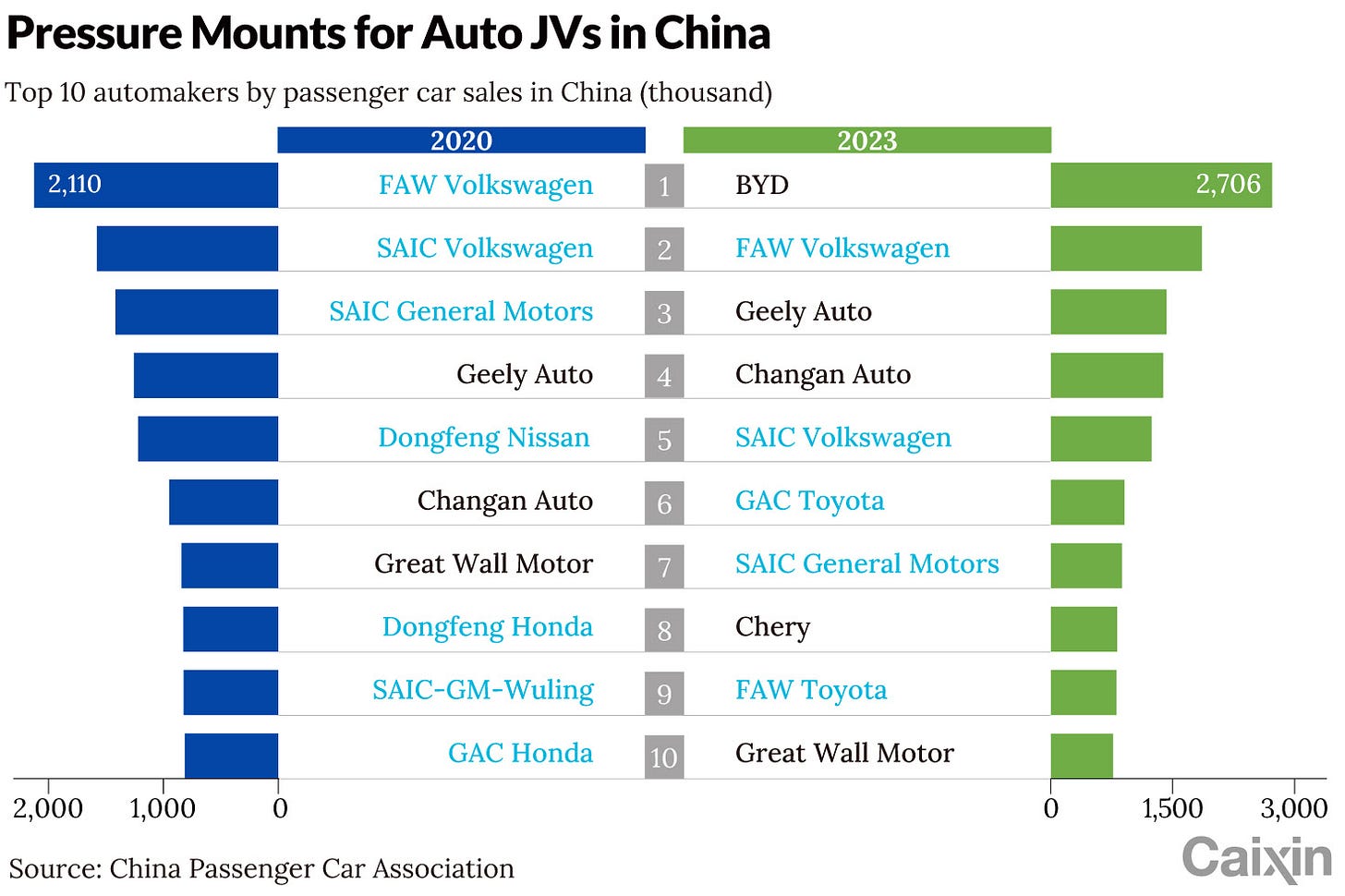

🇨🇳 Analysis: China’s EV Whiz Kids Are Flipping the Script on Joint Ventures (Caixin) $

For decades, foreign carmakers that wanted to sell passenger cars in China had to find a local partner and form a joint venture (JV). These JVs usually sold modified versions of the foreign carmakers’ existing models, manufactured by the local partner.

This rule, which was phased out in 2022, aimed to nurture a domestic automotive industry that would benefit from established giants’ technology and managerial expertise.

🇨🇳 China's Zeekr prices US IPO at top of range to raise $441 million (Reuters)

Chinese electric vehicle maker ZEEKR Intelligent Technology Holding Limited (NYSE: ZK), priced its U.S. initial public offering (IPO) at the top of its indicated range, raising $441 million, it said on Friday.

Zeekr, which is the premium brand of Chinese automaker Geely Automobile Holdings (HKG: 0175), upsized its IPO to sell 21 million American Depositary Shares (ADSs) at $21 per share. It had earlier planned to sell 17.5 million ADSs.

The IPO gives Zeekr a fully diluted valuation, which includes securities such as options and restricted stock units, of $5.5 billion. On a non-diluted basis, the IPO values the company at about $5.1 billion.

🇨🇳 Are pricey warrants powering Lotus Technology’s rally? (Bamboo Works)

Shares of the EV arm of Britain’s luxury Lotus brand have jumped more than 40% over the last two weeks, but are still sharply down from their trading debut in February

Lotus Technology (NASDAQ: LOT) said its backers could raise up to $173 million if holders of warrants to buy its stock at $11.50 per share exercise those warrants

The stock currently trades well below the exercise price, but has rallied more than 40% in the last two weeks, hinting that some believe the company is undervalued

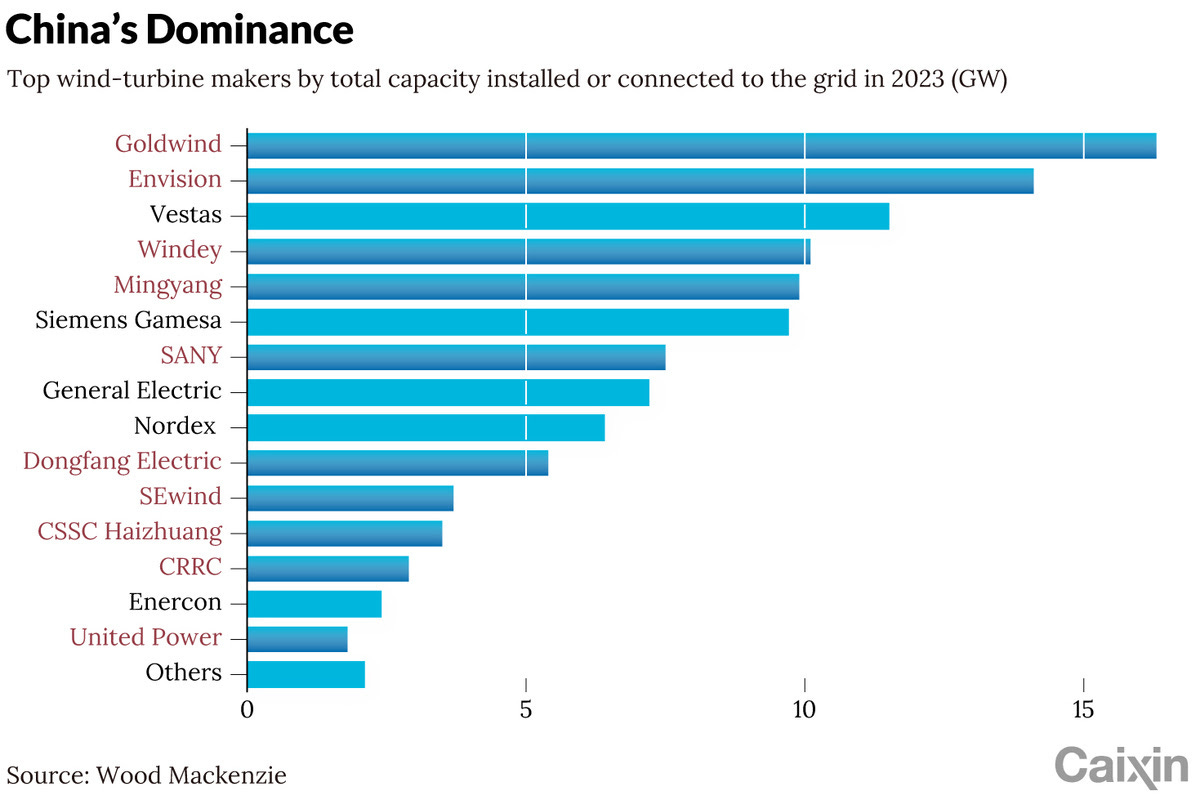

🇨🇳 Charts of the Day: Chinese Wind-Turbine Makers’ Global Dominance (Caixin) $

Chinese wind-turbine makers made up four of the world’s top five manufacturers last year, the first time they have achieved such dominance over the global industry, a new analysis showed.

The achievement came on the back of strong growth in their home market. China accounted for 65% of the world’s newly added wind power capacity in 2023, consultancy Wood Mackenzie said on Wednesday.

🇨🇳 Sam’s Club is the real winner in China’s new retail war? (Momentum Works)

In recent months, it became clear that China’s tech giants were retreating from new (physical) retail, once hailed as the future of omnichannel consumer experience.

At Alibaba Group (NYSE: BABA), Hema’s founder has been retired, while Sun Art Retail (HKG: 6808 / FRA: SRI / OTCMKTS: SURRY / SURRF), retail’s CEO has been replaced. Alibaba Group Chairman Joe Tsai said in the latest earnings call that they will ‘continue to work on (exit physical retail businesses)”.

A recent article in China by consumer-focused writer Dong Jie (董洁) has been widely circulated amongst Friends of Momentum Works. The article, titled “After an eight year dream of new retail, it turns out the winner is Sam’s Club”, synthesised interviews with seasoned executives in retail but also those in tech majors’ efforts of new retail.

The original article is long, detailed, and with a lot of context which might not be straightforward for non-Chinese professionals. We have put some summary plus context below:

🇨🇳 RERE: Trimming 2024 EPS Estimate Ahead of 1Q24 Earnings (SmartKarma) $

Despite a slightly flatter revenue/margin trajectory outlook, we remain optimistic that ATRenew (NYSE: RERE)'s differentiated pre-owned consumer electronics transactions and services platform in China will continue to drive outsized growth in transaction volumes, sales, fees, and profits over the long run.

