EM Fund Stock Picks & Country Commentaries (August 29, 2023)

A variety of emerging market fund stock picks (from fund documentation, articles about funds or fund manager interviews) + how 80% of excess EM returns come from country selection & much more.

A variety of emerging market fund stock picks (mainly from fund documentation, articles about funds or fund manager interviews) to highlight this week (among other stocks also getting mentions late on in this post) with some quick takes being:

An Asian death industry stock pick said to have strong cash generation ability and to be in a solid financial position. In addition, the stock benefits from… favorable demographics…

Several Indonesian stock picks held by fund managers who are bullish on Indonesia being India without the premium valuations.

A number of Indian stock picks from an Indian small cap fund. Although not necessarily small caps any more, most have been solid performers.

Two copper stock picks that could become acquisition targets by bigger mining companies seeking more exposure to the metal that is important to the alternative energy sector.

Some updates on widely held EM stock picks - some were covered in recent webinars, etc.. Note that the shares of a certain supermarket stock that has gained a bit of foreign investor along with Substack writer attention are now falling on weak results and their numbers could get worst (according to local non-English media reports…).

Some people make a living on being contrarians - also known as value investors like Himalaya Capital’s Li Lu who’s “master class” on value investing was included in yesterday’s post.

One recent fund letter has made some interesting contrarian observations about Chinese stocks that should have investors asking this question: If foreign investors were too excited about Chinese stocks several years ago, could they now be overly pessimistic right now?

They suspect that decreasing analyst manpower for covering and researching Chinese stocks might be starting to impact forward looking expectations for them. With less analyst coverage, the greater the chance for pricing discrepancies, underestimates of future earnings, and the like to go unnoticed (or not be widely noticed…). This could mean opportunities for contrarian value investors in beaten down and increasingly less covered Chinese or Hong Kong stocks.

Again, I think China (along with the USA and the EU) has very serious structural economic problems to deal with that have no easy solutions for, and there is considerable geopolitical uncertainty right now.

But as I have mentioned before with regards to South Africa: Carlos Salim’s (the richest man in Mexico) fortune was helped in part by his father buying up valuable commercial properties in Mexico City during the Mexican Revolution - when there were no other buyers around…

Of course and as mentioned last week (CMBI Research China & Hong Kong Stock Picks (July 2023)), now might not be a good time to try and catch falling knives in China. But that does not mean you should completely write-off China and Hong Kong stocks for the foreseeable future or not add them to any watch lists.

I should mention again that last week, our post covered an emerging markets fund manager’s recent TV appearance where he said that 80% of excess returns from emerging markets are explained by which country you are invested in - not which sector, fund, or stock. Apparently, this has been borne out by academic research.

A much longer interview with him has just been posted where he elaborated that picking countries with positive institutional trends tends to be more important than stock picking. He also noted that Chinese stocks tend to collectively move together and (as an asset class) are now priced like a “regulated utility” - meaning you need to focus on getting your China allocation percentage right rather than your stock picking.

Nevertheless, I still think stock picking is important and like Carlos Salim’s father, you can find value and opportunity in unloved places like South Africa (which this particular fund manager is avoiding). Yes, the country is experiencing “state collapse” and other problems; but many South African companies have significant operations abroad and/or are still able to grow their businesses at home despite the headwinds. You just need to be more careful when it comes to stock picking.

In another recent interview, the manager of an Indian small cap fund observed how other fund managers take either a top down approach or a bottom up approach when investing. Then they are always changing the portfolio; but for small cap investing, he says this won’t work.

In addition, his fund holds 170 small cap Indian stocks (and most of his top holdings have been good performers…) instead of a concentrated portfolio. He noted that with small caps, you need significant diversification and to invest for the long term because out of every 10 stocks you buy, 2 or 3 will have something go wrong. And in a concentrated portfolio, that will be disastrous for returns.

