Emerging Market Links + The Week Ahead (September 30, 2024)

All aboard the stimulus train, China wants its own Goldman Sachs + halts bubble tea offshore IPOs, India's lending hangover, EM stock picks + short reports and the week ahead for emerging markets.

China has boarded the stimulus train, but will it be enough? As the perennial bears over at Zerohedge have pointed out (China Crushing Shorts $ 🗃️):

The PBOC brought out the bazooka. JPM market intelligence team's trading conclusion: "So enough to cause a short-squeeze, but in itself arguably not enough to convince LO money to add, unless there are more announcements to follow."

"HFs net sold Chinese equities at the fastest pace in 3.5 months" (GS PB).

Meanwhile, author/blogger Charles Hugh Smith is not impressed with anything the FED and other Central Banks have been doing:

So the Economy Now Depends on Stocks Which Depend on Front-Running the Fed--And This Is Fine?

So the entire economy depends on the stock market going up as punters front-run the Fed--and this is not only fine, it's optimal, the best arrangement the world has ever seen. On which ethereal plane is this considered sane, much less optimal?

🤣🤣🤣:

Does anyone actually buy a stock or index based on the fundamentals?

Those holding index funds convinced that "stocks always go up 8% a year over time" will be bagholders because causal conditions have changed, and the smart money has been selling to retail punters enthralled by statistics--20 out of 20, we can't lose!--and those buying and holding index funds because that's worked so well since front-running the Fed became the entire market and economy, circa 2009.

The economy is dependent on the wealth effect fueling the incomes and spending of the top 10% who collect roughly half the income and account for almost half of all consumption--the high-end consumption that keeps the economy afloat. Should the Fed's next round of financial fentanyl fail to boost housing and stocks even higher, then the income and spending of those reaping the gains of the asset bubble might stop spending, and the economy will promptly crater.

And so will many US stocks…

Finally, on a housekeeping note: The Substack Writers Substack recently indicated they have added auto-generated chapters to posts based on post headings. I had no idea what they were talking about, but just realized where the table of contents appears. On a web browser (I don’t use the app), you will see some small lines on the left side of the screen (for paywalled posts, it appears they may only appear to paid subscribers) and if you hover over them with your mouse, a clickable table of contents will appear like this:

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

🌐 Port Terminal & Port Operator Stocks (September 2024) Partially $

Over 60+ port or port terminal operator stocks from around the world - including a few involved in running ports or port terminals as key parts of their business (e.g. mining companies who export).

🌐 EM Fund Stock Picks & Country Commentaries (September 29, 2024) Partially $

Throwing in the towel on using the word "sustainability," quality Chinese stocks, China stimulus + Japanification, Thailand economy, an EM fund manager to close shop, EM debt guide, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 In Depth: Can CATL Stay Ahead? (Caixin) $

Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750), the world’s largest electric-vehicle (EV) battery maker, is seeking new drivers of growth to help maintain a lead over its rivals and head off a challenge from automakers cutting into its lane.

Potential obstacles include a lack of product differentiation, price wars, and the threat of emerging technologies like solid-state batteries, which if eventually commercialized are expected to charge faster and last longer than those with conventional liquid electrolytes. Then there are the trade roadblocks, like stepped up European and U.S. import tariffs and even possible sanctions over forced labor and military concerns.

🇨🇳 Far from fast: Shein’s overseas odyssey hits fresh obstacles (Bamboo Works)

The fashion retailer’s IPO ambitions are facing political pushback in Britain, while the proposed closure of a U.S. tax loophole could hurt the company’s commercial fortunes

A politician in Britain’s ruling party is calling for a review of Shein’s London IPO bid and a ban on goods sourced from Xinjiang

A proposed U.S. move to revoke a tax exemption for low-value goods could add 20% or more to Shein’s prices

🇨🇳 Prosus X Naspers: Discounts Catch Bid on China Stimulus, Trip.com Stake Fully Exited (Smartkarma) $

On Tuesday, China announced fresh stimulus measures targeting the stock market and property sector.

The PBoC reduced the main policy rate and cut the RRR, signaling that further cuts were on the cards for later this year.

Further stimulus measures were announced today ahead of the Golden Week holiday. The discounts of Naspers (JSE: NPN / FRA: NNWN / OTCMKTS: NPSNY) and Prosus (JSE: PRX / AMS: PRX / OTCMKTS: PROSY / OTCMKTS: PROSF / ETR: 1TY) have rallied on the news, we see room for further upside.

🇨🇳 Kuaishou - leading in AI, growing operating profit by 150+%, trading at EV/FCF of 4.6 (Investing in China)

Why the Market Is Overlooking [China's first short video platform] Kuaishou Technology (HKG: 1024 / 81024 / LON: 0A74 / OTCMKTS: KUASF / KSHTY)’s Hidden Growth Potential

In my earlier articles, I provided an in-depth introduction to Kuaishou, which you can find here (part 1) and here (part 2). Today, I’ll update you on Kuaishou’s performance in the last two quarters, providing a side-by-side comparison to highlight the company’s recent developments.

If their investor day guidance is even remotely accurate, Kuaishou appears to be very undervalued. They project gross profit margins rising to 60%, sales expenses decreasing to 30%, and a net profit margin exceeding 20%.

🇨🇳 CMGE makes a global play with Chinese-themed video games (Bamboo Works)

With a hit product rocketing up the charts, the mid-sized gaming company is diversifying its portfolio and aiming for international impact through a flurry of deals and tie-ups

CMGE Technology (HKG: 0302) announced it was buying the international rights to the game “The Legend of Sword and Fairy” from Taiwan’s Softstar Entertainment

The Chinese gaming company looks to be speeding up an overseas push to offset intense competition in its home market

🇨🇳 🇸🇬 FingerMotion: The Bear Case Is Playing Out (Rating Downgrade) (Seeking Alpha) $ 🗃️

[Mobile data specialist company, provides mobile payment and recharge platform system in China] FingerMotion Inc (NASDAQ: FNGR)

🇨🇳 We Believe Qifu Technology, Inc. (NASDAQ: QFIN) is a China Hustle Stock with Outright Fake Financials, Fraudulent Backers, and an Imploding Business (Grizzly Research LLC)

Qifu (NASDAQ: QFIN) is a major player in the credit-driven services sector, connecting borrowers with financial institutions in China and offering various types of loans. The company, previously known as 360 Jietiao, recently rebranded to Qifu Jietiao. Furthermore, the company changed its corporate identity from 360 DigiTech, Inc. to Qifu Technology, Inc. in March 2023. Since its establishment in 2016, the company has been headquartered in Shanghai, the People’s Republic of China.

After months of research, we believe the company has reported fraudulent financials to the SEC and U.S. investors. In addition, we believe that QFIN is controlled by bad actors who use accounting games and related parties to doctor financials. It is also in active violation of the law in China, which will soon lead to a crackdown on its business operations.

🇨🇳 Luckin Coffee: Growing Profitability With New Product Offerings (Seeking Alpha) $ 🗃️

🇨🇳 Luckin Coffee Offers Growth And Coffee At A Reasonable Price (Seeking Alpha) $ 🗃️

🇨🇳 Luckin Coffee Part I (The Meditations)

🇨🇳 Chinese securities regulator puts lid on Hong Kong IPO tea party (Bamboo Works)

The CSRC has temporarily stopped approving new Hong Kong listings by bubble tea makers, affecting pending applications by Mixue and Guming, according to a Reuters report [Beijing halts bubble tea offshore IPO approvals over soured Hong Kong listings, sources say]

China’s securities regulator has effectively halted new Hong Kong listings of Chinese bubble tea makers by suspending its approval of such IPOs, according to Reuters

The move could signal a more aggressive approach by the CSRC in regulating which Chinese companies can list in Hong Kong and New York

🇨🇳 🇯🇵 Nissin Foods looks ‘Down Under’ to escape China pressure cooker (Bamboo Works)

The instant noodle maker said it will buy an Australian frozen dumpling maker for $23.3 million, as it looks to diversify beyond its China base

Nissin Foods (TYO: 2897 / HKG: 1475 / FRA: NF2 / OTCMKTS: NFPDF) is purchasing Australian frozen dumpling maker ABC Pastry for $23.3 million, seeking to tap demand from the country’s growing Asian population

Nissin is looking to diversify geographically from its base in Mainland China and Hong Kong with other recent moves into Vietnam and Taiwan

🇨🇳 MINISO Bets Big on Yonghui. Should Investors Be Concerned About the Acquisition? (Smartkarma) $

MINISO Group Holding (NYSE: MNSO)'s acquisition of a 29.4% stake in the loss-making supermarket chain Yonghui Superstores Co Ltd (SHA: 601933) for USD 890 million has been viewed negatively by investors, leading to a sharp decline in Miniso's stock.

The deal's size, combined with Yonghui Superstores (601933 CH) unprofitable track record and MINISO(9896 HK) 's unexpected move into the low-margin, highly competitive supermarket space, has likely fueled investor concerns.

However, we believe the acquisition provides Miniso with a strategic opportunity for growth and diversification to a sector that remains vital in the offline retail landscape at undemanding valuations.