While RERE has meaningfully outperformed recently, we believe current levels for the stock still provide investors with an attractive entry point, as awareness and appreciation of the company's business model, growth prospects, competitive positioning, and valuation disconnect increasingly take hold.

Despite what we believe to be conservative inputs/assumptions, our DCF model suggests a wide disconnect between ATRenew's fundamentals and the stock's current price.

🇨🇳 Midea aims to score Hong Kong IPO to boost global profile (Bamboo Works)

The leading Chinese maker of home appliances has been expanding overseas and actively promoting its brand

The Midea (SHE: 000333) failed in its first Hong Kong IPO attempt last October, but is making another run as the market rallies, with a reported fund-raising target of more than $1 billion

The appliance maker logged a record profit of 33.7 billion yuan last year

🇨🇳 Lanvin Group lacks shine amid luxury market slump (Bamboo Works)

The Shanghai-based luxury goods company owned by conglomerate Fosun Tourism (HKG: 1992) / Fosun International (HKG: 0656 / FRA: FNI / OTCMKTS: FOSUF / FOSUY) posted just 1% revenue growth last year, with the figure contracting in the second half

Lanvin Group Holdings Ltd (NYSE: LANV)’s revenue grew just 1% last year, though the figure contracted in the second half of the year after growing 6.4% in the first half

The luxury goods maker’s Caruso menswear line was its best performer with 30% revenue growth last year, while sales for its flagship Lanvin brand fell by 7%

🇨🇳 How China’s ‘Firewater’ Became the World’s Most Valuable Liquor Brand (WSJ) 8:08 Minutes

Kweichow Moutai (SHA: 600519) is the world’s largest beverage company by market cap, yet it remains largely obscure among global consumers. WSJ looks at the liquor giant’s business strategies and the challenges ahead.

🇨🇳 H World Group Limited (HTHT) - Thursday, Feb 8, 2024 (SmartKarma) $

Hotel rooms in China decreased by 5.4% compared to the previous year

H World Group (NASDAQ: HTHT) has maintained its position as a leading hotel operator in China with a diverse portfolio of brands

Founder Qi Ji's strong track record in the hospitality industry has contributed to H World's success in navigating challenges and growing its presence in the industry.

🇨🇳 Flagging a potentially interesting situation: IMAX China (HKG: 1970) (Acid Investments)

IMAX Corp (NYSE: IMAX), listed on the NYSE, is a 71% shareholder of IMAX China (HKG: 1970 / FRA: IMK / OTCMKTS: IMXCF), a HKEX listed subsidiary - in charge of the release of IMAX films in Greater China.

IMAX HK is rather illiquid - 7.15 HK is a mere $0.93 USD - with no investor presentations, no earnings calls - again, as is common with ideas in this blog, we are dealing with a company that is more or less “unownable” for most, flies under the radar, and therefore sports a, for a lack of a better word, shite valuation.

🇨🇳 TAL Education Group: What Is The Progress In Terms Of Expansion of Learning Services? - Major Drivers (SmartKarma) $

TAL Education Group (NYSE: TAL) showcased a strong financial performance in the fiscal fourth quarter and full fiscal year of 2024.

The group's Learning Services and Content Solutions segments demonstrated growth, driven by focused product development and a broadening customer base.

The Learning Services sector saw continuous growth, supported by the expansion of learning centers and increased enrollment.

🇨🇳 China Education Group makes the grade with rising profits (Bamboo Works)

The vocational training provider’s half-year earnings were well received by investors, aided by a broader rally on the Hong Kong stock market

China Education Group Holdings Limited (HKG: 0839) has slowed its school purchases over the past two years, but spent a hefty 2 billion yuan on campus construction projects in the last six months

The company’s financial situation is solid, with a cash reserve of 4.53 billion yuan and an interest-bearing debt ratio of 24.7%

🇨🇳 China Bluechemical Ltd (3983.HK) - Fertiliser Pricing on the Up (SmartKarma) $

[Largest nitrogenous fertilizer manufacturer in Mainland China] China BlueChemical Ltd (HKG: 3983 / FRA: H1Q / OTCMKTS: CBLUY / CBLUF)

A play on higher food and energy prices going forward

Natural Gas moving up from multi-year lows will support fertiliser prices going forward

A Low valuation with a solid balance sheet lowers the risk

🇨🇳 Singamas (716 HK): Net Cash 1.6x of Market Cap, Why Not Privatise? (SmartKarma) $

[Leading manufacturer of containers, operator of container depots and provider of logistics services] Singamas Container Holdings Ltd (HKG: 0716 / OTCMKTS: SNGSF) is interesting in that it has a net cash of US$300m (HK$2.35bn), but its market capitalisation is only HK$1.5bn.

This is a possible privatisation candidate given the steep discount to cash. The thin trading volume made it difficult to function as a financing platform.

Business-Wise, it should have passed the trough as global container box plant utilisation is expected to improve in the next two years, driving profitability recovery.

🇨🇳 ZhongAn may be betting on property rebound with Shanghai office buys (Bamboo Works)

The online insurer has agreed to purchase two office buildings in Shanghai’s iconic Bund area amid signs that China’s commercial property market may have hit bottom

ZhongAn (HKG: 6060 / FRA: 1ZO) has agreed to buy two office buildings in Shanghai from a joint venture majority-owned by the Rockefeller Group

China’s property market has been in a prolonged slump, but the commercial segment is showing early signs of recovery

🇭🇰 Hong Kong’s Café de Coral takes go-slow approach to Mainland dining market (Bamboo Works)

The fast-food chain said its profit doubled in its latest fiscal year, as it makes strong progress in China’s Pearl Delta region, also known as the Greater Bay Area

Cafe De Coral (HKG: 0341 / OTCMKTS: CFCGF) said it would report a HK$330 million profit for its 2024 fiscal year ended March 31, triple the previous year

Hong Kong’s leading fast-food chain has posted strong same-store sales growth in Southern China’s Greater Bay Area, as it tries to export its winning formula to the Mainland

🇭🇰 Best Mart 360 (2360 HK) (Asian Century Stocks) $

Fast-growing Hong Kong discount retailer at 8.1x P/E and 10.6% dividend yield

Best Mart 360 (HKG: 2360 / OTCMKTS: BMTHF) - US$235 million) is a Hong Kong retailer of leisure food with 170 outlets in Hong Kong, Macau and Mainland China.

You can think of Best Mart as a mix between a supermarket and a convenience store. It offers most other food, beverage and household products you might need, including grains, confectionaries, snacks, bakery products, wine, dried fruits, nuts, shampoos, etc.

🇲🇴 ‘Tepid’ GLP, dividends at SJM only after 2025: analyst (GGRAsia)

“Tepid” and “disappointing” were words used by some brokerages to refer to the business ramp up at Macau casino resort Grand Lisboa Palace (GLP), which opened in July 2021 amid the Covid-19 pandemic, and has struggled to gain traction in terms of gambling market share, even since the lifting of travel restrictions at the start of 2023.

JP Morgan Securities (Asia Pacific) Ltd, source of the Friday comment about Grand Lisboa Palace being “disappointing”, nonetheless highlighted some initial recovery for the resort’s promoter, SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY), following the Thursday publication of the Hong Kong-listed casino firm’s first-quarter results highlights.

🇲🇴 SJM 1Q EBITDA US$111mln as revenue grows, loss narrows (GGRAsia)

Macau casino operator SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) reported adjusted earnings before interest, taxation, depreciation, and amortisation (EBITDA) of HKD864 million (US$110.5 million) for the first quarter of 2024, compared with HKD31 million a year earlier, the firm said in unaudited highlights filed with the Hong Kong Stock Exchange on Thursday.

The company said it had “exceptional” results for the first three months this year, “posting impressive gains on multiple fronts,” according to a separate press release.

Among Macau gaming concessionaires with satellite casino interests, SJM Holdings has the greatest number. As of March 31, the nine satellite casinos that use its licence generated aggregate GGR of nearly HKD2.64 billion, up 54.7 percent year-on-year.

But these satellite properties also collectively generated negative adjusted property EBITDA amounting to HKD52 million in reporting period, though that was narrowed from the negative HKD105 million in first-quarter 2023.

🇲🇴 Wynn Macau Ltd 1Q EBITDAR US$340mln on GGR share gains (GGRAsia)

Macau casino operator Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) reported first-quarter operating revenues of US$998.6 million, up 9.7 percent from the preceding quarter. Such revenue increased 66.4 percent from US$600.1 million in first-quarter 2023, according to a Tuesday filing to the Hong Kong Stock Exchange.

JP Morgan Securities (Asia Pacific) Ltd said in a Wednesday note that Wynn Macau Ltd’s first-quarter property EBITDA “was comfortably above” market consensus, “thanks to solid mass-market share, at circa 13.5 percent versus 12.5 percent in recent quarters, and cost discipline … that allowed its margin to hit the highest level in about 10 years”.

🇰🇷 Cosmecca Korea Plans to Switch Listing from KOSDAQ to KOSPI (Douglas Research Insights) $

On 10 May, Cosmecca Korea (KOSDAQ: 241710) announced that it plans to switch its listing from KOSDAQ to KOSPI.

The company plans to convene an extraordinary general meeting of shareholders on 29 August to finalize on the switching of Cosmecca Korea listing from KOSDAQ to KOSPI.

Cosmecca Korea is one of the leading Korean ODM manufacturers of cosmetic products.

🇰🇷 Eoflow Announced that US Federal Court Has Decided to Suspend the Effect of 1st Injunction Decision (Douglas Research Insights) $

On 8 May, Eoflow (KOSDAQ: 294090) announced that the U.S. federal court has decided to suspend the effect of the first injunction decision. In October 2023, the U.S. court in Massachusetts banned the sale, manufacturing, and marketing of the insulin pump 'Eopatch' until the patent lawsuit against Insulet (NASDAQ: PODD) in the U.S. is concluded..

While the effect of the second preliminary injunction decision remains intact, Eoflow has requested a review of the suspension of the effect of the second revised injunction decision as well.

There has been a renewed optimism on Eoflow (294090 KS)'s share price in the past week which increased by 46% from 7 May to 10 May.

