Emerging Market Links + The Week Ahead (October 30, 2023)

China’s sovereign wealth fund tries to shore up stock market, marriage loses its luster in China, Colombia’s leftist president suffers setbacks, EM stock picks and the week ahead for emerging markets.

Caixin has reported that the domestic arm of China’s sovereign wealth fund is buying exchange-traded funds to try and shore up local stock market. Whether that will be enough to make up for foreign fund outflows and local retail investors who are no doubt skittish due to problems in the property sector remains to be seen.

In Latin America, Colombia’s leftist president was dealt blow in local elections. Apparently, Petro’s polarising plans to overhaul health, pension and labour laws have struggled to gain cross-party support in congress while his government and family have been embroiled in scandal (Also see: Global X MSCI Colombia ETF Holdings (September 2023)).

Finally, I had to use up China Airlines frequent flyer miles from before COVID that were about to expire to fly to Tokyo (via longggg layovers in Taiwan due to the lack of redemption seats for Osaka + the autumn Japan foliage season) for a few days, and have just arrived in Kyoto for the next two weeks intending to see as many temples and gardens as possible.

I already have some usual monthly posts almost ready (albeit I might take an extra day to write the Tuesday posts). Later this month, I will do some trip reports for Japan and Taiwan focused more on stocks that you might encounter as a traveler to both e.g. 7-Eleven, etc.

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

🇿🇦 Business Day TV Daily Stock Picks (September 2023)

Exxaro Resources, Naspers, Spar, LVMH Moët Hennessy Louis Vuitton, FirstRand, Grindrod Shipping, Afrimat, Life Healthcare, Bidvest Group, Shoprite, Southern Sun, Impala Platinum, MTN Group, Stadio Holdings, Curro Holdings, ADvTech, Mercadolibre, Motus, SA Banks, Rhodes Food Group, Sun International, Sappi, Mondi, Sibanye-Stillwater, Hosken Consolidated Investments, Antofagasta Plc, African Rainbow Capital Investments, Richemont, Octodec Investments, Mustek, Woolworths, Nepi Rockcastle, Grindrod, Alexander Forbes Group Holdings, Glencore, Calgro M3 and Super Group

📰🔬 Emerging Market Stock Picks / Stock Research

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Cainiao Smart Logistics IPO: The Bear Case (Smart Karma) $

Cainiao Smart Logistics (1437124D HK), a global leader in e-commerce logistics, has filed for a HKEx IPO to raise at least US$1 billion at a US$15-20 billion valuation.

In Cainiao Smart Logistics IPO: The Bull Case, we highlighted the key elements of the bull case. In this note, we outline the bear case.

The bear case rests on declining global cross-border market share, China logistics decelerating growth, high related-party transactions, and FCF burn.

🇨🇳 Guoquan’s growth goes into simmer mode post-Covid (Bamboo Works)

The home hotpot specialist, one of China’s leading ‘dine-at-home’ brands, has been approved for a Hong Kong IPO

Guoquan Food returned to the black in the first four months of this year, earning a profit of nearly 120 million yuan

The dine-at-home family hotpot brand sharply expanded its network of retail stores during the pandemic, but is entering a slower growth phase as dining patterns return to normal

🇨🇳 Luyuan cruises out of IPO gate on zooming electric two-wheeler sales (Bamboo Works)

The maker of battery-powered scooters and bicycles raised about $90 million in an oversubscribed Hong Kong listing

Luyuan Group Holding Cayman Ltd (HKG: 2451) priced its IPO shares close to the top of their indicative range, though the stock is largely unchanged a week after its trading debut

The company’s revenue doubled in the two years to 2022, with its net profit growing even faster

🇨🇳 Noble Family Wine hopes to be the toast of Hong Kong (Bamboo Works)

Inspired by fellow liquor brand ZJLD Group (HKG: 6979), the Chinese wine distributor plans to pull out of the mainland NEEQ market and list its shares in Hong Kong

Noble Family Wine has been profitable for three years in a row, meeting the criteria for a Hong Kong listing

The company’s revenue from red wine sales almost tripled in the first half of the year, but gross margin on the business plunged 3.3 percentage points to 6.3%

🇨🇳 Ping An Health pins recovery hopes on new leadership (Bamboo Works)

The ailing healthcare platform brought in a whole new management team three years ago to drive a business turnaround but it is changing leaders again

The Covid pandemic boosted traffic to online medical platforms, but a strategy shift meant Ping An Healthcare and Technology (HKG: 1833 / FRA: 1XZ / OTCMKTS: PANHF) could not capitalize on the opportunity, and its revenues fell

The platform has become more dependent on its parent, Ping An (HKG: 2318 / OTCMKTS: PNGAY), with its five main customers all affiliated to the insurer and providing nearly 24% of revenue

🇨🇳 Pop Mart (9992 HK): Strong 3Q23 Operational Update; Thesis Intact (Smart Karma) $

Pop Mart International Group (HKG: 9992 / FRA: 735) announced at noon today a business update on 3Q23.

Overall sales in 3Q23 grew 35-40% yoy, with domestic China sales up 25-30% yoy and international sales up 120-125% yoy.

Thesis intact, as the 3Q23 update showed that the international business continued to grow rapidly at 120-125% yoy growth.

