Emerging Market Links + The Week Ahead (September 9, 2024)

Temu hurting Dollar Stores, mainland Chinese stocks see falling profits, Brazil investing mistakes, AI increases global thirst for critical metals, EM stock picks & the week ahead for emerging markets

The Financial Times has reported how America’s dollar stores are now living in a Temu world 🗃️ - aka Temu has made inroads among low-income shoppers. The FT commented:

With lucrative side businesses that range from cloud computing to digital advertising, Amazon’s earnings growth is not at risk. Instead, it is dollar store operators that have the most to worry about.

Note that one of the Dollar stores in the small town I grew up in will also be closing (albeit I think its more due to a rent issue and that the landlord wants to subdivide the space). If the other Dollar store closes, my parents will be left with a pricey local supermarket (plus a local Mexican supermarket that used to be cheap but has recently jacked up their prices…) for all basic items OR driving to big box stores in bigger neighbouring towns/cities…

I also just got back to Asia from California (where I was busy with our almond harvest plus redoing/maintaining my parent’s yard) and I had bought this garden trellis on Temu for only $53:

That was the lowest priced option on Temu and I do see the same exact trellis available for free delivery for $55 from Home Depot (NYSE: HD) which I hadn’t thought to check because, well, I just assumed they would be more expensive on there (and I didn’t really need to buy a trellis…).

Home Depot does have significantly more options when searching their site for trellises and (at least in the area where I grew up where there is still alot of new home construction for people fleeing the Bay Area…) they probably get much of their business from contractors buying in bulk (after running all the local “lumber yards” out of business some decades ago…).

But Home Depot obviously knows they are now competing with Temu for this specific product as its listed as a “special buy” - undercutting other Temu sellers who are offering it at higher prices. In other words, its not just dollar stores catering to low income or rural consumers who need to watch out for Chinese eCommerce sites eating into their margins and profits…

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

📰🔬 Emerging Market Stock Picks / Stock Research

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 America’s dollar stores are now living in a Temu world (FT) $ 🗃️

The Chinese online retailer has made inroads among low-income shoppers

With lucrative side businesses that range from cloud computing to digital advertising, Amazon’s earnings growth is not at risk. Instead, it is dollar store operators that have the most to worry about.

America’s discount stores are struggling. The sector’s two biggest players — Dollar General (NYSE: DG) and Dollar Tree (NASDAQ: DLTR) — have taken the axe to their full-year guidance. Shares have cratered, with the companies losing 43 and 52 per cent of their respective values this year. The assumption that dollar stores would do well in good times and bad has been shattered.

🇨🇳 PDD Holdings Inc.: How Are They Managing Competition and Consumer Demand? - Major Drivers (Smartkarma) $

PDD Holdings (NASDAQ: PDD) or Pinduoduo. has shared their financial results for the second quarter of 2024 along with an overview of strategic actions and challenges.

The company saw substantial revenue growth, with total revenue reaching RMB 97 billion, marking an 86% year-on-year increase.

This significant growth stems mainly from robust online marketing and transaction services.

🇨🇳 Alibaba to Allow Taobao Shoppers to Check Out Through WeChat Pay (Caixin) $

China’s two internet giants Alibaba (NYSE: BABA) and Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY) have taken another step toward breaking down long-standing barriers between their platforms.

Alibaba will finally allow shoppers on its Taobao platform to check out via Tencent’s WeChat Pay. In the past, Alibaba favored Alipay, the digital payment created by its affiliate Ant Group Co.

🇨🇳 Exclusive: JD.com’s Fintech Arm to Buy Troubled Consumer Lending Firm, Sources Say (Caixin) $

The fintech arm of internet giant JD.com (NASDAQ: JD) is set to buy Home Credit Consumer Finance Co. Ltd., China’s first wholly foreign-owned consumer finance company, sources with knowledge of the matter told Caixin.

The government of Tianjin — where the troubled consumer finance firm is based — is supporting the deal, which is pending approval from the National Financial Regulatory Administration, according to the sources.

🇨🇳 NIO Vs. Its Western Peers (Seeking Alpha) $ 🗃️

🇨🇳 In Depth: Can CATL Stay Ahead? (Caixin) $

Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750), the world’s largest electric-vehicle (EV) battery maker, is seeking new drivers of growth to help maintain a lead over its rivals and head off a challenge from automakers cutting into its lane.

Potential obstacles include a lack of product differentiation, price wars, and the threat of emerging technologies like solid-state batteries, which if eventually commercialized are expected to charge faster and last longer than those with conventional liquid electrolytes. Then there are the trade roadblocks, like stepped up European and U.S. import tariffs and even possible sanctions over forced labor and military concerns.

🇨🇳 Li Auto (LI US): 2Q24, Look at Monthly Deliveries, But Not Quarterly Revenue (Smartkarma) $

🇨🇳 Li Auto looks good as large SUV market leader (Bamboo Works)

🇨🇳 Yet more fantastical goings-on in Nasdaq-listed Chinese micro-caps (FT) $ 🗃️

Baiyu Holdings (NASDAQ: BYU) takes a well-timed tumble

We wrote earlier this week about some weird price moves among US-listed, China-based micro-caps, rounded off with a warning from a retail trader that Baiyu Holdings (BYU) — which for weeks has been flogged in seedy Whatsapp groups by persons unknown — might be the next Nasdaq stock to plunge from a recent peak.

🇨🇳 Cango jumps on China car export bandwagon with focus on used vehicles (Bamboo Works)

The car trader’s export-focused Autocango.com site, which launched in March, had more than 20,000 registered users in 207 countries and regions at the end of August

Cango (NYSE: CANG)’s used car exporting platform has listed more than 60,000 car models and signed up more than 20,000 registered users since its launch in March

The company is shifting gears from direct car trading to an asset-light model of providing related services to reduce its inventory risk as China’s car market slows

🇨🇳 NetEase Inc.: An Expanding Game Portfolio with Worldwide Reach! - Major Drivers (Zerohedge) $

NetEase (NASDAQ: NTES)'s 2024 second quarter earnings report revealed considerable strategic progress, although accompanied by some operational challenges typical for a growing enterprise.

The company reported a total revenue of RMB 25.5 billion, indicating a 6% year-over-year increase, driven largely by the success in its gaming division and expanded efforts in international markets.

Baptista Research looks to evaluate the different factors that could influence the company's price in the near future and attempts to carry out an independent valuation of the company using a Discounted Cash Flow (DCF) methodology.

🇨🇳 Baidu's Launch of Advanced AI Model Ernie 4.0 Turbo (Zerohedge) $

Baidu (NASDAQ: BIDU) has reported its financial results for the second quarter of fiscal year 2024, showcasing resilience with its Baidu Core which posted a modest revenue growth to RMB 26.7 billion.

This growth was driven by the accelerating performance in the AI Cloud sector, which somewhat counterbalanced the drag provided by the online marketing segment.

Notably, there was an 8% year-over-year increase in non-GAAP operating profit for Baidu Core, reflecting continued operational efficiencies.

🇨🇳 Lenovo Laptop Launches Cross The AI PC Chip Divide (Seeking Alpha) $ 🗃️

🇨🇳 Kanzhun works investors into selling frenzy with talk of ‘challenging times’ (Bamboo Works)

The leading digital recruitment company’s second-quarter revenue came in at the bottom end of its earlier guidance, as its founder asked investors for ‘confidence’

Shares of Kanzhun (NASDAQ: BZ) fell more than 20% in New York after it issued quarterly results that barely met earlier guidance despite strong profit and revenue growth

The company’s core business customers are less willing to pay for its recruitment services as job seekers flood the market

🇨🇳 Waterdrop stalls in second quarter, but reaffirms annual growth forecast (Bamboo Works)

The online insurance broker’s revenue fell slightly in the latest three-month period, as its core insurance business fell by 4%

Waterdrop (NYSE: WDH)’s revenue fell 0.4% in the second quarter, but its profit rose fourfold as it controlled costs in what it described as a market filled with “challenges”

The company’s recent Waterdrop Guardian AI initiative took a step forward with the signing of a new partnership with an unnamed insurance company

🇨🇳 Chinese Solar Firms Bleed Losses Amid Worsening Glut and Falling Prices (Caixin) $

China’s solar manufacturers have seen their bottom line severely hit by a deepening industry glut that has triggered a brutal price war.

Several companies published first-half results on Friday, showing worsening profitability as the industry grapples with plunging prices. LONGi Green Energy Technology Co Ltd (SHA: 601012), China’s largest solar wafer producer, reported a net loss of 5.2 billion yuan ($732 million) for the first six months, a sharp reversal from the 9.2 billion-yuan net profit recorded a year earlier.