🇰🇷 South Korean Banks; Stick with Woori (316140 KS) And KB Financial (105560 KS) (SmartKarma) $

In our latest South Korean banks screener, we keep Woori Financial Group (NYSE: WF) on the buy list along with KB Financial Group (NYSE: KB) as our Korean banks picks

Delinquency ratios continued to worsen QoQ, yet Woori is the benchmark for NPL ratio; Woori had lagged in terms of returns, but these are holding at the pre-provision level

KB has a low PBV ratio relative to its ROE, it delivers rising post-provision returns, with cost of risk declining and it has a healthy CET1 ratio

🇰🇷 Paradise Co 1Q profit jumps as revenue rises 38pct y-o-y (GGRAsia)

Paradise Co Ltd (KOSDAQ: 034230), an operator of foreigner-only casinos in South Korea, reported net income attributable to shareholders of nearly KRW25.94 billion (US$19.0 million) for the first quarter of 2024, according to a filing published on Thursday.

Such income was up 271.1 percent from the prior-year period, and compared with a net loss of KRW9.10 billion in the final quarter of 2023.

🇰🇷 S. Korean resort boosts Mohegan quarterly revenue (GGRAsia)

Mohegan Tribal Gaming Authority reported net revenues of US$461.7 million for the three months to March 31, 13.8-percent higher than in the prior-year period. The growth was supported by the group’s Mohegan Inspire Entertainment Resort, the newly-opened complex – with a foreigner-only casino – at Incheon, South Korea.

Mohegan Inspire opened its non-gaming facilities on November 30, followed by its foreigner-only casino on February 3. It had an official launch for the property on March 5.

The complex has 1,275 hotel rooms, 11 restaurants, and a 15,000-seat arena.

The casino resort at Incheon recorded net revenues of US$35.9 million in the first three months of 2024, according to Thursday’s announcement.

🇰🇷 Kangwon Land 1Q net profit at US$68mln, up 26pct q-o-q (GGRAsia)

Kangwon Land (KRX: 035250), operator of Kangwon Land (pictured) – a resort with the only casino in South Korea open to locals – saw its first-quarter net profit decline by 8.5 percent year-on-year, to KRW92.9 billion (US$68.1 million). But judged sequentially, first-quarter 2024 net profit rose 26.0 percent from the KRW73.7 billion in the final quarter of 2023.

That is according to the firm’s unaudited financial results filed to the Korea Exchange, and information on the company’s website.

🇰🇷 Netmarble Plans to Sell 2.6% Stake in HYBE Through PRS (Price Return Swap) (Douglas Research Insights)

After the market close on 9 May, [South Korea's largest mobile-gaming company] Netmarble Corp (KRX: 251270) announced that it plans to sell 2.6% stake in [entertainment lifestyle platform company] HYBE (KRX: 352820) for 219.9 billion won.

The transaction is based on PRS (price return swap) basis. Previous to this deal, Netmarble sold 2.5 million shares (about 6%) of HYBE shares in November 2023.

We continue to remain negative on HYBE including on this deal involving Netmarble's plan to sell additional 2.6% stake in HYBE.

🇰🇷 Naver: Under Pressure from the Japanese Government To Sell Its Stake in LINE (Douglas Research Insights)

On 8 May, it was mentioned in numerous local media that NAVER (KRX: 035420 / OTCMKTS: NHNCF) is under pressure from the Japanese government to sell its stake in [Instant messaging and social networking service] LINE.

One of the reasons behind Japanese government's efforts to force Naver to sell its stake in LINE is due a major data breach incident in November 2023.

Based on our current understanding of this situation, the most likely scenario is for Naver to sell about 20-30% stake in A Holdings (the controlling shareholder of LINE) to SoftBank Group Corp (TYO: 9984 / FRA: SFT / OTCMKTS: SFTBF / SFTBY).

🇰🇷 Hankook Tire & Technology to Become the Controlling Shareholder of Hanon Systems (Douglas Research Insights)

On 3 May, it was reported that Hankook Tire & Technology Co Ltd (KRX: 161390) agreed to purchase a 25% in Hanon Systems (KRX: 018880) for 1.37 trillion won from Hahn & Co private equity firm.

After this deal, Hankook Tire & Technology will own a controlling 50.5% stake in Hanon Systems.

We have a negative view on Hankook Tire & Technology's additional purchase of Hanon Systems, which has experienced a declining profit margins in the past several years.

🇰🇷 ICTK IPO Book Building Results Analysis (Douglas Research Insights)

ICTK reported excellent book building results. ICTK's IPO price has been determined at 20,000 won, which is 25% higher than the high end of the IPO price range.

ICTK is a security company specializing in Internet of Things (IoT) based on physical copy prevention technology called PUF which is a cutting-edge technology during the chip manufacturing process.

Our base case valuation is implied market cap of 376.8 billion won or target price of 28,694 won, which is 43% higher than the IPO price (20,000 won).

🇸🇬 UOB Profit Dips, Maintains Optimistic Outlook for 2024: 5 Highlights from the Bank’s Latest Earnings (The Smart Investor)

United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF), or UOB, is the second of the three Singapore banks to report its first quarter 2024 (1Q 2024) earnings.

Here are five highlights from the bank’s latest earnings report.

Net profit dips slightly

Fee income boosted by loan and wealth fees

Record trading and investment income

Slight loan growth offset by softer NIMs

Higher cost-to-income ratio

🇸🇬 3 Quick Thoughts on OCBC’s Latest 1Q 2024 Earnings Report (The Smart Investor)

OCBC pulled off a strong start to the year with a sparkling set of earnings.

Oversea-Chinese Banking Corp (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY) is the last of Singapore’s three big banks to report its first quarter 2024 (1Q 2024) earnings.

And the bank did not disappoint.

Here are three highlights from the bank’s latest earnings report that investors should know about.

Net profit rises to a record high

Sharply higher non-interest income

Slightly lower NIM offset by loan growth

🇸🇬 Better Buy: Mapletree Logistics Trust Vs Mapletree Industrial Trust (The Smart Investor)

We compare two popular Mapletree REITs to determine which makes the better investment choice.

Investors should be familiar with two popular industrial REITs, namely Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF), or MLT, and Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF), or MIT.

Both REITs have the same sponsor in Mapletree Investments Pte Ltd and we decided to compare these two REITs to see which makes the better investment.

🇸🇬 Hospitality Trusts Have Reported Good Results: Is There More DPU Upside for the Segment? (The Smart Investor)

The four hospitality trusts have reported strong sets of earnings and business updates for their latest quarter. Are there more sunny days ahead for this REIT sub-segment?

CDL Hospitality Trusts (SGX: J85 / OTCMKTS: CDHSF), or CDLHT, saw its total revenue for the first quarter of 2024 (1Q 2024) rise 7.3% year on year to S$65.3 million.

Over at CapitaLand Ascott Trust (SGX: HMN / OTCMKTS: ATTRF), or CLAS, 1Q 2024 gross profit increased by 15% year on year because of stronger operating performance coupled with contributions from new properties.

Far East Hospitality Trust (SGX: Q5T), or FEHT, also reported healthy financial numbers.

Visitors can also look forward to the expansion of Resorts World Sentosa by Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) with new attractions such as Minion Land and the expansion and rebranding of the SEA Aquarium into the Singapore Oceanarium.

These plans are multi-year ones that should continue to make Singapore an attractive destination and boost tourism numbers, thereby benefitting hospitality trusts such as FEHT, CLAS, CDLHT and Frasers Hospitality Trust (SGX: ACV).

🇸🇬 🇹🇭 8 Thai Blue Chip Stocks You Can Buy on the SGX (The Smart Investor)

As of last month, five Singapore depository receipts (SDRs) linked to Thailand’s blue chip companies were listed on the Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY), bringing the total SDRs to eight.

There are two key benefits of investing through SDRs.

SDRs are traded in Singapore Dollars, thereby preventing the need for Singaporeans to exchange currency.

Convenience and Accessibility – Grants Singaporeans the ability to invest in foreign markets directly, without incurring additional fees.

Here is a summary of the eight SDRs that are available for you to invest in on the Singapore Stock Exchange.

Advanced Info Services (BKK: ADVANC / SGX: TADD)

Airports of Thailand (SGX: TATD / BKK: AOT / OTCMKTS: AIPUY / AIPUF / ARPRF)

CP All (SGX: TCPD / BKK: CPALL / CPALL-R / OTCMKTS: CVPBF / CVPUF)

Delta Electronics Thailand (BKK: DELTA / SGX: TDED)

Gulf Energy Development (BKK: GULF / SGX: TGED)

Kasikornbank (BKK: KBANK / SGX: TKKD / FRA: TFBF / OTCMKTS: KPCPY / KPCPF)

PTT Exploration & Production (SGX: TPED / BKK: PTTEP / PTTEP-R / OTCMKTS: PEXNY)

Siam Cement Group (BKK: SCC / SGX: TSCD)

🇮🇳 Reasons Why Sify Technologies Is Poised For Success In The 5G Era (Seeking Alpha) $

Sify Technologies (NASDAQ: SIFY) is an Indian company offering digital solutions and infrastructure services, serving over 10,000 businesses.

The company aims to capitalize on the Indian government's 5G infrastructure plan and the growing data center market.

Despite some risks, such as competition and economic crises, SIFY is undervalued and has potential for significant growth.

Forward EBITDA growth stands at close to 27%, which is significantly higher than what companies in the same sector report.

🇦🇪 Wynn UAE scheme tower to be topped off in 4Q 2025: firm (GGRAsia)

Wynn Al Marjan Island, a casino resort project in the United Arab Emirates (UAE) involving Wynn Resorts Ltd (NASDAQ: WYNN), is on track to “open to the public in early 2027,” said the gaming firm in a Monday press release.

🇦🇪 Wynn US$900mln contribution to UAE scheme, eyes Thailand (GGRAsia)

Global gaming operator Wynn Resorts Ltd (NASDAQ: WYNN) will fork out about US$900 million for construction of Wynn Al Marjan Island, a casino resort project in the United Arab Emirates (UAE). That is according to an estimate made by Craig Billings, group chief executive of Wynn Resorts, which is also the parent of Macau casino operator Wynn Macau Ltd.

“The total budget [for Wynn Al Marjan] is around US$4 billion. Budgets [can] move here and there, but no substantial movement” in this case, stated Mr Billings on the group’s Tuesday conference call to discuss the first-quarter earnings released the same day.

“In Thailand, it’s early days and we have yet to see the regulatory and licensing structures,” observed Mr Billings.

🇹🇷 Turkcell Fairly Priced As Inflation Accelerates (Rating Downgrade) (Seeking Alpha) $

Turkcell (NYSE: TKC) has successfully managed inflation and expanded margins, with the stock rising 17% since the previous analysis.

As inflation rises in Turkey, nearing 70%, Turkcell's ability to expand margins will be more limited.

DCF analysis suggests the stock is fairly priced, along with balanced upside and downside potential.