🇨🇳 Asian Dividend Gems: Tingyi Holding (Smart Karma) $

Shares of Tingyi Holding (HKG: 0322 / FRA: TYG / OTCMKTS: TCYMF / TYCMY) are oversold. It has high dividend yield and attractive valuations. Its core instant noodles and beverage businesses are turning around this year.

The consensus expects DPS of HKD 0.62 for Tingyi in 2023 which would suggest a dividend yield of 6.1%. Tingyi Holding's dividend yield averaged 5% annually from 2018 to 2022.

Tingyi's "Master Kong" instant noodle is one of the best known brands in China. The company is also one of the largest producers and distributors of beverages in China.

🇨🇳 Travel rush is not golden enough for investors in CTG Duty Free (Bamboo Works)

Shares in China’s leading operator of duty-free stores have slumped after the company failed to meet high expectations for a post-pandemic rebound

China Tourism Group Duty Free (CTGDF) (HKG: 1880 / SHA: 601888)’s revenues jumped nearly 28% in the third quarter and net profit surged 93%, but the recovery from Covid lows was not vigorous enough to satisfy shareholders

The death of the company chairman, a pivotal figure at the firm, could add to market jitters as CTG’s fourth-quarter performance comes under scrutiny

🇨🇳 Nayuki brews up traditional teahouse concept (Bamboo Works)

The premium tea seller opened its first teahouse concept store in Shenzhen over the weekend, serving traditional-style teas and snacks at affordable prices,

Nayuki Holdings (HKG: 2150 / OTCMKTS: NYKHF) is experimenting with a new store format selling traditional-style teas at affordable prices, with the opening of a concept store in Shenzhen

The premium tea seller recorded its first-ever adjusted profit in the first half of this year, but could face challenges as consumers rein in their spending

🇨🇳 Domino’s China partner serves up profits, new milestone in rapid growth story (Bamboo Works)

DPC Dash (HKG: 1405 / FRA: X12) opened its 700th store of the U.S. pizza chain last month, and said it’s on track to open 180 new stores in China this year

DPC Dash said it’s on track to open 180 new Domino’s stores in China this year – and plans to more than double its total store count to 1,500 by the end of 2026

The company’s stock has risen by nearly 70% since late August after it posted its first-ever profit and became accessible to Mainland China-based traders

🇰🇷 Hansoh Pharmaceutical (3692 HK): New Licensing Deal Boosts Conviction on Innovative Pipeline Prowess (Smart Karma) $

Hansoh Pharmaceutical Group (HKG: 3692 / FRA: 3KY / OTCMKTS: HNSPF) entered into a license agreement with GlaxoSmithKline PLC (GSK LN) for a B7-H4 targeted antibody-drug conjugate candidate, HS-20089, targeted toward gynecological cancers.

Hansoh will receive an upfront payment of $85M and be eligible to receive milestone payments of up to $1.485B subject to achievement of relevant milestone events with respect to HS-20089.

Currently, HS-20089 is in phase 1 clinical trial in China. GSK plans to begin phase 1 trial of HS-20089 outside of China in 2024.

🇰🇷 LS Materials IPO Preview (Smart Karma) $

LS Materials is getting ready to complete its IPO in Korea in late November. The IPO price range is from 4,400 won to 5,500 won per share.

According to the bankers' valuation, the expected market cap after the IPO is from 298 billion won to 372 billion won.

LS Materials is one of the largest players globally in the large-size ultracapacitors, which stabilize power supply and are used to replace and supplement primary batteries and lithium-ion batteries.

🇰🇷 Increasing Probability of Kakao Corp Losing Its Controlling Shareholding of Kakao Bank (Smart Karma) $

In this insight, we discuss the increasing probability of Kakao (KRX: 035720) losing its controlling shareholding of KakaoBank (KRX: 323410).

The FSS Chairman Lee Bok-Hyun emphasized that the FSS may punish Kakao Corp for a potential stock manipulation of S.M.Entertainment amid the M&A tender offer process earlier this year.

At this point, the higher probability event appears to be a combination of fine and Kakao Corp selling at least 10% of its stake in Kakao Bank to another company.

🇰🇭 🇭🇰 NagaCorp says on track to repay fully its 2024 notes (GGRAsia)

NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF), operator of NagaWorld, a casino resort monopoly in the Cambodian capital Phnom Penh, says it will have “sufficient” capital to repay its US$472.2-million outstanding notes, maturing in July 2024.

The company had “cash and bank balances” of US$324 million as of October 17, it stated in a Thursday filing to the Hong Kong Stock Exchange.

Last week the casino firm said it got a loan of US$80 million, at 8.0-percent annual interest. The lender is ChenLipKeong Capital Ltd, a company controlled by The Sakai Trust, a family trust established by Chen Lip Keong. Mr Chen is the controlling shareholder and senior chief executive of NagaCorp.

🇸🇬 These 4 Singapore Stocks’ Share Prices Are Touching Their 52-Week Lows: Are They a Bargain? (The Smart Invvestor)

Raffles Medical Group (SGX: BSL / FRA: 02M1 / OTCMKTS: RAFLF), or RMG, is an integrated healthcare player operating in 14 cities within five countries in Asia.

The Hour Glass (SGX: AGS), or THG, owns a chain of 55 luxury watch boutiques across nine cities in the Asia Pacific region.

