Emerging Market Links + The Week Ahead (June 17, 2024)

Petrodollar rumors (dollar is not dead), tariffs on Chinese EVs, how China penalizes innovative drug makers, SA ANC-DA unity govt, EM stock picks and the week ahead for emerging markets.

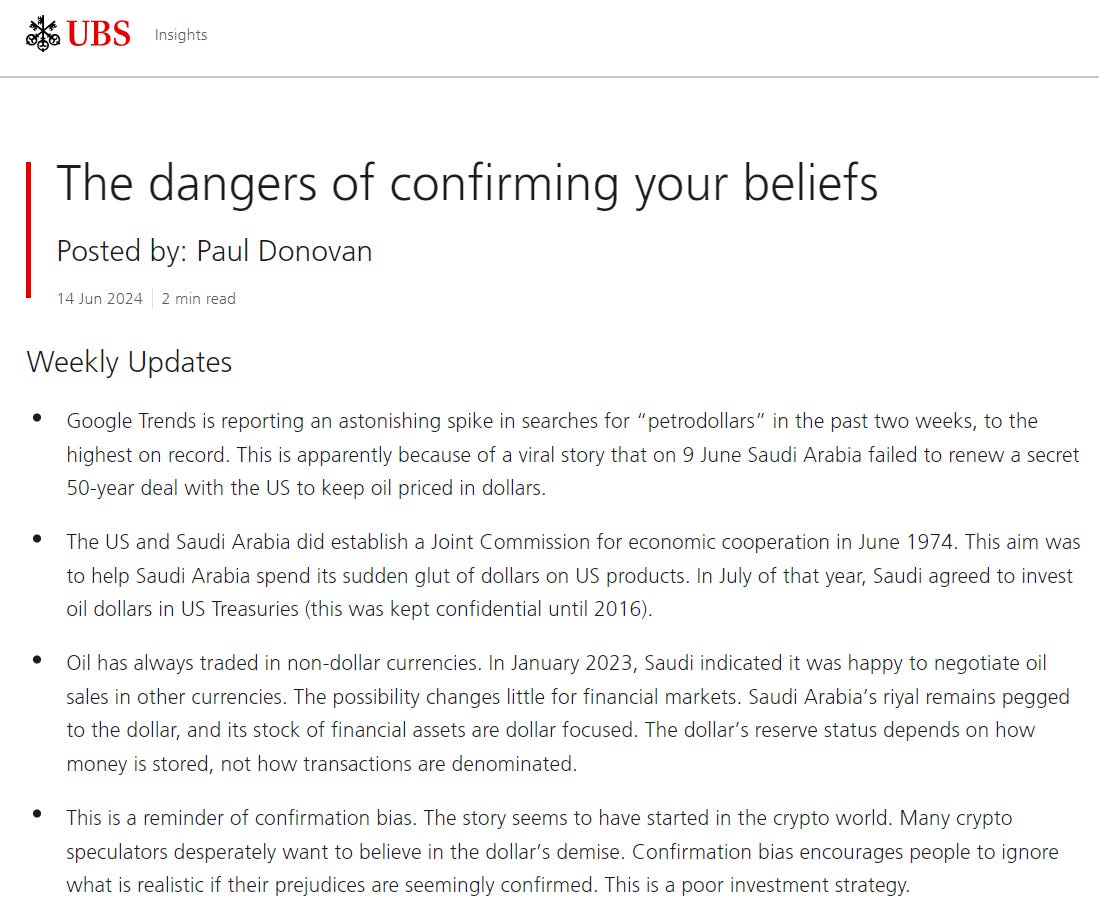

Last week, there were apparently stories circulating the crypto world and the Twittersphere that a so-called Petrodollar agreement between the US and Saudi Arabia had expired. Zerohedge had to set the record straight by tweeting out a screenshot of a UBS report that conveniently left off the last paragraph:

The screenshot below contains the last paragraph of the UBS piece:

In other words, reports of the Dollar’s demise have been greatly exaggerated and don’t believe everything you hear or want to believe…

Many people in emerging and frontier markets (where there is often a dearth of investment options) also view the dollar in the same manner as they view gold, Toyotas, and high quality (usually Japanese made) white goods - as a store of value and that belief is not going to change overnight. Long into the declines of the Roman and Spanish empires, people still had and were using Roman coins and Spanish pieces of eight. They may have transacted less in them, but they still kept them as a store of value…

Finally, Martin Armstrong often points out in interviews that unlike just about every other country, the USA has never cancelled its currency - which appears to be a tradition in Europe: Europe’s Practice of Cancelling Currency – The Dirty Little Secret Everyone Overlooks & European Tradition of Cancelling the Currency (and this is not even counting what happened to old currencies in places like France, Russia, China, South Vietnam, etc. after revolutions, etc.).

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

🌐 Publicly Listed Stock Exchange Stocks (Mid-2024) Partially $

There are close to 30 publicly listed stock exchange stocks or other types of publicly listed exchanges (e.g. futures, commodities, etc.) in developed, emerging or frontier markets.

🌐 EM Fund Stock Picks & Country Commentaries (June 16, 2024) Partially $

Why EM investors need to resist latching on to the latest theme (long India, short China), China trip report, evolving BRICS, digesting South Africa + India elections, India infrastructure bets, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 PDD: Untapped Growth Engine With Hidden Cash Potential (Seeking Alpha) $

PDD Holdings (NASDAQ: PDD) or Pinduoduo shows strong momentum and fast-growing operations with a relatively low multiple due to geopolitical risks.

The business generates compounding power through network effects, leading to fast growth and economies of scale.

PDD has significant cash reserves that offer upside optionality for growth, but investors should be aware of the inherent risks of Chinese tech stocks.

🇨🇳 Temu has launched in Brazil, despite all the challenges (Momentum Works)

Last Wednesday (5 June 2024), Temu went live in Brazil, bringing the total number of countries Temu is available in to 70.

Some thoughts (and facts)…:

Would be interesting to watch how far they would grow, and whether they would eventually pose a serious threat to MercadoLibre (NASDAQ: MELI) and Amazon.com (NASDAQ: AMZN) alike.

🇨🇳 DiDi drives back into growth lane, as aggregators encroach on its turf (Bamboo Works)

The company often called the ‘Uber of China’ reported a fifth consecutive quarter of double-digit revenue growth, as it reportedly eyes a listing in Hong Kong

DiDi Global (OTCMKTS: DIDIY)’s first-quarter revenue grew 14.9% to 49.1 billion yuan, marking a fifth straight quarter of double-digit growth

The ride hailing app has moved past earlier regulatory headwinds, but has lost market share to competition and smaller rivals using aggregating platforms

🇨🇳 Zhihu answers investor doubts with improving margins (Bamboo Works)

The company often called the ‘Quora of China’ posted a sharply higher gross margin in the first quarter, but its revenue fell for the first time since its 2021 IPO

Zhihu Inc (NYSE: ZH)’s revenue fell 3.3% in the first quarter, marking its first-ever decline since its New York listing

The company, often called the “Quora of China,” boosted its gross margin by more than 5 percentage points, and said it expects to achieve non-GAAP profitability by year-end

🇨🇳 Lenovo makes critical calculation with Middle East pivot (Bamboo Works)

The PC giant’s new tie-up with the Alat unit of Saudi Arabia’s sovereign wealth fund will give it access to new funds and help it establish a regional headquarters in Riyadh

Saudi Arabia’s Alat subscribed to $2 billion worth convertible bonds from Lenovo Group (HKG: 0992 / FRA: LHL / LHL1 / OTCMKTS: LNVGY / LNVGF), which the PC giant will use to help strengthen its financial position

Lenovo is stepping up its development efforts in the Middle East and Africa to reduce its exposure to the U.S.

🇨🇳 UP Fintech reaps benefits from early move overseas (Bamboo Works)

The online brokerage posted solid revenue growth in the first quarter as it gained traction in Hong Kong, its newest offshore market

UP Fintech Holding (NASDAQ: TIGR)’s revenue increased 19% year-on-year in the first quarter as its number of funded accounts grew 15%

The online brokerage has entered Hong Kong as its latest new market under a stepped-up international expansion after a major clash with the Chinese regulator

🇨🇳 Caixin Explains: How the EU’s new tariff hikes will affect China-made EVs (Caixin) $

The European Union has decided to provisionally impose extra tariffs of up to 38.1% on battery-electric vehicles shipped from China as part of an ongoing investigation finding that state subsidies are enabling Chinese electric-car makers to undercut their EU rivals, despite divisions in Europe over the issue.

The bloc formally notified carmakers including BYD Company (HKG: 1211 / SHE: 002594 / OTCMKTS: BYDDY / BYDDF), Geely Automobile Holdings (HKG: 0175 / FRA: GRU / OTCMKTS: GELYY / GELYF) and SAIC Motor Corp (SHA: 600104) of the new duties to be implemented from July 4, the European Commission said in a statement Wednesday.

🇨🇳 CATL Overtakes LG as Top EV Battery Supplier for Markets Outside China (Caixin) $