🇿🇦 SA fintech firm Lesaka acquires payments processor Adumo for R1.6bn (IOL)

After consummation of the Adumo acquisition, Lesaka Technologies (NASDAQ: LSAK) will have an ecosystem serving some 1.7 million active consumers and about 119 000 merchants.

This means the South African fintech will be processing more than R250bn in throughput comprised of R40bn in card payments, R100bn in VAS payments that include prepaid airtime, data, electricity, money transfers and DStv payments.

This acquisition also brings Lesaka’s total number of employees to over 3 300 across five sub-Saharan African countries – South Africa, Namibia, Botswana, Zambia, and Kenya.

🇿🇦 🎧 S2E1 | Nicola Comninos, Chief Risk Officer, The Purple Group Ltd (Capital Markets Africa)

In this conversation, Nicola talks about [financial trading platform] Purple Group Ltd (JSE: PPE)'s recent positive financial performance, how it incentivises good investment behaviour on its EasyEquities trading platform, and group risk management.

🇿🇦 Canal+ forges ahead with takeover of MultiChoice by buying more shares (IOL)

Canal+, the French broadcasting multinational, has acquired a further 4.73 million MultiChoice Group Ltd (JSE: MCG / FRA: 30R / 30R0 / OTCMKTS: MCHOY / MCOIF) shares, bringing its shareholding to about 43.54% of the African pay television group’s shares in issue.

Canal+ has been aggressively buying up shares in MultiChoice for almost four years after it started building its stake with an initial 6.5% in October 2020. Canal+ aims to be a leading broadcaster in Africa.

🇿🇦 Harmony Gold: Rally Continues As Operations Expand And Gold Prices Rise (Seeking Alpha) $

Harmony Gold Mining Company Limited (NYSE: HMY) has a positive outlook due to robust gold prices and consistent operations.

The company's shares have performed well and are not considered expensive, but a lower price in the near term is possible.

HMY is well-positioned as a leader in gold production in South Africa and still has expansion projects in place.

🇿🇦 NUM calls for resignation of ‘brutal’ Sibanye-Stillwater CEO over jobs bloodbath (IOL)

The National Union of Mineworkers (NUM) has called for the resignation of Sibanye Stillwater Ltd (NYSE: SBSW) CEO Neal Froneman, amid the company’s process of retrenching nearly 4 000 workers from its South African gold mining operations, saying he and his executive have been “arrogant and brutal" in laying off employees.

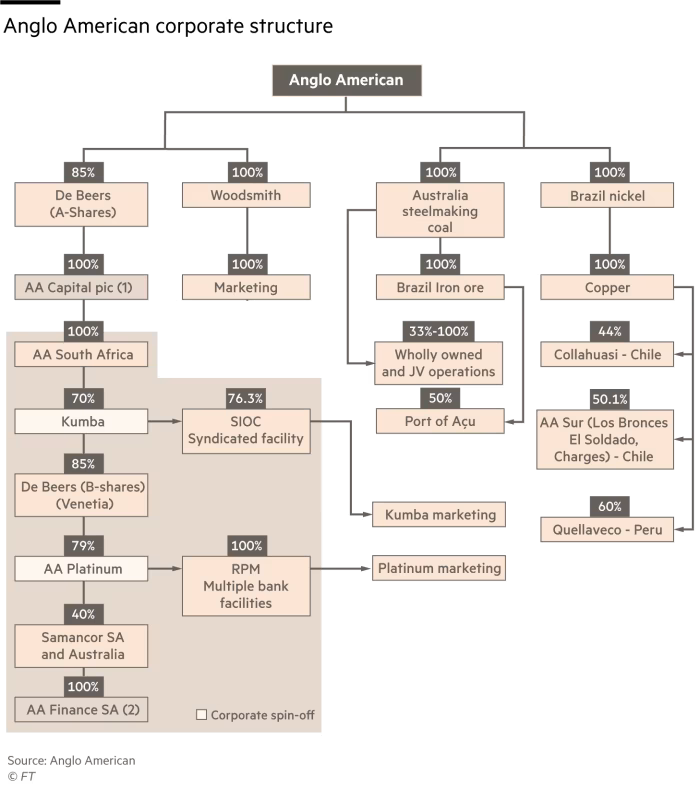

🇿🇦 Anglo American’s South Africa investors open to improved BHP bid (FT) $ 🗃️

Shareholder stance defies government hostility to plan that would break up national champion

🇬🇷 #29 Kri-Kri Milk Industry (Kroker Equity Research)

How Greek yogurt delights investors

Kri-Kri Milk Industry S.A. (ASE: KRI), a key player in the dairy industry, specializes in producing ice cream, yogurt, and fresh milk. The company boasts a widespread distribution network that includes supermarket chains and small retail outlets throughout Greece. Internationally, Kri-Kri exports its products to over 40 countries. The headquarters and main production facilities are situated in Serres, in northern Greece. Additionally, the company operates a logistics center in Aspropyrgos, in the Attica region, which primarily supports the distribution of products to southern Greece.

Kri-Kri is classified as a European small-cap company with a market capitalization of approximately €350 million. The company experiences relatively low trading activity, with an average daily trading volume of about €20,000. This modest volume indicates limited liquidity, which is typical for smaller market cap companies and may be a consideration for investors looking at trading dynamics and ease of entry or exit in Kri-Kri’s shares.

🇭🇺 Wizz Air Stock: A Buy On Strong Engine Crisis Management (Seeking Alpha) $

Wizz Air (LSE: WIZZ / OTCMKTS: WZZZY / FRA: WI20 / FRA: WI2) is facing engine issues with its Airbus A320neo family airplanes, resulting in a significant number of grounded aircraft.

The company has received compensation from RTX Technologies and refunds from Airbus for the disruptions caused by the engine crisis.

Despite the challenges, Wizz Air saw revenue growth in line with cost growth in the third quarter of 2024.

🇵🇱 Hydrotor SA – Crisis Year Offers an "OK" Buying Opportunity (Hidden Zlotys)

Hydrotor SA (HDR) [Przedsiebiorstwo Hydrauliki Silowej Hydt (WSE: HDR)] manufactures hydraulic components such as gear pumps for combine harvesters, loader buckets, forklifts, and vans; hydraulic selection valves with manual and electronic control for loader buckets and construction machinery, as well as motor oil pumps and overpressure and return restrictor valves. At 31 PLN per share, HDR is currently valued at a P/TB of 0.65 and an EV/S of 0.66, which is low for a company that has only had one loss year since at least 2002 (unfortunately, 2023), historically achieved an ROIC of 10%, and consistently paid dividends (55% payout ratio) every year since 2001. In addition, the two largest shareholders have continuously increased their holdings over several years.

🇵🇱 Dino Plolska Q1 - Earnings Update (The Dutch Investors)

Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY): the grocery store king or giant failure?

Dino Polska has just released its Q1 2024 earnings! As $DNP.WA shareholders, here's a quick rundown so you don't miss a thing!

Competition in Poland is intensifying. Dino's EBITDA margin has declined because the cost of sales is rising faster than revenue, partly due to increasing price competition in the retail grocery market.

Dino anticipates its store count to increase by a low double-digit percentage this year. It also expects operating expenses to rise due to low unemployment and higher salaries in Poland.

It recently bought a 72% stake in eZebra.pl, an online cosmetics store, to expand into the beauty and health sectors.

🌎 MercadoLibre: 25 Years of Little Boxes (The Wolf of Harcourt Street)

MercadoLibre (NASDAQ: MELI) Q1 2024 Earnings Analysis

Contents

Financial Highlights

Wall Street Expectations

MercadoLibre Marketplace

Mercado Envíos

Mercado Pago

Mercado Credito

Financial Analysis

Conclusion

🌎 MercadoLibre Q1 2024: Growing Despite Difficulties In Argentina (Seeking Alpha) $

MercadoLibre (NASDAQ: MELI) released strong Q1 results, exceeding revenue and earnings estimates.

The company showed strong growth in Brazil and Mexico, as well as in its fintech unit, MercadoPago.

Despite economic challenges in Argentina, the company's profitability and valuation remain attractive.

🇱🇺 🇦🇷 Globant Earnings: I Would Like To Hear About The AI Initiatives More (Seeking Alpha) $

Globant (NYSE: GLOB) is set to report Q1 earnings on May 17th.

The company's revenues steadily increased throughout 2023, driven by expansion into new markets and strong core growth.

Analysts expect the company to beat estimates for Q1 earnings, and the company's focus on AI initiatives could drive future growth.

🇧🇷 Itaú Unibanco: Q1 2024, Good And Promising Results (Seeking Alpha) $

Itau Unibanco (NYSE: ITUB) achieved a net income of almost $2 billion in the quarter with an ROE of 21.9%.

The bank is achieving good revenue expansion, while keeping costs and expenses under control.

Extraordinary dividends and a P/E below historical levels give even more confidence in the thesis.

🇧🇷 Braskem - ADNOC deal falls through, but there's more to this story (Calvin's Thoughts)

Well, it's been a volatile morning for [Plastic producer] Braskem (NYSE: BAK) holders. At 7:40 AM EST the company put out the following press release informing the market that ADNOC [Abu Dhabi National Oil Company] had informed Novonor it was no longer interested in continuing talks on acquiring their stake.

Shares initially plunged nearly 30% in premarket, and then recovered more than half the losses. Exactly why the deal fell apart is unclear. Analysts from banks and investment groups focused on the transaction are also unsure what happened. There is some speculation, however, that it comes down to price. Novonor is asking for a price approximately 50% higher (around $22/share) than ADNOC offered ($15/share). Another source, the Brazilian financial publication Valor, suggested that the deal fell apart due to ADNOC's apprehensions regarding the political spectacle surrounding the company.

🇧🇷 Gerdau - Resilience Amidst Market Volatility (THE MODERN INVESTING NEWSLETTER)

Margin growth, Dividends & Sentiment = Great Setup

In an ever-evolving global market, the steel industry stands as a pivotal player, Gerdau SA (NYSE: GGB) is among the key players in this industry. The company is Brazil's leading steel producer, with operations spanning North and South America. This article covers the investment opportunity of Gerdau in a challenging market environment for steel.

In conclusion, Gerdau is a highly interesting stock that trades at a low valuation, while the core profitability of the company is improving. The stock pays an attractive dividend that is easily covered by earnings. Im about to enter a starting position and plan to gradually increase the position if the thesis plays out.

🇧🇷 Gerdau: Chinese Steel Taxation Frustrates Brazilian Investors (Seeking Alpha) $

Gerdau SA (NYSE: GGB) has a good track record and the most internationalized operation among Brazilian steel companies. The Brazilian steel industry is facing challenges due to the large supply of Chinese steel.