That’s a very interesting point to make and that approach could make sense when applied to investing in emerging or frontier market stocks (and for Indian small caps that are probably not trading at the sorts of premiums their larger and better known peers tend to trade at). After all, getting on planes to fly around the world to do in-depth on-the-ground company visits and due diligence is costly and time consuming - especially if the position ends up getting churned. And there is still no guarantee the investment still won’t go wrong.

Finally and in another recent podcast interview (not with a fund manager though), it was mentioned how there are no direct flights from NYC to Shanghai or Beijing - another sign of US-China decoupling.

A quick Google search though does show one China Eastern flight on Wednesdays between Shanghai and NYC and none between Washington DC and Shanghai or Beijing. This is hardly a good sign for US-China relations and cross-border investment given how important all four of these cities are financially and politically for the entire world.

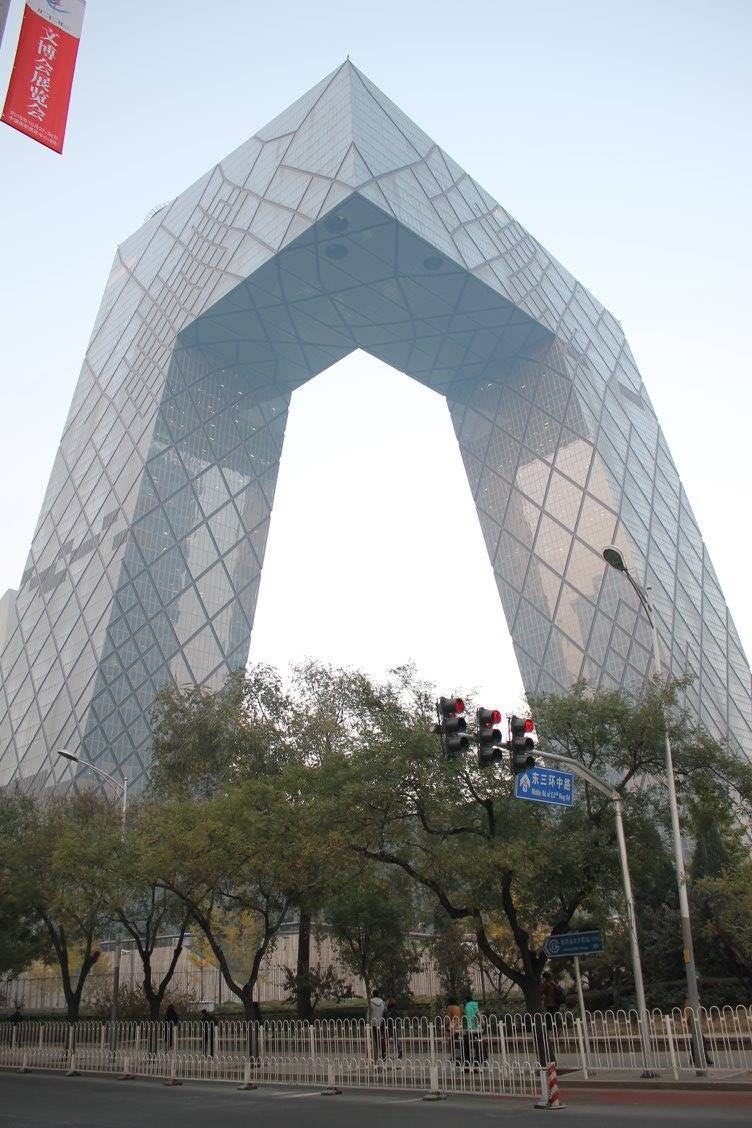

It was also observed how many of the biggest and most monumental buildings on Beijing’s Ring Roads belong to state-owned enterprises. Such entities often play an outsized role in economies around the world; but in China, its more visually striking:

I took the picture in 2016 when even bigger buildings were under construction all around it…

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

For a further disclaimer and an explanation of the reasoning behind these posts: DISCLAIMER: EM Fund Stock Picks & Country Commentaries Posts.

Note: Where possible, company links are to their respective investor relations or corporate pages. Region and country links are to our ADR or ETF pages where there are further country specific resources (e.g. links to local stock markets and media websites). Please report any bad links in the comments section.