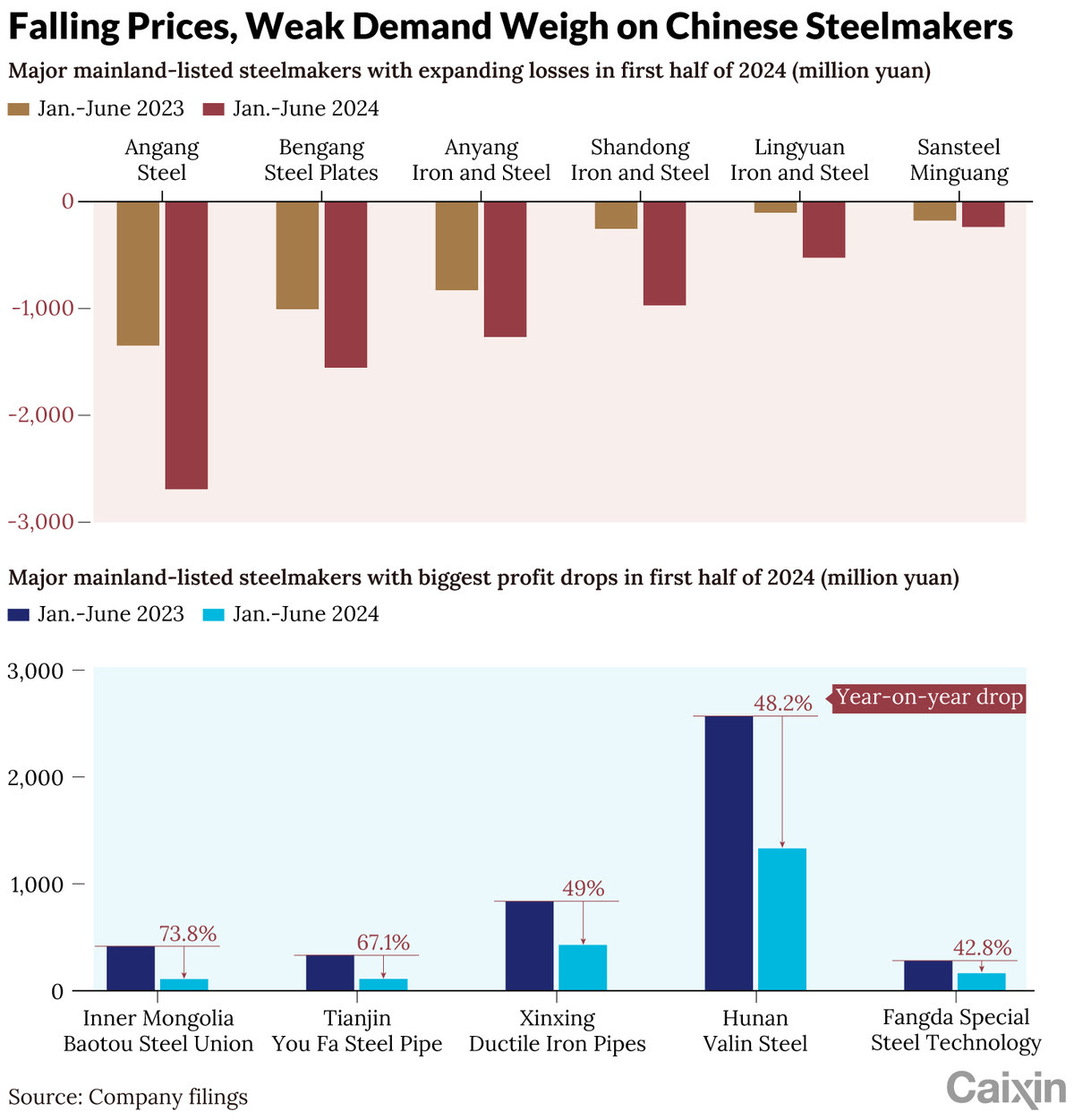

🇨🇳 Chart of the Day: China’s Increasingly Embattled Steelmakers (Caixin) $

Weakening steel demand and a subsequent drop in prices pushed China’s top mainland-listed steelmakers to report tumbling profits or expanding losses in the first half, although by widely divergent amounts.

Shanghai-listed Inner Mongolia BaoTou Steel Union Co Ltd (SHA: 600010) suffered the steepest decline, with its net profit attributable to shareholders plunging 73.8% to 108 million yuan ($15.2 million) in the six months through June, according to its earnings report.

🇨🇳 Two Chinese Shipbuilders to Merge, Creating Global Titan (Caixin) $

Two subsidiaries of China State Shipbuilding Corp. Ltd. (CSSC) are planning a merger that could reduce competition within the state-owned conglomerate and create the world’s largest listed shipbuilder.

China CSSC Holdings Ltd (SHA: 600150) is to absorb China Shipbuilding Industry Co Ltd (SHA: 601989) by issuing A-shares to the latter’s stockholders, the companies said in their stock exchange filings dated Tuesday.

🇨🇳 Chinese shipyards face quality control concerns over LNG vessels (FT) $ 🗃️

Growing demand forces shipowners to turn to China despite its limited experience building complex containers

🇨🇳 Air China: A Stock To Buy If You Do Not Fear China Exposure (Seeking Alpha) $ 🗃️

🇨🇳 Cirrus Aircraft buffeted by headwinds from US-China tensions (Bamboo Works)

The newly listed maker of private jets is cruising to higher profits, but its stock is languishing around 30% below the IPO price, unable to shake off concerns about U.S. policy risks

Cirrus Aircraft Ltd (HKG: 2507 / OTCMKTS: CRRSF) reported its half-year revenues rose nearly 12% and profits jumped almost 24% but the share price felt little benefit

The company is trading at a discount to U.S. counterparts as investors worry about repercussions from Chinese military links through its major shareholder

🇨🇳 Nayuki serves up cup of red ink in China’s overheated tea wars (Bamboo Works)

The bubble tea chain’s revenue slipped 1.9% in the first half of the year, as an 8% decline for its self-operated stores was mostly offset by gains for its newer franchising business

Nayuki Holdings (HKG: 2150 / OTCMKTS: NYKHF) slipped into the red in the first half of the year, as its margins plunged on sharply lower sales per store amid growing consumer caution

The company’s stock is valued far lower than its more aggressive peers that have far bigger store networks using a franchise business model

🇨🇳 Shandong Fengxiang falls afoul of sagging poultry prices (Bamboo Works)

Profits for China’s ‘white-feathered chicken king’ fell 26.8% in the first half of this year, even as the company’s revenue grew

Shandong Fengxiang (HKG: 9977)’s revenue grew 8.9% in the first half of the year, but its profit declined by 26.8%

The leading poultry company’s processed chicken products accounted for 53.4% of its revenue during the period

🇨🇳 Its 10-year plan dying on the vine, what went wrong at Pagoda? (Bamboo Works)

The fruit giant’s shares have crashed this year as it and its food and beverage peers get shunned by China’s increasingly frugal consumers

Shenzhen Pagoda Industrial Group (HKG: 2411 / FRA: D0V)’s profit for the first half of this year plunged by nearly 70%

The fruit seller’s number of franchised stores at the end of June also decreased by 70 from six months earlier

🇨🇳 Hotpot companies are losing steam as China consumers wilt (FT) $ 🗃️

Consumers in China are spending less on everything from clothes and travel to dining out

There is room for growth outside of China. Chinese food and beverage groups have been gaining traction in international markets, including North America and Europe. Reception has been especially strong in south-east Asia. Haidilao International Holding (HKG: 6862 / FRA: 8HI / OTCMKTS: HDALF)’s overseas operator, Super Hi International Holding (HKG: 9658 / OTCMKTS: SPHIF), has more than 110 stores globally.

🇨🇳 DPC Dash finds savory growth in China’s underserved markets (Bamboo Works)

The exclusive master franchisee for Domino’s Pizza in China’s revenue grew 48% in the first half of the year, as it continued to post market-defying positive same-store sales growth

DPC Dash (HKG: 1405 / FRA: X12 / OTCMKTS: DPCDF) reported strong double-digit revenue growth in the first half of 2024, as it opened 146 net new restaurants in China, bringing its total to 914

The exclusive master franchisee for Domino’s Pizza in China became profitable during the period on both a reported and adjusted basis for the first time

🇨🇳 Midea Group: Initial Thoughts on the Hong Kong IPO Listing (Douglas Research Insights) $

[Home appliances, and robotic and automation systems] Midea (SHE: 000333) is getting ready for a Hong Kong IPO listing, trying to raise at least US$3 billion.

Midea Group is trading a relatively attractive valuations. It is trading at P/E of 11.8x, EV/EBITDA of 8.1x, and P/B of 2.5x based on 2024 consensus earnings estimates.

In the past five days, Midea's price is down 2.3%. Some investors have been selling shares in Midea due to concerns about higher discount price offered at HK IPO listing.

🇨🇳 Pop Mart’s ‘blind box’ toys attract fans, detractors (Bamboo Works)

A week after announcing strong interim results, the company came under a veiled attack from state media for the addictive nature of its collectible toys

Pop Mart International Group (HKG: 9992 / FRA: 735)’s revenue rose 62% in the first half of the year and its profit nearly doubled, as its revenue from outside Mainland China more than tripled

The company’s products came under attack this week from the influential Xinhua news agency for the addictive nature of its collectible ‘blind box’ toys

🇨🇳 Yonghui Turns the Tide With Revamp Inspired by Retail Pioneer Pangdonglai (Caixin) $

Taking a leaf out of Pangdonglai’s book, Yonghui Superstores Co. Ltd. (SHA: 601933) has revamped a dozen of its stores, prioritized the quality of goods on offer and improved the pay and conditions of its staff. The result has been a significant increase in performance for the Fuzhou-based supermarket.

At its Xi’an Zhongmao store, daily sales rose from 200,000 yuan ($28,000) to 1.6 million yuan ($225,000) in the first two days after the revamp, while the daily customer flow surged from 3,000 to over 14,000, Yonghui said Monday.

🇨🇳 Top Chinese Securities Firms to Merge as State Calls for Consolidation (Caixin) $

A planned merger between two of China’s leading securities firms could create the country’s biggest brokerage, as the industry responds to the government’s repeated calls to create top-tier, internationally competitive investment banks.