The government's proposed 25% tax on Chinese steel is insufficient to combat the competition, making it unfeasible to recommend buying Brazilian steel producers at the moment.

The company trades at the lowest EV/EBITDA multiple among its competitors. However, there is a lack of trigger to make the thesis more attractive.

🇧🇷 Gerdau: Cheap Stock Void Of Direction (Seeking Alpha) $

Gerdau SA (NYSE: GGB)'s stock is currently trading at a similar level to three years ago, indicating limited growth potential.

The company is experiencing growth trends in multiple markets, including the North American market and the special steel market.

Gerdau's valuation remains compelling, with attractive multiples and strong cash generation, but technical indicators suggest consolidation rather than a bullish move.

🇧🇷 CI&T Revenue Falters As Headwinds Continue (Seeking Alpha) $

CI&T Inc. (NYSE: CINT) is a Brazil-based digital transformation consulting and engineering services company.

CI&T's revenue breakdown shows a focus on financial services, consumer goods, and technology and telecom companies in Latin America and North America.

Customer demand for AI services is in the early stages, and forward revenue growth is likely to be flat.

I remain Neutral [Hold] on CI&T Inc. stock until management can restart meaningful revenue growth.

🇧🇷 WEG Q1 2024: Weak Results To Justify Valuation (Seeking Alpha) $

WEG SA (BVMF: WEGE3) [electric engineering, power and automation technology] reported weak results. Its revenue grew just 5% for the year, although margins were offset by good expense control.

The company has a P/E multiple of 28.9x, and trades at a 12% premium to competitors. Therefore, there is little margin of safety to recommend buying the shares.

Additionally, the valuation of 28.9x earnings does not seem to justify annual growth of 5%, and a sector with discouraging prospects.

🇧🇷 Ambev: Discounted Valuation Compared To Competitors Makes No Sense (Seeking Alpha) $

Ambev (NYSE: ABEV)'s scale and global position is a major competitive advantage, as it mitigates specific risks in each country in which it operates.

The company has good prospects for increasing margins due to the resilient nature of its market and the reduction in commodity prices that impact its cost.

Despite presenting the highest efficiency and profitability among its competitors, the company is traded at a significant discount of 14.8% to its peers.

🇨🇱 Sociedad Química y Minera de Chile: Managing Risks Amidst Lithium Protectionism (Seeking Alpha) $

Sociedad Química y Minera de Chile (NYSE: SQM) is one of the largest lithium producers, with an 18% market share.

Long-term demand for lithium is expected to remain strong due to its role in battery manufacturing, which could lead to a potential recovery for SQM in FY25 and beyond.

However, the Chilean government's protectionist shift poses a significant risk for SQM, and the company is taking steps to diversify its business away from Chile.

🇲🇽 Banorte: Growth From Almost Everywhere (Seeking Alpha) $

Grupo Financiero Banorte SAB de CV (BMV: GFNORTEO / FRA: 4FN / OTCMKTS: GBOOY / GBOOF) is a diversified bank that over the past three years has comfortably outperformed both the local market and the S&P 500.

The bank is exhibiting sustainable growth in ROE, book value, and NII. Also, with a core-bank NIM that has been barely affected by higher funding costs, displaying signs of resiliency.

With a price-to-book trading close to its historical average, coupled with tailwinds in the Mexican economy, and an electoral result that seems anticipated, I rate this company as a buy.

🇲🇽 Coca-Cola Femsa: A Great Brand At A Great Price (Seeking Alpha) $

[Coca-Cola Femsa SAB de CV (NYSE: KOF)]

Management has been able to consistently increase ROE by improving margins and being more efficient with their assets.

Going forward, they are staying within their circle of competence to repeat the formula that worked in the past.

Low growth expectations and margin expansion thanks to its AI platform can increase its expected value.

Just by taking on more debt, the company can unlock more value for its shareholders.

📰🔬 Further Suggested Reading

$ = behind a paywall / 🗃️ = Archived article

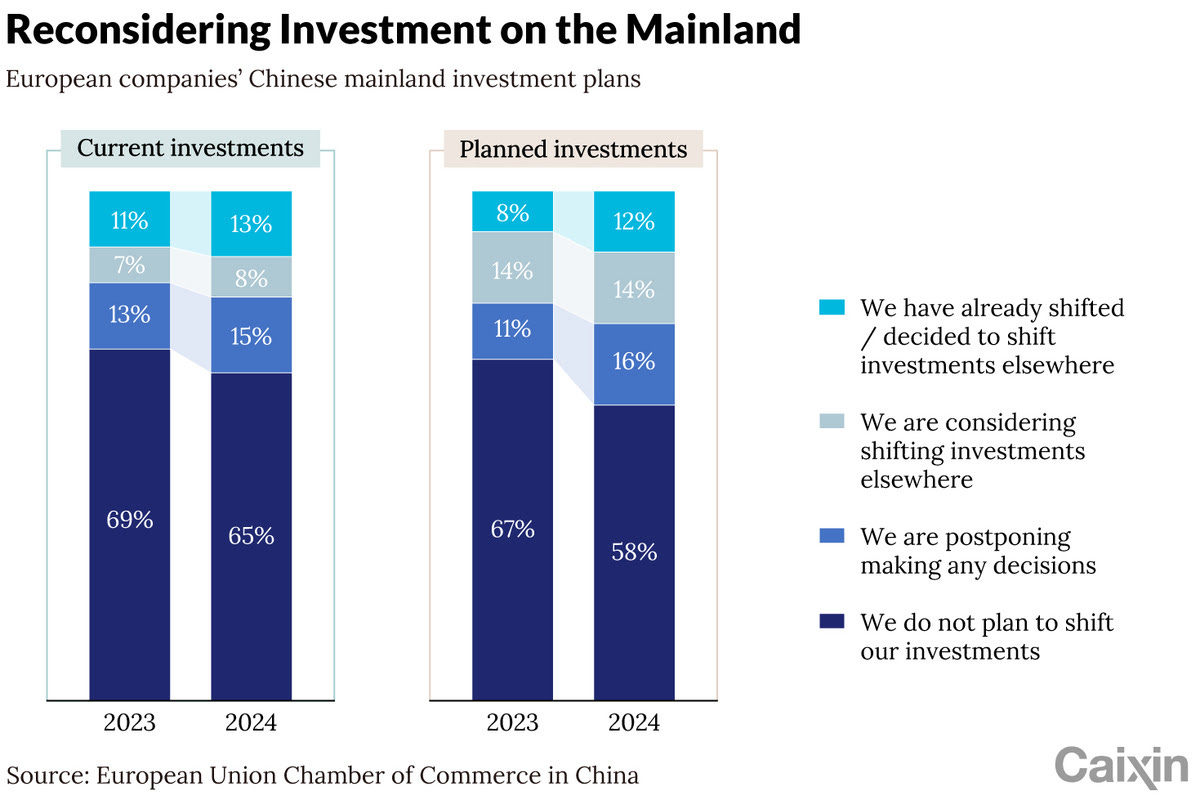

🇨🇳 More European Businesses Moving Investment Out of Chinese Mainland, Survey Shows (Caixin) $ & EUROPEAN CHAMBER CALLS FOR ACTION TO RESTORE BUSINESS CONFIDENCE (EUCCC)

More European businesses are moving investments out of the Chinese mainland to markets such as Southeast Asia and Europe as the world’s second-largest economy is no longer the clear choice as an investment destination, according to new findings by a leading European trade association.

The annual Business Confidence Survey published Friday by the European Chamber of Commerce in China (EUCCC) showed that 13% of respondents have either already moved or made the decision to shift existing investments from the Chinese mainland to other markets. That’s a 2 percentage point increase from last year, the survey showed. Another 8% said they are considering doing so.

🇨🇳 Update: China to Further Open Up Telecom, Medical Sectors to Foreign Investors, Xi Says (Caixin) $

President Xi Jinping vowed to create more business opportunities for European firms and further open up China’s services sector, including telecommunication and medical fields, to foreign companies, during an official visit to France this week.

“We are considering and taking major steps to further deepen reform across the board, steadily expand institutional opening up, further expand market access, and shorten the negative list for foreign investment,” Xi said when addressing a China-France Business Council meeting in Paris Monday.

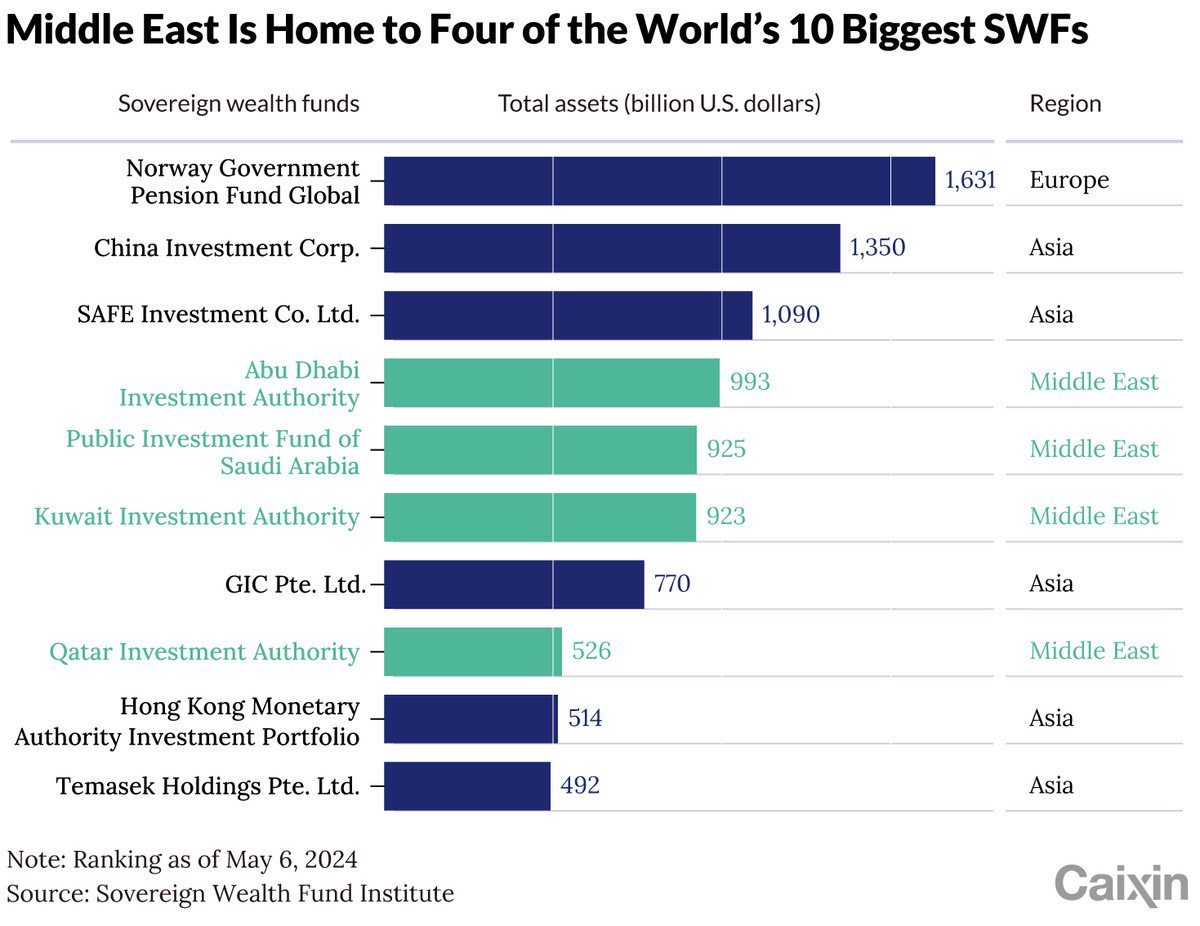

🇨🇳 In Depth: Why Chinese PE and VC Firms Are Chasing Middle East Money (Caixin) $