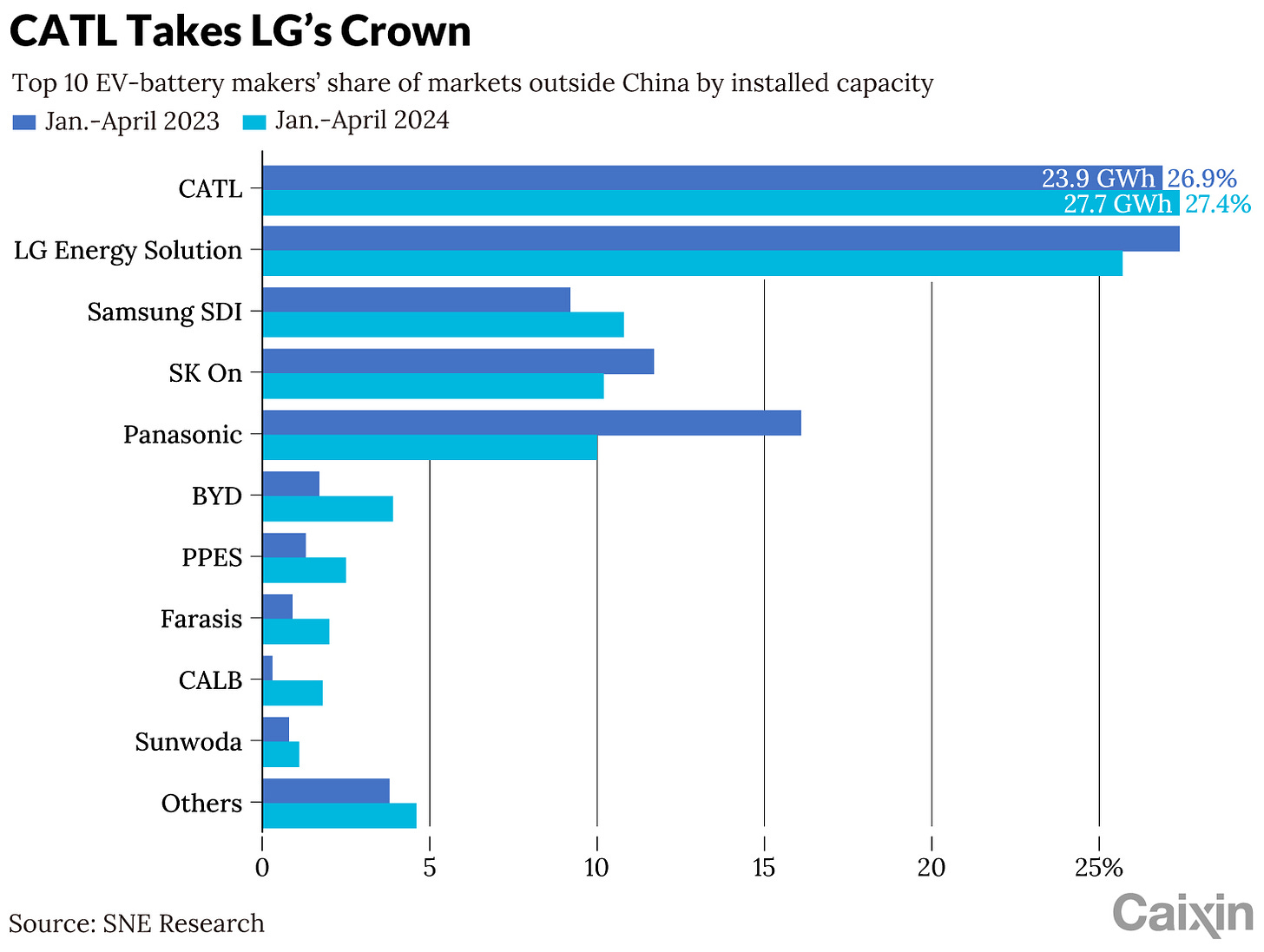

Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750) has stolen LG Energy Solution (KRX: 373220)’s crown as the biggest supplier of electric vehicle (EV) batteries in markets outside China for the first four months of 2024.

Fujian province-based CATL’s share of non-China markets rose to 27.4% of installed capacity, up from 26.9% during the same four months in 2023, according to a report [From Jan to Apr 2024, Non-Chinese Global EV Battery Usage Posted 101.1GWh, a 13.8% YoY Growth] published Monday by Seoul-based consultancy SNE Research. South Korea-based LG Energy Solution’s share of installed capacity slipped to 25.7% for the period.

🇨🇳 Shares of Warren Buffett-backed BYD jump after EU unveils lower than expected tariff (FT) $ 🗃️

BYD Company (HKG: 1211 / SHE: 002594 / OTCMKTS: BYDDY / BYDDF)

Stock of Tesla’s China rival rises as much as 9% following Brussels’ announcement of electric vehicle import duties

🇨🇳 U.S. Politicians Want to Add Two Chinese Battery Makers to Import Ban List (Caixin) $

A number of republican politicians are calling on the Biden administration to add two Chinese electric vehicle battery makers to an import ban list, accusing the companies of using forced labor in their supply chains.

Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750), the world’s largest maker of batteries for electric cars as well as a partner to Ford, and Gotion High-tech Co (SHE: 002074 / FRA: 24U0), a battery company partially owned by Volkswagen AG, should be added immediately to an import ban list, the politicians said in two letters sent to Robert Silvers, the Department of Homeland Security Undersecretary.

🇨🇳 Nio in diversification drive as it tries to stem its flood of red ink (Bamboo Works)

With more losses piling up in this year’s first quarter, the high-end EV maker is betting on two new brands targeting the middle and lower parts of the market

NIO Inc (NYSE: NIO)’s loss widened 9.5% year-on-year in the first quarter to 5.26 billion yuan

The company focuses on higher-end electric vehicles, but plans to tap the middle and lower parts of the market with the launch of two new brands

🇨🇳 China Merchants Group pushes forward plan to consolidate cargo operations (Caixin) $

What’s new: China Merchants Group Ltd. (CMG) is pushing ahead with a major restructuring as the state-owned conglomerate moves to consolidate its container line operations amid a global shipping boom.

Antong Holdings (SHA: 600179) plans to issue shares to China Merchants Energy Shipping (SHA: 601872) to buy the latter’s 100% stake in a container liner and 70% stake in a ro-ro shipping company, according to a stock exchange filing dated Thursday.

🇨🇳 China Trip Notes (5/27~6/5) (East Asia Stock Insights) $

Thoughts on Chinese consumers and more

I visited China for 10 days, splitting my time between Beijing, Chongqing, and Datong. It was a mix of family visits, leisure, and business.

I have family in Beijing, so that’s where I usually go, but Chongqing and Datong were new experiences for me. I was impressed with both cities (in different ways) and enjoyed my stays at both.

Staying at leading Chinese brands like Atour Lifestyle Holdings (NASDAQ: ATAT) and JI (H World Group (NASDAQ: HTHT) is comfortable even by Western standards, while still being affordably priced at 300-500 RMB (US$40-70) per night. They may not offer full-service facilities like spas, swimming pools, or five-star restaurants, but they meet the needs of most domestic travelers with comfortable, well-equipped rooms and good customer service.

🇨🇳 $ATAT 101 - Atour Lifestyle Holdings (East Asia Stock Insights)

Atour Lifestyle Holdings (NASDAQ: ATAT) (“the Company”, “ATAT”, “Yaduo”) is the largest upper-midscale ‘manachised’ hotel operator in China. As at 1Q24, the Company boasted 1,302 hotels (~148k rooms) in operation in China, with 97% of total rooms under the capital-light manachised model. Under this model, Atour is only responsible for sending the Hotel Manager and the “Commissar”

Atour collects a capital-light stream of royalties from its franchisees, provides supply chain services, and sells retail products. In turn, the franchisee is responsible for CapEx + location (lease or owned building) and the costs of hotel staff. The Hotel Manager +“Commissar” are also paid for by the franchisee (they are technically on the payroll of Atour, but Atour is reimbursed by franchisees via “monthly hotel managers’ fee”).

Given its capital-light business model and strong cash position, we believe Atour has a high capacity for returning capital to shareholders.

Management has expressed intention to pay dividends this year, and they can be more aggressive in returning capital to shareholders now, especially that Legend Capital has substantially completed its liquidation (with liquidity being less of a constraint for conducting share repurchases).

🇨🇳 Luckin's Small Step into Non-Coffee Drinks Is a Big Step of Its Future Directions (SmartKarma) $

Luckin (OTCMKTS: LKNCY) launched lemonade drinks with raging success of 5.08 mn cups sold for the first week, ~10% of store sales. Market cheered to send the stock higher;

We view it with mixed feelings. While it is margin accretive and sales enhancing, is not conducive to improving coffee penetration and cultivating consumers' habit for drinking coffee;

We see Luckin as increasingly one of, instead of the, street drink company, because lemonade is actually the top selling SKU of all milk tea vendors in China.

🇨🇳 Luckin Coffee: Profitable Growth At A Discount (Seeking Alpha) $

China's coffee market is booming, and it is now likely the world's biggest.

After doubling its store count in 2023, Luckin (OTCMKTS: LKNCY) holds a market-leading position in China, with its nearest competitors, Starbucks Corp (NASDAQ: SBUX) and Cotti Coffee, struggling to catch up.

Luckin's Gross Margin of 55% meant that despite the high SG&A costs associated with rapid expansion, it remained profitable.

Luckin's shares look extremely inexpensive, even after factoring in a China discount.

🇨🇳 Yoox Net-a-Porter exits China to focus on more profitable markets (FT) $ 🗃️

[Richemont (SWX: CFR / JSE: CFR / FRA: RIT1) owned] Luxury ecommerce platform’s decision comes at a time of weaker economic momentum in the mainland

Yoox Net-a-Porter operated in China under a joint venture with Chinese ecommerce group Alibaba (NYSE: BABA), which will be liquidated, according to a person familiar with the matter.

🇨🇳 AI drugs researcher QuantumPharm makes market debut on long road to profit (Bamboo Works)

The newly floated biotech can boast big-name backers and counts more than a dozen biopharma heavyweights among its customers, but it is still awash with red ink

QuantumPharm (HKG: 2228)’s revenues have grown at a compound annual growth rate of 66.7% over the past three years, powered by a bumper contract with Eli Lilly

But the company struggles with client retention, shedding a big chunk of its customer base each year

🇨🇳 InnoScience flies below the radar with rare Hong Kong microchip IPO (Bamboo Works)

The company’s revenue grew fourfold last year as the cutting-edge gallium nitride (GaN) technology behind its microchips and wafers began to mature

InnoScience has filed for a Hong Kong IPO, making it a rare Chinese chip company to try to raise funds from international investors

The company’s revenue grew fourfold last year as its cutting-edge technology matures, but it could face future challenges from lawsuits and geopolitics

🇭🇰 CK Asset: How I would play a recovery of China / Hongkong (Bos Invest Substack)

Quality assets, diversification abroad for Chinese valuation, and low leverage.

My idea is if I can buy CK Asset Holdings Ltd (HKG: 1113 / FRA: 1CK / OTCMKTS: CHKGF) for the value of its international assets I get upside in China/Hongkong for free. In addition, this means the company has more means to sit out the downturn and enough dry firepower to benefit from a recovery.

🇭🇰 L'Occitane International: All Eyes On Privatization Offer (Seeking Alpha) $

The HK$34 per share privatization offer price for L'Occitane International (HKG: 0973 / FRA: COC / OTCMKTS: LCCTF) is +3.8% above its last traded stock price.

Shareholders have the option to accept a "Potential Alternative Share Offer" which might offer greater upside in the scenario that the company is subsequently listed elsewhere at a higher P/E.

I assign a Buy rating to L'Occitane after assessing the potential privatization offer.

🇰🇷 Block Deal Sale of 3.6% Shares of Enchem (Douglas Research Insights) $

After the market close on 14 June, it was reported that Woori PE/other investors will be selling 705,384 shares of [battery electrolyte maker] Enchem Co Ltd (KOSDAQ: 348370) in a block deal, representing 3.6% of outstanding shares.

The block deal discount rate ranges from 6.9% to 8.92%, resulting in potential block deal sale price of 270,500 won to 276,500 won.

We would not subscribe to this block deal and we are concerned about the valuations of Enchem after a sharp share price appreciation this year.

🇰🇷 Another Block Deal Sale of Ecopro Materials (Douglas Research Insights) $

Shares of Ecopro Materials (KRX: 450080) are down 16% today to 112,300 won, due to another block deal sale of by BRV Capital in the after hours trading on 13 June.

After the second block deal sale on 14 June, BRV's stake declined further from 21.2% to 18.2%.

This block deal sale at a big discount is likely to raise overhang concerns about further block deal sales by BRV Capital in the coming months/years.

🇰🇷 Woori Bank: New Catalysts Ahead (Seeking Alpha) $

Woori Financial Group (NYSE: WF)

South Korea's economy is recovering after a slowdown caused by a decline in tech exports.

