Emerging Market Links + The Week Ahead (September 23, 2024)

China’s consumption downgrade + their start-up sector is in the doldrums, India's index weight surges, shorts target Kaspi, Georgia trip reports, EM stock picks & the week ahead for emerging markets.

Caixin has an article (Analysis: What Noodles Tell Us About China’s Consumption Downgrading - unfortunately, its almost completely behind a paywall) noting an interesting study using data from mobile payment solutions provider Shouqianba:

Chen Qin’s analysis started by looking at the spending of a typical customer who visited the same restaurant over 300 times from late 2022 through July this year. The person bought lunch at the eatery almost every day between 11:00 and 12:00.

At the beginning of last year, the customer’s average lunch cost 10 yuan ($1.40) to 12 yuan, including a bowl of pork noodles with pickled mustard greens, sometimes accompanied by a bottle of iced tea. However, in the last few days of July, the person only spent 7 yuan to 9 yuan, shifting to cheaper options like noodles with an egg or noodles with vegetables.

It would be interesting if anyone else knows anything more about this study or has seen any write-ups of it or similar studies elsewhere.

When I first started more or less living in Malaysia, the Ringgit was RM3 to US$1 and simple sit-down mall restaurants in the Bukit Bintang-KLCC area would be packed with office workers getting their lunch specials with a free drink (usually lemon ice tea or barley). Those simple sit-down mall restaurants and/or lunch specials with free drinks largely disappeared after the Ringgit hit RM4+ to US$1 (implementing a GST also did not help) with the office workers gravitating to street food and hawkers out on the street (who were probably always there but seem more plentiful now). There are still plenty of simple sit-down non-Mamak restaurants or little hawker centers in older buildings where rent is cheap offering reasonable priced lunch meals, but mall food courts and restaurants have prices so high now that they no longer cater to nor seem interested in catering to the daily budget minded lunch crowd…

Finally, a paid subscriber in Hong Kong told me late last week they had trouble paying with a new Visa card (Stripe was receiving the old card’s number which the bank was declining and that decline was showing up on my Stripe dashboard) plus I had trouble using my Visa card to book an airline flight (the website was declining my card while my bank in the US was not receiving any data from the website indicating an attempted transaction). That had me thinking there’s a bug going around involving Visa or payment processing software or FX volatility with the Fed cut (my transaction was in Ringgit).

A human at Substack responded over the weekend by saying a subscriber needs to go to the Substack’s account page and enter the new card details there e.g.:

You can update your payment details before resubscribing by following the steps below:

Navigate to your Substack account Settings at this link: https://emergingmarketskeptic.substack.com/account

Click Upgrade to paid

Click Other payment options

Select Use a different card

Stripe customer service was thinking something at Substack’s end was not transmitting the card number correctly and I am not sure if the above solution worked. If any writer or paid subscriber to a Substack has ever run into any similar issues (especially involving international jurisdictions), do let me know in the comments or by messenger…

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

🇲🇽 Mexico Closed End Fund Stock Picks (Mid 2024) Partially $

Mexico stock picks or potential nearshoring stocks that are the holdings of Mexico closed-end funds Herzfeld Caribbean Basin Fund, Inc (NASDAQ: CUBA), Mexico Equity and Income Fund (NYSE: MXE), and The Mexico Fund (NYSE: MXF).

🌐 EM Fund Stock Picks & Country Commentaries (September 22, 2024) Partially $

Is production moving out of China? Where to hide from the coming US/China debt crisis, Seoul + Mumbai trip reports, visualizing Latin America’s unbanked population, Europe’s hidden tech titans, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Is Baidu Fumbling It Again? (Investing in China)

Why Baidu’s Early Moves Don’t Translate Into Long-Term Success

A few years ago, the equivalent of the “Magnificent Seven” in the United States was the BAT stocks in China: Baidu (NASDAQ: BIDU) BIDU 0.00%↑ , Alibaba (NYSE: BABA) BABA 0.00%↑ , and Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY). These three companies were the top tech giants in China, leading the market and driving growth in the technology sector.

In recent years, Chinese tech stocks taken a heavy beating, but Tencent still holds the top spot in market capitalization by a large margin. Alibaba, despite its decline, ranks seventh, just behind major Chinese banks, Kweichow Moutai (SHA: 600519), PetroChina (HKG: 0857 / SHA: 601857 / OTCMKTS: PCCYF), and China Mobile (HKG: 0941 / 80941 / FRA: CTM).

🇨🇳 AsiaInfo reboots with founder’s return, big investor’s departure (Bamboo Works) $

The telecoms software company and its A-share listed affiliate will merge into a single company with close to 10 billion yuan in revenue

Early internet entrepreneur Edward Tian is leading a restructuring of two companies he founded as he effectively retakes control of AsiaInfo Technologies Ltd (HKG: 1675 / FRA: 51N / OTCMKTS: ASNFF)

Even after a downward adjustment, Tian is still paying a premium of more than 40% for the shares that will give him control of AsiaInfo Technologies

🇨🇳 🌎 Transsion dodges bullet with CFO’s release after two-week detention (Bamboo Works) $

The smartphone maker that leads the African market said longtime CFO Xiao Yonghui was released last week but gave few details on why he was detained

Shenzhen Transsion Holdings’ (SHA: 688036)’s CFO was detained early this month and later released, though investors remain wary due to the company’s thin profit margins and ongoing legal disputes

The smartphone maker’s revenue rose 38% to 34.6 billion yuan in the first half of this year, with 35.7% profit growth, mostly on its expansion into new markets

🇨🇳 CSPC Pharma taps R&D superstar in quest for new breakout drugs (Bamboo Works) $

Liu Yongjun’s drug commercialization experience and ties to multinational firms are urgently needed for his new employer’s ongoing transformation

CSPC Pharmaceutical Group (HKG: 1093 / FRA: CVG / OTCMKTS: CHJTF)’s new R&D head Liu Yongjun engineered the successful tie-up between his former employer Innovent Biologics (HKG: 1801 / FRA: 6IB / OTCMKTS: IVBXF / IVBIY) and France’s Sanofi (NASDAQ: SNY)

CSPC is looking for its next star drug after its revenue rose just 1.3% in the first half of 2024, and as its drugs come under pricing pressure from China’s centralized procurement

🇨🇳 Jiangsu Hengrui Medicine (600276.CH) - Share Price Is at Risk of Correction (Smartkarma) $

On the surface, it seems that Jiangsu Hengrui Pharmaceuticals Co (SHA: 600276)'s performance growth in 24H1 is very high, but if excluding the upfront payment from Merck, the Company’s performance actually falls short of expectations.

Our forecast of revenue growth in 2024, 2025, 2026 (excluding Merck’s upfront payment) is 12% YoY, 8% YoY, 15% YoY, respectively. By 2026, Hengrui may still suffer from VBP.

Hengrui is overvalued and reasonable P/E is about 30 (or lower). We also don’t think Hengrui’s valuation should be higher than that of BeiGene (NASDAQ: BGNE). Current high valuation cannot be justified.

🇨🇳 China’s Two Largest Shipbuilders Set Stock Swap Terms For $38 Billion Merger (Caixin) $

China State Shipbuilding Corp. Ltd. (CSSC) [China CSSC Holdings Ltd (SHA: 600150)] and China Shipbuilding Industry Co Ltd (SHA: 601989) on Wednesday announced a stock exchange proposal in their merger deal. Analysts said the proposed exchange terms are not favorable for shareholders of China Shipbuilding Industry.

The two largest state-owned shipbuilding conglomerates determined the exchange ratio at 0.1335 shares of CSSC for each share of CSIC.

🇨🇳 Pre-IPO Midea Group H Share - Here Are the Risks Behind (Smartkarma) $

During Mid Autumn Festival, home appliance chain sales was up >30% YoY after years of decline. Due to trade-ins policy, there's sharp increase in customer flow for consumption in stores (about twice the number of customers in the past). Sales of mainstream brands like Midea (SHE: 000333) is better than 2nd/3rd tier brands. So, Midea's 2024 performance is guaranteed. But growth may slow down due to risks analyzed

EXECUTIVE SUMMARY

For the reasons why Midea is eager to IPO in HK, investors shouldn’t just look at the surface of its glory, but delve into the “real motives” behind capital operations.

The policy of subsidizing the trade-in of home appliances belongs to “early overdraft of demand” and is unsustainable. Valuation logic for the performance increment brought by such policy is P/B.

If Midea cannot achieve the expected breakthroughs in To B business or internationalization in 2025-2026 to hedge against the weak domestic business, Midea's performance/valuation in following years would inevitable decline.

🇨🇳 Midea A/H Listing - Strong Demand for Quality Asset, Index Flows Could Help in the near Term (Smartkarma) $

Midea (SHE: 000333) raised around US$4.6bn in its H-share listing (including over-allocation), after the deal was upsized.

Midea Group is one of the world’s largest home appliance manufacturing companies with a presence in over 200 countries. Its A-shares have been listed since 2013.

We have covered the deal background in our previous notes. In this note, we talk about the trading dynamics.

🇨🇳 Pre-IPO LinkChem Technology - The Business and the Concerns Behind (Smartkarma) $

The sudden high growth in 2023 was benefited from the cooperation with related party Shandong LinkChem. Is the performance growth driven by LinkChem's reliance on related party transactions sustainable?

LinkChem relies heavily on limited number of customers to contribute performance but the customer stability is not strong. Due to “low voice” in front of customers, cash flow is under pressure.