🇨🇳 Miniso spends US$890 million to challenge Sam’s Club in China (Momentum Work)

MINISO Group Holding (NYSE: MNSO), a leading Chinese value retailer focused on trendy lifestyle and with global presence, announced that it would buy 29.4% shares of Yonghui Superstores Co Ltd (SHA: 601933) for total RMB6.3 billion (US$890 million) cash.

This is not a new investment into Yonghui. Rather, Miniso, through a subsidiary it controls, bought shares from Hong Kong’s Dairy Farm [DFI Retail Group (SGX: D01 / FRA: DFA1 / OTCMKTS: DFIHY)] and Chinese ecommerce firm JD.com (NASDAQ: JD).

Ye Guofu, founder and chairman of Miniso, posted a cryptic message on social media after the announcement:

“It is right that everyone struggles to understand this move; if everyone would understand, that means I have made a mistake.”

🇨🇳 Tianjin Development: Extreme discount is attractive (Bos Invest Substack)

Holdings with a discount are common. The discount that Tianjin Development is trading at is quite absurd though. Below half of net cash & good quality assets make it interesting.

Tianjin Development Holdings Ltd (HKG: 0882 / FRA: TJN / OTCMKTS: TJSCF) is a Chinese state-controlled holding company with a market cap of 1.9B. This does not sound very attractive, but the company has been making the right decisions, holds quality assets & 5.2B in net cash.

In this article I will make the case for Tianjin Development Corp.

Tianjin Development Corp has a diverse set of activities. I will first cover the strategic investments than their operating businesses and pharmaceutical investments.Then I will cover the historic business and share price performance.

Lastly, I will discuss state owned enterprises & how I think of the getting returns going forward.

🇨🇳 Sichuan Kelun Pharmaceutical (002422.CH) - The Real Breakthrough Point in Valuation Is ADC Pipeline (Smartkarma) $

The imagination brought to the market by Sichuan Kelun Pharmaceutical Co Ltd (SHE: 002422)’s traditional businesses (infusion business, antibiotics and bulk pharmaceutical chemicals, generic drugs) is not high. So, the only highlight is Kelun-bio’s ADC pipeline.

Considering that Kelun has lost pricing power due to VBP, and both Yili Chuanning Biotechnology (SSE: 301301) and Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. (HKG: 6990 have been spun off and listed independently, Kelun's valuation will not be too high.

Our forecast is net profit attributable to shareholders in 2024-2026 is in the range of RMB3-5 billion. Reasonable market value is RMB30-50 billion. Subsidiary Kelun Bio is a better bet.

🇨🇳 Facing revenue crisis, Ascletis Pharma tries to bulk up with obesity drugs (Bamboo Works)

The drug maker failed to generate any revenue in the first half of 2024 even with three major commercialized products in hand

Ascletis Pharma (HKG: 1672 / FRA: 2VJ / OTCMKTS: ASCLF) has shifted to weight loss drugs, but its products have only been approved to enter the clinical stage and will require several years to generate revenue

The company currently holds 2.12 billion yuan in cash, which it says can fund its R&D and operations for the next five years

🇨🇳 Angelalign Technology (6699 HK) (East Asia Stock Insights)

Stock pitch + Q&A with a healthcare sector specialist

I recently came across an intriguing stock pitch on Angelalign Technology (HKG: 6699 / OTCMKTS: AGLFF), a Hong Kong-listed (and Shanghai-based) company specializing in clear dental aligners. Angelalign holds the #1 market share in China and has recently embarked on an ambitious global expansion.

The pitch was authored by Healthy Stock Picks (“HSP”), a healthcare sector specialist based in Hong Kong, whom I recently had the pleasure of meeting in person. It was a very thoughtful pitch that I enjoyed a lot, so I’m excited to share the idea, along with a brief Q&A with HSP, with my subscribers.

Following the Q&A, you’ll find the stock pitch and a link to download the full deck. Enjoy!

🇨🇳 AngelAlign - Chinese clear aligners (6699 HK) (Healthy Stock Picks)

And what Private Equity group MBK is up to..

Angelalign Technology (HKG: 6699 / OTCMKTS: AGLFF), listed on the HK exchange has emerged as the only other substantial stand-alone clear aligner brand worldwide [Modern Dental Group Ltd (HKG: 3600 / FRA: 1MD)]. With a 3% global market share, AngelAlign is on par with the other big dental companies who all try land grab within the clear aligner space. Many dentists want to at least have an option to Invisalign to both offer different price points but also to not be at the mercy of Align Technology’s pricing.

By studying the whole dental space I have identified a business acquisition that would make a lot of sense, involving AngelAlign and Private Equity group MBK [MBK Partners]. This is to be clear pure speculation on my part, I have no sources which verifies this thesis. It’s just putting the puzzle pieces together and seeing that this really makes sense.

🇨🇳 Pre-IPO Eternal Beauty Holdings - The Perfume Business in China May Not Be as Good as Expected (Smartkarma) $

The essence of Eternal Beauty [https://hk.eternal.hk/?]’s business model is to earn a “price difference” of the brand and product portfolios, but this business model is difficult to generate high profit margins.

The situation and prospects of China's perfume market are facing major changes. It‘s uncertain whether the perfume sales in the China market can maintain double-digit growth in the long term.

Eternal Beauty’s financial performance would face challenges due to changes in consumer preferences, shifts in China's domestic policies, international trade disputes, geopolitical conflicts, etc. Valuation could be lower than peers.

🇨🇳 WeRide drives into Uber partnership, as U.S. listing plan idles (Bamboo Works)

The robotaxi operator will offer its service to Uber users starting in the UAE, though the pair don’t plan to work together in the U.S. or China for now

WeRide (NASDAQ: WRD) and Uber Technologies, Inc (NYSE: UBER) have launched a partnership starting in the UAE, which will see Uber app users get the option of ordering rides in WeRide’s robotaxis by year-end

WeRide halted its $400 million U.S. listing at the 11th hour in August, but could try to relaunch it by year-end after getting new approval from China’s securities regulator

🇨🇳 Investors charge up XCHG stock in scaled-back IPO (Bamboo Works)

The maker of EV charging stations is relying on Europe for growth, while also setting up a manufacturing base in Texas to tap the U.S. market

Shares of XCHG Ltd (NASDAQ: XCH) nearly tripled in their first week of trading after the company raised $20.7 million in its Nasdaq IPO

The company’s revenue jumped 52% and its profit nearly quadrupled in this year’s first quarter, but it warned of a slowdown in the second quarter

🇭🇰 CLP Holdings: Not The Best Pick Despite Financial Performance Improvement (Seeking Alpha) $ 🗃️

[China Light and Power Company] CLP Holdings Limited (HKG: 0002 / FRA: CLP / OTCMKTS: CLPHY)

🇭🇰 We Do Not See Any Catalyst For CK Hutchison Holdings To Improve Their Stock Price (Seeking Alpha) $ 🗃️

CK Hutchison (HKG: 0001 / FRA: 2CKA / OTCMKTS: CKHUY / CKHUF)

🇭🇰 Fu Shou Yuan (1448.HK) - The Business Model Has "Flaws" (Smartkarma) $

The sharp decline in revenue/profits indicates that Fu Shou Yuan International Group (HKG: 1448 / OTCMKTS: FSHUF)’s business model is not as excellent as previously imagined. The Company’s performance would still be heavily influenced by macro factors.

Once Fu Shou Yuan slows down external expansion and explores endogenous growth, it usually doesn't require too much capital, which means the Company would have greater motivation to distribute dividends.

The economic downturn leading to performance headwinds is just short-term logic. In the long run, the logic behind the increasing demand in funeral industry has not changed. Valuation would rebound.

🇭🇰 🇵🇭 International Entertainment posts 12-mth loss of US$17mln (GGRAsia)

Hong Kong-listed International Entertainment Corporation (HKG: 1009) reported a loss attributable to its owners of just under HKD132.0 million (US$17.0 million) for the 12 months to June 30 this year. That compares with a profit of about HKD18.3 million in the prior financial year, it said in a Wednesday filing.

That was despite a 10.9-percent year-on-year increase in revenue for the period, stated the firm. No recommendation was made for payment of a final dividend.

International Entertainment took over the casino operations at its New Coast Hotel Manila (pictured) property in the Philippine capital in May, under a provisional gaming licence granted by country’s gaming regulator, the Philippine Amusement and Gaming Corp (Pagcor).

🇲🇴 Fresh China economic stimulus boosts Macau gaming stocks (GGRAsia)

Hong Kong stocks linked to Macau casino operators ticked higher on Tuesday, after the Chinese government revealed stimulus measures designed to jolt the country’s economy.

The share price of the stocks connected to Macau’s six casino concessionaires rose between 2.40 percent and 6.65 percent at the close of trading in Hong Kong.

On Monday, nearly a week ahead of mainland China’s seven-day National Day holiday season – also known as October Golden Week – a number of luxury hotels in Macau’s casino resorts was already indicating sellouts for the relevant nights for rooms designed for a maximum two adults.