City Developments Limited (SGX: C09 / FRA: CDE / OTCMKTS: CDEVY), or CDL, is a global real estate company with a presence in 143 locations within 28 countries.

Wilmar International (SGX: F34 / FRA: RTHA / RTH / OTCMKTS: WLMIF / WLMIY) is a leading agribusiness group with an integrated business model that encompasses the entire value chain of the agricultural commodity business.

🇮🇳 ICICI Bank: Earnings Beat Overshadowed By NIM Contraction And Competition (Seeking Alpha) $

ICICI Bank (NYSE: IBN)'s bottom line expanded by +36% YoY in Q2 FY 2024, and this was +9% above market expectations.

But ICICI Bank's outlook isn't that favorable, considering expectations of continued net interest margin compression, and competitive risks.

My Hold rating for IBN stock remains intact, taking into account both its second quarter performance and its near-term prospects.

🇵🇱 Dino Polska: Where is it headed? A destination analysis (Atmos Invest - Hunting for 100-baggers)

Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY)

Nick Sleep popularized the term destination analysis in his letters. (if you haven’t read them, please do, you’ll learn a lot and they are excellently written). My goal is to perform such an analysis in order:

To paint a picture of where Dino could be going in 20 years

To get to a better understanding of the business, to get to the DNA of the company

To identify what management can do to get there in the future (for example are they perhaps sacrificing short-term gains to benefit their long-term destination)

To see the risks, what could prevent the company from reaching its destination

To evaluate if Nick Sleep would buy the company

🇦🇷 Central Puerto: More Risk Than Reward (Seeking Alpha) $

Central Puerto (NYSE: CEPU) is a poor investment choice due to unappealing valuation, deteriorating macroeconomic landscape, and unconvincing acquisitions.

The company's vulnerability to the fluctuating Argentine peso and the shaky national economy poses significant risks.

Central Puerto's financial performance has shown extreme volatility and lacks clear growth, further impacting its investment potential.

🇦🇷 Telecom Argentina: Improvements Don't Justify Its Premium Valuation (Seeking Alpha) $

Telecom Argentina SA (NYSE: TEO) has faced challenges in recent years due to the Argentine debt crisis and increased competition in the telecommunications industry.

The company has managed to offset some costs despite extreme inflation levels in Argentina, and its leverage situation has improved.

The valuation of Telecom Argentina remains elevated compared to its peers in Latin America, as indicated by the high multiples in forward P/E, EV/EBITDA, and Price/Cash Flow ratios.

🇧🇷 BrasilAgro: Real Estate Resilience During A Challenging Harvest (Seeking Alpha) $

Brasilagro - Co Brasileira De Proprieda (NYSE: LND) should report a lower yield due to challenging factors in the 2022/23 harvest, but maintains a positive outlook for the future.

The company's strategy revolves around efficient real estate transactions and profitable agricultural production, with an emphasis on mitigating risk.

Despite dividend concerns and market fluctuations, BrasilAgro remains an attractive option for income-oriented investors, with the potential for strong returns and appreciation in its stock value.

🇧🇷 Suzano: Still A Buy Despite Cyclical Weakness (Seeking Alpha) $

Suzano S.A. (NYSE: SUZ) has seen a 16.5% increase in its stock price since my previous article.

Suzano will release its third quarter 2023 results on October 26 and hold an annual investor day the next day.

In this article, I assess how our investment thesis has fared so far and review the factors that have been driving the recent share price gains.

Suzano stock seems to still be cheap and to have a major catalyst down the road, making this industry leader an attractive target to buy.

🇧🇷 Klabin: Q3 Earnings, Resilience In The Face Of Industry Challenges (Seeking Alpha) $

Klabin (BVMF: KLBN3 / OTCMKTS: KLBAY)'s Q3 results show resilience in the face of challenging sector conditions, particularly low pulp prices.

The paper unit showed promising results with a recovery in packaging sales, while the pulp division had a weak performance.

Despite weak net profit, Klabin's performance in its paper unit and substantial volume of pulp sales are positive highlights.

The company is expected to continue distributing substantial dividends, with a potential yield of 5% to 6%.

🇧🇷 Nu Holdings Stock: Finally Following Warren Buffett's Lead (Seeking Alpha) $

Nu Holdings (NYSE: NU) is among the best-performing portfolio constituents of Berkshire Hathaway this year.

Wall Street analysts, including JPMorgan and Morgan Stanley, have expressed bullish sentiments about Nu Holdings, citing the potential for market share gains and cost advantages.

Latin America remains underpenetrated and underserved by traditional banks, offering a growing market for Nu Holdings to thrive.

Nu's current valuation, in my opinion, is reasonable because of a few main reasons.

🇨🇱 Enel Chile: An Undervalued Company With A Solid Yield (Seeking Alpha) $

Enel Chile (NYSE: ENIC) is a Chilean electricity utility company involved in the complete energy supply chain, including generation, transmission, and distribution.

The company achieved notable growth in its Generation segment, driven by increased solar and hydroelectric production.

However, the Distribution & Networks segment experienced a decline in operating revenues due to changes in the company's consolidation perimeter.

Despite rising sharply over the past year, ENIC stock remains undervalued amid its <2x forward EV/EBITDA and high dividend yield.