Guotai Junan Securities Co Ltd (SHA: 601211 / HKG: 2611 / FRA: 153A / OTCMKTS: GUOSF) and Haitong Securities Co Ltd (SHA: 600837 / HKG: 6837 / OTCMKTS: HAITY / HTNGF) ended months of speculation Thursday by announcing a plan to join together. The merger is awaiting approval from regulators and the companies’ boards and shareholders.

🇨🇳 Zai Lab (9688 HK): Vyvgart Is Not the De-Risking Tool; Future Is Still Uncertain (Smart Karma) $

Zai Lab Limited (NASDAQ: ZLAB) recorded Vyvgart revenue of $10M, $13M, and $23M in 4Q23, 1Q24, and 2Q24, respectively. The company raised 2024 Vyvgart revenue guidance to $80M from $70M earlier.

Despite strong momentum from Vyvgart, Zai Lab still has a lot of pain points. Decelerating revenue growth from Zejula is one of them.

Due to its in-licensing business model, Zai Lab has lower gross profit margin of 64–65%, compared with ~80% for a typical innovator biotech company.

🇨🇳 Innovent Bio hopes for plus-sized profits from obesity drug (Bamboo Works)

The biopharmaceutical company reported a surge in half-year revenues but logged a bigger net loss, as investors look ahead to the launch of its new weight-loss drug

Sales approval for the company’s anti-obesity drug mazdutide may drag out beyond this year, potentially allowing rival products to gain a market advantage

The executive in charge of Innovent Biologics (HKG: 1801 / FRA: 6IB / OTCMKTS: IVBXF / IVBIY)’s R&D activities dropped a bombshell on the eve of the earnings release, announcing his retirement

🇭🇰 China Overseas Property (2669 HK) (Asian Century Stocks) $

SOE managing a growing portfolio of properties at 8.3x P/E

China’s property market is in the midst of a downturn. However, one segment of the market has not only survived but flourished — the niche of state-owned property management companies.

The topic of today’s discussion will be state-owned property manager China Overseas Property Holdings (HKG: 2669 / OTCMKTS: CNPPF)- US$2.0 billion), an affiliate of property developer China Overseas Land & Investment (HKG: 0688 / OTCMKTS: CAOVF)- US$17 billion).

COPL takes care of properties after they’ve been completed. It offers basic services such as security personnel, cleaning, repairs and maintenance, gardening, etc. It’s also moving into value-added services like helping owners rent out their flats.

🇭🇰 Wharf Real Estate Investment: Consider Weak Retail Sales And Attractive Yield (Rating Downgrade) (Seeking Alpha) $ 🗃️

Wharf Real Estate Investment Company Ltd (HKG: 1997 / FRA: 4WF / OTCMKTS: WRFRF)

🇭🇰 Techtronic Industries: Focus On Cash Flow And Geographical Expansion (Seeking Alpha) $ 🗃️

[Hong Kong-based power tools manufacturer] Techtronic (HKG: 0669 / FRA: TIB1 / OTCMKTS: TTNDY / OTCMKTS: TTNDF)

🇭🇰 Samsonite International: Watch Capital Return, Deleveraging Plans (Seeking Alpha) $ 🗃️

Samsonite International SA (HKG: 1910 / FRA: 1SO / OTCMKTS: SMSOF)

🇲🇴 SJM stable outlook backed by easing leverage: Moody’s (GGRAsia)

SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY)’s ongoing debt-reduction effort and the expected contribution from the ramping up of its business at the Grand Lisboa Palace casino resort (pictured) in Cotai, supports a ‘Ba3′ corporate family rating and ‘stable’ outlook for the Macau gaming concessionaire, said Moody’s Investors Service Inc.

But the ratings agency observed it did not expect SJM Holdings to declare significant dividends “at least over the next one to two years”, given its debt-reduction drive.

“Since 2023, as a result of the increase in earnings and operating cash flow, as well as the completion of its major capital spending projects, SJM is generating free cash flow again, which is being used to reduce its debt,” said Moody’s in a Wednesday update.

🇲🇴 Wynn Macau Ltd adjusts bond conversion price after dividend (GGRAsia)

Macau casino business Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) says the conversion price of its US$600 million 4.50-percent convertible bonds due in 2029, will be adjusted subsequent to the company announcing the payment of dividends.

In mid-August, Wynn Macau Ltd declared an interim dividendof HKD0.075 (US$0.01) per share, due to be paid on September 12.

The casino operator resumed this year a dividend payment, announcing in March a 2023 final dividend of HKD0.075 per share.

🇰🇷 Kangwon Land casino to get more gaming tables, machines (GGRAsia)

Kangwon Land (KRX: 035250), operator of Kangwon Land (pictured) – a resort with the only casino in South Korea open to locals – says it has been authorised to increase the area of its gaming venue, including adding more gaming tables and machines.

A Thursday note from JP Morgan Securities (Asia Pacific) Ltd said the planned changes to Kangwon Land’s foreigner-only gaming zone “would not move any needle as the entire foreigner-only business accounts for less than 1 percent of its [the firm’s] revenues,” according to the brokerage’s estimates.

“On the positive side, this will be its first major casino expansion since 2012 … and this suggests the policy backdrop remains pretty benign – if not favourable – to the local casino,” wrote analysts DS Kim, Mufan Shi and Selina Li. In 2012, Kangwon Land expanded its table count and mass gaming floor by 52 percent and 86 percent, respectively, according to the institution.

🇰🇷 Kangwon Land: Regulatory Improvements to Result in Higher Earnings and Valuation Multiples Expansion (Douglas Research Insights) $

Kangwon Land (KRX: 035250) has received approval to expand its total casino area from 14,512 square metres previously to 20,260 square metres (up 40%).

The betting limits in the foreign players only zone will increase significantly from 300,000 won (about US$225) to 300 million won (about US$225,000). This represents a 1000x increase.

We would argue that there is a high probability of Kangwon Land benefiting not just from higher sales and profits but also from higher valuation multiples.

🇰🇷 Samsung C&T: Corporate Value-Up + Reduced Overhang Post Final Lee Family Inheritance Tax in 2025 (Douglas Research Insights) $

We provide an updated NAV analysis of Samsung C&T Corp (KRX: 028260), discuss the reduced overhang post final Lee family inheritance tax payment, and also provide further details of its Corporate Value-Up announcement.

Given 2025 will be the last year of major inheritance tax payment for the Lee family, there is likely to be reduced overhang associated with inheritance tax issue next year.

Our NAV analysis of Samsung C&T suggests NAV of 39.9 trillion won or NAV per share of 224,249 won which is 45% higher from current levels.

🇰🇷 Potential Sale of SK Specialty and Deleveraging of the SK Group - Impact on SK Inc and NAV Analysis (Douglas Research Insights) $

In this insight, we discuss the potential sale of SK Specialty by SK Inc (KRX: 034730) which owns 100% stake in the company.

If SK Inc could sell SK Specialty at about 3 trillion won to 4 trillion won, this could reduce significantly reduce debt burden of SK Inc.

Our base case NAV value per share for SK Inc is 203,288 won per share, representing 38% upside from current levels.

🇰🇷 Hojeon: Activist Minority Investors Threaten to Sell Their Shares to a Competitor in a Block Deal (Douglas Research Insights) $

A group of minority investors started to go activist on [sportswear maker] Hojeon Ltd (KRX: 111110), demanding that the company increase its treasury share buybacks/cancellations, dividends, and cut CEO's salary.

This coalition of minority investors has threatened to sell their shares to a competitor (Hansae Co Ltd (KRX: 105630)) if the company does not abide by their demands.

Hojeon has attractive valuations and are trading at low multiples. It had P/E of 5x, EV/EBITDA of 3.4x, and P/B of 0.5x in 2023.

🇰🇷 Ecopro HN: Rights Offering of 200 Billion Won (Douglas Research Insights) $

On 4 September, [air pollution control materials and parts] Ecopro HN (KOSDAQ: 383310) announced that it plans to conduct a rights offering capital raise of about 200 billion won.

The company plans to issue 5.67 million new shares and the expected rights offering price is 35,300 won (23% lower than current price).

We would not subscribe to this rights offering mainly due to lofty valuations, declining sales and profit growth, continued negative free cash flow, and concerns about excessive shares dilution.

🇰🇷 Corporate Value Up in Korea - Focus On Reducing Outstanding Shares and Comparison to M7 (Douglas Research Insights) $

In this insight, we compare the outstanding shares changes in the Korean stock market (KOSPI and KOSDAQ) relative to M7 (Magnificent 7) companies.

In Korea, there are more companies such as Samsung C&T Corp (KRX: 028260), KB Financial Group (NYSE: KB), and KT&G Corp (KRX: 033780) that are actively reducing their outstanding shares and investors are rewarding them with higher share prices.

Top 10 companies in KOSPI that reduced their outstanding shares (from end of 2019 to 5 Sept 24) experienced average share price increase of 116% on average in this period.

🇰🇷 The Born Korea IPO Preview (Douglas Research Insights) $

[Global catering company] The Born Korea is getting ready to complete its IPO in Korea in November. The total IPO offering is expected to range from 69 billion won to 84 billion won.

Based on the bankers' valuation, the expected market cap of the company ranges from 357 billion won to 419 billion won.

The Born Korea was founded by Baek Jong-Won, the most famous celebrity chef in Korea.

🇰🇷 The Born Korea IPO Valuation Analysis (Douglas Research Insights) $

According to our valuation analysis, it suggests an implied price of 34,365 won, which is 27% higher than the high end of the IPO price range.

We estimate [Global catering company] The Born Korea to generate sales of 467.7 billion won (up 13.1% YoY) and operating profit of 31.4 billion won (up 22.8% YoY) in 2024.

