Emerging Market Links + The Week Ahead (September 16, 2024)

Tariffs to target Shein/Temu, China's banks face headwinds + “Balance Sheet Recession” has started, 99 Speed Mart IPO, Mexico spooks US business, EM stock picks & the week ahead for emerging markets.

If you are a fan of Polish supermarket operator Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY)’s business strategy (or keep reading about them on other Substacks), Malaysia has just seen the IPO of 99 Speed Mart Retail Holdings Bhd (KLSE: 99SMART) who have literally saturated every housing estate and neighbourhood in Malaysia with no-frills convenience stores selling the basics - and eating into the margins of traditional supermarkets and hypermarkets (despite the fact that I find the prices at Speed Mart and similar types of “convenience” stores to be noticeably higher…).

Although I can’t comment on whether the IPO is a good deal for retail investors, Interactive Brokers is now (or will be) giving access to Malaysian stocks and its a retail stock worth taking a closer look at - as opposed to another “hot” (private equity backed) Malaysian retailer that has saturated the country (and is expanding throughout SE Asia) known as Mr. Do Not Have Mr. DIY (MR DIY Group M Bhd (KLSE: MRDIY / OTCMKTS: MDIYF)) who never seems to have what I need when I go there…

Finally, I was having network issues saving this Substack post this evening as well as accessing the Archive.today site (denoted by 🗃️). Hopefully, everything is back to normal now and all my post got saved below…

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

🇨🇳 🇭🇰 CMBI Research China & Hong Kong Stock Picks (July & August 2024) Partially $

August: Akeso, PICC Property and Casualty, DPC Dash, Baozun, BYD Electronic International, AK Medical, Innovent Biologics, Sany Heavy Equipment International Holdings, Hangzhou Tigermed Consulting, Tongda Group Holdings, Great Wall Motor, BYD Company, Li Auto, Nongfu Spring, Proya Cosmetics, Hansoh Pharmaceutical Group Company, Intron Technology, Shengyi Tech, Shennan Circuits, Meituan, Greentown Management Holdings Company, NAURA Technology Group, ANTA Sports Products, Zhejiang Dingli Machinery, SenseTime, Jiangsu Hengli Hydraulic, Trip.com, TK Group Holdings, Ping An, Jiumaojiu International Holdings, Greentown Service Group, PDD Holdings or Pinduoduo, China Tower Corp, AIA Group, iQIYI, Tuhu Car, Cloud Music, Weibo Corp, 3SBio Inc, Zhongji Innolight, Luxshare Precision Industry, Poly Property Services, Yonyou Network Technology, BOE Varitronix, WuXi Biologics, Aac Technologies Holdings, Onewo Inc, CSPC Pharmaceutical, Baidu, Minth Group, NetEase, Bilibili, Xiaomi Corp, Geely Automobile Holdings, Will Semiconductor, Sunny Optical, ZTO Express, Xtep, Sichuan Kelun-Biotech Biopharmaceutical, J&T Global Express, Giant Biogene Holding, XPeng, Tongcheng Travel Holdings, Kuaishou Technology, CR Beer, Yancoal Australia, RemeGen, Li Ning, Kingdee International Software Group, ZTE, China Hongqiao Group, BaTeLab Co Ltd, Samsonite International, GoerTek, Alibaba, JD.com, Tencent, China Lilang, FIT Hon Teng (Foxconn Interconnect Technology), Tencent Music Entertainment Group, Q Technology (Group) Company, 361 Degrees International Limited, Ke Holdings, Jiangxi Rimag Group, Hua Hong Semiconductor, BeiGene, Horizon Construction Development, Yum China, Yuexiu Transport Infrastructure, Tongda Group Holdings, ImmuneOnco Biopharmaceuticals, Hutchmed & New Oriental Education

July: WuXi AppTec, Chow Tai Fook Jewelry Group, QuantumPharm & China MeiDong Auto Holdings

20+ high conviction stock ideas: Li Auto, Geely Automobile, Zoomlion Heavy Industry, Zhejiang Dingli, Bosideng, JNBY, Xtep, Vesync, Kweichow Moutai, BeiGene, Shenzhen Mindray Bio-Medical Electronics, China Pacific Insurance (Group), PICC Property and Casualty, Tencent, Alibaba, PDD Holdings, Amazon.com, CR Land, FIT Hon Teng (Foxconn Interconnect Technology), Xiaomi, BYD Electronic International, Zhongji Innolight, NAURA Technology Group & Kingdee International Software Group

🇰🇷 Mirae Asset Securities' Korean Stock Picks (July-August 2024) Partially $

August: Hyundai Motor, Korea Gas Corporation (KOGAS), GS Engineering & Construction Corp, Lotte Innovate, Iljin HySolus, PharmaResearch, Classys, Hugel, Yuhan Corp, Samsung SDI, CS Bearing, SOCAR, SK Oceanplant, Advanced Nano Products, JYP Entertainment Corp, Daejoo Electronic Materials, LG Uplus, Kia Corp, People & Technology, Cosmecca Korea, Cosmax Inc, Seegene, Krafton, Neowiz, NAVER, Daewoong Pharmaceutical, CJ Logistics, Vatech, Kolmar Korea, Samsung Securities, InBody, Dentium, SK Biopharmaceuticals, Lotte Chemical, Hanon Systems, CS Wind Corp, Korea Zinc, Dio Corp, PearlAbyss, Netmarble, Kakao, SM Entertainment, HanAll Biopharma, Korean Air, JejuAir Co, HYBE, Cafe24 Corp, Kakao Games, Wemade, SK Telecom, Haesung DS Co Ltd, GC Biopharma Corp, Lotte Rental, Amorepacific Corp, Vieworks, LX International, Douzone Bizon, OCI Holdings, Joy City Corp, NCSoft Corp, Kumho Petrochemical, JB Financial Group, BGF Retail, DL E&C Co Ltd, SKC, SK Innovation, i-SENS, Samsung Electro-Mechanics Co Ltd, BNK Financial Group, APR Co Ltd, Kiwoom Securities, Samsung C&T Corp, Hanwha Aerospace & Soop Co Ltd

July: Daewoo Engineering & Construction Co Ltd, Korea Aerospace Industries, HL Mando Corp, DGB Financial Group, Industrial Bank of Korea, Nexon Games, Hyundai AutoEver, Shinhan Financial Group, F&F Co, Hyundai Mobis, LIG Nex1 Co, Hotel Shilla, Hyundai Rotem, Dong-A ST Co Ltd, S-Oil Corp, SK Hynix, LG Energy Solution, Samsung Engineering, LG Electronics, Posco Future M Co Ltd, LG Chem, Posco International Corp, Hanwha Solutions, Hyundai Glovis, LG Innotek, KB Financial Group, Hyundai Engineering & Construction, KT Corp, Koh Young Technology, Samsung Biologics, SK Innovation, Samwha Capacitor, Shinsegae International, ST Pharm, Aekyung Industrial, S-Oil Corp, Meritz Financial Group, Samsung Fire & Marine Insurance, Hana Financial Group, Samsung Electronics & Celltrion

🌐 EM Fund Stock Picks & Country Commentaries (September 15, 2024) Partially $

India is getting ALOT of attention from the fund herd, all about Li Lu, investing in China EVs, ASEAN political shifts, geopolitics of supply chains, pulp/paper/packaging opportunities, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China's Shein and Temu face end to tariff-free imports into U.S. (Nikkei Asia) 🗃️

PDD Holdings (NASDAQ: PDD) or Pinduoduo

White House to propose rules to limit 'loophole' for small shipments

Currently, packages worth less than $800 enter the U.S. duty free under a de minimis trade provision. But over the past 10 years, the volume of shipments claiming de minimis exemptions has ballooned from 140 million to over 1 billion per year, according to the White House.

Shein and Temu accounted for 30% of all de minimis shipments, according to an estimate released last year by a House committee on China.

🇨🇳 Biden targets China’s Temu, Shein with low-value import duty exemption changes (SCMP) 🗃️

Contentious exemptions to be stripped from many textile, clothing and other imports, in a move aimed at Chinese e-commerce platforms

“Since approximately 70 per cent of Chinese textile and apparel imports are subject to section 301 tariffs, this step will drastically reduce the number of shipments entering through the de minimis exemption,” he said, noting the intent was to “curtail de minimis overuse and abuse”.

🇨🇳 Tencent ($TCEHY) | 📈Bull vs Bear📉 (Value Investing Blueprint)

Tencent is a massive company but are they a buy?

Today, I’m breaking down Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY), China’s largest public company. I will lay out the bull and bear case to give you a clear picture of the company. When you have the right context, you can make better decisions and make more money.

🇨🇳 JD.com eyes tricky consumer finance business with pending acquisition (Bamboo Works)

The e-commerce giant is reportedly close to buying Home Credit, but owing such a consumer finance company could create some headaches in the current business climate

JD.com (NASDAQ: JD) is reportedly close to buying Home Credit Consumer Finance, China’s first wholly foreign-owned consumer finance company that has been struggling recently

The deal could help JD.com round out its financial services offerings but also brings various risks, including difficulties in boosting loans and controlling delinquencies

🇨🇳 GigaCloud’s business shines, but investors still rain on its parade (Bamboo Works)

The B2B e-commerce company unveiled a $46 million share repurchase program in its latest move to revive its flagging share price

GigaCloud Technology (NASDAQ: GCT)’s revenue doubled in the second quarter and its net income grew 46.7%, as GMV in its marketplace topped $1 billion for the 12 months through June

Investors seemed to ignore the upbeat report and a new stock repurchase announcement last week, bidding the company’s shares down in the days after the latter

🇨🇳 Is DouYu swimming towards being acquired? (Bamboo Works)

The livestreamer’s business continued to deteriorate in the second quarter, as it remained without long-term leadership after the arrest of its chairman and CEO last year

Douyu International Holdings (NASDAQ: DOYU)’s revenue fell 26% in the second quarter, as the company reported its third consecutive quarterly loss

The livestreaming company could be an attractive acquisition target due to its low valuation, rich experience and big cash reserves

🇨🇳 Sinopharm Group (1099.HK) - Don't Waste the Low Point of Performance, Valuation Will Bounce Back (Smartkarma) $

2024 would be the low point in performance/valuation of Sinopharm (HKG: 1099 / FRA: X2S1 / OTCMKTS: SHTDY). Due to the low base in 2024, revenue/net profit in 2025 is expected to rebound (e.g. high single-digit positive growth).

Declining financial cost ratio is key driving force for profitability. Since the Fed would cut interest rate, a low interest rate environment helps Sinopharm reduce financial costs, thereby increasing profit margin.