The country's equities market is showing signs of improvement.

The bounce back in the economy is a positive sign for South Korea's overall economic health.

🇰🇷 Proposed Merger Between Rebellions and Sapeon - To Challenge Nvidia (Douglas Research Insights) $

On 12 June, SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) confirmed that its affiliate Sapeon plans to merge with its competitor Rebellions by end of this year.

Sapeon and Rebellions' largest global competitor is NVIDIA Corp (NASDAQ: NVDA). A key aim of the merger is to challenge Nvidia and try to take away its global dominance in AI chips.

If the combined Sapeon and Rebellion can take away just 1% market share resulting in 1% of Nvidia's market cap, this would suggest valuation of US$31 billion.

🇰🇷 Korean Food Goes Global (Douglas Research Insights) $

One of the key themes this year that has worked well has been Korean food & beverage stocks that have significantly outperformed KOSPI.

Some of the best selling Korean foods (especially overseas) include Samyang Foods Co Ltd (KRX: 003230)' instant noodles, CJ Seafood Corp (KRX: 011150)'s seaweed products, and Wooyang Co Ltd (KOSDAQ: 103840)'s frozen gimbab.

We prefer a basket approach to investing in Korean F&B stocks. A basket of top 10 F&B stocks in Korea has outperformed the market YTD and this outperformance could continue.

🇰🇷 Tender Offer of Jeisys Medical by Archimed Group (Douglas Research Insights) $

On 10 June, it was announced that France's Archimed Group is conducting a tender offer of 55.72 million shares of Jeisys Medical (KOSDAQ: 287410) (72% of outstanding shares).

The tender offer period will run from 10 June to 22 July. The tender offer price is 13,000 won.

Archimed also signed a contract to purchase the entire stake (23.2%) held by Kang Don-Hwan (Chairman of Jeisys Medical) and (3.2%) held by a Director Myung-Hoon Lee.

🇲🇾 GEN Malaysia tells AGM upbeat on homeland, NY: report (GGRAsia)

Bigger numbers of tourists from Singapore, Indonesia, China and India travelling to Malaysia have helped boost first-quarter leisure and hospitality revenue for Genting Malaysia (KLSE: GENM)’s monopoly casino resort business in its home market. That is according to comments attributed to management and reported by Malaysian Chinese-language news outlet, Sin Chew Daily.

Genting Malaysia also runs casinos in the United States – via associated businesses – and in the Bahamas, the United Kingdom, and Egypt.

At the Wednesday meeting, Genting Malaysia management reportedly told shareholders the firm’s involvement with the upstate gaming business could help it gain one of the three downstate New York gaming licences that might be decided by late 2025.

🇵🇭 Manila Trip Report – An emerging Pacific tiger? (Part 1) (Pyramids and Pagodas)

Exploring the ground truths Southeast Asia’s fastest growing economy and unearthing investment gems amid Manila’s madness

Initially planned around meeting a Chairman of an exciting listed company (to be covered separately), Altraman’s recent trip to Manila quickly morphed into a slew of meetings with other enterprises. His first stop was the The Philippine Stock Exchange, Inc (PSE: PSE / OTCMKTS: PSKXF) – the holding company itself being a potential play on the market as a whole, where he learned of catalysts such as soaring fintech-driven retail investor participation and government reforms to slash transaction costs. Further afield in Quezon, Altraman met with D&L Industries (PSE: DNL / OTCMKTS: DLNDY), a raw materials manufacturer serving many of the country’s blue chips and multinationals. The ramping up of a major new production facility should allow it to move up the value chain and double revenues.

We will be releasing a two-part Series covering Altraman’s recent trip to Manila, sharing economic insights and highlights of meetings with three locally-listed companies. The first piece provides a glimpse of the country’s past, present, and future amidst enduring inequalities and details two of the investor meetings.

🇸🇬 🇨🇳 China Yuchai: Turning Bullish On Buyback Plan And Improved Outlook (Rating Upgrade) (Seeking Alpha) $

China Yuchai International Limited (NYSE: CYD)'s potential shareholder yield has been boosted by a new $40 million share repurchase program.

CYD's outlook has become better, taking into account its peer's industry sales projection and the latest monthly LNG (Liquefied Natural Gas) HDT (Heavy-Duty Truck) sales numbers.

I raised my rating for CYD to a Buy after assessing its buybacks and growth prospects.

🇸🇬 Great Eastern Holdings (GE SP): Playbook as OCBC Offer Declared Final, IFA Opines NOT Fair (SmartKarma) $

Great Eastern Holdings (SGX: G07 / OTCMKTS: GEHDY) IFA opines that the Oversea-Chinese Banking Corp (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY) S$25.60 offer is NOT fair but reasonable as it is below the valuation range of S$28.87-S$36.19 per share.

In response, OCBC declared the price final, and the final closing date is 12 July. Great Eastern will likely breach free float requirements and be suspended when the offer closes.

The offer will likely follow the Boustead Projects/Boustead Singapore blueprint, where SGX RegCo eventually (took seven months) enabled dissenters to receive a fair offer with a 24% uplift.

🇸🇬 Better Buy: Keppel DC REIT Vs Mapletree Industrial Trust (The Smart Investor)

We compare two popular industrial REITs to determine which makes the better investment choice.

After comparing two healthcare REITs last week, we now move back to looking at the industrial REIT space.

This round, we look at two popular industrial REITs – Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF) and Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF), or MINT.

Keppel DC REIT is a pure data centre REIT with a portfolio of 23 data centres located across nine countries as of the first quarter of 2024 (1Q 2024).

MINT, on the other hand, is a diversified industrial REIT with 140 properties across three countries as of 31 March 2024.

🇸🇬 Share Prices of These 3 Singapore Stocks Shot Up 36% or More Year-to-Date: Can Their Run Continue? (The Smart Investor)

These three stocks have performed impressively this year, but could there be more upside for the remainder of 2024?

These businesses could have what it takes for you to add them to your buy watchlist.

Riverstone Holdings (SGX: AP4) is a manufacturer of cleanroom gloves used in highly controlled environments and premium nitrile gloves used in the healthcare industry.

Centurion Corporation Ltd (SGX: OU8) owns, develops, and manages purpose-built workers’ accommodation assets (PBWA) in Singapore and Malaysia and student accommodation assets in Australia, the UK, and the US.

Grand Banks Yachts (SGX: G50), or GBY, is a manufacturer of luxury recreational motor yachts under the Grand Banks, Eastbay, and Palm Beach brands.

🇮🇳 The Beat Ideas- Patel Engineering: Turnaround Play? (SmartKarma) $

Patel Engineering Ltd (NSE: PATELENG / BOM: 531120)'s large order book, strategic sectors focus, and successful debt reduction through QIP and restructuring.

Strong financial resilience, projected revenue growth, and robust order pipeline signal promising future prospects.

Poised for growth strong order pipeline and increased government focus on Infrastructure, Hydro Power segment and Irrigation segment.

🇮🇳 Hyundai plans to list India business unit in one of country’s biggest IPOs (FT) $ 🗃️

South Korean carmaker seeks to capitalise on booming demand in world’s third-largest auto market.

The South Korean automaker will sell up to 142mn shares, or 17.5 per cent, of its holding in Hyundai Motor India on local exchanges, according to the draft prospectus seen by the Financial Times.

🇮🇳 ICICI Bank: Mixed Read-Throughs From Investor Conference And Indian Election (Seeking Alpha) $

There were positive takeaways from ICICI Bank (NYSE: IBN)'s commentary at an investor event relating to different aspects of its business like funding and expenses.

On the other hand, demand for loans in India might possibly weaken, assuming that fewer new capital investments are given the go-ahead because of a narrower win for the ruling party.

A Hold rating for IBN is maintained, considering the bank's mixed outlook in view of recent developments.

🇮🇱 Ituran: Undervalued Company With Solid Growth Potential (Seeking Alpha) $

Ituran Location and Control Ltd (NASDAQ: ITRN) provides location-based services for connected cars.

Q1 FY24 earnings show strong performance with record revenues and subscriber growth.

Using Benjamin Graham's valuation method, ITRN is undervalued with a potential upside of 45%, despite technical chart concerns.

🇿🇦 Sibanye Stillwater: Time To Test The Waters (Rating Upgrade) (Seeking Alpha) $

We have decided to upgrade Sibanye Stillwater Ltd (NYSE: SBSW)'s stock on the basis of an enhanced operational and commodity pricing outlook.

Upward-sloping PGM and Gold futures curves provide a reason to be positive about precious metals prices, especially considering gold's tail hedge properties.

Sibanye's U.S. PGM production has improved after a series of externally-driven delays.

South African operations might improve amid various project expansions and favorable election results.

A non-dividend-paying Sibanye might discourage many. However, we think it is time to test the waters before a recovery is fully in motion.

🇿🇦 Gold Fields: Assessing Its Production Guidance Shift (IOL)

Gold Fields (NYSE: GFI) has lowered its production guidance due to an isolated incident at its Salares Norte mine in Chile.

Although a material event, we think investors overreacted to Gold Fields' production downgrade.

We believe numerous positives exist within Gold Fields' operating framework, namely a lower cost base in Ghana, ongoing quality at the South Deep mine, and no structural concerns in Australia.

However, we remain concerned about GFI stock's valuation and, therefore, maintain our hold rating.

🇿🇦 Renergen’s shares rise as it resumes helium production (IOL)

The share price in Renergen (JSE: REN / ASX: RLT / FRA: 9960 / OTCMKTS: RGNNF / RGNTF), the operator of South Africa’s only onshore producer of LNG and helium at a site in Virginia in the Free State, yesterday leapt 4.08% after it reported that it had resumed the production of helium this week.

Renergen has been at the receiving end of a lot of flak from some of the investor community, who claim that the delays and other problems belie a project that is at its heart not likely to be commercially viable.

Renergen is planning to list on the Nasdaq index so it can begin operation Phase 2.

🇿🇦 MultiChoice losses double on currency and less subscribers (IOL)

.SUPERSPORT and DStv owner, MultiChoice Group Ltd (JSE: MCG / FRA: 30R / 30R0 / OTCMKTS: MCHOY / MCOIF), which is being acquired by global broadcaster Canal+, more than doubled its losses in 2024.

This was after its subscriber numbers fell, substantial currency headwinds and an increase in investment spending such as for the launch of Showmax.

🇿🇦 Telkom shares surge on expected whammy profit for the full year (IOL)

Telkom SA SOC (JSE: TKG / FRA: TZL1) climbed 5.7% to close at R24.99 per share yesterday on news that normalised headline earnings per share (HEPS), a core measure of profitability would climb by as much as 205% in the year to end-March.

Telkom, which recently sold its masts and towers business Swiftnet for R6.75 billion, said next-generation revenues grew by approximately 7% and now comprise almost 80% of its total revenue.

🇿🇦 Spar share price surges as steps to stabilise group are implemented (IOL)

The Spar Group (JSE: SPP / OTCMKTS: SGPPF) passed the interim dividend and was also unlikely to pay a final dividend in the interests of preserving cash and to reduce debt, CEO Angelo Swartz said yesterday.