We believe a premium to comps' valuation is appropriate for The Born Korea mainly due to its higher sales growth, higher ROE, stronger balance sheet, and higher profit margins.

🇰🇭 🇭🇰 CICC cuts NagaCorp EBITDA forecasts due to recovery pace (GGRAsia)

The impairment loss on NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF)’s suspended Vladivostok casino resort scheme in Russia and the company’s post-pandemic recovery pace so far in its Cambodia operation, has led a brokerage to cut 2024 and 2025 estimates for the group’s earnings before interest, taxation, depreciation and amortisation (EBITDA).

“We lower our 2024 and 2025 EBITDA forecasts by 37 percent and 5 percent to US$249 million and US$436 million,” said China International Capital Corp (CICC) Hong Kong Securities Ltd in a Monday memo.

Hong Kong-listed NagaCorp released its interim results on August 27. The following day, management outlined its strategy for capturing more mass-market gambling custom, as the travel and gaming sectors in Southeast Asia recalibrated operations in the post-pandemic recovery period.

🇵🇭 Bank of the Philippine Islands: Loan Mix And Valuations Are Key Investment Considerations (Seeking Alpha) $ 🗃️

Bank of the Philippine Islands (PSE: BPI / OTCMKTS: BPHLF / BPHLY)

🇸🇬 3 Singapore Blue-Chip Stocks Touching Their 52-Week Highs: Can Their Run Continue? (The Smart Investor)

These three blue-chip stocks are seeing their share prices scale a new high. Can they carry on their impressive run?

We profile three Singapore blue-chip firms that recently scaled their 52-week highs to determine if they can continue to climb.

Singtel (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) is Singapore’s largest telecommunication company (telco) and provides a comprehensive range of services including mobile, broadband, pay TV, data centre, and cybersecurity services.

Hongkong Land Holdings (SGX: H78 / LON: HKLJ / FRA: HLH / OTCMKTS: HKHGF / HNGKY), or HKL, is a property investment, management, and development group.

Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF), or FCT, is a retail REIT with a portfolio of nine suburban malls and one office building.

🇸🇬 3 Solid Singapore Stocks That Can Help You to Grow Your CPF Investment Account (The Smart Investor)

These three stocks have the potential to deliver solid returns for your CPF account.

We introduce three dependable Singapore stocks that can help you to effectively grow your CPF IA.

Sheng Siong Group (SGX: OV8 / OTCMKTS: SHSGF) is one of the largest supermarket chains in Singapore with 73 outlets across the island.

Grand Banks Yachts (SGX: G50), or GBY, is a manufacturer of luxury recreational motor yachts.

StarHub (SGX: CC3 / FRA: RYTB / OTCMKTS: SRHBY / SRHBF) is a telecommunication company (telco) that offers mobile, broadband, and pay TV services for consumers along with cybersecurity, artificial intelligence, and data analytics services for corporations.

🇸🇬 3 Singapore Stocks That Raised Their Dividends: Should They Be in Your Investment Portfolio? (The Smart Investor)

The recent earnings season saw this trio of stocks increasing their dividends. Could they be attractive enough to be included in your investment portfolio?

We shine the spotlight on three stocks that upped their dividends during the recent earnings season.

Tiong Woon Corporation Holding Ltd (SGX: BQM) is a leading integrated heavy lift specialist and service provider that supports the oil and gas, petrochemical, infrastructure, and construction sectors.

Civmec Ltd (SGX: P9D / ASX: CVL / FRA: 1CV)is an Australian company and is an integrated and multi-disciplinary construction and engineering services provider to the energy, resources, infrastructure, and marine & defence sectors.

StarHub (SGX: CC3 / FRA: RYTB / OTCMKTS: SRHBY / SRHBF) is one of the three major telecommunication companies (telcos) in Singapore and offers a comprehensive range of mobile, broadband, and pay-TV services.

🇸🇬 Sea Limited: Don't Blink Or You May Miss Something Great (Seeking Alpha) $ 🗃️

Sea Limited (NYSE: SE)

🇸🇬 Singapore Technologies Engineering: A Stock With Sustained Growth Potential (Seeking Alpha) $ 🗃️

Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF)

🇹🇭 Airports of Thailand: A Stock To Buy Backed By Strong Growth Potential (Seeking Alpha) $ 🗃️

🇮🇳 Ipca Laboratories (IPCA IN): Domestic Revenue Drives Q1FY25 Result; Full-Year Margin Guidance Raise (Smartkarma) $

Ipca Laboratories (NSE: IPCALAB / BOM: 524494) reported 12% YoY growth in domestic revenue to INR8.7B in Q1FY25. The company has delivered market beating growth in both acute and chronic segments.

Standalone EBITDA margin expanded 312bps YoY to 22.3% (FY25 guidance: 21%). Margin improvement is driven by favorable product mix, lower input costs as well as lower manufacturing and other costs.

Ipca is reducing FY25 revenue growth guidance to ~9.0% from 10.5–11.0% and raising FY25 consolidated EBITDA margin guidance by 0.5–1.0% to 18.5–19.0%.

🇮🇳 The Beat Ideas: How Ganesha Ecosphere Is Shaping the Future of Recycling? (Smartkarma) $

Ganesha Ecosphere (NSE: GANECOS / BOM: 514167) is expanding from textiles to FMCG packaging with rPET granules, aiming for a 10-12% market share in the recycled PET market by 2029.

The shift to high-margin rPET products and expansion into FMCG packaging aligns with regulatory trends and growing demand for sustainable materials.

GEL’s strategic focus on high-value, sustainable products and robust market position suggests significant growth potential and improved profitability.

🇮🇳 Wipro: Fade The IT Services Bounce (Seeking Alpha) $ 🗃️

🇮🇳 Sify Technologies: Sell Into Ill-Fated Momentum Rally (Seeking Alpha) $ 🗃️

Sify Technologies (NASDAQ: SIFY)

🇮🇳 Hyundai Motor India: Feeling the Heat as SUV Rivals Surge (Smartkarma) $

Hyundai Motor India reported an 8% decline in monthly dispatch volumes ahead of India's festive season, coinciding with a sharp increase in shipments by competitors in the SUV space.

Mahindra & Mahindra (NSE: M&M / BOM: 500520 / OTCMKTS: MAHMF), Toyota Kirloskar Motor (Toyota Motor Corp (NYSE: TM) JV), and Kia Corp (KRX: 000270 / OTCMKTS: KIMTF) each posted high double-digit volume growth in August.

Overall, India's domestic Passenger Vehicle sales growth for the April-August period has slowed year-on-year after two years of strong post-COVID momentum.

🇮🇳 Brainbees (FIRSTCRY IN): First Results Fail to Cheer. Lock-In Expiry May Test Stock Resilience (Smartkarma) $

[Multi-channel retailing platform for mothers', babies', and kids' products] Brainbees Solutions Ltd (NSE: FIRSTCRY / BOM: 544226) reported marginal decline in 1QFY2025 revenues and GMV (India operations) versus previous quarter, though both were up 17% YoY; fell short of market expectations.

Key operating metrics for India business too were soft with Average Order Value slipping both on a QoQ and YoY basis, impacting GMV growth and segment margins.

With 0% promoter holding, nearly 30%-50% shares could possibly start trading post lock-in expiry and this could test the stock's resilience. Softbank Group (9984 JP), the biggest stake holder, owns 19.99%.

🇹🇷 Turkish Airlines: Why The Stock Has Strong Upside Potential Despite Cost Pressures (Seeking Alpha) $ 🗃️

Türk Hava Yolları (IST: THYAO)

🌍 Africa Oil Corp., Buy The Dip (Seeking Alpha) $ 🗃️

Africa Oil (TSE: AOI / STO: AOI / FRA: AFZ / OTCMKTS: AOIFF)

🇿🇦 Gold glitters for Harmony as full year production and earnings soar (IOL)

Harmony Gold Mining Company Limited (NYSE: HMY) lifted headline earnings per share by 132% cents in the year to June, driven by higher gold prices and elevated production boosted by higher grades and cost containment, with CEO, Peter Steenkamp saying there was strong support for bullion prices to remain elevated.

Harmony raised underground recovery rates by 6% 6.11 grams per ton. For the year to June, gold production rose from 1.4 million ounces to 1.5m ounces on the back of a 17% rise in output from Mponeng and a 34% and 17% rise in production at Mine Waste Solutions and Hidden Valley, respectively, due to improved recovered grades.

🇿🇦 The Foshini Group sales fell in the 21 weeks to August but its margins improved (IOL)

The Foschini Group (JSE: TFG) said yesterday its group gross margin increased by more than 100 basis points for the 21 weeks ended August 24 when compared with the same period in 2023, despite 3.5% lower sales as margins improved across all territories.

Gross margin for TFG Africa increased by 200 basis points against a decline in sales of 1% (like-for-like decline of 2.6%), mainly due to high clearance activity during the prior period and the late start to winter in South Africa, a trading statement said.

🇿🇦 Woolworths’ annual dividend slides 15.2% due to weak sales growth in South Africa and Australia (IOL)

Woolworths Holdings (JSE: WHL)’ management said yesterday they were confident they could deliver against their strategies and the group was well placed to benefit from any cyclical consumer recovery.

The group yesterday reported a 15.2% decline in the dividend for the 53 weeks to June 30, to 265.5 cents per share, but the balance sheet remained robust, the group was highly cash generative, and its management said they were leveraging “our strengthened foundations to optimise our existing businesses and invest in new sources and avenues of growth”.