Since China hopes to establish a valuation system with Chinese characteristics, it would help drive up valuation of SOEs. Thus, there’s valuation repair opportunity for Sinopharm (e.g. P/E return to 8).

🇨🇳 Junshi narrows its losses but delivers no cure for share price woes (Bamboo Works)

The drug maker boosted sales of its core anti-cancer product in the first half of the year and reined in its research budget under a reform-minded CEO, but revenue momentum lags the pace of leading rivals

Junshi Bio (SHA: 688180 / HKG: 1877) has made more than 9 billion yuan in losses in its 12-year history and its share price is nearly 90% down from a 2021 peak

The flagship product toripalimab has been approved for a growing number of cancers and is the sole or leading treatment in China for some conditions

🇨🇳 China Banks; Challenged on Credit Quality Trends, with Selective Opportunities to Be Found (Smartkarma) $

In this China banks screen, we focus on the credit quality headwinds going forward and which are the better positioned banks to confront the challenge

China bank shares’ PBV ratios have eroded over time, due to low growth and credit quality concerns; yet through our analysis of these bank, we see selective contrarian positive opportunities

China Construction Bank (HKG: 0939 / VIE: CNCB / SHA: 601939 / OTCMKTS: CICHY / CICHF) is a core GEM bank buy for its deeply discounted valuations and strong balance sheet; Ping An Bank (SHE: 000001) is the deep value contrarian pick; China Minsheng Banking (SHA: 600016 / HKG: 1988 / FRA: GHFH / OTCMKTS: CMAKY / CGMBF) is our fundamental sell

🇨🇳 Chinese Banks’ Cash Flow Plummets After Crackdown on High Deposit Rates (Caixin) $

Chinese banks are under strain as their deposits shrink in the wake of a regulatory crackdown on offering deposit rates higher than regulatory caps.

In the first half of the year, many Chinese mainland-listed commercial banks saw a decline in their net cash flow generated from operating activities — a key indicator of lenders’ liquidity — Caixin calculations based on their interim reports show.

🇨🇳 China Renaissance reborn without rainmaking founder Bao Fan (Bamboo Works)

The privately owned investment bank’s shares lost two-thirds of their value when trading resumed after a suspension of more than a year

China Renaissance Holdings Ltd (HKG: 1911 / OTCMKTS: CSCHF) shares plunged 66% in their first trading day after a 17-month suspension tied to the disappearance of former Chairman Bao Fan

The company’s revenue fell 37% in 2023, and by another 39% in the first half of this year, according to newly results released just before the trading resumption

🇨🇳 Waterdrop stalls in second quarter, but reaffirms annual growth forecast (Bamboo Works)

The online insurance broker’s revenue fell slightly in the latest three-month period, as its core insurance business fell by 4%

Waterdrop (NYSE: WDH)’s revenue fell 0.4% in the second quarter, but its profit rose fourfold as it controlled costs in what it described as a market filled with “challenges”

The company’s recent Waterdrop Guardian AI initiative took a step forward with the signing of a new partnership with an unnamed insurance company

🇨🇳 China Resources Beer: Eyes On Premiumization And Dividends (Seeking Alpha) $ 🗃️

🇨🇳 Uxin finds new friend on difficult road to profitability (Bamboo Works)

The used car superstore operator will receive $15 million in new funding from shared ride company Dida (HKG: 2559), equal to more than four times its cash reserves at the end of March

Dida will provide $15 million in new funding to cash-challenged Uxin Ltd (NASDAQ: UXIN) by purchasing $7.5 million in the latter’s shares and providing a $7.5 million loan

Uxin had just $3.3 million in cash at the end of March, and has continually warned of financial challenges as it races to operate its used car superstore model profitably

🇨🇳 Can Haidilao learn from a busboy-turned-bubble tea magnate? (Bamboo Works)

The regrouping former hotpot highflyer has named a 30-year-old premium tea sensation to its board, after reporting its profit fell in the first half of the year

Haidilao International Holding (HKG: 6862 / FRA: 8HI / OTCMKTS: HDALF) has appointed Zhang Junjie, founder of the fast-growing Chagee bubble tea chain, as an independent with annual pay of 1.2 million yuan

Zhang could bring new views about the latest dining trends as Haidilao attempts to revive its fortunes after expanding too quickly and falling out of favor

🇨🇳 Hisense Home Appliance switches on overseas growth engine (Bamboo Works)

The home appliance maker’s ‘China first doesn’t mean the world is second’ campaign at the UEFA European Soccer Championship triggered discussion at home and abroad

Hisense Home Appliances Group (SHE: 000921 / SHA: 600060 / HKG: 0921)’s profit rose 34.6% to 2.02 billion yuan in the first half of this year, propelled by the company’s rapid overseas growth

Investment banks are bullish on the company, many rating it a “buy,” encouraged by the strong potential of its overseas business

🇨🇳 Midea Group: Offer Upsized at Top Tier. Updated Valuation Analysis (Smartkarma) $

[Home appliances, and robotic and automation systems] Midea (SHE: 000333) has increased the shares on offer in Hong Kong by 15% to 565.9 million shares, priced at the top end of the range at HKD54.8 per share.

With strong investor interest, the company may exercise an over allotment option that could take the deal size to USD 4.6 billion.

Midea’s Hong Kong pricing reflects a nearly 21% discount to its A-share closing price, compared to the average 33% discount for dual-listed companies between Hong Kong and Shanghai or Shenzhen.

🇨🇳 Pre-IPO Midea Group H Share (PHIP Updates) - Some Points Worth the Attention (Smartkarma) $

China’s home appliance industry is facing challenges. Even with large-scale "trade in" activities, its expansion effect on market size still appears limited, making it difficult to trigger significant growth momentum.

However, Midea (SHE: 000333) still achieved strong performance growth in 24H1. Both revenue and net profit showed double-digit growth rates. Midea's business expansion and product profitability are much better than peers.

Performance drivers are overseas business and air conditioners. Our forecast is Midea’s 2024 net profit would reach about RMB37 billion. Valuation of Midea could be higher than Haier Smart Home.

🇨🇳 Midea Group H Share Listing (300 HK): Valuation Insights (Smartkarma) $

Midea (SHE: 000333) has launched its H Share listing at HK$52.00-54.80 per share. Pricing will be on 13 September, and the listing on 17 September.

We previously discussed the listing in Midea Group H Share Listing: Latest Updates Points to a Business in Rude Health and Midea Group H Share Listing: AH Discount Views.

Our valuation analysis suggests that the H Share listing range is attractive. We would participate in the listing.

🇨🇳 Midea Group HK IPO Valuation Analysis (Douglas Research Insights) $

We would subscribe to the HK offering of Midea (SHE: 000333) due to its attractive valuations, strong fundamentals, and meaningful price discount relative to the A shares.

We believe a premium valuation relative to the comps is appropriate for Midea Group due to its higher sales growth, EBIT margin, and ROE.

Pricing of this offering is expected to be completed on 13 September and listing on 17 September.

🇨🇳 Akeso Biopharma Inc (9926 HK) - Something Beautiful Is Happening (Smartkarma) $

AK112’s HARMONi-2 results were impressive, but there’s still critical data gap before obtaining approval from FDA. The main concern is whether good PFS can be translated into significant OS benefits.

Akeso (HKG: 9926 / FRA: 4RY / OTCMKTS: AKESF) will be eligible to receive low double-digit royalties on net sales from Summit Therapeutics (NASDAQ: SMMT). So, Summit is actually a better investment because it has complete global rights of AK112.

Investors are betting Summit to be acquired by MNCs at a high price. Due to anti-monopoly issue, the narrowing pool of potential buyers would increase the difficulty of Summit being acquired.

🇨🇳 Shanghai Henlius Biotech (2696.HK) Privatization Update - Some New Information Worth the Attention (Smartkarma) $

Fosun Pharma will make every effort to promote the success of this privatization. The management has disclosed the afterwards arrangements- Shanghai Henlius Biotech (HKG: 2696 / OTCMKTS: SGBCF) and Fosun Pharma will further expand/integrate in the future.

Henlius’ revenue is expected to reach RMB6 billion in 2024 and RMB8-9 billion in next 2-3 years. Even if the privatization fails, things are still manageable due to strong fundamentals.

Fosun Pharma will not stop its capital operation against Henlius, but the plans of re-listing could be based on a new entity. So, the Cash Alternative is a better choice.

🇨🇳 Chifeng Jilong hitches a ride on market gold rush (Bamboo Works)

Spurred on by a soaring gold price, the Chinese mining company has filed for a Hong Kong share listing to raise money to expand and upgrade production

Chifeng Jilong (SHA: 600988)’s revenue rose nearly 17% in the first quarter and profits more than doubled to 202 million yuan

The company’s production costs fell 12% last year, enabling a rise in profit margin

🇨🇳 China Nonferrous Mining (1258): Results of the First Semester 2024. (La Newsletter de Momentum)

[NOTE: In Spanish. Use a browser translator]

China Nonferrous Mining Corp Ltd (HKG: 1258 / OTCMKTS: CNFMF) (1258 on the Hong Kong Stock Exchange) presented results for the first half of the year. My idea is to highlight the things that I have found interesting in terms of results, balance, production and future projects. It is worth remembering that it is a company that I have had in my portfolio for many years. It is 69% owned by the agency that manages China's state assets, the rest is listed on the Hong Kong Stock Exchange. It operates foundries and copper mines in the Democratic Republic of the Congo and in Zambia, that is, it not only exploits its own mines, but also buys raw materials from third parties to produce metallic copper. To take measure of the complexity of the structure, go as shown in the table with all the subsidiaries of the company. Please note that China Nonferrous Mining does not own 100% of any operating unit.

🇨🇳 Boost for Lithium Mining Stock as CATL Halts Yichun Production After Price Plunge (Caixin) $

An announcement by Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750) that is to halt production at its giant lithium concentrator in Yichun, Jiangxi province, triggered a sharp rise in domestic lithium mining companies’ stocks.

Ganfeng Lithium Group (SHE: 002460 / HKG: 1772 / OTCMKTS: GNENY / GNENF) and Tianqi Lithium Corp (SHE: 002466 / HKG: 9696 / FRA: 2220) hit their daily price limits Wednesday, while other lithium firms saw significant gains.

🇭🇰 Hang Lung Group: Paid To Wait For Better Times (Seeking Alpha) $ 🗃️

[Well-established, top-tier property developer] Hang Lung Group Limited (HKG: 0010 / FRA: HLU / OTCMKTS: HNLGF / HNLGY)

🇲🇴 LVS to pay US$103mln to up Sands China stake to circa 72pct (GGRAsia)

Macau casino concessionaire Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF) says its U.S.-based parent, Las Las Vegas Sands (NYSE: LVS), plans to increase its holding in the Macau unit to nearly 72 percent, from the existing 71.02 percent.