Swartz said consumers were struggling globally, with high inflation and interest rates and low growth and while first half trading was weaker than expected, an improvement was anticipated in the second half.

The interested buyer of SPAR Poland planned to continue operating the SPAR brand in that country. The group owns the SPAR retail brand in South Africa, Switzerland, South West England, Ireland, Poland and via joint venture in Sri Lanka.

Swartz said the focus for the next six months would be on the performance of SPAR Southern Africa, and getting the right level of returns from Spar Switzerland.

🇿🇦 Lucky Star lifts Oceana’s interim earnings after stronger operating profit (IOL)

Interim headline earnings per share in Oceana Group (JSE: OCE / FRA: O1F) jumped 84.6% to 578.8 cents for the six months ended March 31, driven by a 57.1% surge in operating profits which amounted to R1 billion for the same period.

The fishing and food processing company also lifted half-year after tax profits from total operations by 86.1 % to R716 million, mainly driven by record half-yearly earnings from the company’s US-based Daybrook Fisheries.

Oceana CEO Neville Brink said prudent cash and capital management had allowed the group to invest in its business, including upgrades to factories and vessels to improve efficiencies, expand the Lucky Star brand and take advantage of bolt-on acquisition opportunities.

🌎 Harding Loevner - MercadoLibre: Alternative Payment Systems Boosts Core Offering (Seeking Alpha) $

MercadoLibre (NASDAQ: MELI)'s alternative payment system, Mercado Pago, has helped differentiate its offerings and boost market share in Latin America's competitive e-commerce industry.

Mercado Pago's success in Mexico, providing digital payments and credit to underserved populations, has strengthened MercadoLibre's market position against rivals like Amazon and Walmart.

As Mercado Pago's credit business grows, the company must navigate funding and regulatory challenges to maintain its competitive edge and promote financial inclusion in Latin America.

🇦🇷 Lithium Argentina: A Progress Report And Insider Buying (Seeking Alpha) $

Ganfeng invests $70 million in the south Pastos Grandes project, gaining 14.8% ownership.

Lithium Argentina Corp (NYSE: LAAC)'s Cauchari-Olaroz project shows progress with improving lithium purity and an increase in lithium production.

The long-term goal for Cauchari-Olaroz project is over 60,000 tonnes of battery grade lithium produced annually. Combine that with the southern projects and we should see much larger long-term output.

A director just purchased over $194,000 of stock on the open market. This is a strong vote of confidence in the future of the company.

🇦🇷 Lithium Americas: A Few Bullet Points On The Latest Share Price Debacle (Seeking Alpha) $

Lithium Argentina Corp (NYSE: LAAC) shares have dropped below $3.

Thacker Pass is a significant lithium find, and LAC's other holdings in the McDermitt Caldera region are also valuable.

Despite the current low prices, the demand for lithium in various industries, including batteries and electronics, remains strong.

Here is the good, the bad, and the ugly.

🇧🇷 Nu Holdings: The Market Is Still Sleeping, Here Are The Catalysts (Seeking Alpha) $

Nu Holdings Ltd (NYSE: NU) stock has risen 40% YTD, now 3x higher from the January 2023 lows.

Despite this, the stock is undervalued and trading close to its IPO price.

Several near-term catalysts are expected to drive the stock significantly higher.

🇧🇷 Braskem Looks To Exit A Period Of Painful Spread Compression (Seeking Alpha) $

Braskem (NYSE: BAK) has faced significant margin pressure as resin spreads have shrunk due to weaker demand in construction, industrial, and consumer markets and disadvantageous naphtha cost exposure.

Although resin demand should be bottoming out, capacity additions in China and the U.S. leave Braskem vulnerable to an export market that is smaller and dominated by low-cost supply.

I expect below-average EBITDA margins for the next three years and long-term revenue growth of around 3%, but that can still support a fair value as high as $10 today.

M&A rumors aren't going away, but it remains to be seen if regular shareholders will see any benefit.

🇧🇷 Braskem: Likely Waiting To Be Purchased (Seeking Alpha) $

Braskem (NYSE: BAK)'s controlling holding, Novonor, is looking for a buyer for its stake in the company.

The proposals to purchase this stake exceed the company's current market cap by two times.

For this reason, I believe that the dangerous risks, such as the sinking of Maceió, are already in the price, bringing a good opportunity.

🇧🇷 BrasilAgro: Good Structural Trends, Bad Cyclical Trends (Seeking Alpha) $

The company [Brasilagro - Co Brasileira De Proprieda (NYSE: LND / BVMF: AGRO3)] focuses on the agricultural real estate market, earning from crop production and sale of farms, with key crops being soybeans, corn, and sugar cane.

Short and medium-term results may be under pressure due to the commodity price outlook.

Furthermore, valuation based on the EV/EBITDA multiple does not offer a good margin of safety.

🇧🇷 Azul: Preparing For Takeoff (Seeking Alpha) $

Azul Sa (NYSE: AZUL / BVMF: AZUL4) presented good operational trends in its 1Q24 results. It is worth remembering that the airline sector was the most affected by the pandemic and has not yet fully recovered.

Another highlight of 1Q24 was the codeshare agreement with competitor Gol Linhas Aereas Inteligentes Sa (NYSE: GOL / BVMF: GOLL4), and in my view, this agreement will enhance the company's business model.

The valuation shows a 15% discount for Azul compared to its peers when we use the comparative analysis method with the EV/EBITDA multiple.

🇧🇷 Embraer: Ready To Fly Even Higher (Seeking Alpha) $

Embraer (NYSE: ERJ) is an excellent option to capture the improvement in the aviation sector in 2024.

The company's reliance on exports mitigates risk from the Brazilian economy.

Embraer has good financial indicators and a favorable valuation, making it an attractive investment option with a potential 9.6% upside.

🇧🇷 Ultrapar: Potential Regulatory Problems And Unattractive Valuation (Seeking Alpha) $

Ultrapar Participaçoes (NYSE: UGP) faces challenges with increased competition due to the possible return of state-owned Petrobras (NYSE: PBR) in the fuel distribution segment.

New changes to tax rules could further increase sectoral uncertainties.

The valuation is not attractive, both compared to peers and compared to its own history.

🇲🇽 Share Loss And Margin Compression At Grupo Bimbo Leave A Sour Taste (Seeking Alpha) $

Grupo Bimbo SAB de CV (BMV: BIMBOA / FRA: 4GM / OTCMKTS: GRBMF / BMBOY) shares have underperformed, as the company has missed lowered expectations for a few quarters now and seen both volume share losses and margin compression.

Management doesn't yet seem to want to address the market share issues in the U.S., including the risk that continuing with above-average pricing could drive more share to private label.

Limited additional leverage from lower input costs and wage pressures add further complications to the price/margin/share trade-offs.

Bimbo shares don't look expensive now, but I'd prefer to see some stabilization in U.S. volume trends across its major categories before getting more bullish.

📰🔬 Further Suggested Reading

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China’s stock exchanges to tighten controls on high-frequency trading (Caixin) $

China’s stock exchanges plan to impose stricter rules and extra fees on high-frequency trading — one type of controversial trading that has been blamed for fueling market turmoil this year.

The stock exchanges in Shanghai, Shenzhen and Beijing each released draft rules on Friday for program trading — which includes quantitative trading, whereby investors employ mathematical models and algorithms to make trading decisions and execute transactions. The rules, which are similar on the three bourses, are open for public comment through Friday.

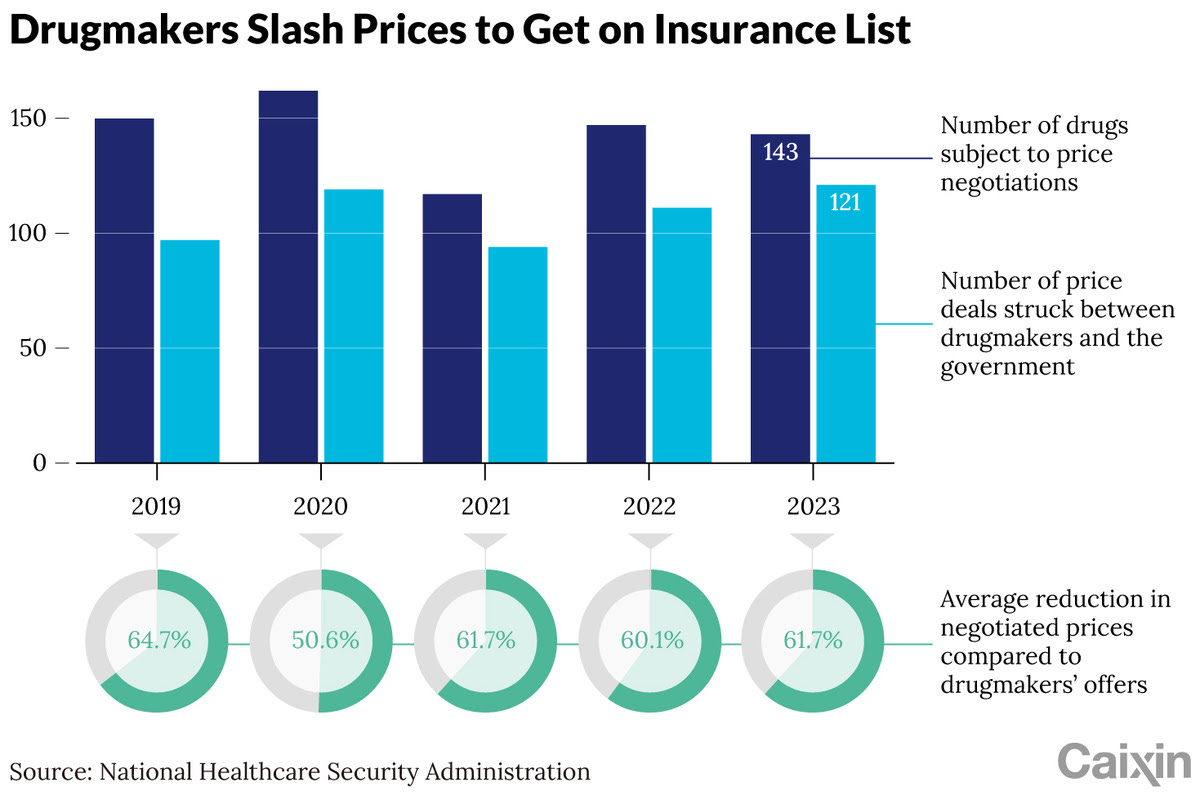

🇨🇳 In Depth: How China’s pricing regime penalizes innovative drugmakers (Caixin) $

For nearly a decade, China’s domestic drug pricing policy has frustrated pharmaceutical companies.

Since 2016, the national insurance regulator has haggled with companies eager to have their innovative drugs covered by state health insurance, to help lower costs for patients.

This has made profits elusive for these companies. As a result, some have expanded into foreign markets in search of wider margins.