The barrier of terbium chloride product is not high and LinkChem will face fierce competition in the future, leading to decreasing YoY growth revenue. Valuation should be lower than peers.

🇨🇳 Pre-IPO Carote Ltd (PHIP Updates) - High Performance Growth May Not Be Sustainable (Smartkarma) $

Relying mainly on online channels and successful internationalization strategy, [Cookware maker] CAROTE’s performance growth showed strong momentum in recent years. However, after the short-term demand outbreak, future performance growth could slow down.

CAROTE adopts a product strategy similar to ZARA, launching a massive product matrix, constantly attracting consumers' interest, but the innovation capability and core competitiveness of products are not high.

Valuation of CAROTE could be higher than Vesync (HKG: 2148 / OTCMKTS: VSYNF). If Trump is elected, the friction/trade war between China and US may escalate, which is detrimental to CAROTE's future valuation performance.

🇭🇰 Hong Kong typhoon trading halts sail into the sunset (Bamboo Works) $

Hong Kong Exchanges & Clearing (HKG: 0388 / 80388 / FRA: D9I / OTCMKTS: HKXCF)

A new rule ending the city’s longtime practice of stock market closures during typhoons will take effect next week, but not in time to prevent one final disruption earlier this month

A new rule that will keep Hong Kong’s stock market open through bad weather events will take effect on Sept. 23

Analysts believe the measure will have limited impact on trading volumes, and say other measures like lowering trading-related taxes will do more to attract investors

🇭🇰 HKEX: Is this the bottom? (East Asia Stock Insights) $

Strong recovery post 2022-2023 slump, with further catalysts ahead

Hong Kong Exchanges & Clearing (HKG: 0388 / 80388 / FRA: D9I / OTCMKTS: HKXCF) looks compelling and merits a revisit (the usual disclaimer: this is not investment advice).

🇭🇰 AGBA Group + Triller With A Punch From BKFC (Seeking Alpha) $ 🗃️

[Four divisions: Platform, Distribution, Healthcare and Fintech] AGBA Group Holding Ltd (NASDAQ: AGBA / AGBAW)

🇭🇰 CK Hutchison: Waiting For Positive Change (Seeking Alpha) $ 🗃️

[Conglomerate] CK Hutchison (HKG: 0001 / FRA: 2CKA / OTCMKTS: CKHUY / CKHUF)

🇲🇴 MGM has leeway to pursue several large-scale projects: CBRE (GGRAsia)

U.S.-based MGM Resorts International (NYSE: MGM), the parent of Macau casino operator MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY), has enough “flexibility to pursue several large-scale developments in the medium-term,” says CBRE Capital Advisors Inc.

“This includes potential opportunities domestically in New York and internationally in Japan and the UAE [United Arab Emirates],” wrote analysts Colin Mansfield and Connor Parks in a Monday memo.

Earlier this month, MGM Resorts announced an offering of US$850.0 million in aggregate principal amount of 6.125-percent senior notes, due in 2029.

🇹🇼 ASE: Still The Global OSAT Powerhouse (Rating Downgrade) (Seeking Alpha) $ 🗃️

[ASE Technology Holding] ASE (NYSE: ASX / TPE: 3711)

🇰🇷 SK Telecom: Positive Signs Are Appearing (Seeking Alpha) $ 🗃️

SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA)

🇰🇷 Celltrion Inc (068270 KS)– Is the Sell-Side’s Bullishness Justified? (Smartkarma) $

The biosimilar market is forecast to grow three to four times faster than the generic drug market over the next five years.

However, we believe that this high growth will not necessarily imply good profitability, given the early stage of the biosimilar market, complications and competition.

We also believe that the company’s guidance is too optimistic resulting in an expensive multiple. We prefer some room for error.

🇰🇷 Samyang Foods (003230 KS) (Asian Century Stocks) $

Samyang Foods Co Ltd (KRX: 003230)

The "hottest" Korean instant noodles maker at 14x run-rate P/E

🇰🇷 Tech Supply Chain Tracker (21-Sep-2024): Samsung unlikely to follow Intel's spinoff. (Smartkarma) $

Samsung Electronics (KRX: 005930 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) unlikely to follow Intel (NASDAQ: INTC) in spinning off its foundry business, focusing on their own semiconductor production.

Marvell Technology (NASDAQ: MRVL) co-founder Sehat Sutardja passes away, leaving a void in the semiconductor industry mourning the loss of a visionary.

HTC Corp (TPE: 2498) launches VIVE Focus Vision with advanced XR features for gamers and enterprises, aiming to capture a niche market.

🇰🇷 Will New KOSDAQ 150 Member HLB Therapeutics Show Webzen-Like Price Moves? (Smartkarma) $

Jeisys Medical (KOSDAQ: 287410)’s getting booted from the KOSDAQ 150, and HLB Therapeutics (KOSDAQ: 115450) is stepping in as the new addition. This change will officially hit the book on Wednesday, September 25.

HLB Therapeutics, with a ₩0.70T market cap and 87% float, is set for a 0.51% weight in KOSDAQ 150, triggering over 2 million shares in passive buying: 3.26x 30-day ADTV.

With today’s after-hours volume spike in HLB Therapeutics, we’re likely to see some price action from early movers spilling into Monday’s open, similar to what we saw with Webzen (KOSDAQ: 069080).

🇰🇷 Details of MBK's Four Major Concerns on Management of Korea Zinc (Douglas Research Insights) $

In this insight, we discuss in detail MBK's four major concerns on the management of Korea Zinc (KRX: 010130).

We believe that MBK has legitimate concerns on especially the three factors including poor investments, deteriorating profitability, and increase in equity capital/disposal of treasury shares.

If and when the 2 trillion won+ is raised, then it could lead to another tender offer and the four concerns highlighted in this insight become much more important.

🇰🇷 Korea Investment Securities to Step up as the White Knight for Choi Family at Korea Zinc (Douglas Research Insights) $

Hankyung Business Daily reported that Korea Investment Securities (KIS) is in a serious discussion with the Choi family of Korea Zinc (KRX: 010130) to step up as a white knight.

KIS/Choi family are considering a plan to launch a counterbid against Jang family and MBK by investing around 2 trillion won+ along with other private equity funds.

It is probable that tender offer price of Korea Zinc could be raised by 15-25% due to a likely counterbid and current price trading 7% higher than tender offer price.

🇰🇷 NAV Valuation of Young Poong Precision and A Case Study for Future Tender Offers in Korea (Douglas Research Insights) $

Our NAV valuation of Young Poong Precision Corporation (KOSDAQ: 036560) suggests NAV of 325 billion won or NAV per share of 20,657 won which is 70% higher than current price.

Young Poong Precision tender offer could become one of the most important case studies for future tender offers in Korea.

The biggest component of the NAV is Young Poong Precision's 1.85% stake in Korea Zinc (KRX: 010130) which is worth 255 billion won (133% of its current market cap).

🇰🇷 K Bank IPO Valuation Analysis (Douglas Research Insights) $

Our base case valuation of K Bank is target price of 9,151 won per share, which is 4% lower than the low end of the IPO price range.

Given the lack of upside in our target price relative to the IPO price range, we would avoid in subscribing to the IPO.

Our base case valuation is based on 1.6x P/B multiple using the company's equity post IPO (2.35 trillion won).

🇰🇷 Sung Woo IPO Preview (Douglas Research Insights) $

Sung Woo is getting ready to complete its IPO in KOSDAQ in October 2024. Founded in 1992, Sung Woo produces components for cylindrical rechargeable battery, energy storage system, and automotive.

The IPO price range is from 25,000 won to 29,000 won. According to the bankers' valuation, the expected market cap is 376 billion won to 436 billion won.

The book building for the institutional investors will be conducted from 10 to 16 October. The lead underwriter of this IPO is Korea Investment & Securities.

🇮🇩 GoTo Gojek Tokopedia(GOTO IJ) - Lifting Clouds (Smartkarma) $

GoTo Gojek Tokopedia (IDX: GOTO / FRA: CK8 / OTCMKTS: GTOFF) together with Alibaba Group (NYSE: BABA) announced a strategic partnership that locks the latter in for the next 5-years, with GOTO committing to utilising Alibaba Cloud.

This move lifts a significant share price overhang and should provide GOTO with both cost benefits and AI capabilities cementing and aligning the interests of the two companies.

GoTo Gojek Tokopedia (GOTO IJ) continues to move the needle on its progress towards adjusted EBITDA breakeven by 4Q2024 led by product-led initiatives.

🇲🇾 Fitch ups revenue forecast for GEN Malaysia on travel uptick (GGRAsia)

Fitch Ratings Inc says it has “raised” its 2024 and 2025 revenue forecast for casino firm Genting Malaysia (KLSE: GENM), expecting the company to achieve “up to 100 percent of the 2019 level,” the last trading year immediately prior to the Covid-19 pandemic.

“We expect higher revenue on a domestic traffic rebound and increase in international tourists as regional travel continues to recover, helped by the completion of repairs to an access road to Genting Highlands in July 2024,” said the ratings agency in a Wednesday report.

Genting Malaysia operates Resorts World Genting (pictured in file photo), at Genting Highlands in Pahang State, Malaysia’s only licensed casino property. The group also runs casinos in the United States – via associated businesses – and in the Bahamas, the United Kingdom, and Egypt.

🇲🇾 GEN Malaysia units offer additional US$100mln in notes (GGRAsia)

Global casino operator Genting Malaysia (KLSE: GENM) said two of its units have priced an additional offer of US$100 million in senior unsecured notes due in 2029, at 7.250 percent.