The share purchase programme of the parent for the Macau unit had been reiterated in a recent note [Sands China delisting not likely at this stage: Seaport] from Seaport Research Partners.

🇰🇷 Gravity: Mobile Games, International Expansion, NBA License, And Cheap (Seeking Alpha) $ 🗃️

🇰🇷 NAV Analysis of Young Poong and Three Potential Scenarios of Choi Family's Strategy to Fight Back (Douglas Research Insights) $

We have significantly raised the NAV of Young Poong Precision Corporation (KOSDAQ: 036560) to 965,193 won (up 105% than previously). Our current NAV estimate of the company is 150% higher than current price.

Some traders have been positioning for Young Poong to be deleted from the KOSPI200 in the next round of rebalancing. Young Poong is not likely to be deleted from KOSPI200.

We also provide three potential scenarios of the Choi family's strategy to fight back to gain control of Korea Zinc (KRX: 010130).

🇰🇷 Tender Offer of 43.4% Stake in Young Poong Precision by MBK (Douglas Research Insights)

After the market close on 12 September, Hankyung Business Daily reported that MBK Partners plans to conduct a tender offer of 43.43% stake in Young Poong Precision Corporation (KOSDAQ: 036560).

The tender offer price is 20,000 won per share (113% higher than the closing price on 12 September).

Choi family currently controls Young Poong Precision. MBK plans to secure a controlling stake and obtain voting rights for the 1.85% stake in Korea Zinc (KRX: 010130) held by Young Poong Precision.

🇰🇷 MBK Partners and Jang Family Partner to Control Korea Zinc + Tender Offer of 14.6% of Korea Zinc (Douglas Research Insights) $

After the market close on 12 September, Maekyung Business Daily reported that MBK Partners will become the largest shareholder of Korea Zinc (KRX: 010130) along with Young Poong Precision Corporation (KOSDAQ: 036560).

MBK Partners, along with Youngpoong and advisor Jang Hyung-jin, also plans to conduct a tender offer of 14.6% stake in Korea Zinc.

The tender offer price for Korea Zinc is 660,000 won per share, which is 18.7% higher than the closing price on 12 September.

🇰🇷 The Born Korea IPO Valuation Vs Recent M&A Valuation of Compose Coffee by Jollibee Foods (Douglas Research Insights) $

In this insight, we compare the IPO valuation of The Born Korea (475560 KS) versus the recent M&A valuation of Compose Coffee by Jollibee Foods (PSE: JFC / OTCMKTS: JBFCF / JBFCY).

Using the recent M&A multiples of Compose Coffee by Jollibee Foods suggests an attractive upside to The Born Korea (relative to the IPO price range).

No other listed company in Korea has a restaurant business model that is consistently profitable, with strong balance sheet, and solid sales growth as The Born Korea.

🇰🇷 Kim Dong-Sun Likely to Purchase More Shares of Hanwha Galleria Post Tender Offer (Douglas Research Insights) $

The tender offer period for Hanwha Galleria (KRX: 452260) ended on 11 September. Its share price closed down 7.4% but still up 8.2% from its price prior to the tender offer announcement.

The local media accounts mentioned today that about 80-90% of the shares targeted in this tender offer have been filled.

If 90% of the tender offer is successful, Kim Dong-Sun's stake in the company will rise from 2.3% to 18.1%.

🇰🇷 K Bank IPO - The Biggest IPO in Korea in 2024 (Douglas Research Insights) $

K Bank is the biggest IPO in Korea in 2024. The IPO price range is from 9,500 won to 12,000 won. It is offering 82 million shares in this IPO.

According to the bankers' valuation, the expected market cap of the company is from 4.0 trillion won to 5.0 trillion won.

The IPO deal size is 779 billion (US$579 million) to 984 billion won (US$732 million).

🇰🇷 K Bank IPO Preview (Douglas Research Insights) $

K Bank finally provided its IPO prospectus which includes more details of the IPO than what the company already announced about the IPO several days ago.

Bankers used KakaoBank (KRX: 323410), SBI Sumishin Net Bank (TYO: 7163 / FRA: B0E / OTCMKTS: SSNBF), and Bancorp Inc (NASDAQ: TBBK) as comps. Average PBR of 2.56x was used to value K Bank.

Some investors will question the inclusion of overseas comps including SBI Sumishin Net Bank and Bancorp in the valuation of K Bank.

🇮🇩 Gudang Garam: Turning Negative On Market Share Loss And Dividend Omission (Rating Downgrade) (Seeking Alpha) $ 🗃️

[Indonesia's second-largest tobacco manufacturer] Gudang Garam Tbk PT (IDX: GGRM / FRA: GGG / OTCMKTS: GDNGY / GGNPF)

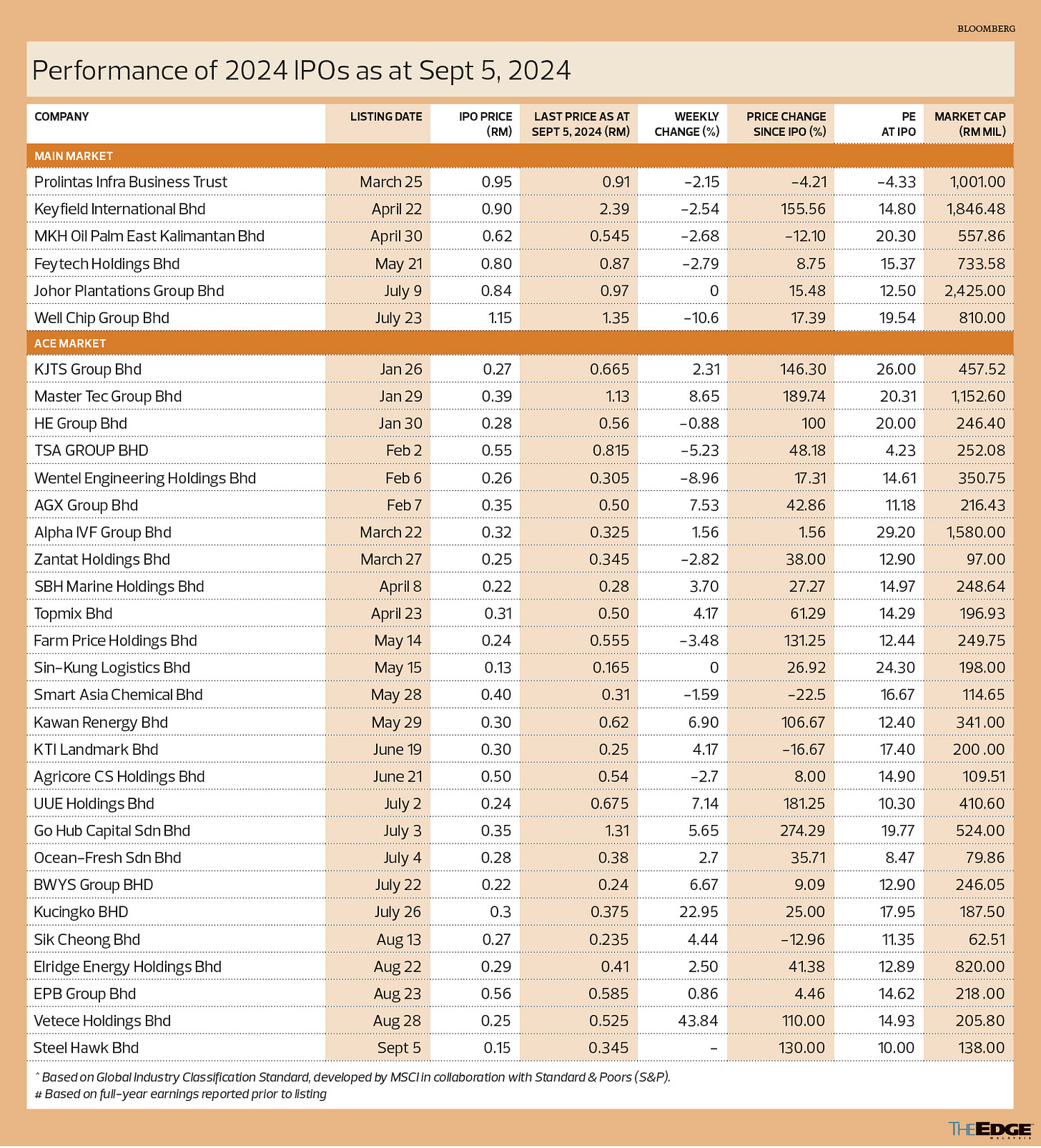

🇲🇾 99 Speed Mart opens 12.1% higher on debut in Malaysia's biggest IPO in seven years (Reuters)