🇨🇴 Ecopetrol: A Beneficiary Of Rising Oil Prices, Macro Risks Still Apparent (Seeking Alpha) $

Global oil prices remain high amid geopolitical tensions, offering risks and opportunities for Energy sector stocks and dividend investors.

I am upgrading Ecopetrol SA (NYSE: EC) from sell to hold due to its decent operating performance and stabilizing earnings.

The company faces risks from debt, volatile oil prices, and political instability in South America.

I outline key price levels to watch on the chart ahead of Q3 earnings due out next month.

🇺🇾 DLocal: Hypergrowth Leaves Room For Stock Appreciation (Seeking Alpha) $

Dlocal (NASDAQ: DLO) has immense revenue growth with a most recent quarterly growth of 59%.

The company operates a payment processing platform in emerging markets, with a current large focus on Latin America.

The company has achieved good profitability while growing with stable cash flows.

My DCF model estimates a good upside for the stock, leading to a buy-rating.

📰🔬 Further Suggested Reading

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 In Depth: China banks jump on AI bandwagon to cut costs (Caixin) $

Banks in China are turning to artificial intelligence to save on labor costs and improve efficiency, but the transition faces both technical and regulatory hurdles, according to experts in the field.

The worldwide AI fervor driven by ChatGPT, the intelligent chatbot developed by Microsoft-backed OpenAI, has led industries across the spectrum to start integrating the smart helpers into their daily operations. Banking is no exception.

🇨🇳 Central Huijin steps up investment to bolster stock market (Caixin) $

Central Huijin Investment Ltd., the domestic arm of China’s sovereign wealth fund China Investment Corp., bought exchange-traded funds Monday in an apparent move to shore up the sagging stock market.

Central Huijin didn’t elaborate on the amount of ETFs it purchased but said it will keep expanding such holdings in the future. It was the second time this month that the state-run fund disclosed its open-market investment, following a 477 million yuan ($65.7 million) purchase of shares in the nation’s Big Four lenders.

🇨🇳 China tech IPOs decline as regulators turn tough on start-ups (FT) $ 🗃️

Policy reversal leads to record number of listing applications pulled this year from tech-focused Star Market

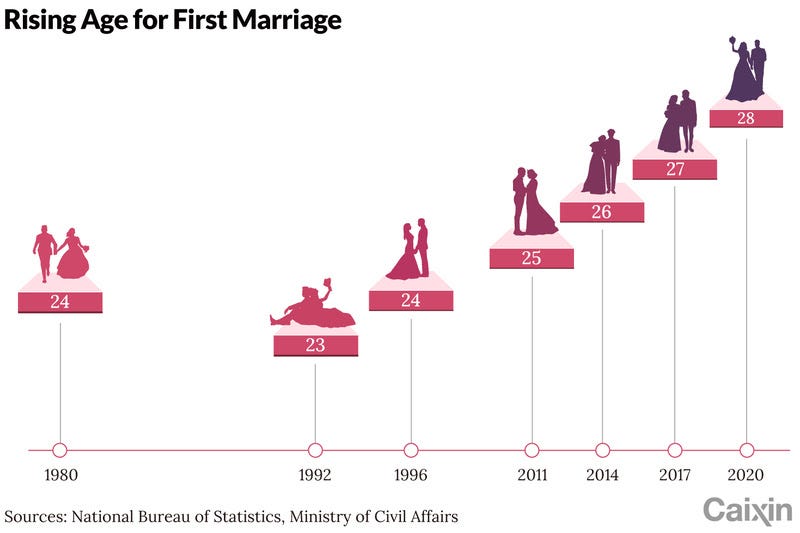

🇨🇳 Charts of the Day: Marriage loses its luster in China (Caixin) $

The number of marriage registrations in China plunged last year to the fewest in 43 years as more young people opted to stay single. The decline adds to pressure on the country’s sliding birth rate, which is driving a profound demographic shift.

Marriage registrations dropped 10.6% year-on-year to 6.8 million couples, according to data from the Ministry of Civil Affairs released earlier this month. The marriage rate was 4.8 per thousand, declining 0.06 of a percentage point from the previous year.

🇨🇳 🇹🇼 Foxconn: China probes warn Taiwanese to Gou figure (FT) $ 🗃️

Note: Gou is running for President of Taiwan.

Historically, such investigations have foreshadowed broader crackdowns

🇮🇳 How can UK retail investors get into India? (FT) $ 🗃️

£4bn in assets under management in UK retail funds focused on India and the subcontinent

🇨🇴 Colombia’s leftist president dealt blow in local elections (FT) $ 🗃️

Gustavo Petro’s allies suffer ‘punishment vote’ as opposition sweeps mayoral races in major cities

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

ArgentinaArgentinian Chamber of DeputiesOct 22, 2023 (d) Confirmed Oct 24, 2021ArgentinaArgentinian SenateOct 22, 2023 (d) Confirmed Nov 14, 2021ArgentinaArgentinian PresidencyOct 22, 2023 (d) Confirmed Aug 13, 2023ArgentinaArgentinian Presidency Nov 19, 2023 (d) Confirmed Oct 22, 2023