Chinese venture capital (VC) and private equity (PE) firms are targeting deep-pocketed Middle Eastern investors, as funding from their traditional backers dwindles amid growing geopolitical tensions and shrinking opportunities for investment partners to sell their stakes through IPOs.

At least 200 Chinese VC and PE firms visited the Middle East last year to drum up business, according to data compiled by an agency that tracks interaction between financial institutions in China and investors in the region. PE firm CMC Capital Partners and VC firm Joy Capital are among those who have set up offices in Abu Dhabi.

🇨🇳 China vs. U.S.: Who's Winning Hearts and Minds? (Gallop)

America's ahead, but the world is growing disillusioned with both

This article is the third in a series detailing the results from the latest Rating World Leaders report, which analyzes trends in approval ratings of the leadership of the U.S., Germany, Russia and China in over 130 countries.

🇨🇳 Temu Cools on the U.S. After Shelling Out Billions (WSJ) $ 🗃️

App looks to reduce reliance on American shoppers as growth slows and scrutiny of TikTok grows

🇰🇷 The End of Korea Exchange's Monopoly - Launch of ATS in Korea in 1H 2025 (Douglas Research Insights)

KRX's monopoly is expected to end next year with the launch of ATS (Alternative Trading System) sometime in 1H 2025 (as early as March) in Korea.

The company that is responsible for operating the ATS is called Nextrade which was established in November 2022. Nextrade's ATS received its preliminary approval in July 2023.

Korea Exchange has been a money making machine. Although there have been repeated discussions of a potential listing of Korea Exchange in the past decade, this has yet to materialize.

🇰🇷 Big Fines on Foreign Investment Banks for Naked Short Selling in Korea - Implications (Douglas Research Insights)

The FSS mentioned it has uncovered 211 billion won of naked short sales by Credit Suisse and 8 other global banks of Korea-listed stocks between 2021 and 2023.

The current ban on short selling stocks could be extended to at least 1H 2025.

The Korean government's imposing these large fines on the foreign brokers is sending a message to the foreign brokers to not engage in naked short selling.

🇮🇳 Themes of India: Future of Data Centre in India (SmartKarma) $

India, with high data generation but low data center capacity, is attracting investments in India.

Rapid digital transformation and lower setup costs are driving India's data center market growth, offering significant investment opportunities.

Understanding India's potential as a data center hub highlights investment prospects and the need for sustainable practices in infrastructure development.

🇿🇦 SA consumers’ disposable income eroded by high interest rates, food inflation, says DebtBusters (IOL)

South African consumers’ disposable income was being eroded by persistently high interest rates and inflation (especially food inflation) while a lack of any meaningful economic growth was constraining their salaries.

This was revealed in the DebtBusters First Quarter 2024 Debt Index released yesterday.

🇿🇦 Big business exodus signals economic storm for SA: Ivo Vegter (BizNews)

As major multinational corporations like BHP, Shell [Shell’s winding down of SA operations part of global transition strategy], and Volkswagen make swift exits from South Africa, the economic horizon darkens. Their departures signal more than just business decisions; they’re ominous signs of a struggling economy 30 years into ANC rule. With plummeting manufacturing and mining sectors, coupled with an exodus of listed companies, South Africa faces a stark reality: without significant change, it risks fading into economic irrelevance. The time for transformation is now, before it’s too late to salvage the dreams of a prosperous nation.

When even big business calls it quits on South Africa, we have to accept that the economic outlook is poor.

🇿🇦 SA is key destination for investment, says Stellantis SA CEO (IOL)

“If you want to capitalise on the future of Africa, you need to be in Africa, and you have to be in South Africa,” Whitfield told a media round table.

Stellantis South Africa is part of Stellantis (NYSE: STLA), a multinational automotive company formed in 2021 by the merger of Fiat Chrysler and PSA Group and is the world's third largest auto manufacturer by sales.

Stellantis has well known brands such as Alfa Romeo, Chrysler, Citroën, Fiat, Jeep, Maserati, Opel, Peugeot, among others, and operates in 54 countries.

🇿🇦 Millennials drive the push to online shopping (IOL)

The Online Retail in South Africa 2023 report released yesterday by World Wide Worx - in partnership with Mastercard, Peach Payments, and Ask Afrika - showed the sector will go past the R100bn mark by 2026 and will also make up 10% of all retail sales in South Africa.

The arrival of Amazon.co.za in South Africa is probably the most momentous event in the local e-commerce industry since the launch of Checkers Sixty60 in 2020, the report states.

🇿🇦 Amazon’s ‘local is lekker’ strategy taps into growth potential (IOL)

Amazon.co.za is promising shoppers a reliable online shopping experience featuring great value, including same-day delivery, more than 3 000 pick-up points, easy returns, 24/7 customer support and free delivery on first orders either via its app or in a browser.

Amazon is competing head-on with Takealot, South Africa’s largest online retailer, but Takealot has a significant advantage in that it has been operating in South Africa since June 2011.

The US retailer will also compete with Loot.co.za and other online retailers, such as Makro.

🇵🇱 Poland's Pledge To Repatriate Conscription-Age Men To Ukraine Could Have Economic Costs (Forbes)

Beyond ethical considerations, the move could have a significant knock-on effect on the Polish economy as thousands of Ukrainian citizens residing in the country might be forced to leave their jobs and join the army.

Additionally, there are mounting concerns that a sizable number of them will seek to leave Poland to avoid draft.

A report by Deloitte for UNHCR, the UN Refugee Agency, found that Ukrainian refugees contributed 0.7-1.1% to Poland’s GDP in 2023 and estimated the effect would grow to 0.9-1.35% in the long term.

Most Ukrainians in Poland are employed in sectors such as industrial manufacturing, transport services, and construction, with nearly half of them holding roles that fall below their qualifications.

🇳🇮 🇨🇳 Chinese Megastores are Suffocating Nicaraguan Businesses (Confidencial)

Chinese stores with bargain basement prices are expanding far beyond Nicaragua’s capital. It’s a “slap in the face” to local commerce, merchants lament

🇦🇷 Milei is already proving the Left-wing economic establishment wrong (The Telegraph) $ 🗃️

Argentina’s reforms prove it’s possible to slash a bloated state

According to Bloomberg data, in the blue-chip swap market the peso was the best-performing currency in the world in the first quarter of this year, and the bond markets are rallying as well.

It may also get better over the months ahead. With stabilising prices, and a rising currency, investment should start flowing again into a country rich in natural resources and hyper-competitive on wages costs.

🇧🇷 Brazil Value Talks: Matoso (Brazil Stocks) $

Today I have the pleasure of interviewing Brazilian investor Matoso

From January 2017 to April 2024 his historic performance will be the envy of anyone.

His portfolio returned more than 6563.44% in the period, versus 113.72% for Ibovespa.

He multiplied the invested capital by 66x!

🌐 A warning from the breakdown nations (FT) $ 🗃️

The fates of former ‘model’ economies carry lessons for current stars

The takeaway here is not that smart countries somehow turned stupid. It is that hidden traps line the path of development and can spring on nations at every income level from the middle to the rich. One basic mistake or miss, and any country can find itself stuck — until it finds the leadership and vision to chart a way out. For current stars, the message is a warning: don’t take growth for granted.