🇿🇦 Remgro: Maziv Deal Could Run Into Trouble (Seeking Alpha) $ 🗃️

[Diversified holding company] Remgro Ltd (JSE: REM / FRA: RE7 / OTCMKTS: RMGOF)

🇿🇦 Impala Platinum's Full-Year Results: Notable Headwinds But Inflection Points Have Emerged (Seeking Alpha) $ 🗃️

🇵🇱 Dino Polska: Step Up In Both Macro And Competitive Pressure (Seeking Alpha) $ 🗃️

Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY)

🌎 MercadoLibre Stock: Fade The Rally Before Jumping Back In (NASDAQ:MELI) (Seeking Alpha) $ 🗃️

MercadoLibre (NASDAQ: MELI)

🌎 Unpacking MercadoLibre's Logistics Advantage: Why It's A Smart Stock Buy (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Frothy Valuations Could Lead To A Harsh Reality Check (Rating Downgrade) (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: High Intrinsic Value Growth Makes It A Buy (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Beating Amazon In LATAM? Likely, But It's Not A Buy (Seeking Alpha) $ 🗃️

🌎 MercadoLibre Is Still One Of The Best Growth Plays Out There (Seeking Alpha) $ 🗃️

🇦🇷 Banco BBVA Argentina: Let Your Winners Run (Seeking Alpha) $ 🗃️

Banco Bbva Argentina (NYSE: BBAR)

🇧🇷 Sendas Distribuidora Q2: High Leverage Overshadows Profitability (Seeking Alpha) $ 🗃️

Sendas Distribuidora S.A. (NYSE: ASAI)

🇧🇷 BrasilAgro's Q4: Extended Weak Performance And Dividend Concerns (Seeking Alpha) $ 🗃️

Brasilagro - Co Brasileira De Proprieda (NYSE: LND / BVMF: AGRO3)

🇧🇷 XP Inc. Q2: Good, But Not Enough To Change The Recommendation (Seeking Alpha) $ 🗃️

🇧🇷 XP Q2 Earnings: On Track To Meet Its 2026 Financial Targets (Seeking Alpha) $ 🗃️

🇧🇷 🇰🇾 StoneCo Q2: Still Not Enough To Raise The Recommendation (Seeking Alpha) $ 🗃️

StoneCo Ltd (NASDAQ: STNE)

🇧🇷 Azul: FX Challenges And Debt Restructuring Concerns Make It A Stock To Avoid (Seeking Alpha) $ 🗃️

🇧🇷 Cemig: A Solid Pick For Dividends In Brazil (Seeking Alpha) $ 🗃️

🇧🇷 Banco do Brasil: Q2 Shows The Effect Of Lower Rates, Long-Term Buy (Seeking Alpha) $ 🗃️

Banco do Brasil (BVMF: BBAS3 / FRA: BZLA / OTCMKTS: BDORY)

🇧🇷 Why I Sold My BB Seguridade Stock (Rating Downgrade) (Seeking Alpha) $ 🗃️

[Insurance stock] BB Seguridade (BVMF: BBSE3 / OTCMKTS: BBSEY)

🇧🇷 Gerdau: Demand From The Automotive Industry And Undervalued (Seeking Alpha) $ 🗃️

🇧🇷 BRF Is Already Priced For Peak Margins, With Poultry Cycles Peaking (Seeking Alpha) $ 🗃️

BRF Brasil Foods SA (NYSE: BRFS / BVMF: BRFS3)

🇧🇷 JBS Poultry And Pork Business Benefit From Lower Grains, While Beef Is Still Challenged - Still A Buy (Seeking Alpha) $ 🗃️

🇧🇷 Ambev Q2: Many Positive Trends (Seeking Alpha) $ 🗃️

🇨🇱 Enel Chile: An Interesting Foreign Opportunity For Income Investors (Seeking Alpha) $ 🗃️

[Electricity utility] Enel Chile (NYSE: ENIC)

🇲🇽 Grupo Mexico: buying the best copper company in the world at a discount (Bos Invest Substack)

In part 8 of the Mexican series, I focus Grupo Mexico (BMV: GMEXICOB / FRA: 4GE / OTCMKTS: GMBXF). This company is the best way I know to get exposure to copper. You get Southern Copper (NYSE: SCCO) at a discount plus some quality assets for free.

As a bonus I will separately discuss GMexico Transportes (BMV: GMXT / OTCMKTS: GMXTF) in which Grupo Mexico owns a 70% stake.

As an addition to my article on Grupo Mexico my analysis of Gmexico Transportes. GMXT is the largest rail company in Mexico. In addition, it has some US operations.

📰🔬 Further Suggested Reading

$ = behind a paywall / 🗃️ = Archived article

🌏 Interview: Raghav Kapoor, Co-founder & CEO of Smartkarma (Asian Century Stocks)

A discussion about Raghav's background, investment philosophy, Philippine equities, Digiplus, the Indonesian Rupiah, Cardig Aero Services Tbk PT (IDX: CASS), To Lam, Chinese & Indian stocks and his favorite book.

Today, I have the great pleasure of talking to Raghav (“Raj”) Kapoor, CEO and co-founder of Smartkarma, an investment intelligence platform based in Singapore.

🇨🇳 Most Chinese Mainland-Listed Firms See First-Half Profits Drop (Caixin) $

Most Chinese mainland-listed companies saw their net profits decline year-on-year in the first half of this year, especially those in the real estate sector.

More than 5,300 companies traded on the mainland posted total revenue of around 34.9 trillion yuan ($4.9 trillion) for the period, down 1.4% year-on-year, according to data released Wednesday by the China Association for Public Companies. The data cover interim reports released by the end of last month.

🇨🇳 Recent Developments in China’s Tech Landscape: The Winners and Losers (Investing in China)

How Open Competition is Reshaping the Market, Empowering Consumers, and Putting Pressure on Weaker Players

China’s tech industry is undergoing significant changes, marked by moves towards self-regulation and the breakdown of long-standing digital barriers. These shifts are reshaping the competitive landscape and altering how major platforms interact with each other and their users. Who will profit from these changes, and who will lose out?

🇨🇳 🇮🇳 Weekend Long Read: Can India Become the World’s Next Manufacturing Powerhouse? (Caixin) $

I. Can India become a manufacturing powerhouse like China?

In the past couple of years, the economic fortunes and outlook for China and India have diverged. After the pandemic, China’s economic recovery has been weak while India’s has been strong. China is also facing many structural challenges: the country’s labor costs have risen sharply while its working age population and total population are declining; recently, foreign direct investment (FDI) has shrunk to low levels, national security concerns are hurting China’s trade and investment links; and local governments are facing fiscal difficulties in sustaining infrastructure investment. In contrast, India has a relatively young and rising labor force, the government has been improving infrastructure and the business environment, foreign investors are interested in coming to India, and it faces a far friendlier external environment than China.

🇲🇴 Macau Golden Week outlook good amid FX crackdown: CLSA (GGRAsia)

The Macau foreign exchange (FX) tout “crackdown” appears to have “stabilised”, with “investors’ concerns likely overdone” regarding the city’s casino sector, says a Tuesday report from brokerage CLSA Ltd.

The institution observed that Macau’s August gross gaming revenue (GGR) had grown month-on-month. That data point was subsequent to publicity about enhanced enforcement in Macau and on the Chinese mainland against unlicensed touts that linger near Macau casinos and offer to change Chinese yuan into Hong Kong dollars and vice versa.

🌏 Fed rate cuts to bolster Asean currencies (The Asset) $ 🗃️

Narrowing interest rate differential with US dollar favourable but risks remain

🇹🇭 Thailand advancing on casinos says deputy finance minister (GGRAsia)

Thailand’s government will move ahead with plans for so-called “entertainment complexes” says Julapun Amornvivat, deputy finance minister, in comments reported on Thursday.

It is the term used in that country to denote large leisure facilities due to include casino space. Mr Julapun added that policy makers would be willing to make adjustments to a draft bill to legalise and regulate casino business – published in early August – based on “useful” feedback from a public consultation process that concluded on August 18.

The draft bill also outlines the involvement of a high-powered body – to include Thailand’s sitting prime minister, a deputy prime minister and five ministers – that would serve on what is termed a “policy committee’ to steer Thailand’s casino policy effort.

🇻🇳 🇵🇱 The origins of prosperity (FT) $ 🗃️

Encouraging wealth creators helps to generate economic growth and affluence

In How Nations Escape Poverty, Rainer Zitelmann, a German historian and sociologist, reminds us of the power of capitalism. He outlines how Poland and Vietnam, two nations that were ravaged by war and poor governance in the 20th century, have now become case studies in developmental success.

🇧🇩 The Development Economist Leading Bangladesh’s Transitional Government (New Lines Magazine)

Muhammad Yunus, ‘banker to the poor’ and Nobel Peace Prize winner, takes the reins at a turning point in his country’s history

🇿🇦 SA has the critical minerals, but is that enough to become a global battery storage powerhouse? (IOL)

South Africa has large reserves of two critical minerals, manganese and vanadium, allowing the country to play a bigger role in the battery storage sector.

Manganese is a crucial component of lithium-ion batteries, which power EVs and renewable energy grids. In 2023, South Africa was the world’s top producer of this essential mineral, followed by Gabon and Australia, according to the US Geological Survey (USGS).

South Africa is also the third vanadium producer, behind Russia and China. The mineral is used in vanadium redox flow batteries (VRFBs), which are known for their efficiency in storing large amounts of energy, says Mikhail Nikomarov, the CEO of Bushveld Energy, a company that produces these batteries.