Egypt Egyptian Presidency Dec 10, 2023 (d) Confirmed Mar 26, 2018

Chile Referendum Dec 17, 2023 (t) Confirmed Sep 4, 2022

Taiwan Taiwanese Legislative Yuan Jan 13, 2024 (d) Confirmed Jan 11, 2020

Taiwan Taiwanese Presidency Jan 13, 2024 (d) Confirmed Jan 11, 2020

Pakistan Pakistani National Assembly Jan 31, 2024 (t) Postponed Jul 25, 2018

Indonesia Indonesian Regional Representative Council Feb 14, 2024 (t) Confirmed Apr 17, 2019

Indonesia Indonesian Presidency Feb 14, 2024 (t) Confirmed Apr 17, 2019

Indonesia Indonesian House of Representatives Feb 14, 2024 (t) Confirmed Apr 17, 2019

Panama Panamanian National Assembly May 5, 2024 (t) Confirmed May 5, 2019

Panama Panamanian Presidency May 5, 2024 (t) Confirmed May 5, 2019

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Prospect Energy Holdings Corp. AMGSU, EF Hutton, 7.5M Shares, 10.00-10.00, $75.0 mil, 10/30/2023 Week of

We are a blank check company focused on the Asia Pacific region, excluding China, and the clean energy sector. Each unit consists of one share of stock and one warrant redeemable for one share of stock. (Incorporated in the Cayman Islands)

While we may pursue a target in any industry, section or geography, we intend to focus our search for a target business in Asia Pacific, excluding China, (with emphasis on Australia) and Canada. We will search for companies engaged in the clean energy industry, concentrating on the utilization of “clean coal” or other evolving segments in the clean energy ecosystem, particularly the use of carbon, hydrogen and renewable energy. Other areas may include energy storage, distributed energy, zero-emission transportation, carbon utilization, low or carbon-free industrial applications and sustainable manufacturing.

We believe that clean energy and sustainability solutions are revolutionizing many traditional industries and creating numerous investment opportunities which are driven by important long-term global trends, such as the cost of carbon emissions, regulatory incentive programs, and consumers’ increasing value placed on clean energy products and services, in addition to advancements in technology providing for more cost-effective solutions and alternatives to fossil fuels. We believe that the regulatory frameworks incentivizing the adoption of sustainable practices and technologies will become increasingly favorable to the sectors that we are targeting. These trends provide long-term benefits for companies that develop and distribute services and products that take part of an integrated approach to the continued decarbonization of the economy.

We intend to target the growth-oriented subsectors of the clean and sustainable energy industry that present particularly attractive investment opportunities. We do not intend to acquire early-stage start-up companies, companies with speculative business plans or companies that are excessively leveraged. We are not, however, required to complete our initial business combination with a clean and sustainable energy business and, as a result, we may pursue a business combination beyond that sector and scope. We will seek to acquire high-quality businesses that can generate attractive, risk-adjusted returns for shareholders.

We believe our management team is uniquely positioned to source and evaluate deals globally, with strong relationships in Asia Pacific (and particularly in Australia) and Canada which may offer attractive growth prospects with advantageous valuation multiples. We believe that our expertise and experience in major worldwide markets, including Asia Pacific, give us a robust pool of targets and increasing the possibility to maximize returns. In addition, our management team has extensive expertise in the evolution of clean energy, especially in Asia Pacific, which will enable us to better evaluate and source target companies. Our management team is also experienced in executing complex financial structures for large scale projects in the energy industry in Asia Pacific, Canada and Australia, which will give us access to leaders in the energy industry and the ability to facilitate future energy projects. We believe this approach, as well as our management team’s recognized track record of completing acquisitions across a variety of subsectors within the clean energy industry will provide meaningful opportunities to drive value creation for shareholders.

(Note: Prospect Energy Holdings Corp. slashed its SPAC IPO by 75 percent to 7.5 million units – down from 30.0 million units – at $10.00 each – to raise $75.0 million in an S-1/A dated Aug. 24, 2023. The S-1 was filed May 3, 2023.)

Zhong Yuan Bio-Technology Holdings Ltd ZYB, Revere Securities / R.F. Lafferty & Co., 1.1M Shares, $5.00-7.00, $6.6 mil, 10/30/2023 Week of

(Note: This is NOT an IPO. This is a micro-cap NASDAQ uplisting from the OTC Market.)

, where the company’s stock traded under the symbol “ZHYBF” and closed on Wednesday, Oct. 26, 2022, at $2.37. In an F-1/A filing dated March 1, 2023, the company said it intends to offer 1.5 million ordinary shares at $5.00 – the mid-point of its $4.00-to-$6.00 price range – to raise $7.5 million. A selling stockholder will offer 500,000 shares. The company will not receive any proceeds from the sale of the selling stockholder’s shares. As of the April 4, 2023, filing with the SEC, the company had still not disclosed its proposed stock symbol for the NASDAQ listing. **Note: On July 24, 2020, the company completed a 1-for-10 reverse stock split.)

Zhong Yuan Bio-Technology Holdings Limited is the Cayman Islands-incorporated holding company, which is offering the shares in this public offering.

We do business through our sole operating subsidiary, Bao Feng, which conducts business operations in China.

Bao Feng is in the business of nervonic acid research, the development of nervonic acid-based herbal and chemical drugs, and the sale of health supplements containing nervonic acid.