“The net proceeds from these additional notes will be used for repaying existing indebtedness,” stated the parent company.

Tuesday’s filing said S&P Global Ratings and Fitch Ratings Ltd had respectively assigned BB+ ‘stable’ and BBB- ‘negative’ ratings to the additional notes.

🇵🇭 Cebu Air: Nice Business, But Unattractive Valuation (Seeking Alpha) $ 🗃️

Cebu Air Inc (PSE: CEB / OTCMKTS: CEBUF / CEBUY)

🇸🇬 Sea Limited: Firing On All Cylinders (Seeking Alpha) $ 🗃️

Sea Limited (NYSE: SE)

🇸🇬 Massive Growth In Users As Grab Holdings Expands Its Suite Of Offerings (Seeking Alpha) $ 🗃️

Grab Holdings Limited (NASDAQ: GRAB)

🇸🇬 Singapore Post: A Buy But With A Questionable Strategy (Seeking Alpha) $ 🗃️

Singapore Post Limited (SGX: S08 / FRA: SGR / OTCMKTS: SPSTY / SPSTF)

🇸🇬 BW LPG: The Largest VLGC Owner As A Bet On Strong LPG Demand (Seeking Alpha) $ 🗃️

BW LPG Ltd (NYSE: BWLP)

🇸🇬 Wilmar International: Interest Rates And China Are Still In The Spotlight (Seeking Alpha) $ 🗃️

🇸🇬 Better Blue-Chip Stock: Keppel Ltd Vs Sembcorp Industries (The Smart Investor)

We compare these two billion-dollar blue-chip stocks to determine which makes the better investment.

However, two blue-chip stocks, Keppel Corp (SGX: BN4 / FRA: KEP1 / OTCMKTS: KPELY / KPELF) and Sembcorp Industries (SGX: U96 / FRA: SBOA / OTCMKTS: SCRPF), or SCI, displayed a lacklustre performance.

Keppel saw its share price dip by 6.8% year-to-date (YTD) while SCI’s share price has inched up just 1.9% YTD.

Both companies have detailed their long-term strategic plans in their Investor Day releases.

So, which of these blue-chip stocks is a more compelling buy? We compare them across various financial metrics.

🇸🇬 Singapore Exchange’s Share Price Hits a 5-Year High: What’s Next for the Bourse Operator? (The Smart Investor)

The bellwether index has delivered a total return of 14.3% up till 11 September and is breaking a new six-year high.

One of the beneficiaries of this surge is Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY), or SGX.

The bourse operator saw its share price surge 13.5% year-to-date to hit S$11.11.

This was after the price had settled from its 52-week high of S$11.80, which was also a five-year high for the group.

Can SGX’s share price continue to rally? What are the initiatives that the group is taking to grow its business?

A strong set of earnings

Firing on many cylinders

MAS review group set up

More IPO aspirants

Get Smart: Riding on the positive momentum

🇸🇬 6 Singapore Semiconductor-Related Stocks Poised to Surge When the Industry Rebounds (The Smart Investor)

If you are looking to ride the recovery wave, here are six semiconductor-related stocks that could be poised to surge once the rebound takes hold.

Frencken Group Ltd (SGX: E28) is a global integrated solutions company that serves customers in semiconductor, life sciences, automotive, and medical and healthcare sectors.

Micro-Mechanics (Holdings) Ltd (SGX: 5DD / OTCMKTS: MCRNF), or MMH, designs and manufactures high precision tools and parts used in the wafer fabrication and assembly processes of the semiconductor industry.

Venture Corporation (SGX: V03 / FRA: VEM / OTCMKTS: VEMLF) is a blue-chip provider of technology products, services, and solutions.

UMS Holdings (SGX: 558 / KLSE: UMS / OTCMKTS: UMSSF) provides equipment manufacturing and engineering services to original equipment manufacturers of semiconductor and related products.

AEM Holdings (SGX: AWX) provides comprehensive semiconductor and electronics test solutions and has manufacturing plants in Singapore, Malaysia, Indonesia, Vietnam, South Korea, the US, and Finland.

Grand Venture Technology (SGX: JLB), or GVT, is a solutions and service provider for the manufacture of complex precision machining, sheet metal components, and mechatronics modules.

🇻🇳 VinFast Auto Stock: Prepare For Fresh Round Of Selling After Q2 2024 Earnings (Seeking Alpha) $ 🗃️

VinFast Auto Ltd. (NASDAQ: VFS)

🇮🇳 Max Healthcare (MAXHEALTH IN): Continues to Strengthen Presence in North India (Smartkarma) $

Max Healthcare Institute (NSE: MAXHEALTH / BOM: 543220) to acquire controlling stake in Jaypee Healthcare (JHL), which owns 3 hospitals in Uttar Pradesh, including the renowned 500-beds Jaypee Hospital, Noida.

JHL reported revenue of INR4.21B and EBITDA of INR70M in FY24. With an EV of INR16.6B, the deal values JHL at EV/EBITDA of 23.7x, which seems reasonable.

This acquisition will significantly enhance Max Healthcare’s network and strengthen its leadership position in NCR, a region which is home to around 46M people.

🇮🇳 Tube Investments of India (TIINDIA IN) | On-Ground Update on EV Foray (Smartkarma) $

Tube Investments of India (NSE: TIINDIA / BOM: 540762) is focused on clean mobility solutions through its subsidiary, TI Clean Mobility Private Limited.

The subsidiary's Montra Electric 3-wheelers have quickly gained market share in southern India, targeting the last-mile mobility segment.

TI's management is keenly focused on the EV segment, with upcoming launches of e-rickshaws and a new Cargo Version poised to drive substantial growth in the near future.

🇮🇳 Ola Electric's Negative Noise. Maruti Suzuki's Electric Plans: India EV Update (Smartkarma) $

Ola Electric Mobility Ltd (NSE: OLAELEC / BOM: 544225) reportedly faces challenges with poor product service, leading to dissatisfied customers. This underscores the urgency to improve its service infrastructure and restore brand trust.

The Indian electric two-wheeler sector saw weak sales in August, following a robust July, with Ola experiencing a sharp decline in monthly volumes and a loss of market share.

Meanwhile, Maruti Suzuki (NSE: MARUTI / BOM: 532500) is gearing up for a January 2025 EV launch and is preparing to establish a 25,000-unit charging infrastructure in advance.

🇮🇳 Infosys: Exposed To Western Risks, But A Medium-Term Buy (Seeking Alpha) $ 🗃️

🇰🇿 Sept 19, 2024 - Kaspi (KSPI): The NASDAQ-Listed Fintech Moving Money for Criminals and Kleptocrats (pdf) (Culper Research)

We are short KASPI (NASDAQ: KSPI / LON: 80TE / FRA: KKS), the operator of the largest payment network and second largest bank in Kazakhstan. We believe Kaspi has systematically misled U.S. investors and regulators in its repeated claims – especially ahead of the Company’s January 2024 NADSAQ listing – that the Company has zero exposure to Russia. Our research exposes this grave deception: we believe that not only do Kaspi’s relationships with Russian partners permeate every segment of its business, but that in the wake of Russia’s February 2022 invasion of Ukraine and into 2024, Russia has contributed materially to Kaspi’s reported growth. Our research further unmasks Kaspi’s history of shadowy dealmaking, which raises not only related party and self-dealing concerns, but also exposes the Company’s vast, longstanding ties to bad actors including sanctioned oligarchs and Russian mobsters. We believe Kaspi’s premium valuation and US listing are at risk, and shares are headed lower.

🇦🇪 MGM Resorts has applied for UAE casino licence: CEO (GGR Asia)

U.S.-based MGM Resorts International (NYSE: MGM), the parent of Macau casino operator MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY), has applied for a casino licence in the United Arab Emirates (UAE), the group’s chief executive, Bill Hornbuckle, has told an investment event.

“We’ve applied for it and hopefully we’ll win the licence there. Each ruler has their city, their state. Each can say yes or no,” said the CEO, as reported by the event’s organiser.

Mr Hornbuckle said previously that MGM Resorts expected to eventually be authorised to operate a casino in the Dubai project.

The project – scheduled to open in 2027 – has been described as US$3.9-billion venture involving local partners, with Wynn Resorts Ltd (NASDAQ: WYNN) as a 40-percent equity investor.

🇹🇷 Hepsiburada Is An Interesting Growth Stock, But Price May Be High (Seeking Alpha) $ 🗃️

[eCommerce operator] D-MARKET Electronic Services & Trading or Hepsiburada (NASDAQ: HEPS)

🇲🇺 Alphamin: Diamond In The Rough (Seeking Alpha) $ 🗃️

Alphamin Resources Corp (CVE: AFM / FRA: 21L / JSE: APH / OTCMKTS: AFMJF)

🇲🇺 African Rainbow Minerals: Staying Positive, Despite Commodity Cycle Headwinds (Seeking Alpha) $ 🗃️

African Rainbow Minerals Ltd (JSE: ARI / FRA: EB9 / OTCMKTS: AFBOF)

🇿🇦 Anglo American Platinum: Going Through A Highly Uncertain Period (Seeking Alpha) $ 🗃️

🇿🇦 DRDGOLD: Why I'm Sticking With My Bullish Outlook (Seeking Alpha) $ 🗃️

🇿🇦 Sibanye Stillwater Stock May Have Found The Bottom (Seeking Alpha) $ 🗃️

Sibanye Stillwater Ltd (NYSE: SBSW)

🇵🇱 InPost: Huge Growth Delivery On Booming E-Commerce (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Vast Ecosystem And Enticing Valuation (Seeking Alpha) $ 🗃️

MercadoLibre (NASDAQ: MELI)

🌎 Uranium Part 4: Yellow Cake in LatAm (TheOldEconomy Substack)

Two nano-junior picks

It's time for Episode 4 of my advantages in the Uranium Universe. The agenda includes LatAm, uranium, and nano-junior caps.