🇧🇷 Brazilians rally to protest supreme court judge’s decision to ban X (FT) $ 🗃️

Demonstrators say ruling by Alexandre de Moraes is unconstitutional assault on free speech

🇧🇷 Brazil - The Twitter ban and the investment environment (Latin America Risk Report)

If anything, Musk's actions showed four things foreign investors get wrong in Brazil. Watching Musk screw this up is a great opportunity for others to learn the mistakes to avoid when investing in Brazil.

Follow the law, especially if you're a big company.

Don't cross business streams.

Don't expose your business to political controversy.

Don't run a social media company.

🌐 The battle to secure economically critical metals (FT) $ 🗃️

To limit China’s leverage, the west needs concerted action on mining, refining and research

🌐 Uranium Part 2: Geography and Risks (TheOldEconomy Substack)

Thoughts on Africa, Kazatomprom (FRA: 0ZQ / OTCMKTS: NATKY), and grey swans

This is the second episode of Adventures in the Uranium Industry. In the previous one, I discussed the three mandatory ingredients for a plausible commodity thesis: stagnating supply, rising demand, and potential catalysts.

🌐 AI and the digital infrastructure revolution – Accelerating the world’s thirst for critical metals (Baker Steel)

A plethora of metals and minerals are needed for the new industrial revolution. Can the mining industry meet demand?

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

Jordan Jordanian House of Deputies Sep 10, 2024 (d) Confirmed Nov 10, 2020

Czech Republic Czech Senate Sep 20, 2024 (d) Confirmed Sep 23, 2022

Sri Lanka Sri Lankan Presidency Sep 21, 2024 (t) Confirmed Nov 16, 2019

Kazakhstan Referendum Oct 6, 2024 (d) Confirmed Jun 5, 2022

Georgia Georgian Parliament Oct 26, 2024 (d) Confirmed Oct 31, 2020

Uzbekistan Uzbekistani Legislative Chamber Oct 27, 2024 (d) Confirmed Dec 22, 2019

Uruguay Referendum Oct 27, 2024 (t) Confirmed Mar 7, 2022

Uruguay Uruguayan Presidency Oct 27, 2024 (d) Confirmed Nov 24, 2019

Uruguay Uruguayan Chamber of Representatives Oct 27, 2024 (d) Confirmed Oct 27, 2019

Uruguay Uruguayan Chamber of Senators Oct 27, 2024 (d) Confirmed Oct 27, 2019

Bulgaria Bulgarian National Assembly Oct 27, 2024 (d) Confirmed Jun 9, 2024

Romania Romanian Presidency Nov 24, 2024 (d) Date not confirmed Nov 24, 2019

Namibia Namibian Presidency Nov 27, 2024 (d) Confirmed Nov 27, 2019

Namibia Namibian National Assembly Nov 27, 2024 (d) Confirmed Nov 27, 2019

Kazakhstan Referendum Nov 30, 2024 (t) Date not confirmed Jun 5, 2022

Romania Romanian Senate Dec 1, 2024 (t) Date not confirmed Dec 6, 2020

Romania Romanian Chamber of Deputies Dec 1, 2024 (t) Date not confirmed Dec 6, 2020

Ghana Ghanaian Presidency Dec 7, 2024 (t) Confirmed Dec 7, 2020

Ghana Ghanaian Parliament Dec 7, 2024 (t) Confirmed Dec 7, 2020

Thailand Referendum Dec 31, 2024 (t) Date not confirmed Aug 7, 2016

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Cuprina Holdings (Cayman) LTD CUPR Network 1 Financial Securities, 3.8M Shares, $4.00-4.50, $15.9 mil, 9/9/2024 Week of

We manufacture and distribute chronic wound care products – medical grade bio-dressing products made from sterile blowfly larvae and sold under the MEDIFLY brand – mostly in Singapore since February 2020 and in Hong Kong since March 2023. (Incorporated in the Cayman Islands)

From the Prospectus: “Looking ahead, we have strategic plans in place for the second half of 2024 and 2025 to expand our sales and establish physical operations in several key regions, including Southeast Asia, the Middle East (in particular, the member states of the Gulf Cooperation Council, or GCC), and mainland China. These expansion initiatives will further enable us to cater to the growing demand for our products in these promising markets, cementing our position as a trusted player in the field of chronic wound care and treatment.”

We are a Singapore-based biomedical and biotechnology company dedicated to the development and commercialization of innovative products for the management of chronic wounds, as well as operating in the health and beauty sectors. Our expertise in biomedical research allows us to identify and utilize materials derived from natural sources to develop wound care products in the form of medical devices which meet international standards. We believe we will be able to build upon and leverage such expertise to develop innovative cosmeceutical products in the future.

As of Dec. 31, 2023, we manufactured and distributed a line of medical grade sterile blowfly larvae bio-dressing products marketed under the MEDIFLY brand name, or the MEDIFLY products. The MEDIFLY products are used as a biological debridement tool for chronic wounds, in a procedure known as Maggot Debridement Therapy, or MDT, which is an effective alternative to surgical debridement.

In addition to our commercialized MEDIFLY products, we have two lines of chronic wound care products in our pipeline:

*Collagen dressings, including sponges, particles and hydrogels, using bullfrog collagen derived from the valorization of abattoir waste streams of American bullfrogs (Lithobates catesbeianus) and

*Products using medical leeches for wound treatment.

We expect development of such products to take place over the course of 2024 and 2025 and to become commercially available subject to regulatory approval.

We believe what sets us apart is our focus on developing functionally specific chronic wound care products designed to address the major stages of the wound healing process from chronic to closure.

Our chronic wound care products, including both our existing commercialized products and forthcoming products in our pipeline, are poised to benefit from escalating global market demand. This demand is primarily fueled by the demographic shift towards an aging population and the concurrent rise in comorbidities such as diabetes, obesity, cardiovascular ailments and peripheral vascular diseases.

For our cosmeceuticals business, we introduced three products in 2023, including a hydrating balm product, a muscle energy cream and a pain relief muscle patch. For our commercialized cosmeceutical products, we have commissioned original equipment manufacturers of skincare products to develop the formulation and manufacture the substantially finished and finished products. In addition, we plan to explore the possibility of developing a range of potential cosmeceutical product candidates incorporating bullfrog collagen with a view to making them commercially available between 2024 and 2028, subject to the progress of the relevant R&D work.

We offer our chronic wound care products to both public and private hospitals and clinics, where patients can obtain them through prescription from a physician. Our customers primarily include major public and private hospitals and clinics in Singapore.

Our commercialized cosmeceutical products can be purchased directly by individual customers through a variety of channels, including retailers and gyms in Singapore, Malaysia and Australia, as well as online shopping platforms such as Shopee.

Note: Net loss and revenue figures are in U.S. dollars for the year that ended Dec. 31, 2023.

Note from the Prospectus: “Our independent registered public accounting firm expressed substantial doubt regarding our ability to continue as a going concern. Our ability to continue as a going concern requires that we obtain sufficient funding to finance our operations.”

(Note: Cuprina Holdings (Cayman) Ltd. filed an F-1/A on Sept. 3, 2024, disclosing that its IPO’s price range is $4.00 to $4.50 – a change from its IPO price of $4.00 – and keeping the IPO’s size at 3.75 million Class A ordinary shares – to raise $15.94 million. Background: Cuprina Holdings (Cayman) Ltd increased the number of shares to 3.75 million – up from 2.5 million shares initially – without disclosing the IPO price – in an F-1/A filing dated June 20, 2024.)

(More Background: Cuprina Holdings (Cayman) Ltd filed an F-1/A dated May 16, 2024, disclosing that it will offer 2.5 million Class A ordinary shares – without stating the IPO price. More Background: Cuprina Holdings (Cayman) Ltd. filed its F-1 on March 7, 2024, without disclosing terms; estimated IPO proceeds were $10 million. Previously: The Cayman Islands-incorporated holding company submitted its confidential filing to the SEC on Oct. 13, 2023.)

Trident Digital Tech Holdings TDTH Wallach Beth Capital, 1.8M Shares, $5.00-7.00, $10.8 mil, 9/9/2024 Week of

We are a leading digital transformation enabler in the small and medium enterprise, or the SME segment of the e-commerce enablement and digital optimizing services market in Singapore. We offer business and technology solutions which are designed to optimize our clients’ experiences with their customers by driving digital adoption and self-service. (Incorporated in the Cayman Islands)

We started our journey in 2014 as a full-service information technology company headquartered in Singapore. Since then, we recognized and captured the opportunities arising from the global fast-growing digital adoption trend in various industries and rapidly developed as a leading digital transformation enabler in the SME segment of e-commerce enablement and digital optimizing services market in Singapore. According to the Frost & Sullivan Report, among the Singapore-based companies who have been approved to participate in the SMEs Go Digital program led by Infocomm Media Development Authority, a statutory board under the Singapore Ministry of Communications and Information of the Republic of Singapore, we ranked fourth, contributing to 1.5% of the SME segment of the e-commerce enablement and digital optimizing services market in Singapore in 2022.

The SMEs Go Digital program is to provide SMEs in Singapore with a variety of digital solutions and services, such as e-commerce platforms, digital marketing tools, and data analytics software. The program also offers government grants to eligible SMEs to subsidize the costs, driving digital adoptions.