Nervonic acid is a long chain unsaturated omega 9 fatty acid that is an important component in myelin biosynthesis in the central and peripheral nervous system. Myelin insulates nerve cell axons to increase the speed at which information (encoded as an electrical signal) travels from one nerve cell body to another or from a nerve cell to another type of cell in the body. It is thought that nervonic acid may enhance brain function and prevent demyelination of nerve cells, and that, therefore, it may be effective in retaining or improving the health of the brain, for example in preventing or ameliorating attention-deficit hyperactive disorder (“ADHD”) in children, Alzheimer’s disease and mental degradation in the elderly and cerebrovascular disease, as well as promoting normal brain development in premature infants. The role of nervonic acid is also being studied with respect to psychotic illnesses, such as schizophrenia.

Bao Feng extracts the nervonic acid that it uses in its products from the seeds of the Acer truncatum tree, a type of maple tree native to northern China, Mongolia and Korea.

Bao Feng intends to expand its product line by building factories for purification of nervonic acid for medical level product usage.

Bao Feng is in the process of developing early screening kits for brain white matter signal abnormalities, Parkinson’s disease and ischemic strokes. It is in the clinical trial stage. After completion of clinical trials, Bao Feng will apply to the Ministry of Health of the PRC for an innovation Class III product registration certificate and related business operation license in China for the production and sale of domestic disposable medical devices. It intends to distribute its innovation Class III products to major clinics and hospitals through domestic distributors, as well as through direct sales to its partner hospitals and other medical institutions.

**Use of net proceeds from this offering: (i) research and development of an in vitro diagnosis kit for early screening of neurological diseases; (ii) research and development of new drugs for neurological diseases, and (iii) working capital and other general corporate purposes.

**Note: Revenue and net loss are for the fiscal year that ended March 31, 2023.

(Note: Zhong-Yuan Bio-Technology Holdings Ltd. slightly increased the size of its micro-cap public offering/NASDAQ uplisting to 1.1 million shares – up from 1.0 million shares – and kept the price range at $5.00 to $7.00 – to raise $6.6 million, according to an F-1/A filing dated Oct. 6, 2023. In that Oct. 6, 2023, SEC filing, Zhong-Yuan Bio-Technology Holdings added R.F. Lafferty & Co. as a joint book-runner and Dominari Securities as a co-manager. Background: Zhong-Yuan Bio-Technology Holdings cut the size of its micro public offering/NASDAQ uplisting to 1.0 million shares – down from 1.5 million shares – and increased the price range to $5.00 to $7.00 – up from $4.00 to $6.00 – to raise $6.0 million, according to an F-1/A filing dated Aug. 22, 2023.)

(Background Note: Zhong-Yuan Bio-Technology Holdings; stock trades under the symbol “ZHYBF” on the OTC market. In an F-1/A filing dated March 1, 2023, the company said it intends to offer 1.5 million ordinary shares at $5.00 – the mid-point of its $4.00-to-$6.00 price range – to raise $7.5 million. A selling stockholder will offer 500,000 shares. The company will not receive any proceeds from the sale of the selling stockholder’s shares. *Note: On July 24, 2020, the company completed a 1-for-10 reverse stock split.)

Richtech Robotics RR, R.F. Lafferty & Co., 3.0M Shares, $4.00-6.00, $17.3 mil11/7/2023 Tuesday

We are a developer of advanced robotic technologies focused on transforming labor-intensive services in hospitality and other sectors currently experiencing unprecedented labor shortages. (Incorporated in Nevada)

With a global R&D team based out of China and the United States, we design, manufacture and sell robots to restaurants, hotels, senior living centers, casinos, factories, movie theaters and other businesses. Our robots perform a variety of services, including restaurant running and bussing, hotel room service delivery, floor scrubbing and vacuuming, and beverage and food preparation. We design our robots to be friendly, customizable to client environments, and extremely reliable. For example, our food service delivery robots typically make over 1,000 deliveries every month in busy environments. Our current customer base includes major hotel brands, national chain restaurants, leading senior care facilities, and top casino management companies.

Our mission is to integrate robotics and automation into our everyday lives. We envision ourselves becoming the first robotics “Super-operator,” where thousands of our robots are deployed out in the field and managed by Richtech’s AI Cloud Platform (ACP). As a Super-operator, our robotic fleet will be performing a wide variety of tasks within a business, from completing deliveries and scrubbing floors to cooking noodles and preparing drinks. Our ACP platform will allow businesses to plug in their robots and immediately leverage an immense amount of data to optimize workflows, lower management complexity, and minimize labor dependency.

Our products are categorized into three kinds of service automation: indoor transport and delivery, sanitation, and food and beverage automation. Our target market is the hospitality sector, which includes restaurants, hotels, casinos, resorts, senior care, hospitals, and movie theaters. We also plan to leverage our expertise in food automation to bring services directly to the consumer with the ADAM system which is described below.