🇨🇳 In Depth: Local Governments Ditch Financing Vehicles to Offload Hidden Debt (Caixin) $

China’s campaign to reduce hidden borrowing parked on the balance sheets of local government financing vehicles (LGFVs) has left many heavily indebted authorities struggling to fund investment and support their economic growth.

Some, including Chongqing, a municipality on an official list of 12 high-risk provincial-level regions, are now attempting to transform some of their LGFVs into market-oriented entities (市场化主体) and offload government liability for the vehicles’ borrowings. The aim is to reduce the authorities’ own debt levels, which they hope will lead to the easing of restrictions imposed by the central government on their ability to borrow money and invest in GDP-boosting projects.

🇨🇳 Weekend Long Read: Why China Is So Keen on Hydrogen (Caixin) $

🇰🇷 Ban on Short Selling Stocks in Korea Extended Until March 2025 (Douglas Research Insights) $

On 13 June, the Korean government announced that it will extend a ban on short selling stocks in Korea until end of March 2025.

For now, the government has not given a 100% go-ahead on the end of the ban on short selling stocks starting 1 April 2025.

However, in our view, the government is likely to allow short selling stocks in Korea once again, sometime in 2Q 2025.

🇰🇷 Korean Government Is Pushing for a Comprehensive Inheritance Reforms - Will They Pass or Fail? (Douglas Research Insights) $

In the past several days, the South Korean Presidential Office has announced that it is pushing for a comprehensive inheritance tax reforms.

Although the Presidential Office mentioned it is pushing to reduce highest inheritance tax rates from 60% to 30%, the more likely scenario is to reduce this rate to about 50%.

The lump sum personal deduction of 500 million won or inheritance tax which has been maintained for nearly 27 years could be doubled to about 1 billion won or more.

🇰🇷 Changes in Law for Allocation of Treasury Shares as New Shares Post Spin-Offs in Korea in 2H24 (Douglas Research Insights) $

On 11 June, the FSC announced that the restrictions on allocation of treasury shares as new shares post spin-offs is expected to be made into law in 2H 2024.

Meanwhile, starting 1 July, the financial regulators will make it more difficult for Korean companies to conduct spin-offs that have separate allocation of treasury shares as new shares.

The top five stocks with highest percentage of treasury shares/outstanding shares are up on average 40.5% YTD.

🌍 Middle East ramps up bid to become global AI hub (The Asset) 🗃️

Abundant capital and enthusiastic government support attract interest from tech firms and start-ups

🇿🇦 ‘We have a deal’ – GNU is unveiled (IOL), Zuma condemns GNU as white-led alliance, vows to expose "white agents" (IOL) & Ramaphosa re-elected South African president after striking deal with opposition (FT) $ 🗃️

Power-sharing arrangement quells investors’ fears of a coalition with radical left parties

🇦🇷 Argentina loses appeal over $1.5bn payment to hedge funds (FT) $ 🗃️

Ruling is setback for Javier Milei’s cash-strapped government as it faces cases brought by former foreign investors

Palladian Partners, HBK Master Fund, Hirsh Group and Virtual Emerald International Limited, which hold about 48 per cent of the securities and which like many emerging market bonds are governed by English law — brought a case against Argentina in 2019 asking to be compensated for their losses and the court ruled in their favour in 2023.

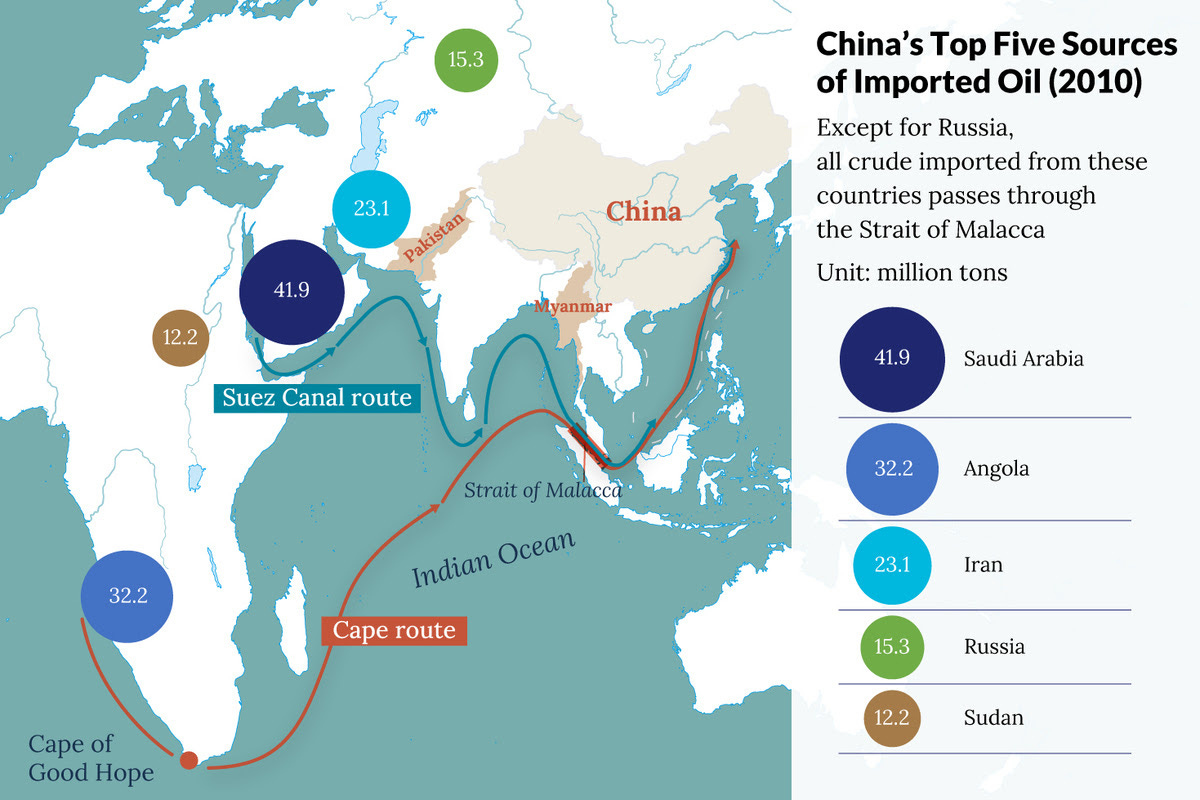

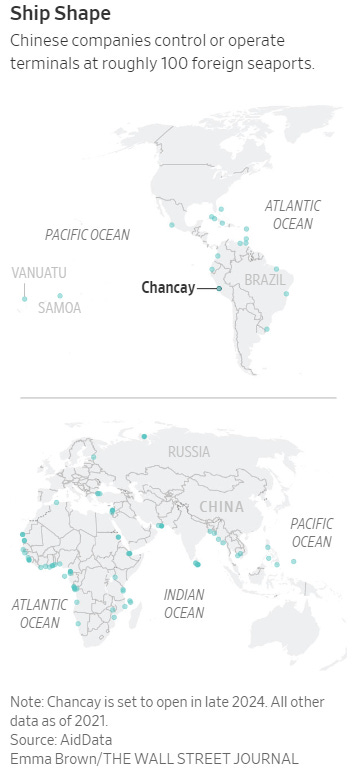

🌎 A New Chinese Megaport in South America Is Rattling the U.S. (WSJ) $ 🗃️

The Peru project could speed trade with Asia and plant Beijing’s flag in Washington’s neighborhood

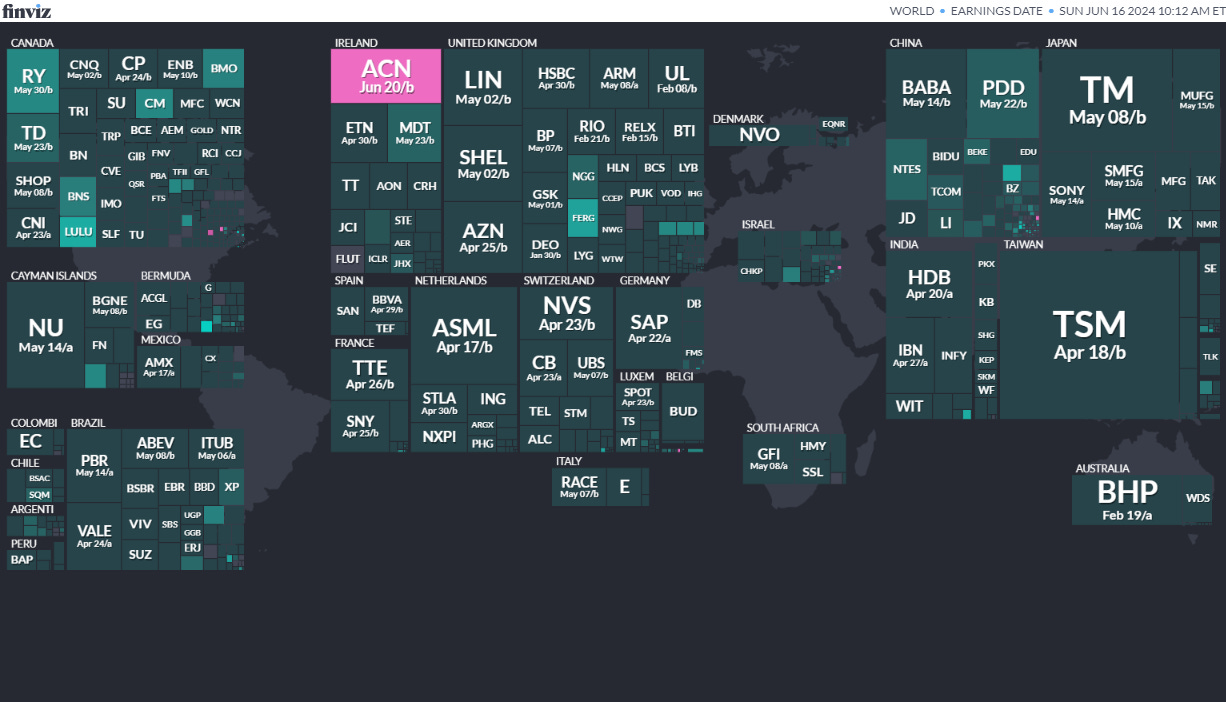

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

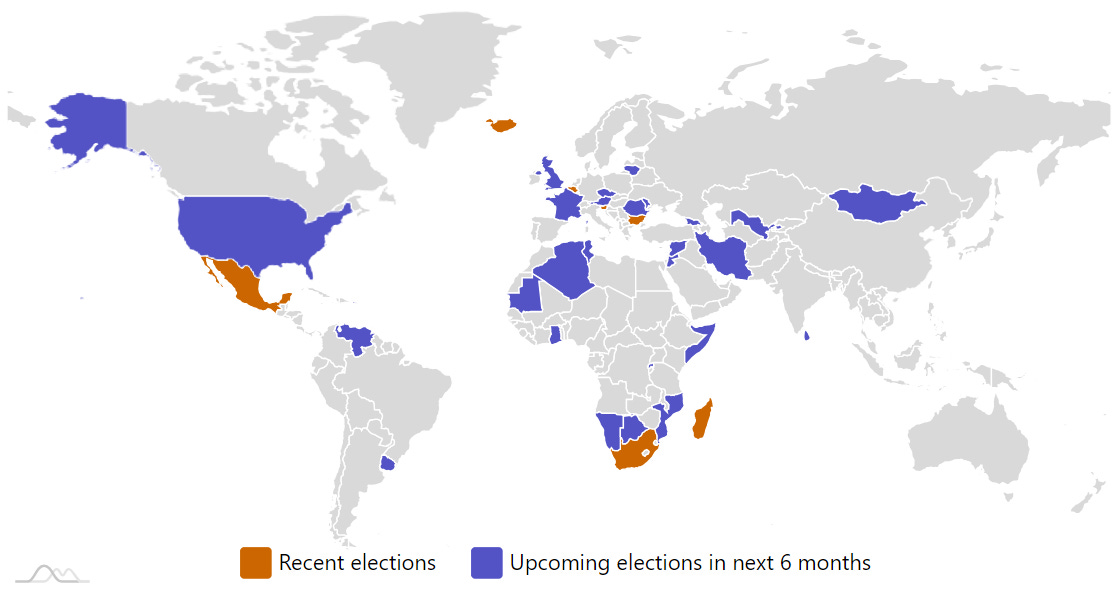

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

BulgariaBulgarian National AssemblyJun 9, 2024 (d) Confirmed Apr 2, 2023Mongolia Mongolian State Great Hural Jun 28, 2024 (d) Confirmed Jun 24, 2020