Our clients and prospective clients are faced with transformative business opportunities due to advances in software and computing technology. These organizations are dealing with the challenge of having to reinvent their core products, services, processes and systems rapidly and position themselves as “digitally enabled.” The journey to the digital future requires not just an understanding of new technologies and new ways of working, but a deep appreciation of existing technology landscapes, business processes and practices. We have been a navigator for our clients as they ideate, plan and execute on their journey to a digital future through our solutions and services, comprising:

• Business consulting: We support clients to define and deliver technology-enabled transformations of their business. Equipped with the complete value chain approach, our suite of offerings ranges from brand proposition, multi-channel commerce and digital marketing to improve customer experience and increase customer acquisition, to insights and real-time predictive analysis for efficient decision-making and optimizing processes.

• IT customization: We offer solutions and services to plan, design, operate, optimize and transform business processes. We support clients to get the best value from technology by developing an IT strategy, optimizing applications and infrastructure, implementing IT operating models, and governing their technical architecture for reliability and security.

We provide customized solutions and services that address the specific needs of clients in our strategic vertical markets. Our primary vertical industries include e-commerce, food and beverage, fintech, healthcare and service, wholesale and retail that are fast-growing and have increasing level of digitalization potentials. Our configurable technology integrates seamlessly into our clients’ systems, empowering our clients to manage, improve their businesses and to win. As of June 30, 2023, we served over 200 clients across our core verticals such as food and beverage, wholesale and retail.

Digital technology continues to impact our world through its transformative capability and pervasive impact. Our management believes we have a successful track record of applying our proprietary technologies to respond to changing business needs and evolving client demands. Leveraging such experiences, we plan to launch a Web 3.0 e-commerce platform whereby customers and merchants can transact in a transparent and secure way, or Tridentity, in the fourth quarter of 2023.

**Note: Net loss and revenue figures are for the 12 months that ended Dec. 31, 2023: Net loss of $4.77 million on revenue of $1.48 million, compared with a net loss of $2.83 million on revenue of $1.27 million for the 12 months that ended June 30, 2023.

(Note: Trident Digital Tech Holdings changed its underwriting team to joint book-runners WallachBeth Capital and Revere Securities – a move from Eddid Securities USA – according to its F-1/A filing dated July 9, 2024. Background: In an F-1/A filing on Jan. 19, 2024, Trident Digital Tech Holdings named Eddid Securities USA as its sole book-runner to replace US Tiger Securities, the original sole book-runner.)

(Note: Trident Digital Tech Holdings adjusted the terms of its IPO in an F-1/A dated Feb. 20, 2024: Each American Depositary Share now represents eight Class B ordinary shares – a change from the original terms in which each ADS represented 10 ordinary shares. The IPO’s terms: 1.8 million ADS at a price range of $5.00 to $7.00 to raise $10.8 million.)

(Background: Trident Digital Tech Holdings cut its IPO’s size by reducing the number of shares to 1.8 million American Depositary Shares (ADS) – down from 1.875 million ADS – and slashing the price range to $5.00 to $7.00 – down from $8.00 to $10.00 – to raise $10.8 million in an F-1/A filing dated Feb. 7, 2024. Background: Trident Digital Tech Holdings filed an F-1/A dated Jan. 19, 2024, in which it named Eddid Securities USA as its sole book-runner to replace US Tiger Securities. Background: Trident Digital Tech Holdings filed an F-1/A on Oct. 19, 2023, in which it disclosed the terms for its IPO: 1.875 million American Depositary Shares (ADS) at a price range of $8.00 to $10.00 to raise $16.88 million. Each ADS represents 10 ordinary shares, the prospectus says. Background: Trident Digital Tech Holdings filed its F-1 on Oct. 4, 2023.)

Galaxy Payroll Group Ltd. GLXG R.F. Lafferty & Co., 2.0M Shares, $4.00-4.00, $8.0 mil, 9/12/2024 Thursday

Galaxy Payroll Group Ltd., a holding company incorporated in the British Virgin Islands, is offering the shares in this IPO. Our principal executive offices are in Hong Kong. (Incorporated in the British Virgin Islands)

As a holding company with no operations, we are not a Chinese operating company. Our operations are conducted by our Operating Entities, which are our indirect wholly owned subsidiaries, Galaxy Payroll Services Limited (“Galaxy Payroll (HK)”), Galaxy GEO Services Limited (“Galaxy GEO Services”), Galaxy Corporate Management Consultancy (Shenzhen) Limited (“Galaxy HR (SZ)”), Galaxy Human Resources Limited (“Galaxy HR (TW)”), and Galaxy Recursos Humanos (Macau) Limitada (“Galaxy HR (Macau)”).

In addition to outsourced payroll services, our subsidiaries also offer employment services, market research services and consulting services to companies in the retail, trading, industrial, financial, professional services, IT and healthcare industries.

*Note: Net income and revenue are in U.S. dollars – converted from the Hong Kong dollar – for the year that ended Dec. 31, 2023.

(Note: Galaxy Payroll Group Ltd. disclosed in an F-1/A filing dated April 10, 2024, that its sole book-runner is R.F. Lafferty & Co. – a change from Prime Number Capital.)

(Note: Galaxy Payroll Group Ltd. cut its IPO’s size to 2.0 million shares – down from 2.5 million shares – and cut the assumed IPO price to $4.00 – down from $5.00 – to raise $8.0 million, according to an F-1/A filing dated Oct. 17, 2023.

(Background: Galaxy Payroll Group Ltd. cut its IPO’s size in an F-1/A dated Aug. 1, 2023, to 2.5 million ordinary shares – down from 4.0 million shares – and set the assumed IPO price at $5.00 – to raise $12.5 million. The company had not previously set an assumed IPO price or a price range. Background: Galaxy Payroll Group Ltd. filed its F-1 dated Dec. 28, 2022, for its IPO: 4.0 million ordinary shares to be offered by the company and the IPO price range was not disclosed. The selling stockholder will sell 960,000 shares. The company will NOT receive any proceeds from the sale of the selling stockholder’s shares.)

(Note – From the prospectus: “On December 19, 2022, the Company filed Amended and Restated Charter with the Registrar to increase our authorized shares from 50,000 Ordinary Shares, par value of US$1 per share, to unlimited number of Ordinary Shares, par value of US$0.000625 per share and effectuated a forward split of all issued and outstanding shares at a ratio of 1,600:1.”)

SAG Holdings Ltd SAG Wilson-Davis & Co., 0.9M Shares, $8.00-8.00, $7.0 mil, 9/23/2024 Week of

We are a holding company incorporated in the Cayman Islands. The ordinary shares offered in the IPO are being offered by the holding company.

We are a Singapore-based provider of high-quality OEM, third-party branded and in-house branded replacement parts for motor vehicles and for non-vehicle combustion engines serving a number of industries. We distribute spare parts through operations primarily based in Singapore and global sales primarily generated from the Middle East and Asia. Through our On-Highway Business, we supply a wide range of genuine OEM and aftermarket parts for use in passenger and commercial vehicles bearing either the manufacturer’s brands or our in-house brands through SP Zone. Through our Off-Highway Business, we supply a wide range of components and spare parts for internal combustion engines with strong focus on filtration products through Filtec. Our Off-Highway Business serves industrial sectors that include marine, energy, mining, construction, agriculture, and oil and gas industries. Our products are sourced from genuine OEM and global premium aftermarket brands to suit the diverse needs of our customers. Over the past several years, our revenues have been relatively evenly split between our On-Highway Business and our Off-Highway Business, and approximately 10% of our revenues are derived from sale of our in-house products.

Our Group’s business can be traced back to the early 1970s, when our late founder, KE Neo, set up Chop Kim Aik, a retail shop specializing in the supply of British-made truck spare parts. KE Neo leveraged his experience as the owner of a transportation business with a fleet of trucks serving the construction industry to building a small retail shop to a large-scale operation with a solid customer base and a recognizable brand.

In 1983, we diversified into the supply of Japanese made automotive spare parts to capitalize on the increase in demand for Japanese vehicles in Singapore. Riding on this global growth of Japanese automotive exports, CE Neo, with the support of his father KE Neo, set up its first automotive spare parts retail outlet in Singapore, naming it Soon Aik Auto Parts Trading Co (which became a private limited company, Soon Aik Auto Parts Trading Co. Pte Ltd in 1995, and is now known and hereinafter referred to as “SP Zone”) specializing in trading Japanese made automotive spare parts, primarily used in passenger and commercial vehicles.

In the late 1980s, SP Zone achieved a major milestone when it was appointed as an authorized dealer of UD Trucks Corporation (“Nissan UD”) automotive genuine spare parts in Singapore, expanding our business of selling authorized genuine spare parts, beyond our historical aftermarket spare parts business model. The business gradually expanded, and the outlet grew to supply automotive spare parts for trucks operating in Singapore sold by respected Japanese brands from the manufacturers such as Nissan UD, Mitsubishi Fuso Truck and Bus Corporation, Hino Motors Ltd and Isuzu Motors Ltd.

In 1993, Jimmy Neo and CK Neo, brothers to CE Neo and sons of KE Neo, joined SP Zone, to assist with the expanding business. In 1995, Jimmy Neo was instrumental in securing the dealership with Cummins Asia Pacific Pte. Ltd (“Cummins”) for Fleetguard filters, a product used in Cummins engines, pursuant to which SP Zone started distributing filters to the marine, energy, mining, agriculture, oil and gas, and construction industries (referred to as the “Off-Highway Business”) in addition to the automotive industry (referred to as the “On-Highway Business”).