Finding uranium miners with projects in Latin America is challenging. There are plenty of juniors exploring moose pastures in Canada. However, in South America, there are only a handful of names. Besides that, pure LatAm-uranium plays are almost nonexistent.

That said, the final contenders are:

Green Shift Commodities Ltd (CVE: GCOM / FRA: 7WV / OTCMKTS: GRCMF)

Blue Sky Uranium Corp (CVE: BSK / FRA: MAL2 / OTCMKTS: BKUCF)

🌎 Arcos Dorados: Hold Until New Franchise Agreement With MCD Materializes (Seeking Alpha) $ 🗃️

Arcos Dorados (NYSE: ARCO)

🌎 Despegar.com: Excellent Value In An Expensive Market (Seeking Alpha) $ 🗃️

[Online travel agency] Despegar.com Corp (NYSE: DESP)

🌎 Ternium: Still Not A Buy As Near-Term Growth Prospects Remain Unfavorable (Seeking Alpha) $ 🗃️

[Steel maker] Ternium S.A. (NYSE: TX) is Luxembourg headquartered.

🇦🇷 🇱🇺 Adecoagro S.A.: A Higher Share Price May Be On The Horizon Shortly (Seeking Alpha) $ 🗃️

[Agricultural and industrial company] Adecoagro Sa (NYSE: AGRO)

🇦🇷 Even At The Peak Of Its 52-Week Range, YPF Looks Like A Value Pick (Seeking Alpha) $ 🗃️

🇦🇷 Bioceres' Q4 2024 Shows Challenges With HB4 Rollout, Still A Hold Despite Lower Stock Prices (Seeking Alpha) $ 🗃️

Bioceres Crop Solutions Corp (NASDAQ: BIOX)

🇧🇷 Companhia Siderurgica Nacional: Leverage And Steel Market Shifts Redefine Outlook (Seeking Alpha) $ 🗃️

Companhia Siderurgica Nacional SA (NYSE: SID)

🇧🇷 Petrobras: Very High Safety Margin (Seeking Alpha) $ 🗃️

🇧🇷 Embraer Q2: Strong Demand, Improving Margins And Positive Outlook (Seeking Alpha) $ 🗃️

Embraer SA (BVMF: EMBR3 / NYSE: ERJ)

🇧🇷 Azul's Pressures Are Mounting Despite Government Support (Seeking Alpha) $ 🗃️

🇧🇷 Inter & Co Q2: Excellent Results, Thesis Materializing (Seeking Alpha) $ 🗃️

Inter & Co Inc (BVMF: INBR32 / NASDAQ: INTR)

🇧🇷 Telefônica Brasil Q2: Above Expectations; I Am Raising The Recommendation (Seeking Alpha) $ 🗃️

Telefônica Brasil S.A. (NYSE: VIV)

🇧🇷 Suzano: Potentially Undervalued And Risks Appear Priced In (Seeking Alpha) $ 🗃️

[Pulp and paper products] Suzano S.A. (NYSE: SUZ)

🇲🇽 Banorte: Mexico's Banking Leader Is Available At A Deep Discount (Seeking Alpha) $ 🗃️

Grupo Financiero Banorte SAB de CV (BMV: GFNORTEO / FRA: 4FN / OTCMKTS: GBOOY / GBOOF)

🇲🇽 Real estate at 0.12x book & interesting financial companies. Mexico part 9. (Bos Invest Substack)

In Mexican stocks there is incredible value at the surface. If you look under the hood you find surprises. Good, bad & strange.

In part 9 of my series covering all Mexican stocks I found many stocks trading at low valuations. Grupo Gicsa SAB de CV (BMV: GICSAB) is a real estate company trading at 12% of its equity value.

Grupo Financiero Banorte SAB de CV (BMV: GFNORTEO / FRA: 4FN / OTCMKTS: GBOOY / GBOOF) - Market cap 410B pesos. Total assets 2,275B pesos, net income of 52.4B pesos & 249B in shareholders equity

Grupo Financiero Inbursa (BMV: GFINBURO / FRA: 4FY / OTCMKTS: GPFOF) - Market cap 273B pesos. Total assets 758B pesos, net income 31B pesos (2023) & shareholders’ equity 240B pesos. Book value looks attractive but intangible assets are 56B pesos

Grupo Gicsa SAB de CV (BMV: GICSAB) - Market cap 3.4B pesos. Total assets 77B pesos, 27.5B pesos in net debt & 27.8B in equity.

Grupo Industrial Saltillo SAB de CV (BMV: GISSAA) - Total assets 20B pesos, equity 9.6B, market cap 6B & 2.6B of net debt. Loss making in last 12 months. No big profits since 2020.

Grupo Nacional Provincal (BMV: GNP) - Total assets 214.3B pesos, equity 16.8B pesos, market cap 31.3B pesos. Net income 4.7B pesos in 2023. GNP is a leading insurer in Mexico.

Grupo Palacio de Hierro (BMV: GPH1) - Total assets 55.7B pesos, equity 22.6B pesos, market cap 16.6B pesos & net debt 2B pesos. Company is consistently profitable except for 2020 (-1B pesos).

Grupo Profuturo SAB (BMV: GPROFUT) - Total assets 124B pesos, net tangible equity 7.7B, market cap 27.4B pesos & net debt 1B pesos. Net income 3B pesos.

📰🔬 Further Suggested Reading

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 PwC looks for way forward in increasingly difficult China terrain (Bamboo Works) $

The Big Four accounting firm was hit with a record fine for its auditing work of Evergrande, whose failure cost investors billions of dollars

China levied a record fine on PwC and suspended its China operations for six months as punishment for lapses in its audits of failed developer Evergrande

Beijing is increasingly encouraging state-run companies to avoid big foreign accounting firms like PwC in favor of Chinese companies, partly due to data security concerns

🇨🇳 Analysis: What Noodles Tell Us About China’s Consumption Downgrading (Caixin) $

When people become less willing to pay so much to fulfill their daily needs, they experience a “consumption downgrade.” This can be observed in highly detailed data.

In this article, we refer to data from Shouqianba, a platform that offers mobile payment solutions to offline merchants. It provides the ordering and payment systems of many restaurants and retail shops nationwide.

Chen Qin’s analysis started by looking at the spending of a typical customer who visited the same restaurant over 300 times from late 2022 through July this year. The person bought lunch at the eatery almost every day between 11:00 and 12:00.

At the beginning of last year, the customer’s average lunch cost 10 yuan ($1.40) to 12 yuan, including a bowl of pork noodles with pickled mustard greens, sometimes accompanied by a bottle of iced tea. However, in the last few days of July, the person only spent 7 yuan to 9 yuan, shifting to cheaper options like noodles with an egg or noodles with vegetables.

🇨🇳 Analysis: Mid-Autumn Festival Spurs Patchy Tourism Rebound (Caixin) $

Chinese travel spending picked up from pre-pandemic levels during the recent Mid-Autumn Festival holiday, but lower flight and hotel prices, driven in part by a growing shift toward local tourism, underscore the persistent and patchy recovery of China’s domestic consumption.

Domestic travelers spent a total of 51 billion yuan ($7.2 billion) during the three-day holiday that ended Tuesday, an increase of 8% over the same period in 2019, the Ministry of Culture and Tourism said on Wednesday.

🇨🇳 The dramatic decline of China’s innovative start-ups (FT) $ 🗃️ & How China has ‘throttled’ its private sector (FT) $ 🗃️

Urge to control the private sector jeopardises Beijing’s tech ambitions

But now, for a variety of reasons, China’s start-up sector is in the doldrums. Some commentary from within the industry is laden with doom. “The whole industry has just died before our eyes,” one executive told the Financial Times [How China has ‘throttled’ its private sector]. “The entrepreneurial spirit is dead. It is very sad to see.”

🇨🇳 Must countries choose between the west and China? (FT) $ 🗃️

The ‘in-betweeners’ have profited from diverse trade relations — but may increasingly have to choose sides

🇨🇳 🇪🇺 European steelmakers plead with Brussels to tackle flood of Chinese exports (FT) $ 🗃️

European prices drop below cost of production as world market is deluged

🇭🇰 Hong Kong property amid rate cuts (Asian Century Stocks) $

A historic moment for Hong Kong's property market.

In this post, I’ll discuss each of Hong Kong’s main property markets - residential, office, retail and hospitality - and how lower interest rates will impact them. I’ll then introduce the key stocks in each of these sectors.

🇰🇷 Announcement of Value-Up Index in Korea on 24 September (Douglas Research Insights) $

The Korea Exchange is expected to announce its long awaited KRX Korea Value-Up index on 24 September. However, the actual launch of this index will begin on 30 September.

It is expected to produce two types of indices including a basic price index (PR) and a total return index (TR) under the name of KRX Korea Value-Up index.

In this insight, we also provide a list of 20 small cap stocks that could be included in the Korea Value Up index.