Shares jump as high as 1.92 ringgit a share

Also Southeast Asia's biggest IPO since July 2023

Malaysia IPO market is region's best performer this year

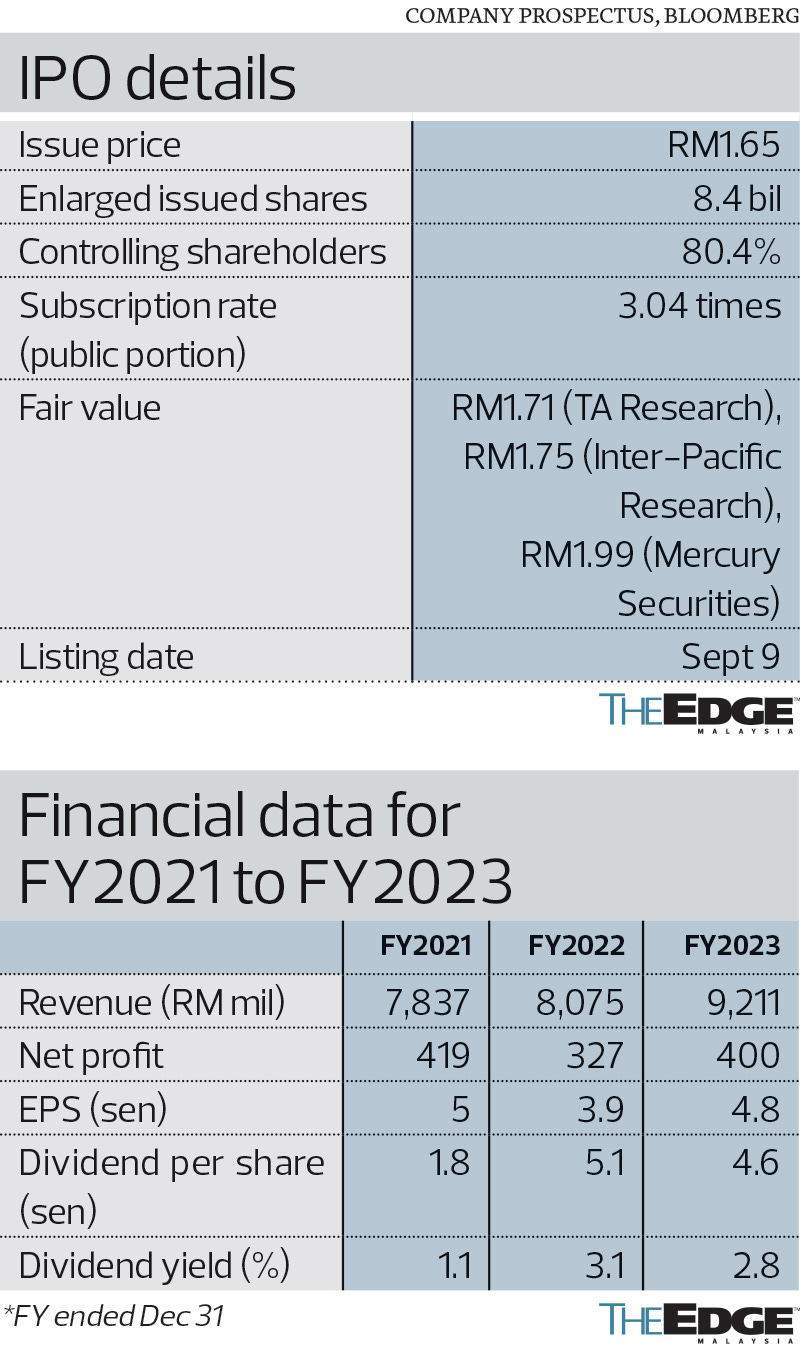

🇲🇾 IPO Watch: Minimarket chain 99 Speed Mart’s IPO anything but small (The Edge Malaysia)

COME Monday, Sept 9, Bursa Malaysia will see the listing of 99 Speed Mart Retail Holdings Bhd (KLSE: 99SMART) on the Main Market. The initial public offering (IPO) is the largest on the local bourse in seven years.

Priced at a finalised RM1.65 a share, the IPO exercise entails the public issuance of 400 million new shares as well as an offer for sale of 1.03 billion existing shares, with 1.22 billion shares allocated to institutional investors and the remaining 210 million shares for retail investors.

The IPO, which closed on Aug 23, values the group at RM13.86 billion.

🇲🇾 Telekom Malaysia: Consider Staff Cost Pressures And Data Center Growth Potential (Seeking Alpha) $ 🗃️

Telekom Malaysia Bhd (KLSE: TM / OTCMKTS: MYTEF)

🇲🇾 9 Questions with Afiq Isa (Asian Century Stocks)

Today, we’ll be talking to financial Afiq Isa. I know Afiq from Twitter, where he writes about Malaysian equities as well as broader trends in the Asia-Pacific.

Interest in Malaysia has picked up after Interactive Brokers announced they would offer full trading access to all of its clients.

Personally I admire two planters in particular: United Plantations Berhad (KLSE: UPBMF / OTCMKTS: UPBMF) - US$2.5 billion) and Kuala Lumpur Kepong Berhad (KLSE: KLK / OTCMKTS: KLKBY / KLKBF) - US$5.4 billion), storied names with decades of experience, capably managed, and adequate capital reserves to undertake expensive replanting exercises to improve overall fresh fruit bunch yields.

The data center angle is a multi-sector thematic. In the short term, major landowners in Johor state such as UEM Sunrise (KLSE: UEMS) - US$1.0 billion), S P Setia Berhad (KLSE: SPSETIA) - US$1.3 billion) and Tropicana Corporation Bhd (KLSE: TROP) - US$759 million) have already recognised proceeds from land sales for data center construction.

Gamuda Bhd (KLSE: GAMUDA) - US$1.0 billion), IJM Corporation Bhd (KLSE: IJM) - US$2.3 billion), and Sunway Construction Group Bhd (KLSE: SUNCON / OTCMKTS: SWCGF) - US$1.2 billion), who are among the country’s largest listed construction companies, have recently announced major contracts to build data centers.

Notably, YTL Power International Bhd (KLSE: YTLPOWR) - US$6.7 billion), the utility giant which had announced a data center collaboration with Nvidia utilizing the next gen Blackwell chips, had recently bought a majority stake in Ranhill Utilities Bhd (KLSE: RANHILL) - US$401 million), the listed Johor state water operator, ostensibly to ensure adequate infrastructure to accommodate DCs over the long term.

🇸🇬 SIA Engineering Company: An Attractive Business But With Stretched Valuation (Seeking Alpha) $ 🗃️

SIA Engineering Company (SGX: S59 / FRA: O3H / OTCMKTS: SEGSF)

🇸🇬 Sea Limited: Still Dirt Cheap Despite The Recent Rally (Seeking Alpha) $ 🗃️

Sea Limited (NYSE: SE)

🇸🇬 Boustead Singapore (BOCS SP) - 2024 update (Asian Century Stocks)

Singapore conglomerate run by legendary FF Wong at 7.9x forward P/E.

I wrote a deep-dive on Boustead Singapore (SGX: F9D / OTCMKTS: BSTGF) early last year [Deep-dive 2023-3: Boustead Singapore (BOCS SP)], back when the company had just made a bid for its separately listed subsidiary Boustead Projects.

Today, the acquisition has just gone through, and Boustead Singapore has now been united as a single company.

Not only was the acquisition value-accretive, it also aligns interests between the controlling shareholder FF Wong and those of minority shareholders. And FF Wong continues to be as sharp as he’s ever been.

In this post, I’ll discuss what happened to Boustead Singapore since my first write-up and what I think the future might hold in store.

🇸🇬 Buying Centurion: benefiting from better worker accommodation (Bos Invest Substack)

Growing real estate company generating high returns & trading at a discount to NAV. Niche might be seen as risky but I see a structural growth opportunity.

Centurion Corporation Ltd (SGX: OU8) is a real estate company focused on worker accommodation & student housing. The company has not been harmed by higher interest rates. The company has been performing & even with the share price doubling since the start of 2023 the stock still feels cheap.

This stock was brought to my attention by an article of Myles Kuah. A younger me would have stopped after seeing a move up like me. I would think I had missed it. Appreciating the value of upward business momentum, I decided to look a little further.

🇸🇬 4 Singapore Companies Reporting Higher Profits: Can Their Share Prices Surge? (The Smart Investor)

These four companies reported an impressive rise in profits, but can their share price increase in tandem?

Here are four Singapore companies that recently reported higher profits that may cause their share prices to increase in tandem.

Straco Corporation Limited (SGX: S85) is a developer and operator of aquatic-related facilities and tourism assets.

Grand Venture Technology (SGX: JLB), or GVT, is a solutions and services provider for the manufacture of complex precision machining, sheet metal components, and mechatronic modules.

Credit Bureau Asia (SGX: TCU), or CBA, provides risk and credit information solutions to banks, financial institutions, multinational corporations, and government bodies.

Frencken Group Ltd (SGX: E28) is a technology solutions provider with customers in diverse industries.

🇸🇬 This Live Streaming Company’s Share Price Soared 170% in 2 Months: Should Investors Take a Second Look? (The Smart Investor)

17LIVE announced a profit for the first half of this year along with expansion plans targeting the region.

It’s not often that you hear of share prices more than doubling in a short space of time.

But that’s what happened with 17LIVE Group (SGX: LVR).

The live-streaming company saw its share price leap by 170% in just a little under two months, going from S$0.43 to the current S$1.16.

Read on as we dig deeper into 17LIVE’s business and prospects.

17LIVE is a pure-play live-streaming platform in Japan and Taiwan.

🇸🇬 Imminent Interest Rate Cut: Is It Time to Sell Singapore Banks? (The Smart Investor)

With the imminent rate cut, can Singapore banks sustain their dividends?

Whether Singapore’s three major banks DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF), Oversea-Chinese Banking Corp (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY), and United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF) can sustain their dividends largely depends on whether they can maintain or grow their income.

🇸🇬 4 Reliable Singapore Engineering Firms That Pay Consistent Dividends (The Smart Investor)

We showcase four dependable engineering firms that dish out predictable dividends.

Here are four Singapore engineering firms that not only reported solid results, but also dish out dependable dividends.

Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF), or STE, is a blue-chip engineering and technology firm serving customers in the aerospace, smart city, defence, and public security sectors.

Boustead Singapore (SGX: F9D / OTCMKTS: BSTGF), or BSL, is a conglomerate with four divisions – energy engineering, real estate, geospatial technology, and healthcare.

Nordic Group (SGX: MR7) is an engineering solutions provider serving the marine, offshore oil and gas, petrochemical, pharmaceutical, infrastructure, and semiconductor industries.

Civmec Ltd (SGX: P9D / FRA: 1CV) is an integrated construction and engineering services provider to the energy, resources, infrastructure, marine, and defence industries.

🇸🇬 Is This High-Yielding Singapore Dividend Stock a Buy? (The Smart Investor)

Investors are often wary of stocks with very high dividend yields but this company could be the real deal.

A great example of a stock with a high dividend yield is CSE Global Ltd (SGX: 544 / FRA: XCC / OTCMKTS: CSYJY / CSYJF).

The stock is offering a yield of 6% at a share price of S$0.46, similar to what REITs in the REIT sector are offering.

Can CSE Global sustain this dividend yield, or should investors look elsewhere for other dividend opportunities?

CSE Global is an engineering firm serving customers across a wide spectrum of industries.

The group provides electrification, communications, and automation solutions to customers in diverse sectors.

🇮🇱 El Al Israel Airlines: The War Airline To Buy? (Seeking Alpha) $ 🗃️

El Al Israel Airlines Ltd (TLV: ELAL / OTCMKTS: ELALF)

🇧🇼 Chobe Holdings Limited (BSE: CHOBE) Part 1 (Possible Value)

Chobe Holdings Limited (BSE: CHOBE), referred to as “Chobe’s” for the remainder of this writeup, is a high return on capital business that owns and operates ecotourism lodges in Botswana. Revenues for FY 2024 were BWP 543 million, and net income was BWP 148 million which were YoY increases of 32% and 41.6%, respectively. Chobe’s is headquartered in the Chobe National Park in Kasane, Botswana.