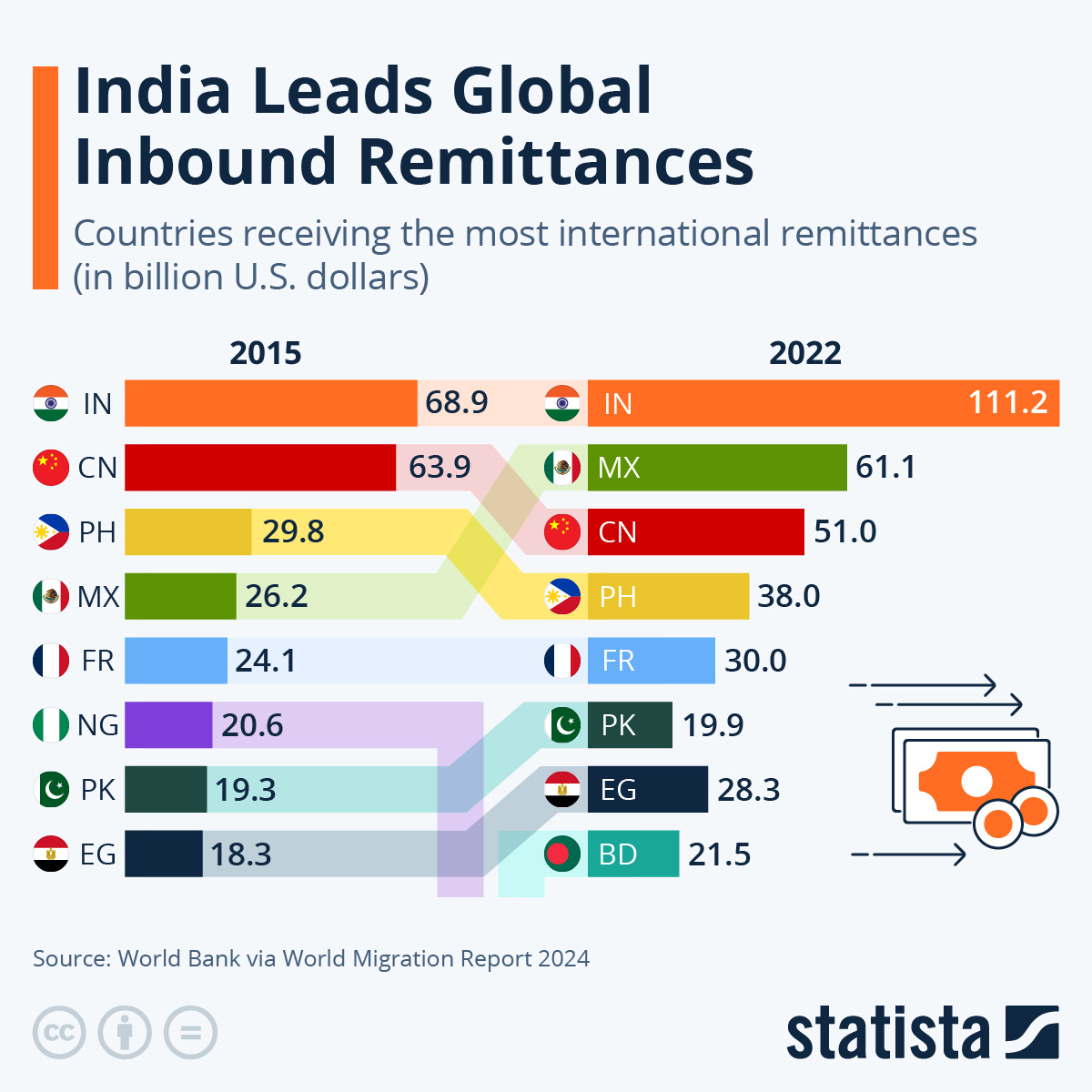

🌐 India Leads Global Inbound Remittances (Statista)

India received by far the highest international remittances of any country worldwide in 2022, according to World Bank data, also published in the International Organization for Migration’s (IOM) 2024 World Migration Report on Tuesday. International remittances are defined as money sent from workers living abroad to their home countries.

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

India Indian People's Assembly Apr 19, 2024 (d) Ongoing Apr 11, 2019

South Africa South African National Assembly May 29, 2024 (d) Confirmed May 8, 2019

Mexico Mexican Senate Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

Mexico Mexican Chamber of Deputies Jun 2, 2024 (t) Date not confirmed Jun 6, 2021

Mexico Mexican Presidency Jun 2, 2024 (t) Date not confirmed Jul 1, 2018

Bulgaria Bulgarian National Assembly Jun 9, 2024 (d) Confirmed Apr 2, 2023

Mongolia Mongolian State Great Hural Jun 28, 2024 (d) Confirmed Jun 24, 2020

Venezuela Venezuela Presidency Jul 28, 2024 (d) Confirmed May 20, 2018

Thailand Referendum Jul 31, 2024 (t) Date not confirmed Aug 7, 2016

Jordan Jordanian House of Deputies Sep 10, 2024 (d) Confirmed Nov 10, 2020

Czech Republic Czech Senate Sep 30, 2024 (t) Date not confirmed Sep 23, 2022

Romania Romanian Presidency Sep 30, 2024 (t) Date not confirmed Nov 24, 2019

Sri Lanka Sri Lankan Presidency Sep 30, 2024 (t) Date not confirmed Nov 16, 2019

Georgia Georgian Parliament Oct 26, 2024 (d) Confirmed Oct 31, 2020

Uruguay Uruguayan Presidency Oct 27, 2024 (t) Date not confirmed

Uruguay Uruguayan Chamber of Representatives Oct 27, 2024 (t) Date not confirmed

Uruguay Uruguayan Chamber of Senators Oct 27, 2024 (t) Date not confirmed

Georgia Georgian Presidency Nov 30, 2024 (t) Date not confirmed Nov 28, 2018

Romania Romanian Senate Nov 30, 2024 (t) Date not confirmed Dec 6, 2020

Romania Romanian Chamber of Deputies Nov 30, 2024 (t) Date not confirmed Dec 6, 2020

Namibia Namibian Presidency Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

Namibia Namibian National Assembly Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

Ghana Ghanaian Presidency Dec 7, 2024 (t) Date not confirmed Dec 7, 2020

Ghana Ghanaian Parliament Dec 7, 2024 (t) Date not confirmed Dec 7, 2020

Uzbekistan Uzbekistani Legislative Chamber Dec 31, 2024 (t) Tentative Dec 22, 2019

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Raytech Holding Ltd. RAY Revere Securities, 1.5M Shares, $4.00-5.00, $6.8 mil, 5/14/2024 Tuesday

Raytech Holding Ltd. is a holding company incorporated in the British Virgin Islands (“BVI”). As a holding company with no material operations, Raytech Holding’s operations are conducted by its wholly owned subsidiary, Pure Beauty Manufacturing Company Limited (“Pure Beauty”), in Hong Kong, a special administrative region of the People’s Republic of China (the “PRC”). (Incorporated in the British Virgin Islands)

We are not based in mainland China and do not have operations or generate revenue in mainland China, except that the manufacturers that manufacture our products are located in mainland China. We currently do not have or intend to set up any subsidiary in mainland China, and do not foresee the need to enter into any contractual arrangements with a variable interest entity (“VIE”) to establish a VIE structure in mainland China. For the fiscal years ended March 31, 2023, and March 31, 2022, we generated all our revenues from Hong Kong.

Leveraging our expertise in the personal care electrical appliance industry, we aim to promote consumer lifestyles and drive the awareness of personal grooming. Through Pure Beauty, we principally engage in the sourcing and wholesaling of personal care electrical appliances for international brand owners. We also provide product design and development collaboration as a value-added service for our customers. Our customers are brand owners of personal care electrical appliances who market and sell their personal care electrical appliances products to end consumers. Our customers include Koizumi Seiki Corp., one of the top 10 sellers in terms of retail volume in the personal care electrical appliance market in Japan as stated in “Personal Care Appliances in Japan” by Euromonitor International in December 2023. For the years ended March 31, 2023, and March 31, 2022, we generated 91.3 percent and 97.8 percent of our total revenue, respectively, from Koizumi Seiki Corp.

Commencing our operation in 2013, we have accumulated over 10 years of experience in the industry.

Over years of operation, we have sourced and wholesaled a wide range of personal care electrical appliances, which can be broadly classified into seven major categories: (i) hair styling series, including hair dryer, hair straightener and curling iron; (ii) trimmer series, including facial shaver, nose trimmer and eyebrow trimmer; (iii) eyelash curler; (iv) neck care series; (v) nail care series; (vi) tooling and (vii) other personal care appliance series, including body and facial brush, reset brush, callus remover, sonic peeling, handy fan and others. In particular, we are specialized in sourcing and wholesaling hair dryers within our hair styling series which primarily include salon-type hair protection and styling functions or compact design for travel. (See “Business – Business Overview – Product Sourcing and Wholesaling” on Page 93 of this prospectus.)

Note: Net income and revenue are in U.S. dollars for the fiscal year that ended March 31, 2023.

(Note: Raytech Holding Ltd. cut the size of its IPO to 1.5 million shares – down from 2.5 million shares – and kept the price range at $4.00 to $5.00 – to raise $6.75 million, according to an F-1/A filing dated Feb. 27, 2024. Background: Raytech Holding Ltd.’s first reduction in the size of its small-cap IPO came in mid-January 2024, when it cut the deal to 2.5 million shares – down from its original size of 3.0 million shares – and kept the price range at $4.00 to $5.00 – to raise $11.25 million. In November 2023, Raytech Holding Ltd. filed its S-1 and disclosed that it intended to offer 3.0 million shares at a price range of $4.00 to $5.00 to raise $13.5 million.)

Jiade Ltd. JDZG WestPark Capital, 2.2M Shares, $4.00-5.00, $9.9 mil, 5/15/2024 Wednesday

Our People’s Republic of China (PRC) subsidiaries are companies that specialize in providing one-stop comprehensive education support services to adult education institutions through a wide spectrum of software platform and auxiliary solutions to meet the evolving needs of their customers in the rapidly changing adult education industry. (Incorporated in the Cayman Islands)

Our PRC subsidiaries’ services are primarily offered through the Kebiao Technology Educational Administration Platform (the “KB Platform”), which facilitates streamlined information and data management throughout the teaching cycle of adult education services, from pre-enrollment to post-graduation. The KB Platform has enabled adult education institutions to improve student management efficiency, save labor costs, and reduce human errors in data management. The KB Platform supports a broad range of functions, such as enrollment consultation, student information collection, enrollment status management, learning progress management, grade inquiry, and graduation management.

As part of the one-stop comprehensive education supporting services, our PRC subsidiaries also provide auxiliary solutions to adult education institutions, which encompass teaching support services throughout the entire teaching cycle and related exam administration services. Specifically, our PRC subsidiaries offer pre-enrollment guidance on school/major selection and application strategy development, training for entrance exams, as well as assistance in the application process. They also provide offline tutoring, exam administration services, and guidance on graduation thesis preparation.

As of Sept. 30, 2023, our PRC subsidiaries had accumulatively provided technological support services to over 17 adult education institutions and had accumulatively provided support services to approximately 57,000 students.

Our PRC subsidiaries place a great premium on technology research and development. As of the date of this prospectus, our PRC subsidiaries have acquired 31 software copyrights since their incorporation in April 2020. In November 2022, Kebiao Technology, one of our PRC subsidiaries, was designated a High and New Technology Enterprise (“HNTE”) (No. GR202251000919) by Sichuan Provincial Department of Science and Technology, Sichuan Provincial Department of Finance, and Sichuan Provincial Tax Bureau of the State Taxation Administration. This certification is awarded to companies that have engaged in continuous research and development and technology commercialization leading to significant independent intellectual property rights within certain high-tech sectors.

Note: Net income of US$1.0 million on revenue of $1.6 million for the 12 months that ended Sept. 30, 2023, according to the prospectus.

(Note: Jiade Ltd. plans to offer 2.2 million ordinary shares at a price range of $4.00 to $5.00 to raise $9.9 million, according to its F-1/A filing dated March 11, 2024. Background: Jiade Ltd. filed its F-1 in late December 2023. The Chinese company’s Cayman Islands parent submitted its confidential IPO filing to the SEC in August 2023.)