🇲🇴 Sands China dividend likely in 2025: Morgan Stanley (GGRAsia)

Macau casino operator Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF) will in likelihood resume dividend payments in 2025, suggested Morgan Stanley in a Thursday note. The banking institution expects dividend payments to restart as the firm’s business performance is likely to improve from the fourth quarter this year.

According to the memo, prior to Covid-19, Sands China “consistently paid out dividend-per-share of HKD1.99 [US$0.256] each year from 2014”.

The casino firm’s ratio of net debt to earnings before interest, taxation, depreciation and amortisation (EBITDA) “declined from 5.7 times at end-2022 to 2.8 times at end of first-half 2024, and shareholder equity turned positive in [the] end of first-half 2024,” wrote analysts Praveen Choudhary, Gareth Leung, and Stephen Grambling.

🇰🇷 Kumyang's Capital Raise Drop: Breaking It Down from an Arb Trading Play (Smartkarma) $

[Range of chemical materials] Kumyang Co Ltd (KRX: 001570)'s major shareholders are backing the capital raise, committing ₩160B of the ₩450B total. We’re also likely to see some robust price support for the stock rights in early phases.

Institutional investors still make up about 10% of the SO, with around 8% being active players. These guys could easily start dumping stock rights in bulk.

Retail holds nearly 50% of the SO, increasing volatility and boosting chances for arb spreads. Kumyang's stock futures have solid liquidity, making it a prime arb trading setup.

🇰🇷 Kum Yang: Rights Offering Capital Raise of 450 Billion Won (Douglas Research Insights) $

Kumyang Co Ltd (KRX: 001570) announced a rights offering capital raise of 450 billion won which will be used for facility investments and debt repayment.

The estimated rights offering price is 38,950 won, which is 31% lower than current price (56,500 won).

We remain negative on Kum Yang. Despite the sharply lower rights offering price relative to current price, we would avoid the rights offering.

🇰🇷 What Are Locals Saying About Potential Allies to Choi Family in Fight for Korea Zinc? (Douglas Research Insights) $

In this insight, we discuss three particular allies that could help the Choi family that have been highlighted by the local media including Hanwha, KIS, and Softbank.

The Hanwha Group is one of the largest shareholders of Korea Zinc (KRX: 010130). In addition, Hanwha Group Vice Chairman Kim Dong-Kwan has a close relationship with Korea Zinc Chairman Choi Yoon-Beom.

Korea Zinc is planning to hold an important press conference on the 24 September to reveal its position on the tender offer of Korea Zinc shares by MBK Partners.

🇰🇷 MBK Raises Tender Offer Price on Korea Zinc by 13.6% to 750,000 Won (Douglas Research Insights) $

MBK Partners announced that it will raise the tender offer prices on Korea Zinc (KRX: 010130) by 13.6% to 750,000 won and Young Poong Precision Corporation (KOSDAQ: 036560) by 25% to 25,000 won.

If 100% of the 3,024,881 shares of Korea Zinc tender offer is completed, at the revised tender offer price of 750,000 won, this would be 2.27 trillion won in amount.

In term of probabilities, we would put a 80-85% probability that MBK/Jang family successfully completes the tender offers and takes over the controlling stakes of these two companies.

🇰🇷 NPS Sues Samsung's Lee Jae-Yong (Douglas Research Insights) $

[National Pension Service] NPS has filed a lawsuit against Samsung Group Chairman Lee Jae-Yong and others involved in the merger of Samsung C&T Corp (KRX: 028260) and Cheil Industries nearly nine years ago.

NPS is trying to recover damages estimated at up to 675 billion won.

If NPS is able to win in this lawsuit, it could result in other minority shareholders launching their own lawsuits which could further raise concerns on Samsung C&T.

🇰🇷 A Special Rebalancing Of Korea Value-Up Index Is Likely in December 2024 (Douglas Research Insights) $

The Korea Exchange announced that it is considering a "special rebalancing" of the Korea Value-Up Index in December 2024.

In our view, the probability of this special rebalancing occurring by the end of this year is high at about 85%+.

If there is a special rebalancing, KB Financial Group (NYSE: KB), Hana Financial Group (KRX: 086790), Samsung Life Insurance (KRX: 032830), SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) and Korea Telecom or KT Corp (NYSE: KT / KRX: 030200 / FRA: KTC) could be considered the top candidates for inclusion.

🇰🇷 Korea Exchange Announces The Korea Value Up Index (Douglas Research Insights) $

Korea Exchange announced the long awaited Korea Value Up Index ("K Value Up Index") (composed of 100 stocks) today.

Korea Exchange used a 5-step screening process to select the 100 companies in this index including market cap, profitability, shareholder returns, market evaluation, and capital efficiency.

This Value Up index is part of the bigger "Corporate Value Up " program in Korea. These efforts to improve Korea's corporate governance policies is a marathon, not a sprint.

🇰🇷 Korea Value Up Index - Surprising Inclusions and Exclusions (Douglas Research Insights) $

There are some major surprises (both inclusions and exclusions) in the Korea Value Up index.

In particular, the telecom sector (SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) and Korea Telecom or KT Corp (NYSE: KT / KRX: 030200 / FRA: KTC)) and large cap holding companies (Samsung C&T Corp (KRX: 028260) and LG Corporation (KRX: 003550)) are surprising exclusions in the index.

There are many surprising inclusions in the Korea Value Up Index. We provide 30 companies are surprising inclusions in the Korea Value Up Index (19 KOSDAQ and 11 KOSPI listed).

🇮🇩 Telekomunikasi Indonesia: Competitive Pressures Easing And Data Center Growth Are Reasons To Be Bullish (Seeking Alpha) $ 🗃️

Telkom Indonesia (Persero) Tbk PT (NYSE: TLK)

🇮🇩 PT Catur Sentosa Adiprana - One-Stop Shop for Homemakers (Smartkarma) $

Catur Sentosa Adiprana Tbk PT (IDX: CSAP) has grown rapidly from a building material distribution company into the leading retailer in building materials and home improvement through Mitra10 and shop-in-shop Atria.

The company already has 52 Mitra10 superstores in Indonesia, with six distribution centres across the country, selling a range of home decoration products, with an increasing portion of private labels.

CSAP has seen a market improvement in margins for Mitra10 through more private label and scale benefits, and margins will continue to improve. Valuations are attractive with earnings growth accelerating.

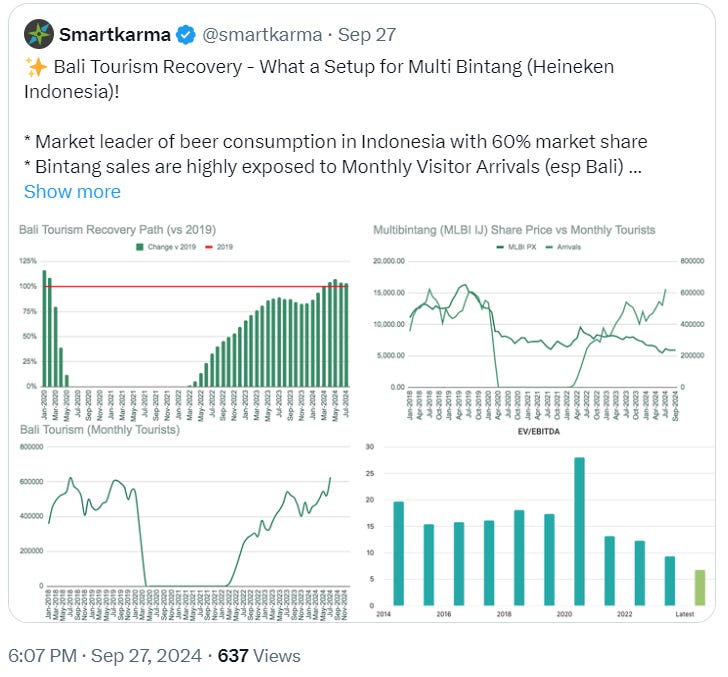

🇮🇩 Mayora Indah Tbk PT (IDX: MYOR / FRA: D7V / OTCMKTS: PTMYF) vs. Multi Bintang Indonesia Tbk PT (IDX: MLBI)

🇮🇩 Multi Bintang Indonesia Tbk PT (IDX: MLBI) [Heineken NV (AMS: HEIA / FRA: HNK1 / OTCMKTS: HINKF / HEINY)]

🇸🇬 Wave Life Sciences: Spiking On Strong DMD Data, But Not Fully De-Risked Yet (Seeking Alpha) $ 🗃️

Wave Life Sciences Ltd (NASDAQ: WVE)

🇸🇬 DBS’s Share Price Hit an All-Time High: Can Singapore’s Largest Bank Continue to Do Well? (The Smart Investor)

Singapore’s largest bank is powering on to new highs, but can it continue its momentum into 2025?

With the Straits Times Index (SGX: ^STI) hitting a 17-year high recently, many blue-chip stocks have also achieved similar highs.

One of these stocks is DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF).

Singapore’s largest bank saw its share price hit an all-time high of S$39.70 recently, giving the lender a market capitalisation of nearly S$113 billion at its peak.