🇿🇦 Lesaka Technologies: This African Fintech Remains Poised For Another Breakout (Seeking Alpha) $ 🗃️

Lesaka Technologies (NASDAQ: LSAK)

🇦🇹 🇷🇺 Raiffeisen Bank International: Russia Is A Major Overhang (Seeking Alpha) $ 🗃️ Raiffeisen Bank International: Still A Buy, Although Russian Assets Should Be Considered Worthless (Seeking Alpha) $ 🗃️

Raiffeisen Bank International AG (VIE: RBI / FRA: RAW / RAW0 / OTCMKTS: RAIFY)

🇨🇿 Colt CZ Group: A Potential Investment Candidate, But I Remain On The Sideline For Now (Seeking Alpha) $ 🗃️

[Firearms, tactical accessories and ammunition] Colt CZ Group SE (FRA: 6QS / OTCMKTS: CZGZF)

🇬🇷 Aegean Airlines: A Speculative Buy With Dividends And Stock Buybacks (Seeking Alpha) $ 🗃️

Aegean Airlines SA (FRA: 32A / OTCMKTS: AGZNF)

🌎 Latin America's e-commerce king says MercadoLibre has huge room for growth (Reuters)

Marcos Galperin, chief executive of Latin American e-commerce giant MercadoLibre (NASDAQ: MELI) - already the region's most valuable listed firm - says the company is just getting started.

He wants to triple the number of users, expand online payments, leverage artificial intelligence (AI) and use drones to reach more shoppers. The company is increasingly pushing loans to consumers and sellers on its platform, in turn driving sales.

"We have a lot of room to continue growing in e-commerce," Galperin told Reuters at the firm's offices in Buenos Aires, saying he wanted to boost users from around 100 million now to 300 million, without giving a specific time frame.

"On our FinTech platform, Mercado Pago, we're really just scratching the surface of all that we can do. I think Mercado Pago has enormous opportunities ahead."

🇧🇷 Sabesp Q2: Stretched Valuation Overshadows The Great Result (Seeking Alpha) $ 🗃️

[Water supply and sewage company owned by Paraná state] Companhia de Saneamento Básico do Estado de São Paulo - SABESP (BVMF: SBSP3)

🇧🇷 Sigma Lithium To Triple Capacity By 2026: Phases 2 And 3 Expansions With ESG Appeal (Seeking Alpha) $ 🗃️

Sigma Lithium Corporation (CVE: SGML)

🇧🇷 BDORY: Exposure To Brazil's Commodity Economy (Seeking Alpha) $ 🗃️

Banco do Brasil (BVMF: BBAS3 / FRA: BZLA / OTCMKTS: BDORY)

🇧🇷 Weg Stands Out In Brazil, But Its Valuation May Be Too High (Seeking Alpha) $ 🗃️

🇧🇷 PagSeguro: Gaining Market Share And Outpacing Industry TPV Growth (Seeking Alpha) $ 🗃️

[Financial services and digital payments company] PagSeguro Digital (NYSE: PAGS)

🇧🇷 Nu Holdings: Arguably The Best Unit Economics In Public Markets (Seeking Alpha) $ 🗃️

Nu Holdings (NYSE: NU)

🇧🇷 COPEL Q2: Another Mixed Result, Maintain Buy (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras Continues To Trade At A Low Valuation With Lofty Potential (Seeking Alpha) $ 🗃️

🇧🇷 Braskem Q2: Mixed Results, Cheap Valuation (Seeking Alpha) $ 🗃️

🇧🇷 Eletrobrás: Mixed Q2, But Shows Good Signs (Seeking Alpha) $ 🗃️

Eletrobras Participacoes S/A (BVMF: LIPR3)

🇨🇴 Two dry holes, wasn’t that a punch line from the Golden Girls?: Parex Resources $PXT.TO (Value Degen’s Substack)

Welcome back to the “Probably Not a Value Trap” series where I discuss businesses with a 10%+ dividend yield which I believe probably won’t get cut and why, but don’t come after me on Twitter if they do.

Parex Resources (TSE: PXT / FRA: QPX / OTCMKTS: PARXF), the Toronto listed, Columbia focused oil and gas explorer and producer broke a few hearts this past month when they announced that their drilling campaign on the Arauca field was suspended due to poor results. The stock price has subsequently dropped from $15 to $10, and the market capitalization similarly from $1.5 billion to $1 billion. This stock price is very near the October 2020 low of $9.48, despite about 20% fewer shares due to buybacks, increased reserves per share, increased production per share, and an increased dividend per share.

🇲🇽 Grupo Aeroportuario del Pacífico: Short-Term Struggles, Long-Term Gains - Time To Buy? (Seeking Alpha) $ 🗃️

Grupo Aeroportuario del Pacífico, known as GAP (NYSE: PAC / BMV: GAPB)

🇲🇽 Grupo Televisa: Mispricing Is Absurd (Seeking Alpha) $ 🗃️

Grupo Televisa SAB (NYSE: TV)

🇲🇽 Cultiba – Analysis of Q2 2024 Results (Dola Capital)

A look at Cultiba's and Grupo Gepp's Q2 2024 results.

In Nov 2023 when I first wrote about Organizacion Cultiba SAB de CV (BMV: CULTIBAB / OTCMKTS: OCVLF), I mentioned Grupo Gepp’s growth strategy. Since 2019, the company has focused on increasing the average price per case it sells by increasing prices with inflation (nominal pricing power), and selling more bottled beverages as a percentage of cases sold. This strategy has allowed the company to profitably grow. Between 2019 and TTM 3Q 2023 the company grew EBITDA from $4,567 million to $7,890 million and operating margins increased from 4.98% to 8.77%.

However, although from an operating perspective Grupo Gepp reported very good results, its liquidity position did worry me. I believed the combination of high dividend payouts, increases in short-term debt, and the requirement to sustain capital expenditures put the company in a position of liquidity stress.

In this article I will analyze 2Q 2023 results to understand how Grupo Gepp’s deteriorating liquidity position impacts my valuation of Cultiba and investment thesis.

🇲🇽 Mexico’s Telecommunications Sector Competitiveness amid a Changing Economic Landscape (CSIS)

Mexico has emerged as one of the most viable destinations for the nearshoring of U.S. investment and supply chains, owing to its close geographical proximity, skilled workforce, and formal economic integration with its North American partners through the U.S.-Mexico-Canada Agreement (USMCA). Despite its natural position to reap the benefits of nearshoring, however, barriers to competition in the information, communications, and technology (ICT) sector hinder Mexico’s ability to reach its full potential.

Although it has decreased somewhat over time, America Movil SAB de CV (NYSE: AMX)’s total market share continues to stand at roughly 70 percent as of 2022, granting the company significant political influence and advantages to ensure success in bidding on spectrum auctions. Furthermore, to state the obvious, the competition to earn the attention of consumers for nearshoring or friendshoring is global, not only regional.

📰🔬 Further Suggested Reading

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China out in the cold for foreign investors (FT) $ 🗃️

Sentiment towards the country’s stock markets has become increasingly pessimistic

🇨🇳 In Depth: China’s Never-Ending Bond Bull Run Fuels Speculation Regulators May Intervene (Caixin) $

Over the past year, China’s bond market has witnessed a surge in trading activities, driven primarily by an influx of funds into long-term government bonds.

The central bank has repeatedly issued warnings, and some large banks have come under investigation for selling long-term bonds and making illegal transactions, leading to speculation that regulators might intervene in the bond investments of financial institutions.

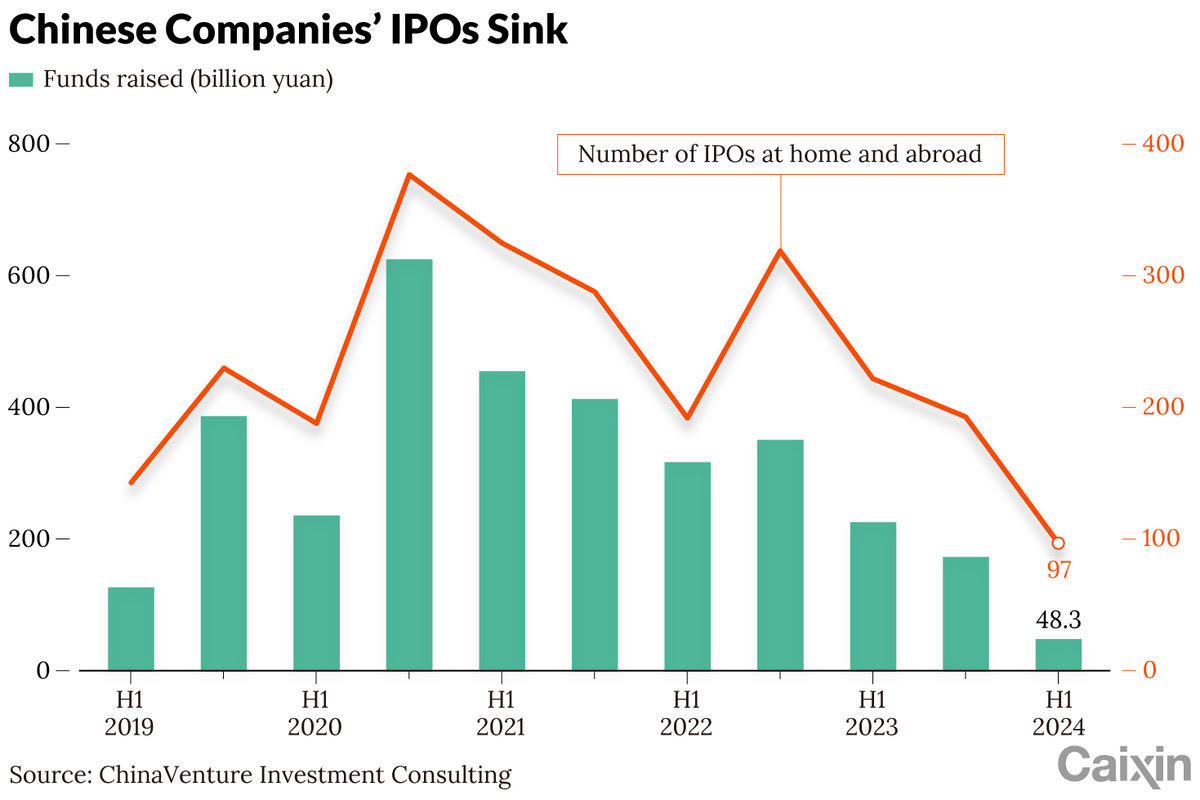

🇨🇳 In Depth: China’s PE investors left empty-handed as cash-strapped startups flout compensation deals (Caixin) $

Private equity (PE) and venture capital (VC) investors in China, struggling to exit their investments amid a slump in the IPO market, are facing additional hurdles to recovering their capital as the founders of portfolio companies that fail to list on time renege on compensation deals.

Although courts are enforcing bet-on agreements that compel companies that miss their IPO deadline to buy back investors’ shares and pay additional interest on their capital, business owners are increasingly unable to make the payments, leaving PE/VC firms empty-handed.