🇮🇳 India overtakes China in world’s biggest investable stock benchmark (FT) $ 🗃️

Red-hot Indian equities propel country past China weighting in MSCI All-Country index

🇱🇰 Neo-Marxist Dissanayake upsets odds to win Sri Lanka presidency (FT) $ 🗃️

Outsider rides anti-establishment wave with pledge to root out dynastic corruption while abiding by $3bn IMF bailout

🇬🇪 Why I travelled to Georgia during the anti-government protests of May 2024 (Pyramids and Pagodas)

Taking a look back at a trip during a tumultuous time, the country’s investment horizons, and some interesting stocks along the way

In May 2024, Desertfox spent two weeks in Tbilisi, the capital of Georgia as well as surrounding rural areas.

Tbc Bank Group Plc (LON: TBCG / OTCMKTS: TBCCF) stock has shown resilience and adaptability in a dynamic market environment. Its fundamentals were strong and offered robust dividend yield of over 7%. Unlike the picture portrayed in Western media, the reality on the ground told us that the protests, in fact, did not have broad support and we believed they would be short-lived.

🇬🇪 3 principles for a small country to survive great-power competition (Part 1) (China Translated)

A travelogue to Georgia (the country)

This travelogue will be made up of 2 parts. In the first part, which is this post, I will document the trip itself.

🇬🇪 3 principles for a small country to survive great-power competition (Part 2) (China Translated)

Just to recap, in Part 1, I documented why, how, and with whom I traveled to Georgia last month. With a group of friends old and new, I visited the beautiful city of Tbilisi, Stalin’s birthplace Gori, and the breathtaking mountains in the Caucasus. If you haven’t read Part 1 yet, please take a look at it before reading this one. It’s important to condition yourself with the right sensing before going onto the more brainy stuff.

For Part 2, I will try to answer the question in the main title of this two-part travelogue: How should a small country survive and prosper in a world defined by great-power competition?

🇲🇽 Mexico Notes - September 2024 (Latin America Risk Report)

Now that judicial reform has passed, some comments on where Sheinbaum's presidency will begin.

🌐 Investors hope US rate cuts will provide lift for emerging market debt (FT) $ 🗃️

Local currency bonds have lagged this year but Fed’s move is expected to ease pressure on developing nations

📅 Earnings Calendar

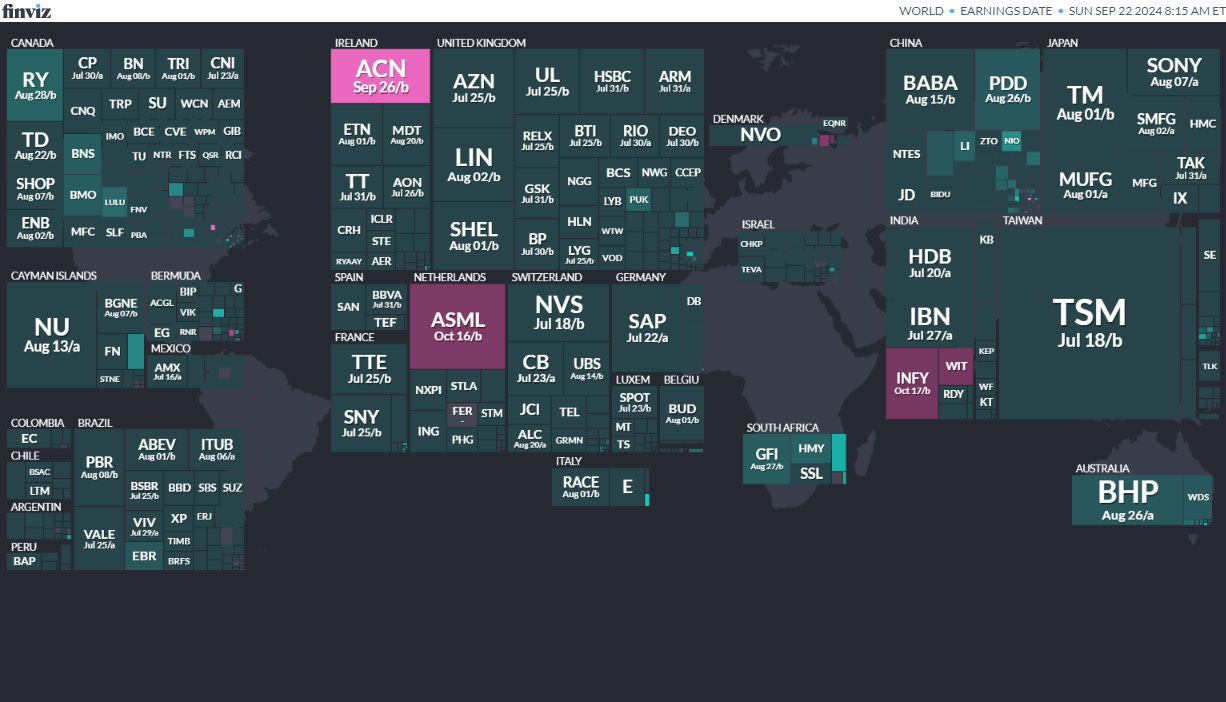

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

Czech RepublicCzech SenateSep 20, 2024 (d) Confirmed Sep 23, 2022Sri LankaSri Lankan PresidencySep 21, 2024 (t) Confirmed Nov 16, 2019Kazakhstan Referendum Oct 6, 2024 (d) Confirmed Jun 5, 2022

Georgia Georgian Parliament Oct 26, 2024 (d) Confirmed Oct 31, 2020

Uzbekistan Uzbekistani Legislative Chamber Oct 27, 2024 (d) Confirmed Dec 22, 2019

Uruguay Referendum Oct 27, 2024 (t) Confirmed Mar 7, 2022

Uruguay Uruguayan Presidency Oct 27, 2024 (d) Confirmed Nov 24, 2019

Uruguay Uruguayan Chamber of Representatives Oct 27, 2024 (d) Confirmed Oct 27, 2019

Uruguay Uruguayan Chamber of Senators Oct 27, 2024 (d) Confirmed Oct 27, 2019

Bulgaria Bulgarian National Assembly Oct 27, 2024 (d) Confirmed Jun 9, 2024

Romania Romanian Presidency Nov 24, 2024 (d) Date not confirmed Nov 24, 2019

Namibia Namibian Presidency Nov 27, 2024 (d) Confirmed Nov 27, 2019

Namibia Namibian National Assembly Nov 27, 2024 (d) Confirmed Nov 27, 2019

Kazakhstan Referendum Nov 30, 2024 (t) Date not confirmed Jun 5, 2022

Romania Romanian Senate Dec 1, 2024 (t) Date not confirmed Dec 6, 2020

Romania Romanian Chamber of Deputies Dec 1, 2024 (t) Date not confirmed Dec 6, 2020

Ghana Ghanaian Presidency Dec 7, 2024 (t) Confirmed Dec 7, 2020

Ghana Ghanaian Parliament Dec 7, 2024 (t) Confirmed Dec 7, 2020

Thailand Referendum Dec 31, 2024 (t) Date not confirmed Aug 7, 2016

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Samfine Creation Holdings Group Limited SFCH Cathay Securities/ Revere Securities, 2.0M Shares, $4.00-5.00, $9.0 mil, 9/24/2024 Tuesday

Through our operating subsidiaries, we are an established one-stop printing service provider which principally provides printing services in Hong Kong and the PRC. (Incorporated in the Cayman Islands)

With over 20 years of experience in the printing industry, our operating subsidiaries offer a wide range of printed products such as (i) book products, which mainly include children’s books, educational books, art books, notebooks, diaries and journals; and (ii) novelty and packaging products, which mainly include handcraft products, book sets, pop-up books, stationery products, products with assembly parts and other specialized products, shopping bags and package boxes. Our operating subsidiaries’ customers principally comprise of book traders located in Hong Kong whose clients are located around the world, mainly in the U.S. and Europe.

Note: Net loss and revenues are for the 12 months that ended Dec. 31, 2023.

(Note: Samfine Creation Holdings Group disclosed that it has named Cathay Securities as a joint book-runner – to work with Revere Securities – according to an F-1/A filing dated Aug. 7, 2024. Background: Samfine Creation Holdings Group Limited filed its F-1 to go public in November 2023. The company submitted a confidential IPO filing to the SEC in 2022.)

AGIIPLUS INC. AGII EF Hutton, 1.4M Shares, $6.00-7.00, $9.1 mil, 9/27/2024 Week of

Note: AgiiPlus Inc., or AgiiPlus, is not an operating company but a Cayman Islands holding company with operations conducted by its subsidiaries, including subsidiaries in China. Investors in our securities are not purchasing equity interests in AgiiPlus’ operating entities in China but instead are purchasing equity interests in a Cayman Islands holding company. (Incorporated in the Cayman Islands)

AgiiPlus’ vision is to build the future of work and to connect businesses with technology, data, services, workspaces and more.

Through its subsidiaries, AgiiPlus is, according to the Frost & Sullivan Report, one of the fastest-growing work solutions providers with a one-stop solution capability in China and Singapore. By leveraging its proprietary technologies, AgiiPlus, through its subsidiaries, offers transformative integrated working solutions to its customers, including brokerage and enterprise services, customizable workspace renovations with smart building solutions, and high-quality flexible workspaces with plug-in software and on-demand services.

AgiiPlus has established an innovative business model called “S²aaS — Space & Software As A Solution,” which combines “Software As A Service”, or SaaS, and “Space As A Service.” This business model relies on proprietary technology, SaaS-based systems, and high-quality physical workspaces to provide customers with integrated work solutions for optimal work efficiency.