Venezuela Venezuela Presidency Jul 28, 2024 (d) Confirmed May 20, 2018

Jordan Jordanian House of Deputies Sep 10, 2024 (d) Confirmed Nov 10, 2020

Romania Romanian Presidency Sep 15, 2024 (t Date not confirmed Nov 24, 2019

Czech Republic Czech Senate Sep 30, 2024 (t) Date not confirmed Sep 23, 2022

Sri Lanka Sri Lankan Presidency Sep 30, 2024 (t) Date not confirmed Nov 16, 2019

Georgia Georgian Parliament Oct 26, 2024 (d) Confirmed Oct 31, 2020

Uruguay Uruguayan Presidency Oct 27, 2024 (t) Date not confirmed

Uruguay Uruguayan Chamber of Representatives Oct 27, 2024 (t) Date not confirmed

Uruguay Uruguayan Chamber of Senators Oct 27, 2024 (t) Date not confirmed

Uzbekistan Uzbekistani Legislative Chamber Oct 31, 2024 (t) Date not confirmed Dec 22, 2019

Georgia Georgian Presidency Nov 30, 2024 (t) Date not confirmed Nov 28, 2018

Romania Romanian Senate Nov 30, 2024 (t) Date not confirmed Dec 6, 2020

Namibia Namibian Presidency Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

Namibia Namibian National Assembly Nov 30, 2024 (t) Date not confirmed Nov 27, 2019

Ghana Ghanaian Presidency Dec 7, 2024 (t) Date not confirmed Dec 7, 2020

Ghana Ghanaian Parliament Dec 7, 2024 (t) Date not confirmed Dec 7, 2020

Romania Romanian Chamber of Deputies Dec 8, 2024 (t) Date not confirmed Dec 6, 2020

Thailand Referendum Dec 31, 2024 (t) Date not confirmed Aug 7, 2016

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

EShallGo Inc. EHGO US Tiger Securities/ Kingswood Capital Partners, 1.3M Shares, $4.00-6.00, $6.3 mil, 6/17/2024 Week of

(Incorporated in the Cayman Islands)

We specialize in two distinct market sectors: office supply sales and leasing, and after-sale maintenance & repair. These market sectors are large and fragmented, and we believe they present opportunities for significant growth through complementary services. Our mission is to become an office integrator and service provider, offer competitive overall office solutions and services, expand our service market beyond office equipment, and continue to create maximum value for customers. We place our customers’ needs, employees’ welfare and shareholders’ value as utmost importance, and we strive to build an enterprise that provides one-stop office solution.

Junzhang Shanghai is an authorized distributor of major brands of office equipment, including HP, Epson, Xerox, Sharp, Toshiba, Konica, Kyocera and other brands. Over the years, our business has expanded to encompass all other supplies offices may require, such as office furniture, IT products, water dispensers, printing paper, among many others. We also provide maintenance with Enterprise Resource Planning (“ERP”) systems we developed on our own. Our office total solution systems bring efficiency and convenience in the office. Our management believes that we have become one of the leading suppliers of office equipment for both private and public sector businesses as well as for large enterprises and institutions such as Ping An Insurance, Taiping Life, Centaline Property, Debon Securities, Tongce Real Estate, among others, and we have developed an e-commerce platform for all types of offices. As of the date of this prospectus, Junzhang Shanghai has established 20 subsidiaries across China and obtained the national high-tech enterprise certification.

Relying on our team’s rich experience in serving customer as well as technology development over the past 20 years, we have created an innovative cross-region service brand, EShallGo, to provide customers from across the country by addressing their customized office needs. As an independently developed solution provider with our own intellectual property rights, EShallGo is adopting “cloud procurement, cloud management and cloud services” and other powerful tools to lay the cornerstones for our future growth plan. We are in the process of establishing a system covering office services, sales, leasing, warranty service and life-time maintenance covering major cities across the country. We have obtained ISO9001, ISO14001, ISO45001 certifications and other national management system certifications.

Although the Chinese economy annual growth rates no longer sustain an unprecedented level of 10%-plus as in the last decade, as 2010 marks the last year China’s GDP grew by 10.3%, the economic activities in China continue to thrive and prosper in recent years, and demand for corporate office services has become a new market growth point. In light of the industry growth, EShallGo is looking to take the lead in this new market by proposing the “Internet & Service E-commerce model.” Although the e-commerce business and related platform is not yet operational and will be launched upon the completion of this offering, EShallGo has completed the initial setup of e-commerce and national service outlets and gained initial success in the market. Specifically, Junzhang Shanghai has set up all service categories on the platform that are in line with the industry by acquiring the ICP certificate and EDI certificate, which are business licenses for e-commerce platform operations in China and could take up to two years to obtain. Junzhang Shanghai has also developed its proprietary software, remote management systems and the mobile applications, all of which await to be further refined and tested to accommodate the business-end users, and to be launched upon the consummation of this offering. Furthermore, Junzhang Shanghai’s continuing geographical expansion efforts have resulted in more than 155 service outlets and more than 1,500 registered technical service personnel in lower-tier cities. These service outlets have contracted with Junzhang Shanghai through one of its 21 subsidiaries to provide local aftersales maintenance and repair services to largely institutional customers of Shanghai Junzhang. In order to continue its expansion efforts, consolidate its relationship with local vendors, and further promote Eshallgo’s brand awareness, Shanghai Junzhang does not currently charge management fees at this stage and allow the service points to retain all service-related revenues. This enabled us to lay a good foundation for Eshallgo’s future e-commerce development.

Note: Net income and revenue are for in U.S. dollars (converted from China’s renminbi) for the 12 months that ended Sept. 30, 2023.

(Note: EshallGo Inc. trimmed its small-cap IPO to 1.25 million Class A ordinary shares – down from 1.5 million shares – and kept the price range at $4.00 to $6.00 to raise $6.25 million, according to an F-1/A filing dated June 10, 2024. Background: EShallGo Inc. cut the size of its small-cap IPO in half – to 1.5 million Class A ordinary shares – down from 3.0 million shares initially – and kept the price range at $4.00 to $6.00 – to raise $7.5 million, assuming that the IPO will be priced at $5.00, the mid-point of its range, according to an F-1/A filing dated May 17, 2024. Background: EShallGo Inc. disclosed terms for its IPO in an F-1 filing dated April 27, 2023: 3.0 million shares at a price range of $4.00 to $6.00 to raise $15.0 million. The Chinese company filed confidential IPO documents with the SEC on Dec. 27, 2021.)

Majestic Ideal Holdings MJID WestPark Capital, 2.5M Shares, $4.00-5.00, $11.3 mil, 6/17/2024 Week of

We offer supply chain services to the apparel industry – yarn products and finished garments – in China. (Incorporated in the Cayman Islands)

We are a provider of SCM services in the apparel industry delivering a one-stop solution to our customers for a broad range of yarn products, textiles and finished garments. (SCM stands for supply chain management.)

Our service offerings encompass every key aspect of the supply chain of these products: market trend analysis, product design and development, raw material sourcing, production and quality control, and logistics management. Through our integrated capabilities, we provide end-to-end supply chain solutions that are tailored to meet our customers’ unique needs.

Competitive Strengths

We believe the following competitive strengths contribute to our success and differentiate us from our competitors:

• We have a vertically integrated operation to provide one-stop apparel SCM services;

• We work with a diverse range of quality suppliers to address different customer demands;

• We are capable of turning a design concept into finished garments under a short lead time; and

• Our management members have deep industry knowledge and proven track records.

Our Strategy

We intend to accomplish our goals by pursuing the following strategies:

• Broaden our customer base and strengthen our customer relationships;

• Maintain a quality supplier base and develop strategic relationships with suppliers;

• Enhance quality of apparel products and efficiency of their production; and

• Integrate sustainability aspects into product sourcing and environmental marketing.

Corporate History and Structure

We are the knitwear business of a group of companies founded by our Controlling Shareholders, in the 1980s. Our business was launched in 2013 through Multi Ridge, a Hong Kong company then wholly-owned by our Controlling Shareholders. In 2014, Multi Ridge established New Brand as its wholly-owned subsidiary in the PRC. Since its establishment, New Brand has been focusing on providing apparel SCM services in China. For more details, see “Corporate History and Structure”.

*Note: Net loss and revenue are in U.S. dollars for the fiscal year that ended Sept. 30, 2023.

(Majestic Ideal Holdings filed an F-1/A dated Nov. 16, 2023, in which it cut the number of shares – to 2.5 million shares – down from 3.8 million shares initially – and kept the price range at $4.00 to $5.00. In the filing, the company also said that is offering all 2.5 million shares in the IPO. Majestic Ideal Holdings also named WestPark Capital as its sole book-runner, replacing Univest Securities. In the Nov. 16, 2023, SEC filing, the company said that selling shareholders will offer 3.25 million shares through a separate resale prospectus. Majestic Ideal Holdings’ original terms had called for selling shareholders to offer 1.25 million shares – or about a third of the IPO – while the company would offer the remaining 2.5 million shares. Background: Majestic Ideal Holdings filed its F-1 on April 27, 2023.)