Since then, shares of DBS have fallen to S$38.83 but are still 28.4% higher than they were at the beginning of this year.

Can the bank stage a share price recovery and see its share price go on to break new highs? Let’s find out.

A sparkling set of earnings

Reducing net interest income sensitivity

Bright prospects for fee income

A technology-driven bank

Sourcing for insurance partners

Get Smart: Loaded with excess capital

🇸🇬 4 Singapore Stocks Conducting Acquisitions to Grow Their Business (The Smart Investor)

These four companies carried out acquisitions to grow their top and bottom lines.

Q&M Dental (SGX: QC7) owns the largest network of private dental clinics in Singapore with 107 such outlets around the island.

iFAST Corporation Limited (SGX: AIY / FRA: 1O3 / OTCMKTS: IFSTF) is a financial technology company that operates a platform for the buying and selling of unit trusts, equities, and bonds.

Digital Core REIT (SGX: DCRU / OTCMKTS: DGTCF), or DCR, is a data centre REIT with a portfolio of 10 data centres worth S$1.4 billion as of 30 June 2024.

Sembcorp Industries (SGX: U96 / FRA: SBOA / OTCMKTS: SCRPF), or SCI, is an energy and urban solutions provider with a balanced energy portfolio of 21.2 GW and urban development projects that span over 14,000 hectares across Asia.

🇻🇳 FPT Software featured in Discovery Channel documentary: "Silicon Delta: The Story of Vietnam's Tech Revolution" (FPT Software) 22:35 Minutes

🇻🇳 VinFast: Sell This EV Laggard (Seeking Alpha) $ 🗃️

VinFast Auto Ltd. (NASDAQ: VFS)

🇮🇳 Genpact Rising On AI Demand, New 3 + 1 Initiative, And Tailwinds (Seeking Alpha) $ 🗃️

🇮🇳 The Beat Ideas: Globus Spirits- Maize, Capex, B2C Play (Smartkarma) $

In Q4FY24, Globus Spirits Ltd (NSE: GLOBUSSPR / BOM: 533104) changed its raw material from rice to maize to improve the margin and stability in margins.

Globus Spirits (GBSL IN) increased its capacity in Q4 recently 120KLPD, 60 each in Jharkhand and West Bengal.

Recently, the government also removed the ban on using FCI grain and sugarcane for Ethanol production.

🇮🇳 The Beat Ideas: Deepak Fertilizers - Specialty Chemical, Capex, Debottlenecking! (Smartkarma) $

Deepak Fertilisers & Petro (NSE: DEEPAKFERT / BOM: 500645) commissioned 500KT of ammonia plant that will remove their dependence on import of critical raw material.

DFPCL's TAN capacity stands at 629 KTPA, with plans to increase it to 1,000 KTPA by FY26 through a new facility in Gopalpur, Odisha.

Deepak Fertilisers & Petro (DFPC IN) is about to complete its restructuring by creating a separate subsidiary for mining chemicals, which in future they may plan to list separately.

🇮🇳 RPSG Ventures (RPSGV): Digital-First and D2C Focus Looks Promising For FMCG Scale Up (Smartkarma) $

RPSG Ventures Ltd (NSE: RPSGVENT / BOM: 542333) reported a decent Q1FY25 with FMCG business sustaining an annualized revenue run-rate of INR 500cr+. The Sports business also reported healthy Q1FY25 revenue (INR 500cr+) led by IPL contribution.

To add to growth aggression, RPSGV announced a new CEO for the FMCG business in August. Mr. Sudhir Langer, an accomplished FMCG professional, took the baton from Mr. Rajeev Khandelwal.

At the current valuation, RPSGV is available at a holding company discount of 75%+. As the scalability potential of the FMCG and Sports businesses become evident, significant re-rating could happen.

🇮🇳 The Beat Ideas- Himadri Speciality Chemical: Vertical Integration into Tyre & Li-Ion Batteries (Smartkarma) $

Himadri Speciality Chemical (NSE: HSCL / BOM: 500184)'s expansion into Li-ion batteries and tires, with a massive Rs. 1,100 crore capex and Birla Tyres acquisition.

Diversification into sunrise industries boosts margins, strengthens competitive positioning, and supports long-term growth.

HSCL's evolving business model makes it more than just a carbon company, enhancing its growth potential and resilience.

🇮🇳 Swiggy IPO: Key Facts and Financials at First Glance (Smartkarma) $

Swiggy (1255298D IN), a popular food and grocery delivery platform in India, plans to launch its much-anticipated IPO in early November.

The company has seen rapid growth in Gross Order Value and revenues, driven by increased food delivery demand and a surge in quick commerce, an on demand grocery delivery service.

The Naspers (JSE: NPN / FRA: NNWN / OTCMKTS: NPSNY) and Softbank Group (9984 JP) backed company that started operations in 2014 is yet to turn profitable while its close competitor Zomato Limited (NSE: ZOMATO / BSE: ZOMATO) reported profits in FY2024.

🇮🇳 Global Health (MEDANTA IN): Margins Pressure To Continue; Possible Takeover Bid In Future (Smartkarma) $

Global Health Limited (Medanta) (NSE: MEDANTA / BOM: 543654) reported double-digit growth in revenue in Q1FY25, while sluggish developing hospitals was a drag on the margins.

The company plans to add 1,000–1,500 beds in next 2–3 years, with most of the planned bed addition being at greenfield projects entailing higher capex per bed.

Medanta does offer synergy as a possible takeover candidate for a leading hospital operator.

🇮🇳 Infosys Inc. (INFY) (Long-term Investing)

A short write-up

Infosys (NYSE: INFY) is an-Indian company in the Information Technology Enabled Services (ITES) space. It is also listed on the NYSE in the form of American Depositary Receipts (ADRs).

We have written tangentially about the company twice in the past but have not done a detailed write up. These reports can be found here and here.

The two largest ITES companies in India are Tata Consultancy Services (NSE: TCS / BOM: 532540) and Infosys. The third and fourth ranking companies are HCL Technologies (NSE: HCLTECH / BOM: 532281) and Wipro Ltd (NYSE: WIT). The latter also has an ADR listed in the USA which trades under the ticket WIT.

We believe Infosys is great solid company. If it was a soccer team, we would say it has a very solid defence (scale, balance sheet, client relationships) but the attack will struggle to score a lot of goals due to some weakness (low growth, competition and current valuation).

🇰🇿 Kaspi.kz: Look Beyond The Short Seller Report, But Hold For Now (Downgrade) (Seeking Alpha) $ 🗃️

Sept 19, 2024 - Kaspi (KSPI): The NASDAQ-Listed Fintech Moving Money for Criminals and Kleptocrats (pdf) (Culper Research)

🇰🇿 Kaspi: The Green Lights Are Starting To Flash (Seeking Alpha) $ 🗃️

🇦🇪 SWVL, a “Transportation-as-a-Service” Start-up Appears to Be a Few Breaths Away from Bankruptcy (Wolfpack Research)

We are short SWVL Holdings (NASDAQ: SWVL) and see 100% near-term downside for this Dubai based bus-sharing app. SWVL’s dire financial condition is easy enough to determine by looking at its dismal financials, but our research into the company, including on-the-ground due diligence in Egypt, indicates that SWVL’s operations are grinding to a halt as they run out of money. They also apparently don’t even have enough money to maintain their website as many of the pages are defunct, which is particularly embarrassing considering they try to pass themselves off as a technology company.

92% of SWVL’s revenue originates in Egypt, so we hired investigators to assess their operations and found they were nearly as dysfunctional as the company’s website. One investigator attempted to sign up as a driver, yet he never received a response from the company.

🇿🇦 Lesaka Technologies: A Tier-1 Overlooked Growth Opportunity (Seeking Alpha) $ 🗃️

[Fintech offering solutions to both merchants and consumers] Lesaka Technologies (NASDAQ: LSAK)

🇿🇦 Impala Platinum: The Only PGM Miner Outperforming SPY YTD; Rating Unchanged (Seeking Alpha) $ 🗃️

🇿🇦 Anglo American Platinum: The Best PGM Miner; Rating Upgrade (Seeking Alpha) $ 🗃️

🇿🇦 Sibanye Stillwater Stock: A Contrarian Bet On PGMs Revival; Rating Unchanged (Seeking Alpha) $ 🗃️

Sibanye Stillwater Ltd (NYSE: SBSW)

🇵🇱 InPost Quick Pitch (The Wolf of Harcourt Street)

Why I Am Buying Shares in InPost (AMS: INPST / LON: 0A6K / FRA: 669)

InPost is a Polish e-commerce delivery company listed on the Euronext Amsterdam. It operates as an out-of-home (OOH) e-commerce platform, providing parcel locker services across Europe.

Irish readers may recall a similar service called Parcel Motel, which was later discontinued after its acquisition by UPS in 2017. Interestingly, Parcel Motel's founder, John Tuohy, was inspired by InPost lockers in Poland. In fact, InPost CEO Rafał Brzoska supplied the lockers to Parcel Motel and helped organise financing through a Polish bank, as Irish banks were initially unwilling to provide it.