🇨🇳 Freight Rates Plummet as China’s Export Growth Slows and U.S. Inventory Replenished (Caixin) $

Freight charges for container shipments are falling dramatically as China’s exports slow down. The Shanghai export container settlement freight index for the North America route has dropped nearly 40% from July highs.

The traditional shipping period for the Christmas retail season runs from August to September, but shipments began as early as April this year. That would indicate container shipments will decline from September to November, according to research by Huatai Futures.

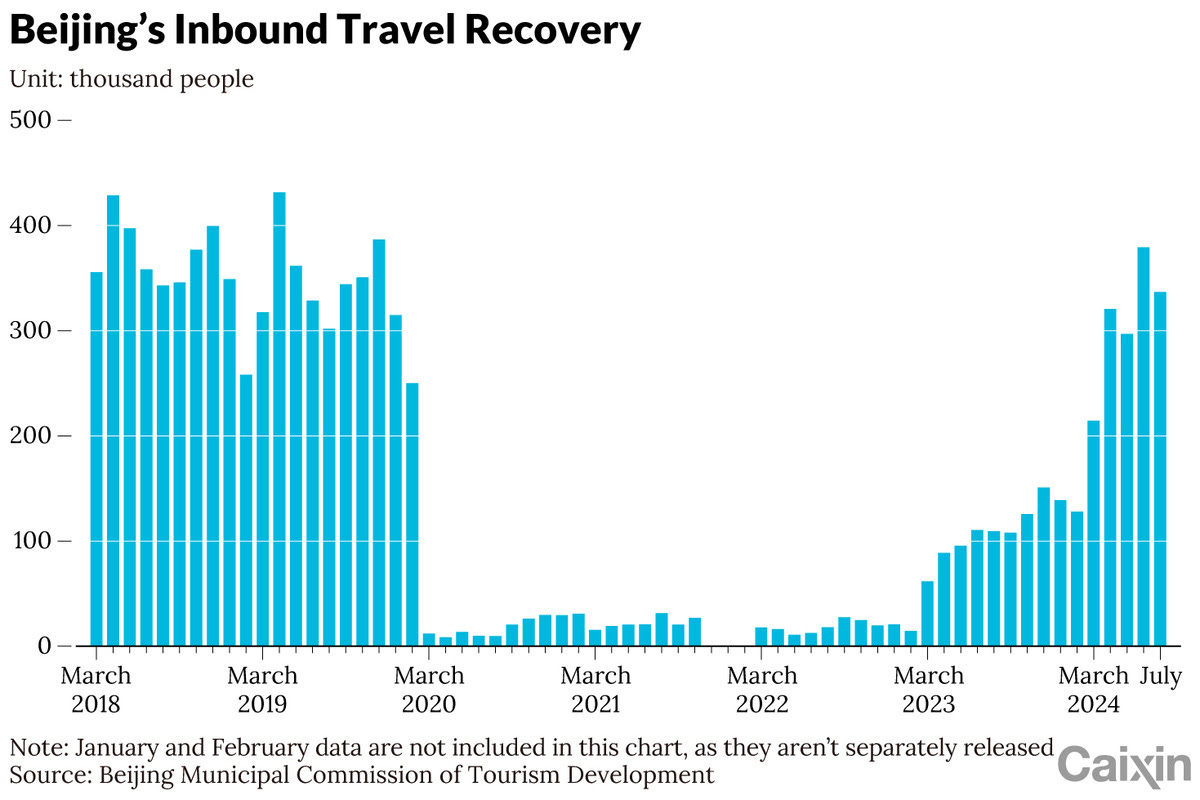

🇨🇳 Chart of the Day: Beijing Inbound Arrivals Bounce Back, With More Russians and Fewer Americans (Caixin) $

The number of inbound travelers to the Chinese capital in recent months has exceeded pre-pandemic levels, with more arrivals now coming from Asia and Russia, and fewer from the U.S., official data showed.

Following over a year of tepid growth after China ended restrictions to control Covid-19, Beijing received 379,300 and 336,900 inbound travelers in June and July this year, according to data from the Beijing Municipal Commission of Tourism Development.

🇨🇳 China’s Retirement Age to Rise by as Much as Five Years Through 2039 (Caixin) $

What’s new: China’s legislature has approved a long-awaited plan to gradually raise the retirement age by as much as five years over the next decade and a half, as the graying nation seeks to ease pressure on its pension system.

Under the plan, the retirement age for men will rise to 63 from the current age of 60, according to a National People’s Congress Standing Committee decision released Friday. For women, it will increase from 50 to 55 for blue-collar workers, and from 55 to 58 for white-collar workers.

🇨🇳 China’s “Balance Sheet Recession” Has Already Started | Richard Koo (Blockworks Macro)

Richard Koo, senior adviser at CSIS, chief economist at Nomura Research Institute, and pioneer of the “balance sheet recession” phenomenon, explains why he thinks China’s balance sheet recession has already begun.

Timestamps: 00:00 Introduction 01:51 What Is A Balance Sheet Recession? 09:39 Balance Sheet Recession In Europe & U.S. After The Great Financial Crisis of 2008 16:28 China's Balance Sheet Recession 26:26 Savings And Bank Credit In China 34:07 Permissionless Ad 35:07 China's Trade Surplus 39:02 China Likely Can't Export Its Way Out Of Its Balance Sheet Recession Because The Rest of the World Won't Let It 46:15 The Currency Adjustment Mechanism To Correct Trade Imbalances Has Been Severely Impaired, Argues Koo 01:02:40 Is The U.S. in a Balance Sheet Expansion?

🇭🇰 HK people head for less-than-dream retirement (The Asset) 🗃️

While Hong Kong investors aim to retire early at age 63 and anticipate to support themselves for 17 years from their pension and saving, it is expected they will face five years of retirement income shortfall given the average life expectancy of 85 years (men 83; women 88), finds Fidelity International’s Asia-Pacific Investor Study, which aims to understand the retirement readiness of investors in Hong Kong, mainland China, Taiwan, Singapore, Japan and Australia.

🇲🇴 Regulation, China economy, focus Macau investors: MS (GGRAsia)

“Continued regulatory noise, GGR [gross gaming revenue] year-on-year deceleration and weaker sentiment of China consumers are not helping” investor attitudes regarding the Macau casino industry, says a note from Morgan Stanley Asia Ltd.

“Investor interest is subdued, mainly because of stock performance and noise around regulations and the recent clampdown on money exchanges,” said the Friday memo from Praveen Chaudhury and Gareth Leung, referring to unauthorised money exchange touts lingering in or around casinos.

They added, referring to the front-runner for the Chief Executive (CE) position in Macau, former chief judge Sam Hou Fai: “Recent comments by the CE aspirant regarding [economic] diversification and a clampdown on illegal money exchanges have hurt sentiment over the past two months, and investors are worried about fourth quarter 2024 (CE election, President Xi [Jinping] visit in December).”

🇰🇷 South Korea’s stock exchange chief defends slow start to corporate reform drive (FT) $ 🗃️

Only 1% of 2,600 listed companies have signed up to new initiative aimed at boosting valuations

🇰🇷 Korea Exchange Plans to List Additional 39 Stock Futures and 6 Stock Options (Douglas Research Insights) $

On 12 September, the Korea Exchange announced that it plans to list additional 39 stock futures (27 KOSPI and 12 KOSDAQ) and 6 stock options on 4 November.

With these listings, the stock options will also be available for most of the top stocks in the stock market, including Samsung Biologics and Samsung Life Insurance.

Given that shorting of stocks is still essentially banned in Korea, the use of stock futures and options are likely to be increasingly used by investors to improve risk management.

🇨🇴 Colombia Security Notes - September 2024 (Latin America Risk Report)

The ELN and Gaitanistas control territory, tax local businesses, campaign for local support, and generally harm Colombia's economy.

Two articles published this week about Colombia provide critical context to the investment and security environment there. Matthew Bristow at Bloomberg reports on the ELN attacks on oil infrastructure near the Venezuelan border. Elizabeth Dickinson from the International Crisis Group writes an op-ed in the New York Times about the Gaitanistas or Gulf Clan near the border with Panama. Go read both articles. Here are seven takeaways:

🇲🇽 Mexico to launch ‘impossible’ process to elect 7,000 judges (FT) $ 🗃️

Voters to choose from vast candidate list following radical overhaul labelled an opportunity for organised crime

🇲🇽 Why Mexico’s Looming Judiciary Overhaul Spooks U.S. Business (WSJ) $ 🗃️

Billions of dollars in foreign-investment plans involving the U.S. and its biggest trading partner are on hold

American companies are delaying investment plans in Mexico as they review how a shake-up of the country’s judicial system would affect doing business with the U.S.’s largest trading partner.

The judiciary overhaul would replace 1,700 federal judges and magistrates, including Supreme Court justices, through nationwide elections and would remove strict qualifications for becoming a judge. The plan—a constitutional amendment expected to pass in the coming days—has worried foreign investors who fear judges will become beholden to constituents or political considerations instead of the law.

At stake is another $18 billion in private investment that Mexico needs to cover rising electricity demand for industrial use. The Supreme Court blocked policy initiatives that could have disrupted Mexico’s electricity sector in violation of the United States-Mexico-Canada Agreement, but some investors fear a new, elected court would approve them.

🌐🇲🇿 Critical metals as another macro event-driven play (TheOldEconomy Substack)

What do the defense industry, sunscreen, and paint have in common?

Kenmare Resources plc (LON: KMR / FRA: JEVA / OTCMKTS: KMRPF) is a mining company that operates the Moma mine on the northeast coast of Mozambique. The mine has been in production since 2009, and it is responsible for 7% of the global titanium supply and 10% of the ilmenite supply.

The company has two major revenue sources: titanium feedstock and zirconium. The next chart from Market Screener shows Kenmare’s revenue composition by product and geography.

🌐 Uranium Part 3: cycles 101 and uranium majors (TheOldEconomy Substack)

Market stages and LEAPS uranium plays

This is Episode 3 of my adventures in the Uranium universe. After Chapter One, where I discuss market fundamentals, and Chapter Two, dedicated to top players in the game, it is time to go to an operational level. In other words, to give my answer to the question of how to ride the uranium bull?

But first, let’s discuss the basics of cyclical investing.