AgiiPlus, through its subsidiaries, has created an integrated platform connecting onsite workspaces and digital services through technology. Through its subsidiaries, AgiiPlus offers office leasing and enterprise services under the brand “Tangtang,” and, through its subsidiaries, AgiiPlus maintains the Distrii app, the proprietary official app for workspace members, offering AgiiPlus’ workspace members a seamless experience beyond physical spaces with easy access to enterprise services offered by AgiiPlus’ subsidiaries. As of Dec. 31, 2021, AgiiPlus’ subsidiaries had 35,771 enterprise customers and 322,252 digitally registered members.

Founded in 2016, AgiiPlus has established a network of workspaces in China and Singapore through its subsidiaries. Through Shanghai Distrii Technology Development Co., Ltd., a PRC subsidiary, AgiiPlus offers enterprise customers flexible and cost-effective space solutions in centrally located business districts in tier-one and new tier-one cities in China and Singapore. As of Dec. 31, 2021, through its subsidiaries, AgiiPlus maintained a network of 61 Distrii workspaces that covered seven different cities, namely Shanghai, Beijing, Nanjing, Suzhou, Jinan and Xiong’an in China, and Singapore, with a total managed area of about 256,291 square meters (approximately 2.8 million square feet) and approximately 41,455 workstations in total.

In addition, AgiiPlus’ asset-light model offers design, build, management and operating services to landlords who bear the costs in building and launching new spaces. This asset-light model allows AgiiPlus’ subsidiaries to economically expand and scale up while enabling landlords to turn their spaces into revenue-generating properties backed by professional services offered by AgiiPlus’ subsidiaries and AgiiPlus’ brand image. As of Dec. 31, 2021, through its subsidiaries, AgiiPlus had eight workspaces under the asset-light model, with a total managed area of about 22,947 square meters (approximately 247,000 square feet) and approximately 4,161 workstations available for members.

**Note: Net loss and revenue figures are in U.S. dollars for the year ended Dec. 31, 2023. (Converted from China’s renminbi)

(Note: AgiiPlus reduced its IPO’s size to 1.4 million shares – down from 2.0 million shares – and increased the price range to a range of $6.00 to $7.00 – up from a range of $5.00 to $6.00 – to raise $9.1 million, according to an F-1/A filing dated June 25, 2024.)

(Note: AgiiPlus disclosed that it named EF Hutton as the sole book-runner – to replace US Tiger Brokers – in an F-1/A filing dated Jan. 26, 2024. In that January 2024 filing, AgiiPlus cut the size of its IPO to 2.0 million shares at a price range of $5.00 to $6.00 to raise $11.0 million.)

(Note: AgiiPlus Inc. cut the size of its IPO by 40 percent in an F-1/A filing dated March 22, 2023: The number of Class A ordinary shares was cut to 4.5 million shares – down from 8.7 million shares previously – and the price range was increased to $4.50 to $6.00 – up from $4.00 to $5.00 – to raise $23.63 million. The new terms cut the IPO’s estimated proceeds by 40 percent from the initial estimate of $39.15 million under the original terms – 8.7 million shares at $4.00 to $5.00 – that were disclosed in an F-1/A filing dated Nov. 7, 2022. The F-1 was filed on Sept. 16, 2022; confidential filing was submitted on June 17, 2022.)

Cuprina Holdings (Cayman) Ltd CUPR Network 1 Financial Securities, 3.8M Shares, $4.00-4.50, $15.9 mil, 9/27/2024 Week of

We manufacture and distribute chronic wound care products – medical grade bio-dressing products made from sterile blowfly larvae and sold under the MEDIFLY brand – mostly in Singapore since February 2020 and in Hong Kong since March 2023. (Incorporated in the Cayman Islands)

From the Prospectus: “Looking ahead, we have strategic plans in place for the second half of 2024 and 2025 to expand our sales and establish physical operations in several key regions, including Southeast Asia, the Middle East (in particular, the member states of the Gulf Cooperation Council, or GCC), and mainland China. These expansion initiatives will further enable us to cater to the growing demand for our products in these promising markets, cementing our position as a trusted player in the field of chronic wound care and treatment.”

We are a Singapore-based biomedical and biotechnology company dedicated to the development and commercialization of innovative products for the management of chronic wounds, as well as operating in the health and beauty sectors. Our expertise in biomedical research allows us to identify and utilize materials derived from natural sources to develop wound care products in the form of medical devices which meet international standards. We believe we will be able to build upon and leverage such expertise to develop innovative cosmeceutical products in the future.

As of Dec. 31, 2023, we manufactured and distributed a line of medical grade sterile blowfly larvae bio-dressing products marketed under the MEDIFLY brand name, or the MEDIFLY products. The MEDIFLY products are used as a biological debridement tool for chronic wounds, in a procedure known as Maggot Debridement Therapy, or MDT, which is an effective alternative to surgical debridement.

In addition to our commercialized MEDIFLY products, we have two lines of chronic wound care products in our pipeline:

*Collagen dressings, including sponges, particles and hydrogels, using bullfrog collagen derived from the valorization of abattoir waste streams of American bullfrogs (Lithobates catesbeianus) and

*Products using medical leeches for wound treatment.

We expect development of such products to take place over the course of 2024 and 2025 and to become commercially available subject to regulatory approval.

We believe what sets us apart is our focus on developing functionally specific chronic wound care products designed to address the major stages of the wound healing process from chronic to closure.

Our chronic wound care products, including both our existing commercialized products and forthcoming products in our pipeline, are poised to benefit from escalating global market demand. This demand is primarily fueled by the demographic shift towards an aging population and the concurrent rise in comorbidities such as diabetes, obesity, cardiovascular ailments and peripheral vascular diseases.

For our cosmeceuticals business, we introduced three products in 2023, including a hydrating balm product, a muscle energy cream and a pain relief muscle patch. For our commercialized cosmeceutical products, we have commissioned original equipment manufacturers of skincare products to develop the formulation and manufacture the substantially finished and finished products. In addition, we plan to explore the possibility of developing a range of potential cosmeceutical product candidates incorporating bullfrog collagen with a view to making them commercially available between 2024 and 2028, subject to the progress of the relevant R&D work.

We offer our chronic wound care products to both public and private hospitals and clinics, where patients can obtain them through prescription from a physician. Our customers primarily include major public and private hospitals and clinics in Singapore.

Our commercialized cosmeceutical products can be purchased directly by individual customers through a variety of channels, including retailers and gyms in Singapore, Malaysia and Australia, as well as online shopping platforms such as Shopee.

Note: Net loss and revenue figures are in U.S. dollars for the year that ended Dec. 31, 2023.

Note from the Prospectus: “Our independent registered public accounting firm expressed substantial doubt regarding our ability to continue as a going concern. Our ability to continue as a going concern requires that we obtain sufficient funding to finance our operations.”

(Note: Cuprina Holdings (Cayman) Ltd. filed an F-1/A on Sept. 3, 2024, disclosing that its IPO’s price range is $4.00 to $4.50 – a change from its IPO price of $4.00 – and keeping the IPO’s size at 3.75 million Class A ordinary shares – to raise $15.94 million. Background: Cuprina Holdings (Cayman) Ltd increased the number of shares to 3.75 million – up from 2.5 million shares initially – without disclosing the IPO price – in an F-1/A filing dated June 20, 2024.)

(More Background: Cuprina Holdings (Cayman) Ltd filed an F-1/A dated May 16, 2024, disclosing that it will offer 2.5 million Class A ordinary shares – without stating the IPO price. More Background: Cuprina Holdings (Cayman) Ltd. filed its F-1 on March 7, 2024, without disclosing terms; estimated IPO proceeds were $10 million. Previously: The Cayman Islands-incorporated holding company submitted its confidential filing to the SEC on Oct. 13, 2023.)

Jinxin Technology NAMI Craft Capital Management/ WestPark /R.F. Lafferty & Co., 1.9M Shares, $4.00-5.00, $8.5 mil, 9/27/2024 Week of

(Incorporated in the Cayman Islands)

We are an innovative digital content service provider in China. Leveraging our powerful digital content generation engine powered by advanced AI/AR/VR/digital human technologies, we are committed to offering our users high-quality digital content services through both our own platform and the content distribution channels of our strong partners.

We currently target K-9 students in China, with core expertise in providing them digital and integrated educational content, and plan to further expand our service offerings to provide premium and engaging digital contents to other age groups. We were the largest digital textbook platform and a leading digital educational content provider for K-9 students in China, both in terms of revenue in 2022, according to Frost & Sullivan. We collaborate with leading textbook publishers in China and provide digital version of mainstream textbooks used in primary schools and middle schools. Our digital textbooks primarily cover Chinese and English subjects used in K-9 schools in China. We also create and develop digital self-learning contents and leisure reading materials in-house. Our AI-generated content technology enables our comprehensive digital contents to deliver an interactive, intelligent and entertaining learning experience.

Textbooks have been the primary teaching instrument for most children. Access to an advanced and intelligent version of textbook is becoming a rising demand, particularly among K-9 students who are at early stage of learning and forming an efficient learning style. There are currently over 150 million K-9 students in China while the digitization rate of textbook remains relatively low. Since our inception in 2014, we have built expertise in creating digitized, interactive and intelligent textbooks that we believe improve K-9 students’ learning experience. Previously, CDs were the most common learning equipment used by K-9 students to assist with studying textbook in China. We are committed to replacing outdated learning materials and equipment with our intelligent, interactive digital products and resources, and eventually cultivate a fresh and innovative learning style.