QMMM Holdings Ltd. QMMM Revere Securities, 2.1M Shares, $4.00-4.00, $8.5 mil, 6/17/2024 Week of

We are the holding company for an award-winning digital media advertising service, virtual avatar and virtual apparel technology service company whose operating subsidiaries are based in Hong Kong. (Incorporated in the Cayman Islands)

We are an award-winning digital media advertising service and virtual avatar & virtual apparel technology service company. Through our operating subsidiaries ManyMany Creations and Quantum Matrix, we have used interactive design, animation, art-tech and virtual technologies in over 500 commercial campaigns. We have worked with large domestic and international banks, real estate developers, world famous amusement park, top international athletic apparel and footwear brands and luxury cosmetic products and international brands for their advertising and creation work in Hong Kong. Standing prominently in Hong Kong for over 18 years in the industry, with top creativity, premium account servicing, and ever-advancing tech R&D, we continue to be one of the top premium choices for enterprises and multinational enterprises looking for large scale content-heavy and tech-integrated campaigns. Our clients include local and international banks, real-estate developers, luxury brands, high fashion houses, and theme parks.

Our subsidiary ManyMany Creations has stood out in the industry by breaking through traditional forms of advertising through digital technology. We endeavour to integrate quality concepts with creative digital media technology and provide a one-stop shop for content creativity and production for ad campaigns, TV commercials, online video, 360 video and animation, VR/AR/MR technology, 3D scanning, motion capture, projection mapping and digital façade production.

In March 2014, our wholly owned subsidiary Quantum Matrix, was incorporated, and it has launched digital avatar “Quantum Human” and “Quantum Fit” solutions, which we believe is the world’s only avatar technology for mass adoption of virtual identity. Quantum Matrix has created over 30,000 digital avatars.

Quantum Matrix owns two patents in Hong Kong, providing among the world’s leading automated avatar creation as well as real-time auto-fitting for virtual fashion & apparel. The first patent is for our method of converting a three-dimensional (3D) scanned object to an avatar. The method contains the steps of conducting a 3D segmentation of the 3D scanned object to obtain segmented results; and adapting a first template to the segmented results to create an avatar. The first template includes a topology, and the adapting step contains the step of mapping the topology of the first template to the segmented results to create the avatar. The invention provides an automated process which requires virtually no human intervention to convert the 3D scanned object to the avatar. The second patent is for our method of automatically fitting an accessory object to an avatar. The method contains the steps of providing an avatar; providing an accessory object; providing a template which the accessory object does not penetrate and fitting the accessory object to the avatar as a result of the template fitted to the avatar. The invention provides an automated process which requires virtually no human intervention to fit an accessory object (e.g. a garment) to the avatar.

These technologies are applied in commercial events, theme-parks, fashion shows, luxury events, entertainment industry, travel-retail, tech platform, among others. In addition, our technologies further provide a strong foundation to develop platforms for social media, entertainment, virtual self-expression, virtual influencers, tradable and sharable digital assets for consumers and creators.

Note: Net loss and revenue are in U.S. dollars for the year that ended Sept. 30, 2023.

(Note: QMMM Holdings Ltd. is offering 2.13 million ordinary shares (2,125,000 Ordinary Shares) at $4.00 to raise $8.5 million, according to its F-1/A filing dated May 20, 2024. Background: QMMM Holdings filed its F-1 on Oct. 6, 2023. The company submitted its confidential IPO filing to the U.S. Securities and Exchange Commission on June 23, 2023.)

Flag Ship Acquisition Corp. FSHPU Lucid Capital Markets, $6.0M Shares, $10.00-10.00, $60.0 mil, 6/18/2024 Tuesday

We will primarily seek to acquire one or more growth businesses with a total enterprise value of between $200 million and $400 million. (Incorporated in the Cayman Islands)

We will not consider or undertake a business combination with an entity or business based in the People’s Republic of China, including Hong Kong and Macau, or that has its principal or a majority of its business operations in such jurisdictions.

We will seek to capitalize on the strength of our management team. Our team consists of experienced professionals and senior operating executives. Collectively, our officers and directors have decades of experience in mergers and acquisitions, and operating companies, in Asia. We believe we will benefit from their accomplishments, and specifically their current and recent activities with companies that have a connection to the Asian market, in identifying attractive acquisition opportunities. However, there is no assurance that we will complete a business combination.

(Note: Flag Ship Acquisition Corp. changed the sole book-runner of its SPAC IPO to Lucid Capital Markets, replacing Ladenburg Thalmann, according to an F-1/A filing dated May 21, 2024.)

(Note: Flag Ship Acquisition Corp. cut the size of its SPAC IPO by 40 percent – to 6.0 million units, down from 10.0 million units initially – at $10.00 each to raise $60.0 million, according to an S-1/A filing dated Dec. 14, 2022. The company also trimmed the size of its potential targets to companies with enterprise values between $200 million and $400 million – down from those with enterprise values between $300 million and $600 million. Flag Ship Acquisition Corp. filed its S-1 on Nov. 12, 2021, after submitting confidential IPO paperwork to the SEC on March 9, 2021.)

JBDI Holdings Ltd. JBDI Spartan Capital Securities, $2.3M Shares, $5.00-5.00, $11.3 mil, 6/24/2024 Week of

(Incorporated in the Cayman Islands)

Our mission is to offer environmentally friendly, efficient, innovative and reliable products and services primarily in Singapore and also for the Southeast Asia region to help our customers move towards a zero environmental impact footprint and to save costs and achieve a better allocation of resources in the process.

Our Group’s history began in 1983 when Mr. Lim CP set up Jurong Barrels with a business partner as an attempt to develop the business in the trading of Reconditioned Containers. Our Group’s business in trading of Reconditioned Containers officially commenced in 1984 when Mr. Lim CP’s two brothers acquired all his business partner’s shares in Jurong Barrels and Jurong Barrels acquired a plant to Recondition used Containers. Following in their father’s footsteps of trading in used Containers, they began trading in Reconditioned Containers as they believed that there is a bigger profit margin for these Containers than just used Containers. Over the nearly last four decades, we have grown from a small reconditioning and recycling business to a comprehensive revitalization, Reconditioning and recycling of drums business comprising a diversified range of drums including open top drums, metal drums, plastic drums, plastic carboys and intermediate bulk containers. We have also, over the years, diversified into the business lines of the sale of new drums and the collection of waste drums and related products. In becoming aware of the necessity of reducing the impact of businesses on the environment, we began the provision of waste water treatment through our direct wholly-owned subsidiary, JBD Systems.

We have a long and proven track record in the supply of revitalized and Reconditioned steel and plastic drums in Singapore.

We have been supplying Reconditioned Containers to our customers for close to four decades and have accumulated industry experience in the Reconditioning of Used Containers. To better serve our customers, we also supply new Containers and offer a range of ancillary services to complement our business. We have been accredited with ISO 9001 (quality management) for Reconditioning of drums since October 2008. We believe our industry knowledge, reputation and consistent delivery of quality products and services have contributed to our success over the years.

We believe our track record in the supply of revitalized and Reconditioned steel and plastic drums and other products as well as our strategy to become environmentally friendly will facilitate the promotion and demand for our products with both existing and new customers, as well as the expansion of our business. As at January 31, 2024, we had a team of 56 workers, five technicians, three mechanics and 14 drivers in our operations department, which enable us to respond promptly to our customers’ requests, in terms of providing customization of Containers and other ancillary services to suit our customers’ needs and requirements. We believe that with the support of our Group’s stable pool of directly-hired skilled workforce and our own facilities (including all machines required for Reconditioning of used Containers, and as of January 31, 2024, a fleet of 13 delivery trucks and 15 forklifts and wastewater treatment facilities), we are self-contained and we are able to maintain the quality of our products and services in an efficient and coordinated manner as we do not have to rely on subcontractors to assist us in any production, service, logistic or maintenance process. Moreover, having our own pool of skilled direct labor and our own facilities will help us control and manage our costs more efficiently and effectively, which we believe helps to boost or stabilize our profit margins.

We are led by Mr. Lim CP, our Executive Director and Chief Executive Officer and one of the founding shareholders, who has been instrumental in spearheading the growth of our Group. Mr. Lim CP has over 40 years of experience in the trading of Reconditioned and new Containers in Singapore and is primarily responsible for planning and execution of our Group’s business strategies. He is supported by the other Executive Directors, Executive Officers and senior management (namely Mr. Liang Zhao Rong, Mr. Lim KS, Mr. Lim TC, Mr. Lim TM and Mr. Quek Che Wah) who collectively possess expertise in Reconditioning services, sales and marketing, operations, customer relationship management, human resources, operations and financial control and have been working with our Group for over 21 years on average.

Note: Net income and revenue are for the 12 months that ended Nov. 30, 2023.

(Note: JBDI Holdings expects its assumed IPO price to be $5.00 – the top of its previous range of $4.00 to $5.00 – on 2.25 million shares. JBDI Holdings filed an F-1/A on BDI Holdings filed an F-1/A on Feb. 22, 2024, to increase its IPO’s size to 2.25 million shares – 1.75 million shares by the company and 500,000 shares by the selling shareholders – at a price range of $4.00 to $5.00 to raise $10.13 million. Background: JBDI Holdings Ltd. filed its F-1 to go public on Feb. 8, 2024, and disclosed terms for its IPO: 1.75 million shares at a price range of $4.00 to $5.00. Spartan Capital was the sole book-runner. . JBDI Holdings Ltd. filed confidential IPO documents on Feb. 2, 2023.

WORK Medical Technology Group, Ltd. WOK Kingswood, 2.0M Shares, $4.00-4.00, $8.0 mil, 6/26/2024 Wednesday

(Incorporated in the Cayman Islands)

We are a holding company incorporated in the Cayman Islands. We conduct all of our operations through our operating entities established in the PRC, primarily Work Hangzhou, our wholly owned subsidiary, and its subsidiaries (collectively referred to herein as the “PRC subsidiaries”). The operations of our PRC subsidiaries could affect other parts of our business.

We are a supplier of medical devices in China. We develop and manufacture Class I and II medical devices and sell Class I and II disposable medical devices through operating subsidiaries in China. The PRC subsidiaries’ products include, to name a few, medical face masks, artery compression tourniquets for bleeding control, disposable breathing circuits for delivering oxygen and anesthetic gases, laryngeal mask airways for keeping patients’ airways open during anesthesia and endotracheal tubes for keeping the trachea open for air to get to the lungs.

The PRC subsidiaries have been providing medical devices to hospitals, pharmacies, and medical institutions since 2002. The PRC subsidiaries currently have a total of 20 medical devices in their product portfolio. All of them are sold domestically, and 15 of them are sold internationally.

In the Chinese market, the PRC subsidiaries’ products are sold in 34 provincial-level administrative regions. Internationally, the products are exported to more than 30 countries in Asia, Africa, Europe, North America, South America, and Oceania. I

The PRC subsidiaries have three types of customers, i) direct end-user customers, which include hospitals, pharmacies, and medical institutions, ii) domestic distributor customers that distribute the PRC subsidiaries’ products to end-user customers in China, and iii) export distributor customers that distribute the PRC subsidiaries’ products to end-user customers in Asia, Africa, Europe, North America, South America, and Oceania. The top 10 countries and regions outside of mainland China where these products are sold are Saudi Arabia, Germany, Switzerland, Hong Kong, France, Poland, Netherlands, Mexico, Romania and Russia.