🇵🇱 Resultados Auto Partner Q2 y H1 2024. (Gekko Capital)

[In Spanish, use a browser translator]

Today we bring you to Substack analysis of the results of [Polish auto parts distributor] Auto Partner SA (WSE: APR / FRA: 6KF) corresponding to the 2nd quarter and first half of 2024. The truth is that I was waiting with enough interest for these results to see above all how the company is behaving in terms of business margins, which were becoming depressed in recent quarters. And the truth is that we have taken some positive surprise.

🇨🇾 🇷🇺 Globaltrans | 2.5x FCF, TTM ROIC of 46.8% but its Russian... (Johnson Equity Analysis)

Globaltrans Investment Plc (GLTR / OTCMKTS: GLTVF) is a quality company trading at crazy low valuation but is it for a good reason?

Globaltrans is a Russian rail logistics company with 6.4% market share. They own over 65,000 railcars to transport goods all over the country. Note they do not own the rail, just the railcars.

The Russian, rail industry operates differently than the US. The main difference is how the rail is operated and owned. In Russia all the rails are owned by Russian Railways which is controlled by the government. This setup means Russia has complete control over the industry, which it uses to set tariffs for the use of the rail system.

With that said, according to forecasts, the total volume of goods shipped will likely grow at a sluggish pace of around 2% per year. This is more than reasonable growth.

Not great, but fortunes can still be made in slow-growth industries.

🌎 Mercado Libre! Deep Dive Part 3/3. (Global Equity Briefing)

Opportunities, Financial Analysis and Valuation

Welcome to 3rd and final Part of this Mercado Libre Deep Dive!

In the first part, we talked about how Mercado Libre built its e-commerce and logistics businesses. In Part 2. I told you how Mercado empowers the money to flow. I recommend readers start with them!

Today we will discuss which opportunities Mercado can execute on, in what shape are its finances and lastly, we’ll look at its valuation!

🇦🇷 Pampa Energía – the outperformer that keeps on giving (Undervalued Shares)

Pampa Energia Sa (NYSE: PAM) is Argentina's largest electricity producer, providing 12% of the country's energy needs.

When I featured the stock in an extensive research report to Undervalued-Shares.com Lifetime Members in 2021, it was very much a fallen angel. Between 2013 and 2018, it had risen 20-fold. Then came Argentina's next crisis as well as the pandemic, and the stock lost 85% of its value.

However, it was always a crisis-resistant business, due to a little-known quirk of Argentina's energy market. About 40% of Pampa Energía's energy production was delivered under long- term supply contracts that were linked to the US dollar. Much as this left another 60% of the production exposed to the vagaries of the Argentinean peso, the dollar-linked contracts gave the company a solid foundation to stand on.

🇧🇷 Vale: A Golden Opportunity For Long-Term Investors (Seeking Alpha) $ 🗃️

🇧🇷 Gerdau Q2: No Prospect Of Robust Improvement In The Short Term (Seeking Alpha) $ 🗃️

🇧🇷 Bradesco Q2: Good Trends, But There Is Still Room For Improvement! (Seeking Alpha) $ 🗃️

Banco Bradesco (NYSE: BBD)

🇧🇷 PagSeguro Q2: Strong! Growing Profitably (Seeking Alpha) $ 🗃️

PagSeguro Digital (NYSE: PAGS)

🇧🇷 Nu Q2: NPL Rising And Provisions Falling (Seeking Alpha) $ 🗃️

Nu Holdings Ltd (NYSE: NU)

🇧🇷 Nu Holdings: We're Still Betting Big On Brazil's Banking Giant (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings Stock Still Growing, But Valuation Raises Red Flags (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇧🇷 StoneCo: Fixing Past Mistakes (Seeking Alpha) $ 🗃️

StoneCo Ltd (NASDAQ: STNE)

🇧🇷 StoneCo's Dip Still Looks Tempting (Seeking Alpha) $ 🗃️

🇧🇷 Why Ambev Stock Remains Unattractive Despite Solid Q2 Results (Seeking Alpha) $ 🗃️

🇲🇽 A Little Rain Won't Slow Down The CEMEX Growth Engine (Seeking Alpha) $ 🗃️

🇲🇽 Grupo Kuo Is Undergoing Cyclical Challenges, But Is Unattractive Even On An Averaged Basis (Seeking Alpha) $ 🗃️

[Sells consumer products, plastics, chemical products, and auto parts] Grupo Kuo SAB de CV (BMV: KUOB)

🇲🇽 Grupo Carso: Interesting And Growing, But Trades Too Dearly And Therefore A Hold (Seeking Alpha) $ 🗃️

[Commercial and Consumer, Industrial and Manufacturing, Infrastructure and Construction, and Energy divisions] Grupo Carso SAB de CV (BMV: GCARSOA1 / FRA: 4GF / OTCMKTS: GPOVF)

🇵🇪 Nexa Resources - LATAM Stocks Investment Analysis #26 (LATAM Stocks)

Nexa Resources SA (NYSE: NEXA) is the 5th Largest Zinc Producer in the World and the Largest Zinc Smelter in Peru.

In this edition, I’m diving into Nexa Resources, the fifth-largest zinc producer in the world and the only zinc smelter in Peru. The zinc price chart recently caught my eye, leading me to explore some major players in this market. Latin America is a key region for zinc production, with Peru being the second-largest producer globally, right after China. However, I found that there are surprisingly few companies focused on zinc.

Most zinc comes from big mining companies like Glencore (LON: GLEN / JSE: GLN / FRA: 8GC / OTCMKTS: GLNCY / OTCMKTS: GLCNF) and Trafigura, where zinc is just a tiny part of their overall business. Because of this, rising zinc prices don’t significantly impact their financials or stock prices. For investors looking to take advantage of higher zinc prices, these stocks aren't viable options.

🇺🇾 Satellogic: A Strong Sell As Company Fails To Scale Constellation (Seeking Alpha) $ 🗃️

[Integrated geospatial company / tasking satellites with monitoring assets] Satellogic (NASDAQ: SATL)

🌐 Deep Dive: Optical Module Market (Deep Fundamental Research)

Powering next-gen connectivity: How optical modules enable fast, reliable data transfer, and What are the opportunities for investors?

Unlike my previous posts, which typically focus on insights into a specific public company, this piece offers a comprehensive overview of the entire industry and its up/downstreams, aiming to provide a foundational understanding of their dynamics before potentially diving into individual stock analyses in the future.

Equities relevant to this report include:

Optical module makers: China Innolight (300308.SZ), Coherent (COHR), TFC Optical Communication (300394.SH), Fabrinet (FN), Eoptolink Technology (300502.SH), Lumentum (LITE)

Component suppliers: Marvell (MRVL), Macom (MTSI), Broadcom (AVGO), Maxlinear (MXL), Semtech (SMTC), Yuanjie (688498.SH), Shijia (688313.SH)

Foundries: GlobalFoundries (GFS), Tower Semiconductor (TLV: TSEM), TSMC (TPE: 2330)

Cloud service providers: Nvidia (NVDA), Microsoft (MSFT), Google (GOOG), Amazon (AMZN), Meta (META)

📰🔬 Further Suggested Reading

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China Panics: Cuts Multiple Rates And Reserve Ratio Requirements, Goes All-In To Prop Up Stocks, China Goes "All Out"As Xi Vows Fiscal Stimulus To Save Private Economy, Stabilize Real Estate And Boost Stock Markets & China Crushing Shorts (Zerohedge) $ 🗃️

The PBOC brought out the bazooka. JPM market intelligence team's trading conclusion: "So enough to cause a short-squeeze, but in itself arguably not enough to convince LO money to add, unless there are more announcements to follow."

"HFs net sold Chinese equities at the fastest pace in 3.5 months" (GS PB).

🇨🇳 Will China’s $100bn war chest for shares lift the real economy? (FT)

Investors welcome ‘unprecedented’ central bank loans to try to boost markets but analysts say fiscal stimulus is needed

🇨🇳 In Depth: Mounting debt defaults fuel crisis in China’s construction industry (Caixin) $

China’s construction industry is reeling from a wave of defaults and financial turmoil as delayed payments and rising bad debts cascade through the sector. Once fueled by a booming real estate market, construction firms are now struggling with unpaid bills and shrinking liquidity.

Xi’an Construction Engineering Group Co. Ltd., a state-owned construction company in Northwest China, became the latest victim of this crisis after defaulting on a 263-million-yuan ($37 million) bond last month after a series of credit downgrades over the previous six months.

🇨🇳 In Depth: Can China Create Its Own Goldman Sachs With Brokerage Mega-Merger? (Caixin) $

As investors await details of the merger of two top Chinese securities firms to form a powerhouse with the potential to compete with global heavyweights, such as Morgan Stanley and Goldman Sachs Group Inc., analysts and academics are debating the merits and risks of a deal that could take over a year to complete.

The marriage between Guotai Junan Securities Co. Ltd. and Haitong Securities Co. Ltd., announced by the two Hong Kong- and Shanghai-listed companies in early September, is being driven by the Shanghai government, which backs both firms.