RF Acquisition Corp. II RFAIU EarlyBird Capital, 10.0M Shares, $10.00-10.00, $100.0 mil, 5/17/2024 Friday

RF Acquisition Corp. II is a Singapore blank check company that intends to search for an acquisition target in Asia. We plan to focus on companies involved in AI (artificial intelligence), quantum computing and biotech. (Incorporated in the Cayman Islands)

Tse Meng Ng, our chairman and CEO since February 2024, is the co-founder and CEO of Ruipeng Wealth Management, a Singapore Capital Markets Services licensed financial institution. Mr. Ng and his team provide fund management services to ultra-high net worth individuals. He previously was a managing director of Credit Agricole.

Chee Soon Tham, our CFO, was an an audit partner at Ernst & Young in Singapore from 2004 until 2018. In 2018, he founded iCFO Advisors Pte Ltd., where he and his team provided outsourced financial due diligence and other services to publicly traded companies, including small and medium enterprises (SMEs).

(Note: RF Acquisition Corp. II disclosed in an F-1/A filing dated May 7, 2024, that Revere Securities has been named a co-manager of the IPO. Background: RF Acquisition Corp. II filed its F-1 on March 12, 2024, and disclosed terms for its SPAC IPO: 10.0 million units at $10.00 each to raise $100.0 million. Each unit consists of one share of common stock and one right to receive 1/20 of a share of stock upon the consummation of an initial business combination.)

🏁 Emerging Market ETF Launches

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

03/19/2024 - Avantis Emerging Markets ex-China Equity ETF AVXC - Active, equity, ex-China

03/15/2024 - Polen Capital China Growth ETF PCCE - Active, equity, China

03/04/2024 - Simplify Tara India Opportunities ETF IOPP - Active, equity, India

02/07/2024 - Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares XXCH - Equity, leveraged, China

01/11/2024 - Matthews Emerging Markets Discovery Active ETF MEMS - Active, equity, small caps

01/10/2024 - Matthews China Discovery Active ETF MCHS - Active, equity, small caps

11/07/2023 - Global X MSCI Emerging Markets Covered Call ETF EMCC - Equity, leverage

11/07/2023 - Avantis Emerging Markets Small Cap Equity ETF AVEE - Active, equity, small caps

09/22/2023 - Matthews Asia Dividend Active ETF ADVE - Active, equity, Asia

09/22/2023 - Matthews Pacific Tiger Active ETF ASIA - Active, equity, Asia

09/22/2023 - Matthews Emerging Markets Sustainable Future Active ETF EMSF - Active, equity, ESG

09/22/2023 - Matthews India Active ETF INDE - Active, equity, India

09/22/2023 - Matthews Japan Active ETF JPAN - Active, equity, Japan

09/22/2023 - Matthews Asia Dividend Active ETF ADVE - Active, equity, Asia

08/25/2023 - KraneShares Dynamic Emerging Markets Strategy ETF KEM - Active, equity, emerging markets

08/18/2023 - Global X India Active ETF NDIA - Active, equity, India

08/18/2023 - Global X Brazil Active ETF BRAZ - Active, equity, Brazil

07/17/2023 - Matthews Korea Active ETF MKOR - Active, equity, South Korea

05/18/2023 - Putnam Emerging Markets ex-China ETF PEMX - Active, value, growth stocks

05/11/2023 - JPMorgan BetaBuilders Emerging Markets Equity ETF BBEM - Passive, large + midcap stocks

03/16/2023 - JPMorgan Active China ETF JCHI - Active, equity, China

03/03/2023 - First Trust Bloomberg Emerging Market Democracies ETF EMDM - Principles-based

1/31/2023 - Strive Emerging Markets Ex-China ETF STX - Passive, equity, emerging markets

1/20/2023 - Putnam PanAgora ESG Emerging Markets Equity ETF PPEM - Active, equity, ESG, emerging markets

1/12/2023 - KraneShares China Internet and Covered Call Strategy ETF KLIP - Active, equity, China, options overlay, thematic

1/11/2023 - Matthews Emerging Markets ex China Active ETF MEMX - Active, equity, emerging markets

12/13/2022 - GraniteShares 1.75x Long BABA Daily ETF BABX - Active, equity, leveraged, single stock

12/13/2022 - Virtus Stone Harbor Emerging Markets High Yield Bond ETF VEMY - Active, fixed income, junk bond, emerging markets

9/22/2022 - WisdomTree Emerging Markets ex-China Fund XC - Passive, equity, emerging markets

9/15/2022 - KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV - Passive, equity, Asia, dividend strategy

9/15/2022 - OneAscent Emerging Markets ETF OAEM - Active, Equity, emerging markets, ESG

9/9/2022 - Emerge EMPWR Sustainable Select Growth Equity ETF EMGC - Active, equity, emerging markets

9/9/2022 - Emerge EMPWR Unified Sustainable Equity ETF EMPW - Active, equity, emerging markets

9/8/2022 - Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH - Active, equity, emerging markets, ESG

7/14/2022 - Matthews China Active ETF MCH - Active, equity, China

7/14/2022 - Matthews Emerging Markets Equity Active ETF MEM - Active, equity, emerging markets

7/14/2022 - Matthews Asia Innovators Active ETF MINV - Active, equity, Asia

6/30/2022 - BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD - Passive, fixed income, emerging markets

5/2/2022 - AXS Short CSI China Internet ETF SWEB - Active, inverse, thematic

4/27/2022 - Dimensional Emerging Markets High Profitability ETF DEHP - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Core Equity 2 ETF DFEM - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Value ETF DFEV - Active, equity, emerging markets

4/27/2022 - iShares Emergent Food and AgTech Multisector ETF IVEG - Passive, equity, thematic [Mostly developed markets]

4/21/2022 - FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM - Passive, equity, ESG

4/6/2022 - India Internet & Ecommerce ETF INQQ - Passive, equity, thematic

2/17/2022 - VanEck Digital India ETF DGIN - Passive, India market, thematic

2/17/2022 - Goldman Sachs Access Emerging Markets USD Bond ETF GEMD - Passive, fixed income, emerging markets

1/27/2022 - iShares MSCI China Multisector Tech ETF TCHI - Passive, China, technology

1/11/2022 - Simplify Emerging Markets PLUS Downside Convexity ETF EMGD - Active, equity, options strategy

1/11/2022 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG - Passive, equity, ESG

🚽 Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

03/25/2024 - Global X MSCI Nigeria ETF - NGE

03/21/2024 - VanEck Egypt Index ETF - EGPT

03/14/2024 - KraneShares Bloomberg China Bond Inclusion Index ETF - KBND

03/14/2024 - KraneShares China Innovation ETF - KGRO

03/14/2024 - KraneShares CICC China Consumer Leaders Index ETF - KBUY

03/13/2024 - Xtrackers MSCI All China Equity ETF - CN

03/13/2024 - Xtrackers MSCI China A Inclusion Equity ETF - ASHX

02/16/2024 - Global X MSCI China Real Estate ETF - CHIH

02/16/2024 - Global X MSCI China Biotech Innovation ETF - CHB

02/16/2024 - Global X MSCI China Utilities ETF - CHIU

02/16/2024 - Global X MSCI Pakistan ETF - PAK

02/16/2024 - Global X MSCI China Materials ETF - CHIM

02/16/2024 - Global X MSCI China Health Care ETF - CHIH

02/16/2024 - Global X MSCI China Financials ETF - CHIX

02/16/2024 - Global X MSCI China Information Technology ETF - CHIK

02/16/2024 - Global X MSCI China Consumer Staples ETF - CHIS

02/16/2024 - Global X MSCI China Industrials ETF - CHII

02/16/2024 - Global X MSCI China Energy ETF - CHIE

02/14/2024 - BNY Mellon Sustainable Global Emerging Markets ETF - BKES

01/26/2024 - The WisdomTree Emerging Markets ESG Fund - RESE

11/11/2023 - Global X China Innovation ETF - KEJI

11/11/2023 - Global X Emerging Markets Internet & E-commerce ETF - EWEB

11/09/2023 - Franklin FTSE South Africa ETF - FLZA

10/27/2023 - Simplify Emerging Markets Equity PLUS Downside Convexity - EMGD

10/20/2023 - WisdomTree India ex-State-Owned Enterprises Fund - IXSE

10/20/2023 - WisdomTree Chinese Yuan Strategy Fund - CYB

10/20/2023 - Loncar China BioPharma ETF - CHNA

10/18/2023 - KraneShares Emerging Markets Healthcare Index ETF - KMED

10/18/2023 - KraneShares MSCI China ESG Leaders Index ETF - KSEG

10/18/2023 - KraneShares CICC China Leaders 100 Index ETF - KFYP

10/16/2023 - Strategy Shares Halt Climate Change ETF - NZRO

09/20/2023 - VanEck China Growth Leaders ETF - GLCN

08/28/2023 - Asian Growth Cubs ETF - CUBS

08/01/2023 - VanEck Russia ETF - RSX

07/07/2023 - Emerge EMPWR Sustainable Emerging Markets Equity ETF - EMCH

06/23/2023 - Invesco PureBeta FTSE Emerging Markets ETF - PBEE

06/16/2023 - AXS Short China Internet ETF - SWEB

04/11/2023 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF - REMG

3/30/2023 - Invesco BLDRS Emerging Markets 50 ADR Index Fund - ADRE

3/30/2023 - Invesco BulletShares 2023 USD Emerging Markets Debt ETF - BSCE

3/30/2023 - Invesco BulletShares 2024 USD Emerging Markets Debt ETF - BSDE

3/30/2023 - Invesco RAFI Strategic Emerging Markets ETF - ISEM

2/17/2023 - Direxion Daily CSI 300 China A Share Bear 1X Shares - CHAD

1/13/2023 - First Trust Chindia ETF - FNI

12/28/2022 - Franklin FTSE Russia ETF - FLRU

12/22/2022 - VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

8/22/2022 - iShares MSCI Argentina and Global Exposure ETF AGT

8/22/2022 - iShares MSCI Colombia ETFI COL

6/10/2022 - Infusive Compounding Global Equities ETF JOYY

5/3/2022 - ProShares Short Term USD Emerging Markets Bond ETF EMSH

4/7/2022 - DeltaShares S&P EM 100 & Managed Risk ETF DMRE

3/11/2022 - Direxion Daily Russia Bull 2X Shares RUSL

1/27/2022 - Legg Mason Global Infrastructure ETF INFR

1/14/2022 - Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (May 13, 2024) was also published on our website under the Newsletter category.