As of Sept. 30, 2022, the PRC subsidiaries had a total of 1,058 customers, of which, 154 are direct end-user customers, 867 are domestic distributor customers, and 37 are export distributor customers.

As of March 31, 2023, the PRC subsidiaries had a total of 874 customers, of which, 64 are direct end-user customers, 800 are domestic distributor customers, and 10 are export distributor customers.

*Note: Net income and revenue are for the fiscal year that ended Sept. 30, 2023.

(Note: WORK Medical Technology Group Ltd. cut the size of its IPO to 2.0 million shares – down from 3.0 million shares initially – and kept the assumed IPO price is $4.00 – the low end of its previous price range of $4.00 to $5.00 – to raise $8.0 million, according to its F-1/A filing on May 21, 2024. Kingswood replaced Univest Securities as the sole book-runner. WORK Medical Technology Group updated its financial statements through Sept. 30, 2023. Background: WORK Medical Technology Group, LTD. filed an F-1/A dated Nov. 6, 2023, and disclosed terms for its IPO: 3.0 million shares at $4.00 to $5.00 to raise $13.5 million. WORK Medical Technology Group, LTD. filed its F-1 on April 27, 2023. The Chinese company submitted confidential IPO documents to the SEC on June 23, 2022.)

🏁 Emerging Market ETF Launches

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

05/16/2024 - JPMorgan Active Developing Markets Equity ETF JADE - Equity

05/09/2024 - WisdomTree India Hedged Equity Fund INDH - Equity, India

03/19/2024 - Avantis Emerging Markets ex-China Equity ETF AVXC - Active, equity, ex-China

03/15/2024 - Polen Capital China Growth ETF PCCE - Active, equity, China

03/04/2024 - Simplify Tara India Opportunities ETF IOPP - Active, equity, India

02/07/2024 - Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares XXCH - Equity, leveraged, China

01/11/2024 - Matthews Emerging Markets Discovery Active ETF MEMS - Active, equity, small caps

01/10/2024 - Matthews China Discovery Active ETF MCHS - Active, equity, small caps

11/07/2023 - Global X MSCI Emerging Markets Covered Call ETF EMCC - Equity, leverage

11/07/2023 - Avantis Emerging Markets Small Cap Equity ETF AVEE - Active, equity, small caps

09/22/2023 - Matthews Asia Dividend Active ETF ADVE - Active, equity, Asia

09/22/2023 - Matthews Pacific Tiger Active ETF ASIA - Active, equity, Asia

09/22/2023 - Matthews Emerging Markets Sustainable Future Active ETF EMSF - Active, equity, ESG

09/22/2023 - Matthews India Active ETF INDE - Active, equity, India

09/22/2023 - Matthews Japan Active ETF JPAN - Active, equity, Japan

09/22/2023 - Matthews Asia Dividend Active ETF ADVE - Active, equity, Asia

08/25/2023 - KraneShares Dynamic Emerging Markets Strategy ETF KEM - Active, equity, emerging markets

08/18/2023 - Global X India Active ETF NDIA - Active, equity, India

08/18/2023 - Global X Brazil Active ETF BRAZ - Active, equity, Brazil

07/17/2023 - Matthews Korea Active ETF MKOR - Active, equity, South Korea

05/18/2023 - Putnam Emerging Markets ex-China ETF PEMX - Active, value, growth stocks

05/11/2023 - JPMorgan BetaBuilders Emerging Markets Equity ETF BBEM - Passive, large + midcap stocks

03/16/2023 - JPMorgan Active China ETF JCHI - Active, equity, China

03/03/2023 - First Trust Bloomberg Emerging Market Democracies ETF EMDM - Principles-based

1/31/2023 - Strive Emerging Markets Ex-China ETF STX - Passive, equity, emerging markets

1/20/2023 - Putnam PanAgora ESG Emerging Markets Equity ETF PPEM - Active, equity, ESG, emerging markets

1/12/2023 - KraneShares China Internet and Covered Call Strategy ETF KLIP - Active, equity, China, options overlay, thematic

1/11/2023 - Matthews Emerging Markets ex China Active ETF MEMX - Active, equity, emerging markets

12/13/2022 - GraniteShares 1.75x Long BABA Daily ETF BABX - Active, equity, leveraged, single stock

12/13/2022 - Virtus Stone Harbor Emerging Markets High Yield Bond ETF VEMY - Active, fixed income, junk bond, emerging markets

9/22/2022 - WisdomTree Emerging Markets ex-China Fund XC - Passive, equity, emerging markets

9/15/2022 - KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KDIV - Passive, equity, Asia, dividend strategy

9/15/2022 - OneAscent Emerging Markets ETF OAEM - Active, Equity, emerging markets, ESG

9/9/2022 - Emerge EMPWR Sustainable Select Growth Equity ETF EMGC - Active, equity, emerging markets

9/9/2022 - Emerge EMPWR Unified Sustainable Equity ETF EMPW - Active, equity, emerging markets

9/8/2022 - Emerge EMPWR Sustainable Emerging Markets Equity ETF EMCH - Active, equity, emerging markets, ESG

7/14/2022 - Matthews China Active ETF MCH - Active, equity, China

7/14/2022 - Matthews Emerging Markets Equity Active ETF MEM - Active, equity, emerging markets

7/14/2022 - Matthews Asia Innovators Active ETF MINV - Active, equity, Asia

6/30/2022 - BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF XEMD - Passive, fixed income, emerging markets

5/2/2022 - AXS Short CSI China Internet ETF SWEB - Active, inverse, thematic

4/27/2022 - Dimensional Emerging Markets High Profitability ETF DEHP - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Core Equity 2 ETF DFEM - Active, equity, emerging markets

4/27/2022 - Dimensional Emerging Markets Value ETF DFEV - Active, equity, emerging markets

4/27/2022 - iShares Emergent Food and AgTech Multisector ETF IVEG - Passive, equity, thematic [Mostly developed markets]

4/21/2022 - FlexShares ESG & Climate Emerging Markets Core Index Fund FEEM - Passive, equity, ESG

4/6/2022 - India Internet & Ecommerce ETF INQQ - Passive, equity, thematic

2/17/2022 - VanEck Digital India ETF DGIN - Passive, India market, thematic

2/17/2022 - Goldman Sachs Access Emerging Markets USD Bond ETF GEMD - Passive, fixed income, emerging markets

1/27/2022 - iShares MSCI China Multisector Tech ETF TCHI - Passive, China, technology

1/11/2022 - Simplify Emerging Markets PLUS Downside Convexity ETF EMGD - Active, equity, options strategy

1/11/2022 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF REMG - Passive, equity, ESG

🚽 Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

05/17/2024 - Global X Next Emerging & Frontier ETF - EMFM

03/25/2024 - Global X MSCI Nigeria ETF - NGE

03/21/2024 - VanEck Egypt Index ETF - EGPT

03/14/2024 - KraneShares Bloomberg China Bond Inclusion Index ETF - KBND

03/14/2024 - KraneShares China Innovation ETF - KGRO

03/14/2024 - KraneShares CICC China Consumer Leaders Index ETF - KBUY

03/13/2024 - Xtrackers MSCI All China Equity ETF - CN

03/13/2024 - Xtrackers MSCI China A Inclusion Equity ETF - ASHX

02/16/2024 - Global X MSCI China Real Estate ETF - CHIH

02/16/2024 - Global X MSCI China Biotech Innovation ETF - CHB

02/16/2024 - Global X MSCI China Utilities ETF - CHIU

02/16/2024 - Global X MSCI Pakistan ETF - PAK

02/16/2024 - Global X MSCI China Materials ETF - CHIM

02/16/2024 - Global X MSCI China Health Care ETF - CHIH

02/16/2024 - Global X MSCI China Financials ETF - CHIX

02/16/2024 - Global X MSCI China Information Technology ETF - CHIK

02/16/2024 - Global X MSCI China Consumer Staples ETF - CHIS

02/16/2024 - Global X MSCI China Industrials ETF - CHII

02/16/2024 - Global X MSCI China Energy ETF - CHIE

02/14/2024 - BNY Mellon Sustainable Global Emerging Markets ETF - BKES

01/26/2024 - The WisdomTree Emerging Markets ESG Fund - RESE

11/11/2023 - Global X China Innovation ETF - KEJI

11/11/2023 - Global X Emerging Markets Internet & E-commerce ETF - EWEB

11/09/2023 - Franklin FTSE South Africa ETF - FLZA

10/27/2023 - Simplify Emerging Markets Equity PLUS Downside Convexity - EMGD

10/20/2023 - WisdomTree India ex-State-Owned Enterprises Fund - IXSE

10/20/2023 - WisdomTree Chinese Yuan Strategy Fund - CYB

10/20/2023 - Loncar China BioPharma ETF - CHNA

10/18/2023 - KraneShares Emerging Markets Healthcare Index ETF - KMED

10/18/2023 - KraneShares MSCI China ESG Leaders Index ETF - KSEG

10/18/2023 - KraneShares CICC China Leaders 100 Index ETF - KFYP

10/16/2023 - Strategy Shares Halt Climate Change ETF - NZRO

09/20/2023 - VanEck China Growth Leaders ETF - GLCN

08/28/2023 - Asian Growth Cubs ETF - CUBS

08/01/2023 - VanEck Russia ETF - RSX

07/07/2023 - Emerge EMPWR Sustainable Emerging Markets Equity ETF - EMCH

06/23/2023 - Invesco PureBeta FTSE Emerging Markets ETF - PBEE

06/16/2023 - AXS Short China Internet ETF - SWEB

04/11/2023 - SPDR Bloomberg SASB Emerging Markets ESG Select ETF - REMG

3/30/2023 - Invesco BLDRS Emerging Markets 50 ADR Index Fund - ADRE

3/30/2023 - Invesco BulletShares 2023 USD Emerging Markets Debt ETF - BSCE

3/30/2023 - Invesco BulletShares 2024 USD Emerging Markets Debt ETF - BSDE

3/30/2023 - Invesco RAFI Strategic Emerging Markets ETF - ISEM

2/17/2023 - Direxion Daily CSI 300 China A Share Bear 1X Shares - CHAD

1/13/2023 - First Trust Chindia ETF - FNI

12/28/2022 - Franklin FTSE Russia ETF - FLRU

12/22/2022 - VictoryShares Emerging Market High Div Volatility Wtd ETF CEY

8/22/2022 - iShares MSCI Argentina and Global Exposure ETF AGT

8/22/2022 - iShares MSCI Colombia ETFI COL

6/10/2022 - Infusive Compounding Global Equities ETF JOYY

5/3/2022 - ProShares Short Term USD Emerging Markets Bond ETF EMSH

4/7/2022 - DeltaShares S&P EM 100 & Managed Risk ETF DMRE

3/11/2022 - Direxion Daily Russia Bull 2X Shares RUSL

1/27/2022 - Legg Mason Global Infrastructure ETF INFR

1/14/2022 - Direxion Daily Latin America Bull 2X Shares LBJ

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (June 17, 2024) was also published on our website under the Newsletter category.