🇨🇳 ‘Too boring’: Chinese students are sleeping through propaganda (FT) $ 🗃️

Hours of political education are supposed to reinforce loyalty but young people struggle to stay awake

🇹🇭 Thailand kicks off bumper cash handouts to boost ailing economy (FT)

Long-awaited scheme may not be enough to turn around slow growth in south-east Asia’s second-largest economy

🇮🇳 India wrestles with unsecured lending hangover (FT) $ 🗃️

Young Indians are racking up personal loan and credit card debts

“You have this aspirational spending meeting easy borrowing,” Ritesh Srivastava, founder and chief executive of Freed, told the Financial Times. “What makes it worse in India is that there’s a lending boom, there’s a lack of financial literacy and household savings are at an all-time low . . . that’s a heady cocktail.”

🇲🇽 Mexico’s $7.5B Gamble to Disrupt the Panama Canal (The Wall Street Journal) 8:43 Minutes

Mexico’s $7.5 billion interoceanic corridor aims to ease a major chokehold in a global shipping mess and rival the Panama Canal. The stretch of land extends 188 miles across the Isthmus of Tehuantepec connecting the Pacific and Atlantic Oceans. But will Mexico’s revived railway be a faster or cheaper option to alternatives for shipping? WSJ explores Mexico’s plan to grab a slice of the multi-trillion dollar global shipping industry.

Chapters:

🇺🇾 Uruguay - Election Notes - September 2024 (Latin America Risk Report)

The first round is about the pension counter-reform referendum. The side that wins the referendum likely loses the second round of the presidential election.

My reading of the current polls indicates that the pension counter-reform referendum would pass if it were held today. Somewhere between 20% and 35% of voters are currently undecided on the pension reform. Many voters say they are relatively uninformed about the issue. As worded, the question appears quite favorable toward improving the conditions of retirees, which will sway some voters to be in favor.

If the pension reform passes (which I think is about 60% likely right now), then markets will panic, voters will believe they need a president capable of moderating the impact of the pension counter-reform, and the odds for the governing party to retain the presidency will increase. However, if the pension reform fails, it makes it more likely that voters will favor the side of change in the second round and choose Orsi of the Frente Amplio to win the presidency.

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

Kazakhstan Referendum Oct 6, 2024 (d) Confirmed Jun 5, 2022

Georgia Georgian Parliament Oct 26, 2024 (d) Confirmed Oct 31, 2020

Uzbekistan Uzbekistani Legislative Chamber Oct 27, 2024 (d) Confirmed Dec 22, 2019

Uruguay Referendum Oct 27, 2024 (t) Confirmed Mar 7, 2022

Uruguay Uruguayan Presidency Oct 27, 2024 (d) Confirmed Nov 24, 2019

Uruguay Uruguayan Chamber of Representatives Oct 27, 2024 (d) Confirmed Oct 27, 2019

Uruguay Uruguayan Chamber of Senators Oct 27, 2024 (d) Confirmed Oct 27, 2019

Bulgaria Bulgarian National Assembly Oct 27, 2024 (d) Confirmed Jun 9, 2024

Sri Lanka Sri Lankan Parliament Nov 14, 2024 (t) Date not confirmed Aug 5, 2020

Romania Romanian Presidency Nov 24, 2024 (d) Date not confirmed Nov 24, 2019

Namibia Namibian Presidency Nov 27, 2024 (d) Confirmed Nov 27, 2019

Namibia Namibian National Assembly Nov 27, 2024 (d) Confirmed Nov 27, 2019

Romania Romanian Senate Dec 1, 2024 (t) Date not confirmed Dec 6, 2020

Romania Romanian Chamber of Deputies Dec 1, 2024 (t) Date not confirmed Dec 6, 2020

Ghana Ghanaian Presidency Dec 7, 2024 (t) Confirmed Dec 7, 2020

Ghana Ghanaian Parliament Dec 7, 2024 (t) Confirmed Dec 7, 2020

Thailand Referendum Dec 31, 2024 (t) Date not confirmed Aug 7, 2016

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Jinxin Technology NAMI Craft Capital Management/ WestPark /R.F. Lafferty & Co., 1.9M Shares, $4.00-5.00, $8.5 mil, 9/30/2024 Week of

(Incorporated in the Cayman Islands)

We are an innovative digital content service provider in China. Leveraging our powerful digital content generation engine powered by advanced AI/AR/VR/digital human technologies, we are committed to offering our users high-quality digital content services through both our own platform and the content distribution channels of our strong partners.

We currently target K-9 students in China, with core expertise in providing them digital and integrated educational content, and plan to further expand our service offerings to provide premium and engaging digital contents to other age groups. We were the largest digital textbook platform and a leading digital educational content provider for K-9 students in China, both in terms of revenue in 2022, according to Frost & Sullivan. We collaborate with leading textbook publishers in China and provide digital version of mainstream textbooks used in primary schools and middle schools. Our digital textbooks primarily cover Chinese and English subjects used in K-9 schools in China. We also create and develop digital self-learning contents and leisure reading materials in-house. Our AI-generated content technology enables our comprehensive digital contents to deliver an interactive, intelligent and entertaining learning experience.

Textbooks have been the primary teaching instrument for most children. Access to an advanced and intelligent version of textbook is becoming a rising demand, particularly among K-9 students who are at early stage of learning and forming an efficient learning style. There are currently over 150 million K-9 students in China while the digitization rate of textbook remains relatively low. Since our inception in 2014, we have built expertise in creating digitized, interactive and intelligent textbooks that we believe improve K-9 students’ learning experience. Previously, CDs were the most common learning equipment used by K-9 students to assist with studying textbook in China. We are committed to replacing outdated learning materials and equipment with our intelligent, interactive digital products and resources, and eventually cultivate a fresh and innovative learning style.

We are authorized by major Chinese textbook publishers to digitize their proprietary textbooks, and design and develop the digital version. Besides digital textbooks, leveraging our deep insights in China’s childhood education sector and our technological strength, we also provide digital self-learning materials and digital leisure reading materials, catering to the evolving and diversified needs of potential users. We have strong in-house content development expertise in digitized materials, amusement features, video and audio effects as well as art design. Our products and contents are imbued with the rich operational know-how and deep understanding of China’s childhood education sector, which we believe make our digital contents highly compelling to our users.

We distribute digital contents primarily through (i) our flagship learning app, Namibox, (ii) telecom and broadcast operators and (iii) third-party devices with our contents embedded. We launched our interactive and self-directed learning app Namibox in 2014, to provide users an integrated entry point to our digital textbooks, self-learning materials and leisure reading materials. Users can access various free contents, subscribe to advanced contents and choose to become premium members through our membership programs. In addition, we partner with all mainstream Chinese telecom and broadcast operators to tap into their large user base. Our partnered telecom and broadcast operators broadcast our various programs to end users through their respective platforms, distribute our educational contents to interested users and share certain percentage of revenues with us. Through networks of our partnered telecom and broadcast operators, individual users gain easy access to our digital contents through TVs or mobile devices. Furthermore, we cooperate with well-known hardware manufacturers, such as manufacturers of digital pads and intelligent TVs, and pre-install our programs in such devices directly. The integrated distribution channels empower us to increase our brand awareness in a cost-efficient manner, grow our user base sustainably and improve our contents continuously based on users’ real time feedbacks.

Our business has evolved significantly since inception and we have never stopped reimagining and innovating our products and digital contents. We are doing this not only to cater to, but influence, the learning habits and lifestyles of our users, to fulfill their goals and enrich their lives. With innovative and high-quality educational contents, we have built a trusted and well recognized brand, as well as a large user base throughout China. Since our inception, our Namibox app has amassed over 79 million cumulative downloads and more than 39 million registered users as of December 31, 2023. The high-frequency interactions we have with users and our unique access to a large amount of mission-critical learning data further provide us deep insights in K-9 education sector.

Fueling all of these great achievements are our technologies. We deploy advanced digitization technologies, AI technologies and big data analysis to provide superior user experience. We also deploy advanced AI technologies that power various teaching and voice assessment tools, all to improve the learning effectiveness for children. Leveraging our proprietary digital content generation engine, we are able to consistently refine and upgrade our educational contents, as well as to intelligently recommend content to our users, continually improving user experience.

We have realized steady growth with healthy financial performance since inception. Despite negative impacts caused by regulatory changes in the online education industry in 2021, our registered users increased from 29.9 million as of December 31, 2021 to 35.3 million as of December 31, 2022, and further to 39.5 million as of December 31, 2023. In addition, we recorded net income of RMB55.1 million and RMB83.5 million (US$11.8 million) in 2022 and 2023, respectively.

Note: Net income and revenue are for the year that ended Dec. 31, 2023.

(Note: Jinxin Technology Holding Company unveiled the terms for its IPO – 1.88 million American Depositary Shares – or 1,875,000 ADS – at a price range of $4.00 to $5.00 – to raise $8.46 million, according to an F-1/A filing dated Aug. 19, 2024. Each ADS represents 33.75 million ordinary shares. Background: Jinxin Technology filed its F-1 on Aug. 10, 2023 – about five months after submitting its confidential IPO documents to the SEC on March 24, 2023.)

