Mexico Closed End Fund Stock Picks (Early 2023)

Mexico stock picks or potential nearshoring stocks that are the holdings of Mexico closed-end funds Herzfeld Caribbean Basin Fund, Mexico Equity and Income Fund, and The Mexico Fund.

If you are looking for investing ideas to cash in on nearshoring or China plus one trends involving Mexico, this post takes a closer look at all of the holdings for the following three Mexico focused closed-end funds:

Herzfeld Caribbean Basin Fund, Inc (NASDAQ: CUBA) - Inception: 1993/09/10

Forward P/E: 2.01 / Forward Annual Dividend Yield: 18.09% (Yahoo! Finance)

Mexico Equity and Income Fund (NYSE: MXE) - Inception: 1990/08/21

Trailing P/E: 3.85 (no forward P/E) / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

The Mexico Fund (NYSE: MXF) - Inception: 1981/06/03

Trailing P/E: 4.02 (no forward P/E) / Forward Annual Dividend Yield: 4.52% (Yahoo! Finance)

Here is a look at the more recent performance of all three closed-end funds covering the COVID period (the charts are linked back to Yahoo! Finance):

And the long term performance of all three:

As you can see from the chart covering the pre-to-post COVID period, there seems to be a performance divergence for MXE and MXF. This is probably explained by stock selection along with investment philosophy or strategy differences.

On the other hand, CUBA is not just invested in Mexican stocks, but also US stocks (those that tend to be based in Florida or operate in the Caribbean e.g. the cruise ship lines, resort operators, etc.) or those based in other Caribbean basin countries.

We also have a list of Mexico ADRs on our website plus here is a screenshot of the list of Mexico ETFs from our website:

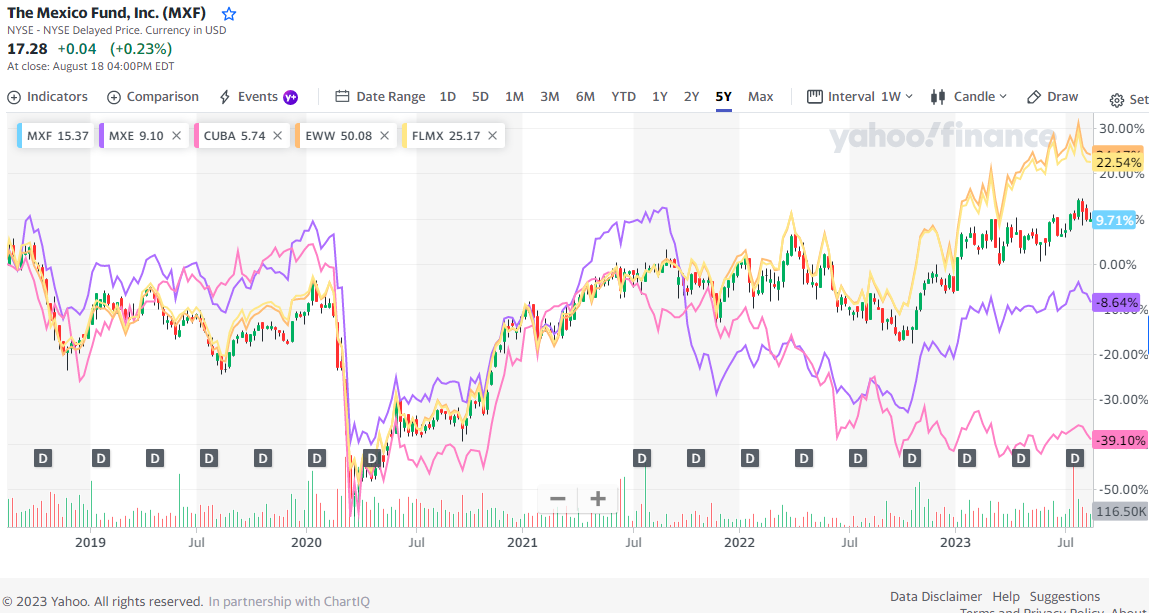

And here are the charts when we add the two non-leveraged Mexico ETFs:

In defense of actively managed closed-end funds (which seem to have lost favor in US markets): I personally think their structure can be better investment vehicles for volatile emerging markets given they don’t have the redemption issues that come with mutual funds or ETFs e.g. the need to sell holdings in order to cover redemptions, etc.

Also and as you can see from our Mexico ETF list, ETFs have a habit of getting culled - especially if they don’t attract enough investor interest.