We are authorized by major Chinese textbook publishers to digitize their proprietary textbooks, and design and develop the digital version. Besides digital textbooks, leveraging our deep insights in China’s childhood education sector and our technological strength, we also provide digital self-learning materials and digital leisure reading materials, catering to the evolving and diversified needs of potential users. We have strong in-house content development expertise in digitized materials, amusement features, video and audio effects as well as art design. Our products and contents are imbued with the rich operational know-how and deep understanding of China’s childhood education sector, which we believe make our digital contents highly compelling to our users.

We distribute digital contents primarily through (i) our flagship learning app, Namibox, (ii) telecom and broadcast operators and (iii) third-party devices with our contents embedded. We launched our interactive and self-directed learning app Namibox in 2014, to provide users an integrated entry point to our digital textbooks, self-learning materials and leisure reading materials. Users can access various free contents, subscribe to advanced contents and choose to become premium members through our membership programs. In addition, we partner with all mainstream Chinese telecom and broadcast operators to tap into their large user base. Our partnered telecom and broadcast operators broadcast our various programs to end users through their respective platforms, distribute our educational contents to interested users and share certain percentage of revenues with us. Through networks of our partnered telecom and broadcast operators, individual users gain easy access to our digital contents through TVs or mobile devices. Furthermore, we cooperate with well-known hardware manufacturers, such as manufacturers of digital pads and intelligent TVs, and pre-install our programs in such devices directly. The integrated distribution channels empower us to increase our brand awareness in a cost-efficient manner, grow our user base sustainably and improve our contents continuously based on users’ real time feedbacks.

Our business has evolved significantly since inception and we have never stopped reimagining and innovating our products and digital contents. We are doing this not only to cater to, but influence, the learning habits and lifestyles of our users, to fulfill their goals and enrich their lives. With innovative and high-quality educational contents, we have built a trusted and well recognized brand, as well as a large user base throughout China. Since our inception, our Namibox app has amassed over 79 million cumulative downloads and more than 39 million registered users as of December 31, 2023. The high-frequency interactions we have with users and our unique access to a large amount of mission-critical learning data further provide us deep insights in K-9 education sector.

Fueling all of these great achievements are our technologies. We deploy advanced digitization technologies, AI technologies and big data analysis to provide superior user experience. We also deploy advanced AI technologies that power various teaching and voice assessment tools, all to improve the learning effectiveness for children. Leveraging our proprietary digital content generation engine, we are able to consistently refine and upgrade our educational contents, as well as to intelligently recommend content to our users, continually improving user experience.

We have realized steady growth with healthy financial performance since inception. Despite negative impacts caused by regulatory changes in the online education industry in 2021, our registered users increased from 29.9 million as of December 31, 2021 to 35.3 million as of December 31, 2022, and further to 39.5 million as of December 31, 2023. In addition, we recorded net income of RMB55.1 million and RMB83.5 million (US$11.8 million) in 2022 and 2023, respectively.

Note: Net income and revenue are for the year that ended Dec. 31, 2023.

(Note: Jinxin Technology Holding Company unveiled the terms for its IPO – 1.88 million American Depositary Shares – or 1,875,000 ADS – at a price range of $4.00 to $5.00 – to raise $8.46 million, according to an F-1/A filing dated Aug. 19, 2024. Each ADS represents 33.75 million ordinary shares. Background: Jinxin Technology filed its F-1 on Aug. 10, 2023, and its confidential IPO documents on March 24, 2023.)

SAG Holdings Ltd SAG Wilson-Davis & Co./Dominari Securities, 1.0M Shares, $8.00-8.00, $8.0 mil, 9/27/2024 Week of

We are a holding company incorporated in the Cayman Islands. The ordinary shares offered in the IPO are being offered by the holding company.

We are a Singapore-based provider of high-quality OEM, third-party branded and in-house branded replacement parts for motor vehicles and for non-vehicle combustion engines serving a number of industries. We distribute spare parts through operations primarily based in Singapore and global sales primarily generated from the Middle East and Asia. Through our On-Highway Business, we supply a wide range of genuine OEM and aftermarket parts for use in passenger and commercial vehicles bearing either the manufacturer’s brands or our in-house brands through SP Zone. Through our Off-Highway Business, we supply a wide range of components and spare parts for internal combustion engines with strong focus on filtration products through Filtec. Our Off-Highway Business serves industrial sectors that include marine, energy, mining, construction, agriculture, and oil and gas industries. Our products are sourced from genuine OEM and global premium aftermarket brands to suit the diverse needs of our customers. Over the past several years, our revenues have been relatively evenly split between our On-Highway Business and our Off-Highway Business, and approximately 10% of our revenues are derived from sale of our in-house products.

Our Group’s business can be traced back to the early 1970s, when our late founder, KE Neo, set up Chop Kim Aik, a retail shop specializing in the supply of British-made truck spare parts. KE Neo leveraged his experience as the owner of a transportation business with a fleet of trucks serving the construction industry to building a small retail shop to a large-scale operation with a solid customer base and a recognizable brand.

In 1983, we diversified into the supply of Japanese made automotive spare parts to capitalize on the increase in demand for Japanese vehicles in Singapore. Riding on this global growth of Japanese automotive exports, CE Neo, with the support of his father KE Neo, set up its first automotive spare parts retail outlet in Singapore, naming it Soon Aik Auto Parts Trading Co (which became a private limited company, Soon Aik Auto Parts Trading Co. Pte Ltd in 1995, and is now known and hereinafter referred to as “SP Zone”) specializing in trading Japanese made automotive spare parts, primarily used in passenger and commercial vehicles.

In the late 1980s, SP Zone achieved a major milestone when it was appointed as an authorized dealer of UD Trucks Corporation (“Nissan UD”) automotive genuine spare parts in Singapore, expanding our business of selling authorized genuine spare parts, beyond our historical aftermarket spare parts business model. The business gradually expanded, and the outlet grew to supply automotive spare parts for trucks operating in Singapore sold by respected Japanese brands from the manufacturers such as Nissan UD, Mitsubishi Fuso Truck and Bus Corporation, Hino Motors Ltd and Isuzu Motors Ltd.

In 1993, Jimmy Neo and CK Neo, brothers to CE Neo and sons of KE Neo, joined SP Zone, to assist with the expanding business. In 1995, Jimmy Neo was instrumental in securing the dealership with Cummins Asia Pacific Pte. Ltd (“Cummins”) for Fleetguard filters, a product used in Cummins engines, pursuant to which SP Zone started distributing filters to the marine, energy, mining, agriculture, oil and gas, and construction industries (referred to as the “Off-Highway Business”) in addition to the automotive industry (referred to as the “On-Highway Business”).

In 1995, SP Zone became a private limited company and expanded its sales channels to include exports to ASEAN markets, capitalizing on unmet demand as there were few suppliers supplying automotive spare parts to those markets at that time. Another major milestone in 1995 occurred when Edward Neo, the third brother and son of KE Neo, joined our Group to manage the local wholesale and retail business, allowing CE Neo to focus on our Group’s newly expanded export business. At this point, the business had grown from a small retail operation to regional family business run by a father and his four sons with multiple areas of focus and utilizing the family member’s different areas of expertise.

In 1999, SP Zone secured another line of filtration products when it was appointed as a distributor for Parker Racor, a line of Parker Hannifin filtration products. Subsequently, we established Filtec as a separate Singapore subsidiary to carry out sales of Off-Highway Business dedicated to handling sales to our Off-Highway customers in the industrial sectors.

In the early 2000s, Edward Neo spearheaded an effort to develop in-house branded brake parts and lubricant products, namely, VETTO and REV-1 in SP Zone, to enhance our competitiveness in the automotive industry. Over the years, the product range of our in-house brands has greatly expanded to include the NUTEQ steering and suspension parts, GENTEQ pumps and cooling system components, ELITO cables and hoses, SUNBLADE wiper blades, FILTEQ filters, and ENERGEO batteries.

In 2010, we consolidated and shifted our business operations to larger headquarters and warehouse that facilitated greater efficiency in our operations and also allowed us to increase our product inventory offerings. Through our On-Highway Business, we entered the Malaysian market by first taking a 70% equity stake, and by 2017 a 100% stake, in Autozone (M), an established company that sells wholesale automotive spare parts as well as the sale of our in-house brands in Malaysia.

Since 2010, we have been selling to wholesale distributors based in Dubai as part of our strategy to expand our business. Like Singapore in Asia, Dubai is an important key trading hub in the Middle East serving customers not only in the Middle East, but also Central Asia, Africa and Europe. This business now represents an estimated 10.7% of our sales.

More recently, in 2019, our Off-Highway Business expanded to include the life science environmental industry, securing distribution and working in close collaboration with MANN+HUMMEL, a European-based multi-national company that provides a number of automotive and industrial commercial products, including filtration and related products with life science applications, for the distribution and promotion of their products in Singapore.

In 2022, we underwent a reorganization. On February 14, 2022, Celestial obtained a 4.9% shareholding interest in SAGI from Soon Aik. On September 29, 2022, Soon Aik transferred the entire issued share capital of our group of companies, consisting of Filtec, SP Zone, Autozone (S) and Autozone (M), to SAGI. Subsequently on September 29, 2022, Soon Aik and Celestial transferred their respective shares in SAGI to the Company in exchange for equivalent proportional percentages of Ordinary Shares of the Company. Upon completion of the group reorganization, Soon Aik owns 8,915,625 shares and Celestial owns 459,375 shares, and SAGI, Filtec, SP Zone, Autozone (S) and Autozone (M) are indirect subsidiaries.

**Note: Net income and revenue are in U.S. dollars (converted from Singapore dollars) for the 12 months that ended Dec. 31, 2023.