FBS Global Ltd. FBGL WallachBeth Capital, 2.3M Shares, $4.50-5.00, $10.7 mil, 10/1/2024 Tuesday

(Note on corporate structure: The predecessor of our principal operating company was incorporated on March 9, 1996, in Singapore under the name Finebuild Systems Pte Ltd. Pursuant to a restructuring that took effect on August 2, 2022, FBS Global Limited, an exempted company incorporated in the Cayman Islands, through its wholly owned subsidiary, Success Elite Developments Limited, a company incorporated in BVI, became the ultimate holding company of our current principal operating subsidiary referred to herein as FBS SG. (Incorporated in the Cayman Islands) )

From its beginning as a construction company since 1996, FBS SG has developed into a premier integrated engineering company that provides a full suite of construction and engineering services. These services include the supply of building materials and precast concrete components, recycling of construction and industrial wastes, research, and development, as well as pavement consultancy services.

We are an established interior design and build (also referred to as “fit-out”) specialist in Singapore with a track record of over 20 years in institutional, residential, commercial and industrial building projects. Our scope of services comprises design, supply and installation of ceilings, partitions, timber deck, carpet, lead lining, acoustic wall panel, built-in furnishing, carpentry and mechanical & electrical services of a building. We also undertake main construction and building works projects.

**Note: Net income of US$55,168.00 on revenue of $12.65 million for the 12 months that ended June 30, 2023 (converted from Singapore dollars)

(Note: FBS Global Ltd. revived its micro-cap IPO and disclosed its revised terms on Aug. 13, 2024, in an F-1/A filing: The company increased the number of shares to 2.25 million – up from 1.88 million shares – and raised the lower end of its price range to $4.50 – up from $4.00 – so the new price range is $4.50 to $5.00 – to raise $10.69 million. The company named WallachBeth Capital as its sole book-runner, replacing Eddid Securities USA.)

(Note: FBS Global Ltd. postponed its IPO in April 2024, when it had been expected to price its micro-cap initial public offering on or around April 13, 202r. Background: FBS Global Ltd. says its assumed IPO price is $4.00 – the low end of its $4.00-to-$5.00 price range – on 1.875 million shares, according to an F-1/A filing dated Feb. 23, 2024. Background: FBS Global Ltd. cut its IPO’s size to 1.875 million shares – down from 2.75 million shares – and set the price range at $4.00 to $5.00 to raise $8.44 million, according to an F-1/A filing dated Dec. 29, 2023. In that Dec. 29, 2023, filing with the SEC, FBS Global Ltd. also disclosed that it has changed its sole book-runner to Eddid Securities USA from Pacific Century Securities.)

(Note: FBS Global Ltd. filed an F-1/A dated July 27, 2023, in which it trimmed the size of its IPO to 2.75 million shares – down from 3.75 million shares – at US$4.00 to raise $11.0 million. The number of shares – 2.75 million – will all be offered by the company – and this is the same as in the previous prospectus (F-1/A) filed on June 26, 2023. The difference: The selling stockholder’s 1.0 million shares are not highlighted in the July 27, 2023, prospectus. However, in the July 27, 2023, filing, there is a note that the selling stockholder still intends to sell up to 1.0 million shares. Background: FBS Global Ltd. filed an F-1/A on June 26, 2023, and updated its financial statements for the year ended Dec. 31, 2022. FBS Global Ltd. filed its F-1 on Jan. 30, 2023, and disclosed terms for its IPO: 3.75 million (3,750,000) shares at US$4.00 to raise $15.0 million. Of the 3.75 million shares in the IPO, the company is offering 2.75 million shares and the selling stockholder is offering 1.0 million shares. FBS Global Ltd. will NOT receive any proceeds from the sale of the selling stockholder’s shares. FBS Global Ltd. filed confidential IPO documents on Sept. 13, 2022.)

Xuhang Holdings, Inc. SUNH Craft Capital/WestPark Capital/ R.F. Lafferty, 2.0M Shares, $4.00-4.00, $8.0 mil, 10/2/2024 Wednesday

We are a holding company incorporated in the Cayman Islands and not a Chinese operating company. As a holding company with no material operations of our own, we conduct all of our operations primarily through our PRC subsidiaries.

Our PRC subsidiaries are content-driven marketing service providers that offer a package of integrated marketing solutions across a broad range of distribution channels with a primary focus on new media content marketing. Customers use our PRC subsidiaries’ marketing services to achieve their branding and marketing goals across multiple channels with a primary focus on we-media platforms such as WeChat official accounts (微信公众号), Weibo (微博), Xiaohongshu (小红书), Toutiao (今日头条), Douyin (抖音), Kuaishou (快手), and Baidu Baijiahao (百度百家号). As of Oct. 31, 2022, our PRC subsidiaries had delivered short videos and advertorials that generated over 156 billion views in total. Our PRC subsidiaries’ new media account base comprised 524 self-operated accounts and 491 cooperative accounts, which collectively reached approximately 207 million Internet followers.

Customers of our PRC subsidiaries include large Internet platform companies and small- to medium-sized local businesses in all segments of urban life, including catering, entertainment and travel.

Currently, our PRC subsidiaries provide two categories of marketing services: (i) new media integrated content marketing services, which rely on creating and distributing relevant, engaging and valuable content in order to attract and retain audiences to promote brands and sell products and services, and (ii) digital advertising services, which emphasize the need to choose better-matched ad distribution channels with the target audience to maximize marketing effectiveness.

Our PRC subsidiaries started their business in 2014 with digital advertising services, where they help marketers—typically app developers and operators and advertising agents thereof—optimize their marketing efforts by identifying, engaging and activating target audiences for user acquisition. Our PRC subsidiaries publish advertisements for their customers’ products or services via their digital advertising channels, which consist primarily of mobile apps embedded with their distribution software development kit (the “Xuhang SDK-embedded Apps”). With their analysis and optimization capabilities in advertisement placement, their industry expertise and the distribution channel resources they have accumulated over the years, our PRC subsidiaries are able to provide customers with effective digital advertising services through better matching the products to be advertised with suitable distribution channels.

Since 2017, our PRC subsidiaries have launched and expanded their new media integrated marketing services that address the growing demands of marketers for social, entertaining, and trendy marketing content in the new media area. Specifically, our PRC subsidiaries’ new media integrated marketing services are mainly composed of two models—the service-to-business (“S2B”) model and the service-to-platform (“S2P”) model. For the S2B business, our PRC subsidiaries provide customers with a package of new media integrated content marketing service solutions. With respect to the S2P business, our PRC subsidiaries provide online traffic services to large Internet media platforms by generating or directing user traffic to those media platforms through editing and producing captivating short videos from authorized TV dramas, movies, and variety shows and posting such short videos on high-profile media platforms such as Toutiao, Douyin, Xigua Video (西瓜视频), Baidu Baijiahao, Kuaishou, Youku (优酷), Tencent Video (腾讯视频), and iQIYI (爱奇艺).

**Note: Net income and revenue are in U.S. dollars (converted from China’s renminbi) for the 12 months that ended Dec. 31, 2023.

(Note: Xuhang Holdings Ltd. has named Craft Capital and R.F. Lafferty as joint book-runners, to work with WestPark Capital, according to its F-1/A filings. Orientert XYZ Securities is no longer involved as a joint book-runner of Xuhang Holdings’ IPO, the filings show.)

(Note: Xuhang Holdings Ltd. cut its small-cap IPO’s size to 2.0 million shares – down from 2.5 million shares – and kept the assumed IPO price at $4.00 – to raise $8.0 million, according to an F-1/A filing dated Sept. 12, 2024. Background: Xuhang Holdings cut its small-cap IPO’s size to 2.5 million shares – down from 2.75 million shares – and kept the assumed IPO price at $4.00 – to raise $10.0 million, according to an F-1/A filing dated June 28, 2024. In that same filing, Xuhang Holdings disclosed that it has named WestPark Capital and Orientiert XYZ as its joint book-runners to replace Univest Securities. )

(Background: Xuhang Holdings Ltd. disclosed the terms for its small-cap IPO – 2.75 million shares at $4.00 to raise $11.0 million – in an F-1/A filing on Feb. 29, 2024. Background: Xuhang Holdings Ltd. filed its F-1 on March 31, 2023. The company submitted confidential IPO documents to the SEC on Sept. 27, 2022.)

Cuprina Holdings (Cayman) LtdCUPR Network 1 Financial Securities, 3.8M Shares, $4.00-4.50, $15.9 mil, 10/4/2024 Friday

We manufacture and distribute chronic wound care products – medical grade bio-dressing products made from sterile blowfly larvae and sold under the MEDIFLY brand – mostly in Singapore since February 2020 and in Hong Kong since March 2023. (Incorporated in the Cayman Islands)

From the Prospectus: “Looking ahead, we have strategic plans in place for the second half of 2024 and 2025 to expand our sales and establish physical operations in several key regions, including Southeast Asia, the Middle East (in particular, the member states of the Gulf Cooperation Council, or GCC), and mainland China. These expansion initiatives will further enable us to cater to the growing demand for our products in these promising markets, cementing our position as a trusted player in the field of chronic wound care and treatment.”