In 1995, SP Zone became a private limited company and expanded its sales channels to include exports to ASEAN markets, capitalizing on unmet demand as there were few suppliers supplying automotive spare parts to those markets at that time. Another major milestone in 1995 occurred when Edward Neo, the third brother and son of KE Neo, joined our Group to manage the local wholesale and retail business, allowing CE Neo to focus on our Group’s newly expanded export business. At this point, the business had grown from a small retail operation to regional family business run by a father and his four sons with multiple areas of focus and utilizing the family member’s different areas of expertise.

In 1999, SP Zone secured another line of filtration products when it was appointed as a distributor for Parker Racor, a line of Parker Hannifin filtration products. Subsequently, we established Filtec as a separate Singapore subsidiary to carry out sales of Off-Highway Business dedicated to handling sales to our Off-Highway customers in the industrial sectors.

In the early 2000s, Edward Neo spearheaded an effort to develop in-house branded brake parts and lubricant products, namely, VETTO and REV-1 in SP Zone, to enhance our competitiveness in the automotive industry. Over the years, the product range of our in-house brands has greatly expanded to include the NUTEQ steering and suspension parts, GENTEQ pumps and cooling system components, ELITO cables and hoses, SUNBLADE wiper blades, FILTEQ filters, and ENERGEO batteries.

In 2010, we consolidated and shifted our business operations to larger headquarters and warehouse that facilitated greater efficiency in our operations and also allowed us to increase our product inventory offerings. Through our On-Highway Business, we entered the Malaysian market by first taking a 70% equity stake, and by 2017 a 100% stake, in Autozone (M), an established company that sells wholesale automotive spare parts as well as the sale of our in-house brands in Malaysia.

Since 2010, we have been selling to wholesale distributors based in Dubai as part of our strategy to expand our business. Like Singapore in Asia, Dubai is an important key trading hub in the Middle East serving customers not only in the Middle East, but also Central Asia, Africa and Europe. This business now represents an estimated 10.7% of our sales.

More recently, in 2019, our Off-Highway Business expanded to include the life science environmental industry, securing distribution and working in close collaboration with MANN+HUMMEL, a European-based multi-national company that provides a number of automotive and industrial commercial products, including filtration and related products with life science applications, for the distribution and promotion of their products in Singapore.

In 2022, we underwent a reorganization. On February 14, 2022, Celestial obtained a 4.9% shareholding interest in SAGI from Soon Aik. On September 29, 2022, Soon Aik transferred the entire issued share capital of our group of companies, consisting of Filtec, SP Zone, Autozone (S) and Autozone (M), to SAGI. Subsequently on September 29, 2022, Soon Aik and Celestial transferred their respective shares in SAGI to the Company in exchange for equivalent proportional percentages of Ordinary Shares of the Company. Upon completion of the group reorganization, Soon Aik owns 8,915,625 shares and Celestial owns 459,375 shares, and SAGI, Filtec, SP Zone, Autozone (S) and Autozone (M) are indirect subsidiaries.

**Note: Net income and revenue are in U.S. dollars (converted from Singapore dollars) for the 12 months that ended Dec. 31, 2023.

(Note: SAG Holdings Ltd. cut its IPO to 875,000 shares – down from 2.13 million shares – and doubled the assumed IPO price to $8.00 – up from $4.00 previously – to raise $7.0 million, according to an F-1/A filing dated March 1, 2024. This is a NASDAQ listing.)

(Note: Wilson-Davis & Co. is the sole book-runner, succeeding Spartan Capital Securities, according to an F-1/A filing dated Aug. 7, 2024.)

(Note: SAG Holdings Ltd. cut its IPO on June 14, 2023, in an F-1/A filing: 2.125 million shares – down from 3.75 million shares – and kept the assumed IPO price at $4.00 to raise $8.5 million. That’s a cut of 32 percent from the $12.5 million in estimated IPO proceeds under the previous terms. The selling shareholders’ portion was cut to 50,000 shares – down from 625,000 shares – according to the S-1/A filing dated June 14, 2023. The company will not receive any proceeds from the sale of the selling stockholders’ shares.)

(Background: SAG Holdings Ltd filed an F-1/A dated April 14, 2023, in which it trimmed the size of its IPO by 16.67 percent to 3.125 million shares (3,125,000 shares) – down from 3.75 million shares – that the company will offer in the IPO – at an assumed IPO price of $4.00 – to raise $12.5 million. Background: The selling shareholders are offering an aggregate of 625,000 shares, according to the March 28, 2023, F-1/A filing. The company will not receive any proceeds from the sale of the selling shareholders’ shares. SAG Holdings also updated its financial statements in the F-1/A dated March 28, 2023. SAG Holdings Ltd filed its F-1 on Oct. 7, 2022: 3.75 million ordinary shares – no price range disclosed; of those 3.75 million shares, the F-1 says that the company is offering 3.125 million shares and the selling shareholders are offering 625,000 shares. )

Ten-League International Holdings Ltd. TLIH Bancroft Capital LLC, 2.8M Shares, $4.00-5.00, $12.6 mil, 9/23/2024 Week of

We are a Singapore-based provider of turnkey project solutions. Our business primarily consists of sales of heavy equipment and parts, heavy equipment rental and provision of engineering consultancy services to port, construction, civil engineering and underground foundation industries. (Incorporated in the Cayman Islands)

Our mission is to provide high-quality equipment, value-added engineering solutions as well as maintenance and repair services through continuous adaptation and application of new technologies.

We currently conduct our operations through our wholly-owned subsidiaries, Ten-League Engineering & Technology Pte. Ltd., or Ten-League (E&T), and Ten-League Port Engineering Solutions Pte. Ltd., or Ten-League (PES), which were previously held by Ten-League Corp prior to our group reorganization for the listing of our ordinary shares. Together with the operating history of Ten-League Corp, we have a total of over 24 years of history operating our business. Our core business activities consist of the following segments:

(a) equipment sales, which involves sale of various new and used heavy equipment and parts, or Equipment Sales Business;

(b) equipment rental, which involves the rental of various new and used heavy equipment, or Equipment Rental Business; and

(c) engineering consultancy services, which primarily includes the provision of value-added engineering solutions, including equipment retrofitting, upgrading, modernization, fleet management and other enhancement on equipment through the replacement or application of, among others, mechanical parts, sensor fusion, software and remote control system. Our engineering consultancy services complements our Equipment Sales Business and Equipment Rental Business. We do not provide such service to third-party equipment sales/rental companies.

The equipment we provide is categorized into (i) foundation equipment; (ii) hoist equipment; (iii) excavation equipment; and (iv) port machinery.

We have been supplying fully electric reach stacker and empty container handler to port operators in Singapore since 2021 and have been contracted to supply electric prime movers with swappable battery pack and build charging infrastructure since October 2022 by a leading port operator based in Singapore, or the Leading Port Operator. Meanwhile, we are actively exploring the market for fully electric wheel loader, excavator and forklift, and offering them as a part of our fleet of electrified equipment.

**Note: Net income and revenue are for the 12 months that ended Dec. 31, 2023, in U.S. dollars converted from Singapore dollars.

(Note: Ten-League International Holdings filed an F-1/A dated July 15, 2024, naming Bancroft Capital as the sole book-runner, replacing Eddid Securities USA. Background: Ten-League International Holdings updated its financial statements to include the year ended Dec. 31, 2023, in an F-1/A filing dated June 4, 2024.)

(Note: Ten-League International Holdings Ltd. filed an F-1/A dated Feb. 23, 2024, and disclosed terms for its IPO: 2.8 million shares at a price range of $4.00 to $5.00 to raise $12.6 million. The company is offering 2.01 million shares (2,009,800 shares) and selling shareholders are offering 790,200 shares, according to the prospectus. Ten-League International will not receive any proceeds from the sale of the selling shareholders’ stock. Background: The company filed its F-1 on Nov. 1, 2023. Ten-League International Holdings submitted confidential IPO documents to the SEC on July 7, 2023.)

Wellchange Holdings WCT Pacific Century Securities/ Revere Securities, 2.0M Shares, $4.00-5.00, $9.0 mil, 9/23/2024 Week of

Our operating subsidiary in Hong Kong provides cloud-based SaaS platforms and software for small to medium enterprises (SMEs). (SaaS stands for Software as a Service.) (Incorporated in the Cayman Islands)

We are an enterprise software solution services provider headquartered in Hong Kong. We conduct operations through our Operating Subsidiary in Hong Kong, Wching HK. We provide customized software solutions, cloud-based software-as-a-service (“SaaS”) platforms, and “white-label” software design and development services. Our mission is to empower our customers and users, in particular, small and medium-sized businesses (“SMBs,” as defined below), to accelerate their digital transformation, optimize productivity, improve customer experiences, and enable resource-efficient growth with our low-cost, user-friendly, reliable and integrated all-in-one Enterprise Resource Planning (“ERP”) software solutions. In Hong Kong, SMBs refer to manufacturing companies with less than 100 employees and non-manufacturing companies with less than 50 employees1.

We believe that SMBs are, and will continue to be, a vital component of the economy. However, we have observed that most SMBs rely on antiquated, laborious, inefficient processes or software systems to manage and execute most of their back-office and front-office operational functions. To compete effectively, we believe SMBs require modern integrated software solutions that can automate and streamline operational functions to reduce costs and allow them to focus on higher value-added activities. Furthermore, the COVID-19 pandemic also accelerated technology adoption by SMBs as they were required to respond to new challenges, such as facilitating remote work and finding new methods to engage with customers. At the same time, SMBs also have distinctive technology needs when adopting and transforming to software technologies — we believe SMBs prefer low-cost solutions that are easy to implement, onboard, and integrate and require little ongoing maintenance.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended June 30, 2023.