The majority of our robots can be characterized as Autonomous Mobile Robots (AMRs), meaning that our robots can understand and move through its environment independently. AMRs differ from their predecessors, Autonomous Guided Vehicles (AGVs), which rely on tracks or predefined paths and often require operator oversight. Our AMRs understand their environment through an array of advanced sensors, with the primary sensor being a LiDAR which stands for Light Detection and Ranging. The LiDAR is able to create a 2D map of the environment by sending out laser pulses and measuring the time it takes to bounce back, similar to sonar but far more accurate. Secondary sensors such as RGBD cameras that detect color and depth of images, ultrasonic proximity sensors, and standard AI machine vision that can recognize objects are used in sync to create an in-depth understanding of the robot’s environment. These sensors, combined with a robust navigation software stack based on AI algorithms, provides our robots the ability to perform dynamic path planning through their environments.

Our ACP service is a business optimization tool that allows customers to benefit from the rich operational data generated by the robots. Each AMR can operate independently in the real world and report data up to the ACP. The ACP can then utilize the data to optimize workflows, enhance guest experiences, and minimize waste. The ACP will store robot utilization metrics for analyses and reporting, providing clients with detailed operational data.

Note: Revenue and net loss figures are for the year that ended March 31, 2023.

(Richtech Robotics Inc. filed a Free Writing Prospectus (FWP) dated Oct. 10, 2023, naming R.F. Lafferty & Co. as the book-runner. The deal’s original book-runner was Pacific Century Securities. Background: Richtech Robotics Inc. filed an S-1/A on Sept. 1, 2023, disclosing terms for its micro-cap IPO: 3.0 million shares at $4.00 to $6.00 to raise $15.0 million. Richtech Robotics Inc. filed its S-1 on Aug. 3, 2023, without disclosing terms for its IPO. The company submitted confidential IPO documents to the SEC on Feb. 10, 2023.))

Trident Digital Tech Holdings TDTH, US Tiger Brokers, 1.9M Shares, $8.00-10.00, $16.9 mil, 11/8/2023 Wednesday

We are a leading digital transformation enabler in the small and medium enterprise, or the SME segment of the e-commerce enablement and digital optimizing services market in Singapore. We offer business and technology solutions which are designed to optimize our clients’ experiences with their customers by driving digital adoption and self-service. (Incorporated in the Cayman Islands)

We started our journey in 2014 as a full-service information technology company headquartered in Singapore. Since then, we recognized and captured the opportunities arising from the global fast-growing digital adoption trend in various industries and rapidly developed as a leading digital transformation enabler in the SME segment of e-commerce enablement and digital optimizing services market in Singapore. According to the Frost & Sullivan Report, among the Singapore-based companies who have been approved to participate in the SMEs Go Digital program led by Infocomm Media Development Authority, a statutory board under the Singapore Ministry of Communications and Information of the Republic of Singapore, we ranked fourth, contributing to 1.5% of the SME segment of the e-commerce enablement and digital optimizing services market in Singapore in 2022.

The SMEs Go Digital program is to provide SMEs in Singapore with a variety of digital solutions and services, such as e-commerce platforms, digital marketing tools, and data analytics software. The program also offers government grants to eligible SMEs to subsidize the costs, driving digital adoptions.

Our clients and prospective clients are faced with transformative business opportunities due to advances in software and computing technology. These organizations are dealing with the challenge of having to reinvent their core products, services, processes and systems rapidly and position themselves as “digitally enabled.” The journey to the digital future requires not just an understanding of new technologies and new ways of working, but a deep appreciation of existing technology landscapes, business processes and practices. We have been a navigator for our clients as they ideate, plan and execute on their journey to a digital future through our solutions and services, comprising:

• Business consulting: We support clients to define and deliver technology-enabled transformations of their business. Equipped with the complete value chain approach, our suite of offerings ranges from brand proposition, multi-channel commerce and digital marketing to improve customer experience and increase customer acquisition, to insights and real-time predictive analysis for efficient decision-making and optimizing processes.

• IT customization: We offer solutions and services to plan, design, operate, optimize and transform business processes. We support clients to get the best value from technology by developing an IT strategy, optimizing applications and infrastructure, implementing IT operating models, and governing their technical architecture for reliability and security.

We provide customized solutions and services that address the specific needs of clients in our strategic vertical markets. Our primary vertical industries include e-commerce, food and beverage, fintech, healthcare and service, wholesale and retail that are fast-growing and have increasing level of digitalization potentials. Our configurable technology integrates seamlessly into our clients’ systems, empowering our clients to manage, improve their businesses and to win. As of June 30, 2023, we served over 200 clients across our core verticals such as food and beverage, wholesale and retail.

Digital technology continues to impact our world through its transformative capability and pervasive impact. Our management believes we have a successful track record of applying our proprietary technologies to respond to changing business needs and evolving client demands. Leveraging such experiences, we plan to launch a Web 3.0 e-commerce platform whereby customers and merchants can transact in a transparent and secure way, or Tridentity, in the fourth quarter of 2023.

**Note: Net loss and revenue figures are for the 12 months that ended June 30, 2023.

(Trident Digital Tech Holdings filed an F-1/A on Oct. 19, 2023, in which it disclosed the terms for its IPO: 1.875 million American Depositary Shares (ADS) at a price range of $8.00 to $10.00 to raise $16.88 million. Each ADS represents 10 ordinary shares, the prospectus says. Background: Trident Digital Tech Holdings filed its F-1 on Oct. 4, 2023.)