We are a Singapore-based biomedical and biotechnology company dedicated to the development and commercialization of innovative products for the management of chronic wounds, as well as operating in the health and beauty sectors. Our expertise in biomedical research allows us to identify and utilize materials derived from natural sources to develop wound care products in the form of medical devices which meet international standards. We believe we will be able to build upon and leverage such expertise to develop innovative cosmeceutical products in the future.

As of Dec. 31, 2023, we manufactured and distributed a line of medical grade sterile blowfly larvae bio-dressing products marketed under the MEDIFLY brand name, or the MEDIFLY products. The MEDIFLY products are used as a biological debridement tool for chronic wounds, in a procedure known as Maggot Debridement Therapy, or MDT, which is an effective alternative to surgical debridement.

In addition to our commercialized MEDIFLY products, we have two lines of chronic wound care products in our pipeline:

*Collagen dressings, including sponges, particles and hydrogels, using bullfrog collagen derived from the valorization of abattoir waste streams of American bullfrogs (Lithobates catesbeianus) and

*Products using medical leeches for wound treatment.

We expect development of such products to take place over the course of 2024 and 2025 and to become commercially available subject to regulatory approval.

We believe what sets us apart is our focus on developing functionally specific chronic wound care products designed to address the major stages of the wound healing process from chronic to closure.

Our chronic wound care products, including both our existing commercialized products and forthcoming products in our pipeline, are poised to benefit from escalating global market demand. This demand is primarily fueled by the demographic shift towards an aging population and the concurrent rise in comorbidities such as diabetes, obesity, cardiovascular ailments and peripheral vascular diseases.

For our cosmeceuticals business, we introduced three products in 2023, including a hydrating balm product, a muscle energy cream and a pain relief muscle patch. For our commercialized cosmeceutical products, we have commissioned original equipment manufacturers of skincare products to develop the formulation and manufacture the substantially finished and finished products. In addition, we plan to explore the possibility of developing a range of potential cosmeceutical product candidates incorporating bullfrog collagen with a view to making them commercially available between 2024 and 2028, subject to the progress of the relevant R&D work.

We offer our chronic wound care products to both public and private hospitals and clinics, where patients can obtain them through prescription from a physician. Our customers primarily include major public and private hospitals and clinics in Singapore.

Our commercialized cosmeceutical products can be purchased directly by individual customers through a variety of channels, including retailers and gyms in Singapore, Malaysia and Australia, as well as online shopping platforms such as Shopee.

Note: Net loss and revenue figures are in U.S. dollars for the year that ended Dec. 31, 2023.

Note from the Prospectus: “Our independent registered public accounting firm expressed substantial doubt regarding our ability to continue as a going concern. Our ability to continue as a going concern requires that we obtain sufficient funding to finance our operations.”

(Note: Cuprina Holdings (Cayman) Ltd. filed an F-1/A on Sept. 3, 2024, disclosing that its IPO’s price range is $4.00 to $4.50 – a change from its IPO price of $4.00 – and keeping the IPO’s size at 3.75 million Class A ordinary shares – to raise $15.94 million. Background: Cuprina Holdings (Cayman) Ltd increased the number of shares to 3.75 million – up from 2.5 million shares initially – without disclosing the IPO price – in an F-1/A filing dated June 20, 2024.)

(More Background: Cuprina Holdings (Cayman) Ltd filed an F-1/A dated May 16, 2024, disclosing that it will offer 2.5 million Class A ordinary shares – without stating the IPO price. More Background: Cuprina Holdings (Cayman) Ltd. filed its F-1 on March 7, 2024, without disclosing terms; estimated IPO proceeds were $10 million. Previously: The Cayman Islands-incorporated holding company submitted its confidential filing to the SEC on Oct. 13, 2023.)

HUHUTECH International Group HUHU Craft Capital Management/EF Hutton, 1.3M Shares, $4.00-6.00, $6.3 mil, 10/4/2024 Week of

We offer process and control systems as well as factory management solutions for industrial clients, mostly semiconductor and electronics manufacturers. Our business is conducted through our subsidiaries in China and Japan. (Incorporated in the Cayman Islands)

Note: The holding company is offering the stock in the IPO.

We, through our subsidiaries, specialize in providing factory facility management and monitoring systems, including high-purity process system (“HPS”) and factory management and control systems (“FMCS”) for our industrial clients, who are mainly semi-conductor manufacturers and electronics manufacturers in China. We believe our products and services are widely used by semi-conductor manufacturers, LED and micro-electronics factories, as well as some pharmaceutical, food and beverage manufacturers.

Within the HPS, we provide two types of solutions: (1) High-purity gas conveyor system. The high-purity gas conveyor consists of a specialized gas cabinet, the valve manifold box (“VMB”), the gas monitoring software and gas valve parts. This system is connected to our clients’ own factory equipment, which will receive gas through the system we install. The gas conveyor ensures that the high-purity gas will not be contaminated by being exposed to air, liquid or small particles during the delivery. (2) High-purity chemicals conveyor system. The high-purity chemicals conveyor system conveys multiple chemicals used in the cleaning, corrosion and grinding process. This system consolidates multiple sub-systems including high-purity chemical pipes, valve, chemical sensor, and the chemical monitoring software. With the high-purity chemical conveyor system, we deliver chemicals from the storage container to the client’s manufacture equipment through the distribution valve. Both high-purity gas conveyor system and high-purity chemicals conveyor system are capable of delivering special high purity gas and chemicals in a highly controlled environment that ensures the gas and chemicals meet the purity requirement of our clients’ production process, as well as monitors potential safety issues in the production.

Our FMCS solution provides instant and effective monitoring over our clients’ manufacturing process through the control center located in the clients’ factory. The FMCS service monitors the facility production atmosphere, and consolidates sub-systems, including gas monitoring system (GMS), chemical monitoring system (CMS), high and low voltage power distribution, air pressure system, air conditioning system, water system, access control system, elevator system, sewage treatment system, waste gas emission system, pure water system and other systems. Our software is capable of consolidating all the sub-systems by creating a facility-wide software monitoring platform, where one can monitor and control every aspect of the factory condition. Additionally, we also develop individual sub-systems for our clients, such as gas monitoring system and chemical monitoring system.

Some of our clients are seasoned manufacturers in their industries in China. Our clients include Li Yi System Engineering (Shanghai) Limited, Hefei Lanke Investment Co., Ltd., Shiyuan Technology Engineering Co., Ltd., and AUO Corporation.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended Dec. 31, 2023.

(Note: HUHUTECH International Group filed its F-1/A on Aug. 28, 2024, and disclosed the terms for its small-cap IPO: The company is offering 1.25 million shares at a price range of $4.00 to $6.00 to raise $6.0 million.)

Jinxin Technology NAMI Craft Capital Management/ WestPark /R.F. Lafferty & Co., 1.9M Shares, $4.00-5.00, $8.5 mil, 10/4/2024 Week of

(Incorporated in the Cayman Islands)

We are an innovative digital content service provider in China. Leveraging our powerful digital content generation engine powered by advanced AI/AR/VR/digital human technologies, we are committed to offering our users high-quality digital content services through both our own platform and the content distribution channels of our strong partners.

We currently target K-9 students in China, with core expertise in providing them digital and integrated educational content, and plan to further expand our service offerings to provide premium and engaging digital contents to other age groups. We were the largest digital textbook platform and a leading digital educational content provider for K-9 students in China, both in terms of revenue in 2022, according to Frost & Sullivan. We collaborate with leading textbook publishers in China and provide digital version of mainstream textbooks used in primary schools and middle schools. Our digital textbooks primarily cover Chinese and English subjects used in K-9 schools in China. We also create and develop digital self-learning contents and leisure reading materials in-house. Our AI-generated content technology enables our comprehensive digital contents to deliver an interactive, intelligent and entertaining learning experience.

Textbooks have been the primary teaching instrument for most children. Access to an advanced and intelligent version of textbook is becoming a rising demand, particularly among K-9 students who are at early stage of learning and forming an efficient learning style. There are currently over 150 million K-9 students in China while the digitization rate of textbook remains relatively low. Since our inception in 2014, we have built expertise in creating digitized, interactive and intelligent textbooks that we believe improve K-9 students’ learning experience. Previously, CDs were the most common learning equipment used by K-9 students to assist with studying textbook in China. We are committed to replacing outdated learning materials and equipment with our intelligent, interactive digital products and resources, and eventually cultivate a fresh and innovative learning style.

We are authorized by major Chinese textbook publishers to digitize their proprietary textbooks, and design and develop the digital version. Besides digital textbooks, leveraging our deep insights in China’s childhood education sector and our technological strength, we also provide digital self-learning materials and digital leisure reading materials, catering to the evolving and diversified needs of potential users. We have strong in-house content development expertise in digitized materials, amusement features, video and audio effects as well as art design. Our products and contents are imbued with the rich operational know-how and deep understanding of China’s childhood education sector, which we believe make our digital contents highly compelling to our users.