(Note: SAG Holdings Ltd. increased its IPO’s size to 1.0 million shares – up from 875,000 shares – and kept the assumed IPO price at $8.00 – to raise $8.0 million, according to an F-1/A filing dated Sept. 20, 2024. Note: Dominari Securities has been added as a joint book-runner to work with Wilson-Davis & Co. Background: SAG Holdings Ltd. cut its IPO to 875,000 shares – down from 2.13 million shares – and doubled the assumed IPO price to $8.00 – up from $4.00 previously – to raise $7.0 million, according to an F-1/A filing dated March 1, 2024. This is a NASDAQ listing.)

(Note: Wilson-Davis & Co. is the sole book-runner, succeeding Spartan Capital Securities, according to an F-1/A filing dated Aug. 7, 2024.)

(Note: SAG Holdings Ltd. cut its IPO on June 14, 2023, in an F-1/A filing: 2.125 million shares – down from 3.75 million shares – and kept the assumed IPO price at $4.00 to raise $8.5 million. That’s a cut of 32 percent from the $12.5 million in estimated IPO proceeds under the previous terms. The selling shareholders’ portion was cut to 50,000 shares – down from 625,000 shares – according to the S-1/A filing dated June 14, 2023. The company will not receive any proceeds from the sale of the selling stockholders’ shares.)

(Background: SAG Holdings Ltd filed an F-1/A dated April 14, 2023, in which it trimmed the size of its IPO by 16.67 percent to 3.125 million shares (3,125,000 shares) – down from 3.75 million shares – that the company will offer in the IPO – at an assumed IPO price of $4.00 – to raise $12.5 million. Background: The selling shareholders are offering an aggregate of 625,000 shares, according to the March 28, 2023, F-1/A filing. The company will not receive any proceeds from the sale of the selling shareholders’ shares. SAG Holdings also updated its financial statements in the F-1/A dated March 28, 2023. SAG Holdings Ltd filed its F-1 on Oct. 7, 2022: 3.75 million ordinary shares – no price range disclosed; of those 3.75 million shares, the F-1 says that the company is offering 3.125 million shares and the selling shareholders are offering 625,000 shares. )

Wellchange Holdings WCT Dominari / Revere Securities, 2.0M Shares, $4.00-5.00, $9.0 mil, 9/27/2024 Week of

Our operating subsidiary in Hong Kong provides cloud-based SaaS platforms and software for small to medium enterprises (SMEs). (SaaS stands for Software as a Service.) (Incorporated in the Cayman Islands)

We are an enterprise software solution services provider headquartered in Hong Kong. We conduct operations through our Operating Subsidiary in Hong Kong, Wching HK. We provide customized software solutions, cloud-based software-as-a-service (“SaaS”) platforms, and “white-label” software design and development services. Our mission is to empower our customers and users, in particular, small and medium-sized businesses (“SMBs,” as defined below), to accelerate their digital transformation, optimize productivity, improve customer experiences, and enable resource-efficient growth with our low-cost, user-friendly, reliable and integrated all-in-one Enterprise Resource Planning (“ERP”) software solutions. In Hong Kong, SMBs refer to manufacturing companies with less than 100 employees and non-manufacturing companies with less than 50 employees1.

We believe that SMBs are, and will continue to be, a vital component of the economy. However, we have observed that most SMBs rely on antiquated, laborious, inefficient processes or software systems to manage and execute most of their back-office and front-office operational functions. To compete effectively, we believe SMBs require modern integrated software solutions that can automate and streamline operational functions to reduce costs and allow them to focus on higher value-added activities. Furthermore, the COVID-19 pandemic also accelerated technology adoption by SMBs as they were required to respond to new challenges, such as facilitating remote work and finding new methods to engage with customers. At the same time, SMBs also have distinctive technology needs when adopting and transforming to software technologies — we believe SMBs prefer low-cost solutions that are easy to implement, onboard, and integrate and require little ongoing maintenance.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended June 30, 2023.

(Note: Wellchange Holdings added Revere Securities as a joint book-runner in its F-1/A filing dated March 27, 2024. Background: Wellchange Holdings filed its F-1 on Feb. 8, 2024, and disclosed terms for its IPO: 2.0 million shares at $4.00 to $5.00 to raise $9.0 million. The company is offering 1.1 million shares and the selling shareholder is offering 900,000 shares. The company will not receive any proceeds from the sale of the selling shareholders’ shares.)

(Note: Wellchange Holdings named Dominari as a joint book-runner in an F-1/A filing in August 2024, replacing Pacific Century Securities.)

Wing Yip Food Holdings Group Limited WYHG Dawson James Securities/ EF Hutton, 2.1M Shares, $4.00-5.00, $9.2 mil, 9/27/2024 Week of

(Note: The prospectus calls this offering a U.S. initial public offering of American Depositary Shares, which is proposed as a NASDAQ listing. The company’s ordinary shares already trade on the Korea Exchange under the symbol “900340” – according to the prospectus. For that reason, IPOScoop views this offering as a NASDAQ uplisting.)

Through the operating subsidiaries in mainland China, we are one of the notable meat product processing companies in mainland China. (Incorporated in Hong Kong)

According to the industry report produced by Frost & Sullivan (Beijing) Inc., Shanghai Branch Co. (“Frost & Sullivan”), whom we commissioned in October 2023: In fiscal year 2022, based on retail sales of cured meat products in mainland China, we ranked second with a market share of 9.2 percent. As of the date of this prospectus, our products are primarily marketed and sold across 18 provinces in mainland China through 7 self-operated stores; 72 distributors, including major retail outlets and supermarkets, and 7 e-commerce platforms, including one platform owned by us.

The operating subsidiaries are primarily engaged in the processing, sales and distribution of i) cured meat products, including cured pork sausages, cured pork meat and other cured meat products, such as cured chicken, cured duck and cured fish; ii) snack products, including ready-to-eat sausages, jerky, duck necks, duck feet and clay pot rice; and iii) frozen meat products, including frozen sausages, frozen beef patties and frozen chicken breast fillets.

We, through the operating subsidiaries, sell and market our products under our flagship brand “Wing Yip” (“荣业”), which can trace its history back to 1915, when our predecessor business began processing and selling cured sausages under the name “Wing Yip” (“荣业”). Since the commencement of operations through our subsidiary, Wing Yip GD in 2010, we have continuously developed our business and built our brand. In addition to “Wing Yip” (“荣业”), we have also developed the snack product brands “Jiangwang” (“匠王”) and “Kuangke” (“狂客”).

Note: Net income and revenue are in U.S. dollars (converted from China’s currency) for the fiscal year that ended Dec. 31, 2023.

(Note: Wing Yip Food Holdings Group Limited slightly increased its IPO’s size to 2.05 million ADS – up from 2.0 million ADS – and kept the price range at $4.00 to $5.00 – to raise $9.23 million, according to an F-1/A filing dated Sept. 4, 2024. Background: Wing Yip Food Holdings Group Limited cut its U.S. IPO’s size to 2.0 million ADS – down from 2.5 million ADS – and kept the price range at $4.00 to $5.00 to raise $9 million – in an F-1/A filing dated Sept. 3, 2024. In that Sept. 3, 2024, filing with the SEC, Wing Yip Food Holdings Group disclosed that Dawson James Securities and EF Hutton are the joint book-runners, replacing Kingswood.)

(Background: Wing Yip Food Holdings Group Limited disclosed in an F-1/A filing dated July 25, 2024, that it has named Kingswood as its sole book-runner to replace EF Hutton. Background: Wing Yip Food Holdings Group Limited disclosed terms for its U.S. IPO of ADS in an F-1/A filing dated May 20, 2024: The company is offering 2.5 million American Depositary Shares (ADS) at a price range of $4.00 to $5.00 to raise $11.0 million. Two ADS represent three ordinary shares, the prospectus says. Note: The company’s ordinary shares trade on the Korea Exchange (KRX) under the symbol “900340” and for that reason, we view this offering as a NASDAQ uplisting. Background: Wing Yip Food Holdings Group filed its F-1 on March 6, 2024, without disclosing terms for its “U.S. initial public offering” of American Depositary Shares (ADS). The Chinese company submitted confidential IPO documents to the SEC on Nov. 28, 2023.)

Xuhang Holdings, Inc. SUNH Craft Capital/WestPark Capital/ R.F. Lafferty, 2.0M Shares, $4.00-4.00, $8.0 mil, 9/27/2024 Week of

We are a holding company incorporated in the Cayman Islands and not a Chinese operating company. As a holding company with no material operations of our own, we conduct all of our operations primarily through our PRC subsidiaries.

Our PRC subsidiaries are content-driven marketing service providers that offer a package of integrated marketing solutions across a broad range of distribution channels with a primary focus on new media content marketing. Customers use our PRC subsidiaries’ marketing services to achieve their branding and marketing goals across multiple channels with a primary focus on we-media platforms such as WeChat official accounts (微信公众号), Weibo (微博), Xiaohongshu (小红书), Toutiao (今日头条), Douyin (抖音), Kuaishou (快手), and Baidu Baijiahao (百度百家号). As of Oct. 31, 2022, our PRC subsidiaries had delivered short videos and advertorials that generated over 156 billion views in total. Our PRC subsidiaries’ new media account base comprised 524 self-operated accounts and 491 cooperative accounts, which collectively reached approximately 207 million Internet followers.

Customers of our PRC subsidiaries include large Internet platform companies and small- to medium-sized local businesses in all segments of urban life, including catering, entertainment and travel.