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

JordanJordanian House of DeputiesSep 10, 2024 (d) Confirmed Nov 10, 2020Czech Republic Czech Senate Sep 20, 2024 (d) Confirmed Sep 23, 2022

Sri Lanka Sri Lankan Presidency Sep 21, 2024 (t) Confirmed Nov 16, 2019

Kazakhstan Referendum Oct 6, 2024 (d) Confirmed Jun 5, 2022

Georgia Georgian Parliament Oct 26, 2024 (d) Confirmed Oct 31, 2020

Uzbekistan Uzbekistani Legislative Chamber Oct 27, 2024 (d) Confirmed Dec 22, 2019

Uruguay Referendum Oct 27, 2024 (t) Confirmed Mar 7, 2022

Uruguay Uruguayan Presidency Oct 27, 2024 (d) Confirmed Nov 24, 2019

Uruguay Uruguayan Chamber of Representatives Oct 27, 2024 (d) Confirmed Oct 27, 2019

Uruguay Uruguayan Chamber of Senators Oct 27, 2024 (d) Confirmed Oct 27, 2019

Bulgaria Bulgarian National Assembly Oct 27, 2024 (d) Confirmed Jun 9, 2024

Romania Romanian Presidency Nov 24, 2024 (d) Date not confirmed Nov 24, 2019

Namibia Namibian Presidency Nov 27, 2024 (d) Confirmed Nov 27, 2019

Namibia Namibian National Assembly Nov 27, 2024 (d) Confirmed Nov 27, 2019

Kazakhstan Referendum Nov 30, 2024 (t) Date not confirmed Jun 5, 2022

Romania Romanian Senate Dec 1, 2024 (t) Date not confirmed Dec 6, 2020

Romania Romanian Chamber of Deputies Dec 1, 2024 (t) Date not confirmed Dec 6, 2020

Ghana Ghanaian Presidency Dec 7, 2024 (t) Confirmed Dec 7, 2020

Ghana Ghanaian Parliament Dec 7, 2024 (t) Confirmed Dec 7, 2020

Thailand Referendum Dec 31, 2024 (t) Date not confirmed Aug 7, 2016

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Cuprina Holdings (Cayman) Ltd CUPR Network 1 Financial Securities, 3.8M, $4.00-4.50, $15.9 mil, 9/16/2024 Week of

We manufacture and distribute chronic wound care products – medical grade bio-dressing products made from sterile blowfly larvae and sold under the MEDIFLY brand – mostly in Singapore since February 2020 and in Hong Kong since March 2023. (Incorporated in the Cayman Islands)

From the Prospectus: “Looking ahead, we have strategic plans in place for the second half of 2024 and 2025 to expand our sales and establish physical operations in several key regions, including Southeast Asia, the Middle East (in particular, the member states of the Gulf Cooperation Council, or GCC), and mainland China. These expansion initiatives will further enable us to cater to the growing demand for our products in these promising markets, cementing our position as a trusted player in the field of chronic wound care and treatment.”

We are a Singapore-based biomedical and biotechnology company dedicated to the development and commercialization of innovative products for the management of chronic wounds, as well as operating in the health and beauty sectors. Our expertise in biomedical research allows us to identify and utilize materials derived from natural sources to develop wound care products in the form of medical devices which meet international standards. We believe we will be able to build upon and leverage such expertise to develop innovative cosmeceutical products in the future.

As of Dec. 31, 2023, we manufactured and distributed a line of medical grade sterile blowfly larvae bio-dressing products marketed under the MEDIFLY brand name, or the MEDIFLY products. The MEDIFLY products are used as a biological debridement tool for chronic wounds, in a procedure known as Maggot Debridement Therapy, or MDT, which is an effective alternative to surgical debridement.

In addition to our commercialized MEDIFLY products, we have two lines of chronic wound care products in our pipeline:

*Collagen dressings, including sponges, particles and hydrogels, using bullfrog collagen derived from the valorization of abattoir waste streams of American bullfrogs (Lithobates catesbeianus) and

*Products using medical leeches for wound treatment.

We expect development of such products to take place over the course of 2024 and 2025 and to become commercially available subject to regulatory approval.

We believe what sets us apart is our focus on developing functionally specific chronic wound care products designed to address the major stages of the wound healing process from chronic to closure.

Our chronic wound care products, including both our existing commercialized products and forthcoming products in our pipeline, are poised to benefit from escalating global market demand. This demand is primarily fueled by the demographic shift towards an aging population and the concurrent rise in comorbidities such as diabetes, obesity, cardiovascular ailments and peripheral vascular diseases.

For our cosmeceuticals business, we introduced three products in 2023, including a hydrating balm product, a muscle energy cream and a pain relief muscle patch. For our commercialized cosmeceutical products, we have commissioned original equipment manufacturers of skincare products to develop the formulation and manufacture the substantially finished and finished products. In addition, we plan to explore the possibility of developing a range of potential cosmeceutical product candidates incorporating bullfrog collagen with a view to making them commercially available between 2024 and 2028, subject to the progress of the relevant R&D work.

We offer our chronic wound care products to both public and private hospitals and clinics, where patients can obtain them through prescription from a physician. Our customers primarily include major public and private hospitals and clinics in Singapore.

Our commercialized cosmeceutical products can be purchased directly by individual customers through a variety of channels, including retailers and gyms in Singapore, Malaysia and Australia, as well as online shopping platforms such as Shopee.

Note: Net loss and revenue figures are in U.S. dollars for the year that ended Dec. 31, 2023.

Note from the Prospectus: “Our independent registered public accounting firm expressed substantial doubt regarding our ability to continue as a going concern. Our ability to continue as a going concern requires that we obtain sufficient funding to finance our operations.”

(Note: Cuprina Holdings (Cayman) Ltd. filed an F-1/A on Sept. 3, 2024, disclosing that its IPO’s price range is $4.00 to $4.50 – a change from its IPO price of $4.00 – and keeping the IPO’s size at 3.75 million Class A ordinary shares – to raise $15.94 million. Background: Cuprina Holdings (Cayman) Ltd increased the number of shares to 3.75 million – up from 2.5 million shares initially – without disclosing the IPO price – in an F-1/A filing dated June 20, 2024.)

(More Background: Cuprina Holdings (Cayman) Ltd filed an F-1/A dated May 16, 2024, disclosing that it will offer 2.5 million Class A ordinary shares – without stating the IPO price. More Background: Cuprina Holdings (Cayman) Ltd. filed its F-1 on March 7, 2024, without disclosing terms; estimated IPO proceeds were $10 million. Previously: The Cayman Islands-incorporated holding company submitted its confidential filing to the SEC on Oct. 13, 2023.)

Global Engine Group Holding Ltd. GLE R.F Lafferty & Co., 2.5M Shares, $4.00-5.00, $11.3 mil, 9/16/2024 Week of

We are a holding company. (Incorporated in the British Virgin Islands)

As a holding company with no material operations, our operations are conducted by our indirect wholly owned subsidiary, Global Engine Limited (“GEL”), in Hong Kong, a special administrative region of the People’s Republic of China (the “PRC”). This is an offering of the Ordinary Shares of Global Engine Group Holding Limited, the holding company incorporated in BVI, instead of shares of GEL, our operating entity in Hong Kong.

From the prospectus: For the six months ended Dec. 31, 2022, we generated approximately 80.9% of our revenues from Hong Kong and 19.1% from Taiwan. For the year ended June 30, 2022, we generated approximately 76.2% of our revenues from Hong Kong and 23.8% from Taiwan. For the year ended June 30, 2021, we generated approximately 81.3% of our revenues from Hong Kong. (Please see the prospectus, including the “Risk Factors” section, for language related to China risk.)

We are an integrated solutions provider that delivers actionable outcomes for organizations by using information communication technologies (“ICT”) solutions to drive business outcomes and innovation. Leveraging our business development and consulting talent, we assess, design, deliver, secure, and manage solutions comprised of leading technologies aligned with our customers’ needs.

Our target customer groups include, but are not limited to, the following: (1) telecom operators; (2) data center and cloud computing services providers and (3) Internet of Things (IoT) Solutions Providers, Resellers and Users.

For telecom operators, we provide comprehensive services to telecom operators, including the one-stop shop purchase from telecom license application service to turnkey network setup as well as service outsourcing that adapted to each client’s specific needs. We especially target the clients that are small to medium-sized telecom operators and ICT service providers seeking growth and expansion in Hong Kong and the South East Asian market.

For data center and cloud computing services providers, we offer business planning, development, technical and operations consulting programs structured to target the cloud computing and data center providers. Our current consultancy projects include the technical and regulatory feasibility study for establishing and acquiring data center facilities in Hong Kong and the South East Asian region.

For Internet of Things (IoT) solutions providers, resellers and users, we offer system design, planning, development and operation services to technology companies who seek to transform their service offerings through adoption of the IoT technology and platform.

We offer a number of products and services to our customers to fit their specific ICT needs as we strive to be their primary ICT solutions and services provider. Some of our offerings include:

- ICT Solution Services – Cloud platform deployment, IT system design and configuration services, maintenance services, data center colocation service and cloud service. We believe that our services view technology purchases as integrated solutions, rather than discrete product and service categories, and most of our sales are derived from integrated solutions involving our customers’ data centers, network and collaboration infrastructure.

- Technical Services – Technical development, support, and outsourcing services for data center and cloud computing infrastructure, mobility and fixed network communications, as well as IoT projects/

- Project Management Services – These services enhance productivity and collaboration management and enable successful implementation and adoption of solutions for customers.

Our primary focus in delivering comprehensive ICT solutions is to deliver custom tailored solutions that address our customers’ business and financial needs while leveraging the expertise of our experienced team, as well as our strong ties with telecom carriers, vendors, and regulators. We begin with a consultation with our clients to better understand their business needs and then design, deploy and manage solutions aligned to such needs. In order to provide custom tailored solutions, we leverage the broader areas of cloud, security, networking, data center, collaboration and specific skills in orchestration and automation, data management, data visualization, analytics, network modernization, edge computing and other innovative and emerging technologies. We possess extensive engineering and operational experience and relationships with a broad range of leading ICT service providers that enable us to offer tailored multi-vendor ICT solutions that are optimized for each of our customers’ specific requirements.

Moreover, our technical resources have enabled us to continue investing in engineering and technology resources to stay on the forefront of technology trends. Our expertise in the ICT industry, fortified by our robust portfolio of consulting, professional, and managed services, has enabled us to remain a trusted advisor for our customers. This broad portfolio of expertise enables us to deliver a wide range of services to our customers that spans from fast delivery of competitively priced products and services, to subsequent operations and maintenance services. This approach permits us to deploy ever-more-sophisticated solutions enabling our customers to achieve their business goals.

**Note: Net income and revenue figures are in U.S. dollars (converted from Hong Kong dollars) for the year ended June 30, 2023.