🏁 Emerging Market ETF Launches

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

08/25/2023 - KraneShares Dynamic Emerging Markets Strategy ETF KEM - Active, equity, emerging markets

08/18/2023 - Global X India Active ETF NDIA - Active, equity, India

08/18/2023 - Global X Brazil Active ETF BRAZ - Active, equity, Brazil

07/17/2023 - Matthews Korea Active ETF MKOR - Active, equity, South Korea

05/18/2023 - Putnam Emerging Markets ex-China ETF PEMX - Value + growth stocks

05/11/2023 - JPMorgan BetaBuilders Emerging Markets Equity ETF BBEM - Large + midcap stocks

03/16/2023 - JPMorgan Active China ETF JCHI - Active, equity, China

03/03/2023 - First Trust Bloomberg Emerging Market Democracies ETF EMDM - Principles-based

1/31/2023 - Strive Emerging Markets Ex-China ETF STX - Passive, equity, emerging markets

1/20/2023 - Putnam PanAgora ESG Emerging Markets Equity ETF PPEM - Active, equity, ESG, emerging markets

1/12/2023 - KraneShares China Internet and Covered Call Strategy ETF KLIP - Active, equity, China, options overlay, thematic

1/11/2023 - Matthews Emerging Markets ex China Active ETF MEMX - Active, equity, emerging markets

12/13/2022 - GraniteShares 1.75x Long BABA Daily ETF BABX - Active, equity, leveraged, single stock

12/13/2022 - Virtus Stone Harbor Emerging Markets High Yield Bond ETF VEMY - Active, fixed income, junk bond, emerging markets

9/22/2022 - WisdomTree Emerging Markets ex-China Fund XC - Passive, equity, emerging markets

9/15/2022 - KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV - Passive, equity, Asia, dividend strategy

9/15/2022 - OneAscent Emerging Markets ETF OAEM - Active, Equity, emerging markets, ESG

9/9/2022 - Emerge EMPWR Sustainable Select Growth Equity ETF EMGC - Active, equity, emerging markets

9/9/2022 - Emerge EMPWR Unified Sustainable Equity ETF EMPW - Active, equity, emerging markets

9/8/2022 - Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH - Active, equity, emerging markets, ESG

7/14/2022 - Matthews China Active ETF MCH - Active, equity, China

7/14/2022 - Matthews Emerging Markets Equity Active ETF MEM - Active, equity, emerging markets

7/14/2022 - Matthews Asia Innovators Active ETF MINV - Active, equity, Asia

6/30/2022 - BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD - Passive, fixed income, emerging markets

5/2/2022 - AXS Short CSI China Internet ETF SWEB - Active, inverse, thematic

4/27/2022 - Dimensional Emerging Markets High Profitability ETF DEHP - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Core Equity 2 ETF DFEM - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Value ETF DFEV - Active, equity, emerging markets

4/27/2022 - iShares Emergent Food and AgTech Multisector ETF IVEG - Passive, equity, thematic [Mostly developed markets]

4/21/2022 - FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM - Passive, equity, ESG

4/6/2022 - India Internet & Ecommerce ETF INQQ - Passive, equity, thematic

2/17/2022 - VanEck Digital India ETF DGIN - Passive, India market, thematic

2/17/2022 - Goldman Sachs Access Emerging Markets USD Bond ETF GEMD - Passive, fixed income, emerging markets

1/27/2022 - iShares MSCI China Multisector Tech ETF TCHI - Passive, China, technology

1/11/2022 - Simplify Emerging Markets PLUS Downside Convexity ETF EMGD - Active, equity, options strategy

1/11/2022 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG - Passive, equity, ESG

🚽 Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

09/20/2023 - VanEck China Growth Leaders ETF - GLCN

08/28/2023 - Asian Growth Cubs ETF - CUBS

08/01/2023 - VanEck Russia ETF - RSX

07/07/2023 - Emerge EMPWR Sustainable Emerging Markets Equity ETF - EMCH

06/23/2023 - Invesco PureBeta FTSE Emerging Markets ETF - PBEE

06/16/2023 - AXS Short China Internet ETF - SWEB

04/11/2023 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF - REMG

3/30/2023 - Invesco BLDRS Emerging Markets 50 ADR Index Fund - ADRE

3/30/2023 - Invesco BulletShares 2023 USD Emerging Markets Debt ETF - BSCE

3/30/2023 - Invesco BulletShares 2024 USD Emerging Markets Debt ETF - BSDE

3/30/2023 - Invesco RAFI Strategic Emerging Markets ETF - ISEM

2/17/2023 - Direxion Daily CSI 300 China A Share Bear 1X Shares - CHAD

1/13/2023 - First Trust Chindia ETF - FNI

12/28/2022 - Franklin FTSE Russia ETF - FLRU

12/22/2022 - VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

8/22/2022 - iShares MSCI Argentina and Global Exposure ETF AGT

8/22/2022 - iShares MSCI Colombia ETFI COL

6/10/2022 - Infusive Compounding Global Equities ETF JOYY

5/3/2022 - ProShares Short Term USD Emerging Markets Bond ETF EMSH

4/7/2022 - DeltaShares S&P EM 100 & Managed Risk ETF DMRE

3/11/2022 - Direxion Daily Russia Bull 2X Shares RUSL

1/27/2022 - Legg Mason Global Infrastructure ETF INFR

1/14/2022 - Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (October 30, 2023) was also published on our website under the Newsletter category.