As for investing in Mexico as a nearshoring play, our August 1st post noted a podcast interview with a fund manager who talked about evidencing nearshoring (something everyone talks about, but still needs to be proven). He recently went to the Northern Mexico city of Monterrey and saw phenomenal growth e.g. the industrial warehouse sector there was 100% leased. This sort of growth from nearshoring will also indirectly benefit many other sectors along with the stocks held by CUBA, MXE and MXF.

In addition and while so many emerging market currencies and investors in their stock markets have been hurt by the strong dollar in recent years, the Mexican peso has been strengthening for several years now:

As Mexico continues to attract capital for nearshoring activities (along with remittances from Mexicans working in the USA or Americans living in Mexico), I would think the Peso should continue to strengthen - or at least hold firm with more limited downside currency risks compared to other emerging market currencies. On the other hand, increased capital inflows from nearshoring could also become inflationary.

With that in mind, here are some more key Mexican economic charts to consider:

More such economic charts are available when searching for Mexico on Trading Economics…

As for potential Mexico stock picks (that are also the holdings of CUBA, MXE and MXF) and to make your life easier, this post includes:

Which fund or funds own the stock as a holding.

A quick description of the stock holding with links to the IR page and stock quote(s) on Yahoo! Finance or Finviz (for US Listings).

A link to any Wikipedia page (for what it might be worth…)

Forward or trailing P/E and dividend yields linked back to the Yahoo! Finance statistics page.

The latest long term technical chart linked back to Yahoo! Finance.

And as always, this post is provided for informational purposes only (and to make your life easier by providing you with relevant information, links, and charts). It does not constitute investment advice and/or a recommendation…

Note: Although the full holdings lists on the fund websites or in their SEC filings are a bit dated, their holdings have probably not changed significantly when it comes to what has been completely sold off or new positions that have been opened in completely new stocks:

Herzfeld Caribbean Basin Fund, Inc - Holdings as of March 31, 2023

Mexico Equity and Income Fund - Holdings as of March 31, 2023

The Mexico Fund - Holdings as of April 30, 2023

Mexico

Alfa SAB de CV

[The Mexico Fund]

Alfa SAB de CV (BMV: ALFAA) is involved in petrochemical and synthetic fiber, refrigerated food, and telecommunications businesses in Mexico. The Company manages the following businesses:

Sigma - Leading multinational food company, that produces, commercializes, and distributes cooked & fresh meats, dry meats, cheese, yogurt, other refrigerated, frozen and plant-based foods.

Alpek - Leading producer of PTA, PET, rPET & EPS in the Americas and polypropylene in Mexico. Operates companies in two business segments: Polyester and Plastics & Chemicals, in the Americas, Europe and the Middle East.

Forward P/E: 8.88 / Forward Annual Dividend Yield: 11.87% (Yahoo! Finance)

Alpek SAB de CV

[Mexico Equity and Income Fund, Inc / The Mexico Fund]

Alpek SAB de CV (BMV: ALPEKA / FRA: 27A / OTCMKTS: ALPKF) is a leading producer of PTA, PET, rPET & EPS in the Americas and polypropylene in Mexico. Alpek operates companies in two business segments: Polyester and Plastics & Chemicals, in the Americas, Europe and the Middle East.

Forward P/E: 17.95 / Forward Annual Dividend Yield: 28.50% (Yahoo! Finance)

Alsea SAB de CV

[The Mexico Fund]

Alsea SAB de CV (BMV: ALSEA / FRA: 4FU / OTCMKTS: ALSSF) is the leading restaurant operator in Latin America and Spain of global brands in the quick service, coffee shop (Starbucks), casual and family dining segments.

The Company has a diversified portfolio, with brands such as Domino’s Pizza, Starbucks, Burger King, Chili’s, P. F. Chang’s, Italianni's, The Cheesecake Factory, Vips, Vips Smart, El Portón, Archies, Foster’s Hollywood, Gino’s, TGI Fridays, Foster’s Hollywood Street, Ole Mole and Corazón. The company operates more than 4,000 units in Mexico, Spain, Argentina, Colombia, Chile, France, Portugal, Netherlands, Belgium, Luxembourg and Uruguay (See: Alsea (BMV: ALSEA / FRA: 4FU / OTCMKTS: ALSSF): Seeing Robust Starbucks and QSR Growth)

Forward P/E: 21.41 / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

America Movil SAB de CV

[Herzfeld Caribbean Basin Fund, Inc / Mexico Equity and Income Fund, Inc / The Mexico Fund]

America Movil SAB de CV (NYSE: AMX) is the 7th largest mobile network operator in terms of equity subscribers and a leading Latin America telecommunication service provider.

Forward P/E: 13.89 / Forward Annual Dividend Yield: 3.82% (Yahoo! Finance)