(Note: Global Engine Group Holding Ltd. cut its IPO’s size to 2.5 million shares – down from 3.0 million shares – and kept the price range at $4.00 to $5.00 – to raise $11.25 million, according to an F-1/A filing dated April 2, 2024. In that same F-1/A filing – dated April 2, 2024 – Global Engine Group Holding named R.F. Lafferty & Co. as the sole book-runner to replace Prime Number Capital.)

(Note: Global Engine Group Holding Ltd. increased its IPO’s size by 50 percent to 3.0 million shares – up from 2.0 million shares – and kept the price range at $4.00 to $5.00 – to raise $13.5 million, according to an F-1/A filing dated Aug. 29, 2023. In that same filing, Global Engine Group Holding Ltd. named a new sole book-runner, Prime Number Capital, which replaced Univest Securities.)

(Background Note: Global Engine Group Holding Ltd. cut its IPO’s size to 2.0 million shares – down from 3.5 million shares – and kept the price range at $4.00 to $5.00 – to raise $9.0 million, according to an F-1/A filing on May 30, 2023. Background: Global Engine Group Holding Ltd. disclosed its IPO price range of $4.00 to $5.00 on 3.5 million shares in its F-1/A filing dated Feb. 7, 2023. Global Engine Group Holding Ltd. filed an F-1/A dated Jan. 11, 2023, in which it disclosed partial terms – 3.5 million shares with no price range stated in the prospectus. Some IPO experts, however, believe the deal could raise up to $17 million – and if that is the case, then the assumed IPO price would be about $4.86. Global Engine Group Holding Ltd. filed its F-1 on Aug. 16, 2022; the company filed confidential IPO documents with the SEC on March 25, 2022.)

Jinxin Technology NAMI Craft Capital Management/ WestPark /R.F. Lafferty & Co., 1.9M Shares, $4.00-5.00, $8.5 mil, 9/23/2024 Week of

(Incorporated in the Cayman Islands)

We are an innovative digital content service provider in China. Leveraging our powerful digital content generation engine powered by advanced AI/AR/VR/digital human technologies, we are committed to offering our users high-quality digital content services through both our own platform and the content distribution channels of our strong partners.

We currently target K-9 students in China, with core expertise in providing them digital and integrated educational content, and plan to further expand our service offerings to provide premium and engaging digital contents to other age groups. We were the largest digital textbook platform and a leading digital educational content provider for K-9 students in China, both in terms of revenue in 2022, according to Frost & Sullivan. We collaborate with leading textbook publishers in China and provide digital version of mainstream textbooks used in primary schools and middle schools. Our digital textbooks primarily cover Chinese and English subjects used in K-9 schools in China. We also create and develop digital self-learning contents and leisure reading materials in-house. Our AI-generated content technology enables our comprehensive digital contents to deliver an interactive, intelligent and entertaining learning experience.

Textbooks have been the primary teaching instrument for most children. Access to an advanced and intelligent version of textbook is becoming a rising demand, particularly among K-9 students who are at early stage of learning and forming an efficient learning style. There are currently over 150 million K-9 students in China while the digitization rate of textbook remains relatively low. Since our inception in 2014, we have built expertise in creating digitized, interactive and intelligent textbooks that we believe improve K-9 students’ learning experience. Previously, CDs were the most common learning equipment used by K-9 students to assist with studying textbook in China. We are committed to replacing outdated learning materials and equipment with our intelligent, interactive digital products and resources, and eventually cultivate a fresh and innovative learning style.

We are authorized by major Chinese textbook publishers to digitize their proprietary textbooks, and design and develop the digital version. Besides digital textbooks, leveraging our deep insights in China’s childhood education sector and our technological strength, we also provide digital self-learning materials and digital leisure reading materials, catering to the evolving and diversified needs of potential users. We have strong in-house content development expertise in digitized materials, amusement features, video and audio effects as well as art design. Our products and contents are imbued with the rich operational know-how and deep understanding of China’s childhood education sector, which we believe make our digital contents highly compelling to our users.

We distribute digital contents primarily through (i) our flagship learning app, Namibox, (ii) telecom and broadcast operators and (iii) third-party devices with our contents embedded. We launched our interactive and self-directed learning app Namibox in 2014, to provide users an integrated entry point to our digital textbooks, self-learning materials and leisure reading materials. Users can access various free contents, subscribe to advanced contents and choose to become premium members through our membership programs. In addition, we partner with all mainstream Chinese telecom and broadcast operators to tap into their large user base. Our partnered telecom and broadcast operators broadcast our various programs to end users through their respective platforms, distribute our educational contents to interested users and share certain percentage of revenues with us. Through networks of our partnered telecom and broadcast operators, individual users gain easy access to our digital contents through TVs or mobile devices. Furthermore, we cooperate with well-known hardware manufacturers, such as manufacturers of digital pads and intelligent TVs, and pre-install our programs in such devices directly. The integrated distribution channels empower us to increase our brand awareness in a cost-efficient manner, grow our user base sustainably and improve our contents continuously based on users’ real time feedbacks.

Our business has evolved significantly since inception and we have never stopped reimagining and innovating our products and digital contents. We are doing this not only to cater to, but influence, the learning habits and lifestyles of our users, to fulfill their goals and enrich their lives. With innovative and high-quality educational contents, we have built a trusted and well recognized brand, as well as a large user base throughout China. Since our inception, our Namibox app has amassed over 79 million cumulative downloads and more than 39 million registered users as of December 31, 2023. The high-frequency interactions we have with users and our unique access to a large amount of mission-critical learning data further provide us deep insights in K-9 education sector.

Fueling all of these great achievements are our technologies. We deploy advanced digitization technologies, AI technologies and big data analysis to provide superior user experience. We also deploy advanced AI technologies that power various teaching and voice assessment tools, all to improve the learning effectiveness for children. Leveraging our proprietary digital content generation engine, we are able to consistently refine and upgrade our educational contents, as well as to intelligently recommend content to our users, continually improving user experience.

We have realized steady growth with healthy financial performance since inception. Despite negative impacts caused by regulatory changes in the online education industry in 2021, our registered users increased from 29.9 million as of December 31, 2021 to 35.3 million as of December 31, 2022, and further to 39.5 million as of December 31, 2023. In addition, we recorded net income of RMB55.1 million and RMB83.5 million (US$11.8 million) in 2022 and 2023, respectively.

Note: Net income and revenue are for the year that ended Dec. 31, 2023.

(Note: Jinxin Technology Holding Company unveiled the terms for its IPO – 1.88 million American Depositary Shares – or 1,875,000 ADS – at a price range of $4.00 to $5.00 – to raise $8.46 million, according to an F-1/A filing dated Aug. 19, 2024. Each ADS represents 33.75 million ordinary shares. Background: Jinxin Technology filed its F-1 on Aug. 10, 2023, and its confidential IPO documents on March 24, 2023.)

SAG Holdings Ltd SAG Wilson-Davis & Co., 0.9M, $8.00-8.00, $7.0 mil, 9/23/2024 Week of

We are a holding company incorporated in the Cayman Islands. The ordinary shares offered in the IPO are being offered by the holding company.

We are a Singapore-based provider of high-quality OEM, third-party branded and in-house branded replacement parts for motor vehicles and for non-vehicle combustion engines serving a number of industries. We distribute spare parts through operations primarily based in Singapore and global sales primarily generated from the Middle East and Asia. Through our On-Highway Business, we supply a wide range of genuine OEM and aftermarket parts for use in passenger and commercial vehicles bearing either the manufacturer’s brands or our in-house brands through SP Zone. Through our Off-Highway Business, we supply a wide range of components and spare parts for internal combustion engines with strong focus on filtration products through Filtec. Our Off-Highway Business serves industrial sectors that include marine, energy, mining, construction, agriculture, and oil and gas industries. Our products are sourced from genuine OEM and global premium aftermarket brands to suit the diverse needs of our customers. Over the past several years, our revenues have been relatively evenly split between our On-Highway Business and our Off-Highway Business, and approximately 10% of our revenues are derived from sale of our in-house products.

Our Group’s business can be traced back to the early 1970s, when our late founder, KE Neo, set up Chop Kim Aik, a retail shop specializing in the supply of British-made truck spare parts. KE Neo leveraged his experience as the owner of a transportation business with a fleet of trucks serving the construction industry to building a small retail shop to a large-scale operation with a solid customer base and a recognizable brand.

In 1983, we diversified into the supply of Japanese made automotive spare parts to capitalize on the increase in demand for Japanese vehicles in Singapore. Riding on this global growth of Japanese automotive exports, CE Neo, with the support of his father KE Neo, set up its first automotive spare parts retail outlet in Singapore, naming it Soon Aik Auto Parts Trading Co (which became a private limited company, Soon Aik Auto Parts Trading Co. Pte Ltd in 1995, and is now known and hereinafter referred to as “SP Zone”) specializing in trading Japanese made automotive spare parts, primarily used in passenger and commercial vehicles.

In the late 1980s, SP Zone achieved a major milestone when it was appointed as an authorized dealer of UD Trucks Corporation (“Nissan UD”) automotive genuine spare parts in Singapore, expanding our business of selling authorized genuine spare parts, beyond our historical aftermarket spare parts business model. The business gradually expanded, and the outlet grew to supply automotive spare parts for trucks operating in Singapore sold by respected Japanese brands from the manufacturers such as Nissan UD, Mitsubishi Fuso Truck and Bus Corporation, Hino Motors Ltd and Isuzu Motors Ltd.

In 1993, Jimmy Neo and CK Neo, brothers to CE Neo and sons of KE Neo, joined SP Zone, to assist with the expanding business. In 1995, Jimmy Neo was instrumental in securing the dealership with Cummins Asia Pacific Pte. Ltd (“Cummins”) for Fleetguard filters, a product used in Cummins engines, pursuant to which SP Zone started distributing filters to the marine, energy, mining, agriculture, oil and gas, and construction industries (referred to as the “Off-Highway Business”) in addition to the automotive industry (referred to as the “On-Highway Business”).

In 1995, SP Zone became a private limited company and expanded its sales channels to include exports to ASEAN markets, capitalizing on unmet demand as there were few suppliers supplying automotive spare parts to those markets at that time. Another major milestone in 1995 occurred when Edward Neo, the third brother and son of KE Neo, joined our Group to manage the local wholesale and retail business, allowing CE Neo to focus on our Group’s newly expanded export business. At this point, the business had grown from a small retail operation to regional family business run by a father and his four sons with multiple areas of focus and utilizing the family member’s different areas of expertise.

In 1999, SP Zone secured another line of filtration products when it was appointed as a distributor for Parker Racor, a line of Parker Hannifin filtration products. Subsequently, we established Filtec as a separate Singapore subsidiary to carry out sales of Off-Highway Business dedicated to handling sales to our Off-Highway customers in the industrial sectors.